Finance

What Is The Standard IRS Deduction For 2016?

Modified: February 21, 2024

Find out the standard IRS deduction for 2016 in the world of finance. Stay informed and maximize your tax benefits.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of IRS Deduction

- Importance of Standard IRS Deduction

- Changes in Standard IRS Deduction for 2016

- Calculation of Standard IRS Deduction for Different Filing Status

- Impact of Standard IRS Deduction on Tax Liability

- Considerations for Itemizing Deductions instead of Taking the Standard Deduction

- Conclusion

Introduction

When it comes to filing taxes, every taxpayer wants to ensure they maximize their deductions to reduce their overall tax liability. One essential aspect of tax deductions is the Standard IRS Deduction. Understanding what it is and how it applies to your tax return can help you make informed financial decisions and optimize your tax strategy.

The Standard IRS Deduction is a predetermined amount set by the Internal Revenue Service (IRS) that reduces your taxable income. It serves as an alternative to itemizing individual deductions such as mortgage interest, medical expenses, and charitable donations. The purpose of the standard deduction is to simplify the tax filing process, especially for individuals who may not have substantial itemized deductions.

It is crucial to note that the standard deduction is not a fixed amount for all taxpayers. The IRS calculates and updates the standard deduction each year to account for inflation and changes in the tax code. Therefore, it is essential to stay up-to-date with current deduction rates to accurately estimate your tax liability.

The standard deduction can significantly impact your tax liability, as it directly reduces your taxable income. By taking the standard deduction, you essentially lower the amount of income subject to taxation. This means you can potentially owe less in taxes or even receive a higher tax refund.

However, it is essential to evaluate whether it is more beneficial for you to take the standard deduction or itemize your deductions. This decision depends on your financial situation, eligible deductions, and filing status. By understanding the standard deduction and its implications, you can make an informed choice that optimizes your tax savings.

In this article, we will explore the standard IRS deduction for the year 2016. We will discuss the changes in the standard deduction, how it is calculated for different filing statuses, and the impact it can have on your tax liability. Additionally, we will consider the factors you should evaluate when deciding whether to take the standard deduction or itemize your deductions on your tax return.

Definition of IRS Deduction

The Standard IRS Deduction is a predetermined amount set by the Internal Revenue Service (IRS) that reduces your taxable income. It is essentially a flat-dollar reduction that can be claimed if you choose not to itemize your deductions. The purpose of the standard deduction is to simplify the tax filing process and provide a baseline deduction for taxpayers.

Unlike itemized deductions, which require you to track and report specific expenses, the standard deduction is a universal dollar amount that varies depending on your filing status. It serves as an alternative for individuals who may not have significant deductible expenses, making it easier and more efficient to calculate their tax liability.

By taking the standard deduction, you reduce your taxable income by a fixed amount, resulting in a lower overall tax burden. The exact amount of the standard deduction is determined by the IRS and is subject to change each year. It is important to note that the standard deduction is subtracted from your adjusted gross income (AGI) to calculate your taxable income.

It is worth mentioning that the standard deduction is available to anyone who files a tax return, regardless of whether they have any qualifying expenses. However, if you are eligible for certain tax credits, taking the standard deduction may affect your eligibility or the amount of credit you can claim. Therefore, it is important to consider all relevant factors and consult with a tax professional or utilize tax software to determine the most advantageous deduction strategy for your specific situation.

Overall, the standard IRS deduction is a valuable tool that simplifies the tax filing process and provides a basic deduction for taxpayers. By taking advantage of the standard deduction, you can lower your taxable income and potentially decrease your overall tax liability.

Importance of Standard IRS Deduction

The Standard IRS Deduction plays a vital role in the tax filing process, offering several key benefits for taxpayers. Understanding the importance of the standard deduction can help you make informed decisions when planning your tax strategy. Here are some of the primary reasons why the standard deduction is important:

1. Simplifies the Tax Filing Process: One of the significant advantages of the standard deduction is that it simplifies tax filing for many individuals. Rather than keeping track of and itemizing specific expenses, taxpayers can opt for the standard deduction to quickly and easily reduce their taxable income. This simplification saves time, effort, and potential headaches during tax season.

2. Universal Deduction: The standard deduction is available to all taxpayers who file a tax return, regardless of their income level or expenses. This universal nature of the deduction ensures that everyone receives a baseline reduction in their taxable income, regardless of their financial situation.

3. Saves Time and Effort: Determining whether to itemize deductions or take the standard deduction can be a complex decision. However, for many taxpayers, the standard deduction provides a straightforward and time-saving option. It eliminates the need to collect and organize receipts and documentation for various deductible expenses.

4. Helps Those without Significant Deductions: The standard deduction proves especially beneficial for individuals who do not have substantial itemized deductions. It provides a guaranteed deduction amount that reduces their taxable income, ensuring they still receive a tax benefit even if they do not have significant qualifying expenses.

5. Reduces Tax Liability: By lowering your taxable income, the standard deduction directly reduces your overall tax liability. The deduction amount is subtracted from your adjusted gross income (AGI), resulting in a lower taxable income and potentially reducing the amount you owe in taxes. In some cases, it can even push you into a lower tax bracket, resulting in additional tax savings.

6. Increased Tax Refund: For eligible taxpayers, taking the standard deduction can result in a higher tax refund. If your taxable income is lower due to the standard deduction, you may be eligible for certain tax credits or a larger refund. This can provide a financial boost and help offset other financial obligations or savings goals.

7. Consistent Deduction Amount: The standard deduction offers predictability as the deduction amount is predetermined by the IRS each year. This stability allows taxpayers to plan their finances and budget accordingly, knowing that they have a set deduction amount that will reduce their taxable income.

In summary, the standard IRS deduction is essential for simplifying the tax filing process, providing a universal deduction for all taxpayers, and reducing tax liability. It offers numerous benefits, such as time-saving, increased tax refund potential, and consistent deduction amounts. Understanding the importance of the standard deduction can empower you to make informed decisions and optimize your tax strategy.

Changes in Standard IRS Deduction for 2016

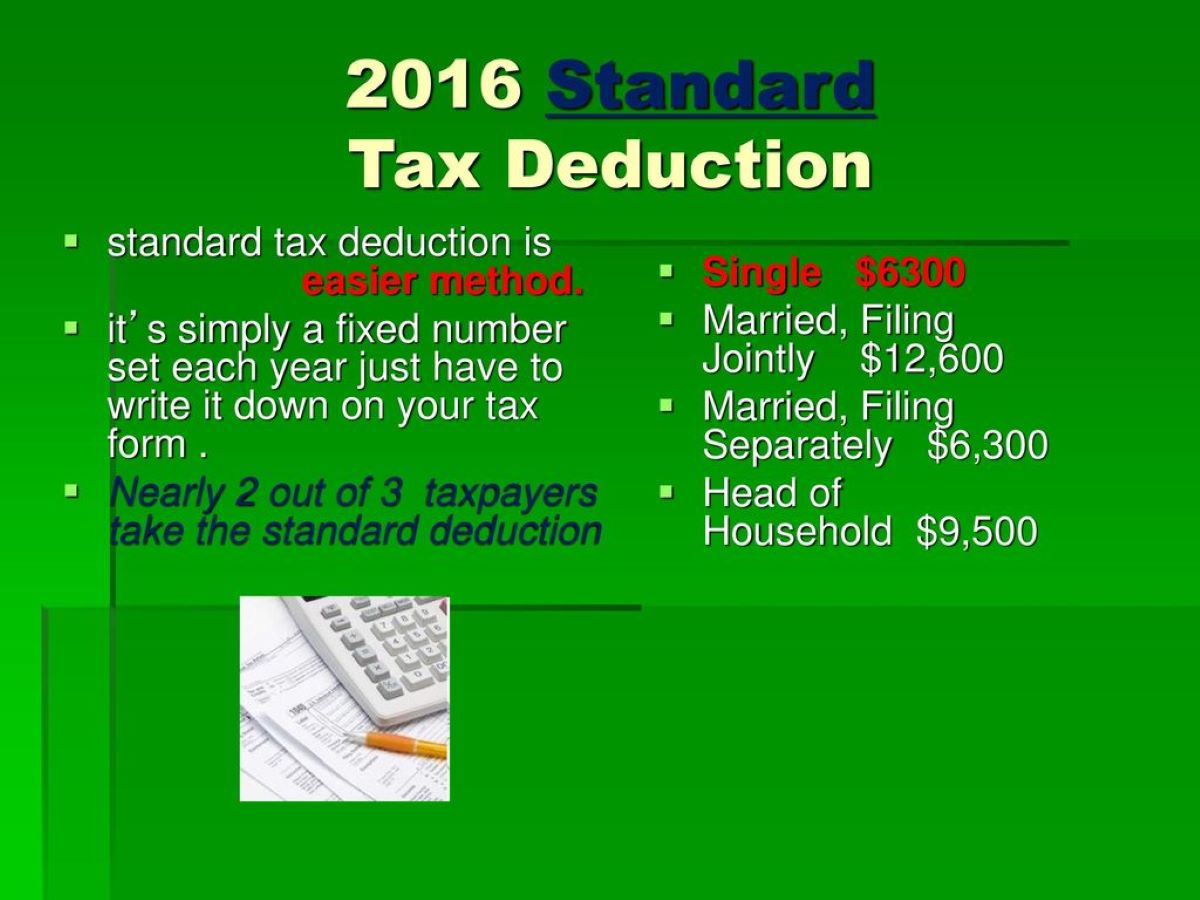

In 2016, the IRS made several changes to the standard deduction amounts, which affected taxpayers filing their tax returns for that year. It is essential to be aware of these changes to ensure you accurately calculate your taxable income and take advantage of the available deductions. Here are the key changes in the standard IRS deduction for 2016:

1. Increased Deduction Amount: The standard deduction amounts for 2016 increased compared to the previous year. This adjustment aimed to account for inflation and rising costs of living. The increase provided taxpayers with a larger deduction, reducing their taxable income even further.

2. Different Deduction Amounts for Different Filing Status: The IRS sets different standard deduction amounts based on the taxpayer’s filing status. In 2016, the standard deduction amounts were as follows:

- Single filers and married individuals filing separately: $6,300

- Married couples filing jointly: $12,600

- Head of household: $9,300

- Qualifying widow(er) with dependent child: $12,600

It is important to note that these figures are for the tax year 2016. The standard deduction amounts may change each subsequent year due to inflation and other factors.

3. Additional Deduction for Individuals Over 65 or Blind: For individuals aged 65 or older or blind, an additional standard deduction was available. The additional amount for 2016 was $1,550 for single taxpayers or head of household and $1,250 for married individuals filing jointly or separately.

4. Limitations for Dependents and Individuals Claimed as Dependents: In 2016, if you could be claimed as a dependent on someone else’s tax return, there were limitations on the standard deduction you could claim. The deductions were limited to the greater of $1,050 or your earned income plus $350, not exceeding the regular standard deduction amount for your filing status.

5. Different Rules for Nonresident Aliens: Nonresident aliens were subject to different standard deduction rules in 2016. The amount generally depended on their residency status, their income source, and any tax treaty benefits. It is important for nonresident aliens to consult the IRS guidelines or a tax professional to determine their applicable standard deduction.

These changes in the standard IRS deduction for the tax year 2016 provided taxpayers with increased deduction amounts, allowing them to reduce their taxable income and potentially lower their tax liability. It is essential to refer to the specific IRS guidelines and consult with a tax professional to ensure you accurately calculate and claim the appropriate standard deduction for your individual tax situation.

Calculation of Standard IRS Deduction for Different Filing Status

The standard IRS deduction varies depending on an individual’s filing status. The filing status determines tax rates, eligibility for certain tax benefits, and the amount of the standard deduction. It is essential to understand how the standard deduction is calculated for each filing status to accurately determine your taxable income. Here is a breakdown of the standard deduction calculation for different filing statuses:

1. Single: For single individuals or those who are married but filing separately, the standard deduction for 2016 was $6,300. This means that their taxable income is reduced by $6,300 before determining the applicable tax rate.

2. Married Filing Jointly: For married couples who choose to file a joint tax return, the standard deduction for 2016 was $12,600. This amount is double that of the single filing status, providing married couples with a higher deduction for their combined income.

3. Head of Household: The head of household filing status is available for individuals who are unmarried but have dependents. For the tax year 2016, the standard deduction for head of household filers was $9,300. This filing status allows individuals to claim a higher deduction due to their responsibility for supporting dependents.

4. Qualifying Widow(er) with Dependent Child: This filing status is applicable to individuals who have lost their spouse and have a dependent child. For 2016, the standard deduction amount for qualifying widow(er)s with a dependent child was $12,600. This status provides a higher deduction similar to married couples filing jointly.

It is essential to note that the standard deduction amounts mentioned above are specific to the tax year 2016. The IRS adjusts these figures annually to account for inflation and changes in the tax code. Therefore, it is crucial to consult the latest IRS guidelines for the most accurate and up-to-date standard deduction amounts.

Additionally, it is important to remember that if you are eligible for certain tax credits or have qualifying deductions that exceed the standard deduction amount, it may be more beneficial for you to itemize your deductions rather than take the standard deduction. This involves tracking and reporting specific expenses such as mortgage interest, medical expenses, and charitable contributions.

Understanding the calculation of the standard IRS deduction for different filing statuses is essential for accurately determining your taxable income and optimizing your tax strategy. By leveraging the appropriate standard deduction based on your filing status, you can lower your taxable income and potentially reduce your overall tax liability.

Impact of Standard IRS Deduction on Tax Liability

The standard IRS deduction has a significant impact on an individual’s tax liability. By reducing the taxable income, it directly affects the amount of tax owed or the size of the tax refund. Understanding the impact of the standard deduction can help taxpayers make informed decisions and optimize their tax planning. Here are the key ways the standard IRS deduction influences tax liability:

1. Reduction of Taxable Income: The primary impact of the standard deduction is that it lowers the taxpayer’s taxable income. By subtracting the standard deduction amount from the adjusted gross income (AGI), the resulting taxable income is reduced. This reduction directly affects the tax rate applied to the income, resulting in a lower tax liability.

2. Lower Tax Bracket: The standard deduction can potentially push taxpayers into a lower tax bracket. As the taxable income is reduced, individuals may find themselves in a lower tax bracket, subject to a lower tax rate. This can result in significant tax savings and a lower overall tax bill.

3. Decreased Tax Liability: The standard deduction directly reduces the tax liability. The lower the taxable income, the less tax that needs to be paid. By leveraging the standard deduction, taxpayers can decrease the amount owed to the government, freeing up funds for other financial goals or expenses.

4. Increased Tax Refund: For eligible taxpayers, taking the standard deduction can lead to a larger tax refund. If the standard deduction lowers the taxable income to such an extent that it exceeds the taxes withheld throughout the year, taxpayers may be entitled to a refund. This can provide a financial boost and potentially be used for savings, debt repayment, or other financial needs.

5. Equal Benefit for All Taxpayers: Unlike itemized deductions, which vary based on individual circumstances and eligible expenses, the standard deduction provides a consistent benefit to all taxpayers. It ensures that everyone receives a predetermined reduction in their taxable income, regardless of their financial situation or specific deductions.

6. Considerations for Alternative Deduction Strategies: While the standard deduction is a valuable tool for many taxpayers, it is essential to consider alternative deduction strategies. For individuals with substantial eligible expenses, such as mortgage interest or medical expenses, itemizing deductions may result in greater tax savings. Evaluating each taxpayer’s specific situation and comparing the standard deduction to itemized deductions is crucial to optimize tax liability.

In summary, the standard IRS deduction has a significant impact on tax liability by reducing taxable income, potentially lowering tax brackets, decreasing tax liability, and increasing tax refunds. It provides a consistent benefit for all taxpayers and serves as a valuable deduction option. However, it is essential to carefully evaluate individual circumstances and consider alternative deduction strategies to ensure optimized tax planning and minimal tax liability.

Considerations for Itemizing Deductions instead of Taking the Standard Deduction

While the standard deduction is a convenient and straightforward option for reducing taxable income, some taxpayers may benefit more from itemizing deductions. Itemizing deductions involves keeping track of and reporting specific expenses, such as mortgage interest, medical expenses, state and local taxes, and charitable contributions. Here are some key considerations for itemizing deductions instead of taking the standard deduction:

1. Higher Deductible Expenses: If you have significant deductible expenses that exceed the standard deduction amount, it may be more advantageous to itemize deductions. This is especially true for homeowners with large mortgage interest payments, individuals with substantial medical expenses, or those who make sizable charitable contributions. By itemizing these deductions, you can potentially lower your taxable income more effectively than by taking the standard deduction.

2. Married Filing Separately: In some cases, married individuals filing separately may benefit from itemizing deductions instead of taking the standard deduction. This can apply if one spouse has high deductible expenses, such as significant medical costs, that would not exceed the standard deduction amount when filing jointly.

3. State and Local Taxes: Itemizing deductions allows you to deduct state and local taxes paid throughout the year. If you live in a state with high income taxes or property taxes, itemizing deductions might result in greater tax savings than the standard deduction.

4. Charitable Contributions: Individuals who make substantial charitable donations can often benefit from itemizing deductions. By tracking and reporting these contributions, taxpayers can deduct the full amount, potentially resulting in significant tax savings. However, it is important to keep proper documentation and adhere to IRS guidelines for deducting charitable contributions.

5. Homeownership: Homeowners may find itemizing deductions more advantageous due to the deduction of mortgage interest and property taxes. These expenses can be substantial, especially in the early years of homeownership when mortgage interest payments are higher.

6. Alternative Minimum Tax (AMT): The alternative minimum tax is a separate tax calculation method that limits certain deductions and credits. Taxpayers subject to AMT may find that itemizing deductions instead of taking the standard deduction does not provide significant tax benefits. It is crucial to consult with a tax professional if you are subject to AMT to determine the best deduction strategy.

7. Documentation and Record Keeping: When itemizing deductions, it is important to maintain proper documentation and records to substantiate your expenses. This includes keeping receipts, invoices, and other supporting documentation. Proper record-keeping is essential in case of an IRS audit or request for verification of deductions.

Itemizing deductions requires more effort and attention to detail compared to taking the standard deduction. However, for individuals with substantial deductible expenses, it can result in significant tax savings and lower overall tax liability. It is important to evaluate your individual situation, consider your eligible deductions, and consult with a tax professional to determine whether itemizing deductions is more advantageous than taking the standard deduction.

Conclusion

The standard IRS deduction is a valuable tool for reducing taxable income and optimizing tax liability. It simplifies the tax filing process, providing a universal deduction for all taxpayers. However, it is essential to consider your individual circumstances and evaluate whether itemizing deductions may result in greater tax savings.

Understanding the standard deduction and its impact on tax liability is crucial for making informed financial decisions. By leveraging the standard deduction, you can lower your taxable income, potentially decrease your overall tax liability, and even receive a larger tax refund.

However, for individuals with substantial deductible expenses, such as mortgage interest, medical costs, state and local taxes, or significant charitable contributions, itemizing deductions may offer greater tax benefits. By carefully tracking and reporting these expenses, you can potentially lower your taxable income more effectively than by taking the standard deduction alone.

It is important to stay updated with the current standard deduction rates, as they are subject to change each year. Consulting IRS guidelines, using tax software, or seeking professional tax advice can help ensure you accurately calculate and claim the appropriate deduction for your filing status.

In conclusion, understanding the standard IRS deduction and its implications empowers you to make informed choices when planning your tax strategy. Whether you decide to take the standard deduction or itemize deductions, the key is to optimize your tax savings while complying with tax laws and regulations.

By staying informed, understanding your eligible deductions, and seeking professional guidance when necessary, you can navigate the tax landscape and make the most of the available deductions to minimize your tax liability and maximize your financial well-being.