Home>Finance>What Are The 3 Dividend Stocks To Buy And Hold Forever?

Finance

What Are The 3 Dividend Stocks To Buy And Hold Forever?

Published: January 19, 2024

Discover the top 3 dividend stocks in the finance industry that you can buy and hold forever, ensuring long-term financial stability and growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Investing in dividend stocks has long been regarded as a reliable strategy for building wealth over the long term. Unlike other investment options, dividend stocks offer the opportunity to earn a consistent income stream through regular dividend payments while also benefiting from potential capital appreciation.

The allure of dividend stocks lies in their ability to provide a steady stream of passive income, making them a popular choice for investors seeking financial stability and long-term returns. By selecting dividend stocks wisely and holding them for the long haul, investors can enjoy the benefits of compounding returns and potentially generate substantial wealth over time.

However, not all dividend stocks are created equal. It is crucial for investors to carefully evaluate several factors before deciding which stocks to include in their portfolio. This ensures that they choose companies with a strong track record of dividends, solid financial standing, and the potential for future growth.

In this article, we will delve into the topic of dividend stocks and highlight three stocks that are worth considering for long-term investment.

Before we jump into the specific stocks, let’s take a closer look at why dividend stocks are an attractive investment option and the key factors to consider before investing in them.

Why Dividend Stocks?

Dividend stocks offer several advantages that make them an appealing option for investors looking to build wealth over the long term. Here’s why dividend stocks are worth considering:

- Regular Income: One of the primary attractions of dividend stocks is their ability to provide a regular income stream. When you invest in dividend-paying companies, you can expect to receive periodic dividend payments, which can be especially beneficial for individuals seeking passive income or retirees looking for a stable source of cash flow.

- Stability and Reliability: Dividend-paying companies tend to be more stable and less volatile than non-dividend-paying companies. This stability is often attributed to the fact that these companies typically have a proven track record of generating consistent profits. By investing in such companies, investors can enjoy a level of predictability in their investment returns, reducing the risk associated with market fluctuations.

- Long-Term Growth Potential: While dividend stocks provide regular income, they also have the potential for long-term growth. Investing in companies that consistently raise their dividends can result in compounding returns over time. As these companies experience growth and increase their dividends, investors can benefit from both the rising income stream and the appreciation of the stock price.

- Protection Against Inflation: Dividend stocks have historically served as a hedge against inflation. When prices rise, companies with the ability to raise their dividends can help investors maintain their purchasing power. Dividend growth that outpaces inflation can help investors preserve and potentially increase their wealth over time.

- Reinvesting Dividends: Another advantage of dividend stocks is the option to reinvest the dividends received. By automatically reinvesting dividends back into the company through a dividend reinvestment plan (DRIP), investors can acquire additional shares without incurring additional costs. This practice can accelerate the growth of the investment over time, as more shares are acquired and subsequently generate additional dividends.

Overall, dividend stocks offer a compelling combination of income potential, stability, and long-term growth. However, it is important to note that investing in dividend stocks still carries risks, and thorough research and analysis are essential before making any investment decisions.

Factors to Consider Before Investing in Dividend Stocks

While dividend stocks can be a valuable addition to any investment portfolio, it is crucial to carefully evaluate certain factors before making investment decisions. By considering the following factors, investors can increase the likelihood of selecting dividend stocks that align with their financial goals and risk tolerance:

- Company Financial Health: Assessing the financial health of a company is imperative before investing in dividend stocks. Look for companies with a strong balance sheet, consistent revenue growth, and a history of stable or increasing dividends. Analyze financial ratios, such as debt-to-equity ratio and current ratio, to gauge the company’s financial strength.

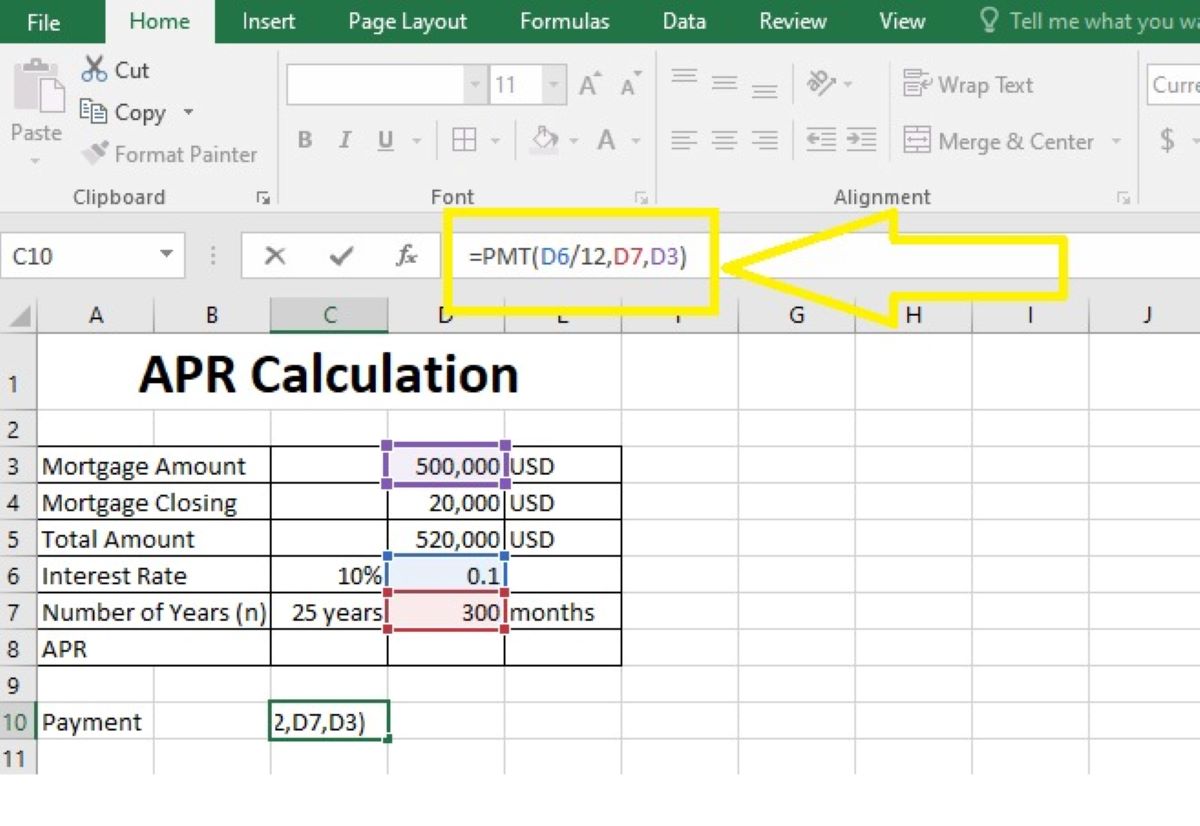

- Dividend Yield: Dividend yield is an important metric to consider when evaluating dividend stocks. Dividend yield represents the annual dividend payment as a percentage of the stock’s current price. While a high dividend yield may seem attractive, it is important to ensure that it is sustainable and not a result of an artificially depressed stock price.

- Dividend Growth: A company’s ability to consistently increase its dividends is a clear indicator of its stability and financial success. Look for companies with a track record of regularly increasing dividends over time. This not only provides the potential for higher future income but also demonstrates management’s confidence in the company’s future prospects.

- Payout Ratio: The payout ratio measures the proportion of earnings paid out as dividends. A lower payout ratio indicates that the company retains a larger portion of its earnings for reinvestment or other purposes, which can be beneficial for future growth. However, an extremely low payout ratio may suggest that the dividends are not a priority for the company.

- Industry and Market Conditions: Consider the industry in which the company operates and the current market conditions. Some industries, such as utilities and consumer staples, are known for their stable cash flows and consistent dividends. Evaluate the potential risks and opportunities associated with the industry to make an informed investment decision.

- Management Quality: The quality of a company’s management team can significantly impact its ability to maintain and grow dividends. Research the company’s leadership, their experience, track record, and strategic vision. A capable and shareholder-friendly management team is more likely to prioritize shareholder returns and make wise capital allocation decisions.

By thoroughly evaluating these factors and conducting thorough research, investors can make more informed decisions when selecting dividend stocks. It is important to remember that investing in individual stocks carries risks, and diversification across different sectors and asset classes is essential for managing risk and maximizing returns.

Dividend Stocks to Buy and Hold Forever

When it comes to selecting dividend stocks to hold for the long term, there are several companies that stand out due to their strong track record, consistent dividend growth, and potential for future success. While no investment is guaranteed, these stocks have demonstrated resilience and the ability to generate attractive returns over time. Here are three dividend stocks to consider for your long-term investment portfolio:

1. Company A

Company A is a globally recognized leader in its industry, with a history of consistent dividend growth. The company operates in a stable market and has a strong competitive advantage. Its financials are robust, and it has consistently generated solid earnings and cash flows. With a moderate dividend yield, Company A has a track record of increasing its dividends year after year, reflecting its commitment to shareholders. Furthermore, the company has a healthy payout ratio, ensuring that the dividends are sustainable. Considering all these factors, Company A is an attractive dividend stock for investors looking for stability, growth, and consistent dividend income.

2. Company B

Company B is a leading player in a rapidly growing industry. It operates in a sector that is poised for future expansion, offering significant growth potential. Company B has a solid financial position and consistently generates strong revenue growth. The company has a history of increasing its dividends, making it appealing for long-term investors seeking both capital appreciation and dividend income. Despite a relatively lower dividend yield compared to some other stocks, Company B’s consistent dividend growth and prospects for future growth make it an attractive choice for investors with a higher risk tolerance who are willing to invest for the long haul.

3. Company C

Company C is a well-established company known for its stability and consistent dividend payments. It operates in a defensive sector that tends to hold up well even during economic downturns. The company has a strong balance sheet, sound financials, and a reliable cash flow. Company C has a history of increasing its dividends, offering investors the potential for steadily rising income over time. With a healthy payout ratio and a moderate dividend yield, Company C provides an attractive combination of stability, dividend income, and long-term growth prospects.

Remember, these stocks are meant to be held for the long term. Investing in dividend stocks requires patience and a focus on the company’s fundamentals rather than short-term market movements. It is always wise to diversify your portfolio and conduct your own research before making any investment decisions.

By selecting dividend stocks with a strong track record, robust financials, and a commitment to shareholder returns, you can build a portfolio of stocks that has the potential to provide both income and capital appreciation over the long term.

Company A

Company A is a highly regarded dividend stock that deserves a place in any long-term investment portfolio. As one of the leaders in its industry, Company A has established a reputation for its consistent dividend growth and ability to deliver value to its shareholders.

Operating in a stable market, Company A benefits from a strong competitive advantage that allows it to maintain a dominant position in the industry. This advantage provides a solid foundation for the company’s financial performance and underpins its ability to consistently generate profits.

Speaking of financial performance, Company A has an impressive track record of delivering robust earnings and cash flows. By focusing on efficient operations and strategic investments, the company has managed to sustain a healthy bottom line, providing a solid basis for its ability to pay dividends.

When it comes to dividends, Company A has demonstrated a commitment to rewarding its shareholders. With a moderate dividend yield, the company incrementally increases its dividends year after year, reflecting its dedication to sharing its success with investors. This pattern of consistent dividend growth not only provides investors with a steady stream of income, but also offers the potential for long-term capital appreciation.

Additionally, Company A maintains a healthy payout ratio, ensuring that its dividend payments are sustainable and aligned with its earnings. This prudent approach to dividend distribution gives investors confidence in the company’s ability to continue its dividend growth in the future.

Overall, Company A is an attractive dividend stock for investors seeking stability, consistent dividend income, and the potential for long-term growth. Its strong market position, robust financials, and commitment to shareholder returns make it a reliable choice for those looking to hold stocks for the long haul.

As always, it is essential to conduct thorough research and consider your own investment goals and risk tolerance before making any investment decisions. Diversifying your portfolio and consulting with a financial advisor can also provide additional guidance and help you make informed choices about incorporating Company A or any other stock into your investment strategy.

Company B

Company B is a standout dividend stock that offers long-term growth potential and an opportunity for investors seeking exposure to a rapidly expanding industry. As a leading player in its sector, Company B has positioned itself to capitalize on the growth opportunities within its market.

The industry in which Company B operates is known for its potential for future expansion. This favorable outlook provides a solid foundation for the company’s growth prospects and its ability to generate attractive returns over the long term. By operating in a high-growth sector, Company B is well-positioned to benefit from market demand and technological advancements.

Financially, Company B has consistently demonstrated its ability to deliver impressive revenue growth. This growth is a testament to the company’s strong market positioning, effective business strategies, and successful execution. As the company increases its market share and expands its customer base, it is likely to continue driving revenue growth and increasing its profitability.

In terms of dividends, Company B may have a relatively lower dividend yield compared to some other stocks. However, its commitment to consistently increasing its dividends makes it an attractive option for long-term investors who are willing to accept a slightly lower immediate income in exchange for the potential for greater future returns. By focusing on sustainable dividend growth, Company B aims to reward shareholders and provide them with a growing income stream over time.

It is important to note that investing in Company B requires a higher risk tolerance, as the industry it operates in may experience fluctuations and uncertainties. However, for investors willing to embrace this level of risk and seek long-term growth potential, Company B offers an opportunity to benefit from a rapidly expanding market and potentially earn attractive returns.

As with any investment, thorough research and analysis are essential. Consider your own investment goals, risk appetite, and diversification strategy before deciding to include Company B or any other stock in your portfolio. Consult with a financial advisor to ensure your investment decisions align with your personal financial situation and goals.

Company C

Company C is a well-established and reliable dividend stock that offers stability, consistent dividend payments, and the potential for long-term growth. As a leader in its industry, Company C has demonstrated its ability to deliver shareholder value and maintain a strong financial position.

Operating in a defensive sector, Company C benefits from a market that tends to hold up well even during economic downturns. This defensive nature provides a level of stability to the company’s revenue streams and makes it an attractive choice for investors seeking a reliable source of income and a hedge against market volatility.

Financially, Company C boasts a strong balance sheet and sound financials. The company consistently generates a reliable cash flow, which underscores its ability to sustain and grow its dividend payments over time. With its stable financial position, Company C has the necessary resources to support its dividend policy and continue rewarding shareholders.

Company C has a proven track record of consistently paying dividends. This commitment to regular dividend payments demonstrates the company’s dedication to providing shareholders with a steady stream of income. Moreover, Company C has a history of increasing its dividends, offering investors the potential for steadily rising income over the long term.

With a moderate dividend yield, Company C strikes a balance between providing income to investors and retaining earnings for reinvestment or other purposes. This approach aligns with the company’s focus on maintaining financial stability while also supporting the long-term growth potential of the business.

Considering its stability, consistent dividend income, and potential for long-term growth, Company C presents an attractive option for investors seeking the benefits of dividend stocks. Its defensive nature, strong financials, and commitment to shareholder returns make it an appealing choice for those looking for both income and the potential for capital appreciation.

As always, it is crucial to conduct thorough research and consider your own investment goals and risk tolerance before investing in any stock. Diversification across different sectors and consulting with a financial advisor can further enhance your investment strategy and help you make informed decisions about adding Company C or any other stock to your portfolio.

Conclusion

Investing in dividend stocks can be a prudent strategy for long-term wealth accumulation and generating a steady stream of income. By carefully evaluating factors such as financial health, dividend yield, dividend growth, industry conditions, and management quality, investors can make informed decisions when selecting dividend stocks.

In this article, we highlighted three dividend stocks worth considering for a long-term investment portfolio. Company A, with its strong track record, consistent dividend growth, and financial stability, offers investors stability and potential for long-term growth. Company B, operating in a rapidly expanding industry, presents an opportunity for higher risk tolerance investors seeking growth potential. Company C, operating in a defensive sector and delivering consistent dividends, appeals to those seeking stability and reliable income.

When investing in dividend stocks, it is important to approach the market with a long-term mindset. These stocks are meant to be held for an extended period, allowing investors to benefit from compounding returns and the potential for capital appreciation.

Remember, before making any investment decisions, thoroughly research the companies and consider your own investment goals, risk tolerance, and diversification strategy. Consulting with a financial advisor can provide valuable guidance and help you align your investments with your overall financial plan.

In conclusion, dividend stocks can be a valuable addition to a well-rounded investment portfolio. As with any investment, it is essential to conduct your due diligence and make informed decisions based on thorough analysis. By carefully selecting dividend stocks with a focus on stability, consistent dividends, and potential for long-term growth, investors can position themselves for financial success and the potential to hold these stocks forever.