Finance

What Category Is Merchant Fee In QuickBooks

Published: February 23, 2024

Learn how QuickBooks categorizes merchant fees in the finance section. Understand the classification and management of merchant fees for better financial tracking.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Welcome to the world of QuickBooks, where businesses can efficiently manage their finances, including the often complex realm of merchant fees. In this article, we will delve into the categorization of merchant fees in QuickBooks, shedding light on this crucial aspect of financial management.

Merchant fees are a ubiquitous aspect of conducting business, encompassing the charges incurred for processing credit card payments, online transactions, and other forms of electronic payments. While QuickBooks serves as a comprehensive financial tool, effectively categorizing merchant fees within its framework is essential for accurate bookkeeping and financial analysis.

Throughout this article, we will explore the intricacies of merchant fees in QuickBooks, offering insights into their categorization and best practices for managing them. By the end of this journey, you will gain a deeper understanding of how to navigate the realm of merchant fees within the QuickBooks ecosystem, empowering you to optimize your financial management processes. Let's embark on this enlightening exploration together.

**

Understanding Merchant Fees in QuickBooks

Merchant fees, also known as credit card processing fees, are charges incurred by businesses when they accept electronic payments from customers. These fees typically include a combination of flat fees and a percentage of the transaction amount, varying based on the payment processor and the type of card used by the customer. In the realm of QuickBooks, accurately comprehending these fees is pivotal for maintaining precise financial records and gaining insights into the true cost of processing electronic payments.

When a business accepts credit or debit card payments, the associated merchant fees can significantly impact its bottom line. QuickBooks enables businesses to track and categorize these fees, providing a clear overview of the expenses incurred during payment processing. By understanding the nuances of merchant fees, businesses can make informed decisions regarding pricing strategies, cost management, and overall financial planning.

It is essential to recognize that merchant fees are not solely limited to credit card transactions. They also encompass fees related to online payment gateways, such as PayPal or Stripe, as well as other electronic payment methods. QuickBooks facilitates the classification of these diverse fees, ensuring that businesses can accurately allocate them to the appropriate expense categories.

By gaining a comprehensive understanding of merchant fees within the QuickBooks framework, businesses can harness the power of data-driven financial analysis. This insight allows for the identification of cost-saving opportunities, the evaluation of payment processing efficiency, and the optimization of financial strategies to enhance overall profitability.

Categorizing Merchant Fees in QuickBooks

Within the QuickBooks platform, categorizing merchant fees is a fundamental aspect of maintaining accurate financial records. QuickBooks provides a robust system for organizing and tracking expenses, including the ability to categorize merchant fees with precision. By effectively categorizing these fees, businesses can gain valuable insights into their expenditure patterns and make informed financial decisions.

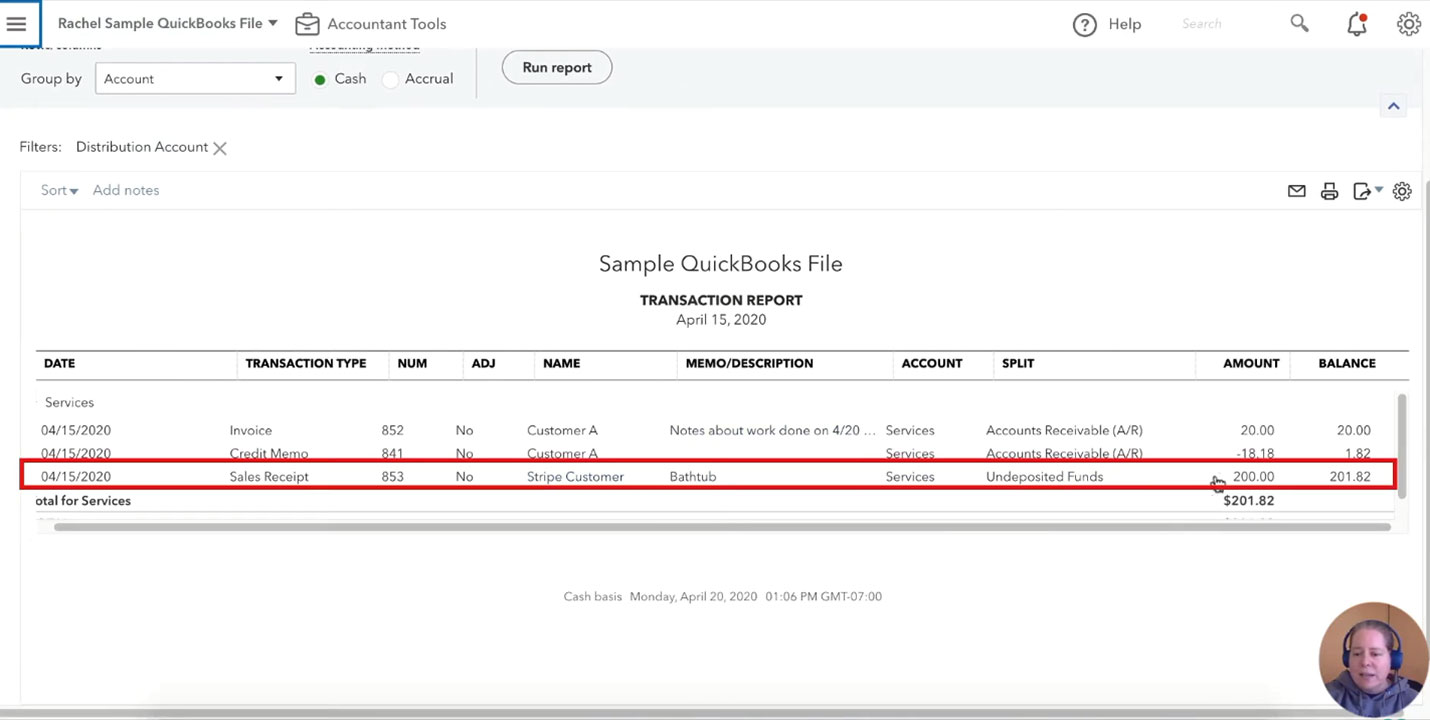

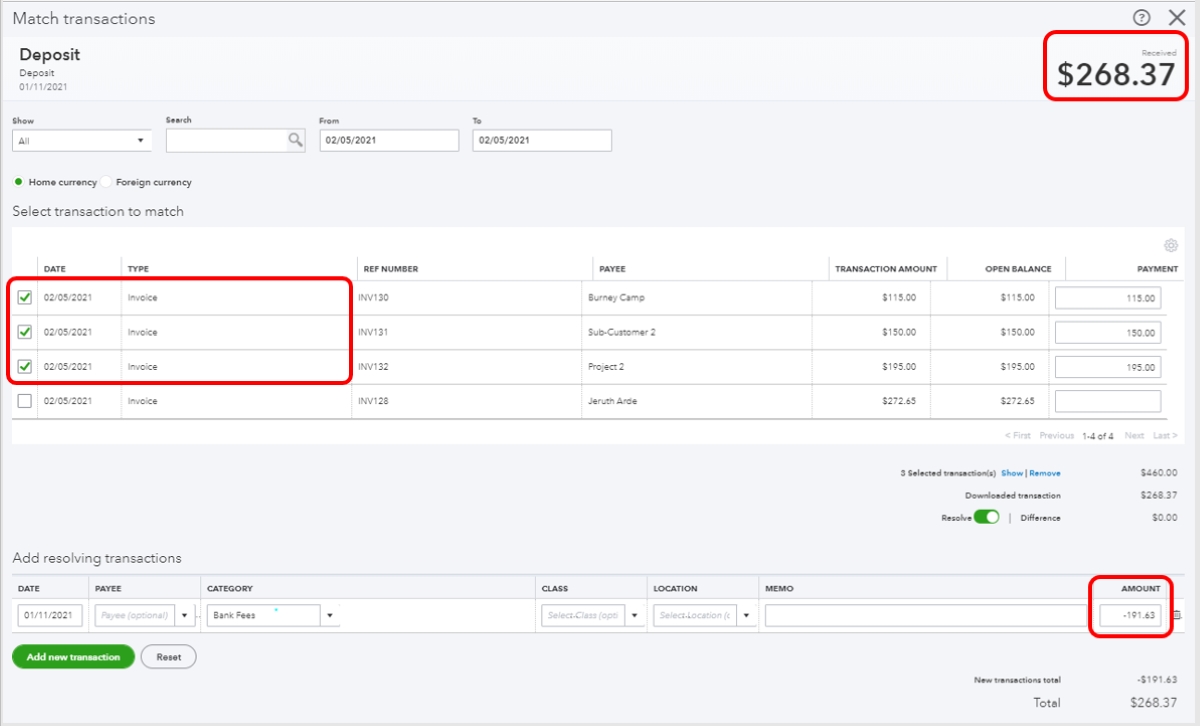

When categorizing merchant fees in QuickBooks, businesses have the flexibility to create specific expense accounts tailored to different types of merchant fees. This allows for granular tracking of expenses associated with credit card processing, online payment gateways, and other electronic payment methods. By assigning the appropriate categories to merchant fees, businesses can generate detailed reports that illuminate the true cost of payment processing.

Moreover, QuickBooks offers the capability to create custom fields, providing businesses with the means to capture additional details related to merchant fees. This level of customization enhances the accuracy and depth of expense tracking, empowering businesses to align their financial records with their unique operational needs.

It is important to note that accurate categorization of merchant fees in QuickBooks facilitates seamless integration with other financial processes, such as budgeting, forecasting, and financial analysis. This integration enables businesses to leverage their financial data effectively, driving informed decision-making and strategic planning.

By harnessing the categorization features within QuickBooks, businesses can gain a comprehensive understanding of their payment processing expenses, identify cost-saving opportunities, and optimize their financial strategies for enhanced profitability.

Best Practices for Managing Merchant Fees in QuickBooks

Effectively managing merchant fees in QuickBooks requires the implementation of best practices that streamline expense tracking, optimize financial analysis, and facilitate informed decision-making. By adhering to these best practices, businesses can harness the full potential of QuickBooks to manage their merchant fees with precision and efficiency.

- Accurate Categorization: Ensure that merchant fees are categorized with specificity, aligning each fee with the appropriate expense account within QuickBooks. This precision enables businesses to generate detailed reports and gain insights into the true cost of payment processing.

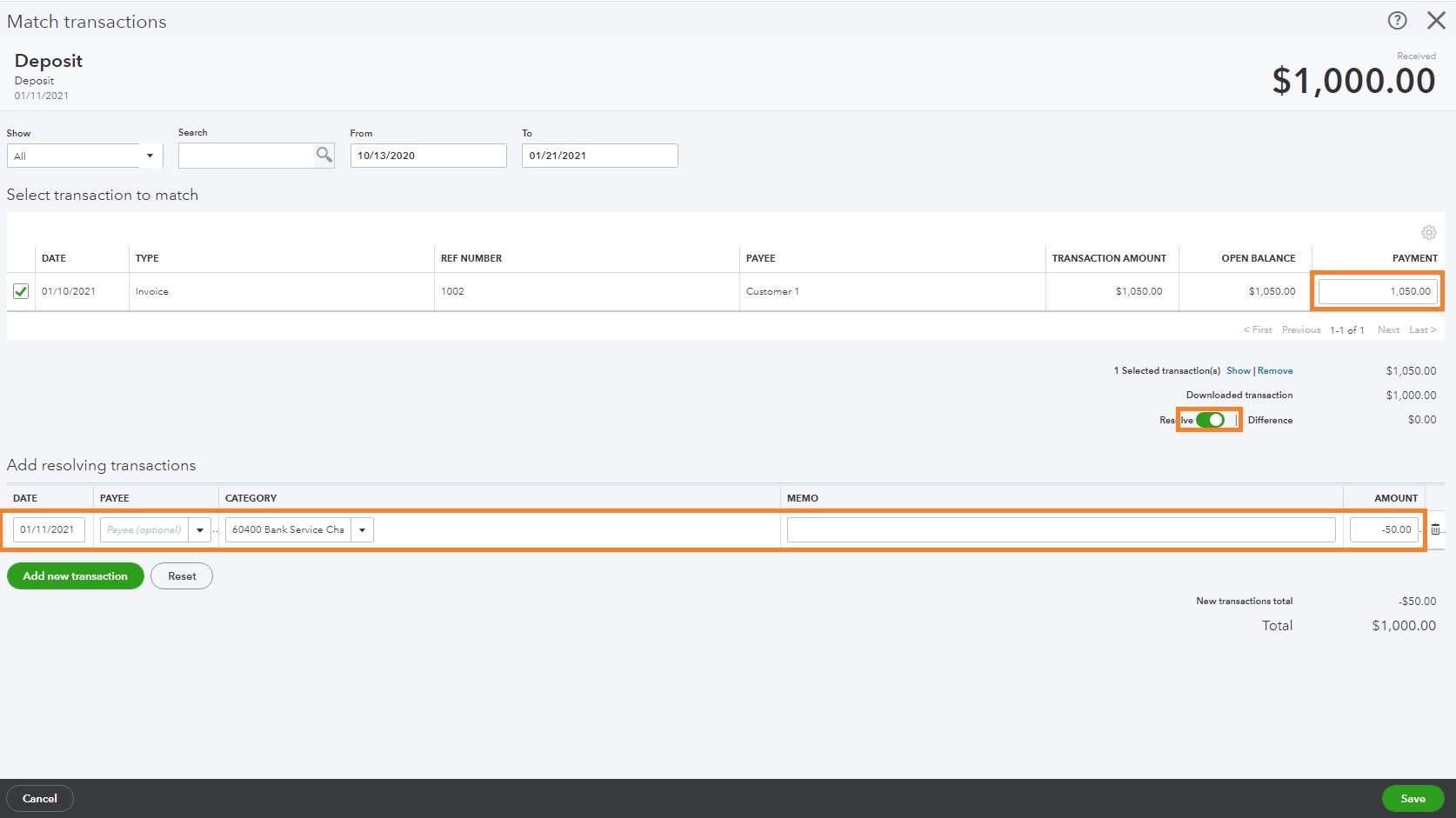

- Regular Reconciliation: Periodically reconcile merchant fee transactions in QuickBooks with statements from payment processors. This practice helps identify discrepancies and ensures the accuracy of recorded fees, contributing to reliable financial records.

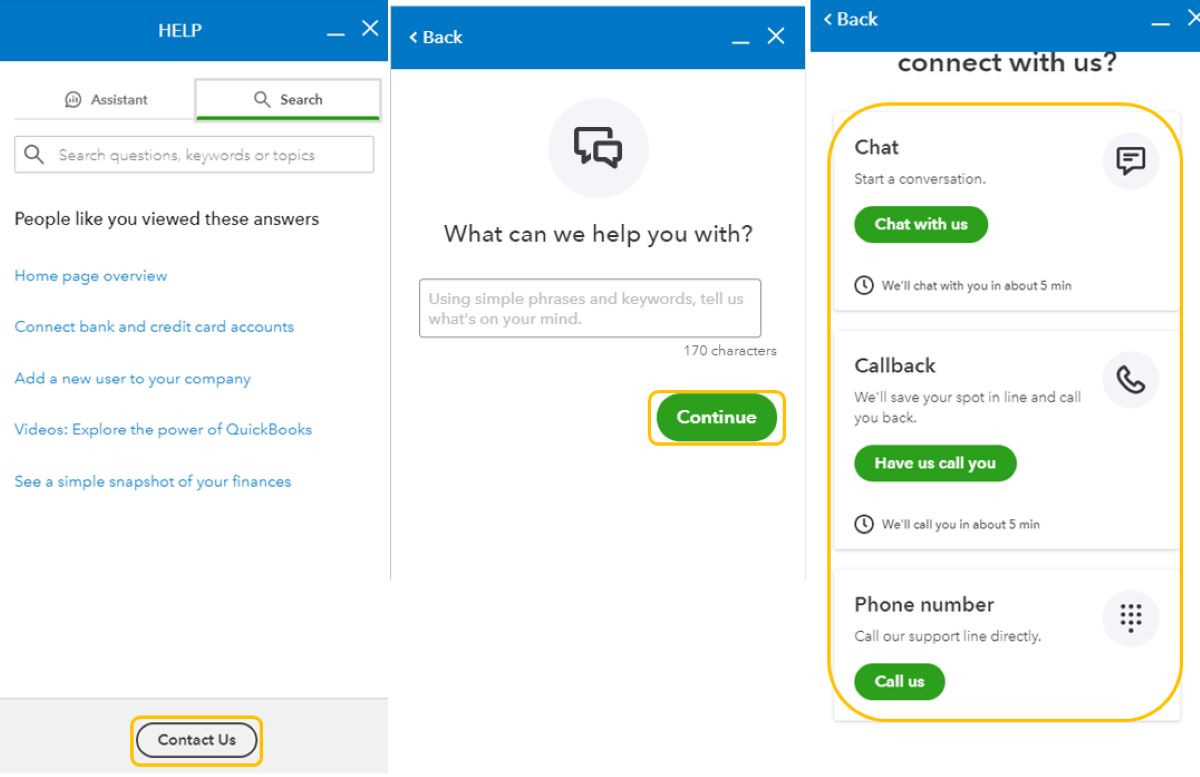

- Utilize Automation: Leverage automation features within QuickBooks to streamline the tracking and categorization of merchant fees. Automation reduces manual errors and enhances efficiency in managing payment processing expenses.

- Custom Reporting: Take advantage of QuickBooks’ reporting capabilities to generate custom reports that specifically focus on merchant fees. Customized reports provide a comprehensive view of payment processing expenses, empowering businesses to make data-driven financial decisions.

- Integration with Budgeting: Integrate merchant fee data into budgeting processes within QuickBooks, allowing businesses to align their expense management strategies with overarching financial goals and forecasts.

- Stay Informed: Keep abreast of updates and developments in payment processing technologies and fee structures. Understanding industry trends and changes in merchant fee structures enables businesses to adapt their financial strategies proactively.

By implementing these best practices, businesses can effectively manage their merchant fees within the QuickBooks ecosystem, optimizing their financial operations and gaining valuable insights into the cost of payment processing.

Conclusion

As we conclude our exploration of merchant fees in QuickBooks, it becomes evident that these fees constitute a critical component of financial management for businesses. QuickBooks provides a robust platform for tracking and categorizing merchant fees, enabling businesses to gain clarity on their payment processing expenses and make informed financial decisions.

By understanding the nuances of merchant fees and leveraging the categorization features within QuickBooks, businesses can unlock valuable insights into their expenditure patterns, identify cost-saving opportunities, and optimize their financial strategies. The ability to generate custom reports, integrate fee data into budgeting processes, and stay informed about industry trends empowers businesses to navigate the complexities of payment processing with confidence.

Effectively managing merchant fees in QuickBooks necessitates the adoption of best practices, including accurate categorization, regular reconciliation, and the utilization of automation and custom reporting features. By adhering to these best practices, businesses can streamline expense tracking, enhance financial analysis, and align their payment processing strategies with overarching financial goals.

As businesses continue to evolve in the digital landscape, the management of merchant fees remains a pivotal aspect of financial operations. QuickBooks serves as a reliable ally in this endeavor, providing the tools and capabilities necessary to navigate the intricacies of payment processing expenses with precision and efficiency.

With a comprehensive understanding of merchant fees and the adept utilization of QuickBooks’ features, businesses can embark on a journey of financial optimization, leveraging data-driven insights to drive growth, profitability, and sustainable success.

**