Finance

What Are Bills Of Credit

Modified: February 21, 2024

Learn about the importance of bills of credit in the world of finance and how they affect the economy. Understand their purpose and impact.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Bills of credit are a significant aspect of the financial world and play a crucial role in economic transactions. Also known as monetary currency, bills of credit are forms of currency that are issued by governments or authorized entities and serve as legal tender within a specified jurisdiction. These bills, which can take the form of paper money or electronic tokens, are used as a medium of exchange for goods and services.

The concept of bills of credit has a long history, dating back centuries. They have been used as a means to facilitate trade, stimulate economic growth, and provide stability in financial systems. In recent times, bills of credit have evolved alongside advancements in technology, with digital currencies gaining significant popularity.

Throughout this article, we will delve into the definition, history, functions, controversies, and examples of bills of credit in different countries. By gaining a deeper understanding of these important financial instruments, we can appreciate their impact on the economy and financial systems in various parts of the world.

Definition of Bills of Credit

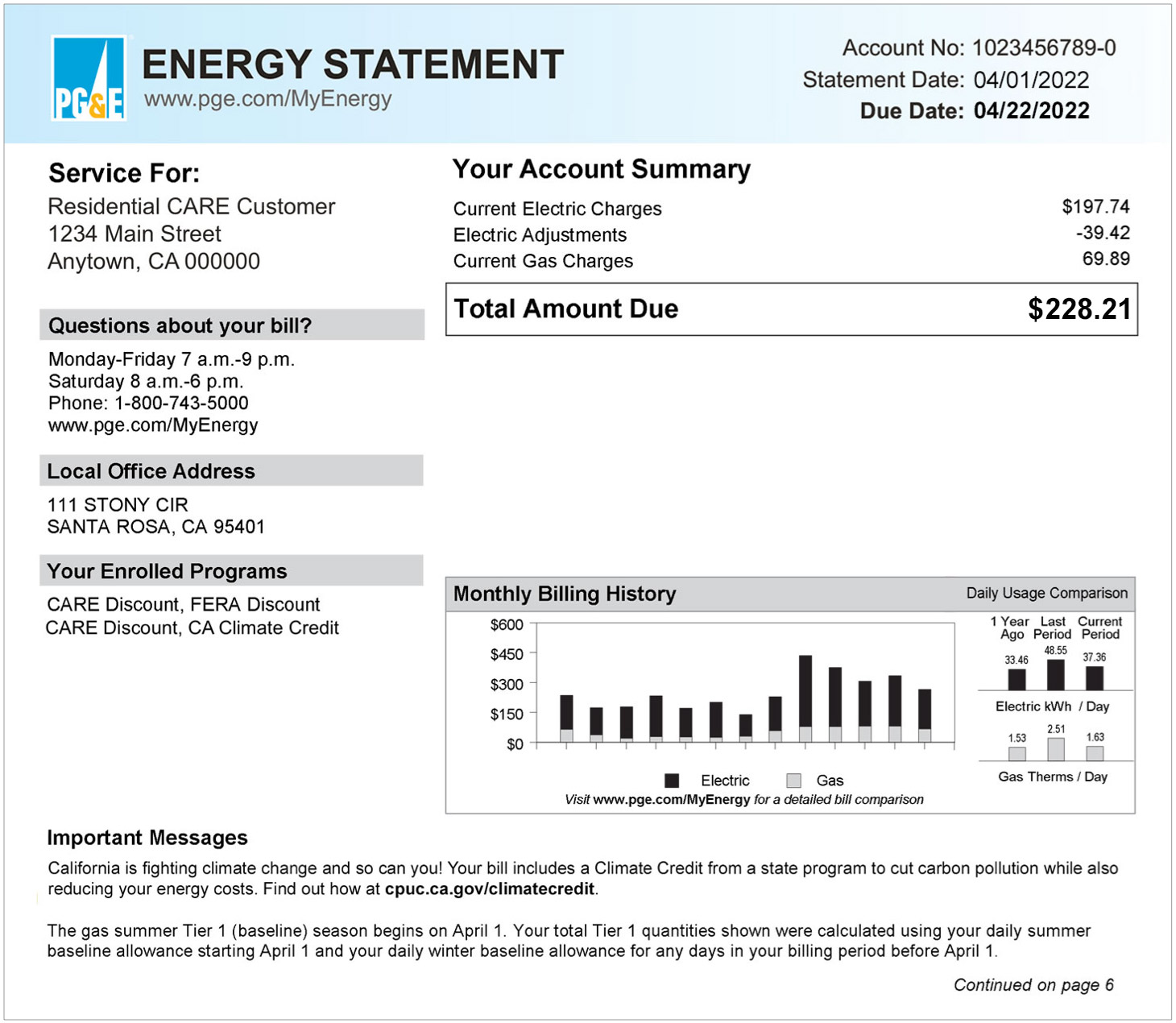

Bills of credit are a form of currency issued by governments or authorized entities that serve as a medium of exchange for goods and services. These bills are considered legal tender within a specific jurisdiction and are used in lieu of physical cash or coins. They can exist in both physical and digital forms, depending on the country and the advancement of its financial systems.

When a government or authorized body issues bills of credit, they essentially declare that the bills hold a certain value and are acceptable for transactions. This value is backed by the trust and confidence that the public places in the issuing entity and the overall stability of the financial system. Unlike physical cash, bills of credit are not backed by a commodity such as gold or silver, but rather by the creditworthiness and faith in the issuing entity.

The issuance of bills of credit is a carefully regulated process, typically conducted by a central bank or a government authority. The government authority or central bank controls the quantity of bills of credit in circulation, ensuring that it is in line with the economic needs and stability of the country. This control helps prevent inflation or deflation, maintaining the value and integrity of the currency.

Bills of credit are usually imprinted with specific security features, such as watermarks, holograms, or special ink, to prevent counterfeiting and maintain the credibility of the currency. Additionally, they often bear the signature or seal of the issuing authority, further enhancing their legitimacy.

Overall, bills of credit play a vital role in the economy by facilitating transactions and providing a means of exchange. They are universally recognized within a specific jurisdiction and are accepted by individuals, businesses, and other entities. The value of these bills fluctuates based on various factors, including the overall economic conditions, government policies, and the level of trust in the issuing entity.

History of Bills of Credit

The history of bills of credit dates back centuries, with their roots traced to ancient civilizations. The concept of using non-physical currency has been present in various forms throughout history, evolving alongside the development of trade and commerce.

One of the earliest forms of bills of credit can be seen in ancient China, where merchants used paper money as a means of exchange during the Tang Dynasty (618-907 AD). These early forms of currency acted as promissory notes and were widely accepted in commercial transactions.

In Europe, the use of bills of credit gained prominence during the medieval period. Italian city-states, such as Venice and Florence, issued bills of credit that were widely accepted and facilitated trade within their regions. This innovative method of payment contributed to the growth of international trade and commerce during that time.

However, it was the development of modern banking systems and the establishment of central banks that revolutionized the use of bills of credit. The Bank of Sweden, established in 1668, introduced banknotes, which were effectively backed by the bank’s holdings of precious metals. This marked a significant shift towards the use of paper money as a recognized form of currency.

During the 18th and 19th centuries, many countries began to adopt paper money as their primary form of currency. The United States, for example, issued its first national banknotes in the mid-19th century. These banknotes, known as “greenbacks,” served as a means of financing the Civil War and establishing a stable monetary system.

In the 20th century, the rise of digital technology led to the emergence of electronic forms of bills of credit. With the advent of credit cards, online banking, and digital payments, the use of physical cash has become less prevalent in many advanced economies.

Today, bills of credit have evolved into various forms, including traditional banknotes, digital currencies like Bitcoin, and central bank digital currencies (CBDCs). These advancements reflect the changing needs of modern economies and the ongoing integration of technology into financial systems.

Overall, the history of bills of credit showcases the evolution of currency and the role it plays in facilitating trade, commerce, and economic growth. From ancient paper money to modern digital currencies, bills of credit have a rich and fascinating history that continues to shape the way we conduct financial transactions in the modern world.

Functions and Uses of Bills of Credit

Bills of credit serve several key functions and have a variety of uses within the financial system. Understanding these functions and uses is essential to grasp the importance of bills of credit in the modern economy.

1. Medium of Exchange: One of the primary functions of bills of credit is to serve as a medium of exchange. They provide a convenient and widely accepted form of payment for goods and services. Individuals, businesses, and other entities can use bills of credit to complete transactions, eliminating the need for barter or the use of physical cash.

2. Store of Value: Bills of credit can act as a store of value, allowing individuals to save their wealth over time. By holding bills of credit, individuals can preserve the value of their money, protecting it from inflation or other economic fluctuations. This makes bills of credit an attractive option for long-term savings and wealth preservation.

3. Unit of Account: Bills of credit serve as a common unit of account, allowing for the measurement and comparison of the value of various goods and services. By using a standardized currency, individuals and businesses can easily evaluate prices, make financial calculations, and engage in economic transactions.

4. Facilitate Economic Growth: Bills of credit play a vital role in facilitating economic growth. They provide the necessary liquidity for trade and investment activities by ensuring smooth transactions between buyers and sellers. Additionally, bills of credit encourage consumption and investment by providing a secure and stable means of exchange.

5. Debt and Credit Instrument: Bills of credit can also serve as a debt and credit instrument. Governments, businesses, and individuals can borrow money by issuing bills of credit, creating a debt that will be repaid in the future. This facilitates the flow of capital and enables economic activities that require funding beyond existing resources.

6. International Trade: Bills of credit are instrumental in international trade. They provide a universally accepted form of payment that allows for seamless transactions between countries. Bills of credit eliminate the need for currency conversions and reduce the risk associated with fluctuating exchange rates, making international trade more efficient and accessible.

7. Monetary Policy Tool: Central banks often utilize bills of credit as a tool for implementing monetary policy. By controlling the supply of bills of credit, central banks can influence interest rates, manage inflation, and stabilize the overall economy. Adjusting the availability of bills of credit allows central banks to regulate the money supply and influence economic conditions.

Overall, bills of credit serve as a foundation for economic transactions, enabling individuals, businesses, and governments to conduct financial activities efficiently and effectively. Their functions and uses extend beyond being a simple medium of exchange, encompassing aspects of savings, investment, debt, international trade, and monetary policy.

Controversies surrounding Bills of Credit

Bills of credit have not been without their fair share of controversies throughout history. These controversies arise from various factors, including issues of trust, economic stability, and government control. Understanding these controversies is crucial for a comprehensive understanding of the implications and challenges associated with bills of credit.

1. Counterfeiting: One of the longstanding controversies surrounding bills of credit is the issue of counterfeiting. As bills of credit became more widely accepted, counterfeiters sought to replicate and distribute fake currency, destabilizing economies and eroding public trust. Governments and authorized entities have implemented various security features and measures to combat counterfeiting, but the problem persists, requiring ongoing vigilance.

2. Inflation and Hyperinflation: Bills of credit are susceptible to inflation, which occurs when the value of the currency decreases over time. Rapid inflation, or hyperinflation, can have detrimental effects on economies, leading to skyrocketing prices, eroded purchasing power, and overall economic instability. Maintaining stable prices and preventing inflation has been a challenge for governments and central banks when managing their bills of credit.

3. Loss of Confidence: The trust and confidence in the issuing entity or government play a crucial role in the value and acceptance of bills of credit. Public perception regarding the stability of the issuing entity can significantly impact the value of the currency. Scandals, economic crises, or political instability can lead to a loss of confidence in bills of credit, leading to a decline in their value and acceptance in the market.

4. Economic Manipulation: Governments and central banks have the power to manipulate the value of bills of credit through monetary policies. While these policies aim to stabilize the economy, they can also have unintended consequences. Criticisms often arise around decisions regarding interest rates, money supply, and currency valuation, as they can impact inflation, exchange rates, and overall economic conditions.

5. Accessibility and Inclusion: Bills of credit can pose challenges in terms of accessibility and financial inclusion. In areas with limited access to banking services or weak financial infrastructure, individuals may face difficulties in obtaining or using bills of credit. This can create disparities and hinder economic participation for marginalized populations.

6. Rise of Cryptocurrencies: The emergence of cryptocurrencies, such as Bitcoin, has brought about a new dimension of controversy surrounding bills of credit. Cryptocurrencies operate outside traditional financial systems and are decentralized, which challenges the control and regulation of governments and central banks. The debate surrounding the adoption and integration of cryptocurrencies alongside bills of credit continues to evolve.

These controversies highlight the complexities and challenges associated with bills of credit. Balancing trust, stability, and accessibility requires careful regulation and a proactive approach from governments, central banks, and financial institutions. Addressing these controversies is crucial to maintain the integrity of bills of credit and ensure their effectiveness as a medium of exchange and store of value.

Examples of Bills of Credit in Different Countries

Bills of credit are utilized in various forms and under different names across different countries. These examples showcase the diversity and adaptability of bills of credit in different economic and cultural contexts.

1. United States – The United States issues bills of credit in the form of Federal Reserve Notes, commonly known as U.S. dollars. These bills of credit are accepted throughout the country as legal tender and serve as the primary medium of exchange. The U.S. dollar is also widely recognized and used as a reserve currency in international trade.

2. European Union – As a collective of member countries, the European Union (EU) has implemented the Euro as a common currency for many of its member states. The Euro, in the form of banknotes and coins, is used across countries such as Germany, France, Italy, and Spain, facilitating seamless transactions and promoting economic integration within the Eurozone.

3. Japan – The Japanese yen, issued by the Bank of Japan, serves as the official currency of Japan. The yen is widely accepted in the country and is known for its stability and liquidity. It plays a significant role in the Japanese economy and is recognized as a reserve currency in international finance.

4. United Kingdom – The British pound sterling is the official currency of the United Kingdom. Banknotes and coins issued by the Bank of England are used as bills of credit in England, Scotland, Wales, and Northern Ireland. The pound sterling has a long history and remains a globally recognized currency.

5. Australia – Australia issues bills of credit in the form of Australian dollar banknotes and coins, which are managed by the Reserve Bank of Australia. The Australian dollar is widely accepted throughout the country and is an important currency in the Asia-Pacific region, facilitating regional trade and economic activities.

6. Switzerland – The Swiss National Bank issues bills of credit in the form of Swiss franc banknotes and coins. The Swiss franc is known for its stability and is widely accepted in Switzerland. Switzerland’s reputation for financial security has contributed to the global recognition and popularity of the Swiss franc.

7. China – The People’s Bank of China issues the Chinese yuan, also known as the renminbi, as the official currency of China. The Chinese yuan is widely used within the country and has become increasingly important in international trade. China has also been at the forefront of exploring digital forms of bills of credit, with the development of a digital yuan.

These examples illustrate the diversity of bills of credit around the world and how they contribute to the financial systems of different countries. The issuance and management of bills of credit are essential tools for governments and central banks in maintaining economic stability and facilitating economic activities.

Conclusion

Bills of credit are a fundamental component of the financial landscape, serving as widely accepted forms of currency in economies around the world. These flexible and versatile instruments facilitate economic transactions, store value, and contribute to the overall stability of financial systems.

Throughout history, bills of credit have evolved from ancient paper money to modern digital currencies, adapting to advancements in technology and addressing changing economic needs. They have played a crucial role in promoting trade, investment, and economic growth, providing a medium of exchange that is universally recognized.

However, bills of credit are not without controversies. Counterfeiting, inflation, loss of confidence, and economic manipulation have posed challenges for governments and central banks. Maintaining trust, stability, and accessibility are ongoing endeavors that require careful regulation, security measures, and technological innovation.

The examples of bills of credit in different countries highlight the diversity and adaptability of these instruments. From the U.S. dollar to the Euro, and from the Japanese yen to the Chinese yuan, each currency represents the unique economic and cultural contexts in which they operate.

In conclusion, bills of credit continue to be a vital aspect of economic transactions, providing a foundation for trade, investment, and financial stability. They are essential instruments for governments, central banks, and individuals, enabling the efficient exchange of goods and services, preserving wealth, and fostering economic growth. As technology continues to advance and new forms of currency emerge, the capabilities and functions of bills of credit will undoubtedly continue to evolve, shaping the future of financial systems.