Finance

What Is Cash Flow Vs Revenue

Published: December 20, 2023

Learn the difference between cash flow and revenue in finance. Understand how each metric is used to measure financial performance and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance and business, terms such as cash flow and revenue are often used interchangeably. However, understanding the differences between cash flow and revenue is crucial for business owners and investors to make informed decisions. While both cash flow and revenue are important metrics to evaluate the financial health of a company, they represent different aspects of its financial operations.

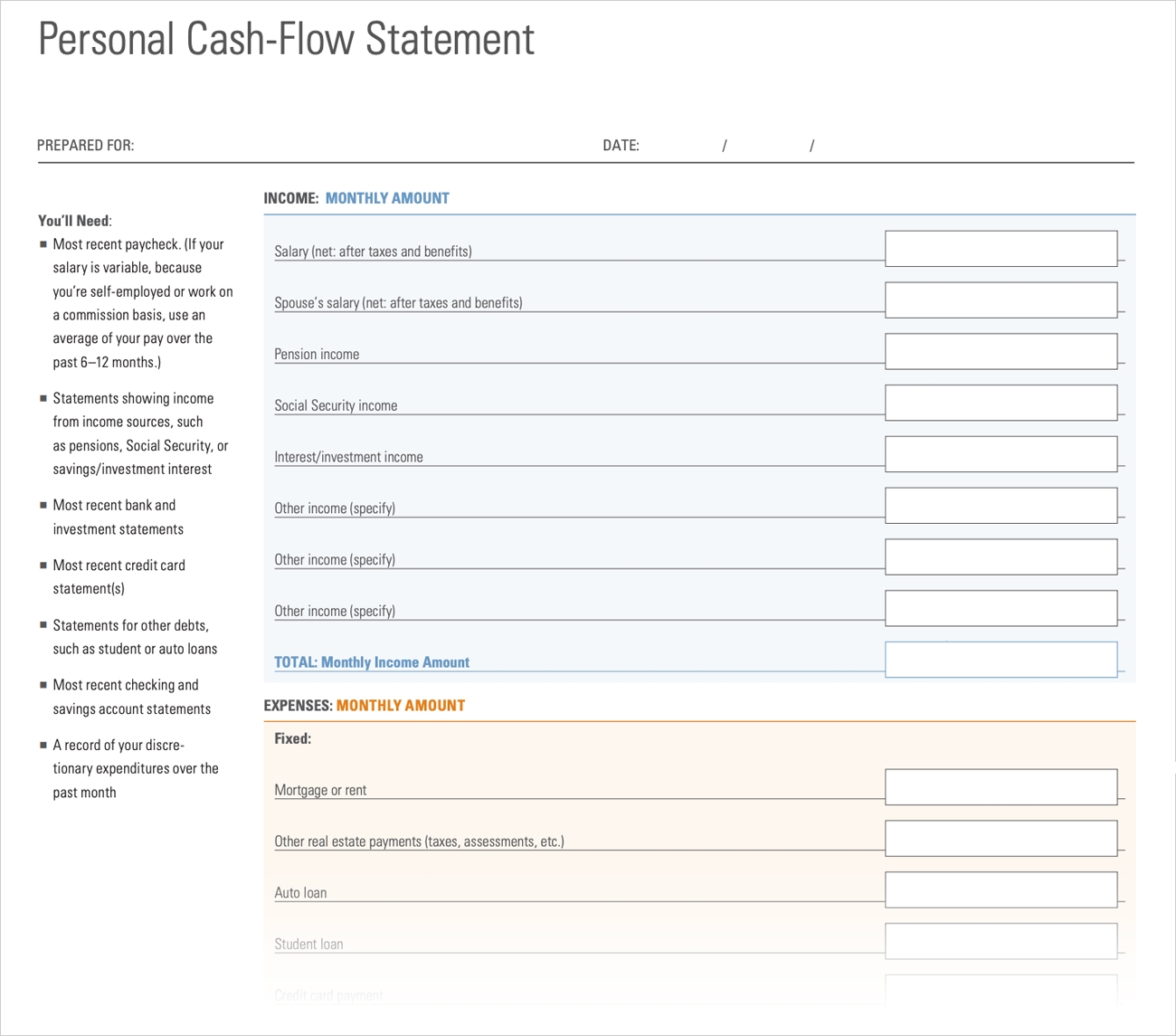

Cash flow refers to the movement of money in and out of a business over a specific period of time. It tracks the actual cash that a company receives and pays out, taking into account both operating activities (sales, expenses, and liabilities) and non-operating activities (investments, financing, and taxes). In simple terms, cash flow measures the liquidity or the actual availability of cash in a company’s accounts.

On the other hand, revenue refers to the total income generated by a business from its primary operations. It represents the total sales or income earned by selling goods or services to customers. Revenue is often derived from sales, fees, royalties, or any other sources of income related to the company’s core business activities. It does not take into account the timing of cash inflows and outflows, but rather focuses solely on the amount of money generated through sales.

While revenue is an essential indicator of a company’s ability to generate income, cash flow provides a more accurate picture of its financial position. A company may generate high revenue, but if it has poor cash flow management, it can still face financial instability or even bankruptcy. Conversely, a company with tight cash flow management can thrive, even if its revenue is relatively lower.

The distinction between cash flow and revenue becomes especially important when evaluating the profitability and sustainability of a company. Revenue may include sales made on credit, which may not result in immediate cash inflows. In contrast, cash flow captures the actual cash received from those sales, reflecting the company’s ability to collect funds from its customers in a timely manner.

In the following sections, we will explore the differences between cash flow and revenue in more detail, and discuss their significance in assessing the financial health of a business.

Definition of Cash Flow

Cash flow refers to the movement of cash in and out of a business during a specific period of time, typically a month, quarter, or year. It tracks the actual cash that a company receives and pays out, taking into account both its operating and non-operating activities.

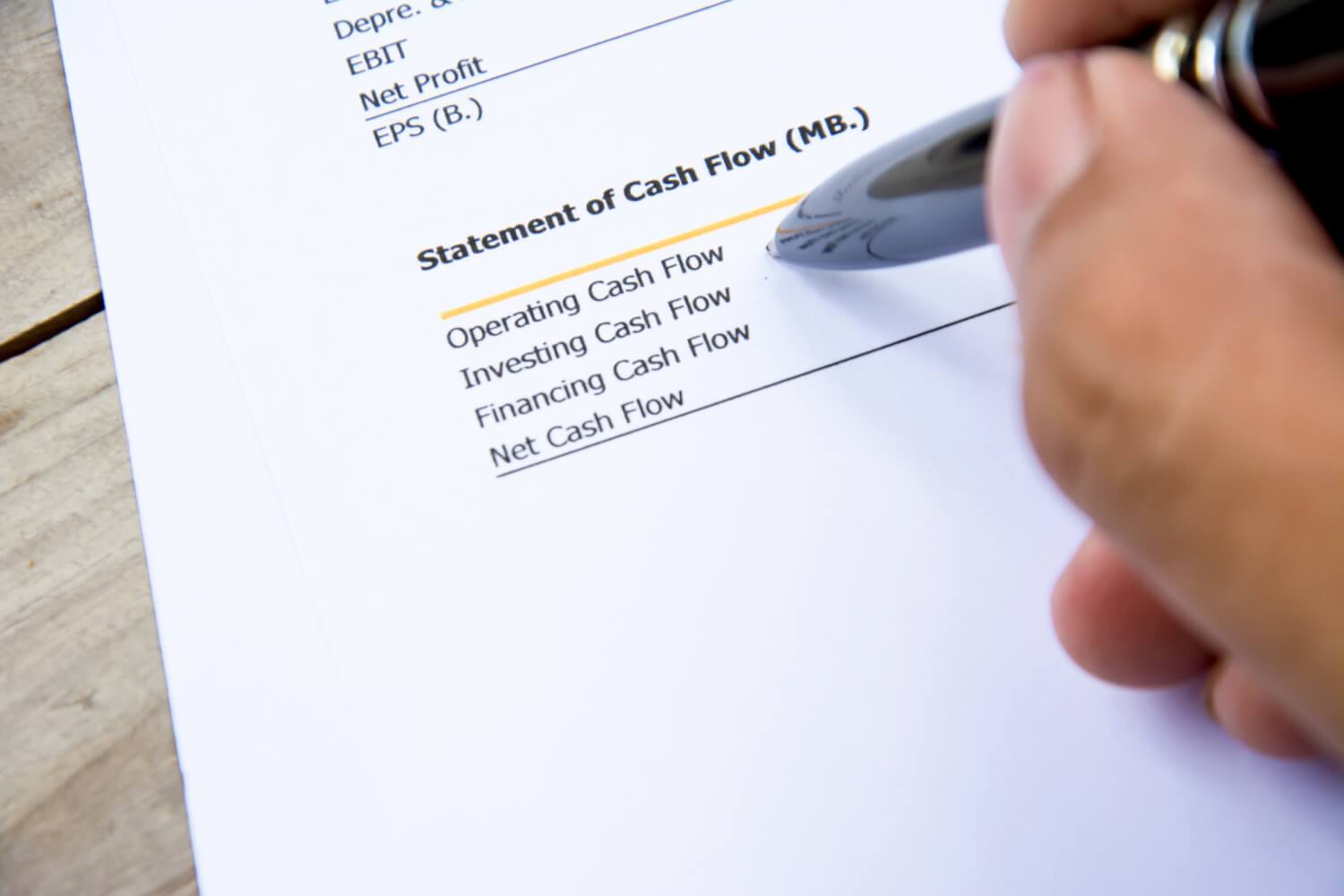

There are three main categories of cash flow:

- Operating Cash Flow: This represents the cash flow generated from a company’s core business operations. It includes cash inflows from sales revenue and cash outflows for expenses such as salaries, rent, utilities, and inventory. Operating cash flow is a key indicator of a company’s ability to generate cash from its day-to-day operations.

- Investing Cash Flow: This refers to the cash flow associated with the buying and selling of long-term assets, such as property, equipment, and investments. Investing cash flow includes cash inflows from asset sales and cash outflows for asset purchases. It helps evaluate a company’s investment decisions and their impact on cash reserves.

- Financing Cash Flow: This represents the cash flow resulting from activities related to the company’s capital structure. It includes cash inflows from sources such as issuing stock, taking on debt, or receiving loans, as well as cash outflows for debt repayment and dividends. Financing cash flow highlights the company’s ability to raise capital and manage its debts.

It’s important to note that a positive cash flow indicates that a company is receiving more cash inflows than outflows, while a negative cash flow suggests the opposite. Positive cash flow is generally seen as a sign of financial stability and allows a company to cover expenses, invest in growth opportunities, and repay debts. Negative cash flow, on the other hand, can signify financial difficulties and may require external funding or cost-cutting measures to address.

Cash flow can be further classified into two types:

- Operating Cash Flow: This represents the net cash generated or consumed by a company’s core business operations. It is calculated by subtracting the operating expenses from the cash inflows generated from sales revenue.

- Free Cash Flow: This is the amount of cash remaining after deducting all expenses, including both operating and non-operating items, such as interest payments and taxes. Free cash flow represents the cash available for distribution to shareholders, reinvestment in the business, or debt reduction.

Understanding cash flow is essential for business owners and investors as it provides insights into a company’s liquidity, solvency, and financial viability. It helps identify potential cash flow issues, anticipate future funding needs, and make informed decisions about investments and financial strategies.

Definition of Revenue

Revenue is the total income generated by a business from its primary operations. It represents the amount of money earned by selling goods or services to customers, and is a key indicator of a company’s top-line performance.

Revenue can come from various sources, including sales of products, fees for services rendered, royalties, licensing agreements, and other income streams related to the core business activities of the company.

It’s important to note that revenue does not take into account the timing of cash inflows and outflows. It simply reflects the amount of money earned from sales, regardless of whether the payment is received immediately or in the future. As a result, revenue may include sales made on credit, where the payment is expected at a later date.

There are different types of revenue that businesses can generate:

- Sales Revenue: This is the revenue derived from the sales of products or services. It represents the main source of income for most companies and is typically reported on the income statement.

- Service Revenue: This refers to the revenue generated from providing services to clients or customers. It includes fees charged for professional services, consulting, maintenance, subscriptions, and other service-based offerings.

- Other Revenue: This category includes any additional income streams that are not directly related to product sales or services rendered. This can include royalties from licensing intellectual property, rent from leasing property, or income from investments.

Revenue is a critical financial metric as it helps assess a company’s ability to generate income and grow its business. Increasing revenue is often a primary goal for businesses, as it indicates a higher level of customer demand, market share growth, and profitability.

However, it’s important to analyze revenue in conjunction with other financial metrics to gain a comprehensive understanding of a company’s performance. Simply having high revenue does not guarantee profitability or financial success. Factors such as costs, expenses, profit margins, and cash flow management all play a role in determining a company’s overall financial health.

Revenue recognition, or the timing of recognizing revenue, can vary based on accounting standards and the nature of a company’s business. Generally accepted accounting principles (GAAP) provide guidelines for when and how revenue should be recognized to ensure consistency and accuracy in financial reporting.

Ultimately, revenue serves as a vital aspect of financial analysis, allowing business owners, investors, and stakeholders to evaluate a company’s growth potential, market position, and overall financial performance.

Differences between Cash Flow and Revenue

While cash flow and revenue are both essential financial metrics, they represent different aspects of a company’s financial operations. Understanding the key differences between cash flow and revenue is crucial for business owners and investors to assess the overall financial health and performance of a company.

Here are the main differences between cash flow and revenue:

- Timing: Revenue represents the total income generated by a business from its primary operations, regardless of when the payment is received. It focuses on the amount of money earned from sales, while cash flow tracks the actual movement of cash in and out of a business over a specific period of time. Cash flow takes into account the timing of cash inflows and outflows, reflecting the company’s liquidity and cash position.

- Source: Revenue is primarily derived from sales of products or services, representing the main source of income for a company. On the other hand, cash flow can come from various sources, including sales revenue, financing activities, investing activities, and operating activities. Cash flow considers both the operational and non-operational cash movements of a business.

- Indicators: Revenue is an indicator of a company’s sales performance and market demand. It demonstrates the company’s ability to generate income from its core operations. Cash flow, on the other hand, provides insights into the company’s liquidity, solvency, and ability to manage its financial obligations. It shows how effectively a company can generate and manage cash resources.

- Profitability vs. Liquidity: Revenue is often used to evaluate a company’s top-line performance and its potential for profitability. A company with high revenue may be considered successful. However, cash flow is a more accurate indicator of a company’s financial stability and viability. A business may have high revenue but still face cash flow problems if it does not effectively manage its operating cash flow.

- Timing of Recognition: Revenue is recognized based on accounting principles and standards, which may differ depending on the nature of the business and the type of revenue. Cash flow, on the other hand, is based on the actual inflow and outflow of cash, regardless of the timing of revenue recognition. Revenue can be recognized even before the cash is received, while cash flow tracks the actual cash movement.

It’s important to analyze both cash flow and revenue together to gain a comprehensive understanding of a company’s financial performance. While revenue indicates the company’s ability to generate income, cash flow provides insights into how effectively the company manages its cash resources and meets its financial obligations.

A company can have high revenue but face cash flow problems if it is not able to convert its sales into cash in a timely manner. Conversely, a company with lower revenue but strong cash flow management may be in a better financial position to sustain and grow its business.

By evaluating cash flow and revenue in conjunction with other financial metrics, such as profitability, expenses, and investment activities, investors and business owners can make well-informed decisions and effectively assess the financial health and performance of a company.

Importance of Cash Flow and Revenue in Business

Cash flow and revenue are crucial metrics that play a significant role in assessing the financial health and sustainability of a business. Both metrics provide valuable insights into different aspects of a company’s operations and determine its ability to generate income, manage expenses, and meet financial obligations. Here are the key reasons why cash flow and revenue are important in business:

- Financial Stability: Cash flow and revenue help gauge a company’s financial stability. Positive cash flow indicates that a company is generating more cash inflows than outflows, providing the necessary liquidity to cover expenses, invest in growth opportunities, and repay debts. Similarly, revenue demonstrates a company’s ability to generate income from its core operations, indicating market demand and growth potential.

- Liquidity Management: Cash flow management is essential for ensuring adequate liquidity to support day-to-day operations and meet financial obligations. By tracking cash inflows and outflows, businesses can identify potential cash flow issues, such as late customer payments or excessive outflows, and take necessary actions to maintain sufficient cash reserves. Effective cash flow management reduces the risk of financial instability and enhances the company’s ability to navigate economic downturns.

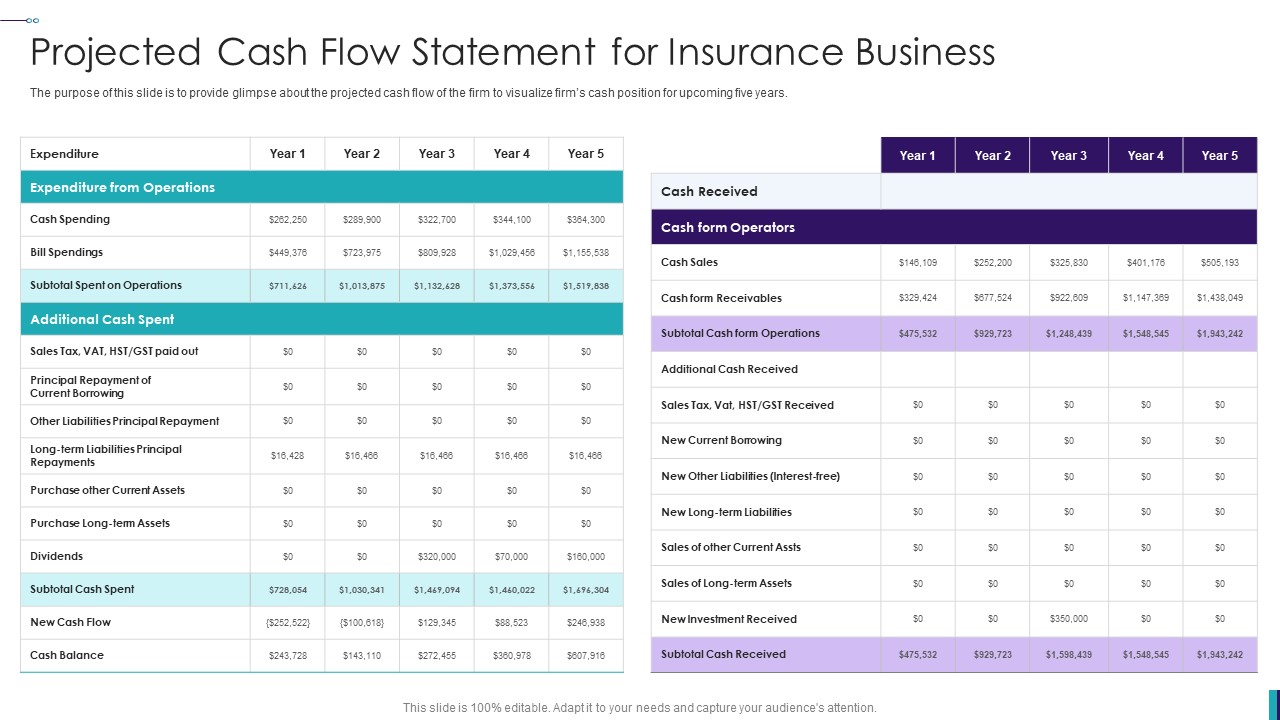

- Business Planning and Decision Making: Cash flow and revenue data provide valuable insights for business planning and decision making. They help in forecasting future financial needs, setting goals, and developing strategies to achieve them. For example, cash flow projections can determine the timing of investments, loan repayments, or new hires. Revenue analysis helps in identifying profitable products or services, target market segments, and potential areas for growth.

- Investor Confidence and Stakeholder Engagement: Cash flow and revenue are key factors that investors and stakeholders consider when evaluating a company’s financial performance. Positive cash flow demonstrates efficient financial management, providing assurance to investors and lenders about the company’s ability to meet its financial obligations. Similarly, revenue growth indicates market demand and business viability, attracting potential investors and fostering stakeholder engagement.

- Risk Assessment and Mitigation: By monitoring cash flow and revenue, businesses can identify potential risks and take proactive measures to mitigate them. For example, a decline in revenue may indicate market changes, competitive pressures, or operational inefficiencies. By analyzing cash flow trends, businesses can anticipate cash shortages and implement cost-cutting measures or alternative financing options to address financial challenges. Regular monitoring of cash flow and revenue allows businesses to stay agile and adapt their strategies to changing market conditions.

Overall, cash flow and revenue are essential metrics that provide valuable insights into a company’s financial health, stability, and growth potential. Monitoring and analyzing these metrics enable businesses to make informed decisions, effectively manage their financial resources, and navigate the dynamic and competitive business environment.

Factors Affecting Cash Flow and Revenue

Several factors can impact the cash flow and revenue of a business. These factors, both internal and external, play a significant role in determining the financial performance and profitability of a company. Understanding these factors is crucial for businesses to effectively manage their cash flow and revenue streams. Here are some key factors that can influence cash flow and revenue:

- Market Conditions: The overall economic conditions, industry trends, and consumer behavior have a direct impact on a company’s cash flow and revenue. For example, during a recession, consumer spending may decrease, resulting in lower sales revenue. Alternatively, favorable market conditions and increased demand can lead to higher revenue and positive cash flow.

- Price and Cost Structure: Pricing decisions and cost management directly affect both cash flow and revenue. Optimizing the pricing strategy can impact the sales volume and overall revenue. Additionally, effective cost control measures can help improve profitability and generate positive cash flow. Managing expenses, such as operational costs, raw material costs, and labor expenses, is crucial to maintaining a healthy cash flow and maximizing revenue.

- Customer and Supplier Relationships: The relationships with customers and suppliers can affect cash flow and revenue. Timely payments from customers positively impact cash flow, while delays or defaults can create cash flow constraints. Strong relationships with suppliers, including favorable payment terms, can help manage cash flow by optimizing inventory levels and negotiating better pricing, which can, in turn, positively impact revenue.

- Operational Efficiency: The efficiency of a company’s operations can impact both cash flow and revenue. Streamlining processes, reducing waste, and optimizing production and delivery schedules can improve operational efficiency and reduce costs. On the revenue side, operational efficiency can positively impact sales, customer satisfaction, and overall profitability.

- Financial Management and Funding: Effective financial management practices, including cash flow forecasting, managing working capital, and strategic financing decisions, can greatly influence cash flow and revenue. Adequate working capital management ensures smooth day-to-day operations and sufficient liquidity. Strategic funding decisions, such as capital investments or debt financing, can impact revenue by enabling growth opportunities or funding new ventures.

- Competition and Market Position: Competitive landscape and market position have a direct impact on both cash flow and revenue. Intense competition can lead to pricing pressures, affecting revenue generation. Maintaining a strong market position, building brand reputation, and offering differentiated products or services can contribute to revenue growth and profitability.

- Regulations and Compliance: Legal and regulatory requirements can affect cash flow and revenue. Compliance with tax obligations, financial reporting standards, and industry-specific regulations is essential to avoid penalties and maintain financial stability. Failure to comply with regulations can impact revenue through fines, legal expenses, or reputational damage.

It’s important for businesses to regularly assess and monitor these factors to effectively manage their cash flow and revenue streams. Understanding the interplay between these factors and implementing appropriate strategies can help businesses optimize their financial performance, adapt to market changes, and achieve long-term success.

Methods to Improve Cash Flow and Revenue

Improving cash flow and revenue is a top priority for businesses seeking financial stability and growth. Various strategies and methods can be implemented to enhance cash flow and increase revenue streams. Here are some effective methods to improve cash flow and revenue:

- Effective Cash Flow Management: Implementing sound cash flow management practices ensures that cash inflows and outflows are carefully monitored and controlled. This includes closely tracking accounts receivable and following up on late payments, negotiating favorable payment terms with suppliers, reducing unnecessary expenses, and optimizing inventory management to avoid overstocking or stockouts.

- Enhancing Pricing Strategies: A well-designed pricing strategy can have a significant impact on revenue. Conducting market research, understanding customer preferences, and analyzing competitor pricing can help determine the optimal price points. Employing dynamic pricing, bundling products and services, or offering discounts and promotions can increase sales volume and revenue.

- Expanding Customer Base: Actively seeking to attract new customers and expanding the customer base is vital for revenue growth. This can be achieved through targeted marketing campaigns, improving customer experience and satisfaction, offering referral programs, and leveraging digital marketing channels to reach a wider audience.

- Upselling and Cross-Selling: Encouraging existing customers to purchase additional products or services through upselling and cross-selling techniques can increase the average transaction value. This strategy can be implemented by offering complementary products, personalized recommendations, or loyalty programs that incentivize customers to spend more.

- Improving Operational Efficiency: Enhancing operational efficiency can lead to cost savings and increased revenue. This can be achieved through process optimization, automation, and streamlined workflows. Consolidating suppliers, negotiating better terms, and optimizing the supply chain can also lower costs and improve cash flow.

- Investing in Marketing and Sales: Allocating resources to marketing and sales activities can help generate leads, increase brand awareness, and drive revenue growth. This may involve investing in online advertising, social media campaigns, search engine optimization, attending industry events, or hiring skilled sales professionals.

- Developing New Products or Services: Continually innovating and introducing new products or services can expand revenue streams. Conducting market research, understanding customer needs, and staying ahead of industry trends can help identify potential opportunities to diversify offerings and cater to a wider customer base.

- Building Strong Customer Relationships: Fostering strong customer relationships and promoting customer loyalty can have a significant impact on revenue. Providing exceptional customer service, offering personalized experiences, and implementing loyalty programs or subscription models can increase repeat purchases and customer lifetime value.

- Exploring Partnerships and Collaborations: Collaborating with other businesses or forming strategic partnerships can open doors to new revenue streams. This can involve joint marketing initiatives, cross-promotions, co-branding, or licensing agreements that allow access to new markets or customer segments.

- Investing in Employee Training and Development: well-trained and motivated employees can contribute to both cash flow and revenue. Investing in employee training and development programs can enhance productivity, improve customer service, and ultimately drive higher sales and revenue.

It’s important for businesses to assess their unique circumstances and goals when implementing strategies to improve cash flow and revenue. Regular monitoring and adjustments to these methods, along with a commitment to ongoing improvement, can lead to sustained growth and financial success.

Conclusion

Cash flow and revenue are vital metrics that provide valuable insights into the financial health and performance of a business. While revenue represents the income generated from sales and services, cash flow reflects the movement of actual cash in and out of a business. Understanding the differences between cash flow and revenue is crucial for making informed decisions and assessing the overall financial stability and viability of a company.

Cash flow management is essential for maintaining adequate liquidity, managing expenses, and meeting financial obligations. Positive cash flow indicates that a company is generating more cash inflows than outflows, providing a strong foundation for growth and financial stability. On the other hand, revenue represents a company’s ability to generate income from its core operations, attracting investors, and showcasing market demand.

To improve cash flow and revenue, businesses can implement various strategies. Effective cash flow management, enhancing pricing strategies, expanding customer base, and improving operational efficiency are just a few methods that can positively impact cash flow and revenue. Investing in marketing and sales, offering new products or services, and building strong customer relationships are also effective approaches to drive revenue growth.

It’s important for businesses to regularly assess and monitor cash flow and revenue, considering external factors such as market conditions, competition, and regulatory requirements. By analyzing these metrics in conjunction with other financial indicators, businesses can make informed decisions, adapt to changing market dynamics, and achieve long-term financial success.

In conclusion, cash flow and revenue are critical aspects of a company’s financial landscape. They provide valuable insights into a company’s financial stability, growth potential, and ability to meet its obligations. By effectively managing cash flow and maximizing revenue streams, businesses can optimize their financial performance, withstand economic downturns, and drive long-term business success.