Finance

What Is Liquidity Risk?

Published: February 23, 2024

Learn about liquidity risk in finance, its impact on investments, and how to manage it effectively. Understand the importance of liquidity risk management in financial planning.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to the world of finance, risk is an ever-present factor that can significantly impact the stability and profitability of investments. One type of risk that often garners attention in financial markets is liquidity risk. Understanding and effectively managing liquidity risk is crucial for financial institutions, investors, and businesses to ensure their ongoing financial health and stability.

Liquidity risk refers to the potential for an entity to encounter difficulty in meeting its short-term financial obligations due to an inability to convert assets into cash swiftly without incurring a significant loss. This risk can arise from a variety of factors, including market conditions, regulatory changes, or the specific structure of an entity’s assets and liabilities.

As an SEO expert with deep knowledge in finance, I will delve into the intricacies of liquidity risk, exploring its various forms, measurement techniques, and management strategies. By the end of this article, you will have a comprehensive understanding of liquidity risk and its pivotal role in the financial landscape.

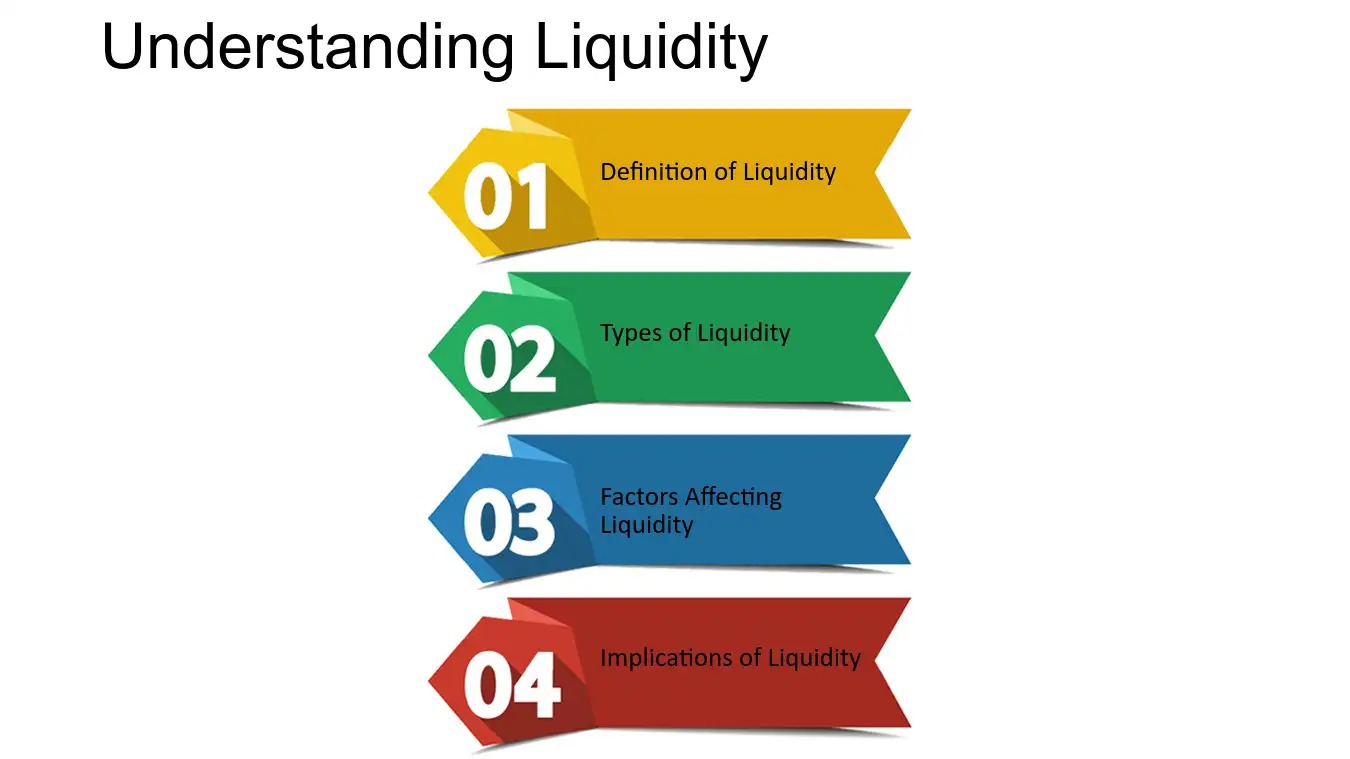

Understanding Liquidity Risk

Liquidity risk is a multifaceted concept that encompasses the potential for adverse outcomes stemming from an entity’s inability to meet its short-term financial obligations. This risk arises from the misalignment between the timing of an entity’s cash flows and the timing of its financial commitments. While all entities face some level of liquidity risk, financial institutions, such as banks and investment firms, are particularly sensitive to this type of risk due to their reliance on short-term funding to maintain operations and meet withdrawal demands from clients.

One of the fundamental drivers of liquidity risk is the inherent unpredictability of cash flows. Fluctuations in cash inflows and outflows can disrupt an entity’s ability to honor its payment obligations, potentially leading to severe financial strain or even insolvency. Additionally, liquidity risk is exacerbated by the illiquidity of certain assets, such as real estate or long-term investments, which cannot be readily converted into cash without incurring substantial losses.

Moreover, market conditions and investor sentiment play a pivotal role in influencing liquidity risk. During periods of economic turmoil or financial distress, market participants may become more risk-averse, leading to decreased liquidity and heightened difficulty in selling assets at fair prices. This phenomenon can further exacerbate an entity’s liquidity risk, especially if it relies on the sale of assets to generate cash.

Understanding liquidity risk involves a comprehensive assessment of an entity’s funding sources, cash flow projections, and the liquidity profiles of its assets and liabilities. By gaining insights into the nature and magnitude of potential liquidity challenges, stakeholders can proactively implement risk mitigation strategies to safeguard the entity’s financial stability and resilience in the face of adverse market conditions.

Types of Liquidity Risk

Liquidity risk manifests in various forms, each presenting unique challenges and implications for entities operating in the financial landscape. Understanding the distinct types of liquidity risk is essential for devising targeted risk management strategies tailored to specific risk exposures. The following are the primary types of liquidity risk:

- Asset Liquidity Risk: This type of risk arises from the illiquidity of an entity’s assets, making it difficult to convert them into cash within a desirable timeframe and without significant loss. Assets such as real estate, long-term investments, and certain securities may exhibit limited marketability, posing challenges when immediate cash needs arise.

- Funding Liquidity Risk: Funding liquidity risk pertains to an entity’s ability to obtain adequate funding to meet its financial obligations as they come due. Inadequate access to funding sources, especially during periods of market stress or credit tightening, can lead to liquidity shortages and hinder the entity’s operational continuity.

- Market Liquidity Risk: Market liquidity risk stems from the potential difficulty in buying or selling assets in the secondary market at fair prices. This risk is particularly pronounced for assets with limited trading activity or during periods of market volatility, as it can impede an entity’s ability to adjust its asset portfolio or raise cash through asset sales.

- Tenant Liquidity Risk: This type of risk applies primarily to real estate investments, where the ability to secure tenants and rental income may impact the property’s cash flow and liquidity. Vacancies or lease defaults can lead to cash flow disruptions, affecting the property’s overall liquidity position.

Recognizing the interplay between these diverse forms of liquidity risk is critical for comprehensive risk management. By identifying and assessing the specific liquidity risk exposures within an entity’s operations and asset portfolio, stakeholders can implement targeted measures to mitigate vulnerabilities and enhance overall liquidity resilience.

Measurement of Liquidity Risk

Effectively quantifying and assessing liquidity risk is a fundamental aspect of proactive risk management within the financial domain. Various quantitative and qualitative measures are employed to gauge an entity’s exposure to liquidity risk and its capacity to withstand potential liquidity shocks. The following are key methods for measuring liquidity risk:

- Liquidity Coverage Ratio (LCR): The LCR is a regulatory requirement that assesses a financial institution’s ability to withstand short-term liquidity stress. It compares high-quality liquid assets with net cash outflows over a specified period, providing insights into the institution’s liquidity buffer and its ability to meet obligations during a stressed scenario.

- Net Stable Funding Ratio (NSFR): The NSFR evaluates the long-term stability of an institution’s funding profile by comparing the available stable funding with the required stable funding over a one-year horizon. This measure aims to mitigate the risk of excessive reliance on short-term funding, promoting a more sustainable funding structure.

- Liquidity Risk Metrics: Various quantitative metrics, such as the cash flow mismatch analysis and the calculation of liquidity gaps, offer detailed assessments of an entity’s liquidity risk exposure. These metrics analyze the timing and magnitude of cash inflows and outflows, identifying potential mismatches that could lead to liquidity strain.

- Stress Testing: Stress testing involves simulating adverse market conditions or economic scenarios to evaluate an entity’s resilience to severe liquidity disruptions. By subjecting the entity to hypothetical stress events, stakeholders can gauge its ability to withstand liquidity shocks and identify potential areas of vulnerability.

Qualitative assessments of liquidity risk involve evaluating an entity’s funding diversification, access to funding markets, and the composition of its asset portfolio in terms of liquidity. Additionally, scenario analysis and sensitivity testing provide valuable insights into how changes in market conditions or investor behavior may impact an entity’s liquidity position.

By employing a combination of quantitative metrics, regulatory measures, and qualitative assessments, stakeholders can gain a comprehensive understanding of an entity’s liquidity risk profile. This knowledge forms the basis for implementing robust liquidity risk management practices and ensuring the entity’s resilience in the face of dynamic market conditions and evolving regulatory requirements.

Management of Liquidity Risk

Effectively managing liquidity risk is imperative for safeguarding an entity’s financial stability and operational continuity. By implementing proactive measures and robust risk management practices, stakeholders can mitigate the impact of liquidity risk and enhance the entity’s resilience in the face of evolving market dynamics. The following strategies are key components of liquidity risk management:

- Liquidity Risk Policies and Limits: Establishing clear liquidity risk policies and predefined limits enables entities to proactively manage their liquidity exposures. These policies outline acceptable levels of liquidity risk and provide guidelines for maintaining adequate liquidity buffers to withstand potential stress events.

- Asset-Liability Management: Implementing rigorous asset-liability management practices allows entities to align the maturity and liquidity profiles of their assets and liabilities. By matching cash inflows and outflows, entities can reduce the potential for liquidity mismatches and enhance their overall liquidity resilience.

- Diversification of Funding Sources: Relying on diverse funding channels, including retail deposits, wholesale funding, and capital markets, reduces an entity’s dependence on a single funding source. Diversification enhances funding stability and mitigates the impact of disruptions in any single funding market.

- Stress Testing and Scenario Analysis: Conducting regular stress tests and scenario analyses allows entities to assess their ability to withstand severe liquidity shocks. By simulating adverse market conditions and stress events, entities can identify potential vulnerabilities and refine their liquidity risk management strategies accordingly.

- Contingency Funding Plans: Developing robust contingency funding plans ensures that entities have predefined strategies for accessing additional liquidity during stress events. These plans outline the sources of emergency funding and the actions to be taken in response to liquidity disruptions, enhancing the entity’s preparedness for adverse scenarios.

Moreover, maintaining open communication with regulatory authorities and market participants fosters transparency and ensures compliance with regulatory liquidity requirements. By actively engaging with stakeholders and staying abreast of evolving regulatory standards, entities can adapt their liquidity risk management practices to align with industry best practices and regulatory expectations.

Overall, a comprehensive approach to liquidity risk management involves a combination of prudent policies, proactive risk mitigation strategies, and ongoing monitoring of liquidity metrics. By prioritizing liquidity resilience and embracing a forward-looking approach to risk management, entities can navigate the complexities of liquidity risk and fortify their financial stability in a dynamic and evolving financial landscape.

Conclusion

In the realm of finance, liquidity risk stands as a pervasive force that can significantly impact the stability and viability of financial institutions, businesses, and investment portfolios. As we have explored, liquidity risk encompasses a spectrum of challenges, including asset illiquidity, funding shortages, and market disruptions, all of which can jeopardize an entity’s financial health.

Understanding the nuanced nature of liquidity risk is paramount for stakeholders seeking to fortify their financial resilience and navigate the complexities of the modern financial landscape. By recognizing the diverse manifestations of liquidity risk and embracing proactive risk management strategies, entities can mitigate the potential impact of liquidity challenges and enhance their capacity to withstand adverse market conditions.

From quantitative measures such as the Liquidity Coverage Ratio and stress testing to qualitative assessments of funding diversification and asset-liability management, the tools and practices available for managing liquidity risk are diverse and robust. By integrating these measures into their risk management frameworks, entities can bolster their liquidity resilience and adapt to the dynamic and evolving nature of financial markets.

Ultimately, effective liquidity risk management demands a forward-looking and comprehensive approach, underpinned by prudent policies, proactive monitoring, and a commitment to regulatory compliance. By embracing these principles, entities can position themselves to navigate the challenges of liquidity risk with resilience and agility, safeguarding their financial stability and sustaining their operations in the face of uncertainty.

As the financial landscape continues to evolve, the management of liquidity risk will remain a focal point for entities and investors alike. By remaining attuned to emerging trends, regulatory developments, and best practices in liquidity risk management, stakeholders can navigate the complexities of liquidity risk with confidence, ensuring the enduring strength and stability of their financial endeavors.