Finance

What Is A Credit Balance On A Bill

Modified: February 21, 2024

Learn about credit balances on bills and how they relate to your finances. Find out what a credit balance means and how it can affect your financial situation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a Credit Balance

- Causes of a Credit Balance

- Billing Errors

- Overpayment

- Refunds and Returns

- Credit Card Rewards or Cash Back

- Implications of a Credit Balance

- Options for Utilizing a Credit Balance

- Applying Credit Towards Future Bills

- Requesting a Refund

- Transferring Credit to Another Account

- Conclusion

Introduction

Have you ever received a bill only to find that you have a credit balance? It can be quite confusing and leave you wondering what to do next. Understanding what a credit balance is and how it occurs is essential in managing your finances effectively. In this article, we will explore the concept of a credit balance on a bill and help you navigate the possible scenarios and implications that come with it.

A credit balance occurs when you have paid more than what is owed on a bill or account. Instead of having a balance due, you have a surplus amount that can be used for future payments or refunded to you. While it may seem like a fortunate situation to have extra funds in your account, it is important to understand the various causes of a credit balance and the options available to utilize or receive the surplus amount.

Whether it’s due to billing errors, overpayment, refunds and returns, or credit card rewards, credit balances can arise from different circumstances. In some cases, they may result from a mistake on the part of the billing department, while in others, they may be intentional, such as when you earn cash back on a credit card purchase. Regardless of the cause, it is crucial to be aware of the implications and how to handle a credit balance to ensure you make the most of your financial situation.

In the following sections, we will delve further into the various causes of a credit balance and explore the implications it can have on your financial health. We will also discuss the different options available to optimize and utilize a credit balance, such as applying it towards future bills, requesting a refund, or transferring it to another account. By the end of this article, you will have a comprehensive understanding of how to navigate credit balances effectively and make informed decisions about managing your finances.

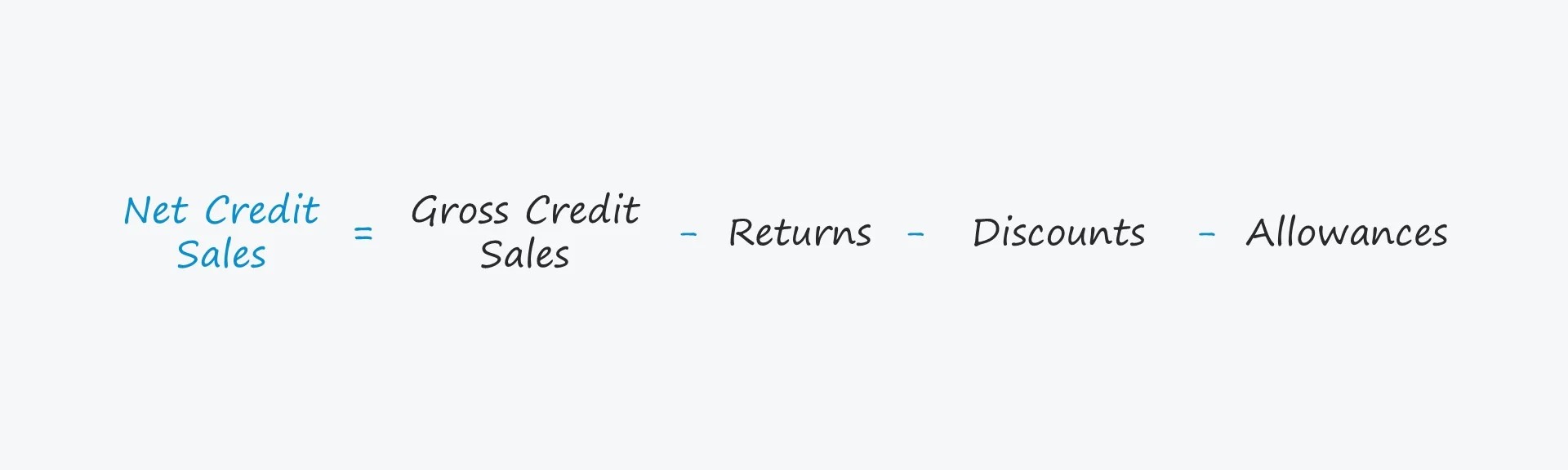

Definition of a Credit Balance

A credit balance, in the context of billing and financial transactions, refers to a surplus amount in your account or a bill where you have paid more than the amount owed. It is essentially an excess of funds that can be carried forward as a credit towards future payments or refunded to you, depending on the policies and options available.

When you receive a bill or statement that shows a credit balance, it means that you have overpaid the amount due. For example, if you have a credit card bill of $500 and you make a payment of $600, you will have a credit balance of $100. This excess amount will be applied to your future purchases or can be requested as a refund based on the terms and conditions of the credit card issuer or the billing entity.

A credit balance can arise from various sources. It can be due to errors in billing, where the billing department mistakenly overcharges you or applies incorrect fees or discounts. In such cases, the excess amount you have paid will result in a credit balance on your account. Alternatively, a credit balance can also be the result of intentional actions on your part, such as making an overpayment or earning cash back rewards through credit card purchases.

It is important to note that a credit balance is different from a negative balance or a debt. A negative balance indicates that you owe money on an account or bill, while a credit balance signifies that you have overpaid and have funds remaining. It is crucial to clarify any discrepancies with the billing entity to ensure accuracy in your financial records and avoid any potential issues in the future.

Understanding the concept of a credit balance is essential in managing your finances effectively. It enables you to make informed decisions about how to utilize the surplus funds and optimize your financial situation. In the following sections, we will discuss the various causes of a credit balance and explore the implications it can have on your billing and financial health.

Causes of a Credit Balance

A credit balance can occur due to several reasons, ranging from billing errors to intentional actions on your part. It is important to understand these causes to effectively manage your finances and address any discrepancies that may arise. Let’s explore the common causes of a credit balance:

- Billing Errors: One of the primary causes of a credit balance is billing errors. This can include incorrect charges, double billing, or applying incorrect fees or discounts. For example, if a vendor inadvertently charges you twice for a service or product, resulting in an overpayment, it will lead to a credit balance on your account.

- Overpayment: Sometimes, you may intentionally make an overpayment on a bill or account. This can be done to ensure that you have a sufficient credit balance to cover future expenses or to reduce the likelihood of falling behind on payments. For instance, if you anticipate higher usage of a service or want to pay off a debt in advance, making an overpayment can result in a credit balance.

- Refunds and Returns: When you return a product or receive a refund for a service, it can lead to a credit balance on your account. This often occurs when you have already made a payment for the item or service and receive reimbursement for the amount paid. The refunded amount is applied as a credit towards future purchases or can be returned to you as a refund, depending on the policies of the vendor or service provider.

- Credit Card Rewards or Cash Back: Many credit cards offer rewards programs or cash back features where you can earn a percentage of your purchases as credit. These rewards can accumulate and result in a credit balance on your credit card statement. The accumulated rewards can be applied towards future purchases or redeemed for other benefits offered by the credit card issuer.

- Insurance Reimbursements: In the case of insurance claims, receiving a reimbursement for expenses covered by your policy can result in a credit balance. For example, if you pay for a medical appointment out-of-pocket and later submit a claim to your insurance company, the reimbursed amount will be credited back to your account.

Understanding the various causes of a credit balance can help you identify the reason behind the surplus funds in your account or bill. This knowledge will enable you to make informed decisions on how to utilize the credit balance, whether it’s applying it towards future bills, requesting a refund, or transferring it to another account. In the following sections, we will discuss the implications of a credit balance and the options available to you for utilizing the surplus amount.

Billing Errors

Billing errors are a common cause of credit balances on bills or accounts. These errors can occur due to various reasons, such as system glitches, miscalculations, or human mistakes. When a billing error happens, it can result in an incorrect charge, overcharge, or undercharge, leading to a credit balance on your account.

There are several types of billing errors that can contribute to a credit balance:

- Incorrect Charges: Sometimes, you may notice charges on your bill that don’t align with the products or services you have availed. These incorrect charges can include items that you didn’t purchase or additional fees that were wrongly applied. If you identify such charges and dispute them, the excess amount paid will be credited back to your account.

- Double Billing: Double billing occurs when you receive duplicate charges for the same item or service. It usually results from a technical error in the billing system or a manual oversight where the same charge is applied twice. Identifying and reporting double billing can help rectify the error and result in a credit balance for the duplicate charge.

- Incorrect Fees or Discounts: Billing errors can also occur when incorrect fees or discounts are applied to your bill. For example, if you are entitled to a promotional discount or a loyalty program benefit, but it is not reflected in your bill, you may end up paying more than you should. In such cases, rectifying the error will lead to a credit balance for the excess amount paid.

- Data Entry Errors: Human mistakes during data entry can lead to incorrect billing amounts. This can happen when the wrong pricing information, quantity, or billing codes are entered into the system. These errors can result in overcharges or undercharges, creating a credit balance on your account.

When you identify a billing error that has resulted in a credit balance, it is important to contact the billing department or customer service of the respective company. Provide them with the necessary documentation, such as receipts, invoices, or statements, to support your claim. Most companies have procedures in place to rectify billing errors and issue a credit or refund for the excess amount.

It is essential to review your bills regularly and carefully to ensure the accuracy of the charges. Paying attention to the details will help you identify any potential billing errors and prevent them from recurring. By addressing billing errors promptly, you can maintain the integrity of your financial records and avoid unnecessary credit balances.

Overpayment

Overpayment is another common cause of credit balances on bills or accounts. Sometimes, you may intentionally make an overpayment to ensure that you have a surplus amount to cover future expenses or to reduce the likelihood of falling behind on payments.

There are a few reasons why you might choose to make an overpayment:

- Future Payment Coverage: By making an overpayment, you can have a credit balance that acts as a reserve to cover future bills or expenses. This can be particularly useful if you anticipate upcoming expenses, such as a higher utility bill during a hot summer or the need for additional services in the near future.

- Paying in Advance: Making an overpayment can also be a way to stay ahead of your financial obligations. By paying off a larger portion of a debt upfront, you can reduce the amount of interest that accrues over time and potentially decrease your overall financial burden.

- Avoiding Late Fees: Overpaying on bills can be a strategy to prevent late fees or penalties. By ensuring that you have a credit balance, you mitigate the risk of missing a payment deadline and incurring additional charges.

- Surplus Income Utilization: If you find yourself with extra funds available, you may choose to utilize them by making an overpayment on a bill. This can be a way to effectively allocate your surplus income and reduce any temptations to spend it on unnecessary expenses.

When you make an overpayment, the excess amount is credited to your account as a credit balance. This surplus can be used towards future expenses or refunded to you, depending on the options and policies of the billing entity.

However, it is important to consider the terms and conditions of the billing entity before making an overpayment. Some companies may have limitations on the amount of credit balance you can carry forward, while others may not offer refunds or only allow refunds after a certain period. It is recommended to familiarize yourself with the policies to ensure that your overpayment aligns with your intended financial goals.

Managing an overpayment and utilizing the resulting credit balance effectively requires careful attention to your financial records and budget. By keeping track of your credit balances and regularly reviewing your bills and statements, you can make informed decisions about how to utilize those surplus funds and optimize your financial situation.

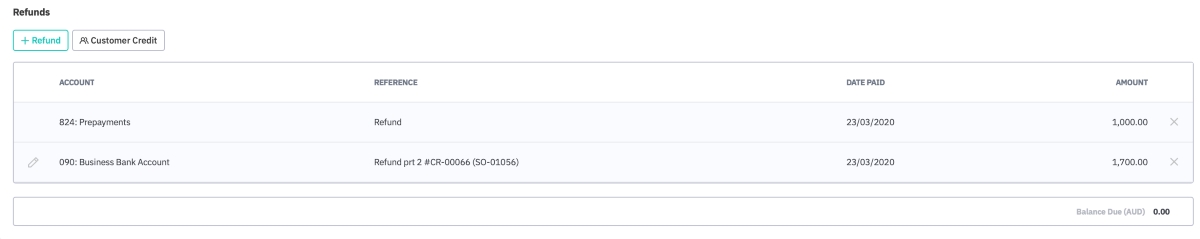

Refunds and Returns

Returns and refunds are another common cause of credit balances on bills or accounts. When you return a product or receive a refund for a service, it can result in a credit balance as the refunded amount is applied as a credit towards future purchases or returned to you as a refund.

Here are a few scenarios where refunds and returns can lead to credit balances:

- Product Returns: If you purchase a product and later decide to return it due to various reasons, such as dissatisfaction or receiving a defective item, you are entitled to a refund. The refunded amount will be credited back to your account as a credit balance or returned to you as a refund, depending on the policies of the vendor.

- Service Refunds: Service-based businesses, such as subscription-based services or memberships, often have refund policies in place. If you decide to cancel a service and are eligible for a refund, the refunded amount will be credited back to your account or refunded to you by the service provider.

- Overpaid Returns: In some cases, when you return a product that you have already paid for, the refunded amount may exceed the remaining balance on your bill or account. This leads to a credit balance, and the excess amount can be utilized for future purchases or can be requested as a refund.

- Insurance Reimbursements: If you have made a payment for a medical service or incurred expenses covered by your insurance policy, you can submit a claim for reimbursement. Once the claim is processed, the reimbursed amount will be credited back to your account or refunded to you, depending on the insurance company’s policies.

It is important to familiarize yourself with the refund policies of the vendors or service providers you engage with. This will help you understand the process of receiving refunds and how they will be applied to your account. Some companies automatically apply the refunded amount as a credit towards future purchases, while others may offer the option to receive a refund directly.

When you have a credit balance resulting from a refund or return, you can consider utilizing the surplus amount in various ways. If you foresee future purchases from the same vendor or service provider, using the credit balance towards those expenses can be a convenient option. Alternatively, you may choose to request a refund to have the surplus amount returned to you.

It is important to review your billing statements and keep track of any credit balances resulting from refunds and returns. By doing so, you can effectively manage your finances and ensure that you utilize the credit balance in a manner that aligns with your financial goals and priorities.

Credit Card Rewards or Cash Back

Credit card rewards and cash back programs are a popular way for credit card users to earn benefits and incentives for their spending. These programs often result in credit balances on credit card statements, allowing cardholders to accumulate rewards or earn a percentage of their purchases as cash back.

Here are the key aspects of credit card rewards and cash back programs:

- Rewards Programs: Many credit card issuers offer rewards programs where cardholders earn points, miles, or other types of rewards based on their spending. These rewards can be redeemed for a variety of benefits, such as travel, merchandise, gift cards, or statement credits. When rewards are redeemed for statement credits, they are applied to the credit card account as a credit balance.

- Cash Back: Cash back programs allow credit card users to earn a percentage of their purchases as cash back. For example, a credit card may offer 2% cash back on all purchases. When these cash back rewards accrue, they are typically applied as a credit balance on the credit card statement, reducing the overall balance owed.

- Accumulating Credit Balances: Over time, credit card users who actively participate in rewards or cash back programs can accumulate significant credit balances on their accounts. These credit balances can be utilized for future purchases, effectively reducing the amount owed or providing cardholders with the option to request a refund or transfer the surplus funds to another account.

- Redemption Options: Credit card issuers often provide various options for redeeming credit card rewards or cash back. Some may automatically apply the credit balance towards future purchases, while others may give you the choice to request a statement credit, receive a check, or transfer the funds to a connected bank account.

- Terms and Conditions: It is important to review the terms and conditions of credit card rewards and cash back programs to understand any limitations or expiry dates associated with the rewards. Some rewards may have expiration dates, redemption thresholds, or specific categories where the rewards or cash back can be earned.

Credit card rewards and cash back programs can be a valuable way to earn benefits based on your spending habits. Accumulating credit balances through these programs provides flexibility and opportunities to offset future expenses or receive refunds. However, it is important to remember to use credit cards responsibly within your budget and pay off the balance in full each month to avoid interest charges that could negate the benefits gained.

By leveraging credit card rewards and cash back programs, you can make the most of your credit card usage and enjoy the perks and advantages that come with them. Regularly reviewing your credit card statements will help you keep track of your earned rewards and credit balances, enabling you to make informed decisions on how to utilize them to optimize your financial situation.

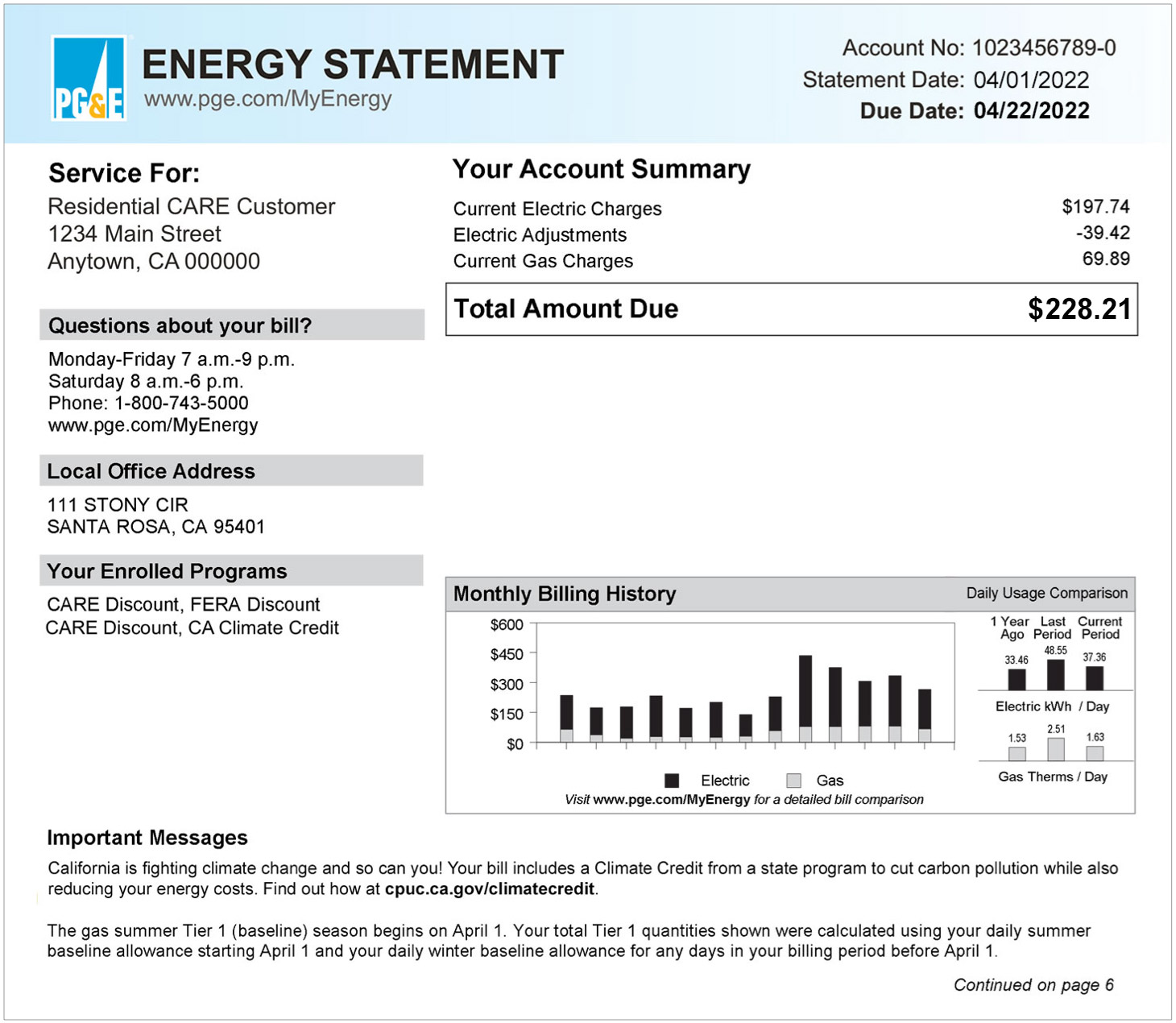

Implications of a Credit Balance

A credit balance on a bill or account can have several implications, both positive and negative, depending on your perspective and financial goals. Understanding these implications is crucial in managing your finances effectively. Let’s explore the potential implications of having a credit balance:

- Positive Cash Flow: One of the primary benefits of a credit balance is that it reflects positive cash flow. It indicates that you have extra funds available that can be utilized towards future expenses or financial goals.

- Reduced Financial Burden: Having a credit balance can also help reduce your overall financial burden. By applying the credit balance towards future bills, you effectively reduce the amount of money you need to allocate from your income.

- Opportunity for Savings: A credit balance provides an opportunity for savings, as you can allocate the surplus funds towards planned or unexpected expenses. This can be particularly beneficial in situations where you may face higher bills or unforeseen costs.

- Limitations on Utilization: Some billing entities may impose limitations or restrictions on how credit balances can be utilized. For example, they may only allow the credit balance to be used for future purchases from their company or have expiry periods after which the credit balance is forfeited.

- Loss of Interest: If you have a credit balance on a savings account or other interest-bearing account, you may miss out on potential interest earnings as the surplus funds are no longer invested or earning interest.

- Complexity in Financial Records: Managing a credit balance can add complexity to your financial records, especially if you have multiple accounts or bills with different credit balances. It is important to keep track of these balances and keep accurate records to ensure financial clarity.

It is crucial to assess the implications of a credit balance based on your personal financial situation and goals. While having a credit balance can provide flexibility and relief, it is important to consider factors such as future expenses, interest earnings, and any limitations imposed by the billing entity.

Regularly reviewing your bills and financial statements will help you stay aware of any credit balances and enable you to make informed decisions about how to best utilize them. Whether you choose to apply the credit balance towards future bills, request a refund, or explore other options, being proactive and intentional with your financial management will ensure that you optimize the benefits of having a credit balance.

Options for Utilizing a Credit Balance

When you have a credit balance on a bill or account, you have several options for utilizing the surplus funds. The choice you make will depend on your financial goals, the policies of the billing entity, and any limitations or restrictions associated with the credit balance. Here are some common options for utilizing a credit balance:

- Applying Credit Towards Future Bills: One of the most straightforward options is to apply the credit balance towards future bills or expenses. This can help reduce the amount of money you need to allocate from your income and provide some relief in managing your financial obligations.

- Requesting a Refund: If you prefer to have the surplus amount returned to you, you can request a refund. This is particularly useful if you do not anticipate any future expenses with the billing entity or if the credit balance exceeds your future billing expectations.

- Transferring Credit to Another Account: In some cases, you may have the option to transfer the credit balance to another account. This can be beneficial if you have multiple accounts with the same billing entity or if you can use the credit balance to offset expenses in a different department or service.

- Utilizing for Other Services or Products: Depending on the policies of the billing entity, you may be able to use the credit balance for other services or products offered by the same company. This can be advantageous if you have a need or desire for additional offerings from the same provider.

- Donating to Charity: If you are feeling generous and want to make a positive impact, you can consider donating your credit balance to a charitable organization. Not all billing entities offer this option, but some may have provisions in place to facilitate charitable contributions using credit balances.

Prior to choosing an option, it is important to review the terms and conditions associated with the credit balance. Some billing entities may have restrictions or limitations on certain actions, such as minimum credit balance requirements for refunds or expiry dates for using the credit balance.

To make an informed decision, consider your current financial needs, future expenses, and any potential benefits or limitations associated with each option. By effectively utilizing a credit balance, you can optimize your finances and ensure that the surplus funds align with your financial goals and priorities.

Remember to keep accurate records of any actions taken with the credit balance, ensuring transparency and clarity in your financial statements. Consistently reviewing your bills and financial records will also help you stay aware of any future credit balances and enable you to make the most of those opportunities.

Applying Credit Towards Future Bills

One of the most common and practical options for utilizing a credit balance is to apply it towards future bills or expenses. This option allows you to effectively reduce the amount of money you need to allocate from your income for upcoming payments and can provide some relief in managing your financial obligations.

Here are several key aspects to consider when applying a credit balance towards future bills:

- Consolidating Payments: By applying the credit balance towards future bills, you can consolidate your payments and streamline your financial management. Instead of making separate payments, you can use the existing credit balance as a credit towards the next billing cycle, effectively reducing the remaining balance.

- Reducing Financial Burden: Applying the credit balance to your upcoming bills reduces the amount of money you need to allocate from your income to cover them. This can be particularly helpful if you have other financial commitments or if you anticipate tight cash flow in the near future.

- Flexibility in Timing: Applying the credit balance towards future bills gives you flexibility in managing your expenses. Instead of making immediate payments, you can adjust the timing based on when the credit balance will be depleted, allowing for more strategic financial planning.

- Utilizing Surplus Funds Efficiently: If you have a credit balance that exceeds your upcoming bills, applying it towards future payments ensures that the surplus funds are used efficiently. This prevents the credit balance from becoming stagnant or unused, maximizes its value, and helps maintain a healthy cash flow.

- Reviewing Billing Entities’ Policies: It is important to review the policies of the billing entity to understand how the credit balance will be applied. Some may automatically deduct the credit balance from your next bill, while others may require you to request the application of the credit balance separately.

Applying a credit balance towards future bills is a practical way to optimize your financial resources and ease your financial burden. It allows you to effectively utilize the surplus funds and maintain a positive cash flow while managing your financial responsibilities.

Remember to monitor your bills and financial statements regularly to ensure that the credit balance is correctly applied and that your future payments are adjusted accordingly. By staying organized and proactive, you can make the most of your credit balance and effectively manage your finances.

Requesting a Refund

If you prefer to have the surplus amount returned to you, requesting a refund is a viable option when you have a credit balance on a bill or account. This option is particularly helpful if you do not anticipate any future expenses with the billing entity or if the credit balance exceeds your future billing expectations.

Consider the following aspects when requesting a refund for a credit balance:

- Evaluating your Financial Needs: Assess your current financial needs and determine whether receiving a refund aligns with your priorities. If you have other pressing financial obligations or would benefit from having the surplus funds available for other purposes, requesting a refund may be the most suitable option.

- Reviewing the Billing Entity’s Policies: Familiarize yourself with the policies of the billing entity regarding refunds. Some billing entities may have specific procedures in place for refund requests, such as a minimum credit balance requirement or a waiting period before processing the refund.

- Documentation and Communication: Prepare the necessary documentation, such as your billing statements, invoices, or other supporting documents, to support your refund request. Reach out to the billing entity’s customer service department or appropriate contact to initiate the refund process and provide any required information.

- Consideration of Fees and Charges: Keep in mind that there may be fees or charges associated with processing the refund. Confirm with the billing entity whether any fees will be deducted from the credit balance or if there are any additional charges for initiating the refund.

- Method of Receiving the Refund: Determine the preferred method of receiving the refund. The billing entity may offer options such as a direct deposit to your bank account, a mailed check, or a credit to a different payment method. Choose the method that is most convenient and aligned with your financial preferences.

Requesting a refund for a credit balance allows you to have the surplus amount returned to you, providing you with greater liquidity and the ability to allocate the funds according to your financial needs and goals. It is important to follow the billing entity’s procedures and maintain clear communication to ensure a timely and successful refund process.

Remember to keep track of the refund request and any related communications. Monitor your financial accounts to ensure that the refund is processed and received accurately. By staying organized and proactive throughout the refund process, you can effectively utilize the surplus funds and maintain financial control.

Transferring Credit to Another Account

In some cases, you may have the option to transfer a credit balance from one account to another. This can be an advantageous option if you have multiple accounts with the same billing entity or if you prefer to allocate the surplus funds to a different department or service.

Consider the following aspects when transferring a credit balance to another account:

- Eligibility and Options: Check with the billing entity to determine if they allow credit balance transfers between accounts. Some companies may have specific policies and procedures in place for such transfers, while others may not offer this option.

- Identify the Target Account: Determine which account you would like to transfer the credit balance to. It could be another account within the same billing entity or a related service that you utilize.

- Notify the Billing Entity: Contact the billing entity’s customer service department or appropriate contact to initiate the credit balance transfer. Provide them with the necessary information, such as the account details and the amount you wish to transfer.

- Follow the Procedure: Follow the billing entity’s procedures for credit balance transfers. They may require you to fill out a form, submit a written request, or provide additional documentation. Ensure that you comply with their instructions to ensure a smooth transfer process.

- Confirmation and Record-Keeping: Keep records of the credit balance transfer confirmation and any related communication. This will serve as documentation of the transfer and help you track the allocation of funds between accounts.

Transferring a credit balance to another account allows you to effectively utilize the surplus funds in a manner that aligns with your financial needs and preferences. It provides flexibility in managing your finances and ensures that the credit balance is distributed to the appropriate account or service.

Remember to review the terms and conditions associated with the credit balance transfer, including any fees or charges that may apply. Keeping a close eye on your financial statements and accounts will help you monitor the transferred credit balance and ensure that it is properly allocated to the target account.

By taking advantage of the option to transfer a credit balance, you can optimize your financial resources and effectively manage your finances across multiple accounts, maximizing the benefits provided by the billing entity.

Conclusion

Having a credit balance on a bill or account can sometimes be a puzzling situation, but understanding the concept, causes, and available options can help you navigate and manage it effectively. Whether it’s due to billing errors, overpayment, refunds and returns, or credit card rewards, credit balances arise from various circumstances and can have implications on your financial health.

By recognizing the causes of a credit balance, such as billing errors or intentional overpayments, you can take appropriate action to rectify any discrepancies and ensure accuracy in your financial records. Additionally, understanding the implications of a credit balance, including positive cash flow and reduced financial burden, will help you make informed decisions about how to utilize the surplus funds.

When it comes to utilizing a credit balance, options like applying it towards future bills, requesting a refund, transferring it to another account, or using it for other services or products provide flexibility in managing your finances. Each option has its own considerations, and it is important to review the policies of the billing entity and your own financial goals to determine the most suitable course of action.

Remember to keep accurate records of your credit balances, monitor your bills and financial statements regularly, and maintain open communication with the billing entity’s customer service department. By staying organized and proactive, you can make the most of your credit balance and optimize your financial resources.

Ultimately, effectively managing a credit balance contributes to your overall financial well-being. Whether you choose to utilize it towards future bills, request a refund, or transfer it to another account, taking control of your credit balance ensures that the surplus funds are used in a way that aligns with your financial goals and priorities.

By understanding the ins and outs of credit balances and the options available to you, you can confidently navigate this aspect of your financial journey and make informed decisions that positively impact your financial health and stability.