Finance

What Are Credit Card Dumps

Modified: December 29, 2023

Learn about credit card dumps in the finance industry. Understand how they work, the risks involved, and how to protect yourself from fraudulent activities

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In today’s digital age, credit cards have become an integral part of our lives. They offer convenience and flexibility in making payments, both online and offline. However, with the rise of online transactions, the risk of credit card fraud has also increased. One form of credit card fraud that has gained notoriety is credit card dumps.

A credit card dump refers to the unauthorized copying of credit card information from a user’s card. This stolen information is then used to create counterfeit credit cards or make fraudulent online purchases. The term “dump” refers to the act of extracting the data from the credit card’s magnetic strip or chip.

Credit card dumps have become a significant concern for both financial institutions and cardholders. The prevalence of this criminal activity showcases the vulnerabilities in our digital payment systems. Understanding how credit card dumps work and the risks associated with them is crucial in safeguarding ourselves against potential financial losses and identity theft.

In this article, we will delve into the world of credit card dumps, exploring how they are obtained, the different types of dumps, the dangers they pose, and how you can protect yourself from falling victim to this form of fraud.

What is a credit card dump?

A credit card dump refers to the unauthorized acquisition of credit card information, including the cardholder’s name, credit card number, expiration date, and sometimes even the CVV (Card Verification Value) code. This data is typically obtained through malicious activities such as hacking, skimming, or phishing.

Once the fraudster has obtained the credit card information, they create a “dump” by encoding the stolen data onto the magnetic strip or embedded chip of a blank card. This allows them to create a cloned credit card that can be used to make purchases or withdrawals.

Credit card dumps are often sold on the dark web or underground forums, where cybercriminals trade stolen information. The buyer of these dumps can then use the cloned cards to make unauthorized transactions or sell them to others.

It is important to note that credit card dumps are illegal and highly unethical. Engaging in such activities carries severe legal consequences and can lead to serious financial damage to both individuals and financial institutions.

How are credit card dumps obtained?

There are several methods that fraudsters use to obtain credit card information for dumps. These include:

- Hacking: Cybercriminals employ various hacking techniques to breach the security systems of merchants, financial institutions, or online platforms that store credit card data. Once inside, they extract the necessary information and use it to create credit card dumps.

- Skimming: Skimming involves the use of devices installed on payment terminals, ATMs, or gas pumps to capture credit card data during legitimate transactions. These devices can be discreetly attached to the card reader and record the magnetic strip data or capture the cardholder’s PIN. The stolen information is then used to create credit card dumps.

- Phishing: Phishing is a method wherein fraudsters deceive users into providing their credit card information through fraudulent websites, emails, or text messages. They pose as legitimate entities, such as banks or online merchants, and trick individuals into submitting their sensitive data.

- Data breaches: Large-scale data breaches have become increasingly common, with cybercriminals targeting organizations that store significant amounts of credit card data. When these breaches occur, large volumes of credit card information are exposed and can be used to create credit card dumps.

- Internal theft: In some cases, credit card dumps are obtained through internal theft, where individuals with access to credit card data misuse their privileges for personal gain. This can occur within financial institutions, merchants, or any organization that handles credit card information.

It is essential to note that credit card dump activities are carried out by skilled individuals who exploit vulnerabilities in security systems. As technology advances, so do their methods, making it crucial for both consumers and businesses to stay vigilant and employ robust security measures to prevent credit card information from falling into the wrong hands.

Types of credit card dumps

Credit card dumps come in various types, each with its own characteristics and implications. Understanding these types can help individuals and businesses identify potential risks and take necessary precautions. The main types of credit card dumps include:

- Classic or Regular Dumps: Classic dumps contain data encoded on the magnetic strip of the credit card. This information includes the cardholder’s name, credit card number, expiration date, and sometimes the CVV. These dumps are typically used for cloning credit cards to make unauthorized transactions in physical stores or for card-present transactions.

- Gold or Premium Dumps: Gold dumps contain additional data, such as the cardholder’s address, phone number, and email address. These dumps fetch a higher price on the underground market due to the increased potential for fraud. Gold dumps are commonly used for online purchases or for conducting fraudulent activities that require comprehensive customer information.

- Platinum Dumps: Platinum dumps are considered to be of the highest quality. They contain extensive cardholder information, including their social security number, date of birth, and mother’s maiden name. With this level of detail, fraudsters can perform various types of identity theft, opening new accounts, applying for loans, or engaging in other forms of financial fraud.

- Signature Dumps: Signature dumps are a type of dump that includes the cardholder’s digital signature. This information is extracted from credit cards that have a chip and PIN system. By having the digital signature, fraudsters can create counterfeit cards that can bypass the need for a PIN during transactions at certain retailers.

It is important to note that credit card dumps can vary in terms of quality, validity, and the presence of encryption or security measures. Some dumps may contain outdated or incorrect information, while others may be freshly obtained and pose a greater risk. Regardless of the type, engaging in or participating in credit card dumping activities is illegal, and individuals found doing so can face severe legal consequences.

Dangers and risks of credit card dumps

Credit card dumps pose significant dangers and risks to both individuals and businesses. Understanding these risks is crucial in taking appropriate measures to protect oneself and mitigate potential damages. Some of the dangers and risks associated with credit card dumps include:

- Financial loss: One of the immediate risks of credit card dumps is financial loss. Fraudsters can use cloned credit cards to make unauthorized purchases, draining the victim’s funds or maxing out their credit limit. This can result in significant financial hardship and damage to one’s credit score.

- Identity theft: Credit card dumps often contain personal information, such as the cardholder’s name, address, and even social security number. This puts individuals at risk of identity theft, where fraudsters can use the stolen information to open new accounts, obtain loans, or commit various forms of financial fraud in the victim’s name.

- Legal consequences: Engaging in credit card dump activities is illegal and can result in severe legal consequences. Those found involved in purchasing or using credit card dumps can face criminal charges, leading to fines, imprisonment, or both. Additionally, individuals who unknowingly become victims of credit card dump fraud may face difficulties in proving their innocence and may be wrongly implicated.

- Reputation damage to businesses: Businesses that fall victim to credit card dump attacks can suffer significant reputation damage. Customers may lose trust in the company’s ability to secure their personal data, leading to a loss of business and a damaged reputation that can take time to recover.

- Compromised financial systems: Credit card dumps exploit vulnerabilities in financial systems, exposing weaknesses in security measures. This can lead to widespread financial disruptions and a loss of confidence in the overall payment ecosystem.

It is crucial for individuals and businesses to remain vigilant and employ robust security measures to mitigate the risks associated with credit card dumps. Implementing measures such as two-factor authentication, encryption, regular system updates, and monitoring for suspicious activity can help minimize the potential damages caused by credit card dump fraud.

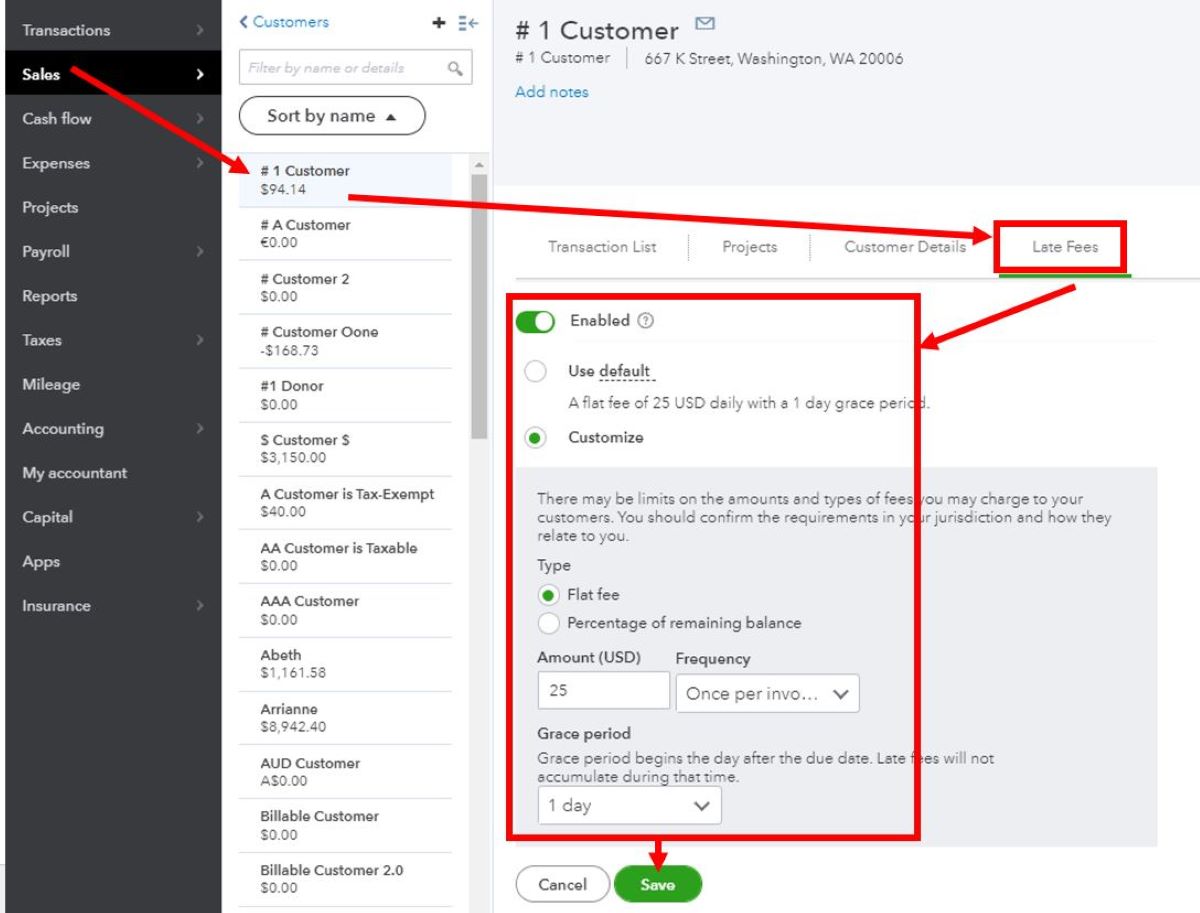

How to protect yourself from credit card dumps

Protecting yourself from credit card dumps requires a proactive approach and adherence to best practices for online and offline security. Here are some essential steps you can take to safeguard yourself from credit card dump fraud:

- Use trusted merchants: Be cautious when sharing your credit card information online. Stick to reputable and secure websites for your online purchases. Look for indicators such as SSL certificates, secure payment gateways, and trusted customer reviews.

- Monitor your accounts: Regularly review your credit card statements and account activity to detect any unauthorized transactions. Report any suspicious activity to your bank or credit card issuer immediately.

- Enable transaction alerts: Set up notifications or alerts for your credit card transactions. This way, you will receive real-time alerts when a transaction is made, allowing you to spot any unauthorized activity promptly.

- Keep your card secure: Ensure physical security of your credit card. Keep it in a safe place, avoid sharing it with others, and never leave it unattended in public places.

- Protect your personal information: Be cautious about sharing personal information such as your social security number, address, and date of birth. Limit the disclosure of sensitive information to trusted entities only.

- Use strong passwords: Create strong and unique passwords for your online accounts, including your credit card account. Use a combination of upper and lowercase letters, numbers, and special characters. Avoid using easily guessable passwords or personal information in your passwords.

- Be wary of phishing attempts: Be cautious of emails, text messages, or phone calls that request your financial information. Legitimate organizations will never ask for sensitive information via these methods. If you suspect a phishing attempt, contact your bank or credit card issuer directly to verify the authenticity of the communication.

- Keep your devices updated: Ensure that your devices, including smartphones, tablets, and computers, are updated with the latest security patches and antivirus software. Regularly update your operating system and applications to protect against vulnerabilities.

- Use two-factor authentication: Enable two-factor authentication whenever possible. This adds an extra layer of security by requiring an additional verification step, such as a unique code sent to your mobile device, to log in or complete a transaction.

By following these measures, you can significantly reduce the risk of falling victim to credit card dump fraud. It is important to stay informed about the latest security threats and continuously educate yourself on best practices for protecting your financial information.

Legal consequences of credit card dump activities

Engaging in credit card dump activities is illegal and carries severe legal consequences. Those involved in credit card dump activities can face criminal charges, leading to fines, imprisonment, or both. The specific legal consequences vary depending on the jurisdiction and the extent of the individual’s involvement in credit card dump fraud.

Here are some of the potential legal consequences individuals may face for participating in credit card dump activities:

- Fraud charges: Credit card dump activities fall under the category of fraud. Individuals found purchasing, using, or selling credit card dumps can be charged with various types of fraud, such as identity theft, credit card fraud, or conspiracy to commit fraud.

- Theft charges: Depending on the jurisdiction, credit card dump activities may be considered theft. This can result in charges such as theft, theft of personal information, or unauthorized access to financial accounts.

- Conspiracy charges: Engaging in credit card dump activities as part of a larger criminal group or network can lead to conspiracy charges. This can increase the severity of the legal consequences, as individuals may be held liable for the actions of the entire group.

- Money laundering charges: In some cases, individuals involved in credit card dump activities may also face charges related to money laundering. This charge can apply if the proceeds from the fraudulent activities are used to conceal or legitimize illegally obtained funds.

- Asset seizure and forfeiture: If convicted, individuals involved in credit card dump activities may have their assets, such as funds, property, or vehicles, seized by law enforcement. This is done to deter and punish individuals involved in financial crimes.

It is important to note that the consequences can extend beyond legal penalties. Individuals convicted of credit card dump activities may also face reputational damage, making it difficult to secure employment, obtain credit, or maintain personal relationships.

To avoid the legal consequences associated with credit card dump activities, it is crucial to abstain from any involvement in such illegal practices. Instead, individuals are encouraged to prioritize ethical and legal means of earning a living and conducting financial transactions.

Conclusion

Protecting ourselves from credit card dumps and the associated risks is essential in today’s digital landscape. Understanding what credit card dumps are, how they are obtained, and the potential dangers they pose allows us to take proactive measures to safeguard our financial well-being and personal information.

The prevalence of credit card dump activities highlights the need for improved security measures in our financial systems. Financial institutions, merchants, and individuals must prioritize robust security protocols, employ encryption technologies, and stay updated on the latest threats to prevent credit card information from falling into the wrong hands.

As individuals, we can protect ourselves by remaining vigilant and following best practices for online and offline security. By using trusted merchants, monitoring our accounts regularly, and keeping our personal information secure, we can minimize the risk of falling victim to credit card dump fraud.

Moreover, it is crucial to remember that engaging in credit card dump activities is illegal and carries severe legal consequences. The allure of easy money is not worth the potential fines, imprisonment, and ruined reputation that can result from participating in such illegal activities.

By promoting awareness, education, and adherence to ethical practices, we can collectively combat credit card dump fraud and create a safer financial environment for everyone. Together, we can work towards a future where digital transactions are secure, and individuals can make financial transactions with peace of mind.