Finance

What Are Fees Earned In Accounting

Published: October 12, 2023

Learn about the concept of fees earned in accounting and their significance in finance. Gain insights into how these fees contribute to financial statements and overall profitability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of accounting, fees earned play a crucial role in measuring the financial performance of a business. Understanding what fees earned are and how they are calculated is essential for both professionals in the field and business owners alike. By gaining a clear understanding of fees earned, individuals can make informed decisions regarding business operations, financial planning, and profitability.

Fees earned refer to the revenue generated by a company for providing services or delivering goods to its customers. This revenue is a reflection of the value that the company provides to its clients and is a significant component of their overall financial health. In the field of accounting, fees earned are an integral part of the income statement – they contribute to the top line revenue and ultimately determine the profitability of the business.

The concept of fees earned goes beyond simply charging clients for products or services. It encompasses the value-added by the company through its expertise, time, and effort. Whether it’s consulting services, audit engagements, tax preparation, or any other type of service, fees earned are an indicator of the company’s ability to meet client needs and deliver results.

In this article, we will delve deeper into the definition of fees earned, discuss their importance in accounting, explore the various types of fees earned, examine the factors that influence fees earned, outline the calculation methods, and address common issues related to fees earned. By the end, you will have a comprehensive understanding of fees earned in the context of accounting and how they impact a company’s financial standing. Let’s dive in!

Definition of Fees Earned

Fees earned can be defined as the revenue generated by a business for providing services or delivering goods to its customers. It represents the amount charged to clients for the value-added by the company in terms of expertise, skill, time, and effort.

Unlike the revenue generated from the sale of products, fees earned are typically associated with professional services, such as accounting, legal advice, consulting, or creative services. These fees are earned by performing tasks, offering guidance, or delivering specific outcomes that meet the clients’ needs or solve their problems.

In the accounting context, fees earned include the income derived from services such as financial statement preparation, bookkeeping, tax preparation, audits, and consulting engagements. These services require specialized knowledge and expertise, and the fees earned reflect the value provided by the accounting professionals.

It’s important to note that fees earned are recognized when the services have been performed or the goods have been delivered, regardless of when the cash is received. This follows the accrual basis of accounting, where revenue is recognized when it is earned, rather than when it is received.

For example, if an accounting firm provides consulting services to a client in September but does not receive payment until October, the fees earned would still be recognized in September. This allows for a more accurate representation of a company’s financial performance.

Overall, fees earned provide a measure of the revenue generated through the provision of services and reflect the value that a company brings to its clients. Understanding and tracking fees earned is crucial for evaluating the financial health of a business and making informed decisions regarding pricing, service offerings, and profitability.

Importance of Fees Earned in Accounting

Fees earned play a vital role in the accounting profession and hold significant importance for both accounting firms and their clients. Understanding the importance of fees earned can help businesses make informed financial decisions and assess their overall profitability. Here are several key reasons why fees earned are crucial in the field of accounting:

- Financial Performance Measurement: Fees earned are a primary indicator of a company’s financial performance. They represent the revenue generated from providing services and help to assess the effectiveness of business operations. By tracking and analyzing fees earned, companies can gauge their revenue streams and identify areas for improvement or growth.

- Determining Profitability: The amount of fees earned is directly linked to a company’s profitability. By comparing fees earned against expenses, businesses can calculate their profit margin and determine their financial viability. It allows accounting firms to measure the effectiveness of their pricing strategies and identify any inefficiencies that may be impacting their profitability.

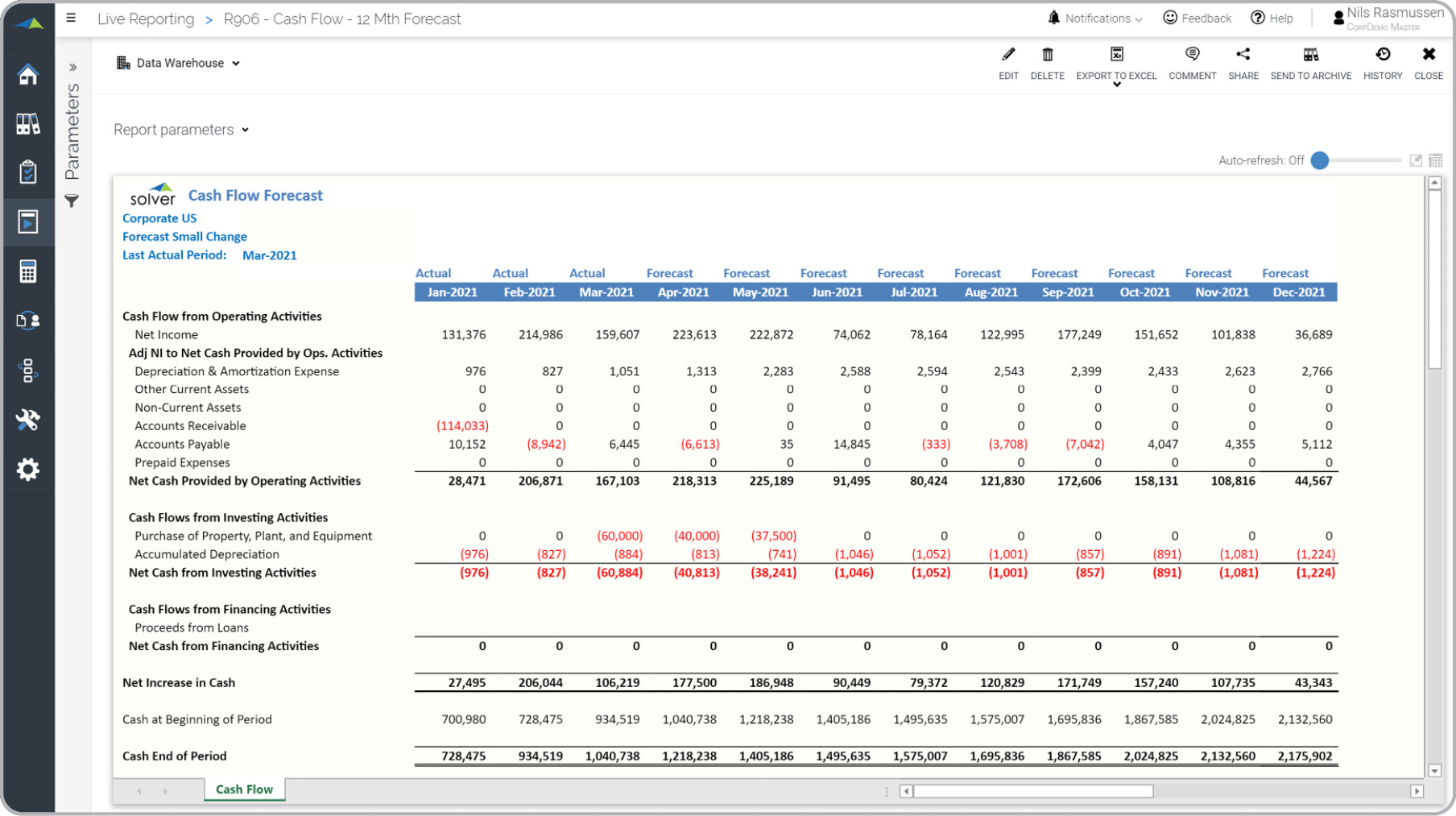

- Budgeting and Financial Planning: Fees earned provide valuable data for budgeting and financial planning purposes. By understanding the revenue generated from different services, accounting firms can allocate resources effectively and plan for future growth. It helps in forecasting income, estimating expenses, and setting financial targets for the business.

- Pricing and Service Offerings: Fees earned help accounting firms establish appropriate pricing for their services. By analyzing the fees earned for different types of tasks or engagements, firms can determine whether their pricing aligns with industry standards and market demand. This information guides business owners in setting competitive prices and developing service packages that meet client requirements.

- Client Relationship Management: Fees earned are closely tied to client satisfaction and relationship management. By tracking fees earned from specific clients or engagements, accounting firms can identify their most profitable relationships and allocate resources accordingly. It also allows them to evaluate the value they provide to clients and make data-driven decisions on how to better serve them.

In summary, fees earned in accounting are essential for measuring financial performance, determining profitability, budgeting and financial planning, setting pricing and service offerings, and managing client relationships. Accounting firms must diligently track and analyze fees earned to assess their business’s health, make informed decisions, and drive sustainable growth.

Types of Fees Earned in Accounting

In the field of accounting, there are various types of fees earned depending on the nature of services provided. Each type of fee represents a specific service or engagement and contributes to the overall revenue of an accounting firm. Here are some common types of fees earned in accounting:

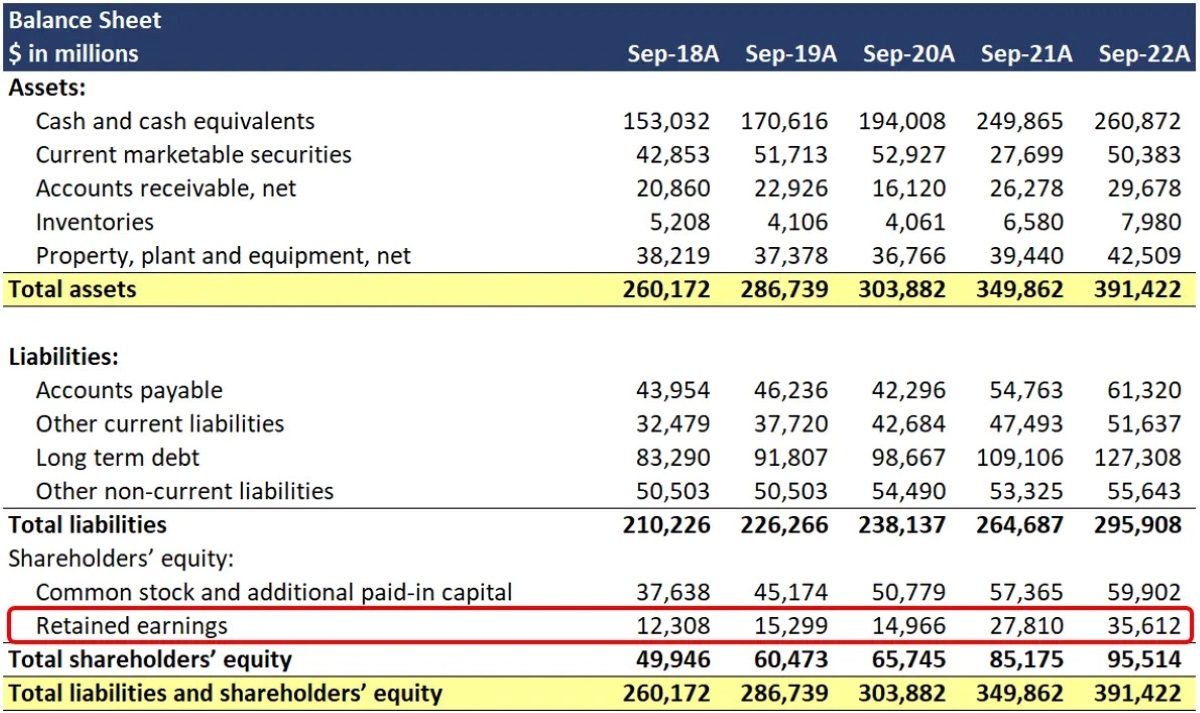

- Financial Statement Preparation Fees: Accounting firms often assist businesses in preparing their financial statements, such as balance sheets, income statements, and cash flow statements. These fees are earned for the time and expertise required to compile and analyze the financial data accurately.

- Bookkeeping Fees: Bookkeeping services involve maintaining accurate records of financial transactions, including recording sales, purchases, receipts, and payments. Accounting firms may charge fees based on the complexity and volume of bookkeeping tasks performed for a client.

- Tax Preparation Fees: Accounting firms help individuals and businesses comply with tax laws by preparing and filing their tax returns. Tax preparation fees can vary depending on the complexity of the tax situation, the number of forms and schedules required, and any additional services provided, such as tax planning or audit support.

- Audit and Assurance Fees: Audit engagements involve examining and verifying a company’s financial records to provide assurance on the accuracy and reliability of the financial statements. These fees are earned for conducting the audit procedures and issuing an audit report in accordance with professional standards.

- Consulting and Advisory Fees: Accounting firms may offer consulting and advisory services to help businesses improve their financial performance, implement internal controls, optimize processes, or make strategic decisions. These fees are earned for providing expert advice and guidance tailored to the specific needs of the client.

- Forensic Accounting Fees: Forensic accounting services involve investigating financial irregularities, fraud, or disputes. Fees earned for forensic accounting services are based on the complexity and scope of the investigation, including data analysis, expert testimony, and report preparation.

- Special Projects and Engagements: Accounting firms may take on special projects or engagements that do not fall into traditional service categories. These may include financial modeling, due diligence for mergers and acquisitions, business valuations, or financial feasibility studies. Fees earned for these projects are typically negotiated based on the scope and complexity of the work.

It’s important to note that the specific fee structure and rates for each type of service can vary depending on factors such as the size of the accounting firm, the level of expertise, the geographic location, and the industry specialization. Accounting firms may have standard rates or adopt customized pricing strategies based on client needs and market conditions.

By offering a range of services and charging fees accordingly, accounting firms can cater to the diverse needs of their clients and generate revenue from multiple sources. This diversity of fees earned helps to ensure a steady income stream and contributes to the firm’s overall financial stability.

Factors Influencing Fees Earned

Several factors can influence the amount of fees earned by an accounting firm. Understanding these factors is crucial for setting competitive pricing, ensuring profitability, and making informed financial decisions. Here are some key factors that can influence the fees earned in the field of accounting:

- Scope and Complexity of Services: The scope and complexity of the services provided play a significant role in determining the fees earned. More complex tasks requiring specialized knowledge, extensive analysis, or advanced skills may command higher fees. On the other hand, simpler tasks or routine services may have lower fee structures.

- Level of Expertise and Qualifications: The level of expertise and qualifications of the accounting professionals involved can impact the fees earned. Accountants with extensive experience, advanced certifications, or specialized knowledge in a particular industry or niche may command higher fees due to their expertise and reputation.

- Time and Resources Required: The amount of time and resources needed to complete a task or engagement can influence the fees earned. Complex projects or those requiring substantial research, analysis, or data processing may require more hours and resources, which in turn can result in higher fees.

- Market Demand and Competition: Market demand and competition within the accounting industry can influence the fees earned. In highly competitive markets, accounting firms may adjust their pricing to attract clients, while firms with a strong reputation or specialized services may command higher fees due to their perceived value.

- Size and Location of the Firm: The size and geographical location of the accounting firm can also impact fees earned. Larger firms with a diverse range of services and a strong presence may have higher fee structures. Additionally, firms located in metropolitan areas or regions with a high cost of living may charge higher fees to account for overhead expenses.

- Client Relationship and Negotiation: The nature of the client relationship and the negotiation skills of the accounting firm can influence the fees earned. Long-term clients or those requiring ongoing services may be eligible for discounted rates or special pricing arrangements. Effective negotiation can also play a role in securing favorable fee structures.

It is important for accounting firms to consider these factors when determining their fee structures. Striking a balance between competitive pricing and sustainable profitability ensures that the firm can attract clients, deliver quality services, and maintain financial stability.

Ultimately, the fees earned by an accounting firm should reflect the value it provides to clients, taking into account the complexity of services, the expertise of professionals, the market dynamics, and the overall cost of delivering the services. By evaluating these factors and making informed pricing decisions, accounting firms can optimize their fees earned and establish mutually beneficial partnerships with their clients.

Calculation of Fees Earned

The calculation of fees earned in accounting depends on the specific service or engagement provided. Different types of services may require different approaches to determine the fees earned. Here are some common methods used to calculate fees earned in the field of accounting:

- Fixed Fee: Under the fixed fee structure, the accounting firm charges a predetermined amount for a specific service. This fee remains constant regardless of the time or resources required to complete the task. Fixed fees are often used for standardized services, such as tax preparation or financial statement preparation, where the scope of work is well-defined and predictable.

- Hourly Rate: The hourly rate method calculates fees earned based on the number of hours spent on a project or engagement. Accounting firms determine an hourly rate based on factors such as the level of expertise of the professionals involved and the overhead costs of the firm. The total fees earned are then obtained by multiplying the hours spent by the respective hourly rates.

- Blended Rate: A blended rate is an average rate that combines the hourly rates of different professionals involved in a project. This method accounts for different levels of expertise within the firm and provides a single rate for billing purposes. The blended rate is calculated by weighting the individual rates based on the number of hours contributed by each professional.

- Value-Based Fees: Value-based fees consider the perceived value or benefit that the service provides to the client. Instead of being tied to the time spent or the tasks performed, the fee is determined based on the value the client will gain from the service. This method requires an understanding of the client’s needs, industry, and potential financial impact to negotiate a fair and equitable fee.

- Percentage-Based Fees: Percentage-based fees are calculated as a percentage of a specific financial metric. For example, in business valuation engagements, the fee may be based on a percentage of the total value of the business being appraised. This method is commonly used when the fee is tied directly to the financial outcome or transaction being evaluated.

It’s important for accounting firms to carefully consider the appropriate fee calculation method for each service or engagement. Factors such as the nature of the task, the value provided, the level of expertise required, and the market dynamics should be taken into account to ensure a fair and reasonable fee structure.

Accounting firms may also use a combination of fee calculation methods depending on the specific circumstances. For example, a tax preparation engagement may have a fixed fee for basic returns, and additional fees may be charged based on the complexity or additional services required.

Ultimately, the goal of calculating fees earned in accounting is to accurately reflect the value provided by the accounting firm to its clients. By selecting the appropriate fee calculation method and considering the unique aspects of each engagement, accounting firms can ensure fair compensation for their services while maintaining client satisfaction and financial viability.

Recording and Reporting Fees Earned in Accounting

Recording and reporting fees earned accurately is essential for maintaining transparent financial records and complying with accounting standards. Properly documenting fees earned allows accounting firms to track revenue, assess profitability, and provide meaningful financial information to stakeholders. Here is an overview of how fees earned are recorded and reported in accounting:

- Accounting System: Accounting firms use specialized accounting software or systems to record and track fees earned. These systems have dedicated accounts or general ledger codes specifically for recording revenue from fees earned. Each type of service or engagement may have a distinct account code to ensure accurate categorization and reporting.

- Invoice Generation: Once the services have been provided or goods have been delivered, accounting firms generate invoices to bill their clients for the fees earned. The invoices typically include details such as the client’s name, services rendered, fees charged, and payment terms. Generating clear and concise invoices helps with proper documentation and timely collection of fees.

- Revenue Recognition: Following the accrual basis of accounting, fees earned are recognized as revenue when the services are performed or the goods are delivered, regardless of when the cash is received. This ensures that revenue is recognized in the period it is earned, providing a more accurate representation of the firm’s financial performance.

- Journal Entries: Once the revenue is earned, accounting firms record journal entries to recognize the fees earned and match them with the corresponding expenses incurred, if applicable. The journal entries involve debiting the accounts receivable or cash account for the fees earned and crediting the appropriate revenue account, such as “Fees Earned” or specific service accounts.

- Financial Statement Presentation: Fees earned are included in the income statement, also known as the profit and loss statement, which presents the revenue and expenses of the accounting firm over a specific period. The fees earned are reported as part of the operating revenue and contribute to the calculation of the firm’s net income or net loss.

- Segment Reporting: For accounting firms with multiple service lines or divisions, segment reporting may be employed to provide more detailed information about the fees earned from different areas of the business. This allows stakeholders to evaluate the financial performance of each segment independently and make informed decisions regarding resource allocation and profitability.

Accurate and timely recording and reporting of fees earned is crucial for financial management and compliance with accounting regulations. It ensures that the financial statements provide a true and fair view of the firm’s revenue generation and helps in evaluating the effectiveness of pricing strategies, profitability of service lines, and overall business performance.

Furthermore, periodic review and analysis of fees earned enable accounting firms to identify trends, assess the success of marketing efforts, and make data-driven decisions to enhance profitability and meet client demands.

By adhering to proper accounting practices and maintaining transparent records, accounting firms can demonstrate their financial stability and credibility to clients, investors, and other stakeholders.

Common Issues Related to Fees Earned

While fees earned are a critical component of accounting revenue, there are several common issues that accounting firms may encounter in relation to fees earned. Understanding and addressing these issues is essential for maintaining financial stability and client satisfaction. Here are some of the common issues related to fees earned:

- Fee Negotiation: Negotiating fees with clients can be challenging, especially when clients have budget constraints or unrealistic expectations. Accounting firms need to find a balance between providing quality services and ensuring fair compensation for their expertise and resources.

- Fee Collection: Getting clients to pay their fees on time can be an ongoing challenge for accounting firms. Late or non-payment of fees can impact cash flow and create financial strain. Implementing clear payment terms and effective collection procedures can help mitigate this issue.

- Scope Creep: Scope creep occurs when the scope of a project or engagement expands beyond the original agreement without a corresponding adjustment in fees. This can lead to additional work and resources being invested without appropriate compensation, resulting in reduced profitability. Maintaining clear communication and managing client expectations can help prevent scope creep.

- Fee Erosion: In competitive markets, accounting firms may face fee erosion, where clients expect lower fees or discounts due to market pressures. Fee erosion can impact profitability and the firm’s ability to sustain high-quality services. It is important to balance competitiveness with value and communicate the unique benefits the firm provides to justify the fees charged.

- Unresolved Fee Disputes: Fee disputes can arise if clients question the charged fees or the quality of the services provided. These disputes can strain client relationships, damage the firm’s reputation, and even lead to legal complications. Clear and detailed engagement letters, regular client communication, and effective conflict resolution processes can help mitigate fee disputes.

- Inaccurate Fee Tracking: Inefficient or inaccurate fee tracking can lead to under- or over-reporting of fees earned. This can impact the firm’s financial statements, profitability analysis, and decision-making processes. Implementing robust accounting systems and training personnel on proper fee tracking procedures can help address this issue.

- Overreliance on Low-Value Services: Overreliance on low-value services with low fee structures can limit revenue potential and hinder the firm’s ability to grow and attract higher-value clients. Diversifying service offerings, exploring new markets, and establishing strategic partnerships can help mitigate this issue and drive revenue growth.

Addressing these common issues requires proactive management, effective communication, and a focus on delivering value to clients while ensuring fair compensation for the services provided. By implementing best practices, maintaining strong client relationships, and continuously evaluating the firm’s fee structure and service offerings, accounting firms can navigate these challenges and foster long-term financial success.

Conclusion

Fees earned are a fundamental aspect of accounting that reflect the revenue generated through the provision of services to clients. Understanding what fees earned are, how they are calculated, and their significance in accounting is crucial for both accounting professionals and business owners.

Throughout this article, we have explored the definition of fees earned, emphasizing their connection to the value provided by accounting firms to their clients. We have discussed the importance of fees earned in measuring financial performance, determining profitability, and facilitating budgeting and financial planning. Additionally, we have examined the different types of fees earned in accounting and the factors that influence their calculation.

Recording and reporting fees earned accurately ensures transparency in financial records and compliance with accounting standards. It allows accounting firms to evaluate their revenue streams, make informed pricing decisions, and assess their overall financial health. Furthermore, we have highlighted common issues related to fees earned, such as fee negotiation, scope creep, and fee collection, underscoring the need for effective management and clear communication to address these challenges.

In conclusion, fees earned play a crucial role in the accounting profession. They serve as a key indicator of financial performance, enable accurate reporting, and contribute to informed decision-making. By understanding and effectively managing fees earned, accounting firms can optimize their revenue generation, maintain strong client relationships, and drive long-term financial success.