Home>Finance>Tax Deduction Definition: Standard Or Itemized?

Finance

Tax Deduction Definition: Standard Or Itemized?

Modified: February 21, 2024

Discover the difference between standard and itemized tax deductions in finance. Learn which deduction method may be right for you and maximize your tax savings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Tax Deductions: Standard or Itemized?

When it comes to filing your taxes, one of the key decisions you need to make is whether to take the standard deduction or choose to itemize. This decision can have a significant impact on your tax liability, so it’s important to understand the difference between these two deduction options. In this blog post, we’ll dive into the tax deduction definition for both standard and itemized deductions, helping you make an informed decision.

Key Takeaways:

- The standard deduction is a fixed amount set by the IRS that reduces your taxable income without the need for detailed documentation.

- Itemized deductions require you to provide specific documentation and receipts to claim deductions on eligible expenses, such as mortgage interest, medical expenses, and charitable donations.

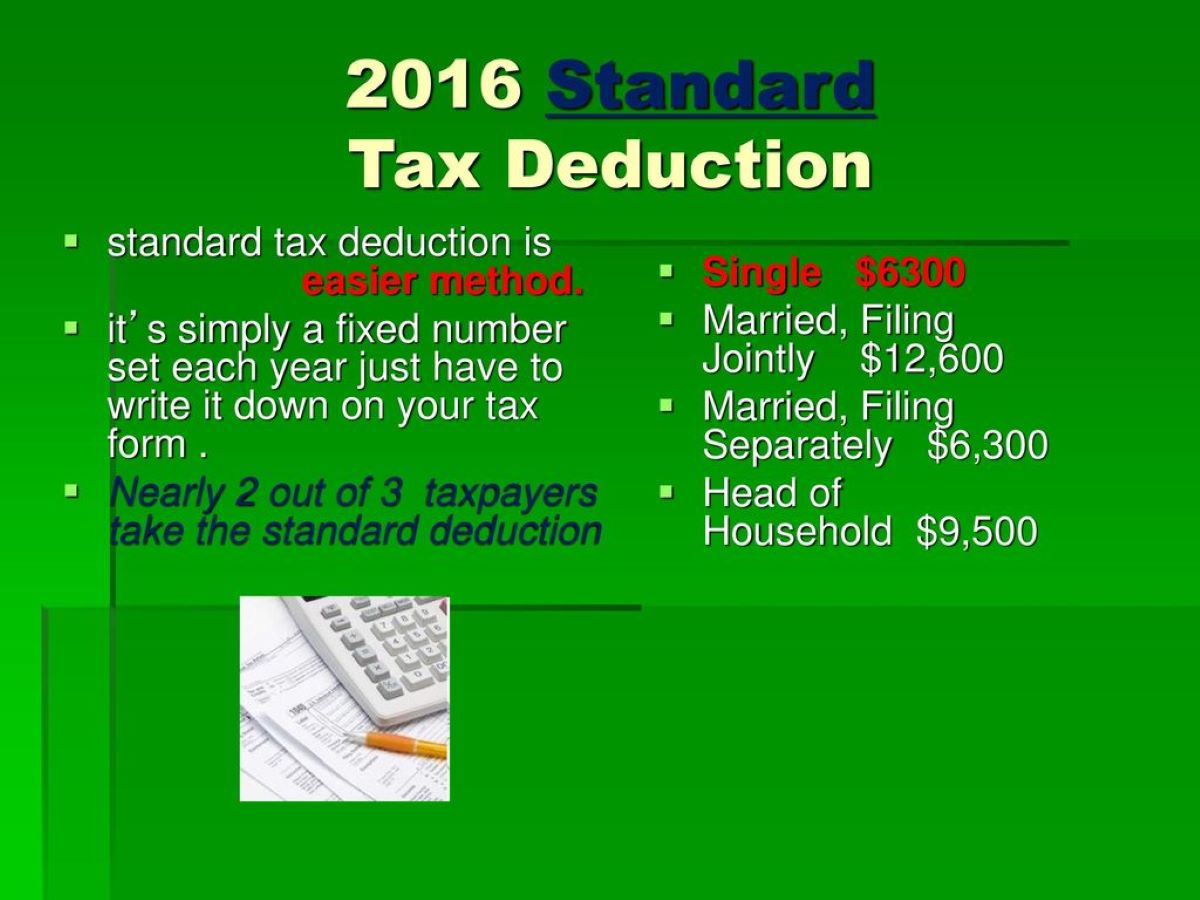

Standard Deduction

The standard deduction is a flat amount that the Internal Revenue Service (IRS) allows you to deduct from your taxable income. This deduction amount is predetermined by the IRS and varies depending on your filing status. The standard deduction is designed to simplify the tax filing process for those who do not have significant deductible expenses to itemize.

For the tax year 2021, the standard deduction amounts are as follows:

- $12,550 for single filers and married individuals filing separately

- $18,800 for heads of households

- $25,100 for married couples filing jointly

By taking the standard deduction, you automatically reduce your taxable income by the applicable amount. However, you will not be able to claim any additional deductions for expenses such as mortgage interest, real estate taxes, medical expenses, or charitable contributions.

Itemized Deductions

If your eligible expenses exceed the standard deduction amount or you have specific expenses that can be itemized, choosing to itemize may result in a higher deduction and potentially lower your taxable income. Itemized deductions require you to keep detailed records and provide specific documentation for each eligible expense.

Common itemized deductions include:

- Mortgage interest

- Real estate taxes

- State and local income taxes

- Medical and dental expenses

- Charitable contributions

- Unreimbursed employee expenses

It’s important to note that itemizing deductions can be more time-consuming and requires more record-keeping compared to taking the standard deduction. However, it may be worthwhile if your itemized deductions exceed the standard deduction amount, resulting in a higher reduction of your taxable income.

Which Deduction Option Should You Choose?

Deciding whether to take the standard deduction or itemize depends on your individual financial situation. Here are a few factors to consider:

- Level of eligible expenses: If your eligible expenses are relatively low and do not exceed the standard deduction amount, it may be more beneficial to take the standard deduction.

- Record-keeping and time commitment: Itemizing deductions requires more record-keeping and time commitment compared to taking the standard deduction. Consider whether you have the necessary documentation and are willing to invest the time to itemize.

- Capturing all eligible expenses: If you have significant eligible expenses, such as mortgage interest or medical expenses, itemizing may allow you to capture more deductions, potentially reducing your taxable income further.

It’s always a good idea to consult with a tax professional or use tax software to help you determine the best deduction option for your specific circumstances. They can provide personalized guidance based on your financial situation and help ensure you maximize your deductions while staying compliant with tax laws.

In Conclusion

Understanding the tax deduction options of standard and itemized deductions is crucial for optimizing your tax filing strategy. While the standard deduction is a simplified approach that many taxpayers choose, itemizing deductions can provide a higher reduction of taxable income for those with substantial eligible expenses.

Remember, each individual’s financial situation is unique, so it’s important to carefully evaluate your eligible expenses and consult with a professional when making your decision. By understanding these deduction options, you can ensure you make the most informed choices when filing your taxes.