Finance

What Is BMO Capital Markets?

Modified: December 30, 2023

Learn about BMO Capital Markets, a leading financial institution specializing in finance. Discover their expertise and services in the finance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

BMO Capital Markets is a leading financial services provider that offers a wide range of investment and corporate banking services to clients around the globe. With a rich history dating back over 200 years, BMO Capital Markets has established itself as a trusted and reliable partner for businesses of all sizes.

As part of BMO Financial Group, one of the largest financial institutions in North America, BMO Capital Markets utilizes its extensive network and expertise to deliver innovative and tailored solutions to meet the diverse needs of its clients. Whether it’s raising capital, providing strategic advisory services, or facilitating mergers and acquisitions, BMO Capital Markets has the experience and capabilities to navigate the complex and ever-changing financial landscape.

With a commitment to building long-term relationships, BMO Capital Markets focuses on understanding the unique objectives and challenges faced by its clients. By combining deep industry knowledge with a global perspective, BMO Capital Markets is able to offer insightful advice and customized solutions that drive growth and maximize value.

As we delve deeper into the world of finance, it’s important to understand the role that BMO Capital Markets plays within the industry. From its comprehensive suite of services to its global presence, BMO Capital Markets has established itself as a key player in the financial services sector, helping companies achieve their strategic goals and navigate the complexities of the global economy.

In the following sections, we will explore the various services offered by BMO Capital Markets, the key divisions within the organization, the history and background of the company, its global presence, as well as any awards and recognition it has received.

So, let’s dive in and discover the world of BMO Capital Markets and the valuable services it provides to its clients.

Overview of BMO Capital Markets

BMO Capital Markets is a prominent financial institution known for its comprehensive range of services in investment banking, corporate banking, and global markets. With its headquarters in Toronto, Canada, BMO Capital Markets operates in key financial centers worldwide, including New York, London, and Hong Kong.

The organization is part of BMO Financial Group, which is one of the oldest and most respected financial institutions in North America with a history dating back to 1817. BMO Capital Markets leverages the strength and stability of its parent company to provide innovative and strategic financial solutions to its clients.

One of the core strengths of BMO Capital Markets is its client-centric approach. The organization believes in taking a deep dive into understanding its clients’ specific needs, challenges, and goals. This allows them to deliver tailored and practical solutions across various industries, including healthcare, energy, technology, and infrastructure.

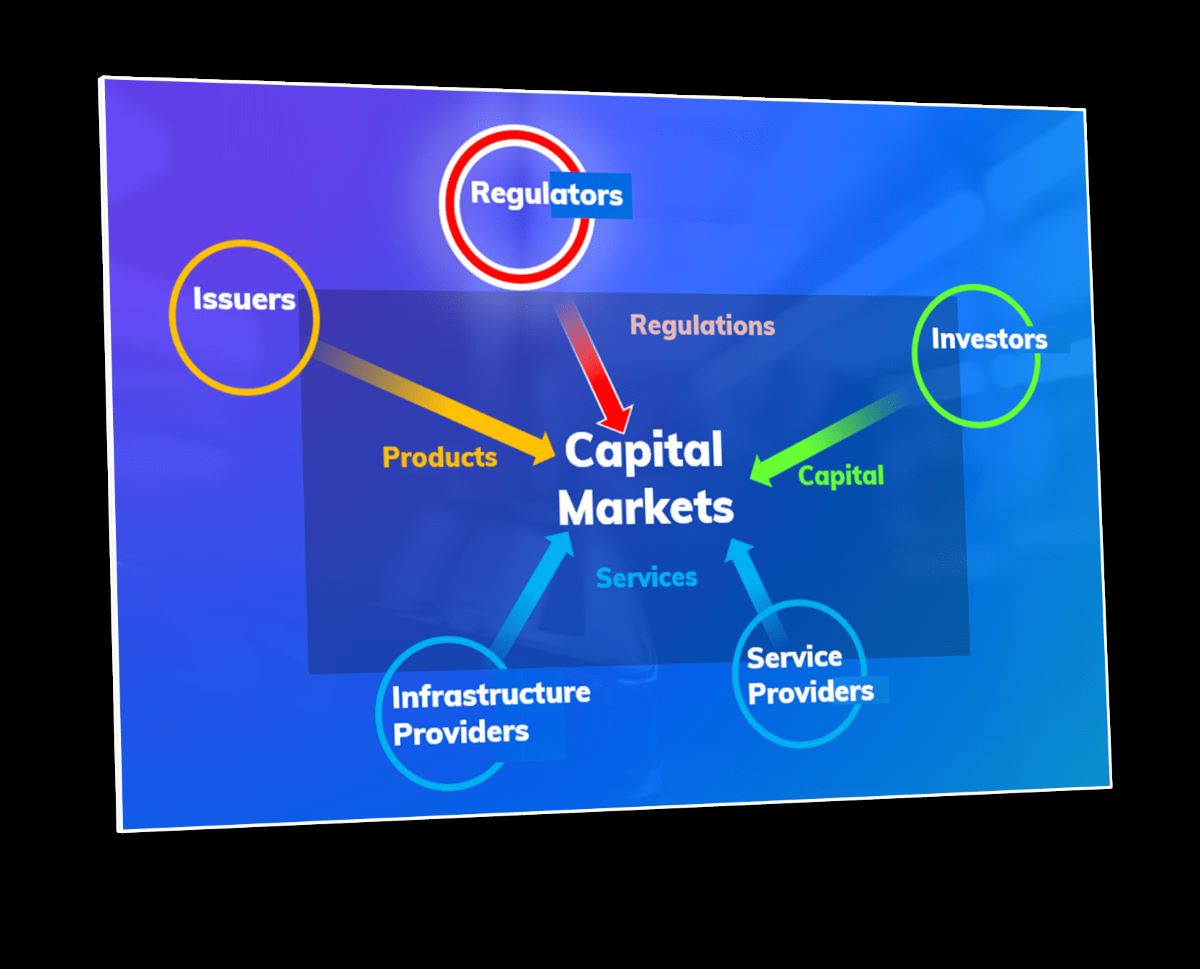

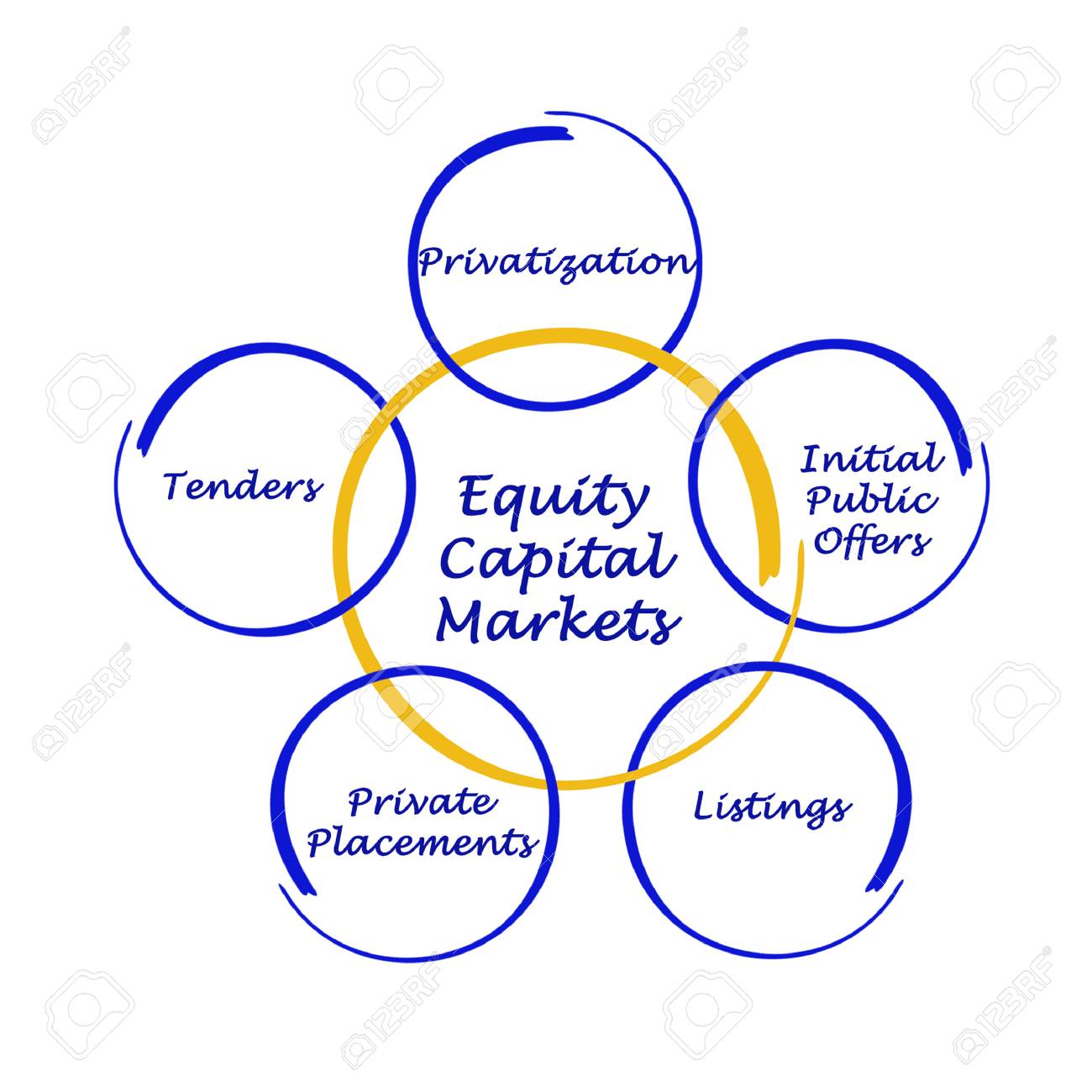

Within the investment banking division, BMO Capital Markets offers a wide range of services, including mergers and acquisitions, equity and debt capital raising, restructuring, and advisory services. These services are designed to assist clients in making strategic business decisions, optimizing their capital structure, and driving growth.

In the corporate banking sphere, BMO Capital Markets provides a comprehensive suite of financial products and services to corporate clients, including lending, cash management, trade finance, and treasury solutions. Their team of experienced bankers works closely with clients to develop custom-tailored financing strategies that best suit their business requirements.

BMO Capital Markets also boasts a successful global markets division, offering clients access to a broad range of asset classes and financial products. Their capabilities span across fixed income, commodities, foreign exchange, and equity markets, providing clients with the tools and expertise to navigate the complexities of global markets.

With a focus on innovation, BMO Capital Markets continues to embrace emerging technologies and digital solutions to enhance client experiences and drive operational efficiency. This includes leveraging data analytics, artificial intelligence, and blockchain technology to deliver smarter and more streamlined financial services.

Overall, BMO Capital Markets stands out as a trusted financial partner, known for its commitment to understanding and delivering on its clients’ unique financial needs. With a global presence, industry expertise, and a client-centric approach, BMO Capital Markets is well-equipped to support businesses in achieving their strategic objectives and navigating the dynamic and ever-evolving global financial landscape.

Services Offered by BMO Capital Markets

BMO Capital Markets offers a wide range of comprehensive financial services to meet the diverse needs of its clients across various industries. With its expertise in investment banking, corporate banking, and global markets, BMO Capital Markets provides tailored solutions to drive growth and maximize value for businesses.

One of the key services offered by BMO Capital Markets is investment banking. Their team of seasoned professionals assists clients in executing strategic transactions such as mergers and acquisitions, divestitures, and corporate restructurings. Whether a company is looking to expand through acquisitions or optimize its capital structure, BMO Capital Markets provides advisory and capital-raising services to help clients achieve their goals.

In addition to investment banking, BMO Capital Markets offers a range of corporate banking services. This includes lending solutions, cash management, trade finance, and treasury services. Their team of experts works closely with corporate clients to provide tailored financing options and cash management solutions to support their day-to-day operations, working capital needs, and long-term growth strategies.

BMO Capital Markets is also recognized for its strengths in the global markets arena. Through its global markets division, BMO offers clients access to a broad range of asset classes and financial instruments. From fixed income and equities to foreign exchange and commodities, they provide market insights, research, and execution capabilities to help clients navigate and capitalize on market opportunities.

Furthermore, BMO Capital Markets offers a suite of risk management solutions to help businesses mitigate and manage their financial risks. This includes derivative products, hedging strategies, and currency risk management solutions. By evaluating clients’ unique risk profiles and market conditions, BMO Capital Markets assists in developing customized risk management strategies to protect clients’ bottom line.

Another notable service provided by BMO Capital Markets is its equity research coverage. Their team of experienced analysts conducts in-depth research on companies and industries, providing valuable insights and recommendations to institutional clients. This research helps investors in making informed decisions regarding stock investments and portfolio management.

Lastly, BMO Capital Markets offers specialized services catered to the needs of specific industries. Through their industry-focused teams, they provide tailored financial solutions to sectors such as healthcare, energy, infrastructure, and technology. By understanding the unique challenges and opportunities within each industry, BMO Capital Markets can deliver specialized expertise and insights to help clients achieve their objectives.

In summary, BMO Capital Markets offers a comprehensive suite of financial services encompassing investment banking, corporate banking, global markets, risk management, equity research, and industry-specific expertise. With their client-centric approach and global reach, BMO Capital Markets is well-positioned to support businesses in navigating the ever-changing financial landscape and achieving their strategic goals.

Key divisions of BMO Capital Markets

BMO Capital Markets operates with a strong foundation of specialized divisions that cater to different aspects of the financial industry. These divisions work cohesively to provide comprehensive solutions and services to their diverse client base. Let’s explore the key divisions of BMO Capital Markets:

- Investment and Corporate Banking: This division focuses on providing strategic advisory services and executing a wide range of financial transactions. It specializes in mergers and acquisitions, equity and debt capital raising, corporate restructurings, and other investment banking services. The team comprises experienced professionals who work closely with clients to develop customized solutions to meet their unique needs.

- Global Markets: This division handles the trading and sales of financial products across various asset classes, including fixed income, foreign exchange, commodities, and equities. BMO Capital Markets’ global markets team provides clients with access to liquidity, market insights, and execution capabilities, enabling them to navigate and capitalize on market opportunities.

- Treasury & Payment Solutions: This division focuses on delivering innovative treasury management and cash management solutions to corporate clients. It provides services such as liquidity management, working capital optimization, and risk mitigation strategies. The team collaborates with clients to tailor solutions that enhance efficiency, reduce costs, and improve overall treasury operations.

- Risk Management: BMO Capital Markets’ risk management division offers comprehensive risk management solutions to clients. This division specializes in providing risk hedging strategies and derivative products to help businesses mitigate market, credit, and operational risks. Their expertise lies in developing customized risk management strategies that align with clients’ risk profiles and objectives.

- Equities Research: BMO Capital Markets has a strong equities research division that provides valuable insights and analysis on individual stocks, industries, and market trends. The team of skilled analysts conducts in-depth research and produces reports that help institutional clients make informed investment decisions and optimize their portfolios.

- Industry Verticals: BMO Capital Markets has dedicated teams that focus on specific industry sectors such as healthcare, energy, infrastructure, technology, and more. These industry verticals possess specialized knowledge, expertise, and insights into the unique challenges and opportunities within each sector. This allows them to provide tailored financial solutions to clients operating in these industries.

By strategically aligning its services under these key divisions, BMO Capital Markets is able to deliver comprehensive and focused financial solutions to its clients. The collaboration across these divisions ensures that clients receive tailored and integrated services that address their specific needs, whether it be capital raising, risk management, or industry-specific expertise.

These key divisions highlight the diverse capabilities and expertise that BMO Capital Markets brings to the table. They enable the organization to effectively serve its clients across different segments of the financial industry and position itself as a leader in providing innovative financial solutions.

History and Background of BMO Capital Markets

BMO Capital Markets has a rich history that dates back over two centuries. Its parent company, BMO Financial Group, was founded in 1817, making it one of the oldest financial institutions in North America. Originally established as the Bank of Montreal, the institution played a pivotal role in the development of Canada’s banking and financial system.

Over the years, BMO Financial Group expanded its operations and diversified its offerings. In 1988, it established BMO Capital Markets as its investment banking and capital markets division. Since then, BMO Capital Markets has grown into a prominent player in the global financial services industry.

BMO Capital Markets has consistently demonstrated its commitment to innovation and client-focused solutions. Throughout its history, it has adapted to the changing needs of its clients and the evolving financial landscape. This adaptability has allowed the organization to remain at the forefront of the industry and establish a strong reputation for excellence.

One notable milestone in BMO Capital Markets’ history was its acquisition of Nesbitt Thomson, a leading investment dealer in Canada, in 1987. This acquisition significantly expanded BMO Capital Markets’ capabilities and client base, solidifying its position as a key player in the investment banking sector.

In the following years, BMO Capital Markets continued to expand its global presence. It opened offices in major financial centers, including New York, London, Chicago, and Hong Kong. This expansion allowed the organization to better serve its clients on a global scale, providing access to international markets, expertise, and opportunities.

Throughout its history, BMO Capital Markets has demonstrated resilience and adaptability, particularly during challenging times in the financial industry. During the global financial crisis in 2008, the organization stood strong and continued to provide its clients with trusted advice and solutions.

Today, BMO Capital Markets remains committed to delivering innovative financial solutions, investing in technology, and expanding its global reach. The organization’s continued focus on client-centricity, expertise, and tailored solutions has contributed to its success and position as a leading financial services provider.

As BMO Capital Markets looks to the future, it aims to leverage emerging technologies and digital solutions to further enhance its offerings and provide more efficient and effective services to its clients. With a rich history and a strong foundation, BMO Capital Markets is poised to continue its growth and deliver value to clients in the ever-evolving financial landscape.

Global Presence of BMO Capital Markets

BMO Capital Markets has established a strong global presence, with offices and operations in key financial hubs around the world. This global footprint enables the organization to serve clients in various regions and provide them with access to international markets and opportunities.

With its headquarters in Toronto, Canada, BMO Capital Markets has a significant presence in North America. It operates in major cities across the United States, including New York, Chicago, Los Angeles, and Houston. These offices serve as important centers for investment banking, corporate banking, and global markets activities, allowing BMO Capital Markets to effectively cater to its North American clients.

Beyond North America, BMO Capital Markets has expanded its reach to Europe and Asia. In Europe, it has a strong presence in London, one of the largest financial centers in the world. BMO Capital Markets’ London office serves as a hub for its operations in the region, providing services to clients across investment banking, global markets, and corporate banking.

In addition to London, BMO Capital Markets has offices in other European cities, including Paris, Frankfurt, and Dublin. These offices enable the organization to offer its comprehensive suite of financial services to clients throughout Europe.

Further expanding its global presence, BMO Capital Markets has a growing footprint in Asia. Its presence in Hong Kong allows the organization to tap into the dynamic Asian markets and provide services to clients in the region. BMO Capital Markets leverages its expertise and network to support clients in areas such as mergers and acquisitions, capital raising, and global markets activities.

Beyond these major financial centers, BMO Capital Markets also has a network of offices and operations in other parts of the world. These include locations in Australia, Brazil, Mexico, and the Middle East. These strategic footholds enable the organization to develop relationships with clients in these regions and gain insights into local markets and industries.

With its extensive global presence, BMO Capital Markets demonstrates its commitment to providing clients with market insights, local expertise, and access to international capital and investment opportunities. The organization’s network of professionals in various regions ensures that clients receive personalized and localized service, tailored to their specific needs and objectives.

As BMO Capital Markets continues to grow and expand its global operations, it remains focused on delivering innovative financial solutions and strengthening its client relationships worldwide. Through its global presence, the organization is able to navigate the complexities of the global financial landscape and effectively serve its clients, regardless of their geographical location.

Awards and Recognition

BMO Capital Markets has received numerous awards and recognition for its excellence in the financial services industry. These accolades highlight the organization’s commitment to delivering innovative solutions, exceptional client service, and thought leadership. Some of the notable awards received by BMO Capital Markets include:

- Best Investment Bank in Canada: BMO Capital Markets has consistently been recognized as one of the top investment banks in Canada. It has received prestigious awards from leading industry publications for its expertise in investment banking, mergers and acquisitions, and capital markets activities.

- Best Equity Research: BMO Capital Markets’ equity research team has been acknowledged for its in-depth analysis and accurate insights. The team’s research reports have received industry recognition and praise for their quality, providing valuable information to institutional clients.

- Best Debt House: BMO Capital Markets’ debt capital markets capabilities have been recognized with awards for excellence. The organization’s expertise in debt financing and bond issuance has earned it a reputation as a leader in the debt capital markets space.

- Leadership in Sustainable Finance: BMO Capital Markets has been acknowledged for its leadership in sustainable finance and responsible investment practices. It has received awards for its efforts in driving environmental, social, and governance (ESG) initiatives in the financial industry.

- Industry Leadership: BMO Capital Markets’ executives and professionals have been consistently recognized for their thought leadership and expertise. They have received awards and accolades for their contributions to the financial industry and their insights on market trends and strategies.

- Diversity and Inclusion: BMO Capital Markets’ commitment to fostering a diverse and inclusive workplace has been acknowledged by various organizations. It has received awards for its efforts in promoting diversity and inclusion within the organization and the broader financial industry.

- Corporate Social Responsibility: BMO Capital Markets has been recognized for its corporate social responsibility initiatives, including philanthropy, community involvement, and sustainability efforts. It has received awards for its commitment to making a positive impact on society and the environment.

These awards and recognition demonstrate the industry’s acknowledgment of BMO Capital Markets’ leadership, expertise, and commitment to excellence. They reflect the organization’s dedication to delivering value to its clients, being at the forefront of industry trends, and making a positive impact in its communities.

As BMO Capital Markets continues to innovate and provide exceptional financial solutions, it strives to maintain its reputation as a trusted and award-winning financial services provider. Through its continued focus on excellence and client-centricity, BMO Capital Markets aims to solidify its position as a leader in the global financial services industry.

Conclusion

BMO Capital Markets, as part of BMO Financial Group, has emerged as a leading financial services provider with a global presence and a rich history spanning over 200 years. With its comprehensive suite of investment banking, corporate banking, and global markets services, BMO Capital Markets offers tailored solutions to meet the diverse needs of its clients across industries.

The organization’s client-centric approach, industry expertise, and commitment to innovation have been recognized through numerous awards and accolades. BMO Capital Markets’ strong performance in investment banking, equity research, debt capital markets, sustainable finance, diversity and inclusion, and corporate social responsibility sets it apart as a trusted and reliable partner for businesses.

Through key divisions such as investment and corporate banking, global markets, treasury and payment solutions, risk management, equities research, and industry verticals, BMO Capital Markets delivers comprehensive financial services to its clients. Its global presence in North America, Europe, and Asia allows it to serve clients across the world and provide them with access to international markets, opportunities, and insights.

As BMO Capital Markets looks to the future, it remains committed to delivering innovative solutions, fostering strong client relationships, and leveraging emerging technologies to stay at the forefront of the financial industry. The organization’s rich history, global presence, and award-winning reputation position it as a trusted partner for businesses seeking strategic financial solutions.

Whether it’s assisting in complex transactions, offering market insights, managing risk, or providing financing and treasury solutions, BMO Capital Markets strives to help its clients navigate the dynamic and ever-changing global financial landscape to achieve their strategic objectives and drive growth.

In conclusion, BMO Capital Markets’ expertise, global reach, and dedication to client success make it a formidable force in the financial services industry. With a commitment to innovation, excellence, and responsible practices, BMO Capital Markets continues to shape the future of finance and support its clients in achieving their financial goals.