Home>Finance>Under Which Circumstance Would Someone Need Disability Insurance?

Finance

Under Which Circumstance Would Someone Need Disability Insurance?

Modified: December 30, 2023

Considering the importance of financial stability, find out when individuals should consider having disability insurance as a crucial aspect of their financial planning.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Disability Insurance

- When and Why You May Need Disability Insurance

- Types of Disabilities Covered by Disability Insurance

- The Importance of Disability Insurance for Different Professions

- Factors to Consider When Choosing Disability Insurance

- Disability Insurance vs. Workers’ Compensation: What’s the Difference?

- How to File a Disability Insurance Claim

- Common Mistakes to Avoid When Applying for Disability Insurance

- Conclusion

Introduction

Disability insurance is a vital financial tool that provides protection and peace of mind in case of unexpected circumstances. It serves as a safety net, offering financial assistance to individuals who are unable to work due to an illness or injury. While many people assume that disability insurance is only relevant for high-risk professions or individuals with pre-existing conditions, the truth is that disability insurance can be valuable for anyone. This article aims to shed light on disability insurance, its importance, and the circumstances under which someone may need it.

Life can be unpredictable, and accidents or illnesses can occur at any time. Whether it’s a car accident, a disabling medical condition, or a serious injury that prevents you from working, disability insurance can provide essential financial support during these challenging times. It’s essential to understand that disability insurance isn’t just for those who engage in physically demanding jobs; it’s relevant to anyone who relies on their income to support themselves and their loved ones.

By having disability insurance in place, you are proactively protecting your financial well-being, allowing you to focus on recovery and rehabilitation without the added stress of financial hardship. Disability insurance can help cover expenses such as mortgage payments, medical bills, utility bills, and daily living expenses, ensuring that you can maintain a basic standard of living even if you are unable to work for a period of time.

Many individuals mistakenly assume that they are already covered for disabilities through workers’ compensation or government programs. While workers’ compensation may provide coverage for work-related injuries or illnesses, it may not offer the same protection for non-work-related disabilities. Government programs such as Social Security Disability Insurance (SSDI) may also have strict eligibility criteria and limitations, leaving individuals with insufficient coverage.

Understanding the nuances of disability insurance and when you may need it can empower you to make informed decisions about your financial protection. This article will explore the different types of disabilities covered by disability insurance, examine the importance of disability insurance for various professions, and provide insights into factors to consider when choosing a disability insurance policy. Additionally, it will differentiate disability insurance from workers’ compensation and offer guidance on how to file a disability insurance claim and avoid common application mistakes.

By the end of this article, you will have a comprehensive understanding of disability insurance and be better equipped to determine if it is a suitable option for your unique circumstances.

Understanding Disability Insurance

Disability insurance is a type of insurance that provides income protection in the event that an individual becomes unable to work due to a disability. It is designed to replace a portion of the individual’s income, typically around 60-80%, thereby helping to cover essential living expenses. Disability insurance can be obtained through an employer-sponsored plan or purchased independently from an insurance provider.

There are two main types of disability insurance: short-term disability (STD) and long-term disability (LTD). Short-term disability insurance provides coverage for a limited period, typically ranging from a few weeks to a few months. It is intended to support individuals who are temporarily unable to work due to a shorter-term illness or injury, such as a surgery or recovery from an accident.

On the other hand, long-term disability insurance offers coverage for an extended duration, often up to several years or until the individual reaches retirement age. It provides financial protection for individuals who experience a more severe disability or chronic illness that prevents them from working for an extended period of time.

Disability insurance policies vary in their terms and conditions, including the definition of disability, waiting periods, and benefit periods. The definition of disability is a crucial factor to consider when choosing a policy. Some policies have a stricter definition that requires the individual to prove they are unable to perform any occupation, while others have a more lenient definition that considers the person’s ability to perform their specific job.

Waiting periods, also known as elimination periods, refer to the time period an individual must wait before they become eligible for benefits after becoming disabled. The waiting period can range from a few days to several weeks, and the length of the waiting period can affect the cost of the policy. The benefit period, on the other hand, refers to how long the insurance company will pay benefits if the insured remains disabled. Benefit periods can range from a few years to the insured’s full lifetime.

It’s important to note that disability insurance policies may have exclusions for certain conditions or injuries, and pre-existing conditions may also impact the coverage. Therefore, it is crucial to thoroughly review the terms and conditions of a disability insurance policy before purchasing it to ensure that it suits your specific needs and circumstances.

Disability insurance can be an invaluable form of protection, providing financial security and peace of mind in the face of unexpected events. By understanding the basics of disability insurance, you can make informed decisions about your insurance coverage and take proactive steps to safeguard your financial well-being in the event of a disability.

When and Why You May Need Disability Insurance

Disability insurance is not something you think about until you need it, but the reality is that anyone can find themselves in a situation where they are unable to work due to a disability. It is essential to consider disability insurance when planning for your financial future to ensure that you are protected in case the unexpected happens.

There are several circumstances in which disability insurance can be crucial:

1. Injuries and Accidents:

Accidents can happen at any time, and they can have a significant impact on your ability to work. If you are involved in a car accident, suffer a severe fall, or experience any other traumatic event that causes a disability, disability insurance can provide the financial support you need during your recovery period.

2. Illnesses and Medical Conditions:

Medical conditions and illnesses can arise suddenly, leaving you unable to work. Whether it’s a chronic illness, a life-altering diagnosis, or a debilitating condition, disability insurance can help replace your lost income and cover your expenses while you focus on treatment and recovery.

3. Job-Related Risks:

While certain professions come with inherent risks, anyone can experience a work-related injury or illness. Whether you work in construction, healthcare, or even an office environment, accidents or occupational hazards can occur. Disability insurance can provide financial protection in case you are unable to work due to a workplace injury or illness.

4. Pre-existing Conditions:

If you have pre-existing medical conditions, you may be at a higher risk of experiencing a disability. Disability insurance can ensure that you have financial support in case your condition worsens and affects your ability to work.

5. Protection for Your Dependents:

If you have dependents who rely on your income, disability insurance becomes even more critical. It helps you meet their financial needs and maintain their standard of living, even if you are unable to work for an extended period.

By having disability insurance in place, you are safeguarding your financial future and protecting yourself and your loved ones from potential financial hardship. It offers peace of mind and ensures that you can meet your financial obligations and maintain a certain quality of life, even in challenging circumstances.

It is essential to purchase disability insurance when you are healthy and working, as it can be difficult or expensive to obtain coverage once a disability occurs or if you have pre-existing conditions. By planning ahead and securing disability insurance, you are taking a proactive step to mitigate the financial risks associated with a disability.

Remember, no one is immune to the possibility of a disability. By investing in disability insurance, you are investing in your financial well-being and ensuring that you have the support you need when you need it the most.

Types of Disabilities Covered by Disability Insurance

Disability insurance aims to provide financial protection for individuals who are unable to work due to a disability. The types of disabilities covered by disability insurance can vary depending on the policy, but they generally fall into the following categories:

1. Physical Disabilities:

Physical disabilities refer to impairments that affect an individual’s ability to move, function, or perform physical tasks. This can include conditions such as back injuries, amputations, paralysis, or diseases that impact mobility, such as multiple sclerosis or muscular dystrophy. Physical disabilities may prevent individuals from engaging in physically demanding jobs or performing specific tasks required by their occupation.

2. Cognitive Disabilities:

Cognitive disabilities involve impairments in mental processes such as memory, concentration, or problem-solving abilities. Conditions such as traumatic brain injury, dementia, or cognitive disorders can significantly impact an individual’s ability to carry out work-related tasks effectively. Disability insurance can provide essential financial support for individuals with cognitive disabilities, allowing them to focus on treatment and rehabilitation.

3. Mental Health Disabilities:

Mental health disabilities include conditions that affect an individual’s emotional and psychological well-being, such as depression, anxiety disorders, bipolar disorder, or post-traumatic stress disorder (PTSD). These conditions can significantly impact a person’s ability to function in a work environment and may require treatment, therapy, or medication. Disability insurance can offer financial assistance to individuals experiencing mental health disabilities, helping them navigate their recovery process without the added burden of financial strain.

4. Chronic Illnesses:

Chronic illnesses are long-term conditions that require ongoing medical management, such as diabetes, heart disease, or autoimmune disorders. These conditions can fluctuate in severity and may result in periods of disability where individuals are unable to perform their regular work duties. Disability insurance can provide support during these periods, allowing individuals to focus on managing their health and well-being.

5. Terminal Illnesses:

Terminal illnesses are conditions in which there is no known cure, and the individual’s life expectancy is limited. These conditions, such as advanced-stage cancer or end-stage organ failure, can greatly impact an individual’s ability to work and earn an income. Disability insurance can provide financial assistance to individuals with terminal illnesses, enabling them to focus on comfort, quality of life, and spending time with loved ones.

It’s important to review the specific terms of a disability insurance policy to understand which types of disabilities are covered and any limitations or exclusions that may apply. Some policies may have restrictions on pre-existing conditions or specific requirements for proving the extent of disability. Understanding these details can help individuals choose a policy that best meets their specific needs and provides appropriate coverage for their particular disability.

By having disability insurance that covers a range of disabilities, individuals can have peace of mind knowing that they will have financial support in the event that a disability prevents them from working. It ensures that they can maintain their livelihood, cover essential expenses, and focus on their health and well-being during challenging times.

The Importance of Disability Insurance for Different Professions

Disability insurance is essential for individuals in all professions, as anyone can be at risk of experiencing a disability that affects their ability to work. However, certain professions may have unique considerations that make disability insurance even more crucial. Let’s explore the importance of disability insurance for different professions:

1. Manual Labor and High-Risk Professions:

Professions that involve manual labor or high-risk activities, such as construction workers, firefighters, or professional athletes, often face a higher likelihood of work-related injuries or disabilities. In these fields, the physical demands and potential for accidents make disability insurance a vital safeguard against the financial impact of disabilities that may prevent individuals from performing their jobs.

2. Healthcare Professionals:

Healthcare professionals, including doctors, nurses, and surgeons, often face long working hours and physically demanding tasks. If they experience a disability that prevents them from practicing medicine, disability insurance can provide crucial income replacement and financial stability during their recovery period. Additionally, disability insurance can protect healthcare professionals who may be exposed to infectious diseases or experience chronic health issues due to the nature of their work.

3. Entrepreneurs and Self-Employed Individuals:

Entrepreneurs and self-employed individuals typically do not have the safety net of employer-sponsored disability insurance. Therefore, it is even more important for them to secure disability insurance independently. Without it, they may face significant financial difficulties if a disability prevents them from running their businesses and generating income. Disability insurance can help entrepreneurs maintain their personal and business expenses during a period of disability, ensuring the longevity and continuity of their ventures.

4. Office Professionals:

While office professionals may not face the same physical risks as those in manual labor professions, disabilities can still arise due to various factors. For example, repetitive strain injuries, such as carpal tunnel syndrome, can impact individuals who spend hours typing on a computer daily. Mental health disabilities, such as anxiety or depression, can also affect office professionals due to high stress levels. Disability insurance provides the necessary financial stability to focus on recovery without worrying about lost income or mounting expenses.

5. Artists and Performers:

Artists, performers, and individuals in creative fields often rely on their physical or mental abilities to produce their work. If a disability hinders their ability to create or perform, it can have devastating consequences on their livelihoods. Disability insurance can be particularly beneficial for individuals in these professions, providing financial support while they navigate their recovery process and potentially adapt their artistic endeavors to accommodate their disability.

Regardless of the profession, disability insurance ensures that individuals can maintain their financial well-being if they are unable to work due to a disability. It helps them cover their expenses, support their dependents, and focus on recovery without the added stress of financial instability.

It’s important for individuals across all professions to consider their unique circumstances, evaluate the risks associated with their work, and make informed decisions about obtaining disability insurance. By doing so, they are protecting their livelihoods, their families, and their financial futures in the face of unexpected disabilities.

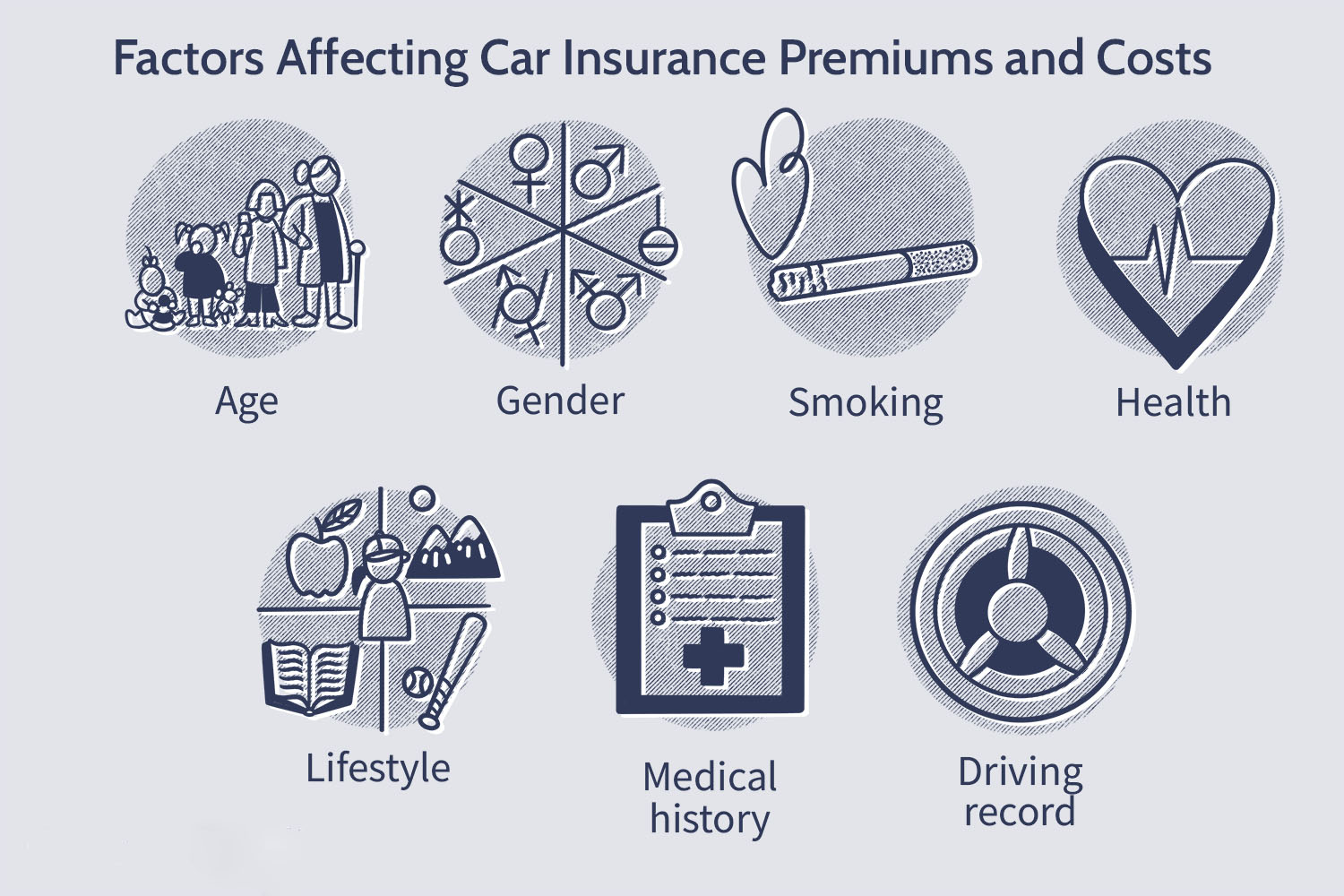

Factors to Consider When Choosing Disability Insurance

Choosing the right disability insurance policy is crucial to ensure that you have appropriate coverage that fits your needs and circumstances. Here are some important factors to consider when selecting disability insurance:

1. Definition of Disability:

Review the policy’s definition of disability to understand the criteria that must be met for benefits to be paid out. Some policies may require that you are unable to work in any occupation, while others may consider your ability to perform your specific job. Understanding this definition will help you determine if the policy aligns with your occupation and level of disability.

2. Benefit Amount and Duration:

Evaluate the percentage of your income that the policy will replace in case of disability. It is essential to choose a benefit amount that will adequately cover your living expenses and financial obligations. Additionally, consider the duration of the benefit period. Some policies provide coverage until you reach retirement age, while others have shorter benefit periods. Choose a duration that aligns with your financial goals and potential recovery timeline.

3. Waiting Period:

The waiting period, also known as the elimination period, is the duration between the onset of the disability and the start of benefit payments. Consider how long you can sustain yourself without income or other sources of financial support during this waiting period. Shorter waiting periods may result in higher premiums, so weigh the cost against your financial situation and needs.

4. Cost and Affordability:

Assess the cost of the disability insurance policy and ensure that it fits within your budget. Consider the premiums you will need to pay regularly and how they align with your income and overall financial plan. Compare multiple quotes from different insurance providers to find the best balance between coverage and affordability.

5. Exclusions and Limitations:

Read the policy carefully to understand any exclusions or limitations. Some policies may exclude coverage for certain pre-existing conditions or disabilities related to self-inflicted injuries, substance abuse, or criminal activities. Understanding these exclusions will help you make an informed decision about the policy’s suitability for your needs.

6. Optional Riders and Additional Coverage:

Consider any optional riders or additional coverage options available with the disability insurance policy. These may include cost-of-living adjustments (COLA) to account for inflation, residual disability coverage for partial disabilities, or future purchase options to increase coverage limits as your income grows. Assess these options to tailor the policy to your specific requirements.

7. Insurance Company Reputation:

Research the reputation and financial stability of the insurance company offering the disability insurance policy. Look for reviews and ratings from independent agencies to ensure that the company has a strong track record of timely claim payments and excellent customer service. A reliable insurance provider will be crucial in supporting you throughout the claims process.

Understanding and evaluating these factors will help you make an informed decision when choosing disability insurance. It’s important to remember that individual needs may vary, so take the time to assess your unique circumstances and consult with an insurance professional if needed. Disability insurance is a critical financial tool that can provide invaluable support in case of unexpected disabilities, ensuring that you can maintain your financial well-being even during challenging times.

Disability Insurance vs. Workers’ Compensation: What’s the Difference?

Disability insurance and workers’ compensation are two types of insurance that provide financial support in the event of a disability or injury. While both coverages serve similar purposes, it’s important to understand the key differences between them:

Definition and Scope:

Disability insurance is a policy that provides income replacement if an individual becomes disabled and unable to work due to sickness or injury. It can cover disabilities that occur both on and off the job, providing broader coverage that extends beyond work-related incidents. Disability insurance is typically purchased independently, either individually or through an employer-sponsored plan.

In contrast, workers’ compensation is a form of insurance specifically designed to provide benefits to employees who experience work-related injuries or illnesses. It is a mandatory coverage for most employers and typically covers medical expenses, rehabilitation costs, and a portion of lost wages for employees injured on the job.

Eligibility and Coverage:

Disability insurance is available to individuals in all professions and occupations, providing coverage for disabilities that occur both on and off the job. It covers a wide range of disabilities and illnesses, regardless of their cause or where they occur.

Workers’ compensation, on the other hand, typically covers employees who have suffered a work-related injury or illness. It is only applicable to injuries that occur within the scope of employment and can include accidents, occupational diseases, or injuries that arise from repetitive motions or work-related stress.

Claim Process:

The claim process for disability insurance involves notifying the insurance provider of the disability or inability to work, providing medical documentation, and demonstrating that you meet the policy’s definition of disability. Benefits are usually paid directly to the insured on a regular basis, according to the terms of the policy.

Workers’ compensation claims, on the other hand, usually require the injured employee to notify their employer of the accident or illness, complete necessary forms, and provide supporting medical documentation. The employer’s workers’ compensation insurance will then process the claim and provide benefits directly to the employee for medical expenses and lost wages.

Coverage Limits and Benefits:

Disability insurance benefits are typically based on a percentage of the insured individual’s pre-disability income, up to a predetermined maximum limit. It provides income replacement while the individual is unable to work due to disability, offering financial stability during that period.

Workers’ compensation benefits, on the other hand, typically cover a portion of the employee’s lost wages and medical expenses related to the work-related injury or illness. The specific benefits and limits vary depending on state regulations and the severity of the disability.

Optional Coverage:

With disability insurance, optional riders may be available to enhance coverage, such as cost-of-living adjustments (COLA) to account for inflation, residual disability coverage for partial disabilities, or future purchase options to increase coverage limits over time.

Workers’ compensation typically does not offer optional coverage, as it is regulated by state laws and generally provides a standardized set of benefits based on the severity and type of the work-related injury or illness.

In summary, disability insurance and workers’ compensation serve distinct purposes. Disability insurance provides broader coverage for disabilities that occur both on and off the job, while workers’ compensation specifically covers work-related injuries or illnesses. Understanding the differences between these two types of coverage will help individuals ensure they have the appropriate protection in place to safeguard their financial well-being in the event of a disability.

How to File a Disability Insurance Claim

Filing a disability insurance claim involves a series of steps to ensure a smooth and efficient process. Here is a general guide on how to file a disability insurance claim:

1. Review your Policy:

Start by thoroughly reviewing your disability insurance policy. Familiarize yourself with the terms, conditions, and requirements for filing a claim. Understand the definition of disability, waiting period, benefit amount, and any exclusions or limitations that may apply.

2. Notify Your Insurance Provider:

Once you determine that you meet the criteria for disability as stated in the policy, contact your insurance provider to initiate the claim process. Follow their guidelines for reporting a claim, providing all necessary information and documentation.

3. Obtain Medical Documentation:

Gather the appropriate medical documentation to support your claim. This may include medical records, diagnosis reports, treatment plans, and statements from healthcare professionals explaining the extent of your disability and its impact on your ability to work.

4. Complete Claim Forms:

Fill out the claim forms provided by your insurance provider. Be thorough and accurate when providing information about your disability, symptoms, medical treatments received, and any relevant details that support your claim.

5. Submit Required Documentation:

Submit all required documentation along with your claim forms. Ensure that you include all medical records, diagnostic tests, and any other supporting evidence requested by your insurance provider. Keep copies of all documents for your records.

6. Follow Up with Healthcare Providers:

Stay in touch with your healthcare providers and ensure that they promptly submit any additional documentation or forms requested by your insurance provider. This will help expedite the processing of your claim and provide the necessary supporting evidence.

7. Cooperate with the Insurance Provider:

Cooperate fully with your insurance provider throughout the claims process. Respond promptly to any requests for information, attend medical evaluations, and provide any updates regarding your disability and treatment as requested.

8. Await Claim Decision:

Allow the insurance provider to review your claim and make a decision. The length of time for a decision may vary depending on the complexity of your case and the insurance company’s processes. Stay in contact with your insurance provider to check the status of your claim if needed.

9. Appeal if Necessary:

If your claim is denied or if you believe the amount of benefits awarded is insufficient, explore the appeals process outlined in your policy. Follow the guidelines for filing an appeal and provide any additional evidence or documentation that supports your case.

It is important to remember that every insurance policy and provider may have slightly different claim procedures. Therefore, it is crucial to carefully review your specific policy and follow the instructions provided by your insurance company when filing a claim. If needed, consult with a professional, such as an attorney or insurance agent, who can guide you through the process and provide assistance.

By following these steps and providing accurate and thorough information, you can increase the chances of a successful disability insurance claim and receive the financial support you need during your period of disability.

Common Mistakes to Avoid When Applying for Disability Insurance

When applying for disability insurance, it is important to be diligent and avoid common mistakes that can potentially impact the outcome of your application. By being aware of these pitfalls, you can increase your chances of a successful application and ensure that you have the coverage you need. Here are some common mistakes to avoid:

1. Not Understanding the Policy:

One of the biggest mistakes is not thoroughly understanding the policy before applying. Review the terms, conditions, and coverage details carefully. Understand the definition of disability, waiting periods, benefit amounts, and any exclusions or limitations. This will help you choose a policy that aligns with your needs and avoid any surprises in the future.

2. Providing Inaccurate or Incomplete Information:

When completing the application, make sure to provide accurate and complete information. This includes details about your health history, occupation, and income. Failing to disclose relevant information or providing false information can result in a denial of your claim or cancellation of the policy. Be honest and transparent throughout the application process.

3. Not Seeking Professional Help If Needed:

If you are uncertain about any aspect of the application process, consider seeking professional assistance. An insurance agent or attorney experienced in disability insurance can guide you through the process, help you understand the policy terms, and ensure that you provide the necessary information accurately. Their expertise can help you avoid critical mistakes that could negatively impact your application.

4. Neglecting to Gather Sufficient Medical Records:

Insufficient medical documentation is a common reason for claim denials. When applying for disability insurance, make sure to gather and include all relevant medical records, including diagnosis reports, treatment plans, and supporting statements from healthcare professionals. This will provide a comprehensive overview of your medical condition and its impact on your ability to work, increasing the likelihood of a successful application.

5. Not Monitoring Pre-Existing Conditions:

If you have pre-existing conditions, it is important to understand how they may impact your disability insurance coverage. Some policies may exclude coverage for pre-existing conditions or impose waiting periods before coverage takes effect. Failure to disclose or properly manage pre-existing conditions can result in claim denial or cancellation of the policy. Be proactive in understanding the policy’s terms and ensure that you meet the eligibility requirements.

6. Overlooking the Importance of Regular Check-Ups:

Regular medical check-ups play a crucial role in maintaining accurate records and providing evidence of your health status. By keeping up with regular check-ups, you have a better chance of detecting any changes in your health and obtaining the necessary medical documentation to support your disability claim, if needed.

7. Waiting Too Long to Apply:

Applying for disability insurance when you are healthy is crucial. Waiting until you develop a disability or pre-existing condition can significantly impact your chances of obtaining coverage. The earlier you apply for disability insurance, the more likely you are to secure the coverage you need before any health-related issues arise.

Avoiding these common mistakes will help you navigate the disability insurance application process more effectively. Taking the time to educate yourself, gather necessary documents, and seek professional guidance when needed will increase your chances of a successful application and ensure that you have the right coverage in place to protect your financial well-being in the event of a disability.

Conclusion

Disability insurance is a critical financial tool that provides protection and peace of mind in the face of unexpected circumstances. Whether you work in a physically demanding job, an office setting, or have a high-risk profession, disability insurance is relevant for everyone. It offers essential financial support if you become unable to work due to a disability, ensuring that you can maintain your standard of living and cover necessary expenses.

Understanding disability insurance and its importance is key to making informed decisions about your financial well-being. By securing disability insurance, you are proactively protecting yourself and your loved ones from the potential financial hardships that can arise from a disability.

When choosing disability insurance, consider factors such as the definition of disability, benefit amount and duration, waiting period, and affordability. Thoroughly review the policy, seek professional help if needed, and provide accurate and complete information during the application process to avoid common mistakes.

It is also important to differentiate disability insurance from workers’ compensation to understand the specific coverage each provides. Workers’ compensation typically covers work-related injuries or illnesses, while disability insurance offers broader coverage for disabilities that occur both on and off the job.

Should you need to file a disability insurance claim, follow the steps diligently, submit all required documentation, and cooperate fully with your insurance provider. Avoid common mistakes such as providing inaccurate information or neglecting to gather sufficient medical records that could hinder the claim process.

In conclusion, disability insurance is a vital component of your financial plan, regardless of your profession or current health status. By securing disability insurance, you are taking a proactive step towards protecting your income, financial stability, and overall well-being in case of a disability. With the right coverage in place, you can focus on recovery and rehabilitation without the added stress of financial uncertainty.