Home>Finance>What Are The Requirements For Amazon Credit Card

Finance

What Are The Requirements For Amazon Credit Card

Published: November 7, 2023

Find out the requirements for an Amazon credit card and start managing your finances with ease. Explore the benefits and apply now.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of online shopping where convenience and endless variety are just a few clicks away. In this era of digital shopping, Amazon has become a household name, providing customers with access to an unparalleled selection of products at competitive prices. To further enhance the shopping experience, Amazon offers its customers the option to apply for an Amazon credit card, providing them with exclusive benefits and rewards.

Whether you are a frequent Amazon shopper or are simply considering expanding your financial options, understanding the requirements for an Amazon credit card is essential. By obtaining an Amazon credit card, you can unlock a host of benefits and take advantage of exclusive discounts, cashback offers, and promotional financing options.

However, before diving into the enticing world of Amazon credit cards, it is important to be aware of the eligibility criteria that must be fulfilled to qualify for this financial tool. In this article, we will explore the various requirements for acquiring an Amazon credit card, including age, income, and credit score considerations. We will also provide insights into the application process and required documents, helping you navigate your way to securing this valuable financial instrument. So, let’s dive in and discover what it takes to obtain an Amazon credit card!

Benefits of Having an Amazon Credit Card

Having an Amazon credit card comes with a host of exclusive benefits and rewards that can enhance your shopping experience and help you save money. Let’s explore some of the enticing perks of owning an Amazon credit card:

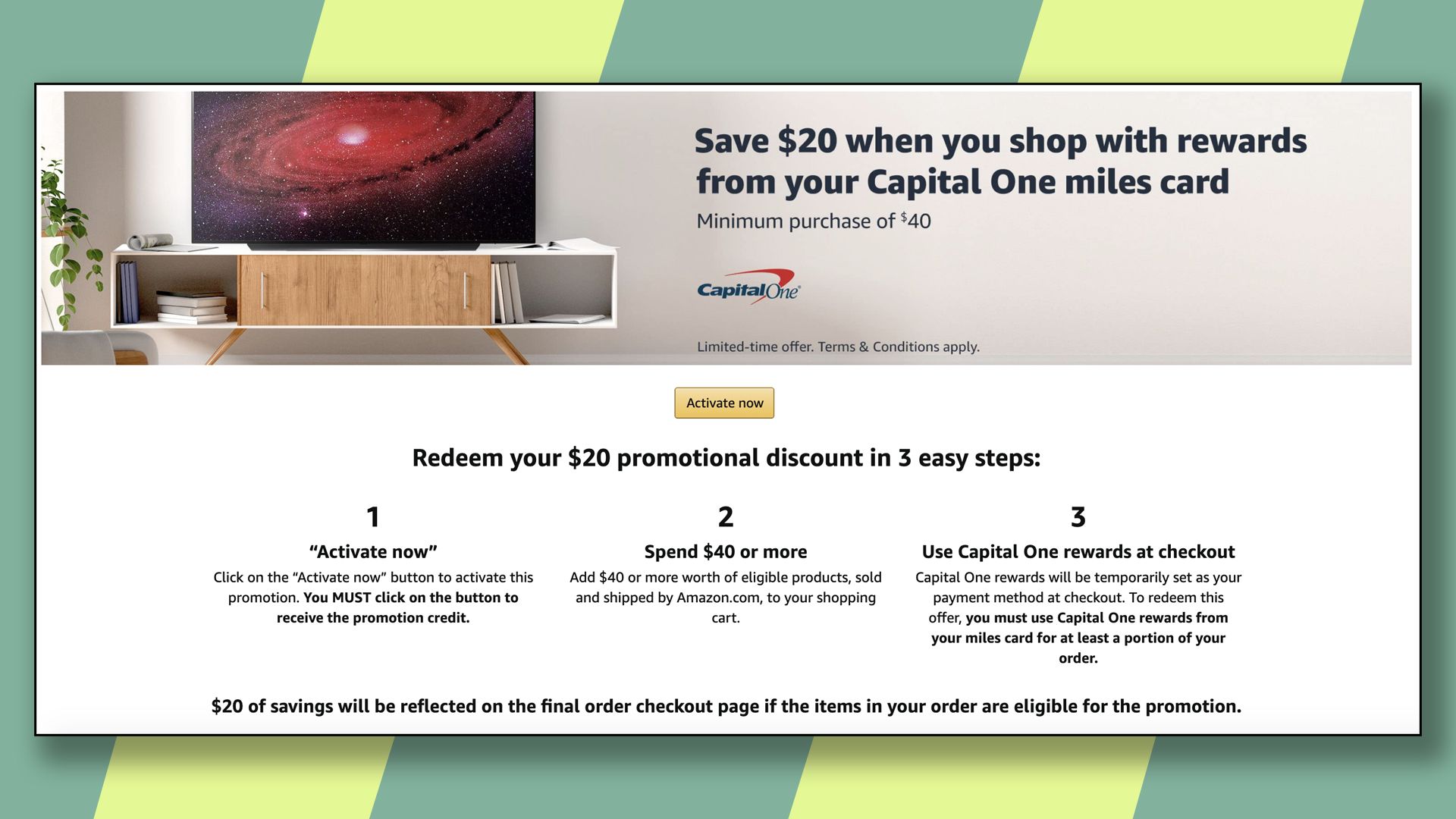

- Cashback Rewards: One of the primary incentives to obtain an Amazon credit card is the cashback rewards program. Depending on the type of Amazon credit card you choose, you can earn cashback on both Amazon purchases and other eligible transactions. With every purchase, you can earn a percentage of cashback, which can accumulate over time and be redeemed for future purchases or as statement credit. This cashback feature provides a tangible way to save money on your everyday expenses.

- Special Financing: Amazon offers special financing options for certain purchases made with an Amazon credit card. This can be particularly beneficial for larger purchases, such as electronics, furniture, or appliances. With promotional financing, you can make purchases and pay them off over time without accruing interest, making it easier to manage your budget and enjoy the items you desire.

- Exclusive Discounts: Amazon credit cardholders are often granted early access to sales, promotions, and limited-time offers. This means you can snag discounted prices, exclusive deals, and even early access to popular products before they become available to the general public. These discounts can add significant value to your shopping experience and help you save money on a wide range of products.

- No Annual Fee: Many Amazon credit cards come with no annual fee. This means you can enjoy the benefits and rewards of the card without having to pay a recurring fee simply for being a cardholder. This can be a significant advantage, especially if you want to enjoy the perks of the card without any additional financial burden.

- Travel benefits: Some Amazon credit cards offer travel benefits, such as no foreign transaction fees or travel insurance. If you frequently travel or make purchases from international vendors, these benefits can be particularly valuable, helping you save money and provide added peace of mind during your trips.

These are just a few of the many benefits of having an Amazon credit card. As an online retail giant, Amazon strives to provide its customers with top-notch services and attractive rewards, making their credit card offerings a worthy consideration for any avid shopper. Now that we’ve explored the benefits, let’s move on to the eligibility criteria for obtaining an Amazon credit card.

Eligibility Criteria for Amazon Credit Card

Before applying for an Amazon credit card, it is important to understand the eligibility criteria that determine whether you qualify for this financial tool. Let’s take a closer look at the key requirements:

- Age Requirement: To be eligible for an Amazon credit card, you must be at least 18 years old. This ensures that you are legally able to enter into a financial agreement and responsibly manage the credit card.

- Income Requirement: Amazon credit cards typically have income requirements that vary depending on the specific card you are applying for. The income requirement ensures that you have the financial means to manage the credit card and make timely payments. It’s important to note that higher-income individuals may qualify for premium versions of the Amazon credit card with additional benefits.

- Credit Score Requirement: Your credit score plays a crucial role in determining your eligibility for an Amazon credit card. Most Amazon credit cards require a good to excellent credit score to qualify. A higher credit score demonstrates your ability to manage credit responsibly, which is an important factor for credit card issuers when approving applications.

While these are the general eligibility requirements for an Amazon credit card, it’s important to note that additional factors, such as your employment status and credit history, may also be considered in the application process. It’s always a good idea to review the specific requirements for the Amazon credit card you are interested in to ensure you meet the necessary criteria.

Now that we have discussed the eligibility criteria, let’s move on to exploring the application process for an Amazon credit card and the required documents.

Age Requirement

When it comes to applying for an Amazon credit card, one of the primary eligibility criteria is meeting the age requirement. To be eligible for an Amazon credit card, you must be at least 18 years old.

The reason for this age requirement is to ensure that applicants have reached the legal age to enter into a financial agreement and can responsibly manage a credit card. Credit cards come with certain responsibilities, such as making timely payments, adhering to credit limits, and understanding the terms and conditions associated with the card. By setting the minimum age requirement at 18, credit card issuers can ensure that applicants have the maturity and legal capacity to handle these responsibilities.

Additionally, the age requirement is also in line with the laws and regulations governing financial institutions. In many jurisdictions, individuals under the age of 18 are considered minors and are prohibited from entering into binding financial contracts. Therefore, to comply with legal requirements, credit card issuers establish a minimum age for cardholders.

It’s important to note that the age requirement for an Amazon credit card may vary depending on the country or region you are applying from. Some regions may have a higher minimum age requirement due to local regulations or the specific terms of the credit card. Therefore, it’s essential to review the eligibility criteria specific to your location to ensure you meet the necessary age requirement.

By meeting the age requirement for an Amazon credit card, you can take advantage of the various benefits and rewards offered by Amazon, making your online shopping experience more convenient and cost-effective.

Now that we’ve discussed the age requirement, let’s move on to exploring the income requirement for an Amazon credit card.

Income Requirement

When applying for an Amazon credit card, one of the important eligibility criteria to consider is meeting the income requirement. The income requirement ensures that you have the financial means to manage the credit card and make timely payments. The specific income requirement may vary depending on the type of Amazon credit card you are applying for.

The income requirement typically reflects the minimum annual income that an applicant needs to demonstrate to be considered eligible for the Amazon credit card. This requirement is in place to ensure that applicants have a stable and sufficient income to responsibly manage credit card payments and potentially take advantage of higher credit limits.

An income requirement serves two primary purposes. Firstly, it helps assess an applicant’s ability to handle the financial responsibility associated with a credit card. It ensures that individuals have a regular income source that allows them to make timely payments and avoid accumulating excessive debt.

Secondly, the income requirement helps credit card issuers determine the credit limit they can offer to an applicant based on their financial capacity. A higher income generally indicates a higher ability to repay debts, which may result in a higher credit limit. By considering an applicant’s income, credit card issuers can provide appropriate credit limits that align with the individual’s financial profile.

It’s important to note that the specific income requirements may vary based on the type of Amazon credit card you are interested in. While some cards may have more flexible income requirements, premium versions of the Amazon credit card may have higher income thresholds to qualify for additional benefits and perks.

When applying for an Amazon credit card, you will be required to provide proof of income, such as recent pay stubs, tax returns, or bank statements, to verify that you meet the income requirement. It’s crucial to ensure that your income documentation accurately reflects your financial situation to improve your chances of being approved for an Amazon credit card.

By meeting the income requirement for an Amazon credit card, you can unlock a world of exclusive benefits and rewards, making your online shopping experience even more rewarding.

Now that we’ve covered the income requirement, let’s move on to discussing the credit score requirement for an Amazon credit card.

Credit Score Requirement

When it comes to applying for an Amazon credit card, one of the crucial factors that credit card issuers consider is your credit score. Your credit score serves as an indicator of your creditworthiness and demonstrates your ability to manage credit responsibly. While the specific credit score requirement for an Amazon credit card may vary, most cards typically require a good to excellent credit score.

Why is your credit score important for an Amazon credit card application? Your credit score provides lenders with a snapshot of your credit history and financial behavior. It takes into account factors such as your payment history, credit utilization, length of credit history, and the types of credit accounts you have. By evaluating your credit score, credit card issuers can assess the level of risk involved in extending credit to you.

A good credit score indicates that you have consistently demonstrated responsible borrowing habits, making payments on time and keeping credit card balances low. This reassures credit card issuers that you are likely to meet your financial obligations and manage your credit card effectively. Consequently, a higher credit score increases your chances of being approved for an Amazon credit card.

It’s important to note that different types of Amazon credit cards may have varying credit score requirements. Some basic Amazon credit cards may have more lenient requirements, catering to individuals with limited credit history or lower credit scores. On the other hand, premium Amazon credit cards with enhanced benefits and rewards may require a higher credit score to qualify.

Before applying for an Amazon credit card, it’s a good idea to check your credit score. You can obtain a free copy of your credit report from various credit bureaus or use online credit monitoring services. Reviewing your credit report allows you to assess your creditworthiness and address any potential errors or issues that could negatively impact your credit score.

If your credit score doesn’t meet the minimum requirement for an Amazon credit card, you may want to consider taking steps to improve your credit before applying. This can include making timely payments, reducing credit card balances, avoiding new credit applications, and keeping a close eye on your credit utilization ratio.

By meeting the credit score requirement for an Amazon credit card, you can unlock the benefits and rewards that come with the card, ensuring a more rewarding online shopping experience.

Now that we’ve covered the credit score requirement, let’s move on to exploring the application process for an Amazon credit card and the required documents.

Application Process

The application process for an Amazon credit card is relatively straightforward and can be completed online. Here are the steps involved in applying for an Amazon credit card:

- Research and Compare: Begin by researching the different types of Amazon credit cards available. Each card offers its own set of benefits, rewards, and terms. Take the time to compare the features and determine which card best suits your needs and spending habits.

- Gather Required Information: Before starting the application, gather all the necessary information. This typically includes personal details such as your full name, contact information, social security number, and employment information.

- Visit the Amazon Credit Card Page: Access the Amazon website and navigate to the credit card section. Here, you will find information about the available cards and a link to begin the application process.

- Start the Application: Click on the link to start your application. You will be directed to a secure webpage where you can enter your personal information, employment details, and financial information.

- Submit the Application: After filling in all the required fields, review your application to ensure accuracy. Once you are confident that all the information is correct, submit your application for review.

- Wait for Approval: After submitting your application, the credit card issuer will review your information and assess your eligibility. This process typically involves verifying your identity, income, and creditworthiness. The time it takes to receive a decision can vary, but you will generally receive a response within a few weeks.

If your application is approved, you will receive your new Amazon credit card in the mail. The associated credit limit and terms will be outlined in the cardholder agreement provided with your card. It’s important to review this information carefully to understand the terms and conditions of your Amazon credit card.

If your application is denied, the credit card issuer will provide you with an explanation for the decision. Common reasons for denial may include a low credit score, insufficient income, or discrepancies in the information provided. You can take steps to address the issue and improve your chances of approval in the future.

Now that you have an understanding of the application process, let’s move on to the required documents for applying for an Amazon credit card.

Required Documents

When applying for an Amazon credit card, you will need to provide certain documents to support your application. These documents are typically required to verify your identity, income, and other relevant details. Here are the common documents you may need to submit:

- Proof of Identity: To establish your identity, you will need to provide a valid government-issued identification document. This can include a driver’s license, passport, or national ID card. Ensure that the document is not expired and contains your full legal name and a clear photograph.

- Proof of Income: To verify your income, you may need to provide supporting documents such as recent pay stubs, W-2 forms, or income tax returns. These documents help the credit card issuer determine your financial capacity to manage credit and make timely payments. If you are self-employed or have additional sources of income, you may need to provide additional documentation such as business income statements or bank statements.

- Proof of Address: To confirm your residential address, you may be required to provide a utility bill, bank statement, or rental agreement that clearly displays your full name and address. This document helps establish your residency and provides a reliable means of contact.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): In the United States, you will need to provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). This information is required for identity verification and to comply with legal and financial regulations.

It is essential to ensure that the documents you provide are current, accurate, and complete. Any discrepancies or inconsistencies in the information provided may delay the application process or result in a denial.

It’s important to note that the specific documentation requirements may vary depending on the credit card issuer and the country or region where you are applying for an Amazon credit card. It’s always a good idea to review the documentation guidelines provided by the credit card issuer to ensure you meet their requirements.

By having the necessary documents readily available, you can streamline the application process for an Amazon credit card and increase your chances of a successful application.

Now that we’ve discussed the required documents, let’s move on to exploring the online application process for an Amazon credit card.

Online Application

Applying for an Amazon credit card is a simple and convenient process that can be completed online. The online application allows you to provide all the necessary information and submit the required documents digitally. Here are the key steps involved in the online application process:

- Visit the Amazon Credit Card Page: Start by visiting the official Amazon website and navigating to the credit card section. Here, you will find detailed information about the available credit cards and their respective benefits and rewards.

- Select the Desired Amazon Credit Card: Choose the Amazon credit card that best suits your needs and click on the “Apply Now” button. This will direct you to the online application form specific to the chosen credit card.

- Fill in the Required Information: Start the online application by providing your personal information, such as your full name, contact details, and social security number or taxpayer identification number. Ensure that all the information entered is accurate and matches your official documents.

- Enter Employment and Financial Details: Provide information about your employment status, including your occupation, employer’s name, and annual income. You may also be asked to provide additional details about your financial situation, including any existing debts or monthly expenses.

- Submit Supporting Documents: As part of the online application, you may be required to upload the necessary supporting documents to verify your identity, income, and address. These typically include scanned copies or clear photographs of your identification document, proof of income, and proof of address. Follow the instructions provided to upload these documents securely.

- Review and Confirm: Before finalizing your application, carefully review all the information you have provided. Make sure there are no errors or missing details. It’s crucial to double-check your application to ensure its accuracy and completeness.

- Submit Your Application: Once you are confident that all the information is accurate, submit your application online. At this point, you may be required to agree to the terms and conditions of the Amazon credit card.

- Wait for Approval: After submitting your application, the credit card issuer will review your application and supporting documents. The approval process typically takes a few weeks. You can check the status of your application online or wait for communication from the credit card issuer through email or mail.

Applying for an Amazon credit card online offers convenience and efficiency, allowing you to complete the application process from the comfort of your own home. Make sure to provide accurate information and submit the required documents promptly to increase your chances of a successful application.

Now that we’ve covered the online application process for an Amazon credit card, let’s move on to exploring the approval process and what to expect after submitting your application.

Approval Process

After submitting your online application for an Amazon credit card, the approval process begins. The credit card issuer will review your application, verify the information provided, and assess your eligibility for the card. Here’s what you can expect during the approval process:

- Application Review: The credit card issuer will thoroughly review your application, ensuring that all the required fields have been completed accurately. They will assess your eligibility based on factors such as your income, creditworthiness, and the information provided in the application.

- Identity Verification: To combat identity theft and fraud, the credit card issuer may verify your identity by cross-checking the information provided with official documents. This verification process helps ensure that you are the authorized individual applying for the credit card.

- Income Verification: The credit card issuer will review the income information you provided during the application process. They may request additional documentation, such as pay stubs, tax returns, or bank statements, to verify your income. This step is crucial for assessing your financial capacity to manage the credit card.

- Credit Evaluation: Your credit report and credit score will be evaluated to determine your creditworthiness. The credit card issuer will assess your payment history, credit utilization, length of credit history, and any negative marks on your credit report. A good credit history improves your chances of approval, while a poor credit history may result in a denial.

- Decision and Communication: Once the credit card issuer completes the review process, they will send you a decision regarding your application. If approved, you will receive notification of your credit limit and any additional terms and conditions associated with the card. If denied, the credit card issuer will provide a reason for the decision, which could include factors such as a low credit score or insufficient income.

The time it takes to receive a decision can vary depending on the credit card issuer and other factors. In some cases, you may receive an instant decision, while in others, it can take several weeks to receive a response. During this time, it’s important to monitor your email and physical mail for communication from the credit card issuer.

If your application is approved, you will typically receive your Amazon credit card in the mail within a few business days. You can then activate the card following the instructions provided and start enjoying the benefits and rewards associated with it.

If your application is denied, it’s essential to review the reason for the denial and take steps to improve your creditworthiness before reapplying. This can include paying off debts, building a positive payment history, and addressing any errors or discrepancies on your credit report.

Now that we’ve covered the approval process, you have a better understanding of what to expect after submitting your application for an Amazon credit card.

Conclusion

Obtaining an Amazon credit card can be a valuable addition to your financial arsenal, providing you with exclusive benefits and rewards while shopping online. However, it’s important to understand the requirements and process involved in securing this financial tool.

In this article, we explored the various criteria for eligibility, including the age requirement, income requirement, and credit score requirement. We discussed how meeting these criteria plays a crucial role in determining your eligibility for an Amazon credit card.

We also delved into the benefits of having an Amazon credit card, such as cashback rewards, special financing options, exclusive discounts, and more. These perks can enhance your shopping experience and help you save money on a variety of products.

Furthermore, we discussed the different stages of the application process, from researching and comparing the available Amazon credit cards to completing the online application and submitting the required documents. Understanding the application process sets you up for a smooth and efficient experience when applying for an Amazon credit card.

The approval process was also covered, highlighting the steps involved in reviewing and evaluating the application, including identity verification, income verification, and credit evaluation. We emphasized the importance of maintaining a good credit history and provided insights into what you can expect after submitting your application.

By familiarizing yourself with the eligibility criteria, benefits, and application process, you are better prepared to apply for an Amazon credit card. Remember to review the specific requirements and guidelines provided by the credit card issuer, as they may vary based on your country or region.

Now that you have obtained a comprehensive understanding of the requirements for an Amazon credit card, you can make an informed decision and pursue the benefits and rewards that come with it. Explore the different Amazon credit card options, gather your documents, and embark on the journey of enhancing your shopping experience with the power of an Amazon credit card.