Finance

What Can I Do With A 677 Credit Score

Modified: March 1, 2024

Learn how your credit score can impact your financial options. Discover what you can do with a 677 credit score and how to improve it.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Scores

- What is a 677 Credit Score?

- How is a 677 Credit Score Determined?

- Impact of a 677 Credit Score

- What Can I Do with a 677 Credit Score?

- Qualify for Loans with Moderate Interest Rates

- Rent an Apartment or House

- Get Approved for Credit Cards

- Obtain Auto Financing

- Improve Your Credit Score

- Tips for Managing a 677 Credit Score

- Conclusion

Introduction

Welcome to the world of credit scores! Whether you’re just starting out on your financial journey or you’ve been managing your finances for some time, understanding your credit score is crucial. Your credit score essentially serves as a numeric representation of your creditworthiness, indicating to lenders how likely you are to repay borrowed money.

In this article, we will be exploring the topic of credit scores, specifically focusing on what you can do with a 677 credit score. A credit score of 677 falls in the fair range, indicating that you have a moderate credit history and may have had a few financial mishaps in the past. While it’s not the highest credit score, there are still several financial opportunities available to you.

Having a solid understanding of what you can do with a 677 credit score will empower you to make informed decisions about your financial future. Whether you’re looking to obtain a loan, rent an apartment, or get approved for a credit card, we’ll delve into the options and opportunities that you can explore with your credit score of 677.

Understanding Credit Scores

Before we dive into the specifics of a 677 credit score, it’s important to have a fundamental understanding of credit scores in general. A credit score is a three-digit number that helps lenders assess your creditworthiness and determine the level of risk involved in lending you money. It is calculated based on various factors such as your payment history, credit utilization, length of credit history, types of credit, and new credit accounts.

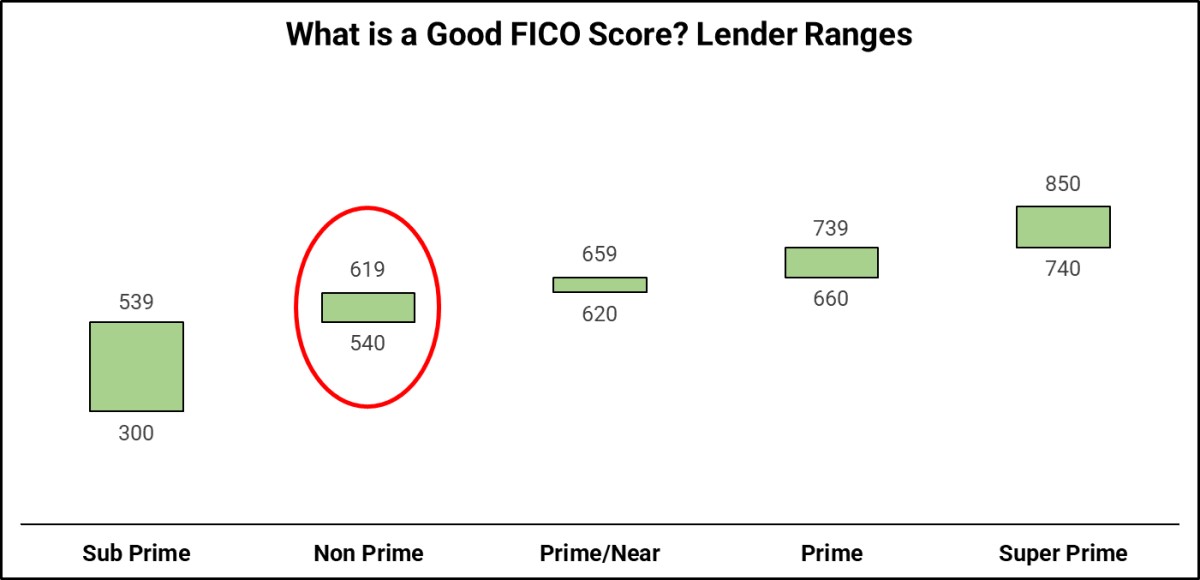

The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850. A higher credit score indicates a lower risk to lenders and generally leads to more favorable borrowing terms, such as lower interest rates and higher credit limits.

A credit score is typically categorized into different ranges, including poor, fair, good, and excellent. While these ranges may vary slightly depending on the scoring model, a 677 credit score is generally considered fair. While it’s not the highest credit score, it still provides opportunities for financial growth and stability.

It’s important to note that credit scores are not static. They can change over time as your financial behavior and circumstances evolve. By understanding the factors that impact your credit score, you can take proactive steps to improve and maintain a healthy credit profile.

What is a 677 Credit Score?

A credit score of 677 falls within the fair range, indicating a moderate credit history. While it is not considered excellent or even good, it is still high enough to provide you with financial opportunities.

When lenders assess your creditworthiness, they take various factors into consideration, such as your payment history, credit utilization, length of credit history, types of credit, and recent credit activity. With a 677 credit score, lenders may view you as an average borrower, meaning you may have had some late payments or other negative marks on your credit history.

While a 677 credit score may not qualify you for the best interest rates or highest credit limits, it still puts you in a position to access certain financial products and services. It’s important to note that your credit score is just one aspect that lenders consider when evaluating your creditworthiness. They may also review your income, employment history, and debt-to-income ratio.

While a 677 credit score is not ideal, it is a starting point for improving your credit health. By demonstrating responsible financial behavior and making timely payments, you can work towards raising your credit score over time.

Now that we have a better understanding of what a 677 credit score signifies, let’s explore the potential impact it can have on your financial journey.

How is a 677 Credit Score Determined?

A credit score is determined by various factors that reflect your credit history and financial behavior. While the exact calculation may vary slightly between credit scoring models, the following components generally contribute to determining your credit score:

- Payment History: Your payment history has the most significant impact on your credit score. It takes into account whether you have made your payments on time, any missed or late payments, and any accounts that have gone into collections.

- Credit Utilization: This factor considers the amount of credit you are using compared to the total amount of credit available to you. It is recommended to keep your credit utilization ratio below 30% to maintain a healthy credit score.

- Length of Credit History: The length of your credit history refers to how long you have been using credit. Generally, a longer credit history is considered more favorable as it provides a better indication of your creditworthiness.

- Types of Credit: Having a mix of different types of credit, such as credit cards, loans, and mortgages, can positively impact your credit score. It shows that you can effectively manage different types of credit.

- New Credit: Opening several new credit accounts within a short period of time can negatively impact your credit score. Lenders may view this as a sign of financial instability.

These factors are combined and analyzed to generate a credit score, which in the case of a 677 credit score, indicates a moderate credit history with room for improvement.

It’s essential to regularly monitor your credit report and address any errors or discrepancies that may be impacting your credit score. By understanding how your credit score is determined, you can take proactive steps to improve your financial standing.

Impact of a 677 Credit Score

While a credit score of 677 may not be considered excellent or even good, it still carries a noticeable impact on your financial opportunities. It’s important to understand how your credit score can affect various aspects of your financial life:

1. Loan Eligibility: With a 677 credit score, you may still be eligible for loans, but you may encounter some challenges. Lenders may offer you loans with slightly higher interest rates and stricter terms, as your credit score suggests a moderate level of risk.

2. Credit Card Access: Obtaining a credit card with a 677 credit score is still possible. However, you may have limited options and may be offered cards with lower credit limits and less favorable rewards and benefits.

3. Housing Options: Renting an apartment or house with a 677 credit score is generally feasible, although landlords may conduct additional screenings or require a higher security deposit.

4. Employment Opportunities: While credit scores are not typically considered during the hiring process, certain industries, such as finance, may conduct credit checks as part of their background screening. This can impact your chances of securing certain job positions.

5. Insurance Premiums: Insurance companies often consider credit scores when determining premiums. A lower credit score may result in higher insurance rates for auto, home, or renters insurance.

While a 677 credit score may present some challenges, it is important to remember that it is not a permanent situation. By practicing responsible financial habits and improving your credit score, you can increase your eligibility for better financial opportunities in the future.

In the next section, we will explore the specific things you can do with a 677 credit score to make the most of your financial situation.

What Can I Do with a 677 Credit Score?

While a credit score of 677 may not be considered excellent, it still provides you with several financial options. Here are some things you can do with a 677 credit score:

- Qualify for Loans with Moderate Interest Rates: With a 677 credit score, you may still qualify for loans, such as personal loans or mortgages. While you may face slightly higher interest rates compared to those with higher credit scores, it’s still possible to secure financing.

- Rent an Apartment or House: Many landlords review credit scores as part of their tenant screening process. With a credit score of 677, you should be able to rent an apartment or house, although you may face additional scrutiny or a higher security deposit.

- Get Approved for Credit Cards: While you may not qualify for premium credit cards, there are still credit card options available. Look for credit cards designed for individuals with fair credit scores, which can help you build credit and potentially qualify for better cards in the future.

- Obtain Auto Financing: Need a new car? With a 677 credit score, you can still secure auto financing. However, you may need to provide a larger down payment and potentially face higher interest rates.

- Improve Your Credit Score: A 677 credit score provides room for improvement. By practicing good financial habits, such as making payments on time, keeping credit utilization low, and avoiding the opening of new credit accounts, you can gradually improve your credit score over time.

It’s important to note that while these options are available with a 677 credit score, it’s advisable to continue working towards improving your credit. This will open up even more opportunities and provide access to better financial products and terms in the future.

In the following section, we’ll provide you with some valuable tips on managing your 677 credit score effectively.

Qualify for Loans with Moderate Interest Rates

With a 677 credit score, you may still be eligible for loans, although you may encounter slightly higher interest rates compared to those with higher credit scores. However, there are several steps you can take to maximize your chances of qualifying for loans with more favorable terms:

Research and Compare Lenders: Different lenders have varying criteria and lending standards. It’s important to research and compare lenders to find those more willing to work with individuals in the fair credit range. Look for lenders who specialize in providing loans to individuals with moderate credit scores.

Improve Other Aspects: While your credit score is an essential factor when applying for a loan, it’s not the only consideration. Lenders also assess your income, employment history, and debt-to-income ratio. Strengthening these areas can help offset the impact of your credit score.

Provide Collateral: Offering collateral, such as a car or home, can increase your chances of loan approval. By securing the loan with valuable assets, you minimize the risk to the lender, potentially leading to more favorable loan terms.

Consider a Co-Signer: If you’re having difficulty getting approved for a loan on your own, you may consider asking a trusted friend or family member with a stronger credit history to act as a co-signer. Their creditworthiness can help you secure the loan with better terms.

Shop Around for the Best Rates: Don’t settle for the first loan offer you receive. Take the time to shop around and compare interest rates and fees from different lenders. Even small differences in rates can significantly impact the total cost of a loan over time.

Keep in mind that while qualifying for loans with moderate interest rates is possible with a 677 credit score, it’s essential to borrow responsibly and maintain a manageable level of debt. Make sure to budget for loan payments and only borrow what you comfortably afford to repay.

In the next section, we’ll explore the option of renting an apartment or house with a 677 credit score.

Rent an Apartment or House

Having a credit score of 677 can still enable you to rent an apartment or house, although you may encounter additional scrutiny or requirements from landlords. Here are some tips to help you navigate the rental process:

Be Prepared: Before starting your apartment or house search, gather all necessary documents such as proof of income, previous rental history, and references. Having these documents readily available demonstrates your preparedness and reliability as a tenant.

Show Stability: Landlords want to ensure that tenants can consistently pay their rent on time and fulfill their lease agreements. Highlighting your stability in terms of employment, income, and rental history can help alleviate concerns about your credit score.

Offer a Higher Security Deposit: Some landlords may be more willing to overlook a lower credit score if you offer a higher security deposit. By providing additional funds upfront, you can mitigate the perceived risk and increase your chances of being approved for the rental.

Get a Co-Signer: If you’re concerned about your credit score impacting your rental application, you may consider asking someone with a stronger credit history to act as a co-signer. Their presence offers added reassurance to landlords and can increase your chances of being approved.

Explain Your Situation: If you have a specific reason for your lower credit score, such as a past financial hardship, consider explaining the circumstances to potential landlords. Providing context can help them understand your situation and may lead to greater leniency in their decision-making process.

Work with Rental Agencies: Consider working with rental agencies or property management companies that specialize in working with individuals with fair credit scores. These agencies may have a better understanding of credit challenges and be more inclined to work with you.

Remember, each landlord may have their own criteria for approving tenants. While a 677 credit score may raise some concerns, emphasizing your stability, reliability, and willingness to work with the landlord can help you secure your desired rental.

In the next section, we’ll explore how you can get approved for credit cards with a 677 credit score.

Get Approved for Credit Cards

Obtaining a credit card with a credit score of 677 is still possible, although you may have more limited options compared to individuals with higher credit scores. Here are some strategies to increase your chances of getting approved for credit cards:

Research Credit Cards for Fair Credit: Look for credit card options specifically designed for individuals with fair credit scores. These cards are more likely to consider applicants with a 677 credit score and may offer more favorable terms compared to general credit cards.

Secured Credit Cards: Consider applying for a secured credit card, which requires a security deposit that serves as your credit limit. Secured credit cards are an excellent option for building credit. Make sure the card issuer reports to the credit bureaus to ensure your responsible card usage helps improve your score.

Become an Authorized User: If you have a trusted family member or friend with a strong credit history, you may consider asking them to add you as an authorized user to one of their credit cards. This allows you to piggyback on their good credit behavior, helping to improve your own credit score over time.

Apply for Retail or Store Credit Cards: Retail or store credit cards are often more lenient in their approval process compared to traditional credit cards. Use these cards responsibly and make timely payments to demonstrate your creditworthiness over time.

Apply for a Card with a Co-Signer: If you have difficulty getting approved for a credit card on your own, you may consider applying for one with a co-signer who has a stronger credit history. However, keep in mind that both you and the co-signer are equally responsible for the debt incurred on the card.

Manage Your Credit Responsibly: Once you are approved for a credit card, use it responsibly. Make timely payments, keep your credit utilization ratio low, and avoid accumulating too much debt. Responsible credit card usage over time can help improve your credit score.

While it may take some time and effort to be approved for a credit card with a 677 credit score, building a positive credit history is an important step in improving your overall financial health.

In the next section, we’ll explore how you can obtain auto financing with a 677 credit score.

Obtain Auto Financing

Getting approved for auto financing with a credit score of 677 is definitely possible, although it may come with certain considerations. Here’s what you can do to increase your chances of obtaining auto financing:

Check your Credit Report: Before applying for auto financing, review your credit report for any errors or discrepancies. Dispute any inaccuracies and ensure that your credit score is an accurate reflection of your credit history.

Save for a Sizeable Down Payment: Saving for a substantial down payment can have a positive impact on your auto financing approval. A larger down payment reduces the amount you need to borrow, which may make lenders more willing to approve your application.

Research Lenders: Research lenders who specialize in working with individuals with fair credit scores. These lenders understand the unique challenges faced by borrowers with lower credit scores and may be more willing to offer financing options.

Consider a Co-Signer: If you’re having difficulty getting approved for auto financing on your own, consider asking a family member or a close friend with a stronger credit history to act as a co-signer. Their creditworthiness can help bolster your application and may allow you to secure better financing terms.

Shop Around for the Best Rates: Don’t settle for the first auto financing offer you receive. Shop around and compare interest rates, loan terms, and repayment options from different lenders. By doing so, you can secure the most favorable financing terms available to you.

Work on Building Credit: Although you may be applying for auto financing now, it’s an excellent opportunity to focus on building a positive credit history. Make timely payments, manage your credit responsibly, and avoid taking on additional debt.

Remember that while obtaining auto financing with a 677 credit score may result in slightly higher interest rates, it’s still a stepping stone towards improving your credit standing. Over time, as you continue to make timely payments and demonstrate responsible credit behavior, you can work towards accessing better financing options in the future.

In the next section, we’ll discuss some tips for managing your 677 credit score effectively.

Improve Your Credit Score

While a credit score of 677 is considered fair, there are steps you can take to improve it over time. Here are some tips to help you raise your credit score:

Make Timely Payments: One of the most significant factors affecting your credit score is your payment history. Be diligent about making all of your payments on time, including credit cards, loans, and other bills. Late payments can have a negative impact on your credit score.

Reduce Credit Utilization: Credit utilization refers to the amount of credit you are using compared to your total credit limits. Aim to keep your credit utilization below 30%. Paying down existing balances and avoiding maxing out your credit cards can have a positive impact on your credit score.

Avoid Opening Too Many New Credit Accounts: Opening multiple new credit accounts within a short period can lower your average account age and raise red flags for lenders. Only open new credit accounts when necessary and be cautious about taking on too much new credit too quickly.

Keep Old Accounts Open: While it may be tempting to close unused credit accounts, keeping them open can actually benefit your credit score. Length of credit history is an important factor, and older accounts can positively contribute to this aspect of your credit profile.

Diversify Your Credit Mix: Having a healthy mix of different types of credit accounts, such as credit cards, loans, and a mortgage, can have a positive impact on your credit score. This demonstrates your ability to manage different types of credit responsibly.

Regularly Monitor Your Credit Report: Check your credit report regularly to ensure its accuracy. Look out for any errors or fraudulent activity that may be impacting your credit score. Dispute any inaccuracies and work towards resolving any issues promptly.

Be Patient and Persistent: Improving your credit score is a gradual process. It takes time and consistent effort. Stick to your responsible credit habits and continue working on your financial goals.

By implementing these strategies consistently, you can raise your credit score and improve your overall financial health. Building a strong credit history allows you to access better financial opportunities and enjoy more favorable terms when borrowing or applying for credit in the future.

In the next section, we’ll provide you with some valuable tips for managing your 677 credit score effectively.

Tips for Managing a 677 Credit Score

Managing a 677 credit score requires diligence, financial responsibility, and a proactive approach. Here are some tips to help you effectively manage your credit score:

Create a Budget: Establish a budget that aligns with your income and financial goals. This will help you prioritize your expenses, make timely payments, and avoid overspending.

Pay Bills on Time: Pay all of your bills, including credit card payments, loans, and utilities, on or before their due dates. Late payments can have a negative impact on your credit score, so make sure to stay organized and set reminders if necessary.

Monitor Your Credit: Regularly monitor your credit report and score to stay aware of changes and potential errors. Consider using credit monitoring services that provide alerts for any suspicious activity or changes to your credit profile.

Reduce Debt: Aim to reduce your overall debt, including credit card balances and outstanding loans. Focus on paying off high-interest debts first and consider debt consolidation strategies if it makes financial sense for your situation.

Avoid Applying for Multiple Credit Cards: While it’s possible to get approved for credit cards with a 677 credit score, avoid opening multiple new credit accounts within a short period. Too many credit inquiries can lower your credit score.

Keep Credit Utilization in Check: Aim to keep your credit card balances low and avoid maxing out your credit limits. High credit utilization can negatively impact your credit score. Consider paying down outstanding balances regularly to keep your utilization ratio low.

Build a Positive Credit History: Show a track record of responsible credit behavior by making payments on time, keeping credit utilization low, and avoiding negative marks on your credit report. Over time, these positive habits will contribute to an improved credit score.

Be Patient: Improving your credit score takes time and consistent effort. Stick to your financial plan, stay disciplined, and avoid taking on unnecessary debt. Gradually, as you demonstrate responsible credit management, your credit score will begin to improve.

Seek Professional Advice if Needed: If you need guidance on improving your credit score or managing your finances, consider consulting with a financial advisor or credit counseling service. They can provide personalized advice based on your unique situation and help you make informed decisions.

Remember, managing a 677 credit score is about taking proactive steps towards improving your financial health and establishing a solid credit foundation. With time, effort, and responsible financial habits, you can work towards achieving a better credit score and enjoying the benefits that come with it.

Let’s conclude the article in the next section.

Conclusion

Managing a credit score of 677 may present some challenges, but it should not discourage you from pursuing your financial goals. While it may not be the highest credit score, a 677 credit score still provides opportunities to access credit, rent an apartment, obtain auto financing, and even qualify for credit cards.

By understanding how credit scores work and taking proactive steps to improve your financial habits, you can gradually raise your credit score over time. Focus on making timely payments, reducing debt, and responsibly managing your credit.

Remember to research lenders, compare options, and seek out financial products specifically designed for individuals with fair credit scores. Additionally, maintaining stability, demonstrating responsibility, and considering alternative options such as secured credit cards or co-signers can help you access the financial opportunities you need.

Building and maintaining a good credit score is a journey that requires patience, persistence, and financial discipline. As you improve your credit score, you’ll open up more doors to better interest rates, higher credit limits, and improved financial opportunities.

Lastly, always monitor your credit report, keep track of changes, and address any errors promptly. Regularly reviewing your credit profile will give you insight into your progress and allow you to respond to any potential issues that may arise.

With a 677 credit score, it’s essential to stay focused on your financial goals and continue working towards improving your credit. By managing your credit responsibly and staying proactive, you can pave the way for a stronger credit score and a brighter financial future.