Finance

What Millennials Want From A Checking Account

Modified: February 20, 2024

Get the perfect checking account for millennials. Discover the finance options that cater to their unique needs and aspirations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing their finances, millennials have specific expectations and preferences. With the rise of technology and the increasing integration of digital solutions into all aspects of life, millennials seek convenience, accessibility, and transparency in their banking experience. This includes their checking accounts, which serve as the foundation for day-to-day financial management.

Much like previous generations, millennials value features such as low fees and excellent customer support. However, they are also highly focused on mobile banking capabilities, personalized options, and enhanced security measures. Furthermore, millennials prioritize aligning themselves with brands that exhibit social and environmental responsibility. To meet these evolving demands, financial institutions must adapt and provide the features and services that millennials desire.

In this article, we will explore the key features and qualities that millennials seek in their checking accounts. By understanding these preferences, both financial institutions and consumers can work towards creating a banking experience that meets the unique needs of this generation.

Convenience and Accessibility

One of the top priorities for millennials when it comes to their checking accounts is convenience and accessibility. Millennials are known for their busy and often hectic lifestyles, and they require banking solutions that can keep up with their fast-paced lives. This means having access to their accounts whenever and wherever they need it.

To cater to this demand, banks need to offer user-friendly online and mobile banking platforms. Millennials want the ability to check their account balances, make transfers, pay bills, and deposit checks using their smartphones or other devices. They value the convenience of not having to visit a physical branch and being able to complete their banking tasks on the go.

Additionally, millennials expect seamless integration between their checking accounts and digital payment systems such as Apple Pay, Google Pay, or Venmo. The ability to make contactless payments and easily split expenses with friends is highly desirable.

Furthermore, accessibility extends beyond just the digital realm. Millennials expect ATMs to be widely available and convenient to use. Banks that have a robust ATM network, with machines strategically placed in convenient locations, will attract millennials who want quick and easy access to their cash.

Overall, convenience and accessibility are essential for millennials when it comes to their checking accounts. Banks that prioritize user-friendly digital platforms and provide widespread access to their services will be well-positioned to attract and retain millennial customers.

Mobile Banking Features

For millennials, mobile banking is not just a convenience – it’s a necessity. With their smartphones always within arm’s reach, this tech-savvy generation expects robust mobile banking features that enable them to manage their finances on the go.

One key feature that millennials seek in their checking accounts is mobile check deposit. The ability to snap a photo of a check and deposit it directly into their account saves time and avoids the hassle of visiting a physical branch. Additionally, millennials appreciate features like instant notifications for account activity, including deposits, withdrawals, and purchases. This real-time information keeps them informed about their finances and helps them stay on top of their spending.

Another important mobile banking feature for millennials is the ability to easily transfer funds between accounts, whether within the same bank or to external accounts. Millennials value the flexibility to manage their money seamlessly and swiftly, without any unnecessary hurdles or delays.

Moreover, millennials look for advanced security features in mobile banking apps. They expect multi-factor authentication options, such as fingerprint or facial recognition, to protect their accounts from unauthorized access. A strong and secure mobile banking experience is crucial for gaining the trust and confidence of this tech-savvy generation.

In summary, mobile banking features such as mobile check deposit, instant notifications, seamless fund transfers, and advanced security measures are key considerations for millennials when choosing a checking account. Banks that prioritize and invest in their mobile banking capabilities will appeal to the preferences of this digitally-focused generation.

Low or No Fees

When it comes to their checking accounts, millennials are highly conscious of fees. They value transparency and affordability, and therefore, prefer checking accounts with low or no fees.

One fee that millennials particularly want to avoid is the monthly maintenance fee. They do not want to pay just for the privilege of having a checking account. Financial institutions that offer fee-free checking accounts have a significant advantage in attracting millennial customers. Alternatively, if a monthly fee is necessary, millennials appreciate options to waive it by meeting certain criteria, such as maintaining a minimum balance or setting up direct deposit.

In addition, millennials place importance on avoiding excessive overdraft fees. Accidental overdrafts can happen to anyone, and millennials look for banks that offer reasonable overdraft policies and fees. A transparent and fair approach to overdrafts demonstrates the bank’s commitment to the financial well-being of its customers.

Furthermore, millennials appreciate banks that minimize other miscellaneous fees, such as ATM withdrawal fees and foreign transaction fees. The ability to access their money without incurring additional charges is a significant factor when choosing a checking account.

Overall, millennials seek checking accounts with low or no fees. Banks that offer transparent fee structures and provide options to avoid fees altogether are more likely to attract this cost-conscious generation.

Transparent and Fair Policies

Transparency and fair policies are key considerations for millennials when it comes to their checking accounts. This generation values honesty and openness from their financial institutions, and they expect clear and easily understandable terms and conditions.

First and foremost, millennials want to know exactly what they are signing up for. They appreciate banks that provide clear information about account fees, interest rates, and any potential charges. Having this information readily available allows millennials to make informed decisions about their banking relationships.

Additionally, millennials are wary of hidden fees and fine print. They expect banks to be upfront about any additional charges that may be incurred, such as fees for using out-of-network ATMs or for certain types of transactions. Banks that proactively disclose these fees and provide educational resources on how to avoid them will gain the trust and loyalty of millennial customers.

Moreover, fair policies regarding holds on deposits are important to millennials. They expect timely access to the funds they’ve deposited into their checking accounts, and they appreciate banks that have reasonable hold policies that are clearly communicated.

Lastly, millennials value banks that treat all customers fairly and without discrimination. They seek financial institutions that promote inclusivity and equality, offering equal access to financial services and opportunities for all individuals, regardless of their background or financial situation.

In summary, millennials prioritize transparency and fair policies when choosing a checking account. Banks that are transparent about their fees, avoid hidden charges, have reasonable hold policies, and promote equality will attract millennial customers who value honesty and integrity in their financial institutions.

Personalized and Customizable Options

Millennials value personalized and customizable options when it comes to their checking accounts. They seek banking solutions that can adapt to their individual financial needs and goals.

One aspect of personalization that millennials appreciate is the ability to customize their account preferences. This may include choosing the types of alerts they receive, setting spending limits on their debit cards, or even personalizing the design of their physical debit cards. The ability to tailor their checking account settings allows millennials to have a banking experience that aligns with their unique preferences.

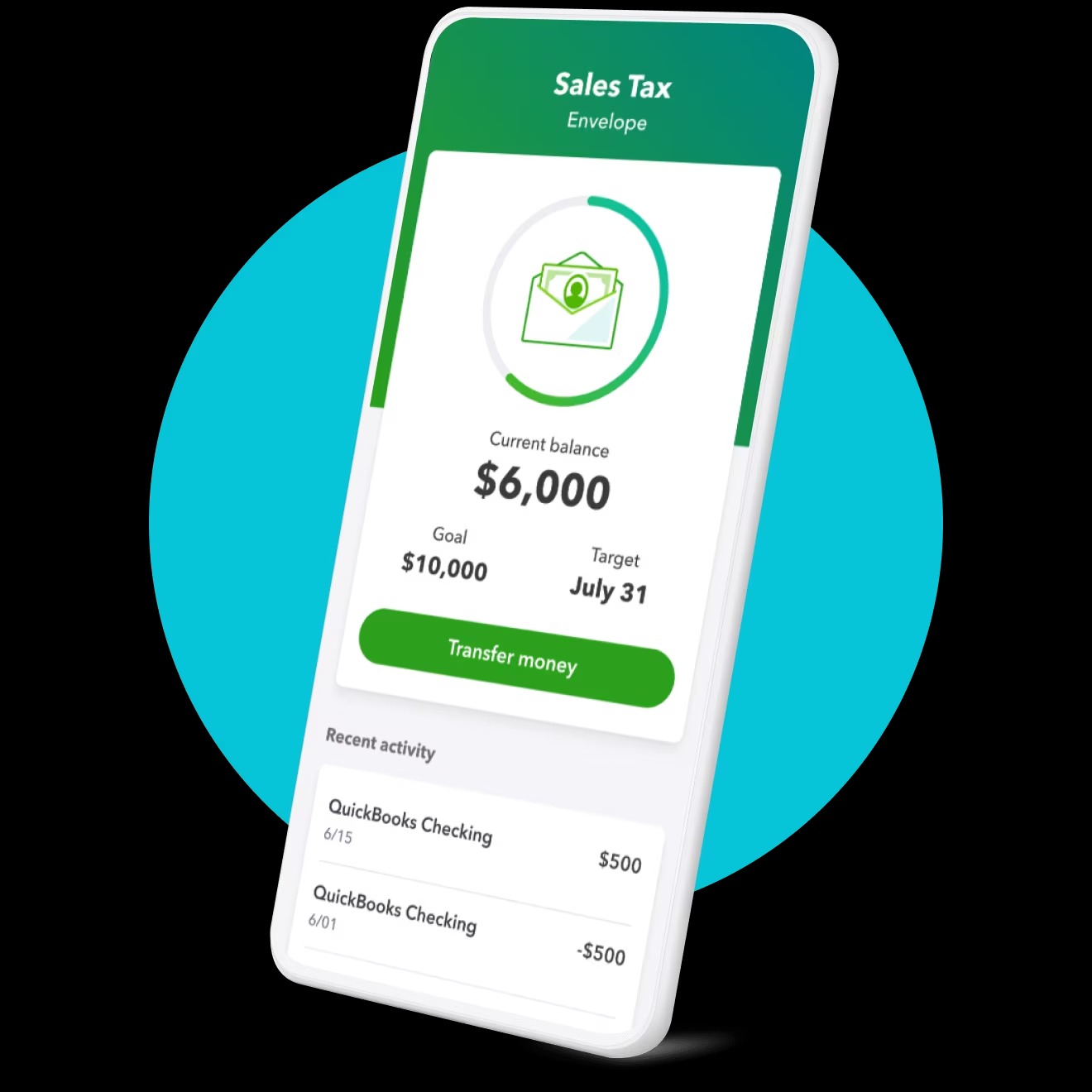

Furthermore, millennials appreciate banks that offer innovative features and tools to help them manage their finances more effectively. This may include budgeting and spending tracking tools within the mobile banking app, goal-setting features to save for specific financial goals, or even personalized savings plans based on spending patterns. The more control and guidance they have over their finances, the more engaged and satisfied millennials will be with their checking accounts.

In addition to personalization, millennials value banks that offer tailored and relevant financial advice and educational resources. They want access to information that can help them make informed decisions about their money, whether it’s guidance on saving for retirement, managing debt, or investing. Banks that provide personalized financial education and resources demonstrate their commitment to the financial success of millennials.

Overall, millennials seek checking accounts that offer personalized and customizable options. Banks that provide flexibility, innovative tools, and tailored financial guidance will attract and retain millennials who value a banking experience that fits their unique needs and aspirations.

Enhanced Security Measures

When it comes to their checking accounts, millennials prioritize enhanced security measures to protect their financial information and transactions. As digital natives, they are well aware of the potential risks and threats in the online world, and they expect their banks to have robust security measures in place.

One security feature that millennials highly value is multi-factor authentication. They want to ensure that only authorized individuals can access their accounts, and they appreciate banks that offer options such as fingerprint or facial recognition, in addition to traditional username and password credentials. These additional layers of security provide peace of mind in an increasingly interconnected and vulnerable digital landscape.

Moreover, millennials expect banks to have advanced fraud monitoring and detection systems in place. They want to know that their bank is actively monitoring their account for any suspicious activity or unauthorized transactions. In the event of potential fraud, they appreciate banks that can quickly and effectively resolve the issue, providing timely notifications and offering support to rectify any fraudulent charges.

Additionally, millennials look for banks that offer secure communication channels for inquiries and support. They prefer encrypted messaging platforms or secure chat features to communicate sensitive information with their bank. This ensures that their personal and financial details remain confidential and protected.

Furthermore, millennials appreciate banks that provide options for additional security measures, such as the ability to set transaction alerts or temporary card freezes. These tools allow them to have more control over their account security and help mitigate the risk of unauthorized activity.

In summary, enhanced security measures are a top priority for millennials when choosing a checking account. Banks that invest in cutting-edge technologies, offer multi-factor authentication, monitor for fraud, provide secure communication channels, and offer additional security options will gain the trust and confidence of millennial customers who prioritize their account’s protection.

Integration with Other Financial Tools

Millennials value seamless integration between their checking accounts and other financial tools or services they use. They seek a cohesive and connected financial ecosystem where they can easily manage and track their finances all in one place.

One aspect of integration that millennials appreciate is the ability to link their checking accounts to personal finance apps or budgeting tools. They want to be able to sync their transactions, track their spending, and monitor their financial goals effortlessly. Banks that provide APIs or have partnerships with popular financial apps offer added value to millennials who prioritize a holistic and consolidated approach to their finances.

In addition, millennials expect integration with payment platforms such as PayPal, Zelle, or Venmo. They want the ability to easily send and receive money from their checking accounts without having to navigate multiple platforms or incur additional fees. Integration with these payment services simplifies the process for millennials and increases the versatility of their checking accounts.

Moreover, millennials value integration with personal finance management tools that offer features like expense categorization, budgeting insights, and financial goal tracking. The ability to visualize their spending patterns, receive personalized financial recommendations, and track progress towards their goals is highly desirable. Banks that offer these features within their online or mobile banking platforms attract millennials who seek convenient and comprehensive financial management.

Lastly, millennials appreciate integration with investment tools or platforms. They want the ability to easily transfer funds from their checking accounts to investment accounts or portfolios. The seamless connection between their checking and investment accounts allows them to manage their finances holistically, making investments and monitoring their overall financial health more efficiently.

In summary, millennials desire checking accounts that seamlessly integrate with other financial tools and services. Banks that prioritize partnerships, offer APIs, and provide robust integration options with personal finance apps, payment platforms, personal finance management tools, and investments will appeal to millennials who value a connected and streamlined financial experience.

Customer Support and Assistance

Customer support and assistance are vital considerations for millennials when choosing a checking account. This generation expects top-notch customer service and values banks that prioritize their needs and provide timely and reliable support.

One aspect of customer support that millennials appreciate is the availability of various communication channels. While many millennials prefer digital interactions, they still want the option to speak with a live representative when needed. Banks that offer 24/7 customer support through phone, email, and online chat platforms cater to the needs of millennials who value flexibility and convenience.

Moreover, millennials expect quick and efficient resolution of any issues or inquiries. They appreciate banks with responsive customer support teams that can provide timely assistance and resolve problems promptly. The ability to track the progress of their inquiries or issues through a centralized platform is also highly valued.

Furthermore, millennials appreciate banks that provide educational resources and personalized financial guidance. They want access to tools, articles, videos, or even workshops that help them navigate financial challenges and make informed decisions. Banks that offer financial education platforms or personalized advice demonstrate their commitment to the financial success of their millennial customers.

In addition to traditional customer support, millennials value self-service options. They want the ability to perform common banking tasks, such as updating personal information, ordering checks, or disputing transactions, through user-friendly online portals or mobile apps. Self-service options empower millennials to take control of their banking needs and save time.

In summary, excellent customer support and assistance are important to millennials when selecting a checking account. Banks that provide multiple communication channels, quick issue resolution, educational resources, and self-service options will attract and retain millennial customers who prioritize a positive and supportive banking experience.

Social and Environmental Responsibility

Social and environmental responsibility is increasingly important to millennials, and they expect their financial institutions to share their values and contribute to positive societal and environmental impacts.

Millennials seek banks that actively practice corporate social responsibility by supporting community initiatives and charitable causes. They value and appreciate financial institutions that invest in local communities through donations, volunteer programs, or partnerships with non-profit organizations. Millennials want to align themselves with banks that demonstrate a commitment to making a positive difference in the world.

In addition, millennials are concerned about the environmental impact of their financial decisions. They seek banks that prioritize sustainability and adopt environmentally friendly practices. This can include initiatives such as using renewable energy sources, reducing paper usage through digital banking options, or supporting eco-friendly projects. Millennials appreciate financial institutions that incorporate sustainability into their operations and actively contribute to a greener future.

Moreover, transparency is crucial to millennials when it comes to a bank’s social and environmental responsibility. They expect clear communication about the bank’s initiatives and progress in these areas. Millennials want to know how their money is being used and the positive impacts it can have on society and the environment.

Furthermore, millennials value banks that offer socially responsible investment options. They want the ability to invest their money in companies or funds that align with their values, whether it’s supporting clean energy, promoting diversity and inclusion, or prioritizing ethical business practices. The availability of these options within their checking accounts allows millennials to have a holistic approach to their finances, combining banking and investments in support of their values.

In summary, social and environmental responsibility is a key consideration for millennials when choosing a checking account. Banks that actively practice corporate social responsibility, promote sustainability, offer socially responsible investment options, and communicate transparently about their initiatives will attract and retain millennial customers who prioritize making a positive impact through their financial choices.