Finance

How Does A Secured Card Work?

Published: March 1, 2024

Learn how secured credit cards function and can help you build or rebuild your credit. Discover the benefits and potential drawbacks. Explore secured card options.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

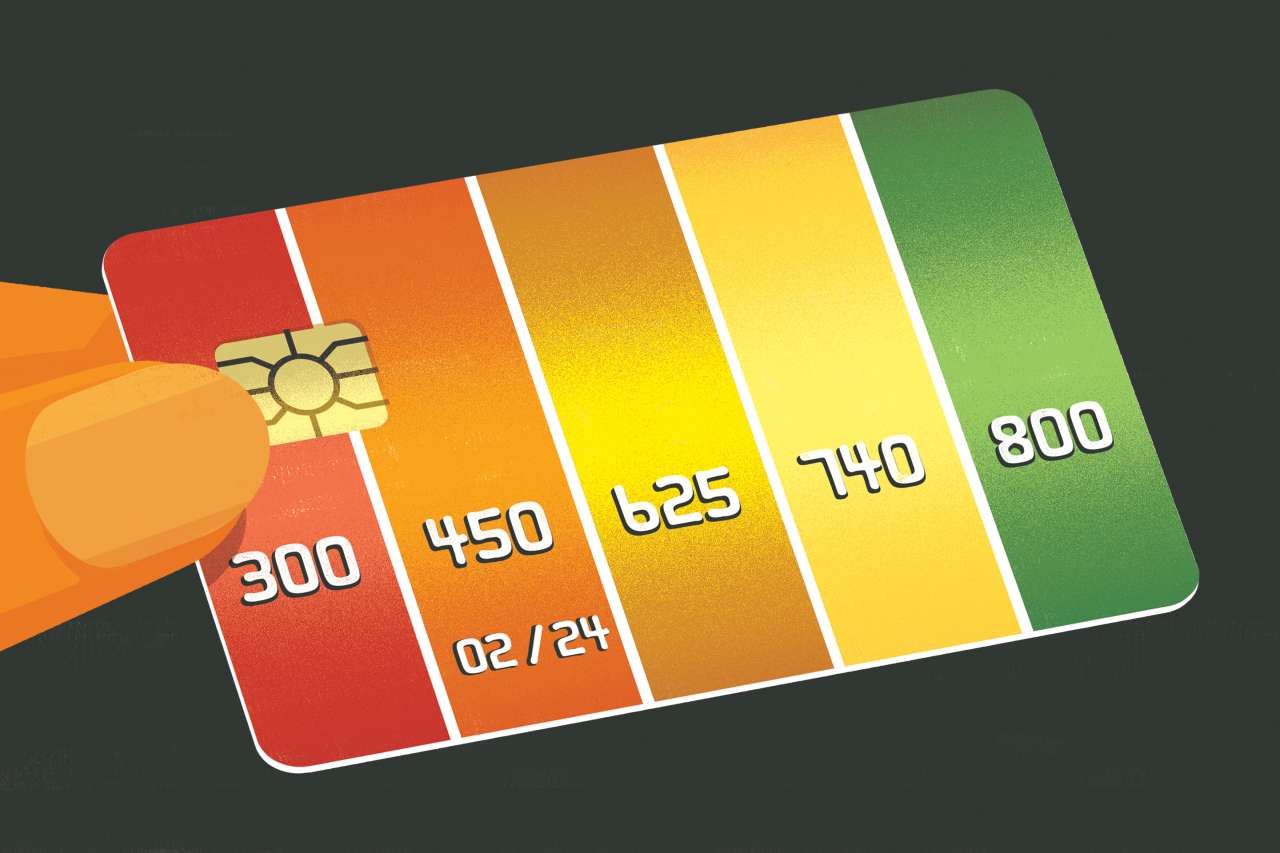

Secured credit cards are a valuable financial tool for individuals looking to build or rebuild their credit. These cards offer a pathway to establish a positive credit history, even for those with limited or damaged credit profiles. Understanding the workings of a secured card is crucial for making informed financial decisions and leveraging this financial instrument effectively.

A secured credit card operates differently from a traditional unsecured card. It requires the cardholder to provide a security deposit, which serves as collateral and determines the credit limit. This deposit minimizes the risk for the card issuer, making it an accessible option for individuals with poor or no credit history. By responsibly managing a secured card, cardholders can improve their creditworthiness over time, potentially leading to eligibility for unsecured credit cards with better terms and benefits.

This comprehensive guide will delve into the intricacies of secured credit cards, elucidating their function, application process, responsible usage, credit-building potential, as well as the advantages and disadvantages associated with these financial tools. By the end of this exploration, readers will have a clear understanding of how secured cards work and how they can be leveraged to achieve long-term financial goals.

What is a Secured Card?

A secured credit card is a financial product designed to help individuals establish or rebuild their credit. Unlike traditional unsecured credit cards, a secured card requires the cardholder to provide a refundable security deposit, typically equal to the desired credit limit. This deposit serves as collateral and mitigates the risk for the card issuer, making it a viable option for individuals with limited credit history, poor credit scores, or no credit at all.

Secured cards function similarly to unsecured cards in that they can be used for various transactions, including purchases and bill payments. They are accepted at most merchants that honor major credit cards. However, the key distinction lies in the collateral requirement, which provides a level of security for the card issuer while offering an opportunity for the cardholder to demonstrate responsible credit management.

It’s important to note that the security deposit is not used to cover monthly payments. Instead, it acts as a safeguard for the issuer in case the cardholder defaults on their payments. As long as the cardholder uses the secured card responsibly and makes timely payments, the deposit remains intact and is refunded when the cardholder decides to close the account or upgrade to an unsecured card.

Secured cards are typically recommended for individuals who are new to credit, have experienced financial setbacks, or are working to improve their credit scores. By using a secured card conscientiously, individuals can establish a positive credit history and demonstrate their creditworthiness to potential lenders and creditors.

How Does a Secured Card Work?

A secured credit card operates by requiring the cardholder to provide a security deposit, which determines the credit limit. This deposit serves as collateral and minimizes the risk for the card issuer, making it an accessible option for individuals with limited or damaged credit profiles. The cardholder’s responsible usage and timely payments help build a positive credit history, potentially leading to improved credit scores and future access to unsecured credit products.

When a cardholder opens a secured credit card account, they are typically required to deposit a specific amount, often starting at around $200, with the card issuer. This deposit establishes the credit limit, providing a clear and tangible link between the deposit amount and the available credit. For instance, if a cardholder submits a $500 security deposit, their credit limit will typically be set at $500.

As the cardholder uses the secured card for purchases and payments, they are expected to make at least the minimum monthly payment by the due date. It’s crucial to manage the card responsibly, keeping balances low and paying bills on time, as payment history is a significant factor in determining credit scores. It’s important to note that the security deposit is not used to cover monthly payments unless the cardholder defaults, in which case the issuer can use the deposit to offset the outstanding balance.

Over time, with consistent and responsible usage, the cardholder can demonstrate creditworthiness, potentially leading to an increase in credit scores. Some card issuers may offer the option to upgrade to an unsecured card after a period of responsible card usage, returning the security deposit to the cardholder while maintaining the credit account.

Understanding how a secured card works empowers individuals to make informed decisions about their credit journey. By utilizing a secured card responsibly, cardholders can lay a foundation for a positive credit history and unlock opportunities for improved financial well-being.

Applying for a Secured Card

Obtaining a secured credit card involves a straightforward application process, typically requiring individuals to provide personal and financial information to the card issuer. While the specific requirements may vary among issuers, the general steps for applying for a secured card are relatively consistent.

First, individuals need to research and compare secured card offerings from different issuers to find a product that aligns with their financial needs and goals. It’s important to consider factors such as annual fees, interest rates, reporting to credit bureaus, and the potential for transitioning to an unsecured card in the future. Once a suitable secured card is identified, the application process can commence.

When applying for a secured credit card, individuals are typically required to provide personal details such as their full name, contact information, social security number, and employment information. Additionally, they will need to submit the required security deposit, which often determines the initial credit limit. Some issuers may allow the deposit to be paid in installments, while others may require the full amount upfront.

After submitting the application and security deposit, the card issuer will review the information provided and assess the individual’s creditworthiness. Since secured cards are tailored for individuals with limited or damaged credit, the approval process is generally more lenient compared to unsecured cards. Once approved, the individual will receive the secured card and can begin using it to make purchases and payments, effectively building or rebuilding their credit.

It’s important to use the secured card responsibly by making timely payments and keeping balances low to maximize the credit-building potential. By demonstrating responsible credit management, individuals can pave the way for improved credit scores and potentially qualify for unsecured credit products in the future.

Applying for a secured credit card is a proactive step toward establishing a positive credit history and expanding financial opportunities. With thoughtful consideration and responsible card usage, individuals can leverage secured cards as a valuable tool for enhancing their overall financial well-being.

Using a Secured Card Responsibly

Responsible usage of a secured credit card is pivotal in leveraging this financial tool to build or rebuild credit effectively. By adopting prudent financial habits and employing the secured card judiciously, individuals can make significant strides toward improving their creditworthiness and setting the stage for future financial opportunities.

One of the fundamental aspects of using a secured card responsibly is making timely payments. Paying the monthly bill in full and on time demonstrates reliability and contributes positively to the individual’s credit history. Late or missed payments can have adverse effects on credit scores, potentially undermining the progress made in rebuilding credit.

Another crucial element of responsible usage is maintaining low balances relative to the credit limit. Keeping credit utilization—the ratio of credit card balances to credit limits—low is essential for demonstrating prudent financial management. Ideally, individuals should aim to keep their credit utilization below 30% to avoid signaling financial strain and to positively impact credit scores.

Regularly monitoring the secured card account for any unauthorized charges or errors is also part of responsible card usage. By reviewing statements and promptly addressing any discrepancies, individuals can safeguard their financial interests and ensure the accuracy of their credit reports.

Furthermore, refraining from applying for multiple credit products within a short timeframe is advisable. Each application typically triggers a hard inquiry on the individual’s credit report, which can temporarily lower credit scores. Focused and deliberate credit applications reflect positively on creditworthiness.

Finally, it’s beneficial for individuals to consider the long-term strategy for their secured card. Some issuers may offer the opportunity to upgrade to an unsecured card after a period of responsible card usage. This transition can potentially result in the return of the security deposit and the retention of the credit account, providing a pathway to unsecured credit with improved terms and benefits.

By conscientiously adhering to these principles of responsible credit management, individuals can harness the potential of a secured card to lay a foundation for a robust credit history and future financial well-being.

Building Credit with a Secured Card

Secured credit cards serve as a valuable tool for building credit, particularly for individuals who are new to credit or are working to recover from past financial challenges. By utilizing a secured card responsibly, individuals can establish a positive credit history and improve their credit scores over time, opening doors to enhanced financial opportunities.

One of the primary ways in which a secured card aids in credit building is through the reporting of payment history to major credit bureaus. Timely payments on the secured card contribute to a positive payment history, a crucial factor in determining credit scores. Consistent demonstration of responsible credit management through on-time payments can significantly enhance an individual’s creditworthiness.

Additionally, responsible usage of a secured card contributes to the establishment of a credit utilization ratio, which compares the amount of credit used to the total credit available. Maintaining a low credit utilization ratio, ideally below 30%, showcases prudent financial management and positively influences credit scores. By exercising restraint and keeping balances in check, individuals can bolster their credit profiles.

Furthermore, the length of credit history plays a pivotal role in credit scoring. By initiating a secured card account and managing it responsibly over time, individuals can lay the groundwork for a lengthy and positive credit history. This long-term approach to credit management can position individuals favorably in the eyes of potential lenders and creditors.

As credit scores improve through the conscientious use of a secured card, individuals may become eligible for unsecured credit products with better terms and benefits. This progression reflects the positive impact of the secured card in facilitating credit building and enhancing financial prospects.

Overall, leveraging a secured card to build credit involves consistent and responsible card usage, adherence to prudent financial habits, and a long-term perspective on credit management. By embracing these principles, individuals can harness the credit-building potential of a secured card and pave the way for a stronger financial future.

Advantages of Using a Secured Card

Secured credit cards offer several compelling advantages that make them a valuable financial tool for individuals looking to build or rebuild their credit. Understanding these benefits can help individuals make informed decisions about utilizing secured cards to improve their financial standing.

- Accessible Approval: Secured cards are more accessible to individuals with limited or damaged credit histories. The security deposit mitigates the risk for the card issuer, making it feasible for individuals with poor credit scores or no credit history to obtain a credit card.

- Credit Building: One of the primary advantages of using a secured card is its potential to aid in credit building. By responsibly managing the card and making timely payments, individuals can establish a positive credit history, leading to improved credit scores over time.

- Financial Discipline: Secured cards encourage financial discipline and responsible credit management. Cardholders must be mindful of their spending and payment habits, fostering valuable financial habits that can extend beyond the use of the secured card.

- Transition to Unsecured Credit: Some secured card issuers offer the possibility of transitioning to an unsecured card after a period of responsible card usage. This transition can result in the return of the security deposit and the retention of the credit account, providing a pathway to unsecured credit with improved terms and benefits.

- Universal Acceptance: Secured cards are typically accepted at most merchants that honor major credit cards, allowing individuals to use the card for various transactions, including purchases and bill payments, much like traditional unsecured cards.

- Credit Score Monitoring: Many secured card issuers provide access to credit score monitoring or reporting to major credit bureaus. This feature allows individuals to track their credit progress and gain insights into their credit behavior.

These advantages collectively position secured credit cards as a practical and effective means for individuals to embark on a journey toward improved credit and enhanced financial opportunities. By leveraging the benefits of a secured card and employing it responsibly, individuals can pave the way for a stronger and more secure financial future.

Disadvantages of Using a Secured Card

While secured credit cards offer numerous advantages, it is important to consider the potential drawbacks associated with these financial products. Understanding the limitations of secured cards can help individuals make informed decisions and navigate their credit-building journey effectively.

- Security Deposit Requirement: One of the primary disadvantages of secured cards is the necessity of providing a security deposit to establish the credit limit. This initial deposit may pose a financial hurdle for individuals who are unable to allocate funds for the deposit.

- Annual Fees and Interest Rates: Some secured cards may carry annual fees and higher interest rates compared to traditional unsecured cards. It is essential for individuals to assess these costs and consider the overall affordability of the secured card.

- Limited Credit Limit: The credit limit of a secured card is typically determined by the amount of the security deposit. As a result, individuals may have a lower credit limit initially, which can impact their purchasing power and financial flexibility.

- Temporary Credit Score Impact: While responsible usage of a secured card can lead to improved credit scores over time, the initial application and credit inquiry may result in a temporary dip in credit scores. It’s important for individuals to be aware of this potential impact.

- Transition to Unsecured Card: While some secured card issuers offer the possibility of transitioning to an unsecured card, not all individuals may qualify for this transition. The inability to upgrade to an unsecured card can limit the long-term benefits of using a secured card.

- Credit Reporting: Not all secured card issuers report to all three major credit bureaus. Inconsistent or limited reporting may diminish the impact of responsible card usage on credit scores.

It’s crucial for individuals to weigh these disadvantages against the benefits of using a secured card. By carefully evaluating the potential drawbacks and considering their individual financial circumstances, individuals can make informed decisions about leveraging secured credit cards as a means to build or rebuild their credit.

Conclusion

Secured credit cards serve as a valuable bridge to financial stability for individuals aiming to establish or rebuild their credit. By requiring a security deposit and offering a pathway to responsible credit management, secured cards empower individuals to embark on a journey toward improved creditworthiness and enhanced financial opportunities.

Understanding the mechanics of secured cards, from the initial application process to responsible card usage and credit-building potential, is essential for individuals seeking to leverage this financial tool effectively. The advantages of secured cards, including accessibility, credit-building potential, and the opportunity for transitioning to unsecured credit, make them a compelling option for individuals with limited or damaged credit profiles.

However, it’s important to consider the potential drawbacks of secured cards, such as security deposit requirements, fees, and the impact on credit scores. By carefully weighing these factors and making informed decisions, individuals can navigate the credit-building journey with clarity and purpose.

Ultimately, the responsible use of a secured credit card can set the stage for a positive credit history, improved credit scores, and expanded financial possibilities. By embracing financial discipline, making timely payments, and managing credit responsibly, individuals can harness the potential of secured cards to pave the way for a stronger and more secure financial future.

As individuals progress on their credit-building journey, the knowledge and insights gained from understanding secured cards can extend beyond the realm of credit. The financial habits cultivated through responsible card usage can contribute to overall financial well-being and serve as a foundation for long-term financial success.

In conclusion, secured credit cards offer a pathway to credit empowerment, providing individuals with the tools and opportunities to shape a positive financial trajectory. By leveraging the advantages of secured cards and navigating potential challenges with prudence, individuals can embark on a transformative journey toward enhanced credit and financial resilience.