Finance

What Are My Merchant Fees With PayPal?

Published: February 24, 2024

Learn about the merchant fees with PayPal and manage your finances effectively. Understand the costs involved to make informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding PayPal Merchant Fees

If you're a business owner, especially one operating in the digital realm, you've likely considered using PayPal as a payment processing solution. PayPal offers a convenient and widely used platform for businesses to accept payments, but it's essential to understand the associated merchant fees to make informed decisions for your enterprise. Navigating the realm of merchant fees can be a daunting task, but with the right knowledge, you can effectively manage your financial resources and optimize your business operations.

In this comprehensive guide, we'll delve into the intricacies of PayPal merchant fees, shedding light on the various charges that businesses may encounter when utilizing PayPal as a payment gateway. Understanding these fees is crucial for businesses of all sizes, as they directly impact the bottom line and can significantly influence profitability.

By gaining insight into PayPal's fee structure, you'll be better equipped to make strategic choices for your business, whether you're a budding entrepreneur venturing into e-commerce or an established company seeking to streamline your payment processes. Let's embark on this journey to unravel the nuances of PayPal merchant fees and empower your business with the knowledge needed to thrive in the digital economy.

Understanding PayPal Merchant Fees

When utilizing PayPal as a payment processing solution for your business, it’s essential to comprehend the various merchant fees that may apply. These fees are integral to PayPal’s revenue model and are designed to cover the costs associated with processing payments, mitigating risks, and providing a secure and reliable platform for businesses and consumers alike.

PayPal’s merchant fees encompass a range of charges, including transaction fees, cross-border fees, currency conversion fees, chargeback fees, and additional expenses that may arise during payment processing. By understanding these fees in detail, businesses can make informed decisions and effectively manage their financial resources.

Moreover, gaining clarity on PayPal’s fee structure enables businesses to transparently communicate pricing to customers, fostering trust and confidence in the payment process. This, in turn, can contribute to enhanced customer satisfaction and loyalty.

As we delve into the specifics of PayPal’s merchant fees, it’s important to approach the topic with a strategic mindset, aiming to optimize cost-efficiency while delivering a seamless payment experience for both merchants and customers. Let’s explore each category of PayPal merchant fees to gain a comprehensive understanding of the financial considerations involved in leveraging PayPal as a payment gateway for your business.

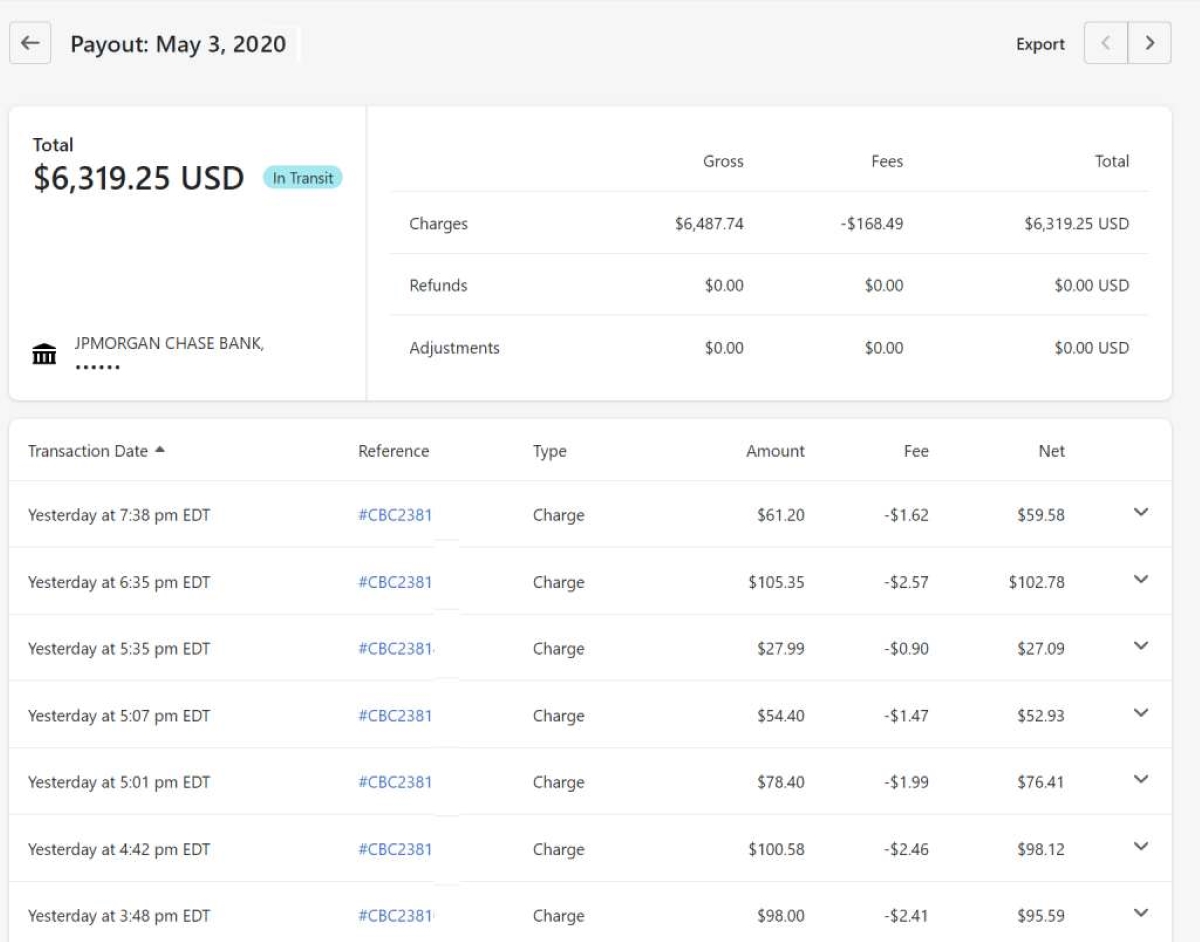

PayPal Transaction Fees

One of the primary components of PayPal’s merchant fees is the transaction fee, which is incurred every time a customer makes a purchase using PayPal as the payment method. The transaction fee is typically calculated as a percentage of the total transaction amount, coupled with a fixed fee for each transaction. The specific percentage and fixed amount depend on various factors, including the merchant’s location, the customer’s location, the type of transaction (e.g., domestic or international), and the volume of sales processed through PayPal.

For domestic transactions within the same country, PayPal’s transaction fees are generally lower compared to international transactions involving customers from different countries. This fee structure is designed to account for the additional complexities and risks associated with cross-border transactions, such as currency exchange and diverse regulatory requirements.

It’s important for businesses to consider these transaction fees when pricing their products or services, as they directly impact the profitability of each sale. Additionally, understanding the nuances of domestic and international transaction fees empowers businesses to tailor their sales strategies and expand their reach across global markets while managing the associated costs effectively.

By comprehending PayPal’s transaction fees, businesses can make informed decisions regarding pricing, sales channels, and geographic target markets. Moreover, transparently communicating these fees to customers fosters trust and transparency, contributing to a positive and reliable payment experience for all parties involved.

PayPal Cross-Border Fees

When conducting transactions across international borders, businesses utilizing PayPal as a payment gateway encounter cross-border fees. These fees are applied when the customer and the merchant are located in different countries, necessitating the conversion of currencies and compliance with diverse regulatory frameworks.

PayPal’s cross-border fees are designed to account for the additional complexities and risks associated with international transactions. These fees typically encompass a percentage of the transaction amount, coupled with a fixed fee. The specific percentage and fixed amount vary based on factors such as the countries involved in the transaction, the currency exchange process, and the type of PayPal account held by the merchant.

For businesses venturing into global markets or engaging with international customers, understanding and managing cross-border fees is crucial for strategic pricing and financial planning. By factoring these fees into the overall cost structure, businesses can effectively navigate the complexities of international commerce while optimizing profitability.

Moreover, transparently communicating cross-border fees to customers fosters trust and transparency, enhancing the overall customer experience and bolstering the reputation of the business as a reliable and upfront entity. By embracing a proactive approach to cross-border fees, businesses can expand their global footprint and capitalize on international growth opportunities while mitigating the financial implications of cross-border transactions.

PayPal Currency Conversion Fees

When engaging in international transactions that involve currency conversion, businesses utilizing PayPal may encounter currency conversion fees. These fees arise when the primary currency of the merchant’s account differs from the currency in which the payment is received. As a result, PayPal facilitates the conversion of the received funds into the merchant’s primary currency, applying a currency conversion fee in the process.

The currency conversion fee typically consists of a percentage of the transaction amount, along with a fixed fee based on the specific circumstances of the currency exchange. The percentage and fixed amount are influenced by factors such as the currencies involved, the applicable exchange rates, and the type of PayPal account held by the merchant.

For businesses operating in multiple countries or catering to a diverse international customer base, understanding and managing currency conversion fees is paramount. By factoring these fees into pricing strategies and financial planning, businesses can optimize their approach to cross-border transactions and effectively navigate the complexities of currency exchange.

Transparently communicating currency conversion fees to customers fosters trust and transparency, contributing to a positive and reliable payment experience. Moreover, by proactively addressing currency conversion fees, businesses can streamline their international operations and capitalize on global opportunities while mitigating the financial impact of currency exchange.

PayPal Chargeback Fees

Chargebacks can occur when customers dispute a transaction with their card issuer or bank, leading to the funds being reversed from the merchant’s account. In the event of a chargeback, PayPal may levy chargeback fees to cover the administrative and processing costs associated with managing the dispute resolution process.

The chargeback fee imposed by PayPal typically includes a fixed amount, which is debited from the merchant’s account when a chargeback is initiated. This fee serves to offset the expenses related to investigating and addressing the dispute, as well as the potential loss of funds resulting from the chargeback.

For businesses utilizing PayPal as a payment gateway, understanding chargeback fees is crucial for managing financial risks and implementing measures to mitigate the occurrence of chargebacks. By proactively addressing potential causes of disputes and providing exceptional customer service, businesses can minimize the likelihood of chargebacks and the associated fees.

Effectively managing chargeback fees involves maintaining detailed transaction records, promptly addressing customer inquiries and concerns, and adhering to best practices for fraud prevention and dispute resolution. By cultivating a customer-centric approach and fostering open communication, businesses can build trust and loyalty, reducing the incidence of chargebacks and safeguarding their financial resources.

Transparently communicating chargeback policies and associated fees to customers can contribute to a positive payment experience, reinforcing the business’s commitment to integrity and accountability. Additionally, by staying informed about chargeback regulations and diligently monitoring transaction activities, businesses can navigate the landscape of chargeback fees with prudence and foresight.

Other PayPal Merchant Fees

In addition to transaction fees, cross-border fees, currency conversion fees, and chargeback fees, PayPal may impose various other merchant fees that businesses should consider when utilizing the platform for payment processing. These additional fees encompass a spectrum of charges that can impact a business’s financial operations and should be factored into pricing strategies and financial planning.

One notable fee is the micropayments fee, which applies to transactions involving small payment amounts. PayPal offers a specific fee structure tailored to micropayments, enabling businesses that predominantly process low-value transactions to optimize their cost-efficiency within this niche.

Furthermore, businesses utilizing PayPal for subscription-based services or recurring billing may encounter fees related to subscription payments. These fees are designed to accommodate the unique characteristics of subscription-based models and enable businesses to effectively manage the associated payment processing costs.

Additionally, businesses leveraging PayPal’s advanced features, such as virtual terminal or in-store payments, may encounter specific fees related to these functionalities. These fees are tailored to the distinct attributes of these services, reflecting the added value and convenience they offer to businesses seeking diverse payment solutions.

It’s essential for businesses to thoroughly review PayPal’s fee structure and stay informed about any updates or modifications to the fee schedule. By maintaining awareness of the full spectrum of merchant fees, businesses can make informed decisions, optimize their financial resources, and align their payment processing strategies with their operational needs and growth objectives.

Transparently communicating these fees to customers fosters trust and transparency, contributing to a positive and reliable payment experience. By proactively addressing the nuances of other PayPal merchant fees, businesses can streamline their payment operations and cultivate a robust financial foundation for sustained success.

Conclusion

Understanding PayPal merchant fees is pivotal for businesses seeking to leverage PayPal as a payment processing solution. By unraveling the intricacies of transaction fees, cross-border fees, currency conversion fees, chargeback fees, and other associated expenses, businesses can make informed decisions, optimize their financial resources, and foster trust and transparency in their payment processes.

As businesses navigate the digital landscape and engage in global commerce, comprehending and managing PayPal merchant fees empowers them to strategically price their products and services, expand their market reach, and enhance customer satisfaction. Transparently communicating these fees to customers builds credibility and reliability, contributing to a positive payment experience and long-term loyalty.

Furthermore, by proactively addressing the nuances of PayPal merchant fees, businesses can mitigate financial risks, streamline their payment operations, and cultivate a robust financial foundation for sustained success. Embracing a customer-centric approach, maintaining awareness of industry best practices, and staying informed about updates to PayPal’s fee structure are essential elements of effectively managing merchant fees.

In essence, the journey to comprehending PayPal merchant fees is a strategic endeavor that intertwines financial acumen, customer trust, and operational efficiency. By embracing this journey with diligence and foresight, businesses can harness the power of PayPal as a reliable and versatile payment gateway, driving growth and prosperity in the dynamic landscape of digital commerce.