Finance

What Can I Do With A 725 Credit Score

Published: October 21, 2023

Discover the possibilities of finance with a 725 credit score. Find out how you can secure loans, qualify for better interest rates, and achieve your financial goals.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Scores

- What is a 725 Credit Score?

- Benefits of a 725 Credit Score

- Managing and Maintaining a 725 Credit Score

- Financial Options with a 725 Credit Score

- Applying for Loans and Credit Cards with a 725 Credit Score

- Renting and Housing Options with a 725 Credit Score

- Employment and Insurance with a 725 Credit Score

- Improving Your Credit Score from 725 to an Excellent Score

- Conclusion

Introduction

Welcome to the world of credit scores! In today’s financial landscape, credit scores play a crucial role in determining our financial well-being. Your credit score reflects your creditworthiness and can have a significant impact on your ability to secure loans, rent an apartment, and even land a job. It is a number that lenders, landlords, and employers use to evaluate your creditworthiness and determine how responsible you are with your finances.

In this article, we will explore the significance of having a 725 credit score. If you find yourself in the range of 725, congratulations, you have achieved a good credit score! A credit score of 725 puts you in a favorable position, giving you access to various financial opportunities. We will delve into the benefits of having a 725 credit score, how to manage and maintain it, and the possibilities that open up to you in terms of loans, housing, employment, and insurance. Additionally, we will provide tips on how to further improve your credit score to reach the pinnacle of creditworthiness.

Keep in mind that credit scores can vary across different scoring models. The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850. The higher your score, the better your creditworthiness.

Now, let’s explore the world of a 725 credit score and discover the opportunities it brings!

Understanding Credit Scores

Before we dive into the specifics of a 725 credit score, let’s take a moment to understand what credit scores are and how they are calculated. A credit score is a numerical representation of your creditworthiness based on various factors such as your credit history, payment history, credit utilization, length of credit history, and types of credit in use.

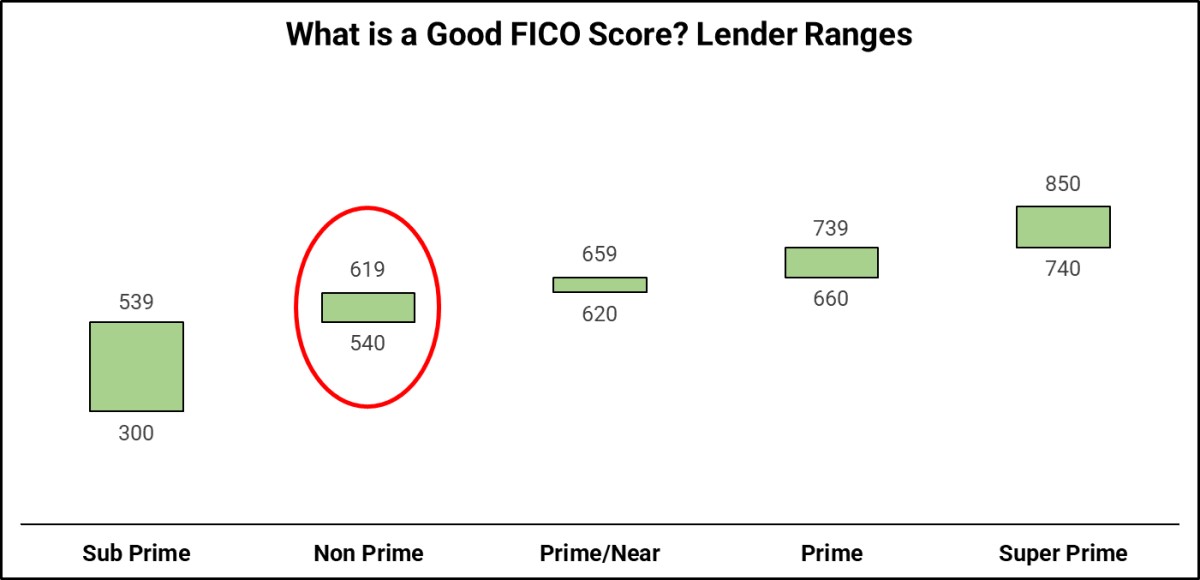

There are different credit scoring models used by lenders and financial institutions, with the most common one being the FICO score. FICO scores range from 300 to 850 and are categorized into different credit score ranges. These ranges include poor, fair, good, very good, and excellent.

A credit score of 725 falls within the “good” range. This means that you have demonstrated responsible financial behavior and are seen as a trustworthy borrower. Lenders generally view a credit score of 725 positively, as it indicates that you are likely to make payments on time and manage your debts responsibly.

It’s important to note that credit scores are not fixed and can change over time. They are influenced by your financial habits, such as making timely payments, keeping credit card balances low, and avoiding negative marks on your credit report, such as late payments or collections.

Understanding the factors that contribute to your credit score is essential in maintaining and improving it. By being aware of how credit scores are calculated, you can take proactive steps to ensure your financial health and achieve a higher credit score in the long run.

Now let’s explore what having a 725 credit score entails and the benefits it brings.

What is a 725 Credit Score?

A 725 credit score is considered a good credit score on the FICO credit scoring model, ranging from 300 to 850. With a score of 725, you are in a favorable position when it comes to borrowing money or engaging in financial transactions.

Having a 725 credit score indicates that you have managed your credit responsibly and have a history of making on-time payments. It shows that you have a good credit utilization ratio, which is the amount of credit you are using compared to your total available credit. A lower credit utilization ratio is seen as positive, as it demonstrates that you are not relying heavily on credit.

With a 725 credit score, you are more likely to be approved for loans, credit cards, and other forms of credit. Lenders consider you to be a reliable borrower and are willing to extend credit to you with favorable terms and interest rates. This means that you have access to a wider range of financial options and can take advantage of better loan terms and credit card rewards.

A credit score of 725 also reflects positively when it comes to other areas of your financial life. Landlords may view you as a responsible tenant and are more likely to approve your rental application. Employers and insurance companies may also consider your credit score as an indicator of responsibility and reliability, potentially influencing your job prospects and insurance premiums.

It’s important to note that while a 725 credit score is considered good, there is still room for improvement. With a few adjustments and continued responsible financial habits, you can work towards achieving an excellent credit score, which typically starts around 750.

Now that we have covered what a 725 credit score represents, let’s explore the specific benefits that come with having this score.

Benefits of a 725 Credit Score

Holding a 725 credit score comes with a variety of financial benefits. Lenders and financial institutions view a credit score of 725 as a sign of responsible credit management, making you an attractive borrower. Here are some of the key benefits you can enjoy with a 725 credit score:

1. Access to Better Interest Rates: With a 725 credit score, you are likely to qualify for loans and credit cards with lower interest rates. Lower interest rates mean less money you’ll pay in interest over time, saving you significant amounts of money on long-term loans such as mortgages or car loans.

2. Increased Credit Card Options: Credit card issuers typically offer a wider selection of credit cards to individuals with good credit scores. These cards often come with better rewards programs, such as cash back or travel rewards, which can help you save money and earn perks on your everyday expenses.

3. Higher Credit Limits: Lenders may be more willing to extend higher credit limits to borrowers with a 725 credit score. This can provide you with more financial flexibility and room for larger purchases or unexpected expenses.

4. Easier Approval for Loans: Whether you are applying for a personal loan, auto loan, or mortgage, having a 725 credit score increases your chances of loan approval. Lenders see you as a lower-risk borrower and are more confident in your ability to repay the loan on time.

5. Better Insurance Premiums: Insurance companies often consider credit scores when determining premiums for auto, home, and even life insurance policies. With a 725 credit score, you are more likely to secure better insurance rates, potentially saving you money in the long run.

6. Rental Opportunities: Landlords frequently conduct credit checks on prospective tenants. Having a 725 credit score gives you an advantage when renting an apartment or house, as it demonstrates your financial responsibility and reliability.

7. Potential Employment Opportunities: Some employers perform credit checks as part of the hiring process, particularly for positions that involve financial responsibilities. A 725 credit score can reflect positively on your character and financial habits, potentially boosting your chances of landing certain job opportunities.

In summary, a 725 credit score opens doors to better interest rates, improved credit card options, higher credit limits, easier loan approvals, favorable insurance premiums, more rental opportunities, and potential employment prospects. However, it’s important to maintain good credit habits to preserve and further enhance your score.

Managing and Maintaining a 725 Credit Score

While achieving a 725 credit score is a great accomplishment, it’s equally important to know how to manage and maintain it. Here are some key strategies to keep your credit score in the optimal range:

1. Pay Your Bills on Time: Timely payment of your credit card bills, loans, and other financial obligations is crucial to maintaining a good credit score. Late payments can negatively impact your score and remain on your credit report for up to seven years.

2. Keep Your Credit Utilization Low: Aim to keep your credit utilization ratio below 30%. This means utilizing only a portion of your total available credit. High credit utilization can indicate financial dependence on credit and may lower your credit score.

3. Diversify Your Credit Mix: Having a healthy mix of credit accounts, such as credit cards, loans, and a mortgage, can positively impact your credit score. It demonstrates your ability to manage different types of credit responsibly.

4. Avoid Opening Too Many Accounts: While having a diverse credit mix is beneficial, it’s important to avoid opening too many credit accounts within a short period. Each new credit application results in a hard inquiry on your credit report, which can temporarily lower your credit score.

5. Regularly Review Your Credit Report: Obtain free copies of your credit report from the three major credit bureaus (Equifax, Experian, and TransUnion) and check for any errors or inaccuracies. Dispute any incorrect information promptly to ensure your credit score is based on accurate data.

6. Limit New Credit Applications: Be cautious when applying for new credit. Each application generates a hard inquiry, which can lower your credit score. Only apply for credit when necessary and compare offers to choose the most favorable terms.

7. Monitor Your Credit: Stay alert to any changes in your credit score or credit report. Many credit monitoring services are available to help you keep track of your credit and detect any suspicious activity or potential identity theft.

8. Maintain a Budget: Establish a budget to manage your finances effectively. By understanding your income and expenses, you can ensure that you have enough funds to meet your financial obligations and avoid relying heavily on credit.

By implementing these strategies, you can effectively manage and maintain your 725 credit score. Remember, maintaining a good credit score is an ongoing process that requires responsible financial habits and consistent monitoring of your credit.

Financial Options with a 725 Credit Score

With a 725 credit score, you have a range of financial options available to you. Lenders consider you as a reliable borrower, opening doors to various financial opportunities. Here are some of the financial options you can explore:

1. Loans: With a 725 credit score, you are eligible for a variety of loans, including personal loans, auto loans, and home loans. Lenders are more likely to approve your loan application and offer you favorable interest rates and terms. Whether you need to consolidate debt, purchase a car, or buy a home, having a good credit score will make the process smoother and more affordable.

2. Credit Cards: A 725 credit score gives you access to a wide array of credit cards. You can choose from options that offer rewards, cashback, or low-interest rates. Credit card issuers are more likely to extend credit with higher limits and more attractive benefits to individuals with good credit scores. Having a credit card also helps you build your credit history further if managed responsibly.

3. Balance Transfer Credit Cards: If you have existing high-interest credit card debt, a 725 credit score makes you eligible for balance transfer credit cards. These cards allow you to transfer balances from higher-interest cards to a new card with low or 0% introductory interest rates. This can help you save money on interest and pay off your debt faster.

4. Refinancing Options: If you have existing loans, such as a mortgage or student loans, a 725 credit score makes it easier to explore refinancing options. Refinancing can potentially lower your interest rates, reduce your monthly payments, or shorten the term of your loan.

5. Personal Lines of Credit: A 725 credit score makes you eligible for personal lines of credit. A personal line of credit functions similarly to a credit card but typically offers lower interest rates. It provides you with a flexible source of funds that you can use for various purposes, such as home improvements, emergencies, or other personal needs.

6. Mortgage Down Payment Assistance Programs: Some mortgage down payment assistance programs require a minimum credit score, and with a 725 credit score, you may qualify for these programs. These initiatives provide financial assistance to homebuyers to help them with down payments and closing costs.

Remember, while a 725 credit score provides you with various financial options, it’s essential to choose credit and loans wisely, keeping in mind your financial capabilities and long-term goals.

Applying for Loans and Credit Cards with a 725 Credit Score

A credit score of 725 puts you in a favorable position when applying for loans and credit cards. Lenders and credit card issuers view you as a responsible borrower, increasing your chances of approval. Here are some key things to keep in mind when applying for loans and credit cards with a 725 credit score:

1. Research and Compare: Before applying for any loan or credit card, it’s important to research and compare various options available to you. Look for lenders or credit card issuers that offer favorable interest rates, rewards, and terms that align with your financial goals.

2. Maintain a Stable Income: Lenders want to ensure that you have a stable source of income to make timely repayments. Having a steady job and a reliable income stream will strengthen your loan or credit card application.

3. Prepare Necessary Documentation: When applying for a loan or credit card, be prepared to provide necessary documentation such as proof of income, identification, and address verification. Having these documents readily available will streamline the application process.

4. Understand the Terms and Conditions: Before signing any loan or credit card agreement, carefully review and understand the terms and conditions. Pay attention to interest rates, fees, repayment terms, and any potential penalties. Make sure the terms align with your financial situation and repayment abilities.

5. Apply Selectively: While having a good credit score increases your chances of approval, it’s essential to apply selectively and avoid submitting multiple applications within a short period. Each credit application generates a hard inquiry on your credit report, which can temporarily impact your credit score.

6. Manage Your Debt-to-Income Ratio: Lenders consider your debt-to-income ratio (DTI) when assessing your loan application. It’s important to manage your DTI by paying down existing debts and keeping your monthly debt obligations within a reasonable range.

7. Use Credit Responsibly: Once approved for a loan or credit card, use credit responsibly. Make timely payments, keep credit card balances low, and avoid taking on excessive debt. Responsible credit usage will help you maintain a good credit score and strengthen your financial profile.

Keep in mind that approval and terms for loans and credit cards ultimately depend on individual lenders and their specific criteria. It’s always wise to shop around, compare offers, and make informed decisions that align with your financial goals and capabilities.

Renting and Housing Options with a 725 Credit Score

Having a credit score of 725 can significantly benefit you when it comes to renting and housing options. Landlords often conduct credit checks to assess the financial responsibility of potential tenants. Here’s what you can expect with a 725 credit score:

1. Increased Approval Opportunities: A 725 credit score puts you in a favorable position to secure rental housing. Landlords perceive a good credit score as a sign of financial responsibility and are more likely to approve your rental application.

2. More Rental Options: With a good credit score, you’ll have access to a wider range of rental properties. Landlords of higher-end or in-demand properties may prefer tenants with good credit scores, giving you more choices in terms of location, amenities, and rental terms.

3. Negotiation Power: A 725 credit score gives you negotiation power when it comes to rental rates and lease terms. Landlords may be more willing to negotiate lower rent or flexible lease terms if they consider you a reliable tenant based on your credit score.

4. Security Deposit Flexibility: Landlords often require a security deposit before moving into a rental property. With a 725 credit score, you may be able to negotiate a lower security deposit or even have it waived altogether, saving you money upfront.

5. Lower Rental Insurance Premiums: Rental insurance is essential for protecting your personal belongings in case of theft, damage, or liability. With a good credit score, insurance companies may offer you lower premiums, resulting in potential savings on your monthly insurance costs.

6. Easier Home Loan Approval: If your long-term goal is to purchase a home, a 725 credit score puts you in a better position for future mortgage approval. A good credit score demonstrates your responsible financial behavior and increases your chances of securing favorable loan terms and interest rates.

Although a good credit score can enhance your rental and housing options, it’s essential to remember that other factors also come into play during the rental application process, such as employment verification, references, and rental history. Therefore, maintaining good overall financial health is crucial for securing the rental or housing option you desire.

Employment and Insurance with a 725 Credit Score

Having a credit score of 725 can positively impact your prospects in terms of employment and insurance. While employers and insurance companies consider various factors in their decision-making process, a good credit score can contribute to favorable outcomes in these areas:

1. Employment Opportunities: Some employers conduct credit checks as part of the hiring process, particularly for positions that involve financial responsibilities or access to sensitive information. A 725 credit score reflects positively on your financial habits and responsibility. It can enhance your credibility and increase your chances of being considered for job opportunities that require a good credit standing.

2. Job Stability: Employers may view individuals with good credit scores as more stable and reliable. A solid credit score can indicate your ability to manage your personal finances effectively, which employers may see as a positive indicator of your organizational skills and attention to detail.

3. Insurance Premiums: When determining insurance premiums, insurers often consider credit scores as a factor in assessing risk. With a 725 credit score, you may qualify for lower insurance premiums. Insurance companies view good credit as a sign of responsibility, translating to potentially lower rates for auto, home, or renters insurance.

4. More Favorable Insurance Terms: In addition to lower premiums, a good credit score can also lead to more favorable terms and conditions for your insurance policies. Insurance companies may offer higher coverage limits or additional benefits based on your creditworthiness.

5. Eligibility for Bundled Policies: Insurance providers frequently offer discounted rates for bundling multiple policies together, such as combining home and auto insurance. With a good credit score, you are more likely to be eligible for these bundled options, which can result in significant savings on your overall insurance costs.

6. Enhanced Trust and Negotiation Power: A positive credit score can instill confidence in insurers and employers regarding your financial responsibility. This trust may provide you with more leverage when negotiating employment packages or insurance coverage.

While a good credit score can positively influence employment and insurance outcomes, it’s important to note that other factors also come into play. Employment history, qualifications, and experience remain significant in the hiring process, while insurance companies assess other risk factors beyond credit scores. Nonetheless, maintaining a good credit score can contribute to favorable opportunities in these areas.

Improving Your Credit Score from 725 to an Excellent Score

While a credit score of 725 is considered good, you may aspire to reach an excellent credit score to take full advantage of the benefits it offers. Here are some strategies to help you improve your credit score from 725 to an excellent score:

1. Pay On Time, Every Time: Timely payment of your bills is crucial for maintaining and improving your credit score. Set up automatic payments or reminders to ensure you never miss a payment, as payment history has a significant impact on your credit score.

2. Reduce Your Credit Utilization: Aim to keep your credit card balances low and avoid maxing out your credit limits. Keeping your credit utilization ratio below 30% demonstrates responsible credit management and can positively affect your credit score.

3. Avoid Opening Too Many New Accounts: While having a diverse credit mix is beneficial, opening too many new accounts within a short period can negatively impact your credit score. Limit new credit applications and space them out over time.

4. Regularly Monitor Your Credit: Keep a close eye on your credit report for any errors, discrepancies, or signs of identity theft. You can request free copies of your credit report from the major credit bureaus once a year. Promptly address any issues to ensure the accuracy of your credit information.

5. Maintain a Mix of Credit Types: Having a healthy mix of credit accounts, including credit cards, installment loans, and a mortgage, can positively impact your credit score. However, only open accounts that you need and can manage responsibly.

6. Pay Off Debt Strategically: Focus on paying off high-interest debts first while making minimum payments on other debts. This approach can save you money on interest payments and reduce your overall debt burden.

7. Keep Old Accounts Open: Closing old accounts can potentially shorten your credit history, which may negatively impact your credit score. Instead, keep those accounts open, even if you don’t actively use them, to maintain a longer credit history.

8. Limit Credit Inquiries: Be cautious about applying for new credit. Each credit application results in a hard inquiry on your credit report, which can temporarily lower your credit score. Apply for credit only when necessary and do your research beforehand.

Improving your credit score takes time and dedication to responsible financial habits. By following these strategies consistently, you can gradually improve your credit score from 725 to an excellent score and enjoy the benefits that come with it.

Conclusion

Having a credit score of 725 provides you with numerous financial opportunities. It reflects responsible credit management and enhances your chances of securing loans, obtaining favorable interest rates, renting an apartment, and even landing certain job opportunities. However, the journey doesn’t end at a good credit score of 725. To reap the maximum benefits, it’s important to continue practicing good financial habits and work toward achieving an excellent credit score.

Maintaining a good credit score requires consistent on-time payments, responsible credit utilization, and a diverse credit mix. Regularly monitoring your credit report, minimizing new credit applications, and managing your debt are also vital steps in improving and maintaining a strong credit profile.

Remember that building an excellent credit score is a marathon, not a sprint. Consistency and patience are key. As you continue to demonstrate financial responsibility and maintain good credit habits, you will inch closer to an excellent credit score, which opens doors to even more favorable financial opportunities.

Whether you’re looking to apply for loans, credit cards, housing, or insurance, having a 725 credit score puts you in a favorable position. By leveraging the benefits and opportunities that come with a good credit score, you can enhance your financial well-being and pave the way for a brighter future.

So keep managing your credit responsibly, stay informed about the factors that affect your credit score, and continue striving for financial success. With dedication and the right financial habits, you’re on your way to achieving not just a good credit score, but an excellent one.