Finance

What Are The Standard Tax Deductions For 2016

Published: January 20, 2024

Discover the standard tax deductions for 2016 and save more on your finances. Ensure you take advantage of all available deductions to maximize your tax savings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Standard Deductions Explained

- Standard Deduction for Single Filers

- Standard Deduction for Married Couples Filing Jointly

- Standard Deduction for Head of Household

- Standard Deduction for Married Couples Filing Separately

- Additional Standard Deductions for the Elderly and the Blind

- Standard Deduction for Trusts and Estates

- Conclusion

Introduction

When it comes to filing taxes, understanding the deductions available to you is crucial. One commonly utilized deduction is the standard deduction. The standard deduction is a fixed amount that reduces your taxable income, thereby lowering the overall amount of taxes you owe. It is an alternative to itemized deductions, which require you to track and report individual expenses.

The standard deduction is intended to simplify the tax filing process for many Americans. It provides a baseline deduction that is available to all taxpayers, regardless of their specific financial situation. The amount of the standard deduction can vary depending on your filing status, such as single, married filing jointly, head of household, or married filing separately.

Understanding the standard deduction is important because it directly impacts your tax liability. By taking the standard deduction, you reduce your taxable income, which in turn can lead to a lower tax bill. For many taxpayers, the standard deduction provides a significant benefit and may be the preferred option over itemizing deductions.

In this article, we will explore the standard deductions for the tax year 2016. We will break down the deduction amounts based on different filing statuses and discuss additional standard deductions for specific groups of taxpayers. By understanding the standard deduction for 2016, you can make more informed decisions when filing your taxes and potentially save money.

Standard Deductions Explained

The standard deduction is a fixed amount that reduces your taxable income without the need for itemizing individual expenses. It serves as an alternative to itemized deductions and is available to all taxpayers. The standard deduction aims to simplify the tax filing process by providing a baseline deduction that is easy to calculate and claim.

By taking the standard deduction, you essentially reduce the amount of income that is subject to taxation. This results in a lower taxable income and ultimately a lower tax liability. The standard deduction amounts are determined by the Internal Revenue Service (IRS) and can vary based on your filing status, age, dependents, and other factors.

The standard deduction for a particular tax year is not a one-size-fits-all amount. Instead, it is determined based on the taxpayer’s filing status. The most common filing statuses are:

- Single

- Married filing jointly

- Head of household

- Married filing separately

Each filing status has its own corresponding standard deduction amount. It’s important to note that taxpayers can only claim either the standard deduction or itemized deductions, not both. The standard deduction is usually beneficial for taxpayers who do not have significant qualifying expenses to itemize.

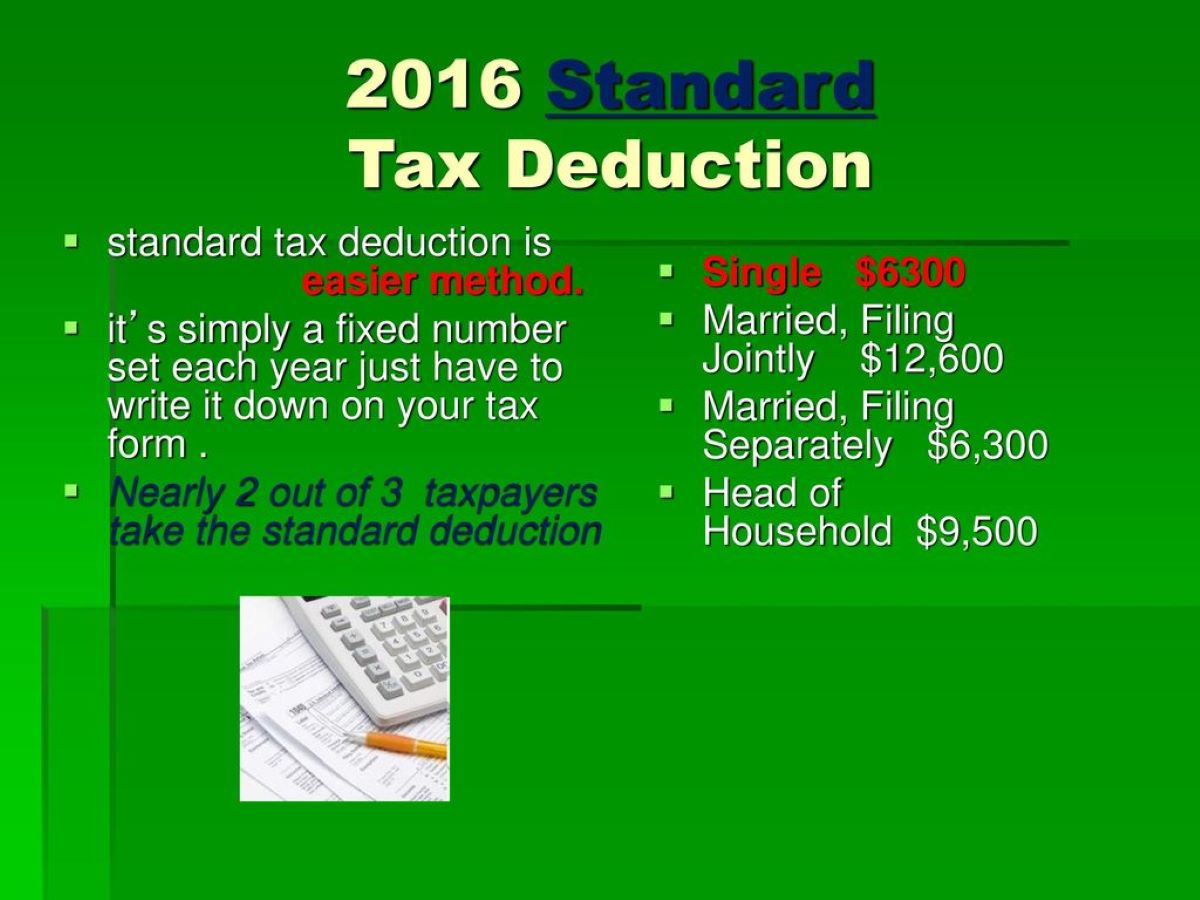

For the tax year 2016, the standard deduction amounts are as follows:

- Single: $6,300

- Married filing jointly: $12,600

- Head of household: $9,300

- Married filing separately: $6,300

These amounts are subject to change each tax year and are adjusted for inflation. It’s important to refer to the IRS guidelines for the specific tax year you are filing.

While the standard deduction is the most commonly claimed deduction, it’s worth mentioning that some taxpayers may still benefit from itemizing deductions. Itemizing deductions involves listing and totaling eligible expenses, such as mortgage interest, state and local taxes, medical expenses, and charitable contributions. To determine whether itemizing or taking the standard deduction is more advantageous for you, it’s recommended to consult with a tax professional or use tax software that can help you compare the two options based on your specific financial situation.

Standard Deduction for Single Filers

For individuals who file their taxes as single, the standard deduction for the tax year 2016 is $6,300. This means that if you choose to take the standard deduction, you can reduce your taxable income by $6,300.

Single filers are individuals who are not married or are legally separated according to their state’s laws. They do not qualify for any other filing status such as head of household or married filing jointly. The single filing status is often used by individuals who are unmarried or those who do not meet the criteria for other filing statuses.

Choosing to take the standard deduction as a single filer may be beneficial if your eligible itemized deductions do not exceed the standard deduction amount. It eliminates the need to track and report individual expenses, making the tax filing process simpler and faster.

However, it’s important to note that some individuals may still find it more advantageous to itemize their deductions if they have significant qualifying expenses. Examples of itemized deductions can include mortgage interest, state and local taxes paid, medical expenses, charitable donations, and more.

Before deciding whether to take the standard deduction or itemize deductions, it’s recommended that single filers carefully consider their eligible expenses and consult with a tax professional or use tax software to determine which option would result in the greatest tax savings.

Standard Deduction for Married Couples Filing Jointly

For married couples who choose to file their taxes jointly, the standard deduction for the tax year 2016 is $12,600. This means that if you and your spouse decide to take the standard deduction, you can reduce your taxable income by $12,600.

Filing jointly as a married couple has several advantages, including the ability to combine your incomes and potentially qualify for certain deductions and credits. The standard deduction for married couples filing jointly is generally higher than for single filers, as it takes into account the combined income and financial situation of both spouses.

By choosing to take the standard deduction, married couples filing jointly can simplify the tax filing process and avoid the need to itemize individual expenses. This can be beneficial if your eligible itemized deductions do not exceed the standard deduction amount.

However, it’s important to evaluate your specific financial circumstances before deciding whether to take the standard deduction or itemize deductions. Depending on your eligible expenses, such as mortgage interest, state and local taxes paid, medical expenses, and charitable donations, it may be more advantageous to itemize deductions and potentially lower your tax liability even further.

It’s recommended that married couples consult with a tax professional or use tax software to compare the benefits of taking the standard deduction versus itemizing deductions. By carefully considering your eligible expenses and maximizing your deductions, you can optimize your tax savings and potentially reduce the amount you owe.

Standard Deduction for Head of Household

For taxpayers who qualify as head of household, the standard deduction for the tax year 2016 is $9,300. This means that if you meet the criteria for head of household status and choose to take the standard deduction, you can reduce your taxable income by $9,300.

The head of household filing status is available to individuals who are unmarried, or considered unmarried for tax purposes, and have paid more than half the cost of maintaining a home for themselves and a dependent. This filing status is often used by single parents or individuals who are financially responsible for supporting dependents.

Choosing to take the standard deduction as a head of household may be advantageous if your eligible itemized deductions do not exceed the standard deduction amount. It simplifies the tax filing process and eliminates the need to track and report individual expenses.

However, it’s important to evaluate your specific financial circumstances before deciding whether to take the standard deduction or itemize deductions. Depending on your eligible expenses, such as mortgage interest, state and local taxes paid, medical expenses, and charitable donations, it may be more beneficial to itemize deductions and potentially lower your tax liability even further.

As a head of household, it’s crucial to accurately determine your qualifying expenses and consult with a tax professional or use tax software to compare the benefits of taking the standard deduction versus itemizing deductions. By carefully considering your eligible expenses and maximizing your deductions, you can optimize your tax savings and potentially reduce the amount you owe.

Standard Deduction for Married Couples Filing Separately

For married couples who choose to file their taxes separately, the standard deduction for each spouse for the tax year 2016 is $6,300. This means that if you and your spouse decide to take the standard deduction, you can each reduce your taxable income by $6,300.

Filing separately as a married couple can have certain advantages, such as maintaining separate finances or reducing liability for any errors or mistakes made by your spouse. However, it’s important to note that the standard deduction for married couples filing separately is generally lower compared to filing jointly or as head of household.

Choosing to take the standard deduction as a married couple filing separately may be beneficial if your eligible itemized deductions do not exceed the standard deduction amount for each spouse. It simplifies the tax filing process and eliminates the need to itemize individual expenses.

However, it’s important to carefully evaluate your specific financial circumstances before deciding whether to take the standard deduction or itemize deductions. Depending on your eligible expenses, such as mortgage interest, state and local taxes paid, medical expenses, and charitable donations, it may be more advantageous to itemize deductions and potentially lower your tax liability further.

Keep in mind that if one spouse chooses to itemize deductions, the other spouse must also itemize and cannot take the standard deduction. Therefore, it’s essential to consider the overall financial impact for both spouses when making this decision.

Consulting with a tax professional or using tax software can help you analyze the benefits of taking the standard deduction versus itemizing deductions for married couples filing separately. By carefully considering your eligible expenses and maximizing your deductions, you can make an informed decision that optimizes your tax savings and potentially reduces the amount you owe.

Additional Standard Deductions for the Elderly and the Blind

In addition to the standard deduction amounts mentioned previously, there are additional standard deductions available for elderly individuals and those who are blind. These additional deductions aim to provide further tax relief for individuals who may have unique financial circumstances or special needs.

For taxpayers who are 65 years of age or older, they may be eligible for an additional standard deduction. For the tax year 2016, the additional standard deduction amount for individuals who are 65 or older is $1,550. This means that if you meet the age criteria and choose to take the additional standard deduction, you can further reduce your taxable income by $1,550.

In addition to the age-based additional standard deduction, taxpayers who are blind may also qualify for an additional deduction. The additional standard deduction for blindness is the same amount as the additional deduction for individuals who are 65 or older, which is $1,550.

It’s important to note that these additional standard deductions are per individual. Therefore, if both spouses meet the age or blindness criteria, they can each claim the additional standard deduction.

Qualifying for the additional standard deductions for the elderly and the blind is determined by specific criteria set by the IRS. The IRS considers an individual to be blind if their central visual acuity does not exceed 20/200 in the better eye with corrective lenses, or if they have a field of vision that is limited to 20 degrees or less.

To claim the additional standard deductions for the elderly and the blind, you must indicate your eligibility on your tax return. This can be done by checking the appropriate boxes or providing the necessary information in the designated sections of your tax form.

By taking advantage of these additional standard deductions, eligible taxpayers can further reduce their taxable income and potentially lower their tax liability. It’s recommended to consult with a tax professional or use tax software to ensure that you are correctly claiming all eligible deductions and maximizing your tax savings.

Standard Deduction for Trusts and Estates

Trusts and estates, just like individuals, are also eligible for a standard deduction. The standard deduction for trusts and estates for the tax year 2016 is $630. This deduction helps reduce the taxable income of a trust or estate, thereby reducing the overall amount of taxes owed.

A trust is a legal entity that holds assets for the benefit of beneficiaries, while an estate refers to the assets and liabilities left behind after an individual’s death. Both trusts and estates are subject to tax obligations, and claiming the standard deduction can help to minimize their tax liability.

It’s worth noting that the standard deduction for trusts and estates is typically much lower than the standard deduction for individuals. This is because trusts and estates have specific tax rules and considerations that distinguish them from individual taxpayers.

Trusts and estates also have the option to itemize deductions if their eligible expenses exceed the standard deduction amount. Just like individuals, itemized deductions can include expenses such as mortgage interest, state and local taxes paid, medical expenses, and charitable donations.

When determining whether to take the standard deduction or itemize deductions, trustees or executors of trusts and estates should consider the specific financial circumstances and expenses associated with the trust or estate. It may be beneficial to consult with a tax professional or use tax software to assess which option would result in the greatest tax savings.

It’s important to accurately report and document all income and expenses related to the trust or estate when filing taxes. This includes properly tracking and reporting assets, distributions to beneficiaries, and any other financial transactions relevant to the trust or estate.

By taking advantage of the standard deduction or properly itemizing deductions, trusts and estates can optimize their tax savings and ensure compliance with tax laws and regulations.

Conclusion

Understanding the standard deductions for different filing statuses is essential for maximizing your tax savings and reducing your overall tax liability. The standard deduction serves as a baseline deduction that is available to all taxpayers and provides a simplified alternative to itemizing individual expenses.

In this article, we have explored the standard deductions for the tax year 2016. We have discussed the deduction amounts for single filers, married couples filing jointly, head of household, and married couples filing separately. Additionally, we have highlighted the additional standard deductions available for the elderly and the blind.

When deciding whether to take the standard deduction or itemize deductions, it’s important to carefully evaluate your specific financial situation. Consider factors such as eligible expenses, income sources, age, and filing status to determine the best approach for minimizing your tax liability.

For many taxpayers, the standard deduction provides a convenient and advantageous option. It simplifies the tax filing process and eliminates the need to track and report individual expenses. However, for some individuals with significant qualifying expenses, itemizing deductions may result in greater tax savings.

It’s recommended to consult with a tax professional or use tax software to ensure that you are properly claiming all available deductions and maximizing your tax savings. These resources can guide you through the decision-making process and help you understand the potential benefits of taking the standard deduction versus itemizing deductions.

By utilizing the standard deduction or itemizing deductions effectively, you can ensure compliance with tax laws and regulations while optimizing your tax savings. Stay informed about any changes to the standard deduction amounts in future years to make informed decisions when filing your taxes.

Remember that while tax deductions can provide significant benefits, it’s crucial to keep accurate records and file your taxes correctly. By doing so, you can streamline the tax filing process, minimize errors, and maximize your potential tax savings.