Home>Finance>Wells Fargo Credit Inquiry Dispute: Where To Send

Finance

Wells Fargo Credit Inquiry Dispute: Where To Send

Published: March 5, 2024

Learn how to dispute a Wells Fargo credit inquiry and where to send your inquiry dispute. Get expert advice on finance and credit disputes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Importance of Wells Fargo Credit Inquiry Dispute

Welcome to the world of finance, where your credit history plays a pivotal role in shaping your financial journey. When it comes to managing your credit, every inquiry matters. Whether you are applying for a loan, a credit card, or any other financial product, each credit inquiry has the potential to impact your credit score. However, what happens when you spot an unauthorized or inaccurate credit inquiry on your report? This is where the process of disputing credit inquiries comes into play, and understanding how to navigate this process with a major financial institution like Wells Fargo is crucial.

Wells Fargo, a prominent player in the banking and financial services sector, is known for its wide array of products and services, including credit cards, loans, and mortgages. As a Wells Fargo customer, it is essential to be well-informed about the steps to take when disputing a credit inquiry associated with your Wells Fargo account. This article aims to provide you with a comprehensive guide on how to address credit inquiries with Wells Fargo, offering valuable insights into the dispute resolution process and the specific channels through which you can initiate your dispute.

Understanding the intricacies of credit inquiry disputes and knowing where to send your dispute can make a significant difference in safeguarding your credit standing. By equipping yourself with the right knowledge and resources, you can effectively navigate the complexities of credit disputes and work towards maintaining a healthy credit profile. Let’s delve into the specifics of Wells Fargo credit inquiry disputes and explore the best practices for addressing and resolving these issues.

Understanding Wells Fargo Credit Inquiry Dispute

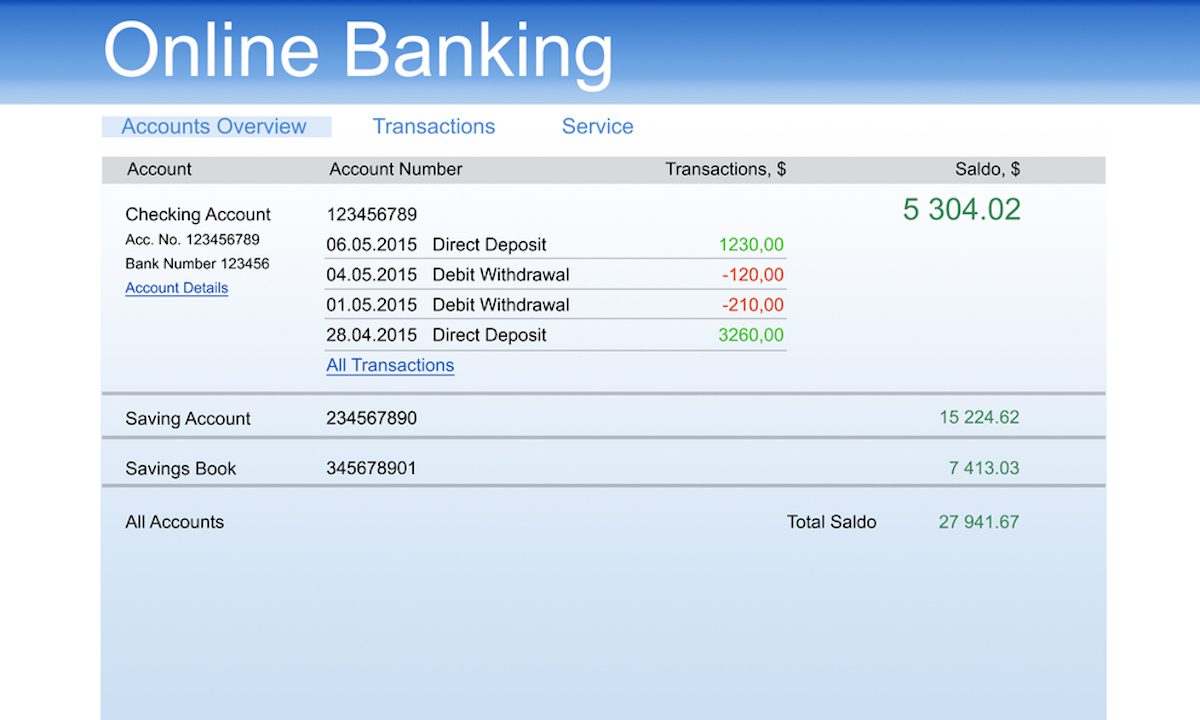

Before delving into the process of disputing credit inquiries with Wells Fargo, it’s essential to grasp the fundamental aspects of credit inquiries and their impact on your financial well-being. A credit inquiry occurs when a potential lender or creditor requests to view your credit report as part of their assessment process. There are two types of credit inquiries: hard inquiries and soft inquiries. Hard inquiries typically arise when you apply for credit, such as a loan or credit card, and have the potential to affect your credit score. On the other hand, soft inquiries, which occur when you check your own credit or when a company conducts a background check, do not impact your credit score.

When it comes to disputing a credit inquiry with Wells Fargo, it’s crucial to differentiate between unauthorized or inaccurate inquiries and legitimate ones. Unauthorized inquiries may signal potential fraud or identity theft, while inaccurate inquiries could stem from administrative errors or misunderstandings. Regardless of the nature of the inquiry you intend to dispute, being able to identify and address it effectively is paramount to safeguarding your credit integrity.

Wells Fargo, like other financial institutions, adheres to the Fair Credit Reporting Act (FCRA), which grants consumers the right to dispute any information on their credit reports that they believe to be inaccurate or unauthorized. This legal framework provides the foundation for the credit inquiry dispute process and outlines the responsibilities of both consumers and credit reporting agencies in resolving such disputes.

By understanding the nuances of credit inquiries and the regulatory framework that governs them, you can approach the dispute resolution process with clarity and confidence. In the next section, we will explore the specific avenues through which you can initiate a credit inquiry dispute with Wells Fargo, empowering you to take proactive steps in safeguarding your credit standing.

Where to Send Wells Fargo Credit Inquiry Dispute

When it comes to disputing a credit inquiry associated with your Wells Fargo account, it’s essential to know the appropriate channels through which you can initiate the dispute resolution process. Wells Fargo provides clear guidelines for submitting credit inquiry disputes, ensuring that customers have accessible avenues to address potential inaccuracies or unauthorized inquiries on their credit reports.

One of the primary methods for initiating a credit inquiry dispute with Wells Fargo is through written correspondence. You can send a formal dispute letter to the address specified by Wells Fargo for handling credit report disputes. In your letter, it’s important to clearly outline the details of the disputed inquiry, including the specific information on your credit report that you believe to be inaccurate or unauthorized. Providing as much supporting evidence as possible, such as documentation highlighting the discrepancy, can strengthen your case and expedite the resolution process.

Additionally, Wells Fargo offers online resources for submitting credit inquiry disputes. Through the Wells Fargo website or customer portal, you may have the option to initiate a dispute electronically. This streamlined approach can offer convenience and efficiency, allowing you to submit the necessary information and documentation digitally. Be sure to follow the specific instructions provided by Wells Fargo for submitting an online credit inquiry dispute to ensure that your request is processed effectively.

Furthermore, if you have been in communication with a Wells Fargo representative regarding the disputed credit inquiry, you can inquire about the appropriate channels for submitting your dispute. Whether it’s through secure messaging on the Wells Fargo online platform or via direct correspondence with a customer service agent, seeking guidance on the most effective way to escalate your dispute can be beneficial in ensuring that your concerns are addressed promptly and accurately.

By familiarizing yourself with the designated avenues for sending Wells Fargo credit inquiry disputes, you can take proactive steps towards resolving potential discrepancies on your credit report. In the subsequent section, we will delve into valuable tips and best practices for navigating the credit inquiry dispute process with Wells Fargo, empowering you to advocate for the accuracy and integrity of your credit history.

Tips for Resolving Credit Inquiry Disputes with Wells Fargo

Resolving credit inquiry disputes with Wells Fargo requires a strategic and informed approach to effectively address potential inaccuracies or unauthorized inquiries on your credit report. By leveraging the following tips and best practices, you can navigate the dispute resolution process with confidence and diligence, safeguarding the integrity of your credit history.

- Thoroughly Review Your Credit Report: Before initiating a dispute, carefully examine your credit report to identify the specific inquiry that you believe to be inaccurate or unauthorized. Understanding the context and details of the inquiry will enable you to provide comprehensive information when submitting your dispute.

- Document the Discrepancy: Gather any supporting documentation that corroborates your dispute, such as correspondence with Wells Fargo, account statements, or any other relevant evidence. Clear documentation can strengthen your case and facilitate a swifter resolution.

- Compose a Clear and Concise Dispute Letter: If opting for written correspondence, craft a well-articulated dispute letter that succinctly outlines the details of the inquiry in question. Clearly state the reasons for disputing the inquiry and provide any pertinent evidence to substantiate your claim.

- Utilize Online Dispute Submission: Take advantage of Wells Fargo’s online dispute submission platform if available. This can streamline the process and provide a digital trail of your dispute submission.

- Follow Up Promptly: After submitting your dispute, follow up with Wells Fargo to ensure that your request has been received and is being processed. Timely communication can help expedite the resolution process.

- Stay Informed About Regulatory Rights: Familiarize yourself with the consumer rights outlined in the Fair Credit Reporting Act (FCRA) to understand the protections and procedures available to you as a consumer disputing credit inquiries.

- Engage with Wells Fargo Customer Service: If you encounter challenges or require clarification during the dispute process, engage with Wells Fargo’s customer service representatives to seek guidance and support.

By incorporating these tips into your approach to resolving credit inquiry disputes with Wells Fargo, you can navigate the process effectively and advocate for the accuracy of your credit report. Proactive engagement and attention to detail are key elements in ensuring that potential inaccuracies are addressed and rectified in a timely manner, ultimately contributing to the preservation of your credit integrity.