Home>Finance>Which Item Would Not Appear On A Credit Report?

Finance

Which Item Would Not Appear On A Credit Report?

Published: October 20, 2023

Learn about the impact of finance on credit reports and discover which items do not appear, helping you make informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

A credit report is a crucial document that provides a comprehensive overview of an individual’s credit history. It plays a significant role in determining a person’s financial credibility and is widely used by lenders, landlords, employers, and other parties to assess an individual’s creditworthiness.

In essence, a credit report serves as a financial report card, detailing an individual’s borrowing and repayment history. It includes information about credit cards, loans, mortgages, and other forms of credit that an individual has utilized in the past. Lenders use this information to assess the level of risk involved in extending credit and to make informed decisions about interest rates and loan approvals.

Understanding the items that appear on a credit report is essential for individuals who want to maintain a healthy credit standing. While credit reports contain a wealth of information, it’s essential to note that not every financial transaction or account is included on a credit report. This article will explore the items that typically appear on a credit report and shed light on those that do not.

What is a Credit Report?

A credit report is a detailed record of an individual’s credit history and financial behavior. It is compiled by credit bureaus, such as Equifax, TransUnion, and Experian, based on information obtained from lenders, banks, credit card companies, and other financial institutions.

At its core, a credit report provides a snapshot of an individual’s borrowing and repayment history. It includes information about credit accounts, outstanding balances, payment history, credit inquiries, and public records, such as bankruptcies or liens. The credit report also includes a credit score, which is a numerical representation of an individual’s creditworthiness, based on a scoring model determined by the credit bureaus.

Credit reports are used by lenders, landlords, employers, and other entities to assess an individual’s financial reliability and creditworthiness. Lenders rely on credit reports to evaluate the risk associated with extending credit, determining interest rates, and making loan decisions. Landlords utilize credit reports to screen potential tenants and decide whether to approve a rental application. Employers may request credit reports to assess an individual’s financial responsibility, particularly for positions involving financial management.

It is important to note that credit reports are not static documents. They are updated periodically as new information is reported to the credit bureaus. Regularly reviewing and monitoring your credit report is crucial to ensure accuracy and identify any potential errors or fraudulent activity.

Importance of Credit Reports

Credit reports play a crucial role in the financial lives of individuals. They provide a comprehensive record of an individual’s credit history, which is used by various parties to assess creditworthiness and make important financial decisions.

Here are the key reasons why credit reports are important:

- Lending Decisions: Lenders rely heavily on credit reports to evaluate the creditworthiness of borrowers. When you apply for a loan or credit card, lenders will review your credit report to assess the level of risk involved in lending to you. They will consider your payment history, outstanding debts, credit utilization, and other factors to determine whether to approve your application.

- Interest Rates: Your credit report is also a determining factor in the interest rates you are offered. Individuals with good credit scores are more likely to qualify for lower interest rates, saving them money on interest expenses over time. On the other hand, those with poor credit scores may face higher interest rates, which can significantly increase the cost of borrowing.

- Housing Opportunities: Landlords often review credit reports when considering rental applications. A positive credit report can increase your chances of being approved for a rental property. Landlords look for responsible financial behavior to ensure that tenants will pay rent on time and take care of the property.

- Employment Considerations: In certain industries, employers may request credit reports as part of the hiring process. This is particularly common for roles that involve financial management, handling sensitive financial data or require a high level of trust. A positive credit report can enhance your chances of securing employment in such positions.

- Building Financial Reputation: A solid credit history is essential for building a strong financial reputation. By consistently making payments on time and maintaining low credit utilization, you can establish a positive credit profile. This, in turn, can open doors to better financial opportunities and favorable terms when seeking credit in the future.

Given the significance of credit reports in various aspects of life, it is essential to proactively manage your credit and ensure that the information in your credit report is accurate and up-to-date.

Items Included on a Credit Report

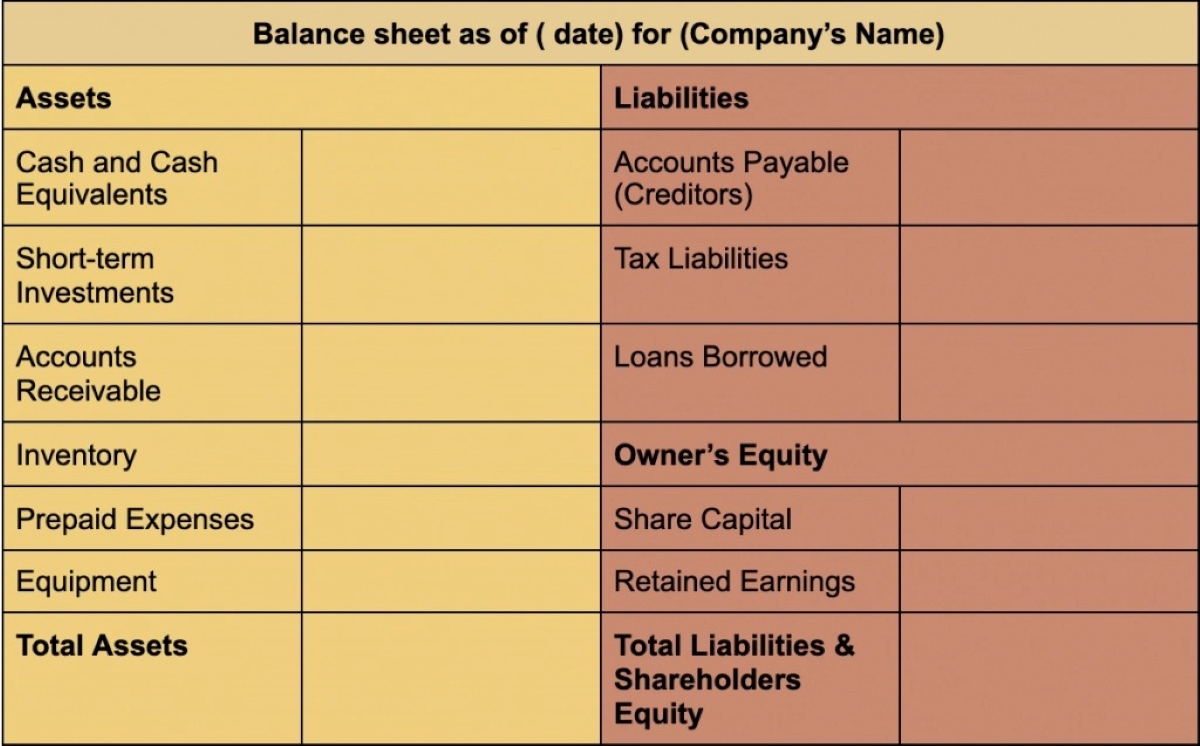

A credit report provides a comprehensive overview of an individual’s credit history and financial behavior. It includes various items that lenders and other entities use to evaluate creditworthiness. Here are the key items typically included on a credit report:

- Credit Accounts: This section lists all credit accounts, such as credit cards, loans, mortgages, and lines of credit, that you have opened in the past or currently have. It includes details like the type of account, the date it was opened, the credit limit or loan amount, and the current balance.

- Payment History: The payment history section reflects how you have managed your credit accounts over time. It includes information about your payment dates, whether payments were made on time, and any late or missed payments. Timely payments contribute positively to your credit score, while late payments can have a negative impact.

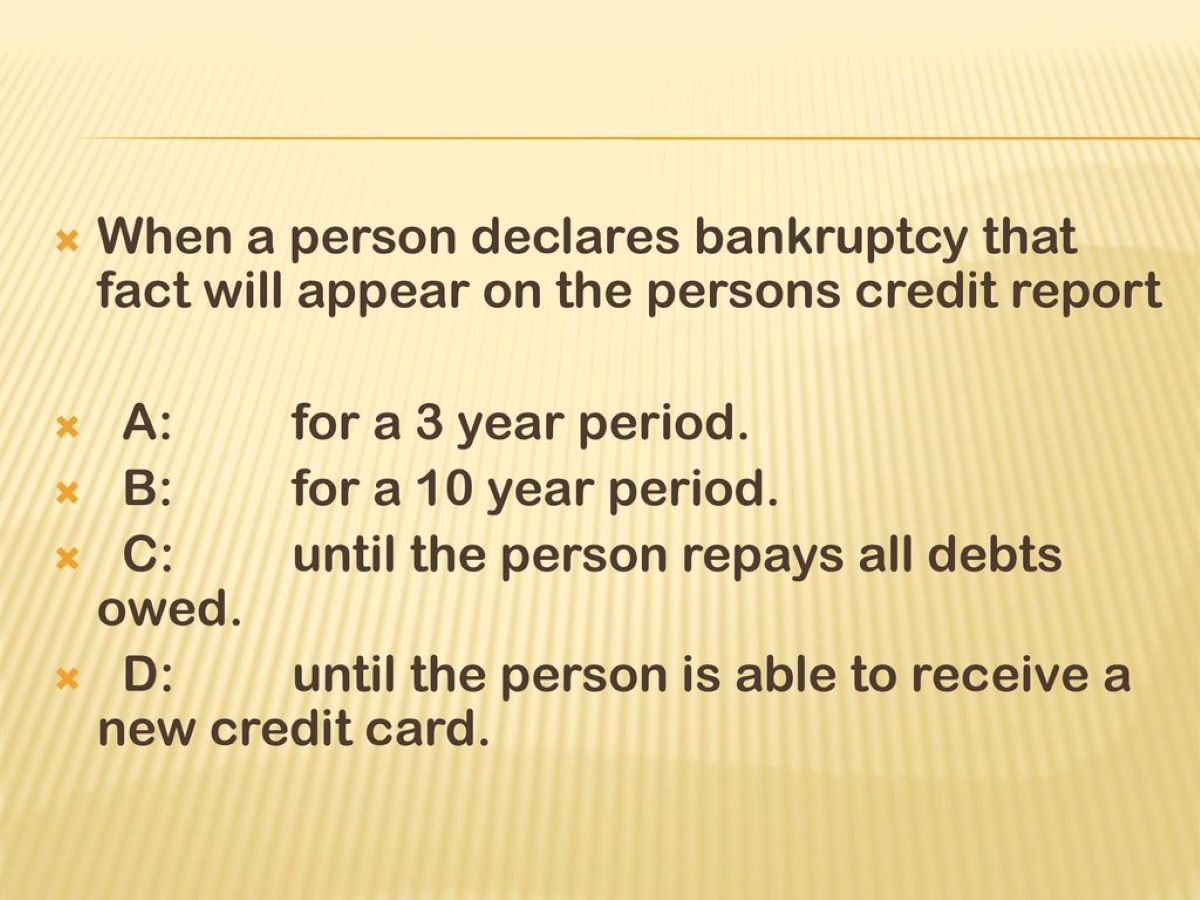

- Public Records: Public records are legal judgments against you, such as bankruptcies, tax liens, or civil judgments. These records can significantly impact your creditworthiness and may stay on your credit report for several years.

- Credit Inquiries: Whenever you apply for new credit, the lender will request a copy of your credit report. These credit inquiries are recorded on your credit report and are categorized as either hard inquiries or soft inquiries. Hard inquiries, such as those made when you apply for a new loan or credit card, can temporarily impact your credit score. Soft inquiries, such as those made by lenders for pre-approval offers, do not affect your credit score.

- Collection Accounts: If you have unpaid debts that have been sent to a collection agency, this information will appear on your credit report. Collection accounts typically arise when you default on payments to creditors, and they can have a negative impact on your credit score.

- Account Age: The age of your credit accounts is also included on your credit report. This refers to how long you have held each account. Longer credit history is generally viewed positively by lenders and can contribute to a higher credit score.

- Derogatory Remarks: Derogatory remarks appear on your credit report when you have serious delinquencies or defaults on your credit obligations. These remarks can include notations such as charge-offs, foreclosures, or repossessions, and they can have a long-lasting negative impact on your credit profile.

It’s important to review your credit report regularly to ensure accuracy and identify any discrepancies or fraudulent activity. By understanding the items included on a credit report, you can better manage your credit and take steps to improve your overall financial health.

Items Not Included on a Credit Report

While a credit report provides valuable insight into an individual’s credit history, it’s important to note that not all financial information is included on a credit report. Here are some key items that are typically not included:

- Income: Your income information is not included on a credit report. Lenders may consider your income when determining loan eligibility, but it is not a factor that directly appears on your credit report.

- Bank Account Balances: The balances or transactions in your bank accounts are not reported on your credit report. Bank accounts and credit reports are managed by separate entities and have no direct correlation.

- Personal Information: While personal information, such as your name, address, and Social Security number, is included on your credit report, it does not impact your credit score or affect your creditworthiness.

- Medical History: Medical history, including medical bills and payments, is not reported on credit reports. However, overdue medical bills that have been sent to collection agencies may eventually appear on your credit report as a collection account.

- Criminal Records: Criminal records are not included on credit reports. Credit bureaus do not have access to such information and focus solely on an individual’s credit history and financial behavior.

- Utility Payments: Monthly recurring bills like utilities (electricity, water, gas) and telecommunications (phone, internet) typically do not appear on credit reports unless they are in arrears and the account has been sent to collections.

- Rent Payments: While timely rental payments can demonstrate good financial responsibility, they are not automatically included on credit reports. However, there are alternative services that specialize in reporting rental payment history to credit bureaus.

It’s worth noting that while these items may not be included directly on credit reports, they may still impact financial decisions made by lenders, employers, and landlords through other means of verification or documentation.

Understanding what is and isn’t included on a credit report helps individuals have a clearer picture of how their credit history is assessed and enables them to take appropriate steps to manage their overall financial well-being.

Reasons for Items Not Appearing on a Credit Report

There are several reasons why certain items may not appear on a credit report. Understanding these reasons can provide clarity on why specific financial information may not be reflected in your credit history. Here are some common reasons for items not appearing on a credit report:

- Reporting Practices: Credit bureaus rely on information provided by lenders, banks, and other financial institutions to compile credit reports. Not all entities report their data to the credit bureaus. Some creditors may choose not to report account information, while others may only report to specific credit bureaus.

- Timeframe: It takes time for certain financial activities to appear on a credit report. This includes opening a new credit account, making payments, or closing an account. Creditors typically update credit bureaus on a monthly basis, so there may be a lag between the activity and its reflection in the report.

- Type of Account: Certain types of accounts, such as utility bills and rent payments, are not typically reported to credit bureaus, unless there is a delinquency or the account is sent to collections. Mortgage accounts and credit card accounts are more commonly reported, as they are considered credit obligations.

- Limited Credit History: Individuals who are new to credit or have limited credit history may have fewer items appearing on their credit report. Lenders may not have had enough time to report account information, resulting in a sparse credit report.

- Privacy Laws: In certain jurisdictions, privacy laws restrict the sharing of certain types of information, such as income or medical history, with credit bureaus. As a result, these details are not included in the credit report, even though they may be relevant to lenders or employers in their decision-making process.

- Errors or Omissions: Credit reports are not immune to errors or omissions. It is possible that some information may be inadvertently excluded or not properly reported by the creditor. It’s important to regularly review your credit report to identify any inaccuracies and take steps to correct them.

It’s essential to remember that a credit report provides a snapshot of an individual’s credit history, and its completeness may vary based on various factors. However, even if certain items are not on your credit report, it doesn’t necessarily mean they have no impact on your overall financial situation or the decisions made by lenders, employers, or landlords.

By understanding the reasons for items not appearing on a credit report, individuals can have a better understanding of the limitations and take proactive steps to build a strong credit history and maintain a healthy financial profile.

Conclusion

A credit report serves as a vital tool for assessing an individual’s creditworthiness and financial behavior. It provides a comprehensive view of an individual’s credit history, payment patterns, and credit utilization. While credit reports are essential, it’s crucial to understand both the items that appear on a credit report and those that do not.

Items included on a credit report typically consist of credit accounts, payment history, public records, credit inquiries, collection accounts, account age, and derogatory remarks. These items are used by lenders, landlords, employers, and other entities to evaluate an individual’s financial responsibility and creditworthiness.

However, it’s important to acknowledge that not all financial information is included on a credit report. Items like income, bank account balances, personal information, medical history, criminal records, utility payments, and rent payments are typically not reported or reflected in credit reports. Nevertheless, these factors may still be considered by different entities through alternative means of verification or evaluation.

The reasons for items not appearing on a credit report vary, including reporting practices of creditors, timeframes for updates, type of accounts, limited credit history, privacy laws, and potential errors or omissions. Regularly reviewing your credit report for accuracy and taking steps to build a strong credit history are essential for maintaining a healthy financial profile.

By understanding the components of a credit report and the factors that may impact its completeness, individuals can make informed decisions regarding their credit, improve their creditworthiness, and take control of their financial well-being. Remember to monitor your credit report regularly, address any discrepancies, and practice responsible financial habits to maintain a positive credit standing.