Finance

What Are The American Express Merchant Fees?

Published: February 24, 2024

Learn about American Express merchant fees and how they impact your finances. Understand the costs involved and make informed decisions for your business.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of American Express merchant fees! As a business owner, understanding the intricacies of payment processing fees is crucial for your financial well-being. American Express, a renowned player in the credit card industry, offers a range of merchant fees that impact the cost of accepting their cards for transactions. In this comprehensive guide, we will delve into the various aspects of American Express merchant fees, shedding light on their types, calculation methods, and strategies for negotiation.

Navigating the realm of merchant fees can be daunting, especially with the myriad of terms and percentages involved. However, fear not, as we will unravel the complexities and equip you with the knowledge needed to make informed decisions for your business. Whether you're a small business owner or a seasoned entrepreneur, grasping the nuances of American Express merchant fees is pivotal for optimizing your payment processing costs and enhancing your bottom line.

Join us on this enlightening journey as we demystify American Express merchant fees, empowering you to navigate the terrain of payment processing with confidence and clarity. Let's embark on this insightful exploration together, uncovering the intricacies of American Express merchant fees and arming you with the tools to make informed financial decisions for your business.

Understanding American Express Merchant Fees

Before delving into the specifics of American Express merchant fees, it’s essential to grasp the fundamental concept of these fees and their significance to businesses. Merchant fees, also known as processing fees, are the charges incurred by merchants for accepting credit card payments. American Express, like other major credit card companies, imposes these fees on businesses that choose to accept their cards as a form of payment.

One distinctive aspect of American Express merchant fees is that they are typically higher compared to those of other credit card networks. This variance is attributed to the premium positioning of American Express cards and the array of benefits they offer to cardholders. As a result, businesses that accept American Express cards often face slightly higher processing costs.

Understanding the impact of American Express merchant fees on your business’s finances is crucial for making informed decisions regarding payment acceptance. While the higher fees may initially seem daunting, it’s important to weigh them against the potential benefits of catering to a customer base that favors American Express cards. By comprehending the rationale behind these fees and the value they bring to your business, you can navigate the landscape of payment processing more effectively.

As we delve deeper into the intricacies of American Express merchant fees, we will explore the various types of fees imposed, the methods used to calculate these fees, and strategies for negotiating favorable terms. This comprehensive understanding will empower you to optimize your payment processing costs and make strategic choices that align with your business objectives.

Types of American Express Merchant Fees

When it comes to American Express merchant fees, it’s essential to familiarize yourself with the different fee categories that may apply to your business. Understanding these distinct fees is pivotal for gaining clarity on the cost structure associated with accepting American Express cards. Let’s explore the primary types of American Express merchant fees:

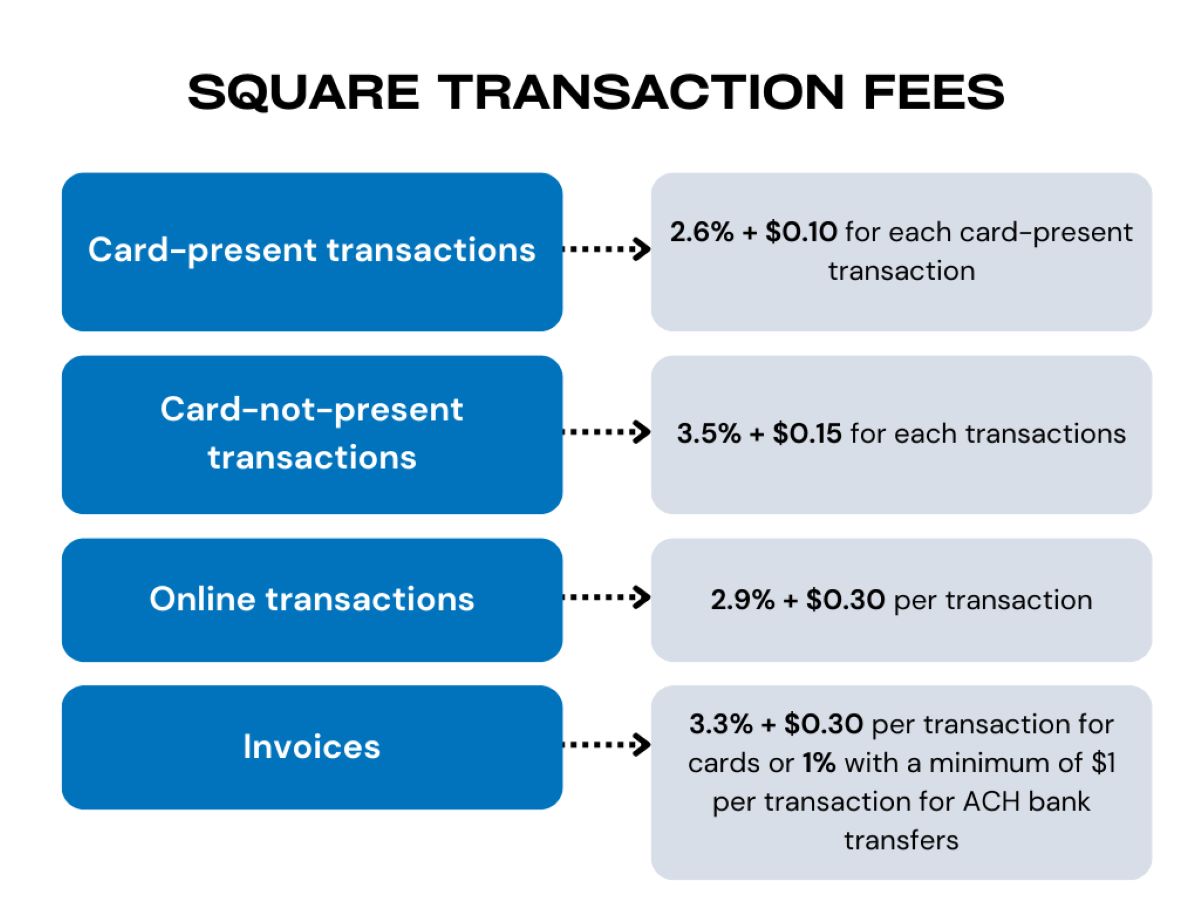

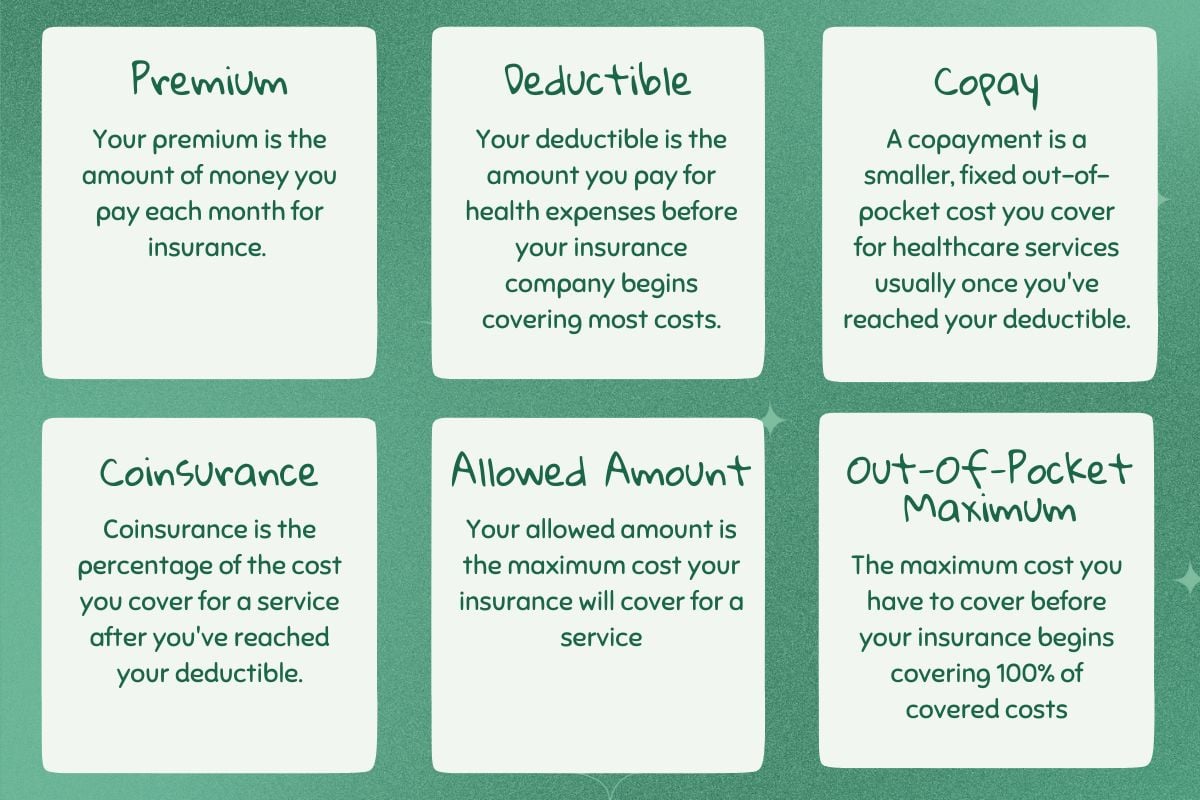

- Discount Rate: The discount rate, also known as the merchant discount rate, represents the percentage of each transaction that the merchant pays to American Express. This fee is based on the transaction volume and is a core component of the overall processing costs.

- Flat Fees: In addition to the discount rate, American Express may impose flat fees per transaction. These fees are fixed amounts that apply to each transaction, regardless of the purchase amount. Understanding the existence and applicability of flat fees is crucial for accurately assessing the total cost of processing American Express transactions.

- Assessment Fees: American Express assessment fees are charges levied directly by the card network. These fees contribute to the operational and administrative costs associated with maintaining the American Express network and providing cardholder benefits. Understanding assessment fees is vital for comprehending the comprehensive cost structure of processing American Express transactions.

- Incidental Fees: Incidental fees encompass a range of additional charges that may arise under specific circumstances, such as chargebacks, retrieval requests, and other exceptional scenarios. Being aware of these incidental fees is essential for anticipating potential costs beyond standard transaction processing.

By familiarizing yourself with these distinct types of American Express merchant fees, you can gain a comprehensive understanding of the cost components involved in accepting American Express cards. This knowledge forms the foundation for effectively managing your payment processing expenses and making informed decisions regarding your card acceptance strategy.

How American Express Merchant Fees are Calculated

Understanding the methodology behind the calculation of American Express merchant fees is pivotal for businesses seeking to manage their payment processing costs effectively. The calculation of these fees involves several key factors and variables that contribute to the overall expense of accepting American Express cards. Let’s delve into the essential elements that determine how American Express merchant fees are calculated:

- Transaction Volume: The volume of transactions processed through American Express cards directly influences the total merchant fees incurred. The discount rate, which is a percentage of each transaction, contributes significantly to the overall cost. As the transaction volume increases, so does the cumulative impact of the discount rate on the merchant’s expenses.

- Purchase Amounts: The value of each transaction plays a crucial role in fee calculation, especially concerning flat fees. While the discount rate is based on a percentage, flat fees are fixed amounts that apply to individual transactions. Consequently, higher purchase amounts result in higher flat fee expenses, alongside the proportional impact on the discount rate component.

- Card Type and Reward Programs: American Express offers a diverse range of cards, each with distinct reward programs and benefits. The type of card used for a transaction, along with any associated rewards or incentives, can influence the applicable merchant fees. Cards with premium rewards may entail higher processing costs for the merchant.

- Assessment Fees: The assessment fees imposed by American Express contribute to the overall cost structure and are factored into the fee calculation. These fees, which support the operational aspects of the card network, are integrated into the comprehensive calculation of merchant fees.

By comprehending the interplay of transaction volume, purchase amounts, card types, and assessment fees, businesses can gain insight into the holistic process of calculating American Express merchant fees. This understanding empowers merchants to evaluate the cost implications of accepting American Express cards and make informed decisions regarding their payment acceptance strategy.

Negotiating American Express Merchant Fees

For businesses seeking to optimize their payment processing costs, engaging in negotiations with American Express to secure favorable merchant fee terms can yield significant benefits. While the standard fee structure may seem non-negotiable, American Express often provides avenues for businesses to explore potential adjustments and concessions. Here are essential strategies for negotiating American Express merchant fees:

- Understand Your Transaction Profile: Before initiating negotiations, thoroughly analyze your transaction profile, including the volume and average ticket size of American Express transactions. This data provides valuable insights that can be leveraged during negotiations, demonstrating the value of your business to American Express.

- Highlight Growth Potential: Emphasize your business’s growth trajectory and the potential for increased American Express transactions. Demonstrating future growth opportunities can incentivize American Express to consider accommodating your needs through adjusted fee structures.

- Explore Value-Added Services: Inquire about value-added services and benefits that American Express can offer in conjunction with potential fee adjustments. This approach positions the negotiation as a collaborative effort to enhance the partnership and mutually benefit both parties.

- Seek Customized Solutions: Request customized fee structures tailored to your business’s specific needs and industry dynamics. American Express may be open to crafting personalized fee arrangements that align with your operational requirements and growth objectives.

- Utilize a Payment Processor: Engage with payment processors that specialize in negotiating favorable terms with card networks. These processors often have established relationships and leverage that can lead to more advantageous merchant fee agreements.

By adopting a strategic and informed approach to negotiating American Express merchant fees, businesses can potentially secure cost-saving arrangements that positively impact their bottom line. Effective negotiation tactics, coupled with a thorough understanding of the business’s transaction profile and growth potential, can pave the way for mutually beneficial agreements with American Express.

Conclusion

In conclusion, navigating the realm of American Express merchant fees is a critical aspect of managing the financial dynamics of accepting credit card payments. Understanding the nuances of these fees, including their types, calculation methods, and negotiation strategies, empowers businesses to make informed decisions that optimize payment processing costs and enhance overall financial performance.

By comprehending the distinct types of American Express merchant fees, such as discount rates, flat fees, assessment fees, and incidental fees, businesses gain clarity on the comprehensive cost structure associated with accepting American Express cards. This knowledge forms the foundation for effectively managing payment processing expenses and anticipating potential cost implications.

Furthermore, understanding how American Express merchant fees are calculated provides valuable insights into the factors and variables that influence the overall expense of processing transactions. Transaction volume, purchase amounts, card types, and assessment fees collectively contribute to the fee calculation, enabling businesses to assess the cost implications of accepting American Express cards.

Engaging in negotiations with American Express to secure favorable merchant fee terms presents an opportunity for businesses to potentially reduce costs and enhance their financial outcomes. By leveraging negotiation strategies, understanding their transaction profile, and emphasizing growth potential, businesses can explore avenues for customized fee arrangements that align with their operational needs and growth objectives.

In essence, a comprehensive understanding of American Express merchant fees equips businesses with the knowledge and strategies needed to navigate the payment processing landscape with confidence and financial acumen. By leveraging this knowledge, businesses can optimize their payment acceptance strategies, manage costs effectively, and cultivate mutually beneficial partnerships with American Express, ultimately contributing to their long-term financial success.