Home>Finance>What Is The Relationship Between Premiums And Deductibles?

Finance

What Is The Relationship Between Premiums And Deductibles?

Published: December 19, 2023

Learn about the relationship between premiums and deductibles in finance. Find out how these factors influence your insurance costs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

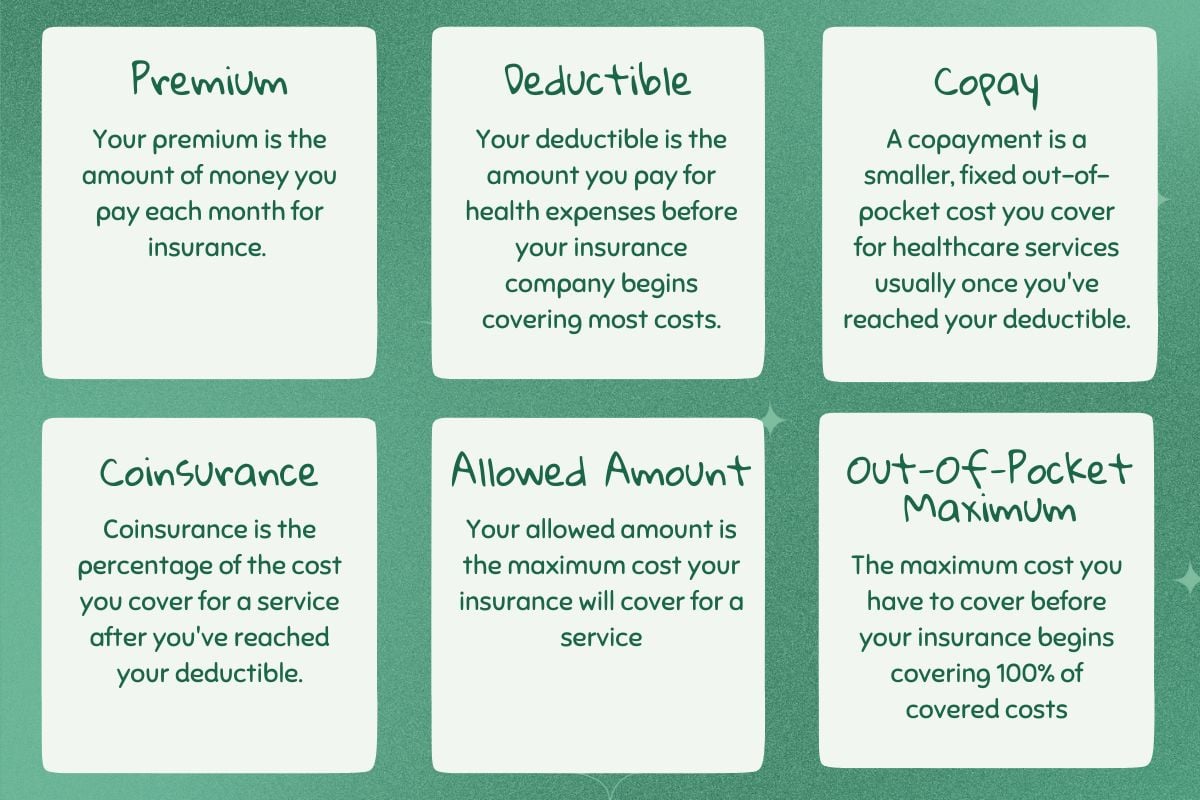

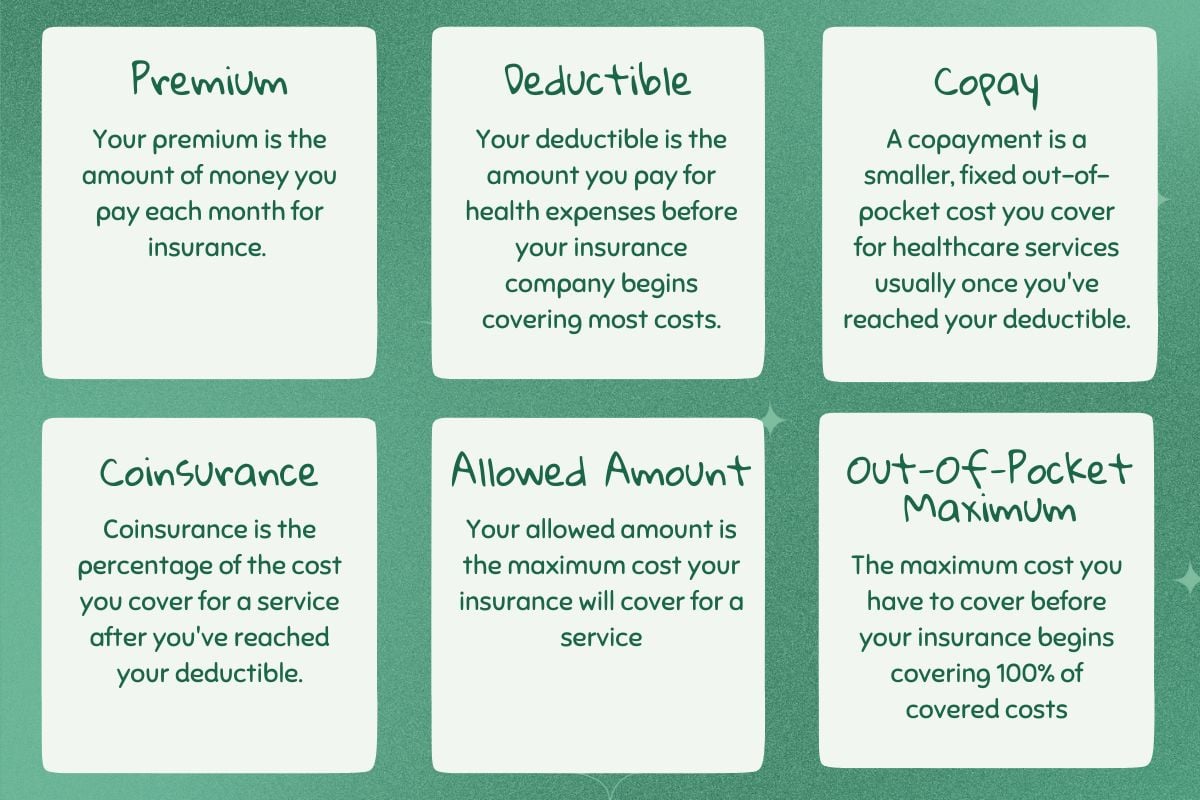

When it comes to understanding insurance policies, two terms that often come up are premiums and deductibles. These terms are crucial to grasp as they have a direct relationship and can significantly impact your finances. Simply put, premiums are the regular payments you make to the insurance company to maintain coverage, while deductibles are the out-of-pocket expenses you must pay before your insurance coverage kicks in.

The relationship between premiums and deductibles is an essential aspect of any insurance policy, whether it’s health insurance, auto insurance, or homeowners insurance. Understanding this relationship is key to making informed decisions about your insurance coverage and selecting the right policy for your needs.

In this article, we will delve deeper into the relationship between premiums and deductibles, exploring how they interact and the factors that affect this relationship. Additionally, we will provide examples of different premium-deductible scenarios and offer guidance on how to choose the right combination that suits your specific situation.

By the end of this article, you will have a better understanding of how premiums and deductibles work together and how they can impact your overall insurance costs.

Understanding Premiums

Before we delve into the relationship between premiums and deductibles, let’s first define what premiums are and understand their significance in insurance policies.

Premiums are the regular payments you make to the insurance company in exchange for coverage. They can be paid monthly, quarterly, annually, or on other agreed-upon schedules. The amount of the premium is determined by several factors, including the type of insurance policy, coverage limits, your age, your health condition (in the case of health insurance), the value of the insured property (in the case of homeowners or auto insurance), and the level of risk associated with the insured individual or property.

The insurance company calculates premiums based on the likelihood of you making a claim and the potential cost of that claim. For example, if you choose a health insurance policy with comprehensive coverage and a low deductible, your premiums will likely be higher compared to a policy with a higher deductible and less extensive coverage. This is because the insurance company takes on more risk by offering lower deductibles and comprehensive coverage, which translates into higher premiums.

In addition to these factors, insurance premiums also take into account administrative costs, marketing, underwriting, and profit margins for the insurance company. It’s important to note that premiums are not a one-time payment but an ongoing expense for as long as you hold the insurance policy.

One concept to keep in mind when discussing premiums is the notion of “rate.” The rate refers to the cost of the premium per unit of coverage. For example, in auto insurance, the rate may be calculated based on the value of the car or the miles driven. In health insurance, the rate may depend on age, existing medical conditions, or geographic location.

Understanding how premiums are calculated and the factors that influence them is crucial in making informed decisions about your insurance coverage. By having a clear understanding of premiums, you can determine the amount you are willing to pay regularly for insurance coverage and evaluate different policies to find the best fit for your needs and budget.

Understanding Deductibles

Now that we’ve covered the basics of premiums, let’s turn our attention to deductibles and how they fit into the insurance equation. A deductible is the amount of money you must pay out of pocket for covered expenses before your insurance coverage begins to apply. It is a fixed amount specified in your insurance policy and can vary depending on the type of coverage you have.

In essence, the deductible acts as a threshold or hurdle that you must meet before your insurance company starts covering the costs. Once you have met the deductible, the insurance company will typically pay a percentage or a set amount of the remaining expenses, while you are responsible for the remaining portion.

Deductibles are primarily designed to avoid small claims and manage risk for both the insured individual and the insurance company. By requiring policyholders to bear a portion of the initial costs, deductibles help prevent people from making frequent small claims, which would increase administrative costs for the insurance company. Instead, deductibles encourage policyholders to use insurance for significant and costly events.

It’s important to note that deductibles can be structured in different ways depending on the insurance policy. Some policies have a single deductible that applies to all covered expenses, while others have separate deductibles for different types of coverage (e.g., health insurance with separate deductibles for medical services and prescription drugs).

Another key aspect of deductibles is that they can be either per-incident or annual. A per-incident deductible means that you need to meet the deductible for each individual claim or event. For example, if your auto insurance policy has a per-incident deductible of $500 and you get into two separate accidents in a year, you will need to meet the deductible for each accident. On the other hand, an annual deductible means that you only need to meet the deductible once during the year, regardless of the number of claims made.

It’s essential to carefully review the terms of your insurance policy to understand how deductibles are structured and how they will impact your out-of-pocket expenses in the event of a claim. Deductibles vary widely depending on the type of insurance and the level of coverage you choose. Keep in mind that policies with lower deductibles tend to have higher premiums, while policies with higher deductibles generally have lower premiums.

Now that we have a solid understanding of deductibles, let’s explore the relationship between premiums and deductibles and how they work in tandem to determine your overall insurance costs.

The Relationship between Premiums and Deductibles

The relationship between premiums and deductibles is an integral part of any insurance policy. Understanding this relationship is crucial for making informed decisions about your insurance coverage and managing your overall insurance costs.

At first glance, it may seem like premiums and deductibles are in opposition to each other. Higher premiums mean paying more upfront, while higher deductibles mean you have to pay more out-of-pocket when making a claim. However, there is an inverse relationship between premiums and deductibles. In general, if you opt for a policy with lower premiums, you will likely face higher deductibles, and vice versa.

A policy with higher premiums typically translates into a lower deductible. This means that you will have less out-of-pocket expenses when making a claim, but you will be paying more in premiums regularly. On the other hand, a policy with lower premiums usually comes with a higher deductible, meaning you will have more significant out-of-pocket expenses before your insurance coverage kicks in.

It’s essential to consider your individual circumstances and preferences when choosing between higher premiums and lower deductibles or lower premiums and higher deductibles. Some people prefer the peace of mind that comes with lower deductibles and being able to rely on insurance coverage sooner, even if it means paying higher premiums. Others may be comfortable with higher deductibles to lower their regular premium payments, taking on more financial responsibility in the event of a claim.

It’s crucial to strike a balance between your budget and your risk tolerance. If you rarely use your insurance coverage and have the financial means to cover higher out-of-pocket expenses, opting for a policy with higher deductibles and lower premiums may be a suitable choice. On the other hand, if you anticipate needing frequent or significant coverage, it may be worth paying higher premiums for lower deductibles.

Ultimately, the decision regarding the premium-deductible balance depends on your individual financial situation, your expected usage of insurance coverage, and your comfort level with assuming higher out-of-pocket costs.

Now that we understand the relationship between premiums and deductibles, let’s explore the factors that can influence this relationship and affect your insurance costs.

Factors Affecting the Relationship between Premiums and Deductibles

The relationship between premiums and deductibles in insurance policies is influenced by several factors. Understanding these factors can help you make an informed decision about finding the right balance for your insurance coverage.

1. Insurance Type: Different types of insurance have varying cost structures and risk factors. For example, auto insurance premiums are typically based on factors such as the value of the vehicle, the driver’s age, and driving history. In contrast, health insurance premiums can vary based on factors like age, pre-existing conditions, and desired levels of coverage. The type of insurance you choose will impact the premiums and deductibles offered by insurance companies.

2. Coverage Level: The extent of coverage you seek plays a significant role in determining premiums and deductibles. Comprehensive coverage with lower deductibles often comes with higher premiums, while policies with higher deductibles tend to have lower premiums. It’s essential to carefully evaluate your needs to determine the appropriate level of coverage and associated out-of-pocket expenses you are comfortable with.

3. Risk Assessment: Insurance companies assess risk when determining premiums and deductibles. Higher-risk individuals or properties may face higher premiums or lower deductibles to compensate for the increased likelihood of claims. Factors such as age, health condition, driving record, and location can affect risk assessment and ultimately impact the premium-deductible relationship.

4. Insurance Company Policies: Each insurance company has its own underwriting guidelines and pricing models, influencing the premiums and deductibles they offer. It’s advisable to obtain quotes from multiple insurance providers to compare rates and explore different premium-deductible combinations that suit your needs and budget.

5. State Regulations: Insurance regulations can vary by state, affecting the premiums and deductibles offered. Some states may have specific requirements or limitations on how insurance companies structure their policies. Familiarizing yourself with the regulations in your state can help you understand the options available to you.

It’s important to consider these factors and how they interact to impact the relationship between premiums and deductibles. By analyzing these aspects, you can better navigate the insurance landscape and make informed decisions about your coverage.

Now that we understand the factors that influence the premium-deductible relationship, let’s explore some examples to better illustrate how this relationship can vary.

Examples of Different Premium-Deductible Relationships

Understanding how premiums and deductibles interact can be easier when examining specific examples. Let’s consider a few scenarios to illustrate the varying relationships between premiums and deductibles:

1. Health Insurance: In a health insurance policy, a plan with a low premium might have a higher deductible, meaning you pay less each month but have to meet a significant out-of-pocket cost before coverage starts. On the other hand, a plan with a higher premium often comes with a lower deductible, providing more immediate coverage but requiring higher monthly payments.

2. Auto Insurance: In auto insurance, a policy with a low premium might have a high deductible. This means you pay less upfront but are responsible for a larger portion of repair costs in the event of an accident. Conversely, a policy with a higher premium typically has a lower deductible, offering more coverage upfront but requiring higher monthly payments.

3. Homeowners Insurance: Homeowners insurance policies also exhibit different premium-deductible relationships. A policy with lower premiums generally has a higher deductible, while a higher premium often corresponds to a lower deductible. This allows homeowners to select a plan based on their risk tolerance and budget.

4. Deductible Options: Insurance companies often offer various deductible options within the same policy. For example, a health insurance plan may allow you to choose between a $1,000 deductible or a $2,500 deductible. The premium will vary accordingly, with the lower deductible resulting in a higher premium. This flexibility allows individuals to customize their coverage to their specific needs and financial situation.

It’s important to note that these examples are broad generalizations, and individual insurance policies can vary significantly. Factors such as location, age, coverage level, and risk assessment all contribute to the specific premium-deductible relationship for each policy.

When selecting an insurance policy, carefully evaluate your needs and budget. Consider your financial ability to manage higher out-of-pocket expenses and your willingness to pay higher monthly premiums. It may be helpful to compare multiple policies and obtain quotes from different insurance providers to find the best premium-deductible combination that suits your unique circumstances.

Now that we have explored the different premium-deductible relationships, let’s discuss strategies for choosing the right combination that suits your needs.

Choosing the Right Premium and Deductible Combination

Choosing the right premium and deductible combination for your insurance policy is a crucial decision. It requires careful consideration of your budget, risk tolerance, and expected usage of insurance coverage. Here are some strategies to help you make an informed choice:

1. Assess Your Finances: Start by evaluating your financial situation and determine how much you can comfortably afford to pay in premiums and out-of-pocket expenses. Consider your monthly budget and ensure that you can consistently meet the premium payments. Additionally, assess your emergency savings and ability to cover higher deductibles if needed.

2. Evaluate Your Risk Tolerance: Different individuals have varying levels of risk tolerance. Some may prefer to have the peace of mind that comes with lower deductibles, even if it means paying higher premiums. Others may be comfortable taking on higher deductibles to reduce their monthly expenses and assume more risk in the event of a claim. Assess your comfort level with assuming higher out-of-pocket costs and choose accordingly.

3. Consider Usage and Claims History: Evaluate how often you anticipate needing to use your insurance coverage. If you have a history of few or low-cost claims, opting for a higher deductible policy may be a viable choice. On the other hand, if you frequently rely on insurance for various reasons, a lower deductible policy could offer more immediate coverage.

4. Compare Multiple Quotes: Obtain quotes from different insurance providers and compare the premium-deductible combinations offered. Consider the coverage limits, additional benefits, and customer reviews in addition to the costs. This comparison allows you to make an informed choice and select a policy that meets your specific needs.

5. Seek Expert Advice: If you feel overwhelmed or unsure about the premium-deductible combination, consider reaching out to an insurance agent or financial advisor with expertise in insurance. They can provide guidance based on your unique circumstances and help you navigate the decision-making process.

Remember that your insurance needs may change over time. Reevaluate your policy periodically and adjust the premium and deductible amounts as necessary. Keep in mind that striking a balance between premiums and deductibles allows you to manage your insurance costs effectively while ensuring adequate coverage when you need it.

Now that we have discussed strategies for choosing the right premium and deductible combination, let’s summarize the key points before concluding.

Conclusion

The relationship between premiums and deductibles is a fundamental aspect of insurance policies. By understanding this relationship, you can make informed decisions about your coverage and manage your overall insurance costs effectively.

Premiums represent the regular payments made to the insurance company in exchange for coverage, while deductibles are the out-of-pocket expenses that must be met before the insurance coverage applies. They work in tandem to determine your overall insurance costs and the level of financial responsibility you assume in the event of a claim.

Factors such as insurance type, coverage level, risk assessment, insurance company policies, and state regulations all influence the relationship between premiums and deductibles. Evaluating these factors allows you to determine the right premium-deductible combination for your needs. Considering your budget, risk tolerance, and expected usage of insurance coverage is essential in striking a balance that suits your unique circumstances.

When choosing a premium and deductible combination, assess your finances, evaluate your risk tolerance, consider your usage and claims history, compare multiple quotes, and seek expert advice if needed. Regularly reviewing and adjusting your policy ensures that it aligns with your changing needs and circumstances.

Understanding the relationship between premiums and deductibles empowers you to make well-informed decisions about your insurance coverage. By finding the right balance, you can effectively manage your insurance costs while ensuring adequate coverage and financial protection when you need it most.