Finance

What Are State Pension Funds?

Published: January 23, 2024

Learn how state pension funds play a crucial role in finance and retirement planning. Discover the benefits and considerations of these essential financial instruments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

State pension funds play a crucial role in ensuring the financial security of retired individuals. These funds are established and managed by state governments to provide retirement benefits to public sector employees, including teachers, firefighters, police officers, and other government workers. The significance of state pension funds extends beyond the realm of retirement planning, influencing the overall stability of the economy and the well-being of retirees.

State pension funds are a cornerstone of retirement planning for public sector employees, serving as a reliable source of income during their post-employment years. The management and sustainability of these funds are vital for upholding the commitment to provide retirement benefits to dedicated public servants who have contributed to the betterment of their communities and society at large.

As we delve into the intricate workings of state pension funds, it becomes evident that these financial mechanisms are not only instrumental in safeguarding retirees' financial futures but also have a notable impact on the fiscal landscape of the states in which they operate. Understanding the nature and function of state pension funds is essential for policymakers, financial professionals, and the general public alike, as it sheds light on the interconnectedness of retirement security, public finance, and economic stability.

**

Definition of State Pension Funds

State pension funds, also known as public pension funds, are investment pools established and maintained by state governments to provide retirement benefits to public sector employees. These funds are designed to ensure that individuals who have dedicated their careers to public service receive financial support during their retirement years. State pension funds are typically funded through contributions from both employees and their respective state governments, with the aim of building a substantial pool of assets that can generate income to cover pension obligations.

These funds are governed by specific regulations and investment guidelines, with the primary objective of preserving and growing the fund’s assets to fulfill long-term pension obligations. State pension funds are often managed by a board or committee responsible for overseeing investment decisions, fund performance, and the overall administration of the pension system. The management of these funds is guided by fiduciary responsibilities to act in the best interests of the pension beneficiaries and ensure the long-term sustainability of the fund.

State pension funds are a critical component of the broader pension landscape, alongside private pension funds and other retirement savings vehicles. They serve as a pillar of financial security for millions of public sector employees, offering a reliable source of income during retirement. The structure and operation of state pension funds are shaped by state-specific laws and regulations, reflecting the diverse approaches to retirement benefits across different regions of the United States.

Understanding the nature of state pension funds is essential for grasping the dynamics of retirement planning within the public sector and the broader context of pension management. The intricate mechanisms and governance structures of these funds underscore their significance in upholding the retirement security of public employees and the financial stability of state governments.

**

Purpose of State Pension Funds

The primary purpose of state pension funds is to provide a secure and sustainable source of retirement income for public sector employees who have dedicated their careers to serving the community. These funds are established with the overarching goal of ensuring that individuals in public service professions, such as teachers, law enforcement officers, and government workers, can enjoy financial stability during their retirement years.

State pension funds serve as a means of recognizing and rewarding the contributions of public sector employees by offering them a reliable mechanism for building retirement savings. By participating in these pension programs, employees gain access to a defined benefit plan, which guarantees a predetermined level of retirement income based on factors such as years of service and salary history. This provides public sector workers with a sense of financial security, knowing that they will receive regular pension payments after concluding their active employment.

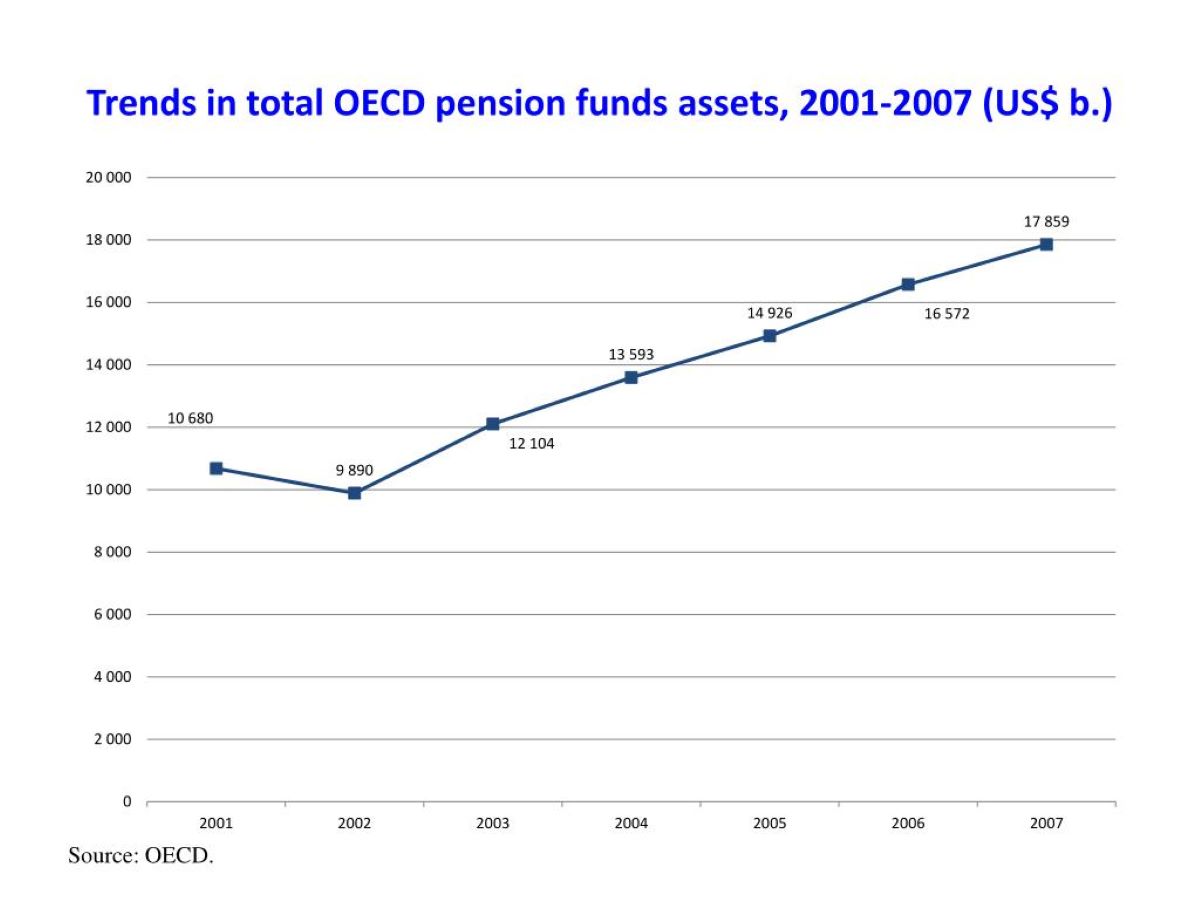

Beyond the individual benefits to retirees, state pension funds also contribute to the broader economic welfare of the community. By facilitating the accumulation of retirement savings and investment in various financial instruments, these funds play a role in capital formation and the stimulation of economic growth. Furthermore, the presence of robust pension funds can enhance the overall attractiveness of public sector employment, helping to recruit and retain talented individuals who are essential to the effective functioning of government agencies and educational institutions.

Another vital purpose of state pension funds is to mitigate the risk of financial hardship in old age for public sector employees. With the uncertainty surrounding social security and the absence of employer-sponsored 401(k) plans in many public sector positions, state pension funds serve as a crucial pillar of retirement security for government workers. By providing a steady stream of income during retirement, these funds alleviate the potential burden on public assistance programs and contribute to the overall welfare of retirees.

Understanding the multifaceted purpose of state pension funds underscores their significance in supporting the financial well-being of public sector employees and bolstering the economic fabric of the communities they serve.

**

How State Pension Funds Work

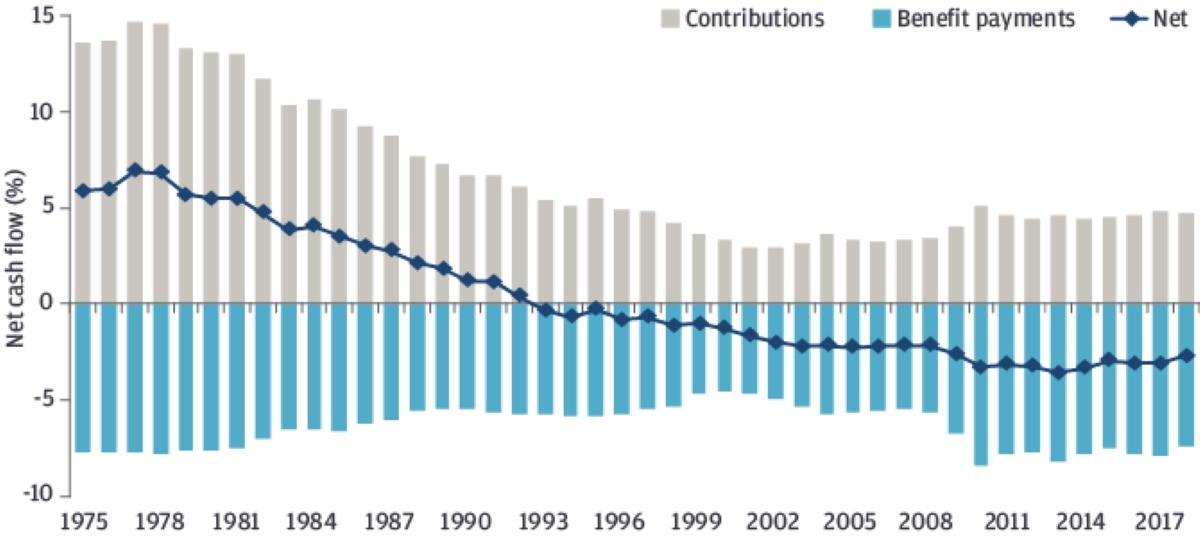

State pension funds operate through a structured process that involves contributions, investment management, and the distribution of retirement benefits. The functioning of these funds is underpinned by a long-term perspective, aiming to accumulate assets and generate returns to fulfill pension obligations over time.

Contributions to state pension funds typically come from both employees and their respective state governments. A portion of the employees’ salaries is allocated toward funding the pension system, often in the form of mandatory payroll deductions. Simultaneously, state governments make contributions to the pension fund, with the specific funding mechanisms and levels of contribution varying across states.

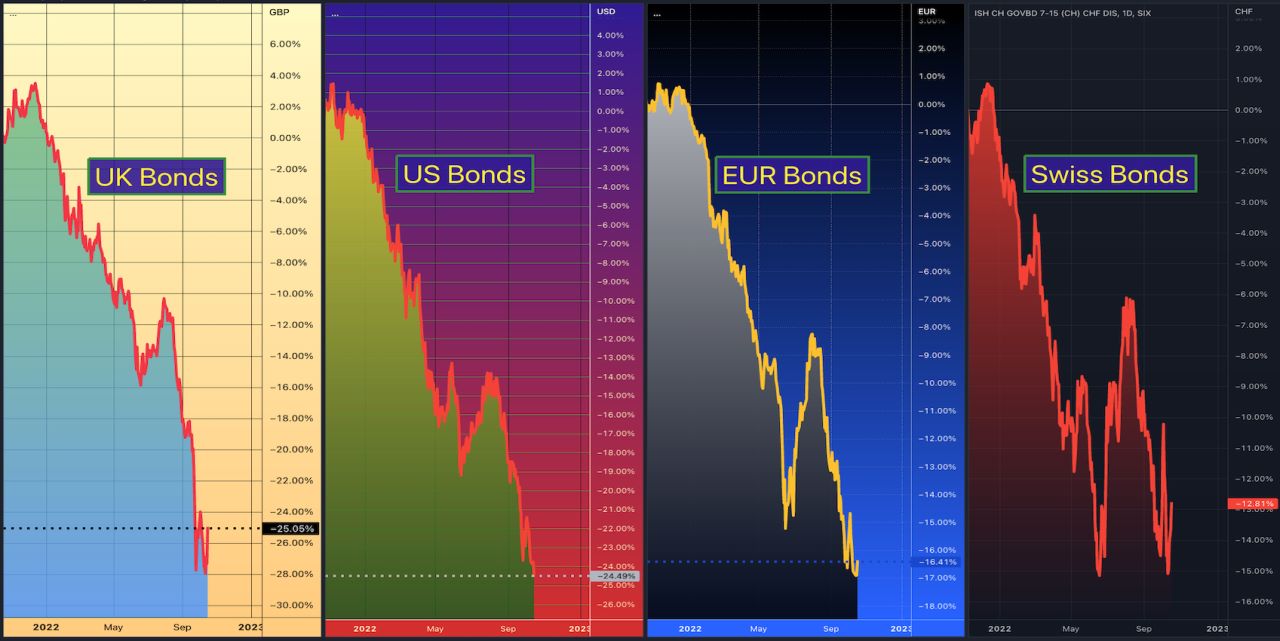

Once the contributions are pooled, state pension funds engage in prudent investment practices to grow the fund’s assets. This involves allocating the assets across a diversified portfolio of investments, such as stocks, bonds, real estate, and alternative assets. The investment strategy is guided by the fund’s long-term objectives, risk tolerance, and the need to generate returns that can support the payment of future pension benefits.

The management of state pension funds is overseen by a board or committee responsible for making strategic investment decisions, monitoring the fund’s performance, and ensuring compliance with regulatory requirements. The investment decisions are guided by the fiduciary duty to act in the best interests of the pension beneficiaries, with a focus on achieving a balance between risk and return to sustain the fund’s financial health.

As public sector employees progress in their careers and contribute to the pension fund, their accrued benefits are calculated based on factors such as years of service and salary history. Upon reaching retirement eligibility, employees are entitled to receive pension benefits, which are typically distributed in the form of monthly payments throughout their retirement years. The amount of the pension benefit is predetermined based on the established formula, providing retirees with a steady income stream to support their living expenses.

Understanding the operational framework of state pension funds illuminates the intricate interplay between contributions, investments, and the fulfillment of retirement benefits, underscoring the commitment to ensuring the long-term financial security of public sector employees.

**

Benefits and Drawbacks of State Pension Funds

State pension funds offer several notable benefits that contribute to the financial security of public sector employees and the broader economy. At the same time, they are accompanied by certain drawbacks and challenges that warrant consideration.

Benefits

- Retirement Security: State pension funds provide public sector employees with a dependable source of retirement income, ensuring that they can maintain their standard of living after concluding their active careers.

- Stable Income Stream: Retirees receive regular pension payments, offering a predictable income stream that helps cover living expenses and supports a comfortable retirement lifestyle.

- Economic Stimulus: By investing in various financial instruments, state pension funds contribute to capital formation and economic growth, fostering a positive impact on the overall economy.

- Recruitment and Retention: The presence of robust pension benefits enhances the attractiveness of public sector employment, aiding in the recruitment and retention of talented individuals who are vital to the effective functioning of government agencies and educational institutions.

Drawbacks

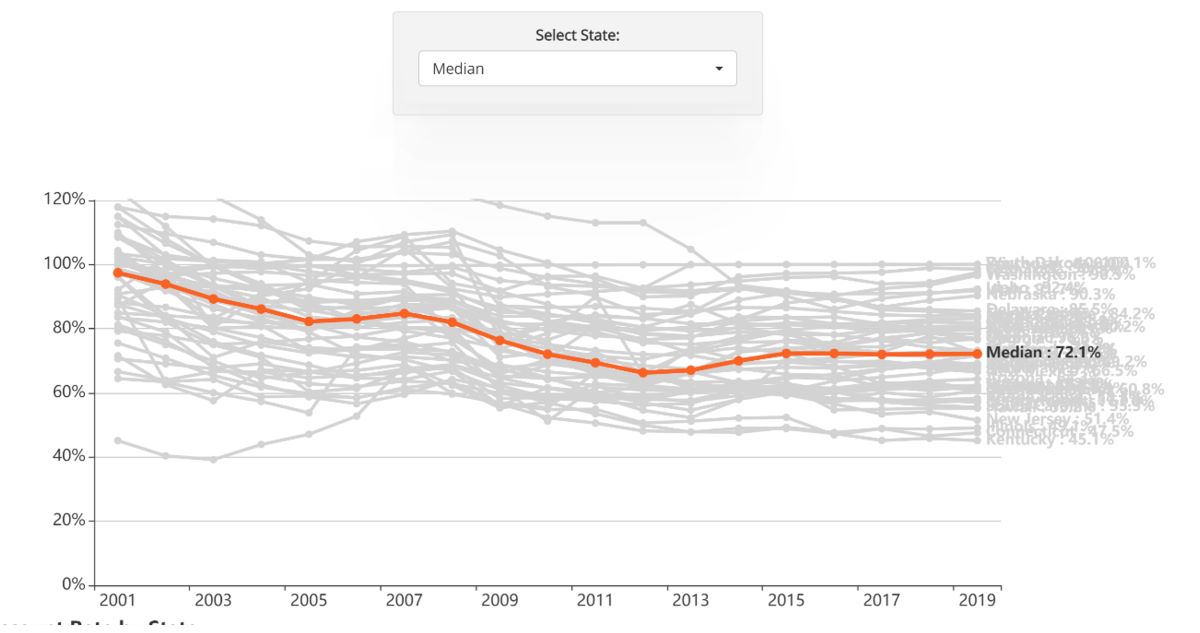

- Funding Challenges: State pension funds may face funding challenges due to factors such as demographic shifts, economic downturns, and inadequate contribution levels, potentially leading to funding gaps and financial strain.

- Investment Risks: The management of pension fund assets involves investment risks, and market volatility can impact the fund’s performance, potentially affecting the ability to meet pension obligations.

- Long-Term Liabilities: Pension funds carry long-term liabilities, and ensuring the sustainability of benefits over an extended period requires careful financial planning and risk management.

- Regulatory Complexities: Compliance with evolving regulatory requirements and accounting standards adds complexity to the administration and governance of state pension funds.

Understanding the benefits and drawbacks of state pension funds is essential for policymakers, pension administrators, and public sector employees, as it provides insights into the opportunities and challenges associated with these vital retirement programs.

**

Examples of State Pension Funds

State pension funds vary in their structures and operations across different states, reflecting the diverse approaches to retirement benefits and public sector employee compensation. Here are a few examples of prominent state pension funds in the United States:

California Public Employees’ Retirement System (CalPERS)

CalPERS is one of the largest public pension funds globally, serving more than 2 million members and retirees. It provides retirement, health, and related financial programs and benefits to California’s public employees, retirees, and their families. CalPERS manages a diversified portfolio of assets and plays a significant role in shaping corporate governance practices through its investment activities.

New York State Common Retirement Fund

The New York State Common Retirement Fund is the third-largest public pension fund in the United States, providing retirement security for more than one million New York State and local government employees, retirees, and their beneficiaries. Managed by the New York State Comptroller, the fund’s investments support job creation, infrastructure projects, and economic development initiatives across the state.

Texas Teachers Retirement System (TRS)

TRS is dedicated to providing retirement benefits and services to Texas public education employees, managing a substantial investment portfolio to secure the financial futures of its members. With a focus on long-term sustainability, TRS aims to fulfill its pension obligations while prudently managing investment risks and opportunities.

Ohio Public Employees Retirement System (OPERS)

OPERS administers retirement, disability, and survivor benefits for eligible Ohio public employees. The fund’s investment strategies are designed to generate returns that support the payment of benefits, with a commitment to transparency and accountability in its operations.

These examples underscore the diverse landscape of state pension funds, each playing a pivotal role in safeguarding the retirement security of public sector employees and contributing to the economic vitality of their respective states.

**

Conclusion

State pension funds stand as pillars of financial security for public sector employees, embodying the commitment to honor and support the contributions of those who dedicate their careers to serving the community. These funds serve a dual purpose, offering individual retirees a reliable source of income during their post-employment years while also contributing to the economic well-being of the states in which they operate.

As evidenced by the diverse examples of state pension funds, these programs play a crucial role in shaping the retirement landscape across the United States. From the vast reach of CalPERS to the strategic investments made by the New York State Common Retirement Fund, each fund embodies a dedication to securing the futures of public employees and retirees.

While state pension funds offer substantial benefits, they also face challenges, including funding uncertainties, investment risks, and long-term liabilities. Addressing these challenges requires diligent oversight, prudent financial management, and a commitment to upholding the fiduciary responsibilities associated with pension fund governance.

As we navigate the complex terrain of retirement planning and pension management, it becomes clear that state pension funds are integral components of the broader financial ecosystem. Their impact extends beyond individual retirees, influencing economic growth, workforce dynamics, and the overall stability of public sector employment.

Understanding the intricacies of state pension funds is essential for fostering informed decision-making, promoting the long-term sustainability of these vital programs, and ensuring the continued fulfillment of retirement commitments to public sector employees. By recognizing the significance of state pension funds and addressing their challenges, we can uphold the promise of retirement security for those who have dedicated their careers to public service.