Home>Finance>What Happens To Aggregate Demand When Interest Rates Increase?

Finance

What Happens To Aggregate Demand When Interest Rates Increase?

Published: November 1, 2023

Discover the impact of increasing interest rates on aggregate demand in the field of finance. Explore the implications and understand the dynamics that unfold.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- The relationship between interest rates and aggregate demand

- Impact of interest rate increase on consumption

- Impact of interest rate increase on investment

- Impact of interest rate increase on government spending

- Impact of interest rate increase on net exports

- Overall effect on aggregate demand

- Factors that may mitigate the impact of interest rate increase on aggregate demand

- Conclusion

Introduction

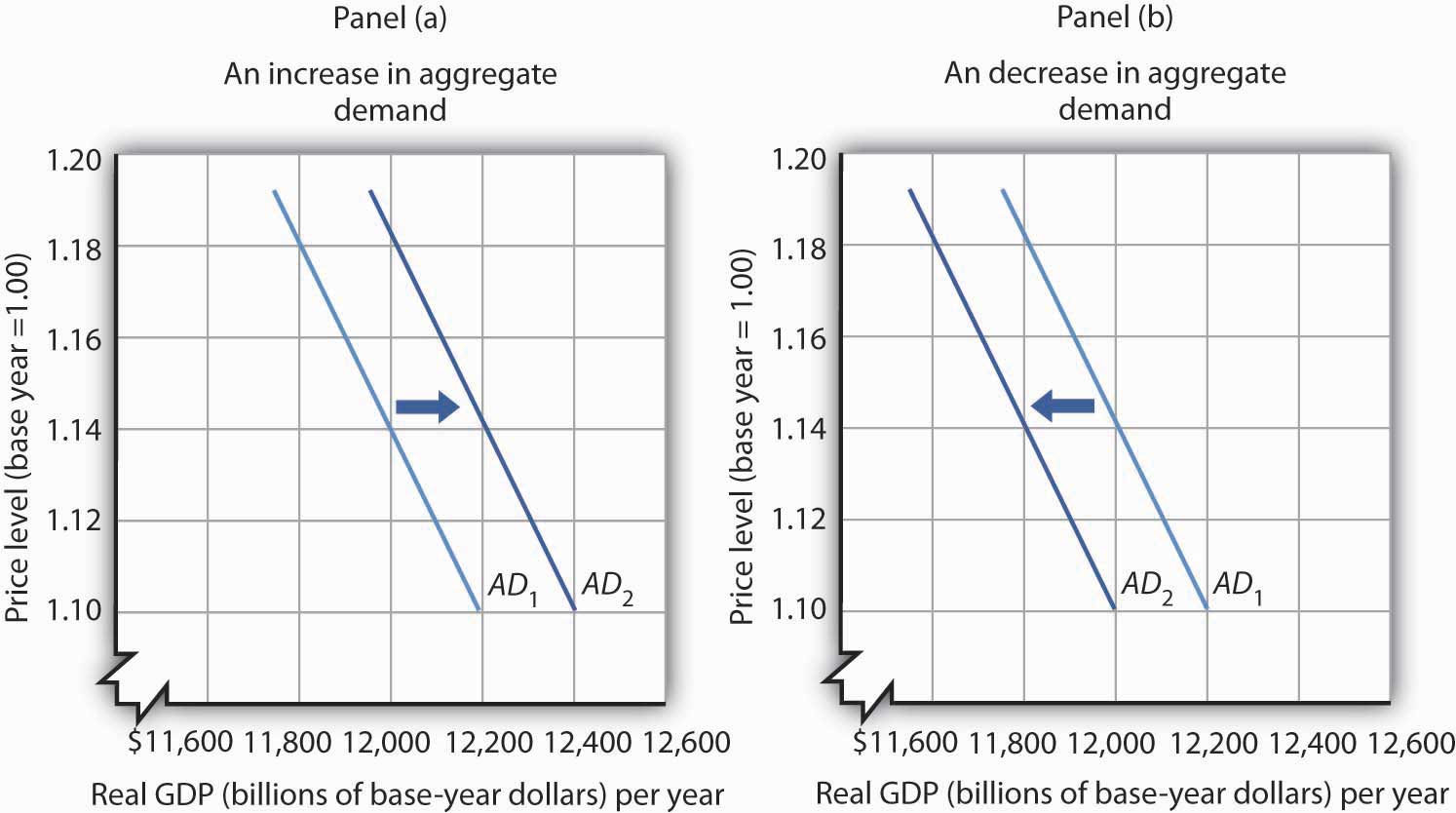

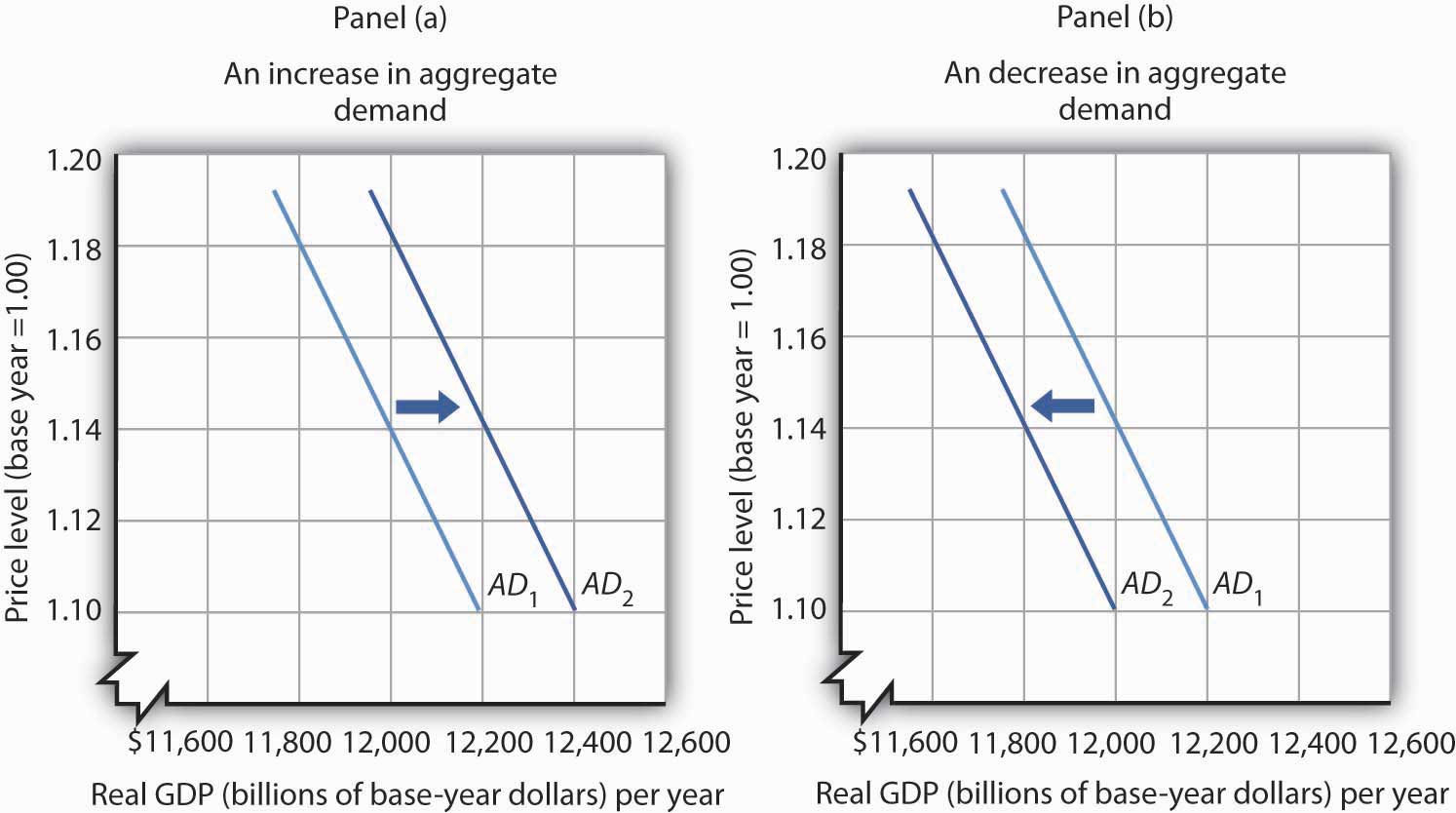

The relationship between interest rates and aggregate demand is a crucial aspect of macroeconomics. Aggregate demand refers to the total demand for goods and services in an economy at a given price level. Interest rates, on the other hand, represent the cost of borrowing money and play a significant role in influencing economic activity.

When interest rates increase, the impact on aggregate demand can be profound. This is because interest rates affect various components of aggregate demand, including consumption, investment, government spending, and net exports. Understanding how these factors interplay is essential for policymakers and investors looking to anticipate and respond to changes in the economy.

As interest rates rise, the cost of borrowing money also increases. This can have a direct impact on consumers’ ability and willingness to spend money on goods and services, which ultimately affects aggregate demand. Additionally, changes in interest rates can influence investment decisions, as higher interest rates can make borrowing for investment projects more expensive.

Government spending, another component of aggregate demand, can also be affected by changes in interest rates. The cost of servicing government debt can increase when interest rates rise, which may lead to a decrease in discretionary spending. Lastly, changes in interest rates can influence the exchange rate, affecting net exports and consequently impacting aggregate demand.

Throughout this article, we will explore in more detail the impact of an increase in interest rates on each component of aggregate demand. Additionally, we will discuss factors that may mitigate the effects of rising interest rates on aggregate demand. By examining these factors, we can gain a more comprehensive understanding of how interest rate changes impact the overall health and growth of an economy.

The relationship between interest rates and aggregate demand

The relationship between interest rates and aggregate demand is complex but crucial for understanding the overall state of an economy. Interest rates serve as a fundamental determinant of both borrowing costs and returns on savings, influencing the decisions made by consumers, businesses, and governments.

When interest rates are low, borrowing money becomes cheaper, encouraging consumers and businesses to take on debt for consumption and investment purposes. This increase in borrowing and spending leads to a higher level of aggregate demand, driving economic growth and expansion. Conversely, when interest rates rise, borrowing becomes more expensive, which can reduce the willingness of individuals and businesses to borrow and spend.

One of the key channels through which interest rates affect aggregate demand is through consumption. As interest rates increase, the cost of borrowing for big-ticket purchases such as houses, cars, and appliances rises, leading to a decrease in consumer spending. Higher interest rates also increase the cost of credit card debt and other forms of consumer debt, putting downward pressure on consumer spending. This reduction in consumption can have a significant impact on overall aggregate demand.

Investment, another component of aggregate demand, is also sensitive to changes in interest rates. When interest rates rise, the cost of financing investment projects increases. This discourages businesses from undertaking new investments or expanding existing operations. Higher interest rates can also lead to a decrease in stock market returns, reducing the attractiveness of investing in equities. This can further dampen business investment and negatively impact aggregate demand.

Government spending, which includes both consumption and investment by the public sector, can also be influenced by changes in interest rates. When interest rates rise, the cost of servicing government debt increases, potentially leading to a reallocation of funds away from discretionary spending. This can result in a decrease in government spending on infrastructure, social services, and other programs. The reduction in government spending can further contribute to a decline in aggregate demand.

Lastly, changes in interest rates can impact net exports and their contribution to aggregate demand. An increase in interest rates can lead to a higher exchange rate, making domestic goods more expensive for foreign buyers. This can reduce exports and increase imports. As a result, net exports may decrease, putting downward pressure on aggregate demand.

In summary, interest rates have a significant impact on aggregate demand through their influence on consumption, investment, government spending, and net exports. When interest rates rise, consumers and businesses face higher borrowing costs, which can lead to reduced spending and investment. Additionally, rising interest rates can affect government spending and impact the competitiveness of exports. Understanding the relationship between interest rates and aggregate demand is crucial for policymakers and investors in assessing the state of the economy and making informed decisions.

Impact of interest rate increase on consumption

An increase in interest rates can have a significant impact on consumer spending, one of the key components of aggregate demand. When interest rates rise, the cost of borrowing money for big-ticket purchases or credit card debt increases, which can deter consumers from spending. Consequently, the increase in interest rates can have both direct and indirect effects on consumption patterns.

Directly, higher interest rates affect consumers’ purchasing power. For example, if the interest rate on a mortgage loan increases, the monthly mortgage payments also increase. This can discourage potential homebuyers from entering the housing market or cause existing homeowners to cut back on other discretionary spending to accommodate the higher mortgage payments. Similarly, an increase in credit card interest rates can lead to higher monthly payments for individuals carrying credit card debt, reducing their capacity to spend on other goods and services.

Indirectly, higher interest rates can impact consumer spending through changes in savings and interest income. When interest rates rise, the returns on savings accounts, certificates of deposit (CDs), and other fixed-income investments increase as well. This may incentivize individuals to allocate more of their disposable income towards savings, reducing the amount available for consumption. Higher interest rates can also lead to higher interest income for individuals who rely on fixed-income investments, potentially increasing their purchasing power. However, the overall impact on consumption from changes in savings and interest income will depend on individual preferences and financial circumstances.

Additionally, changes in interest rates can affect consumer sentiment and confidence. Higher interest rates can be viewed as an indicator of tighter monetary policy or economic uncertainty. This may lead to a decrease in consumer confidence, causing individuals to become more cautious in their spending habits. Reduced consumer confidence can have a ripple effect throughout the economy, contributing to a decrease in overall aggregate demand.

It is important to note that the impact of an interest rate increase on consumption can vary across different income groups and types of goods and services. Higher-income individuals may be less sensitive to changes in interest rates, as their borrowing costs represent a smaller portion of their disposable income. In contrast, lower-income individuals, who may rely more on credit for everyday expenses, may feel the effects of higher interest rates more profoundly.

In summary, an increase in interest rates can lead to a decrease in consumer spending. The direct impact of higher borrowing costs reduces individuals’ purchasing power, while changes in savings and interest income indirectly influence consumption patterns. Moreover, changes in consumer sentiment and confidence can further dampen spending behavior. Understanding the impact of interest rate increases on consumption is vital for analyzing the overall health and future direction of an economy.

Impact of interest rate increase on investment

The relationship between interest rates and investment is a crucial aspect of understanding the impact of interest rate changes on aggregate demand. Investment refers to the expenditures made by businesses and individuals on capital goods, such as machinery, buildings, and equipment, with the aim of increasing future production and economic growth.

When interest rates increase, the cost of borrowing money for investment purposes also rises. This can have a significant impact on investment decisions. Higher interest rates make it more expensive for businesses to finance new investment projects or expand existing operations. As a result, businesses may postpone or reduce their investment plans, leading to a decrease in overall investment levels.

Higher interest rates can also affect the stock market and investor sentiment, influencing investment decisions. Rising interest rates can decrease the attractiveness of investing in equities, as higher interest rates can offer an alternative avenue for potential returns on investment. This can lead to a decrease in stock market valuations, reducing the incentives for businesses to expand or undertake new investment projects.

Additionally, higher interest rates can impact the cost of financing for small businesses, which may heavily rely on borrowing to fund their growth. The increased cost of borrowing can make it more difficult for small businesses to access capital and obtain favorable loan terms. This can further inhibit their ability to invest in new projects or expand their operations.

It is important to note that the impact of interest rate increases on investment can vary across different sectors of the economy. Some industries, such as construction, real estate development, and manufacturing, may be more sensitive to changes in interest rates due to their high capital intensity. Conversely, sectors that rely less on borrowing for investment funding, such as technology or service industries, may be less affected by changes in interest rates.

Furthermore, the response of investment to interest rate changes may also depend on the overall economic climate and business expectations. In times of economic uncertainty, businesses may become more cautious and risk-averse, making them less inclined to undertake new investment projects, even if interest rates are low. On the other hand, in times of economic expansion and favorable business conditions, businesses may be more willing to invest despite higher interest rates.

In summary, an increase in interest rates can have a dampening effect on investment levels. Higher borrowing costs make it more expensive for businesses to finance investment projects, leading to a potential decrease in overall investment. The impact of interest rate increases on investment can vary across sectors and depend on the overall economic climate and business sentiments. Understanding the relationship between interest rates and investment is essential for policymakers and investors alike when analyzing the prospects for economic growth and development.

Impact of interest rate increase on government spending

Changes in interest rates can have significant implications for government spending, which is a key component of aggregate demand. When interest rates rise, the cost of servicing government debt increases, potentially leading to a reallocation of funds and a decrease in discretionary spending by the government.

Higher interest rates can result in increased interest payments on outstanding government bonds and other forms of debt. As the cost of borrowing rises, more of the government’s budget must be allocated towards servicing the debt, leaving fewer resources for other expenditures. This can lead to a reduction in government spending on various programs, such as infrastructure development, healthcare, education, and social services.

The impact of interest rate increases on government spending can also depend on the debt structure and composition. For instance, if the government has a significant portion of its debt in variable-rate instruments, such as Treasury bills, the rise in interest rates can have an immediate impact on interest expenses. On the other hand, if the debt is predominantly in fixed-rate securities, the increase in interest rates may take time to fully materialize.

Furthermore, changes in interest rates can influence the government’s ability to borrow and issue new debt. Higher interest rates can raise the cost of financing for the government, making it more expensive to issue new bonds to raise funds. This can limit the government’s capacity to engage in deficit spending or can force them to explore alternative funding sources or financial instruments.

It is important to note that changes in interest rates can also have an impact on revenue generation for governments. Higher interest rates can lead to an increase in interest income for governments that hold fixed-income securities as part of their investment portfolios. This additional income can partially offset the higher costs associated with servicing the debt and provide some relief for the government’s budget.

Moreover, the impact of interest rate increases on government spending can also be influenced by fiscal policies and the overall macroeconomic conditions. In times of economic growth and optimism, governments may be more willing and able to accommodate higher interest expenses without significantly reducing discretionary spending. Conversely, in periods of economic hardship or fiscal constraints, governments may be more inclined to prioritize debt servicing and may implement austerity measures, leading to a more dramatic decrease in government spending.

Overall, an increase in interest rates can have a negative impact on government spending. The rise in borrowing costs can put pressure on the government’s budget, leading to a potential reduction in discretionary spending on various programs. The specific impact will depend on the debt structure, revenue sources, fiscal policies, and the state of the broader economy. Understanding the relationship between interest rate increases and government spending is crucial for policymakers and analysts in assessing the fiscal outlook and potential effects on aggregate demand.

Impact of interest rate increase on net exports

The relationship between interest rates and net exports, the difference between a country’s exports and imports, is a crucial aspect of understanding the impact of interest rate changes on aggregate demand. Changes in interest rates can influence currency exchange rates, which in turn affect the competitiveness of a country’s exports and imports.

When interest rates rise, it can attract international investors seeking higher returns on their investments. This increased demand for the country’s currency can lead to an appreciation of the exchange rate. A stronger currency makes domestic goods more expensive for foreign buyers, potentially decreasing the competitiveness of exports. As a result, an increase in interest rates can lead to a decrease in exports and an increase in imports, resulting in a negative impact on net exports.

Conversely, when interest rates decrease, it can discourage international investors from holding the country’s currency, leading to a depreciation of the exchange rate. A weaker currency makes domestic goods more affordable for foreign buyers, potentially increasing the competitiveness of exports. This can stimulate exports and decrease imports, resulting in a positive impact on net exports.

It is important to note that the relationship between interest rates and net exports is not always straightforward. Other factors, such as relative economic growth, trade policies, and political stability, can also influence net exports. Additionally, the responsiveness of net exports to changes in interest rates may vary across different countries and industries.

Furthermore, the impact of interest rate changes on net exports can also depend on the elasticity of demand for exports and imports. If the demand for a country’s exports is highly price-sensitive, changes in interest rates and exchange rates can have a more significant impact on net exports. However, if the demand for exports is relatively inelastic, meaning that buyers are less responsive to changes in prices, the impact of interest rate changes on net exports may be less pronounced.

Moreover, changes in interest rates can affect the cost of borrowing for businesses engaged in international trade. An increase in interest rates can raise the cost of trade financing, including letters of credit or trade financing loans. This can impact the profitability of exporting firms and potentially reduce their ability to compete in international markets.

In summary, changes in interest rates can impact net exports through their influence on currency exchange rates. An increase in interest rates can lead to a stronger currency, making domestic goods more expensive for foreign buyers and potentially decreasing exports. Conversely, a decrease in interest rates can result in a weaker currency, making domestic goods more affordable for foreign buyers and potentially stimulating exports. However, the relationship between interest rates and net exports is influenced by various factors, including economic growth, trade policies, and the elasticity of demand. Understanding the impact of interest rate changes on net exports is crucial for policymakers and analysts gauging the influence of monetary policy on international trade and aggregate demand.

Overall effect on aggregate demand

Changes in interest rates can have a profound impact on aggregate demand, which represents the total demand for goods and services in an economy. As discussed in the previous sections, interest rate increases can affect various components of aggregate demand, including consumption, investment, government spending, and net exports.

When interest rates rise, the cost of borrowing money increases for consumers, businesses, and the government. This can lead to a decrease in consumption, as higher borrowing costs reduce individuals’ purchasing power and deter them from taking on additional debt. Reduced consumption can then result in lower overall aggregate demand.

Higher interest rates can also discourage businesses from investing in new projects or expanding existing operations. The increased cost of borrowing for investment purposes can lead to a decrease in business investment, which further contributes to a decline in aggregate demand.

Furthermore, changes in interest rates can impact government spending. Higher borrowing costs for the government can result in a reallocation of funds toward debt servicing, potentially reducing discretionary spending on various programs. This reduction in government spending can further contribute to a decrease in aggregate demand.

Additionally, an increase in interest rates can impact net exports through currency exchange rate movements. A stronger domestic currency, influenced by higher interest rates, makes domestic goods more expensive for foreign buyers, potentially reducing exports. This can lead to a decrease in net exports and further dampen aggregate demand.

Considering the interconnectedness of consumption, investment, government spending, and net exports, the overall effect of interest rate increases on aggregate demand is generally negative. Higher interest rates can result in reduced consumer spending, decreased business investment, lower government spending, and potentially reduced exports. This can lead to a contraction in economic activity and slower economic growth.

However, it is important to note that the impact of interest rate changes on aggregate demand is not the sole factor influencing the overall health of an economy. Other factors such as fiscal policies, exchange rate movements, and external shocks can also play a significant role in determining the state of aggregate demand. Additionally, the effects of interest rate changes on aggregate demand can be influenced by various economic conditions, including the stage of the business cycle and the overall level of economic confidence.

Understanding the overall effect of interest rate changes on aggregate demand is crucial for policymakers, economists, and investors to make informed decisions. By monitoring and analyzing the dynamics between interest rates and aggregate demand, stakeholders can better anticipate economic trends, manage risks, and formulate effective monetary and fiscal policies.

Factors that may mitigate the impact of interest rate increase on aggregate demand

While an increase in interest rates can have a negative impact on aggregate demand, there are several factors that may help mitigate the effects and soften the overall impact on the economy. These factors can influence the responsiveness of consumption, investment, government spending, and net exports to changes in interest rates.

One factor that can mitigate the impact of interest rate increases on aggregate demand is fiscal policy. Governments can implement expansionary fiscal policies, such as increasing government spending or reducing taxes, to stimulate aggregate demand and offset the restrictive effect of higher interest rates. By providing additional spending power to consumers and businesses, fiscal measures can help sustain consumption and investment levels.

Another factor that can dampen the impact of interest rate increases is the availability of credit. Even with higher interest rates, if financial institutions continue to provide access to credit at reasonable terms, individuals and businesses may still be able to borrow and spend. The extent to which credit remains accessible and affordable can play a crucial role in mitigating the negative effects of interest rate increases on aggregate demand.

Moreover, the responsiveness of consumption and investment to interest rate changes can be influenced by consumer and business confidence. If consumers and businesses have a positive outlook on the economy and expect future income and profit growth, they may be more willing to continue spending and investing despite higher borrowing costs. Positive sentiment and confidence can help cushion the impact of interest rate increases on aggregate demand.

Additionally, the exchange rate can affect the impact of interest rate increases on net exports. A higher interest rate can lead to an appreciation of the domestic currency, making exports more expensive for foreign buyers. However, if the exchange rate is flexible and responds to changes in interest rates, the appreciation of the currency can be moderated, helping to maintain export competitiveness. This can reduce the negative impact on net exports and mitigate the overall effects on aggregate demand.

Furthermore, external factors such as global economic conditions and trade policies can influence the impact of interest rate changes on aggregate demand. The performance of major trading partners, international trade agreements, and tariffs can all impact the demand for goods and services and the competitiveness of exports. Favorable external conditions can help offset the negative effects of interest rate increases on aggregate demand.

In summary, several factors can help mitigate the impact of interest rate increases on aggregate demand. Expansionary fiscal policies, the availability of credit, consumer and business confidence, the flexibility of the exchange rate, and external economic conditions can all play a role in softening the impact of higher interest rates. By considering and managing these factors, policymakers and economists can potentially offset some of the negative effects on consumption, investment, government spending, and net exports, leading to a more balanced and stable economy.

Conclusion

The relationship between interest rates and aggregate demand is a complex and influential aspect of macroeconomics. Changes in interest rates can have significant impacts on consumption, investment, government spending, and net exports, all of which contribute to aggregate demand.

When interest rates increase, the cost of borrowing money rises, leading to a decrease in consumer spending and business investment. Additionally, government spending may be constrained as higher interest rates increase the cost of servicing debt. The competitiveness of exports can also be affected, as a stronger domestic currency can make goods more expensive for foreign buyers.

However, various factors can help mitigate the impact of interest rate increases on aggregate demand. Expansionary fiscal policies, such as increased government spending or tax cuts, can stimulate consumer and business spending. The availability and affordability of credit can also soften the effects of higher interest rates. Consumer and business confidence, as well as the flexibility of the exchange rate, can influence the responsiveness of consumption, investment, and net exports to interest rate changes. External economic conditions and trade policies can also shape the impact of interest rate increases on aggregate demand.

In conclusion, understanding the relationship between interest rates and aggregate demand is crucial for policymakers, economists, and investors. By monitoring and analyzing the effects of interest rate changes on consumption, investment, government spending, and net exports, stakeholders can make informed decisions and formulate effective monetary and fiscal policies to promote economic stability and growth.