Finance

What Can I Do With A 552 Credit Score

Modified: March 6, 2024

Discover the options available for your finance needs with a 552 credit score. Explore ways to improve your credit and secure better financial opportunities.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Scores

- What is a 552 Credit Score?

- Impact of a 552 Credit Score

- Options for Individuals with a 552 Credit Score

- Building Credit with a 552 Credit Score

- Loans and Credit Cards for a 552 Credit Score

- Renting and Housing Options with a 552 Credit Score

- Employment and Insurance Considerations with a 552 Credit Score

- Steps to Improve a 552 Credit Score

- Conclusion

Introduction

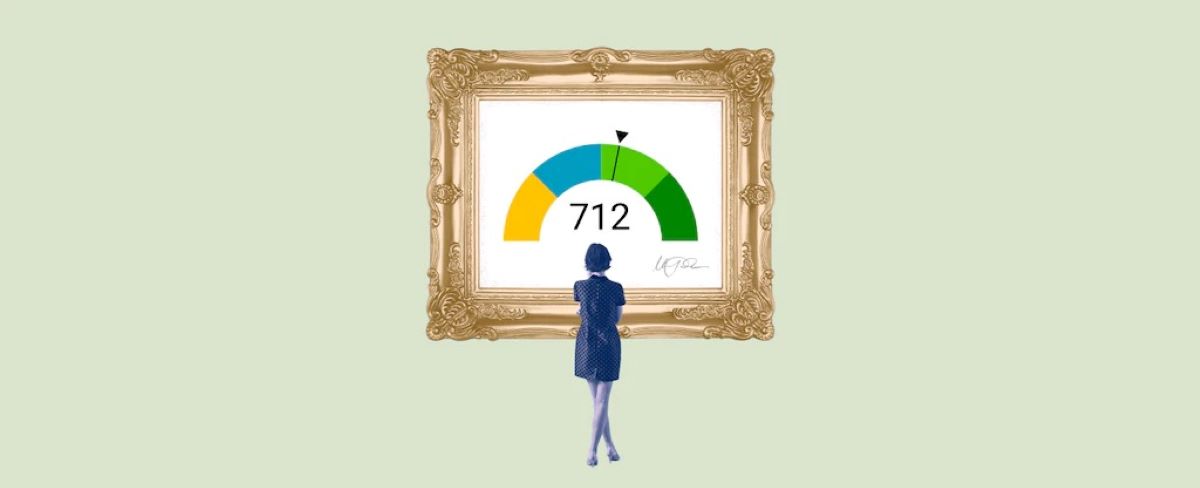

Having a good credit score is essential when it comes to managing your finances. Your credit score is a three-digit number that is calculated based on your credit history and provides lenders with an indication of your creditworthiness. A higher credit score indicates a lower risk for lenders, which makes it easier for you to qualify for loans, credit cards, and other financial opportunities.

However, not everyone has a perfect credit score. Life circumstances, financial struggles, or past mistakes can lead to lower credit scores. If you find yourself with a 552 credit score or any lower score, it’s important to understand its implications and what options are available to you.

A credit score of 552 falls into the fair or average category and may limit your access to certain financial products and services. This article will explore what a 552 credit score means, how it can impact your financial options, and steps you can take to improve your creditworthiness.

Understanding Credit Scores

Credit scores are numerical representations of an individual’s creditworthiness and financial history. They are calculated using algorithms that analyze various components of a person’s credit report, such as payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries.

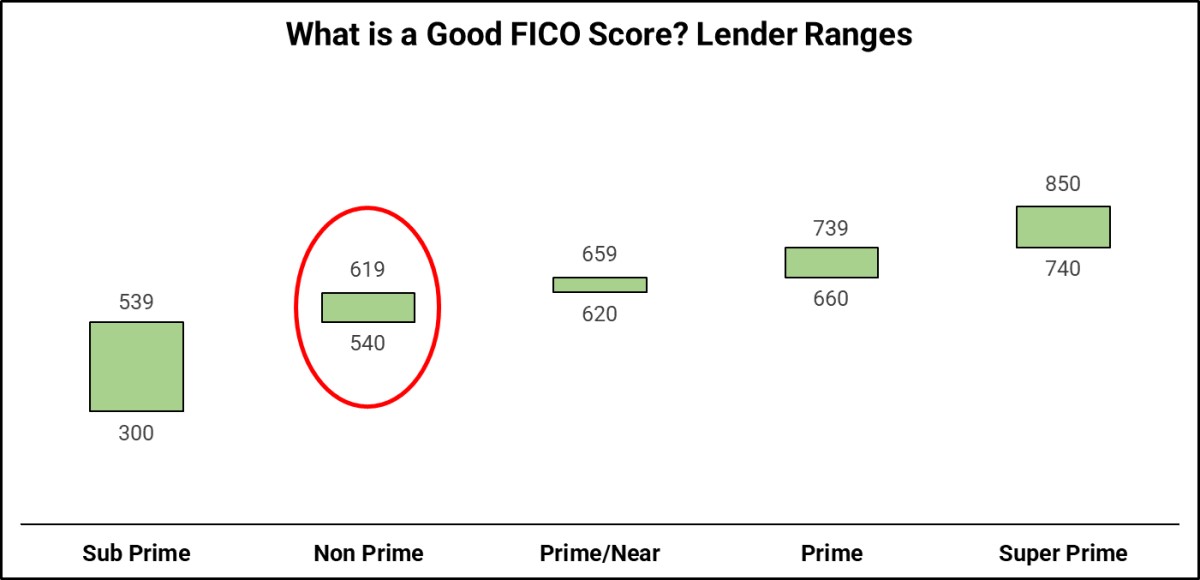

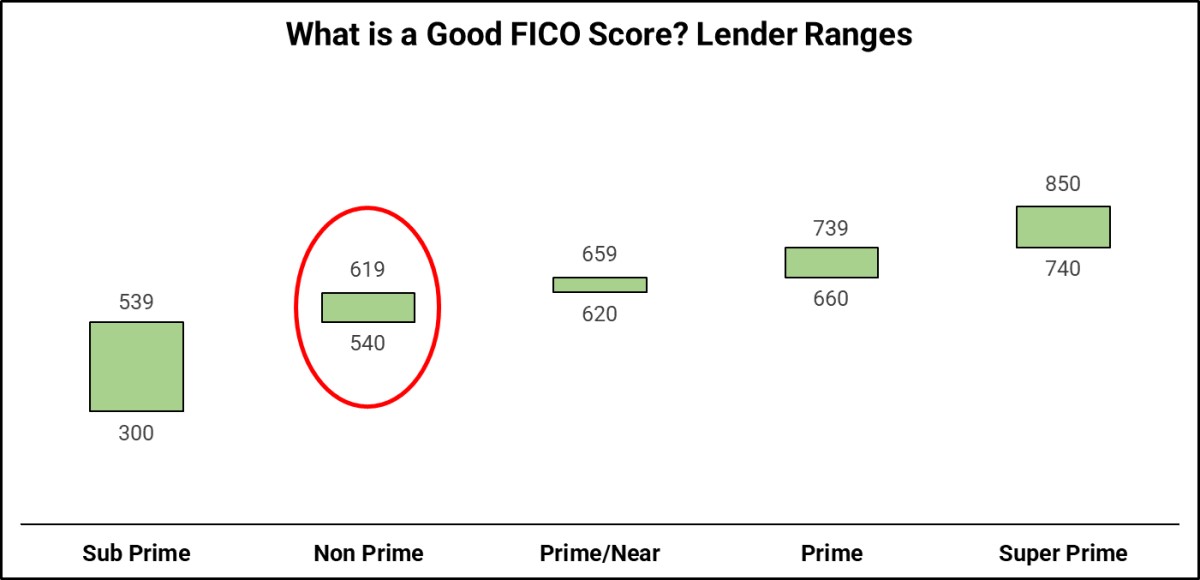

The most commonly used credit scoring models are FICO® Scores and VantageScores. FICO® Scores range from 300 to 850, with higher scores indicating better creditworthiness. VantageScores have a range of 300 to 850 as well.

Generally, credit scores are categorized into different ranges to provide a simplified understanding of an individual’s creditworthiness:

- Exceptional: 800+

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

Keep in mind that these ranges may vary slightly depending on the credit scoring model being used.

It is important to note that credit scores are not permanent. They can change over time based on your financial behavior and actions. Making consistent, on-time payments, keeping credit card balances low, and avoiding new credit applications can all have a positive impact on your credit score.

What is a 552 Credit Score?

A credit score of 552 falls within the fair or average range of credit scores. While it is not a terrible score, it does indicate that there may be room for improvement. Lenders may see a 552 credit score as a sign of increased risk and may be more cautious when considering extending credit to individuals with this score.

With a 552 credit score, you may still qualify for some financial products, such as loans or credit cards, but you may encounter limitations and higher interest rates. It’s important to understand that each lender may have their own policies and criteria for credit approvals.

A 552 credit score suggests that there have been some issues with managing credit in the past. This could include late or missed payments, a high credit utilization ratio, or possibly even a history of delinquencies or accounts in collections.

It’s worth noting that a credit score is just one component that lenders consider when making lending decisions. They may also take into account your income, employment history, and other factors in determining your creditworthiness.

While a 552 credit score is not ideal, it is not the end of the world. There are steps you can take to improve your creditworthiness, and over time, you can work towards a better credit score.

Impact of a 552 Credit Score

Having a credit score of 552 can have several implications on your financial life. It’s important to understand the potential impact so that you can plan accordingly and work towards improving your score.

1. Difficulty in obtaining loans and credit cards: With a 552 credit score, you may find it challenging to qualify for loans and credit cards. Lenders may consider you to be a higher risk borrower and may either deny your application or offer you loans with higher interest rates.

2. Limited borrowing options: The types of loans you can access with a 552 credit score may be limited. You may have difficulty securing a mortgage or an auto loan, and if you do get approved, the terms may not be as favorable as those offered to borrowers with higher credit scores.

3. Higher interest rates: If you are able to obtain a loan or credit card with a 552 credit score, the interest rates will likely be higher. This means that you will end up paying more in interest over the life of the loan, making it more expensive for you.

4. Difficulty renting an apartment: Landlords often perform credit checks on potential tenants. With a 552 credit score, you may face challenges in securing a rental apartment. Landlords may view your credit score as an indication of your financial responsibility and ability to pay rent on time.

5. Impact on insurance premiums: Some insurance companies may use credit scores as a factor in determining premiums. A lower credit score could lead to higher insurance premiums for auto or home insurance.

While a 552 credit score may have these negative impacts, it’s important to remember that it is not a permanent situation. By taking proactive steps to improve your credit score, you can gradually improve your financial options and access better opportunities in the future.

Options for Individuals with a 552 Credit Score

While a credit score of 552 may present some challenges, there are still options available for individuals in this credit range. It’s important to explore these alternatives to meet your financial needs and work towards improving your credit score.

1. Credit Builder Loans: Credit builder loans are designed to help individuals build or rebuild credit. These loans are typically secured by your own funds, such as a savings account, and the lender reports your payment history to the credit bureaus. By making on-time payments, you can demonstrate responsible credit behavior and gradually improve your credit score.

2. Secured Credit Cards: Secured credit cards require a security deposit that determines your credit limit. Using a secured credit card responsibly by making regular payments and keeping your balance low can help you establish a positive credit history and improve your score over time.

3. Peer-to-Peer Lending: Peer-to-peer lending platforms connect borrowers directly with individual investors. These platforms often have more flexible lending criteria compared to traditional banks, meaning your credit score may have less impact on your eligibility for a loan. However, keep in mind that interest rates on these loans may still be higher than those offered to individuals with better credit scores.

4. Credit Unions: Credit unions are not-for-profit financial institutions that often have more lenient lending criteria than traditional banks. They may be willing to work with individuals with lower credit scores and offer more favorable terms on loans and credit cards.

5. Authorized User or Joint Account: If you have a trusted family member or friend with good credit, they may add you as an authorized user or open a joint account with you. Their positive credit behavior can have a positive impact on your credit score, as long as the account is managed responsibly.

Remember, these options may come with certain limitations, higher interest rates, or stricter terms. It’s important to carefully review the terms and conditions and consider the impact they may have on your financial situation.

Building Credit with a 552 Credit Score

If you have a credit score of 552, it’s important to take proactive steps to improve your creditworthiness and gradually raise your score. Here are some strategies to help you build credit:

1. Make all payments on time: Payment history is one of the most significant factors in determining your credit score. Ensure that you make all your payments, including credit cards, loans, and bills, on time. Late or missed payments can have a negative impact on your credit score.

2. Reduce credit utilization: Keep your credit card balances low and try to maintain a credit utilization ratio below 30%. Credit utilization ratio is the percentage of your available credit that you are currently using. Lowering your credit utilization can demonstrate responsible credit management.

3. Apply for a secured credit card: Secured credit cards require a cash deposit as collateral, reducing the risk for the lender. By using a secured credit card and making regular, on-time payments, you can establish a positive credit history.

4. Become an authorized user: Ask a family member or friend with good credit to add you as an authorized user on one of their credit cards. Their positive payment history and credit behavior can help boost your credit score.

5. Check your credit report regularly: Review your credit report for any errors or inaccuracies that may be negatively impacting your score. Dispute any incorrect information and work towards resolving any outstanding debts or collections.

6. Avoid new credit applications: Limit the number of new credit applications you make, as multiple hard inquiries can lower your credit score. Instead, focus on responsible credit management with your existing accounts.

7. Seek credit counseling if needed: If you are struggling with managing your finances and improving your credit, consider seeking help from a reputable credit counseling agency. They can provide guidance and develop a plan to help you become financially stable.

Remember, building credit takes time and consistent effort. Patience and responsible financial habits will eventually lead to an improved credit score and better financial opportunities.

Loans and Credit Cards for a 552 Credit Score

With a credit score of 552, you may face some limitations when it comes to obtaining loans and credit cards. However, there are still options available to help you access credit and improve your financial situation.

1. Personal Loans: Some lenders specialize in providing personal loans to individuals with lower credit scores. These loans may come with higher interest rates or stricter terms, but they can still provide you with the funds you need for various purposes, such as debt consolidation or unexpected expenses.

- Online Lenders: Online lenders often have more flexible lending criteria compared to traditional banks. They may consider factors beyond just your credit score, such as your income and employment history.

- Credit Unions: Credit unions are known for their willingness to work with individuals with lower credit scores. They may offer more favorable terms on personal loans compared to traditional banks.

2. Secured Credit Cards: Secured credit cards can be a valuable tool in rebuilding your credit. With a secured credit card, you provide a cash deposit as collateral, which becomes your credit limit. Making regular, on-time payments and keeping your credit utilization low can improve your credit score over time and potentially lead to access to unsecured credit cards.

3. Store Credit Cards: Some retail stores offer credit cards that are easier to qualify for compared to traditional credit cards. These cards often have lower credit limits and higher interest rates, so it’s important to use them responsibly and pay off the balances in full each month to avoid accumulating debt.

4. Credit Builder Loans: Credit builder loans are specifically designed to help individuals build credit. With a credit builder loan, you borrow a small amount from a lender, and the funds are placed in a savings account or certificate of deposit as collateral. As you make regular payments, the lender reports your payment history to the credit bureaus, contributing to the improvement of your credit score.

It’s worth noting that while these options are available to individuals with a 552 credit score, they may come with higher interest rates and stricter terms compared to those offered to individuals with better credit scores. It’s important to carefully review the terms and conditions of any loan or credit card offer and consider how it fits into your overall financial goals and capabilities.

Renting and Housing Options with a 552 Credit Score

When it comes to renting and housing options, a credit score of 552 may pose some challenges. Many landlords and property management companies perform credit checks as a part of their tenant screening process. However, there are still ways to navigate the rental market with a lower credit score.

1. Be open and honest: When applying for a rental property, be upfront about your credit score and any financial difficulties you may have faced in the past. Some landlords may be understanding and willing to work with you if they see a commitment to improving your credit and a stable income.

2. Provide additional documentation: You can help strengthen your rental application by providing additional documentation that highlights your financial stability. This can include proof of steady employment, income verification, references from previous landlords, or a letter of explanation addressing any negative marks on your credit history.

3. Offer a larger security deposit: A higher security deposit may reassure landlords about your commitment to the property and offset the perceived risk associated with a lower credit score. Discuss the possibility of providing a larger deposit with the landlord to increase your chances of securing the rental property.

4. Seek a cosigner or guarantor: If possible, you can ask a family member or trusted friend with a stronger credit profile to act as a cosigner or guarantor for the rental agreement. This person will be responsible for making payments if you are unable to do so.

5. Look for rentals from individual landlords: Individual landlords, as opposed to large property management companies, may have more flexibility and be more open to working with tenants with lower credit scores. They may be more willing to consider your overall financial picture and rental history rather than solely relying on your credit score.

Remember, not all landlords or rental properties will have the same requirements or criteria. It’s important to keep searching and be patient until you find a landlord who is willing to work with you. Additionally, continuing to improve your credit score over time will expand your options and increase your chances of qualifying for rentals in the future.

Employment and Insurance Considerations with a 552 Credit Score

While employers and insurance providers may not directly access your credit score, they may still consider your credit history as part of their evaluation process. Here’s how a credit score of 552 can impact your employment and insurance options:

1. Employment Background Checks: Many employers conduct background checks on potential employees, which may include a review of their credit history. While a low credit score alone is unlikely to disqualify you from a job, certain industries, such as finance or government, may place more importance on financial responsibility. It’s important to be prepared to address any concerns raised by a poor credit history during the hiring process.

2. Job Positions that Involve Financial Responsibility: For positions that involve handling money, managing accounts, or financial decision-making, a low credit score may be seen as a potential risk. Employers may assume that individuals with poor credit could be susceptible to financial pressures or even potential theft. However, it’s important to note that each employer’s policies and criteria may vary, and some may be more lenient than others.

3. Insurance Premiums: While credit scores do not directly affect your ability to obtain insurance coverage, some insurers may consider credit history as a factor when determining premiums for auto, home, or renters insurance. They argue that individuals with poor credit may be more likely to file claims. Be prepared for the possibility of slightly higher insurance premiums if you have a lower credit score.

It’s essential to be proactive in addressing any negative items on your credit report and work towards improving your credit score. By doing so, you can mitigate the potential impact on your employment and insurance options. Additionally, it’s a good idea to be upfront and transparent with potential employers or insurance providers about your credit history, as they may appreciate your honesty and willingness to take responsibility.

Steps to Improve a 552 Credit Score

If you have a credit score of 552, there are several steps you can take to improve your creditworthiness over time. While it may not happen overnight, consistent effort and responsible financial habits can help raise your credit score. Here are some steps to get you started:

1. Pay your bills on time: Late or missed payments can have a significant impact on your credit score. Make sure to pay all your bills, including credit card payments, loans, and utilities, on time each month.

2. Reduce your credit utilization: Aim to keep your credit card balances low and your credit utilization ratio below 30%. High credit utilization can negatively affect your credit score. Consider paying off balances or making multiple payments throughout the month to keep utilization in check.

3. Check your credit reports regularly: Obtain a free copy of your credit reports from each of the three major credit bureaus (Equifax, Experian, and TransUnion). Review the reports for any errors or inaccuracies that may be dragging down your score. Dispute any incorrect information and follow up to ensure it is corrected.

4. Build a positive credit history: Establish a positive credit history by using credit responsibly. This can be done through timely payments, responsible borrowing, and maintaining a mix of different types of credit (such as credit cards and installment loans).

5. Avoid opening new accounts unnecessarily: Multiple credit inquiries and new accounts can have a negative impact on your credit score. Only apply for credit when necessary and carefully consider the terms and conditions before opening new accounts.

6. Keep old accounts open: Closing old accounts can shorten your credit history and potentially lower your credit score. Try to keep your oldest accounts open, even if they have a zero balance, as they contribute positively to the length of your credit history.

7. Be patient and consistent: Building or rebuilding credit takes time. Focus on making positive financial decisions and practicing responsible credit habits consistently over an extended period. With time, you will see improvements in your credit score.

Remember, improving your credit score is a gradual process. It requires discipline, patience, and responsible financial management. By following these steps and developing good credit habits, you can work towards a higher credit score and open up better financial opportunities in the future.

Conclusion

Havig a credit score of 552 may present some challenges, but it is important to remember that your credit score is not set in stone. With patience, perseverance, and responsible financial habits, you can work towards improving your creditworthiness and raising your score over time.

While it may be more difficult to access certain financial products and services with a 552 credit score, there are still options available to you. Look for alternatives such as credit builder loans, secured credit cards, and loans from online lenders or credit unions that are more lenient in their lending criteria.

When it comes to renting and housing, be transparent about your credit score and provide additional documentation to demonstrate stability and willingness to improve. Consider options such as individual landlords or offering a larger security deposit.

Employment and insurance considerations may come into play as well, but by taking steps to improve your credit, being open and honest, and seeking opportunities that align with your financial goals, you can overcome these challenges.

Remember to focus on the fundamental steps of improving your credit score, such as making timely payments, reducing credit utilization, and monitoring your credit report for errors. Consistency and patience are key, as building credit takes time.

In conclusion, a 552 credit score may be a temporary setback, but it does not define your financial future. By taking control of your finances, practicing responsible credit behavior, and seeking opportunities to improve, you can pave the way towards a higher credit score and achieve your financial goals.