Finance

What Are Notes Payable In Accounting

Modified: March 1, 2024

Discover the importance of notes payable in accounting and how they contribute to the overall financial stability of a business. Gain insights into finance and its role in managing financial obligations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing finances, businesses often rely on various forms of debt to fund their operations and growth. One common type of debt instrument used in accounting is called “notes payable.” Understanding what notes payable are and how they impact financial statements is crucial for both business owners and investors.

Notes payable are liabilities that arise from borrowing money by signing a promissory note, which serves as a legal agreement between the borrower and the lender. These notes are typically used for obtaining short-term or long-term financing and can be issued to individuals, banks, or other financial institutions.

The purpose of notes payable is to provide companies with the necessary funds to finance their operations, invest in new projects, purchase assets, or meet other financial obligations. By utilizing notes payable, businesses can manage their cash flow needs and take advantage of growth opportunities without exhausting their available working capital.

There are different types of notes payable, including line of credit agreements, term loans, and bonds. Each type has varying terms, interest rates, and repayment structures, depending on the specific needs of the borrower and the lender’s requirements.

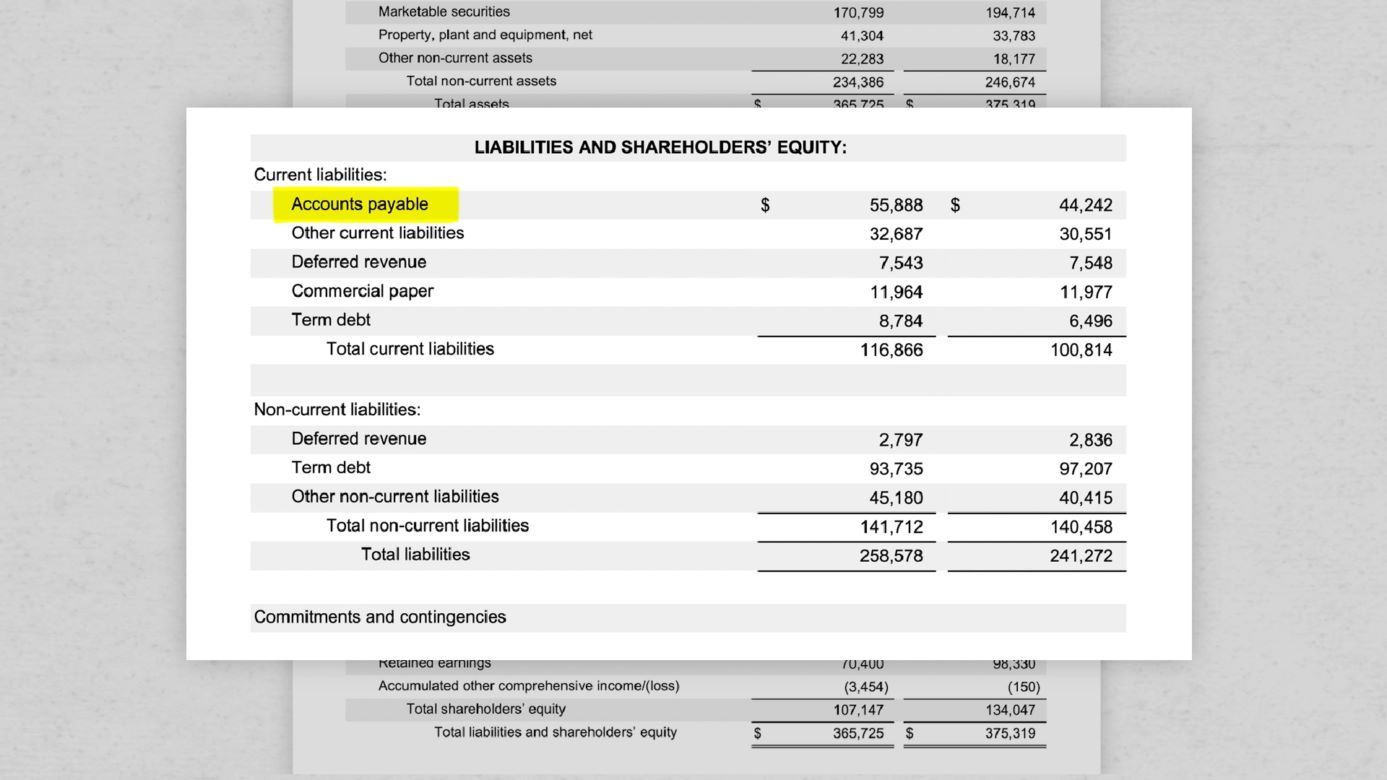

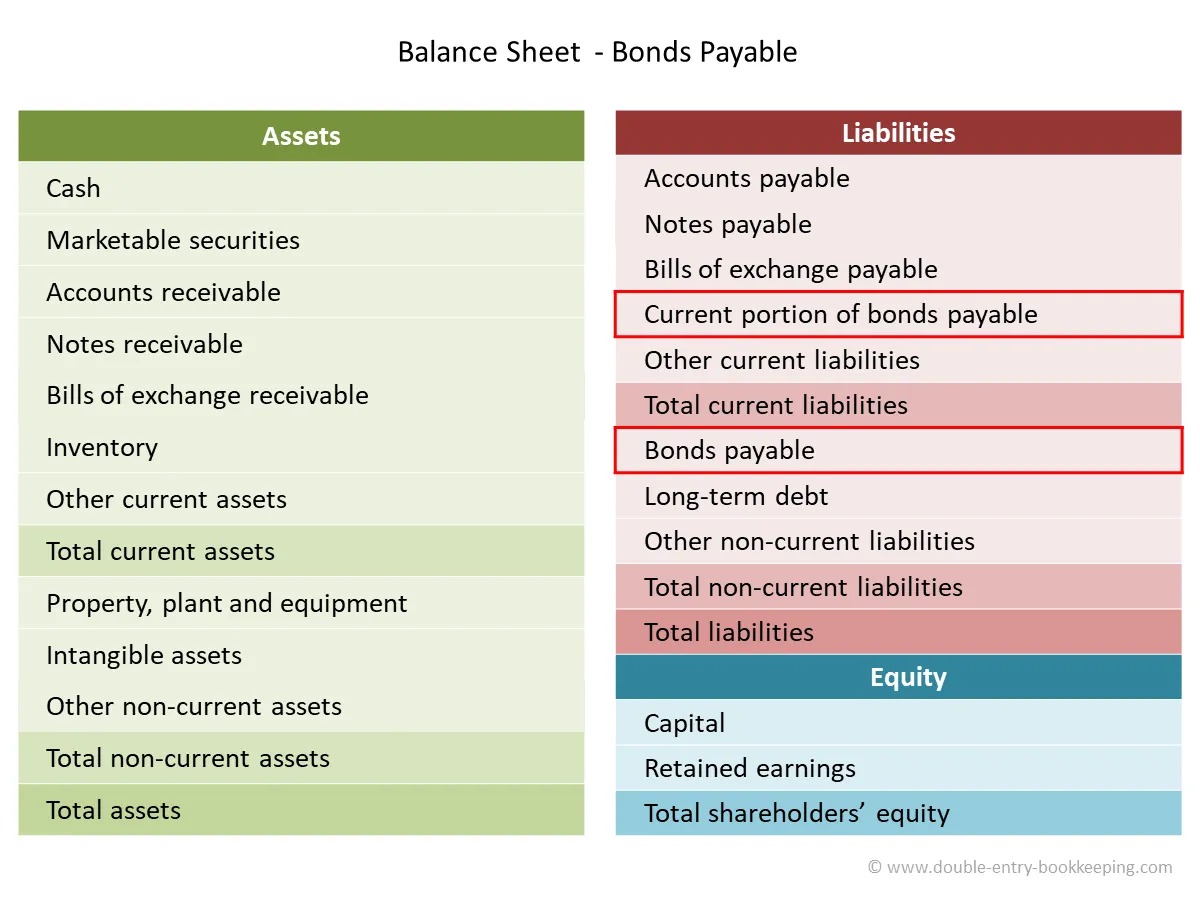

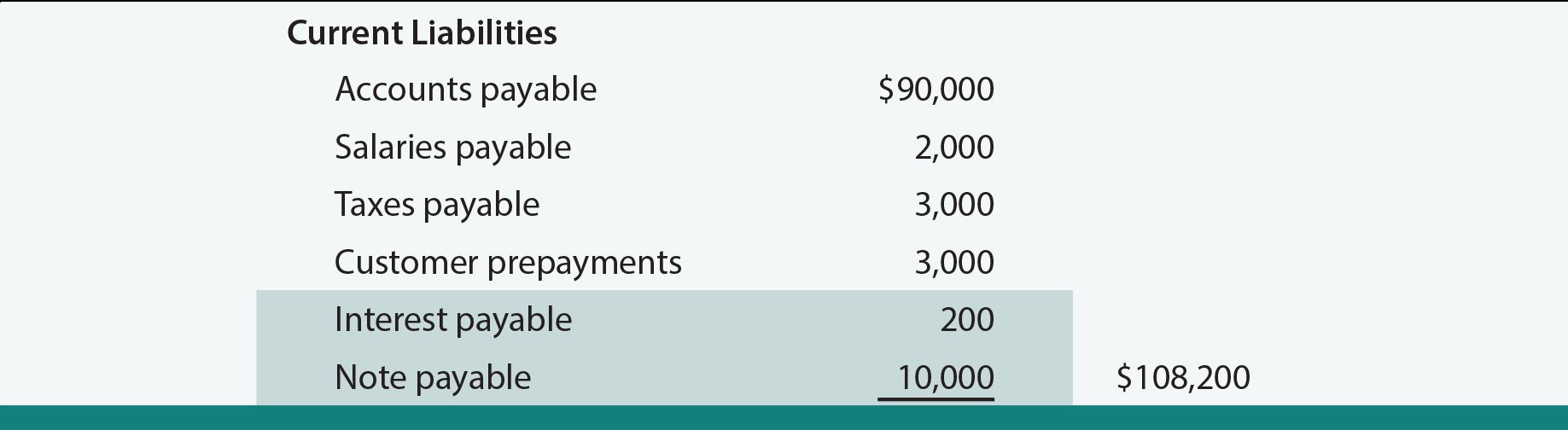

In accounting, notes payable are recorded as a liability on the balance sheet and are classified as either current or long-term depending on the repayment terms. The amount owed on the notes is reported as the principal amount, while any interest expense accrued is reported separately on the income statement.

It’s important to note that notes payable are different from accounts payable. While accounts payable represent amounts owed for goods or services purchased on credit, notes payable represent debts incurred through borrowing.

In this article, we will delve deeper into the definition of notes payable, discuss their purpose, explore the various types, examine the accounting treatment, provide examples of notes payable transactions, and highlight their significance in financial statements. Let’s jump right in!

Definition of Notes Payable

Notes payable, also known as promissory notes or debt obligations, are financial instruments that represent a company’s or individual’s borrowing arrangement with a lender. Essentially, it is a written agreement detailing the terms and conditions of the loan, including the amount borrowed, interest rate, repayment schedule, and any other applicable terms.

When a company or individual needs to fund its operations or finance specific projects, they may opt to borrow money from banks, financial institutions, or even private lenders. In such cases, a promissory note is issued, which outlines the legal obligations and repayment obligations of the borrower.

The terms of notes payable can vary widely depending on the borrower’s creditworthiness, the lender’s policies, and the nature of the loan. For example, notes payable may be short-term, usually with a repayment period of less than a year, or long-term, with repayment periods extending beyond one year.

Additionally, notes payable can have fixed or variable interest rates. Fixed rates remain constant over the term of the loan, while variable rates fluctuate based on an agreed-upon benchmark such as the prime rate or LIBOR.

Notes payable can serve various purposes, including funding working capital needs, financing the purchase of assets, funding expansion plans, or managing cash flow. By issuing notes payable, businesses and individuals can secure the necessary capital to support their financial objectives while managing their debt obligations effectively.

It’s important to note that notes payable differ from other liabilities, such as accounts payable. Accounts payable are amounts owed to suppliers or vendors for goods or services purchased on credit, while notes payable represent formal contractual obligations to repay borrowed funds.

In summary, notes payable are legal agreements that outline the terms and conditions of a loan between a borrower and a lender. They provide businesses and individuals with a means to secure financing for various purposes and are an essential component of the financial landscape.

Purpose of Notes Payable

Notes payable serve a crucial role in the financial operations of businesses and individuals by providing access to funds that can be used for a variety of purposes. Let’s explore some of the key purposes of notes payable:

1. Working capital: Notes payable can be used to finance day-to-day operations, including inventory purchases, payroll, and other operating expenses. By utilizing notes payable for working capital needs, businesses can ensure smooth operations and maintain a healthy cash flow.

2. Business expansion and growth: When businesses are looking to expand their operations, notes payable can provide the necessary capital to fund growth initiatives. This may include opening new locations, investing in additional equipment or technology, or hiring new employees.

3. Asset acquisition: Companies often use notes payable to finance the purchase of assets such as real estate, vehicles, or machinery. By spreading out the cost of these acquisitions over time, businesses can better manage their cash flow while still acquiring the assets needed to support their operations.

4. Debt refinancing: In some cases, businesses may have existing debt with higher interest rates or unfavorable terms. By issuing new notes payable at more favorable rates, companies can refinance their debt to reduce interest expenses and improve their overall financial position.

5. Short-term financing: Notes payable can provide businesses with short-term financing for unexpected expenses or temporary cash flow gaps. This can be particularly beneficial for businesses with seasonal fluctuations or cyclical revenue patterns.

6. Opportunity utilization: Sometimes, businesses come across unique opportunities that require immediate capital. Whether it’s a chance to acquire a rival company, invest in new technology, or secure a lucrative contract, notes payable can be a quick and convenient source of funds to seize these opportunities.

7. Personal financing: Individuals can also utilize notes payable for personal financing needs. This may include funding education expenses, purchasing a home or vehicle, or covering emergency expenses.

By providing access to funds for various purposes, notes payable enable businesses and individuals to achieve their financial goals, manage their cash flow effectively, and seize growth opportunities. It’s important, however, to carefully consider the terms and implications of notes payable to ensure responsible and sustainable borrowing.

Types of Notes Payable

Notes payable can take different forms depending on the specific needs and circumstances of the borrower and lender. Let’s take a closer look at some common types of notes payable:

1. Line of Credit: A line of credit is a type of notes payable that provides businesses with access to a predetermined amount of funds. Borrowers can withdraw and repay funds as needed, similar to a credit card. The interest is typically charged only on the amount borrowed.

2. Term Loans: Term loans are a common type of notes payable that provide borrowers with a fixed amount of funds that must be repaid over a specified period, usually with a fixed interest rate and regular payments. These loans are often used for specific purposes such as purchasing equipment, funding expansion, or financing long-term projects.

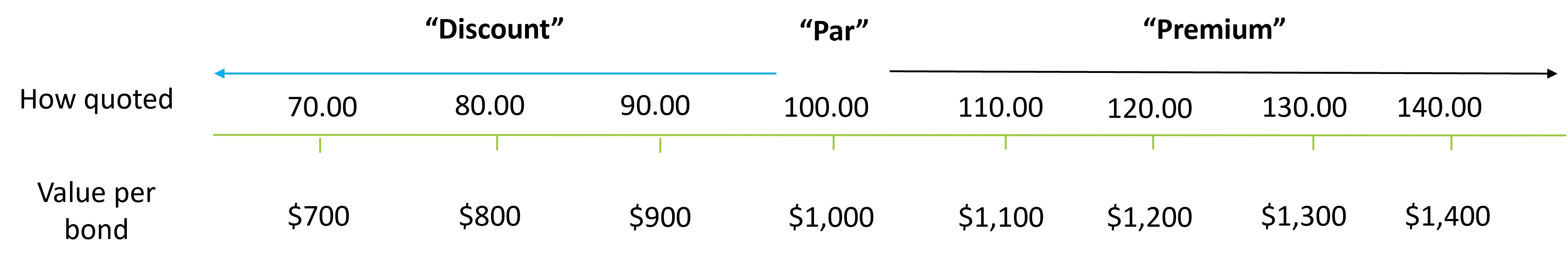

3. Bonds: Bonds are debt securities issued by corporations or government entities to raise capital. They typically have a longer maturity period and are sold to investors in the form of bonds. The issuer pays regular interest payments to bondholders during the term, and the principal amount is repaid at maturity.

4. Convertible Notes: Convertible notes are a hybrid form of financing that allows borrowers to raise funds through debt that can be converted into equity at a later date. This type of notes payable is commonly used by startups and high-growth companies as a way to attract investors while deferring the valuation of the company until a later financing round.

5. Commercial Paper: Commercial paper is a short-term unsecured promissory note issued by corporations to raise funds for short-term financing needs. These notes are typically sold to investors in the money market and have a maturity period of less than 270 days.

6. Secured Notes: Secured notes are backed by collateral, such as real estate or equipment, which serves as security in case of default. Lenders have the right to seize the collateral if the borrower fails to repay the loan.

7. Unsecured Notes: Unsecured notes are not backed by any collateral and are solely based on the borrower’s creditworthiness. These notes typically have higher interest rates to compensate for the increased risk to lenders.

These are just a few examples of the different types of notes payable that borrowers can utilize to meet their financial needs. Each type has its own features, benefits, and risks, and it’s important for borrowers to carefully evaluate their options and select the type of note that best aligns with their financial goals and circumstances.

Accounting Treatment for Notes Payable

Proper accounting treatment for notes payable is essential for accurately reflecting a company’s financial position and performance. Let’s discuss the key aspects of the accounting treatment for notes payable:

1. Initial Recognition: When a company borrows money and signs a promissory note, the initial recognition involves recording the note as a liability on the balance sheet. The amount is recorded as the principal amount of the note.

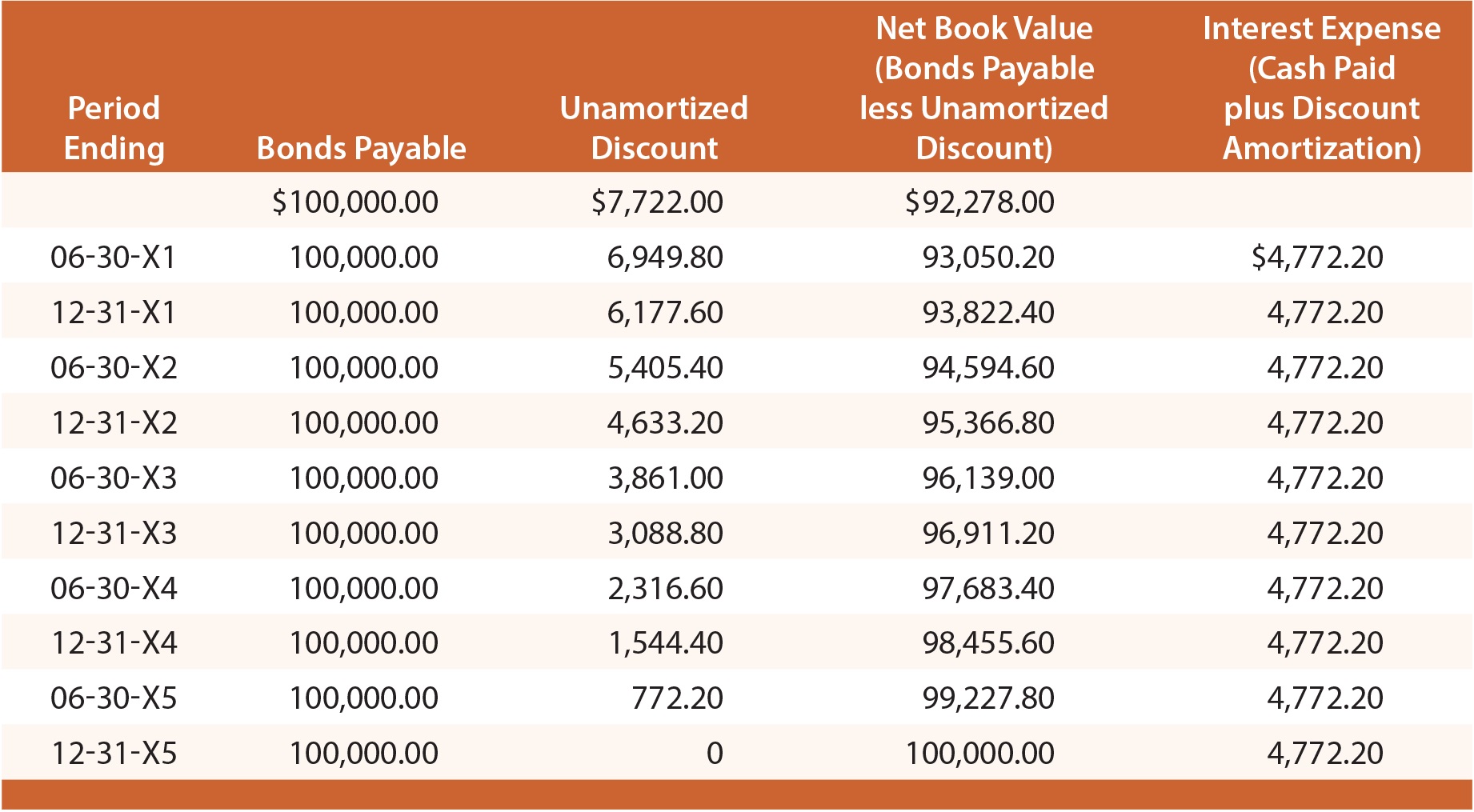

2. Interest Expense: As notes payable typically involve the payment of interest, companies need to recognize interest expense over the term of the note. The interest expense is calculated based on the interest rate and the time period for which the note remains outstanding. It is reported separately on the income statement.

3. Amortization: In some cases, notes payable may require periodic payments that include both principal and interest. These payments typically occur on a regular basis, such as monthly or quarterly. The portion of each payment that represents interest expense is recognized as an expense, while the portion that represents a reduction of the principal amount is used to reduce the carrying value of the notes payable.

4. Classification: Notes payable are classified on the balance sheet as either current liabilities or long-term liabilities. Current liabilities are those that are expected to be settled within a year, while long-term liabilities have a longer repayment period.

5. Disclosures: Companies are required to provide detailed disclosures related to their notes payable in the financial statements. This includes information about the terms and conditions of the notes, interest rates, maturity dates, and any collateral provided.

It’s important for companies to adhere to the accounting principles and regulations, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), when recording and reporting their notes payable. This ensures consistency and comparability in financial reporting, enabling stakeholders to make informed decisions.

In summary, the accounting treatment for notes payable involves initially recognizing the liability on the balance sheet, recording interest expense over the term of the note, amortizing principal payments, classifying the notes as current or long-term liabilities, and providing appropriate disclosures in the financial statements. Proper accounting treatment is crucial for accurately reflecting a company’s financial obligations and performance related to notes payable.

Examples of Notes Payable Transactions

Notes payable transactions occur when a company borrows money and signs a promissory note as evidence of the loan. Let’s explore some examples of notes payable transactions to better understand how they are used:

1. Line of Credit: A manufacturing company obtains a line of credit from a bank to finance its working capital needs. The company can borrow up to $500,000 at an interest rate of 5%, and the line of credit is valid for one year. The company draws $100,000 from the line of credit to purchase raw materials for production. A notes payable is created for $100,000, with a maturity date of one year, and interest accrued monthly.

2. Term Loan: A small business owner wants to expand their operations by opening a second location. They approach a lender and secure a term loan of $250,000 with a fixed interest rate of 6%, to be repaid over a period of five years. The business receives the funds and purchases the necessary equipment and inventory for the new location. A notes payable is created for $250,000, and monthly payments are made to repay the loan.

3. Convertible Note: A startup raises funds from angel investors through a convertible note. The investors lend $500,000 to the company, which will convert into equity if a future financing round is conducted. The convertible note has an interest rate of 8% and a maturity period of two years. The company uses the funds to develop its product and grow its customer base.

4. Bond Issue: A large corporation issues bonds with a total value of $1 million to finance a major infrastructure project. The bonds have a maturity period of 10 years and pay a fixed interest rate of 4% annually. Investors purchase the bonds, lending money to the company. The company will make regular interest payments to the bondholders and repay the principal amount at maturity.

5. Commercial Paper: A multinational corporation needs short-term financing to cover its operating expenses until it receives payments from customers. The company issues commercial paper with a total value of $5 million, with a maturity period of three months. Institutional investors purchase the commercial paper, providing the company with the required funds. The company repays the principal amount to the investors at maturity.

These examples illustrate different scenarios in which companies use notes payable to obtain financing for various purposes. It’s important for businesses to carefully consider their borrowing needs, interest rates, repayment terms, and any associated risk factors before entering into notes payable transactions. Proper financial planning and management of notes payable can help businesses meet their financial goals effectively.

Importance of Notes Payable in Financial Statements

Notes payable play a significant role in a company’s financial statements, providing valuable information about its debt obligations and financial health. Let’s examine the importance of notes payable in financial statements:

1. Debt Analysis: Notes payable allow stakeholders, including investors, creditors, and analysts, to assess a company’s debt levels and its ability to manage its financial obligations. By including notes payable in the balance sheet, financial statements provide a comprehensive view of a company’s total liabilities and its debt-to-equity ratio, helping stakeholders evaluate its financial stability.

2. Cash Flow Management: Including notes payable in financial statements helps companies monitor and manage their cash flow effectively. By disclosing repayment schedules and interest payments, companies can anticipate and plan for upcoming cash outflows. This information is critical for financial decision-making and ensures that a company has sufficient liquidity to meet its debt obligations.

3. Comparison and Benchmarking: Financial statements that include notes payable allow for meaningful comparisons of a company’s performance against industry peers. Investors and analysts can assess a company’s debt structure, interest rates, and repayment terms relative to its competitors, enabling informed investment decisions. It also helps identify potential risks associated with debt levels and assess the company’s ability to compete effectively.

4. Financial Reporting Compliance: Notes payable are an essential element of financial reporting compliance. Accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), require companies to disclose their notes payable in their financial statements. Compliance with these standards ensures transparency and accountability, promoting trust and confidence in the financial information provided by companies.

5. Investor Confidence: Including notes payable in financial statements promotes transparency and provides investors with important information they need to make informed investment decisions. Investors can assess a company’s debt structure, repayment capacity, and financial risk through the information disclosed in the financial statements. Transparent reporting builds investor confidence and enhances the company’s reputation in the market.

6. Decision-Making: For management, notes payable in financial statements assist in making strategic decisions. They provide insights into the cost of debt, cash flow commitments, and debt repayment schedules. This information helps management evaluate borrowing options, assess the impact of debt on profitability, and make informed decisions about investment, expansion, and financing strategies.

In summary, notes payable are essential components of financial statements as they provide crucial information about a company’s debt obligations, cash flow management, financial health, and compliance with accounting standards. They enable stakeholders to assess a company’s debt structure, make informed investment decisions, compare performance against industry peers, and evaluate the company’s ability to fulfill its financial obligations. Understanding the importance of notes payable in financial statements is vital for all parties involved in analyzing a company’s financial position and making informed decisions.

Notes Payable vs. Accounts Payable

While both notes payable and accounts payable represent amounts owed by a company, there are significant differences between the two in terms of their characteristics, purpose, and accounting treatment. Let’s explore the distinctions between notes payable and accounts payable:

1. Definition: Notes payable is a form of borrowing that involves a legally binding agreement, documented by a promissory note, between the borrower and the lender. On the other hand, accounts payable refers to the amounts owed by a company for goods or services received on credit from suppliers or vendors.

2. Formality: Notes payable transactions are formal commitments with specific terms and conditions, including repayment schedules and interest rates. Accounts payable, on the other hand, are typically informal and do not involve legal agreements or formal documentation.

3. Time Period: Notes payable can have both short-term and long-term repayment periods, typically extending beyond one year. Accounts payable, in contrast, are short-term liabilities that are expected to be settled within a year.

4. Interest: Notes payable typically involve interest payments, which reflect the cost of borrowing the funds. In contrast, accounts payable do not involve interest charges, as they represent amounts owed for goods or services purchased on credit.

5. Accounting Treatment: Notes payable are recorded as liabilities on the balance sheet, and the interest expense is reported separately on the income statement. In contrast, accounts payable are also recorded as liabilities on the balance sheet, but they do not attract interest expenses. Instead, once payment is made, the accounts payable balance is reduced, and the corresponding expense is recognized in the income statement.

6. Collateral: Notes payable can be secured by collateral, such as real estate or equipment, which provides security to the lender. In contrast, accounts payable are unsecured and do not involve any collateral.

7. Usage: Notes payable are typically used for larger expenses or long-term financing needs, such as capital expenditures or business expansion. Accounts payable, on the other hand, represent day-to-day operational expenses, including the purchase of inventory or the payment of utilities.

In summary, notes payable and accounts payable differ in their formality, repayment terms, interest involvement, accounting treatment, collateral requirements, and usage. While notes payable represent formal borrowing arrangements, accounts payable reflect short-term obligations arising from credit purchases. Understanding the distinctions between notes payable and accounts payable is essential for accurate financial reporting and effective management of a company’s liabilities.

Conclusion

Notes payable are a fundamental aspect of financial management and accounting for businesses and individuals. They provide a means to secure financing for various purposes, such as working capital, expansion, asset acquisition, and more. Understanding the definition, purpose, types, and accounting treatment of notes payable is essential for accurately reflecting a company’s financial position and effectively managing debt obligations.

In financial statements, notes payable provide valuable information about a company’s debt levels, repayment terms, and interest expenses. They allow stakeholders to assess a company’s financial health and debt management practices, compare its performance with industry peers, and make informed investment decisions. Transparent disclosure of notes payable promotes investor confidence and ensures compliance with accounting standards.

Distinctions between notes payable and accounts payable are important to understand, as they differ in terms of formality, repayment period, interest involvement, accounting treatment, collateral requirements, and usage. While notes payable represent formal borrowing arrangements, accounts payable reflect short-term liabilities arising from credit purchases.

In conclusion, notes payable are critical tools for managing finances and supporting the growth of businesses and individuals. They provide access to necessary capital, facilitate strategic decision-making, and contribute to the overall financial well-being of entities. Adequate financial planning, careful evaluation of borrowing options, and responsible debt management are essential to effectively utilize notes payable and ensure long-term financial success.