Finance

Retroactive Interest Rate Increase Definition

Published: January 20, 2024

Learn about the definition of retroactive interest rate increase in finance. Understand how it impacts borrowers and lenders.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Retroactive Interest Rate Increase Definition: What You Need to Know

Welcome to the Finance category of our blog! In this post, we’ll delve into the intriguing world of retroactive interest rate increases. Whether you’re a seasoned investor or just starting out on your financial journey, understanding this concept is crucial for making informed decisions about your money. So, let’s dive in and explore what retroactive interest rate increases are and why they matter.

Key Takeaways:

- Retroactive interest rate increases are adjustments made to the interest rates charged on existing financial products.

- These increases can have significant financial implications for borrowers, creditors, and investors.

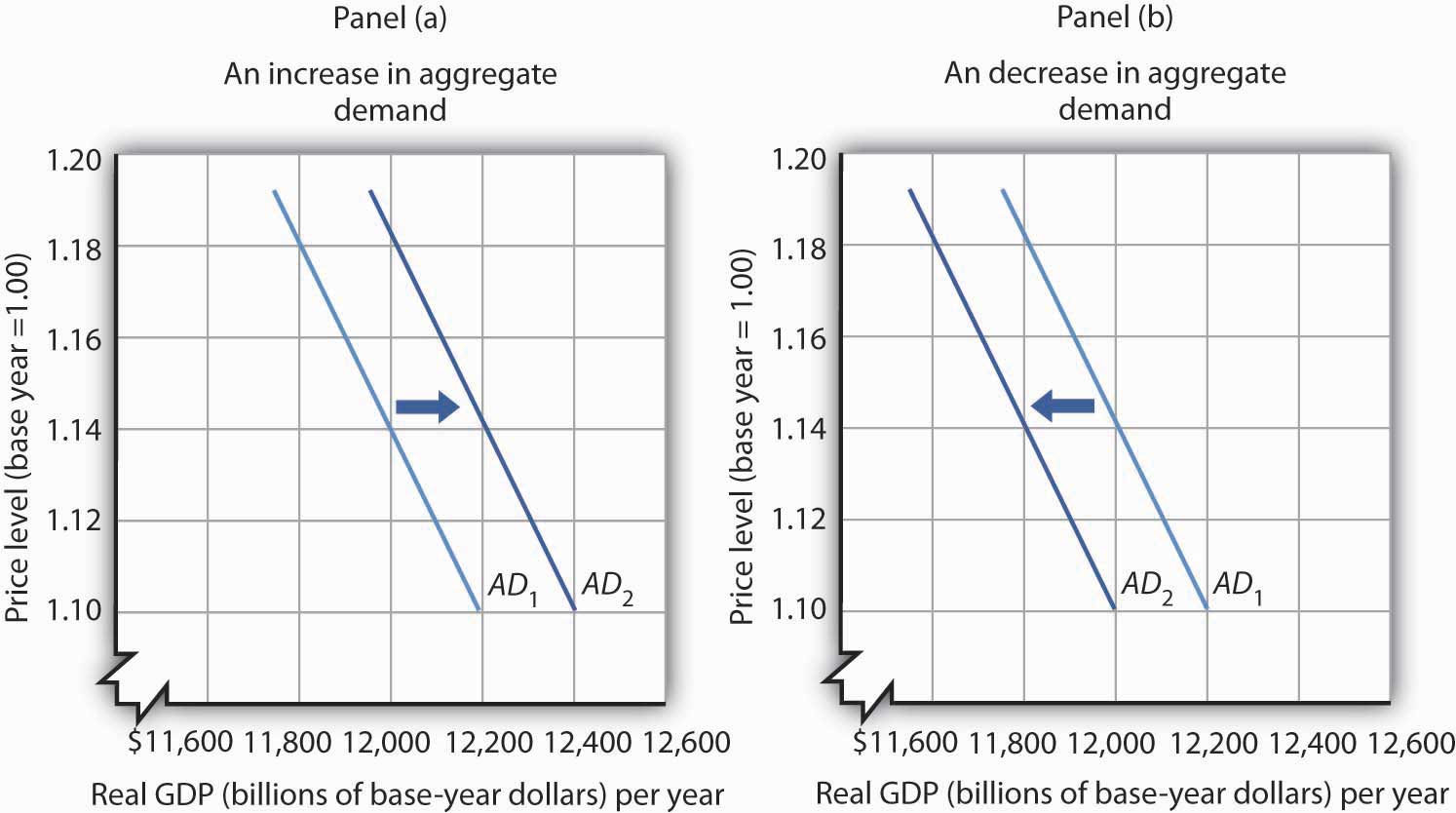

What is a Retroactive Interest Rate Increase?

A retroactive interest rate increase occurs when there is an adjustment made to the interest rates charged on existing financial products, such as loans, credit cards, or lines of credit. Unlike regular interest rate adjustments, which apply to future transactions, retroactive increases are implemented on past transactions as well. This means that borrowers may be subject to higher interest rates on the outstanding balances of their loans or credit card debt, even if those debts were incurred before the increase took effect.

Retroactive interest rate increases are usually triggered by changes in the market or regulatory environment, causing lenders to reassess their rates. For example, if the Federal Reserve increases benchmark interest rates, it may prompt credit card issuers to adjust their rates accordingly, including retroactively. However, it’s important to note that retroactive interest rate increases are not limited to credit cards but can also affect other types of loans and financial products.

It’s worth mentioning that retroactive interest rate increases can have significant financial implications for all parties involved. Let’s take a closer look at how each group might be affected:

Implications for Borrowers

Borrowers, especially those carrying balances on credit cards or outstanding loans, may face increased financial burdens due to retroactive interest rate increases. Here are a few key consequences:

- Increased Monthly Payments: By raising the interest rates on existing debt, borrowers can expect to pay more each month towards interest charges. This can strain their budgets and make it harder to pay down the principal balance.

- Extended Repayment Periods: Higher interest rates can also result in longer repayment periods. As the interest compounds over time, borrowers may end up paying significantly more in interest charges over the life of the loan.

- Credit Score Impact: Difficulty in meeting increased payments or concerns about credit utilization can negatively impact a borrower’s credit score, making it harder for them to secure favorable loan terms in the future.

Implications for Creditors and Investors

Retroactive interest rate increases can benefit creditors and investors but may also have potential drawbacks:

- Increased Profitability: Lenders stand to gain from retroactive interest rate increases as higher interest charges translate into greater profitability.

- Customer Dissatisfaction: However, such increases might lead to customer dissatisfaction and potential loss of business. Borrowers might resort to refinancing or transferring their balances to creditors offering better rates, which could impact lenders financially.

- Legal and Regulatory Risks: Creditors may also face legal and regulatory risks if retroactive interest rate increases are deemed unfair or violate consumer protection laws.

In conclusion, retroactive interest rate increases can have far-reaching implications for borrowers, creditors, and investors. It’s crucial to stay informed about changes in interest rates and carefully review the terms and conditions of any financial product you’re considering. By understanding the potential impact of retroactive interest rate increases, you can make sound financial decisions and plan accordingly.

We hope this article has shed light on the concept of retroactive interest rate increases and their significance in the financial world. If you have any further questions or would like more information, feel free to reach out to us!