Finance

What Is Personal Credit?

Modified: March 10, 2024

Learn about personal credit and how it impacts your finances. Discover the importance of managing and improving your credit score for a stronger financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In today’s world, personal credit plays a crucial role in our financial lives. Whether we are buying a house, securing a loan, or even applying for a credit card, our personal creditworthiness plays a significant role in determining our financial success. But what exactly is personal credit?

Personal credit refers to an individual’s ability to borrow money based on their past borrowing and repayment history. It is essentially a measure of how creditworthy a person is, indicating their reliability in repaying debts and fulfilling financial obligations. Lenders use personal credit scores to assess the risk of lending to individuals, and these scores play a vital role in determining loan approvals, interest rates, and credit limits.

Understanding personal credit is essential for anyone looking to navigate the world of finance successfully. It impacts various aspects of our lives, including our ability to secure housing, obtain financing for education or business ventures, and even determine the affordability of insurance premiums. By maintaining good personal credit, individuals can enjoy favorable borrowing terms, lower interest rates, and improved financial opportunities.

However, personal credit is not set in stone. It is dynamic and can change over time based on an individual’s financial behavior and responsibilities. This means that whether you have excellent credit or poor credit, there are steps you can take to improve your creditworthiness over time.

In this article, we will delve deeper into the world of personal credit, exploring its definition, importance, factors affecting it, different types, as well as strategies for managing and improving personal credit. By gaining a comprehensive understanding, you can take control of your credit journey and make informed decisions to secure a solid financial future.

Definition of Personal Credit

Personal credit refers to an individual’s financial history and their ability to borrow money from financial institutions or lenders based on their creditworthiness. It is a measure of an individual’s trustworthiness and reliability in repaying borrowed funds. Personal credit is typically represented by a credit score, which is a three-digit number that reflects an individual’s creditworthiness.

When you apply for a loan or credit, lenders assess your personal credit to determine the risk involved in lending you money. They consider various factors such as your payment history, outstanding debts, credit utilization, length of credit history, and types of credit accounts.

Your personal credit score is generated based on these factors, with the most common credit scoring model being the FICO score. FICO scores range from 300 to 850, with a higher score indicating better creditworthiness. A good credit score generally falls within the range of 670 to 850.

Having a high credit score indicates that you have a history of responsibly managing your credit obligations, making timely payments, and keeping your debt levels manageable. On the other hand, a low credit score suggests a higher risk to lenders, making it more challenging to secure favorable loan terms or obtain credit.

It’s important to note that personal credit is separate from business credit. Business credit refers to the creditworthiness of a business entity and is assessed based on factors such as the business’s payment history, financial statements, and industry performance. Personal credit, on the other hand, focuses solely on an individual’s financial history.

In summary, personal credit is a measure of an individual’s creditworthiness, represented by a credit score. It serves as a determining factor for lenders when assessing loan applications and setting interest rates. Maintaining good personal credit is essential for accessing favorable financial opportunities and achieving long-term financial stability.

Importance of Personal Credit

Personal credit plays a crucial role in our financial lives and has far-reaching implications. Having good personal credit is essential for various reasons:

- Access to Financing: Personal credit is a key factor that lenders consider when evaluating loan applications. Whether you’re applying for a mortgage, car loan, or personal line of credit, a strong credit history increases your chances of getting approved. Lenders are more willing to lend to individuals with good credit because they have a proven track record of responsible borrowing and repayment.

- Better Loan Terms: Good personal credit can lead to more favorable loan terms, including lower interest rates and higher borrowing limits. Lenders view individuals with excellent credit as less risky, allowing them to offer more competitive rates and flexible repayment options. This can result in significant savings over the life of a loan.

- Credit Card Benefits: With good personal credit, you are more likely to qualify for credit cards with attractive rewards programs, such as cashback, travel rewards, or discounts on purchases. These benefits can add value to your daily spending while helping you build credit with responsible card use.

- Employment Opportunities: Some employers conduct credit checks as part of their hiring process, especially for positions that involve financial responsibility or access to sensitive information. Having a solid credit history can give you an edge over other candidates and instill confidence in your reliability and trustworthiness.

- Lower Insurance Premiums: Insurers often consider personal credit when determining insurance premiums. A good credit score suggests that you are financially responsible and less likely to file claims, making you a lower risk to insure. This can result in lower premiums for auto insurance, homeowner’s insurance, and other types of coverage.

Overall, personal credit has a profound impact on our financial well-being. It affects our ability to obtain financing, the terms we receive, and our overall financial opportunities. By establishing and maintaining good personal credit, we can open doors to better financial outcomes and access a wide range of benefits and opportunities.

Factors Affecting Personal Credit

Several factors contribute to the calculation of an individual’s personal credit score. Understanding these factors can help you make informed decisions and take steps to improve your creditworthiness. Here are the key factors that influence personal credit:

- Payment History: Your payment history has the most significant impact on your credit score. Lenders want to see a track record of on-time payments. Late payments, missed payments, or defaulted accounts can have a detrimental effect on your credit score.

- Credit Utilization Ratio: The credit utilization ratio measures the amount of credit you are using compared to your total available credit. It is recommended to keep your credit utilization below 30%. Higher credit utilization can indicate financial strain and may lower your credit score.

- Length of Credit History: The length of your credit history is an important factor. Lenders prefer individuals with a longer credit history, as it provides a better understanding of your borrowing and repayment behavior. However, even with a shorter credit history, you can still establish a good credit score by maintaining responsible credit practices.

- Types of Credit: Having a mix of credit types, such as revolving credit (credit cards) and installment loans (mortgages, auto loans), can positively impact your credit score. It shows that you can manage various types of credit responsibly.

- New Credit Applications: When you apply for new credit, it can have a temporary negative impact on your credit score. Multiple credit inquiries within a short period can suggest financial instability. Avoid unnecessary credit applications, and only apply for credit when needed.

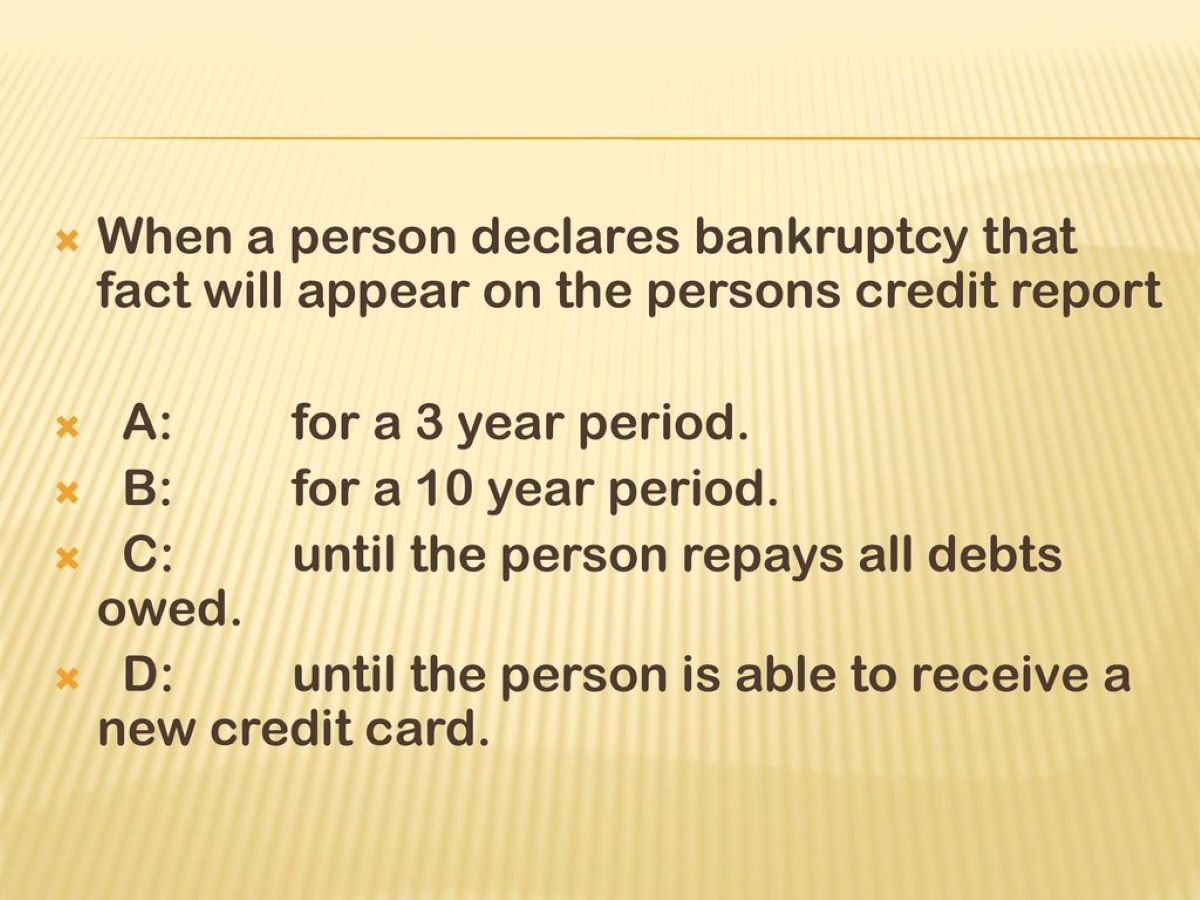

- Public Records and Collections: Bankruptcies, tax liens, foreclosures, or accounts sent to collections significantly harm your credit score. These negative records can stay on your credit report for several years, making it challenging to rebuild your credit.

It’s important to note that the weight of these factors may vary for each individual, depending on their unique credit history and circumstances. For example, someone with a shorter credit history may have a heavier emphasis on their payment history and credit utilization ratio.

By understanding these factors, you can take proactive steps to improve your credit and maintain a good credit score. Paying bills on time, keeping credit utilization low, and managing different types of credit responsibly are key strategies to boost your creditworthiness.

Types of Personal Credit

Personal credit comes in various forms and can be accessed through different borrowing options. Understanding the types of personal credit available can help you choose the most suitable option for your financial needs. Here are some common types of personal credit:

- Secured Loans: Secured loans are backed by collateral, such as a car or home. If you fail to repay the loan, the lender has the right to seize the collateral. Secured loans typically offer lower interest rates because the collateral mitigates the risk for the lender.

- Unsecured Loans: Unsecured loans do not require collateral and are based solely on the borrower’s creditworthiness. These loans are riskier for lenders, resulting in higher interest rates. Personal loans and credit cards are examples of unsecured loans.

- Credit Cards: Credit cards allow individuals to make purchases on credit, up to a predetermined credit limit. Cardholders must make minimum monthly payments and pay interest on any outstanding balances. Proper credit card usage can help build credit when payments are made on time.

- Revolving Credit Lines: Revolving credit lines, such as a home equity line of credit (HELOC), allow borrowers to access funds up to a set limit and repay the borrowed amount over time. Interest is charged on the outstanding balance, and as payments are made, funds become available again for future use.

- Installment Loans: Installment loans involve borrowing a fixed amount of money and repaying it through regular payments over a specified term. Auto loans, student loans, and mortgages are common examples of installment loans. These loans usually require a down payment and are repaid in equal installments.

- Payday Loans: Payday loans are short-term loans that provide quick access to cash, typically to be repaid by the borrower’s next paycheck. These loans often come with high interest rates and fees, making them a costly option. Payday loans should be used sparingly and for emergency situations only.

The type of personal credit you choose depends on factors such as your financial needs, creditworthiness, and repayment ability. It’s important to ensure that you borrow responsibly, only taking on debt that you can comfortably repay.

Additionally, it is crucial to review the terms and conditions of any credit agreement carefully, including interest rates, fees, and repayment terms. Understanding the specifics of the credit product will help you make informed decisions and avoid any potential pitfalls.

Managing Personal Credit

Proper management of personal credit is essential for maintaining a healthy financial profile. Effective credit management involves responsible borrowing, timely repayment, and monitoring your credit regularly. Here are some tips for managing personal credit:

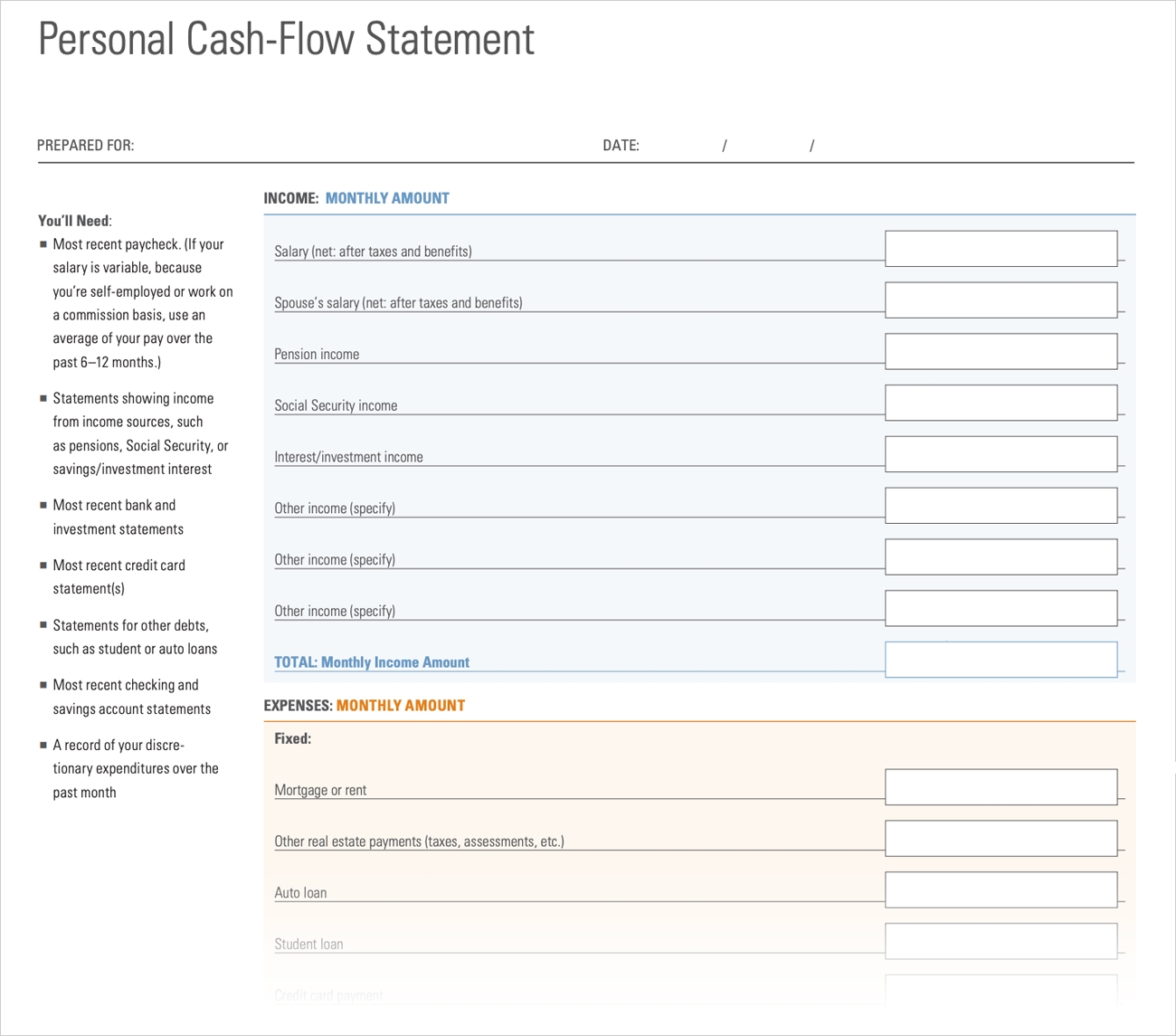

- Create a Budget: Establish a monthly budget to track your income and expenses. This will help you prioritize debt repayments and avoid unnecessary spending. By staying within your means, you can prevent excessive borrowing and maintain better control over your credit.

- Pay Bills on Time: Late payments can have a negative impact on your credit score. Ensure all your bills, including credit card payments, loan installments, and utility bills, are paid on time. Consider setting up automatic payments or calendar reminders to avoid missing due dates.

- Monitor Your Credit: Regularly checking your credit reports allows you to identify any errors or fraudulent activity. You are entitled to a free annual credit report from each of the major credit bureaus: Equifax, Experian, and TransUnion. Review your reports for accuracy and report any discrepancies promptly.

- Manage Credit Utilization: Aim to keep your credit utilization ratio below 30%. This means using only a portion of your available credit. High credit utilization can negatively impact your credit score. Consider paying down balances or requesting credit limit increases to improve your utilization ratio.

- Avoid Excessive Debt: Be cautious of taking on excessive debt. Only borrow what you need and can afford to repay comfortably. Avoid maxing out credit cards or taking on multiple loans simultaneously, as it can strain your budget and impact your creditworthiness.

- Limit Credit Applications: Avoid frequently applying for new credit. Each time you apply, a hard inquiry is placed on your credit report, which can temporarily lower your credit score. Be selective with credit applications and only apply for credit when necessary.

- Establish a Credit History: If you are new to credit, consider starting with a secured credit card or becoming an authorized user on someone else’s credit card. Making timely payments and demonstrating responsible credit use will help you build a positive credit history over time.

- Communicate with Creditors: If you are experiencing financial difficulties, communicate with your creditors early on. They may be willing to work out a modified payment plan or provide temporary relief. Ignoring bills or defaulting on payments will severely damage your credit.

By implementing these credit management practices, you can establish a solid foundation for your personal credit. Remember, managing personal credit is an ongoing process, requiring diligence and responsible financial behavior. Continuously monitoring and making adjustments as needed will help you navigate the credit landscape successfully.

Benefits of Good Personal Credit

Having good personal credit opens up a world of financial opportunities and provides several benefits. Here are the key advantages of maintaining a strong credit score:

- Favorable Loan Terms: Good personal credit increases your chances of getting approved for loans and obtaining more favorable terms. Lenders view individuals with excellent credit as low-risk borrowers, which often leads to lower interest rates, higher loan amounts, and more flexible repayment options.

- Access to Credit Cards: With good personal credit, you are more likely to qualify for credit cards with attractive benefits, such as cashback rewards, travel perks, and lower annual fees. Credit cards can provide convenience, financial flexibility, and the opportunity to build credit further when used responsibly.

- Lower Interest Rates: A good credit score allows you to secure loans and credit at lower interest rates. This can result in significant savings over time, as lower rates mean paying less in interest charges. Whether it’s a mortgage, auto loan, or personal loan, favorable interest rates can save you thousands of dollars.

- Ability to Rent or Buy a Home: Good credit is crucial when renting an apartment or applying for a mortgage. Landlords and lenders often review an applicant’s credit history to assess their reliability and financial responsibility. With good credit, you are more likely to secure your desired rental unit or obtain a mortgage with attractive terms.

- Employment Opportunities: Some employers conduct credit checks as part of their hiring process, particularly for positions that involve financial responsibilities or access to sensitive information. Good credit can enhance your employability, as it reflects your trustworthiness and financial stability.

- Insurance Premiums: Insurers consider personal credit when determining insurance premiums. A strong credit score may lead to lower rates on auto insurance, homeowner’s insurance, and other types of coverage. Good credit suggests that you are a responsible policyholder and pose a lower risk to insurers.

- Flexible Financing Options: Having good credit opens the door to various financing options. Whether you need to purchase a new vehicle, start a business, or pursue further education, good credit increases your chances of securing the financing you need and obtaining better terms.

Ultimately, good personal credit empowers you to make more informed financial decisions and enjoy greater financial freedom. It provides access to better borrowing opportunities, saves you money through lower interest rates, enhances your purchasing power, and brings peace of mind by establishing a solid financial foundation.

Consequences of Bad Personal Credit

Having bad personal credit can have significant repercussions on your financial well-being and limit your opportunities. Here are some of the consequences of having poor credit:

- Difficulty Obtaining Loans: One of the most immediate consequences of bad personal credit is difficulty in obtaining loans or credit. Lenders view individuals with low credit scores as high-risk borrowers, making it challenging to secure financing for major purchases like a home or car. Even if you do get approved, you may face higher interest rates and less favorable loan terms.

- Higher Interest Rates: Bad credit often leads to higher interest rates on loans and credit cards. Lenders charge higher rates to compensate for the added risk they perceive in lending to individuals with poor credit. This can result in substantially higher monthly payments and long-term interest costs.

- Limited Access to Credit: Poor credit can limit your ability to access credit options. You may find it difficult to get approved for new credit cards, lines of credit, or other financing options. This limitation can hinder your ability to handle financial emergencies or take advantage of opportunities that require additional funds.

- Difficulty Renting or Buying a Home: Landlords often conduct credit checks when screening prospective tenants. Bad credit can make it challenging to rent an apartment or secure housing. Similarly, when applying for a mortgage, lenders may require a higher down payment, charge higher interest rates, or even reject your application altogether due to poor credit.

- Higher Insurance Premiums: Insurance companies also consider credit scores when determining insurance premiums. Bad credit may result in higher rates for auto insurance, homeowner’s insurance, and other types of coverage. Insurers view individuals with poor credit as higher risks, translating into increased premiums.

- Difficulty Finding Employment: Some employers conduct credit checks as part of their screening process. Bad credit can raise concerns about financial responsibility and honesty, potentially impacting your chances of being hired for certain positions. It’s particularly relevant in roles that involve financial management, accounting, or handling sensitive information.

- Collection Actions and Legal Consequences: Failure to pay debts can lead to collection actions by creditors or debt collection agencies. This can result in a barrage of collection calls and letters. In extreme cases, unpaid debts may result in legal action, such as wage garnishment or even asset seizure.

It’s crucial to recognize that bad personal credit can have long-term consequences. It can limit your financial opportunities, cost you more in the form of higher interest rates and insurance premiums, and impact your overall financial well-being. However, it’s never too late to start improving your credit. Taking proactive steps towards responsible credit management and diligently addressing any credit issues can help you rebuild your creditworthiness over time.

Improving Personal Credit Score

If you have a less-than-desirable credit score, don’t despair. There are steps you can take to improve your personal creditworthiness over time. Here are some strategies to consider:

- Pay Bills on Time: Making timely payments is one of the most critical factors in improving your credit score. Set up payment reminders or automatic payments to ensure you never miss a due date.

- Reduce Credit Card Balances: Paying down credit card balances can significantly impact your credit utilization ratio. Aim to keep your credit utilization below 30% to demonstrate responsible credit management.

- Establish a Consistent Credit History: Length of credit history is an important factor. Open new credit accounts only when necessary and keep them active to establish a consistent credit history over time.

- Address Past Due Accounts: If you have past due accounts, work on bringing them up to date as soon as possible. Catching up on missed payments can help improve your payment history and reduce the negative impact on your credit score.

- Dispute Inaccurate Information: Regularly review your credit reports for any errors or inaccuracies. Dispute any incorrect information with the credit bureaus to ensure your credit report is accurate and reflects your actual credit history.

- Use Secured Credit Cards: If you’re struggling to get approved for traditional credit cards, consider applying for a secured credit card. These cards require a security deposit, typically equal to the credit limit. Responsible use of a secured credit card can help rebuild your credit.

- Keep Old Credit Accounts Open: Closing old credit accounts can negatively impact your credit history and credit utilization ratio. Keep your older accounts open, even if they have a zero balance, to maintain a longer credit history.

- Avoid Excessive Credit Applications: Multiple credit inquiries can harm your credit score. Limit new credit applications and only apply for credit when necessary.

- Manage Debt Responsibly: Focus on reducing and managing your debt responsibly. Make consistent payments and avoid taking on unnecessary debt to demonstrate financial stability.

- Seek Professional Guidance: If you’re struggling to improve your credit or need assistance, consider seeking guidance from a reputable credit counseling agency. They can provide personalized advice and guidance tailored to your specific financial situation.

It’s important to note that improving your credit score takes time and patience. There is no quick fix, and be wary of anyone promising rapid credit repair. By implementing these strategies consistently and practicing responsible credit behavior, you can gradually improve your creditworthiness over time.

Remember, the journey of improving your credit is about establishing good financial habits and making responsible decisions. As you build a positive credit history, you’ll open doors to better borrowing opportunities and financial stability.

Conclusion

Personal credit is a crucial aspect of our financial lives, impacting our ability to obtain loans, secure favorable interest rates, and access various financial opportunities. Understanding the definition, importance, factors, types, and management strategies of personal credit is essential for navigating the financial landscape successfully.

By maintaining good personal credit, individuals can enjoy a range of benefits, including better loan terms, lower insurance premiums, increased employment opportunities, and access to credit cards with attractive rewards. On the other hand, bad personal credit can lead to difficulties in obtaining loans, higher interest rates, limited access to credit, and even challenges in securing rental housing or employment.

Improving personal credit takes time and commitment. By consistently making timely payments, reducing credit card balances, and addressing any past due accounts, individuals can gradually build a positive credit history. It’s crucial to manage credit responsibly, monitor credit reports for accuracy, and seek professional guidance if needed.

Remember, personal credit is not set in stone. It is a dynamic aspect of our financial profile that can be improved over time. By taking control of your personal credit and making informed financial decisions, you can set yourself up for a brighter financial future, with increased financial opportunities and stability.