Finance

What Can You Do With A 620 Credit Score

Published: October 23, 2023

Learn how to manage your finances with a 620 credit score. Discover tips and strategies to improve your credit and achieve financial stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to your financial health, few things are as important as your credit score. Your credit score is a numerical representation of your creditworthiness and plays a significant role in determining your ability to secure loans, obtain credit cards, and even rent an apartment.

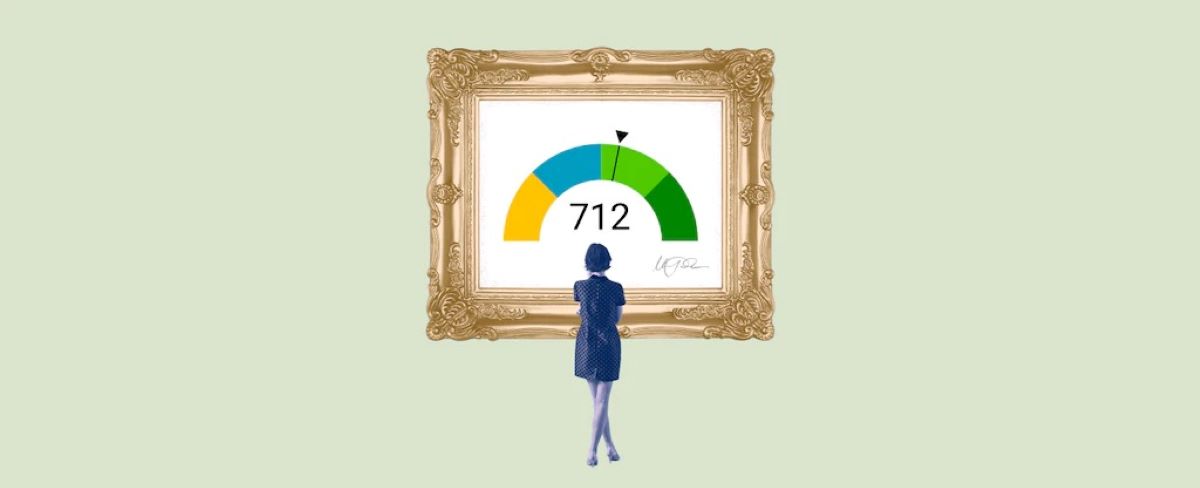

One common credit score that individuals often find themselves with is a score of 620. While it’s not the highest credit score attainable, a 620 credit score doesn’t necessarily mean you’re doomed or locked out from financial opportunities. Understanding what a 620 credit score entails and the potential limitations can help you make informed decisions to improve your financial situation.

In this article, we’ll delve into the details of a 620 credit score, exploring what it means, how it impacts your financial options, and what you can do to improve your score. Whether you’re looking to achieve financial stability, buy a car, or secure a mortgage, understanding the implications of a 620 credit score is essential to make the right financial decisions for your future.

Understanding Credit Scores

Before diving into the specifics of a 620 credit score, it’s crucial to have a basic understanding of credit scores in general. Credit scores are numerical values that lenders use to assess an individual’s creditworthiness. They are based on various factors, including payment history, amounts owed, length of credit history, types of credit used, and new credit accounts.

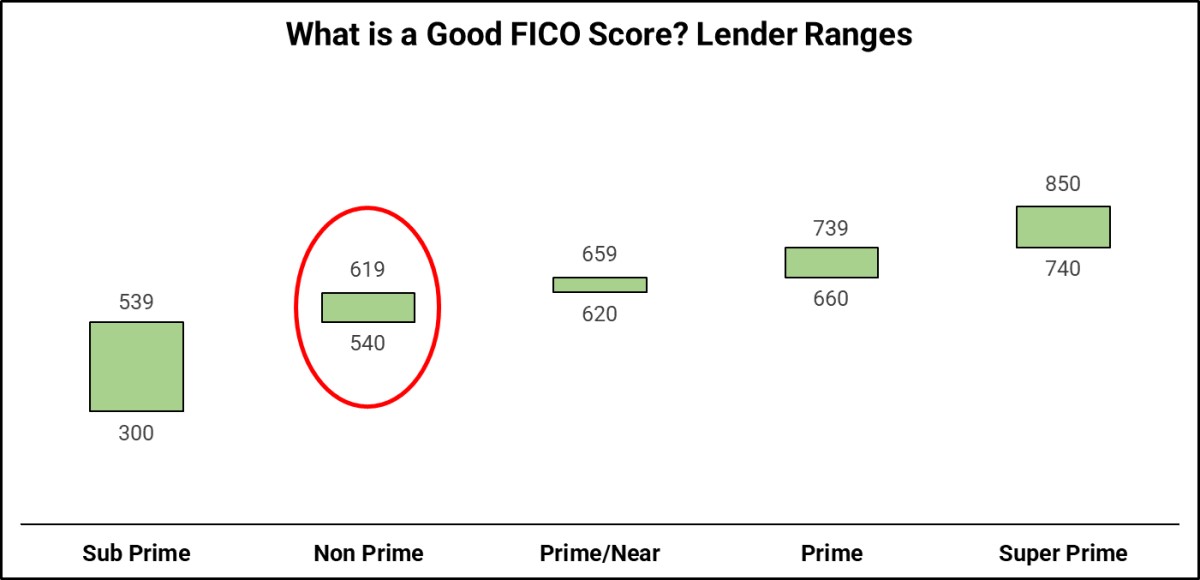

The most commonly used credit score model is the FICO score, which ranges from 300 to 850. A higher credit score indicates a lower credit risk and is more favorable to lenders. Generally, credit scores above 700 are considered good, while scores below 600 are considered poor.

Credit scores enable lenders to evaluate the risk associated with extending credit to individuals. The higher the credit score, the more likely you are to qualify for loans, credit cards, and favorable interest rates. On the other hand, a lower credit score may result in limited financial opportunities and higher interest rates.

It’s important to note that while credit scores follow a similar range, different lenders may have varying criteria and scoring models. So, it’s essential to understand the scoring algorithm used by the lender you are dealing with.

What Does a 620 Credit Score Mean?

A 620 credit score is considered fair, but it falls in the lower range of credit scores. While it may not bar you from accessing credit, it does come with some limitations and challenges. Here’s what a 620 credit score typically indicates:

- Limited Credit Options: With a 620 credit score, you may find it challenging to qualify for certain types of credit, such as low-interest loans or credit cards with attractive rewards. Lenders may view you as a higher-risk borrower and may require a larger down payment or collateral to secure a loan.

- Higher Interest Rates: If you are approved for credit with a 620 credit score, you may encounter higher interest rates. Lenders compensate for the perceived risk by charging higher interest, which can result in increased monthly payments and additional interest costs over time.

- Difficulty Obtaining Traditional Mortgages: A 620 credit score may pose challenges when seeking a traditional mortgage. While not impossible, you may need to explore alternative options, such as government-backed loans or working with specialized lenders who cater to borrowers with lower credit scores.

- Limited Rental Options: Some landlords and property management companies use credit scores to evaluate prospective tenants. With a 620 credit score, you may encounter difficulties renting an apartment or face additional hurdles, such as higher security deposits or stricter leasing requirements.

While a 620 credit score may present obstacles, it’s important to remember that it is not permanent, and there are steps you can take to improve your score and access better financial opportunities. Understanding the factors affecting your credit score is crucial in devising a plan to raise it and achieve financial stability.

Factors Affecting a 620 Credit Score

Several key factors contribute to a credit score of 620. Understanding these factors can help you identify areas where you can improve your credit standing. Here are the main factors that affect a 620 credit score:

- Payment History: Your payment history has a significant impact on your credit score. Late payments, defaults, and accounts sent to collections can all have a negative effect. If you have a 620 credit score, it’s important to demonstrate a consistent record of on-time payments moving forward.

- Amounts Owed: The amount of debt you have compared to your available credit, known as credit utilization, also influences your score. Keeping your credit card balances low and paying off outstanding debts can help improve your credit utilization ratio.

- Length of Credit History: The length of time you’ve had credit accounts is another factor. Having a longer credit history can positively impact your score, so it’s generally beneficial to maintain older accounts in good standing.

- Types of Credit Used: Your credit mix, including credit cards, loans, and mortgages, also plays a role in your credit score. A diverse mix of credit accounts, responsibly managed, can be viewed positively by lenders.

- New Credit Accounts: Opening multiple new credit accounts within a short period can indicate financial instability and may negatively impact your score. It’s important to approach new credit accounts judiciously and only if necessary.

By addressing these factors, such as making timely payments, reducing debt, and maintaining a healthy credit mix, you can improve your credit score over time. It’s important to remember that credit scores are not static and can be improved with consistent and responsible credit behavior.

Can You Get a Mortgage with a 620 Credit Score?

Securing a mortgage with a credit score of 620 is possible, but it can be more challenging compared to borrowers with higher credit scores. Lenders typically consider credit scores as an indicator of an individual’s ability to repay a loan. While a 620 credit score may fall in the fair range, lenders may view it as a higher risk and impose certain limitations.

There are several options you can explore if you want to obtain a mortgage with a 620 credit score:

- Government-Backed Loans: Government-backed loans, such as those offered by the Federal Housing Administration (FHA) or the U.S. Department of Veterans Affairs (VA), often have more flexible credit requirements. These loans may be an option for borrowers with lower credit scores who want to become homeowners.

- Adjusting Loan Terms: Some lenders may be willing to work with borrowers with a 620 credit score by adjusting the terms of the mortgage. This could include a higher interest rate, a larger down payment, or additional documentation to prove financial stability.

- Seeking Assistance: Consulting with a mortgage broker or a housing counseling agency can help you explore potential options and understand what programs or lenders may be more lenient with credit scores.

While it may be possible to obtain a mortgage with a 620 credit score, it’s important to carefully weigh the financial implications. Higher interest rates and less favorable loan terms can significantly impact your monthly payments and the overall cost of homeownership. Additionally, improving your credit score over time can open doors to better mortgage opportunities with lower interest rates and more favorable terms.

Remember, each lender has its own criteria and policies. It’s essential to shop around, compare offers, and consider working with a reputable mortgage professional who can guide you through the process and find the best possible options for your specific situation.

Renting with a 620 Credit Score

When it comes to renting an apartment or a house, many landlords and property management companies use credit scores as a part of their tenant screening process. With a credit score of 620, you may encounter some challenges in the rental market, but it doesn’t make it impossible to find a place to live.

Here are a few things to consider when renting with a 620 credit score:

- Be Honest and Transparent: If you have a lower credit score, it’s important to be upfront and honest with potential landlords. Explain any factors that may have contributed to your credit score and provide additional documentation to demonstrate your financial stability.

- Show Proof of Income: Alongside your credit score, providing proof of a steady income and employment can help reassure landlords that you have the means to pay your rent consistently.

- Offer a Larger Security Deposit: Some landlords may be willing to work with you if you’re willing to provide a larger security deposit. This can give them added reassurance in case of missed payments or damages.

- Find a Cosigner: If your credit score is a significant barrier, you may consider finding a trusted individual with a higher credit score to be a cosigner on the rental agreement. This person assumes responsibility for the rent should you default.

- Search for Alternative Rental Options: Not all landlords or property management companies focus solely on credit scores. Look for independent property owners who may be more flexible in their screening process or consider renting from individuals who value other factors like references or rental history more than credit scores.

Remember that each landlord or property management company has its own policies and criteria for tenant screenings. Even with a lower credit score, by presenting yourself as a responsible tenant, providing additional documentation, and exploring alternative rental options, you can increase your chances of finding a suitable place to live.

Auto Loans with a 620 Credit Score

Obtaining an auto loan with a credit score of 620 is possible, but it may come with some challenges. Lenders consider credit scores as an indicator of a borrower’s creditworthiness, and a lower credit score can result in higher interest rates and more stringent loan terms. However, there are steps you can take to improve your chances of securing an auto loan with a 620 credit score.

Here are some considerations when seeking an auto loan with a 620 credit score:

- Review Your Credit Report: Before applying for an auto loan, review your credit report for any errors or discrepancies. If you find any inaccuracies, dispute them and have them corrected as they can potentially impact your credit score.

- Save for a Down Payment: Having a larger down payment can demonstrate your commitment and reduce the loan amount, making you a more favorable borrower in the eyes of lenders. Saving up and paying a significant down payment can help mitigate the risks associated with a lower credit score.

- Consider Pre-Approval: Getting pre-approved for an auto loan from a lender can give you a clearer understanding of the loan terms and interest rates you may qualify for. By shopping around and comparing offers, you can potentially find more favorable rates despite your credit score.

- Explore Subprime Lenders: Subprime lenders specialize in providing loans to borrowers with lower credit scores. While interest rates may be higher, these lenders may be willing to work with individuals with credit scores as low as 620.

- Focus on Affordable Options: When choosing a vehicle, opt for a reliable but affordable option. A lower-priced car may increase your chances of loan approval and make it easier to manage monthly payments.

- Improve Your Credit Score: While it may not happen overnight, taking steps to improve your credit score can have a positive impact on your auto loan options in the future. Make on-time payments, reduce outstanding debts, and manage your credit responsibly.

While securing an auto loan with a 620 credit score may require extra effort, it’s important to remember that it’s not a permanent situation. By taking proactive steps to improve your credit and working with lenders who specialize in subprime loans, you can still find options available for purchasing a vehicle.

Credit Cards for a 620 Credit Score

Having a credit card can be a valuable tool for building credit and managing your finances, even with a credit score of 620. While it may be more challenging to qualify for certain credit cards with higher credit limits or attractive rewards, there are still credit card options available for individuals with a 620 credit score.

Here are some considerations when looking for credit cards with a 620 credit score:

- Secured Credit Cards: Secured credit cards are designed for individuals with less-than-ideal credit scores. They require a cash deposit as collateral, which becomes your credit limit. Secured cards are a great way to build or rebuild credit as they report your payment history to credit bureaus.

- Retail Store Credit Cards: Some retail stores offer credit cards with more lenient credit requirements. While these cards often have lower credit limits and higher interest rates, they can be a stepping stone towards improving your credit standing.

- Subprime Credit Cards: Subprime credit cards are specifically designed for individuals with lower credit scores. These cards may have higher fees and interest rates, but they can provide an opportunity to rebuild credit when used responsibly.

- Consider Credit Unions: Credit unions are not-for-profit financial institutions that may be more willing to work with individuals with lower credit scores. They often offer credit cards with competitive rates and fees.

- Become an Authorized User: Another option is to become an authorized user on someone else’s credit card account, such as a family member or a trusted friend. This allows you to benefit from their positive credit history and can help improve your own credit score over time.

Regardless of the credit card option you choose, it’s important to use credit responsibly and make timely payments. This is crucial for building credit and improving your credit score in the long run. With consistent responsible credit card usage, you may be able to qualify for better credit card offers and increase your credit limit over time.

Improving a 620 Credit Score

If you have a 620 credit score, the good news is that there are steps you can take to improve it over time. While it may require patience and diligence, improving your credit score can open up more financial opportunities and provide a solid foundation for your future. Here are some strategies to consider:

- Make On-Time Payments: Payment history is one of the most important factors that contribute to your credit score. Make it a priority to pay all of your bills on time, including credit cards, loans, and utility bills. Consistently making on-time payments will demonstrate responsible credit behavior.

- Reduce Debt: Paying down outstanding debts can positively impact your credit score. Focus on reducing high balances on credit cards and other loans. Keeping your credit utilization low, ideally below 30% of your available credit, can improve your credit score.

- Manage Credit Wisely: Avoid excessive credit inquiries and opening new credit accounts, as these can negatively impact your score. Instead, focus on managing the credit you currently have. Use credit cards sparingly and only charge what you can afford to pay off each month.

- Check Your Credit Report: Regularly review your credit report for any errors or inaccuracies. If you find any, dispute them with the respective credit bureau. Correcting these errors can help improve your credit score.

- Build a Positive Credit History: If you have a limited credit history, consider taking steps to build a positive credit history. One way to do this is by becoming an authorized user on someone else’s credit card account or by applying for a secured credit card. Paying on time and building a positive credit history will contribute to improving your credit score.

- Be Patient: Improving your credit score takes time and consistent effort. It’s important to be patient and stay committed to responsible credit behavior. As you consistently demonstrate good credit practices, your score will gradually increase.

Remember, there is no quick fix for improving your credit score. It requires responsible financial management and time to rebuild your credit history. By implementing good credit habits and staying persistent, you can raise your credit score and gain access to better financial opportunities in the future.

Conclusion

Having a credit score of 620 may present some challenges, but it doesn’t mean that you’re without options. Understanding the implications of a 620 credit score and the factors that contribute to it is the first step towards improving your financial situation. While it may take time and effort, there are strategies you can implement to raise your credit score and open up more opportunities.

Whether you’re looking to secure a mortgage, rent an apartment, obtain an auto loan, or get a credit card, there are options available for individuals with a 620 credit score. Exploring government-backed loan programs, working with specialized lenders, and focusing on responsible credit behavior are just a few ways to achieve your financial goals.

Remember, improving your credit score is a journey that requires discipline and patience. By making on-time payments, reducing debt, and managing credit responsibly, you can gradually raise your credit score over time. With persistence, you can move towards a higher credit score and the financial stability you desire.

Lastly, it’s important to continue educating yourself about personal finance and credit management. By learning about credit scores, understanding your credit report, and staying updated on financial best practices, you can maintain good credit habits and continue to improve your financial well-being.

In conclusion, a 620 credit score may not be ideal, but it’s not the end of the road. With determination, smart financial choices, and a long-term perspective, you can improve your credit score and unlock a world of financial possibilities.