Home>Finance>Which Behavioral Factor Would Influence The Premiums Of Auto Insurance

Finance

Which Behavioral Factor Would Influence The Premiums Of Auto Insurance

Published: October 6, 2023

Find out how finance and behavioral factors can impact auto insurance premiums. Learn which factors influence the cost of coverage and how to save money.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of auto insurance premiums! If you’ve ever wondered why two people with similar cars and driving histories may pay vastly different amounts for their car insurance, then you’ve come to the right place. Auto insurance premiums are not just determined by the make and model of your vehicle or your driving record. There are various behavioral factors that also play a significant role in influencing the premiums you pay.

Understanding these behavioral factors can help you take control of your insurance costs and make informed decisions when shopping for coverage. In this article, we will explore the key behavioral factors that insurance companies consider when determining your auto insurance premiums.

From your age and gender to your marital status and occupation, insurance providers delve into several aspects of your personal life to assess the level of risk you pose as a driver. Your credit score and driving record are also scrutinized to determine your eligibility for certain discounts or surcharges. Even factors like your annual mileage can contribute to the determination of your insurance rates.

By gaining insight into how these behavioral factors influence auto insurance premiums, you can become empowered to take steps to potentially lower your costs. Whether you’re a young driver, a newlywed, or a high-mileage commuter, understanding the impact of these factors can help you make informed decisions to optimize your insurance coverage.

So, let’s dive into the world of auto insurance premiums and explore which behavioral factors can have an impact on how much you pay for your car insurance coverage.

Overview of Auto Insurance Premiums

When it comes to auto insurance, premiums are the amount you pay to your insurance company for coverage. These premiums can vary widely from person to person, as they are determined by several factors, including behavioral factors, to assess the level of risk you present as a driver.

Insurance companies use a combination of statistical data, historical claims information, and individual characteristics to calculate auto insurance premiums. While factors such as the make and model of your vehicle and your geographic location play a role in determining your premiums, behavioral factors provide additional insights into your driving habits and likelihood of being involved in an accident.

By assessing and analyzing these behavioral factors, insurance companies aim to offer personalized coverage and determine the appropriate premium amount for each individual. Let’s explore some of the key behavioral factors that can influence your auto insurance premiums.

It’s important to note that each insurance company may weigh these factors differently, and the impact of each factor can vary from one insurer to another. Therefore, it’s always a good idea to compare quotes from different insurance providers to find the best coverage at the most competitive rates.

Now that we have a general understanding of auto insurance premiums, let’s delve into the specific behavioral factors that can impact the amount you pay for your car insurance coverage.

Behavioral Factors Influencing Auto Insurance Premiums

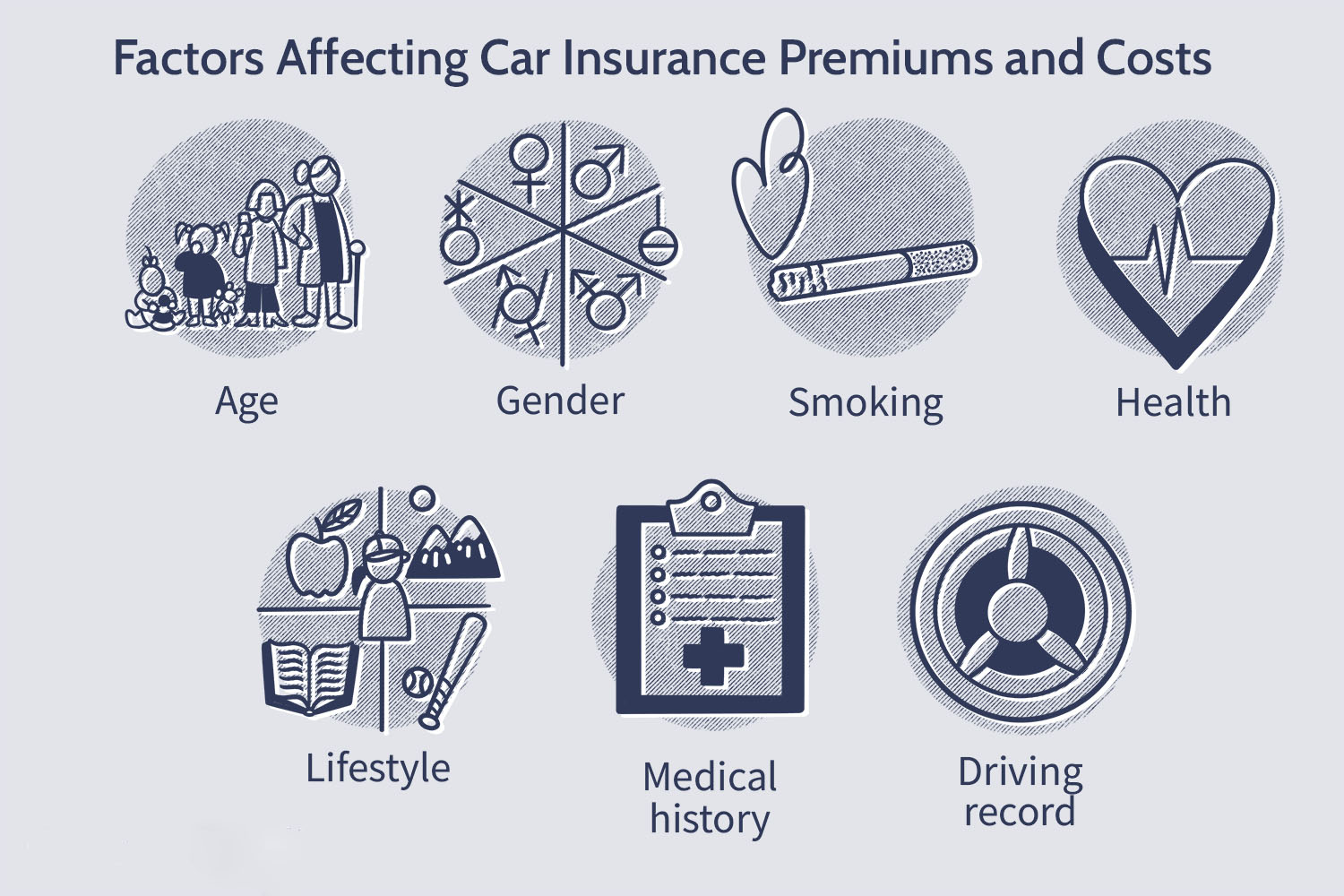

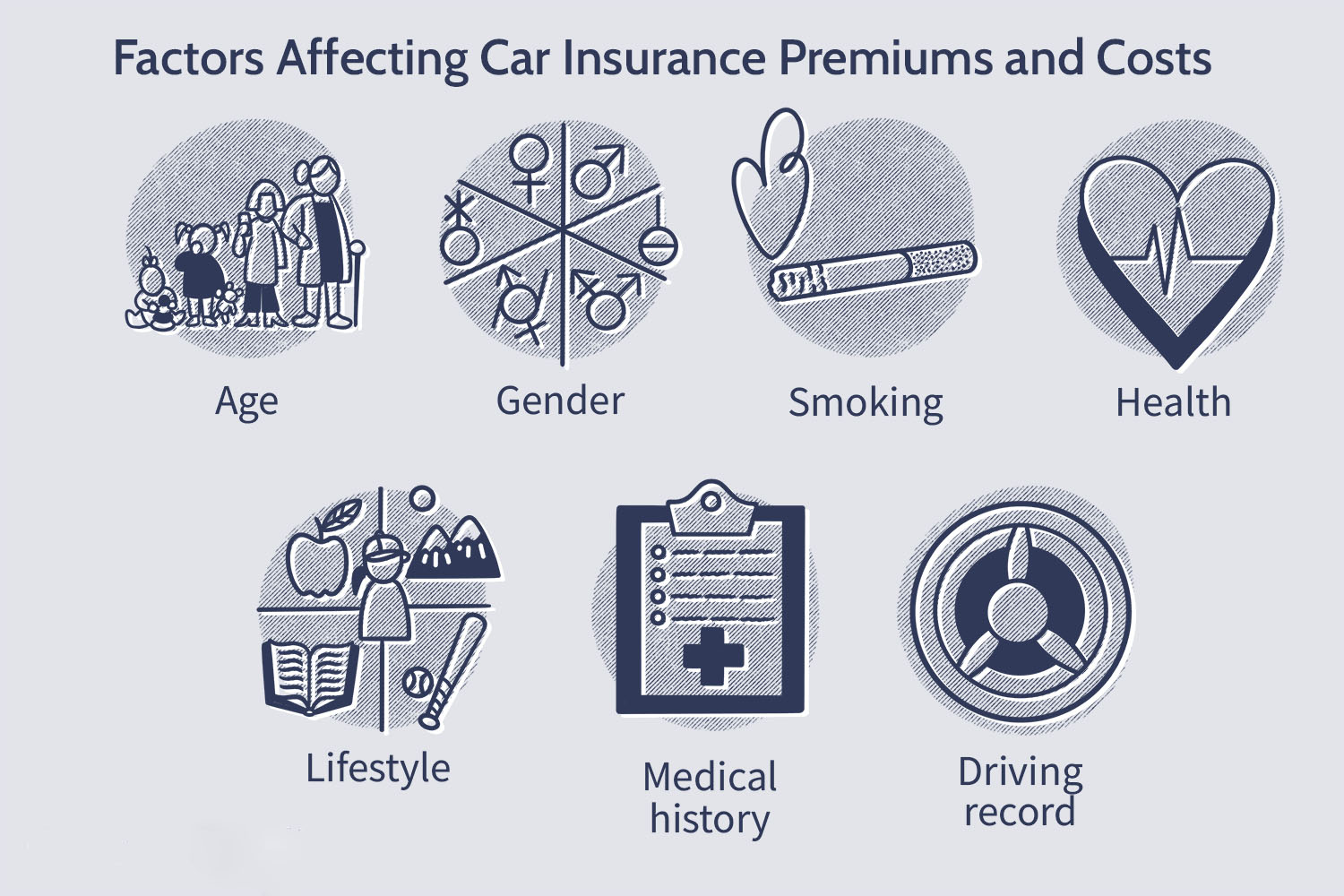

When it comes to determining your auto insurance premiums, insurance companies take into account various behavioral factors to better assess the level of risk you represent on the road. These factors go beyond the traditional considerations like your age, gender, and driving record. Let’s take a closer look at some of the key behavioral factors that can influence your auto insurance premiums:

- Age and Driving Experience: Young, inexperienced drivers often pay higher premiums due to their higher likelihood of being involved in accidents. As drivers gain more experience and reach certain age milestones, such as turning 25 or 30, their premiums tend to decrease.

- Gender: Traditionally, male drivers have been considered higher-risk than female drivers, leading to higher premiums for males. However, this can vary between insurance providers and is subject to individual driving records and other factors.

- Marital Status: Married individuals often enjoy lower auto insurance premiums compared to their single counterparts. Statistically, married individuals are considered to be more responsible drivers and less likely to engage in risky behavior behind the wheel.

- Occupation: While it may seem unrelated, your occupation can impact your auto insurance premiums. Certain professions are associated with lower risk, such as teachers or accountants, while others, like delivery drivers or musicians, may be considered higher risk due to the nature of their work.

- Credit Score: In many states, insurance companies can use your credit score as a factor in determining your premiums. Studies have shown a correlation between lower credit scores and increased likelihood of filing insurance claims, leading to higher premiums for individuals with poor credit.

- Driving Record: Your driving history is one of the most important factors considered by insurance companies. Drivers with a history of accidents, traffic violations, or DUI convictions are likely to face higher premiums due to their increased risk profile.

- Annual Mileage: The number of miles you drive annually can also impact your insurance premiums. Generally, the more you drive, the higher the potential for accidents. If you have a low annual mileage, you may qualify for discounted rates.

It’s important to note that the weight given to each behavioral factor may vary between insurance companies. Additionally, some insurers may consider additional factors not listed here. To ensure you are getting the best rates, it’s wise to compare quotes from different providers and discuss your specific circumstances with an insurance agent.

Age and Driving Experience

One of the key behavioral factors that significantly influence auto insurance premiums is your age and driving experience. Insurance companies use age as a determining factor because it is closely correlated with driving skill and experience.

Young, inexperienced drivers are typically considered high-risk by insurance providers. This is due to their lack of experience on the road, which increases the likelihood of accidents and claims. As a result, insurance premiums for drivers in their teens and early twenties tend to be higher compared to older, more experienced drivers.

However, as you gain more experience and a proven track record of responsible driving, your premiums are likely to decrease. Insurance companies often provide discounts or lower rates for drivers who have reached certain age milestones, such as turning 25 or 30.

Additionally, insurance premiums may vary based on the age group you belong to. For example, drivers in their forties and fifties may enjoy lower premiums compared to younger or older drivers. This is because statistically, drivers in the middle-aged range are considered to be more cautious and less likely to engage in risky behavior on the road.

It’s worth noting that age isn’t the sole factor that insurers consider. Your driving record also plays a significant role in determining your premiums. Even if you are an older driver, a history of accidents or traffic violations can increase your insurance costs.

To save on premiums, younger drivers can consider taking defensive driving courses or driver’s education programs to demonstrate their commitment to safe driving. Additionally, maintaining a clean driving record over time and avoiding accidents and moving violations can help lower premiums as you age.

Keep in mind that each insurance company may have different policies and approaches when it comes to age and driving experience. It’s important to shop around, compare quotes, and discuss your specific situation with insurance agents to find the best rates and coverage for your age group.

Gender

Gender is another behavioral factor that can influence auto insurance premiums. Traditionally, insurance companies have considered gender as a factor in determining rates, although this practice has evolved over time and can vary between insurers and jurisdictions.

Historically, statistics have shown that men tend to be involved in more accidents and engage in riskier behavior on the road compared to women. As a result, insurance premiums for male drivers have been higher on average. This is because insurance companies base their rates on the likelihood of claims, and the data suggested that male drivers were more prone to accidents.

However, it’s important to note that this generalized approach has faced criticism and has been challenged in recent years. Many argue that gender should not be the sole determinant of insurance premiums, as it can perpetuate gender-based stereotypes and may not accurately reflect an individual’s driving habits or risk profile.

In some jurisdictions, such as the European Union, the use of gender as a factor in determining auto insurance premiums has been banned as a result of gender equality legislation. Insurers in these areas must rely on other factors to assess risk and determine premiums.

It’s essential to understand that insurance companies consider various factors in addition to gender when calculating premiums. Elements such as driving record, age, and even the type of vehicle being insured can have a more significant impact on insurance rates than gender alone.

If you are concerned about how your gender may affect your auto insurance premiums, it’s crucial to compare quotes from different insurers. Each company may have its own methodology for assessing risk, and rates can vary significantly. By shopping around and obtaining multiple quotes, you can find the best coverage and rates tailored to your individual circumstances.

Marital Status

Your marital status is another behavioral factor that insurance companies consider when determining your auto insurance premiums. In general, married individuals tend to enjoy lower premiums compared to their single counterparts.

Statistically, married individuals are considered to be more responsible and less likely to engage in risky driving behaviors. Insurance companies believe that married couples are more likely to prioritize safety and adhere to traffic laws, which reduces the likelihood of accidents and claims.

While the impact of marital status on insurance rates can vary between insurers and jurisdictions, it is widely recognized that being married can result in lower premiums. Some insurance companies even offer specialized policies or discounts for married couples, recognizing the perceived lower risk associated with this demographic.

However, it’s important to note that simply getting married doesn’t guarantee lower premiums. Other factors, such as your driving record and claims history, still play a significant role in determining your rates.

It’s worth mentioning that insurance companies typically consider legally recognized marriages when assessing marital status. Domestic partnerships or cohabitation may not have the same impact on insurance premiums since they are not universally recognized in all jurisdictions.

If you recently got married or are planning to tie the knot, it’s a good idea to inform your insurance provider. They can update your policy and assess if any adjustments or discounts are applicable based on your new marital status.

On the other hand, if you are single, there are still opportunities to save on your auto insurance premiums. Maintaining a clean driving record, taking advantage of other available discounts, and shopping around for the best rates are effective strategies for securing affordable coverage.

Remember, insurance companies evaluate a combination of factors to determine premiums, and while marital status is one of them, it is always recommended to explore options from multiple insurers and discuss your specific situation with an insurance agent to find the best rates and coverage.

Occupation

Your occupation is an often overlooked but influential behavioral factor when it comes to auto insurance premiums. Insurance companies analyze your occupation to assess the level of risk associated with your profession.

Some occupations are considered lower risk by insurance providers. These may include jobs such as teachers, accountants, and professionals who primarily work in office environments. These occupations tend to be associated with less time spent on the road and a lower likelihood of accidents.

On the other hand, certain occupations are deemed higher risk by insurance companies. These may include occupations that involve frequent driving, such as delivery drivers, couriers, or sales representatives. Jobs that require driving long distances or operating heavy machinery are also typically considered riskier.

Insurance companies base their assessments on historical data and claims statistics related to different professions. This data helps insurers determine the likelihood of accidents or claims based on the type of work individuals engage in.

It’s essential to note that insurers may categorize occupations differently, and the impact on premiums can vary. For example, one insurance company might consider a job as high risk, resulting in higher premiums, while another insurer might classify the same occupation as moderate risk.

When obtaining insurance quotes, be sure to inform the insurance provider accurately about your occupation. Some companies may have specific policies or discounts tailored to certain professions. Additionally, insurance rates may also depend on other factors such as your driving record and the type of vehicle you drive.

If you change careers or occupations, it’s important to notify your insurance company to ensure accurate coverage and potentially updated premiums. Updating your policy can help you avoid any pitfalls that may arise from providing inaccurate information that could potentially jeopardize your coverage.

Remember, insurance companies evaluate occupational risk differently, so it’s crucial to shop around and compare quotes from various insurers to find the best coverage and rates for your specific occupation.

Credit Score

Your credit score is a behavioral factor that can significantly impact your auto insurance premiums. In many states, insurance companies use credit scores as a factor in determining the cost of your coverage.

Insurance providers believe that individuals with higher credit scores tend to exhibit responsible financial behavior, which translates into responsible driving habits. On the other hand, lower credit scores are often associated with a higher likelihood of filing insurance claims, which leads to higher premiums.

It’s important to note that not all states allow the use of credit scores in determining insurance rates, and the practice can be controversial. However, in states where it is permitted, insurance companies factor credit scores into their pricing models.

When determining premiums based on credit scores, insurance companies consider various factors, including payment history, debt levels, credit utilization, and the length of credit history. Each of these factors contributes to the overall credit score and influences the resulting insurance premiums.

It’s worth mentioning that insurers typically access credit scores through specialized insurance credit reports, which are different from the credit reports used for loan or credit card applications. These insurance credit reports focus on specific factors relevant to underwriting, rather than your full credit history.

It’s recommended to maintain a good credit score to potentially benefit from lower auto insurance premiums. This can be achieved by making timely bill payments, keeping credit card balances low, and avoiding excessive debt. Regularly monitoring your credit report for errors or discrepancies is also important to ensure accurate information is being considered by insurance companies.

If you have a lower credit score, there are still ways to find affordable coverage. Shopping around, looking for discounts, and maintaining a clean driving record can help offset higher premiums associated with lower credit scores.

It’s crucial to understand the regulations specific to your state and to compare quotes from multiple insurance companies to find the best rates and coverage options personalized to your credit situation.

Driving Record

Your driving record is one of the most critical behavioral factors that auto insurance companies consider when determining your premiums. Your driving record provides insights into your past driving behavior and serves as an indicator of your future risk as a driver.

If you have a clean driving record with no accidents or violations, you are likely to be considered a low-risk driver by insurance providers. This can result in lower insurance premiums compared to drivers with a history of accidents or traffic violations. On the other hand, a history of accidents, speeding tickets, DUI convictions, or other infractions can significantly impact your insurance premiums.

Insurance companies use historical data and statistics to assess the likelihood of you being involved in future accidents or making claims. Drivers with a record of unsafe driving behaviors are assumed to have a higher probability of causing accidents and filing claims, which results in higher premiums.

It’s important to note that insurance companies typically consider driving records from the past several years when determining premiums. If you have a recent accident or violation on your record, it might have a more significant impact on your premiums compared to older incidents.

If you have a less-than-perfect driving record, there are still ways to manage your insurance costs. Some insurers offer accident forgiveness programs that may overlook your first at-fault accident or provide discounts for completing defensive driving courses. Over time, as violations and accidents come off your record, you may become eligible for lower rates.

It’s essential to be honest about your driving history when obtaining insurance quotes. Misrepresenting or hiding information about your driving record can result in policy cancellation or denial of claims. It’s always best to disclose any accidents or violations upfront to ensure accurate pricing and coverage.

However, don’t be discouraged if you have a less-than-perfect driving record. By practicing safe driving habits, adhering to traffic laws, and maintaining a clean record going forward, you can demonstrate to insurance companies that you are a responsible driver and potentially qualify for lower premiums in the future.

Comparing quotes from multiple insurers and discussing your specific situation with an insurance agent can help you find the best coverage and rates based on your driving record.

Annual Mileage

The number of miles you drive annually, also known as your annual mileage, is an important behavioral factor that can influence your auto insurance premiums. Insurance companies consider annual mileage because it provides insights into your driving habits and the amount of time you spend on the road.

The logic behind this is simple: the more you drive, the higher the risk of being involved in an accident. Insurance companies assume that the more time you spend on the road, the greater the exposure to potential hazards and the likelihood of filing a claim.

Typically, insurance companies offer lower premiums to individuals with lower annual mileage. If you have a short commute, work from home, or use public transportation frequently, you may be eligible for discounted rates because your exposure to potential accidents is reduced.

On the other hand, if you have a long daily commute or frequently drive long distances, your premiums may be higher. This is because insurance companies perceive longer drives as increasing the chances of accidents and therefore the likelihood of filing a claim.

It’s important to provide accurate information about your annual mileage when obtaining insurance quotes. Underestimating your mileage may result in inaccurate premiums, and your insurer could adjust your rates or deny coverage if inconsistencies are discovered.

Keep in mind that insurance companies may verify your annual mileage periodically. Some insurers use tracking devices or telematics programs that monitor the number of miles you drive. These programs can provide additional discounts if you demonstrate responsible driving habits and maintain lower mileage.

If your annual mileage changes significantly, such as due to a change in employment or lifestyle, it’s important to inform your insurance provider. Adjusting your coverage based on the new mileage can help ensure adequate protection and prevent potential issues in case of a claim.

By accurately reporting your annual mileage and exploring discounts or programs, you can find insurance coverage that suits your driving habits and potentially save on premiums.

Conclusion

Auto insurance premiums are determined by a combination of factors, including behavioral factors that help insurance companies assess the level of risk you pose as a driver. Understanding these behavioral factors is essential for making informed decisions about your insurance coverage and potentially lowering your premiums.

Age and driving experience, gender, marital status, occupation, credit score, driving record, and annual mileage are all important considerations that influence insurance premiums. While some factors, such as age and gender, may be beyond your control, others, such as maintaining a good driving record and managing your credit wisely, can help you secure more affordable coverage.

It’s important to remember that each insurance company weighs these factors differently, and rates can vary between providers. Comparing quotes from multiple insurers and discussing your specific circumstances with an insurance agent can help you find the best coverage at the most competitive rates.

Additionally, taking proactive steps such as completing defensive driving courses, keeping annual mileage low, and updating your insurer about any life changes or occupational adjustments can potentially lead to discounts or lower premiums.

By staying informed and being mindful of these behavioral factors, you can take control of your auto insurance premiums and ensure that you have the coverage you need while maximizing potential savings.

Remember, insurance is not a one-size-fits-all solution. Your personal circumstances and driving behaviors play a significant role in determining your premiums. By considering the behavioral factors discussed in this article, you can navigate the world of auto insurance with confidence and make choices that align with your needs and financial goals.