Finance

What Capital Structure To Use In WACC

Modified: December 30, 2023

Discover the optimal capital structure for your business and understand its impact on the weighted average cost of capital (WACC). Learn how to make informed financial decisions in our comprehensive finance guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to finance, finding the optimal capital structure is a crucial aspect of managing a company’s financial health. The capital structure refers to the mix of debt and equity that a company uses to fund its operations. Understanding the concept of weighted average cost of capital (WACC) is essential in determining the best capital structure for achieving financial efficiency and maximizing shareholder value.

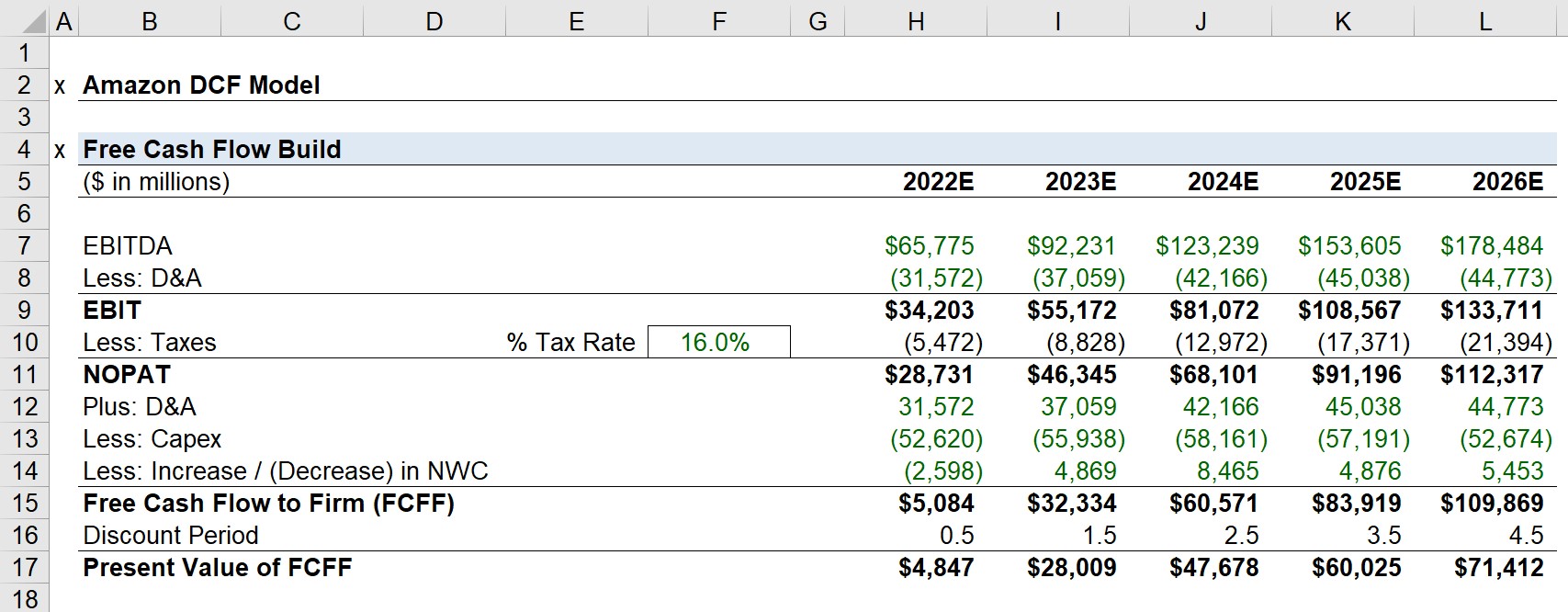

WACC is a financial metric that calculates the average rate of return a company needs to generate to satisfy both its debt and equity investors. It represents the average cost of financing a company’s operations and is often used as a benchmark for assessing the profitability of investments.

The capital structure plays a significant role in determining WACC, as it directly influences a company’s cost of capital. Debt financing typically comes with lower costs compared to equity financing due to the tax advantages associated with interest payments. On the other hand, equity financing provides ownership in the company and carries higher costs due to the expectation of future returns.

Choosing the right capital structure for WACC involves carefully considering various factors, such as industry norms, company size, growth prospects, risk tolerance, and market conditions. The decision should aim to strike a balance between minimizing costs and ensuring adequate financing to support business operations.

In this article, we will delve deeper into the importance of capital structure in WACC and discuss the factors that influence the choice of capital structure. We will also explore how to evaluate the debt-to-equity ratio and determine the optimal capital structure for WACC. Additionally, we will examine the impact of capital structure on WACC through real-life case studies. By the end of this article, you will have a better understanding of the crucial role that capital structure plays in financial management and how it affects a company’s WACC.

Understanding WACC

Weighted average cost of capital (WACC) is a financial metric used to determine the average cost of capital of a company. It takes into account the proportion of debt and equity financing used by the company and calculates the weighted average of the cost of each component.

WACC is a critical measure for companies as it represents the minimum return on investment required to satisfy both its debt and equity investors. It is used as a benchmark to evaluate the feasibility of potential investment projects and can help determine the attractiveness of different financing options.

The calculation of WACC involves determining the cost of debt, cost of equity, and the respective weights of each component. The cost of debt is the interest rate or coupon rate that a company pays on its outstanding debt. It is relatively straightforward to calculate, as it is directly tied to the interest payments made by the company.

The cost of equity, on the other hand, is more complex to measure. It represents the return expected by investors who provide equity financing to the company. The cost of equity takes into account factors such as the company’s risk profile, market conditions, and the required rate of return based on similar investments in the market.

Once the cost of debt and equity are determined, they are weighted by the proportion of debt and equity in the company’s capital structure. The weights are calculated based on the market value of debt and equity, reflecting their respective contributions to the overall financing of the company.

By calculating the weighted average cost of debt and equity, the WACC provides an indication of the minimum return that needs to be generated by the company’s investments to meet the expectations of both debt and equity investors.

It is important to note that WACC is used as a hurdle rate for investment decisions rather than an actual cost of financing. Companies aim to generate returns on their investments that exceed the WACC to create value for shareholders and to ensure the company’s long-term financial stability.

Understanding WACC is crucial for financial decision-making, as it assists in evaluating the profitability and feasibility of investment opportunities. By comparing the expected return on investment with the WACC, companies can assess whether a project will create value and enhance shareholder wealth.

In the next section, we will explore the importance of capital structure in WACC and how it impacts a company’s cost of capital.

Importance of Capital Structure in WACC

The capital structure of a company plays a crucial role in determining its weighted average cost of capital (WACC). A well-balanced and optimized capital structure can significantly impact a company’s cost of capital and, ultimately, its financial performance and value for shareholders.

The capital structure determines the mix of debt and equity used to finance a company’s operations. Debt financing involves borrowing funds from external sources, such as banks or bondholders, while equity financing involves raising capital from shareholders through the issuance of stocks or equity instruments.

The main goal of optimizing the capital structure is to minimize the cost of capital while ensuring adequate funding to support company operations, growth, and investment opportunities.

There are several key reasons why capital structure holds importance in WACC:

- Cost of Capital: The primary reason for considering capital structure in WACC is to determine the overall cost of capital for the company. The proportion of debt and equity in the capital structure directly impacts the cost of debt and equity components. By selecting an appropriate capital structure, a company can achieve a lower WACC, reducing the overall costs associated with financing its operations.

- Tax Advantage of Debt: Debt financing often comes with tax advantages due to the deductibility of interest payments. Interest expenses associated with debt are tax-deductible, reducing the overall tax liability of the company. This tax shield effectively lowers the cost of debt and can help achieve a lower WACC.

- Flexibility and Financial Stability: The capital structure affects a company’s financial flexibility and stability. A well-structured capital mix can provide the right balance between debt and equity, allowing the company to access funding from various sources and adapt to changing market conditions. It can also help maintain a healthy financial position and avoid excessive dependence on a single form of financing.

- Investor Perception and Risk: Investors and stakeholders evaluate a company’s capital structure as it reflects its risk profile. Too much debt can signal financial distress and increase the perceived riskiness of the company’s operations. On the other hand, a more equity-focused capital structure can instill investor confidence and enhance the company’s access to capital markets. The capital structure directly influences investor perception and plays a vital role in shaping the company’s valuation and cost of capital.

By carefully considering the importance of capital structure in WACC, companies can make informed decisions about their financing mix. Striking the right balance between debt and equity can result in a lower cost of capital and create a solid foundation for sustainable growth and value creation.

In the next section, we will explore the factors that influence the choice of capital structure and how to evaluate the debt-to-equity ratio for WACC optimization.

Factors Affecting Capital Structure

The choice of capital structure is influenced by various factors that impact a company’s financial decisions and overall risk profile. These factors play a crucial role in determining the optimal mix of debt and equity in the capital structure, which in turn affects the weighted average cost of capital (WACC).

Let’s explore some of the key factors that influence the choice of capital structure:

- Industry Norms: Different industries have varying capital structure norms and practices. For example, capital-intensive industries such as manufacturing or infrastructure may rely more heavily on debt financing due to the large upfront investment requirements. Understanding industry-specific expectations and benchmarks can help companies establish an appropriate capital structure that aligns with industry practices.

- Company Size: The size of a company can impact its capital structure decisions. Smaller companies with limited access to capital markets may rely more on debt financing to meet their funding needs. On the other hand, larger established companies may have more flexibility and access to equity financing options. The company size determines the availability and affordability of different financing alternatives.

- Growth Prospects: Companies with high growth potential often require significant investment in research and development, infrastructure, or market expansion. These companies may choose to have a higher proportion of equity financing to support their growth initiatives, as equity financing typically provides greater financial flexibility and lower risk of financial distress compared to excessive debt.

- Risk Profile: The risk appetite of a company influences its capital structure decisions. Companies that operate in stable industries with predictable cash flows and lower risk may opt for higher levels of debt financing to benefit from the tax advantages and lower cost of debt. However, companies operating in volatile or cyclical industries may opt for a more conservative approach with a lower debt-to-equity ratio to mitigate the risk of financial distress.

- Market Conditions: The prevailing market conditions, such as interest rates and investor sentiment, can impact a company’s capital structure decisions. Lower interest rates may make debt financing more attractive, while higher interest rates can increase the cost of debt and prompt companies to seek alternative financing options. Investor sentiment and the availability of equity capital also influence the feasibility and cost of equity financing.

These are just some of the key factors that companies consider when making capital structure decisions. It’s important to note that each company’s situation is unique, and the optimal capital structure will depend on its specific circumstances.

In the next section, we will discuss how to evaluate the debt-to-equity ratio, a crucial aspect in determining the capital structure for WACC optimization.

Evaluating Debt-to-Equity Ratio

The debt-to-equity ratio is a critical parameter in evaluating the capital structure of a company. It represents the proportion of debt and equity financing used to fund the company’s operations and investments. By assessing the debt-to-equity ratio, companies can determine the appropriate level of leverage in their capital structure and optimize their weighted average cost of capital (WACC).

The debt-to-equity ratio is calculated by dividing the total debt of a company by its total equity. Debt includes both short-term and long-term liabilities, such as bank loans, bonds, and other forms of borrowing. Equity represents the ownership interest and includes common stock, preferred stock, and retained earnings.

The debt-to-equity ratio provides insights into the financial risk and solvency of a company. A high debt-to-equity ratio indicates that the company relies more on debt financing, which can increase the risk of financial distress, especially if the company is unable to meet its debt obligations. On the other hand, a low debt-to-equity ratio suggests a more conservative financing approach with a higher proportion of equity, which reduces the risk of financial distress but may limit the company’s leverage and growth potential.

Companies evaluate the debt-to-equity ratio in the context of several factors:

- Industry Standards: Each industry has its own benchmarks and norms for debt-to-equity ratios. Companies compare their ratios to industry averages to assess whether they are in line with the industry practices or deviating significantly.

- Financial Stability: Companies need to evaluate their ability to meet their debt obligations and maintain financial stability. A high debt-to-equity ratio may put the company at risk if it faces economic downturns or cash flow disruptions. Assessing the company’s profitability, cash flow generation, and liquidity is crucial in determining an appropriate debt-to-equity ratio.

- Tax Shield Benefits: Debt financing offers tax advantages as interest payments are tax-deductible. Companies consider the potential tax shield benefits when evaluating the debt-to-equity ratio. However, it’s important to strike a balance between maximizing tax benefits and avoiding excessive debt that may outweigh the tax advantages.

- Risk Appetite: Companies should assess their risk appetite and tolerance when determining their debt-to-equity ratio. The optimal ratio depends on factors such as the industry dynamics, market conditions, and the company’s financial position and growth plans.

- Investor Perception: Investor perception and access to capital markets can also influence the debt-to-equity ratio. A company with a high proportion of equity financing may be perceived as less risky by investors, which can improve its ability to raise capital and access financing options.

Evaluating the debt-to-equity ratio is a key step in determining the optimal capital structure for a company. By analyzing industry norms, financial stability, tax benefits, risk appetite, and investor perception, companies can strike the right balance between debt and equity financing to achieve an optimal WACC and ensure sustainable financial performance.

In the next section, we will explore the concept of optimal capital structure for WACC optimization.

Optimal Capital Structure for WACC

The optimal capital structure refers to the ideal mix of debt and equity financing that minimizes the weighted average cost of capital (WACC) and maximizes the value of a company. Establishing the appropriate capital structure is crucial for financial management, as it directly impacts a company’s cost of capital and its ability to generate returns for shareholders.

Determining the optimal capital structure involves weighing the advantages and disadvantages of debt and equity financing, considering the specific circumstances of the company. Although there is no one-size-fits-all approach, several considerations can guide companies in finding their optimal capital structure:

- Financial Stability: Companies should maintain a capital structure that provides financial stability and avoids excessive leverage. Striking a balance between debt and equity ensures the company can meet its debt obligations while minimizing the risk of financial distress.

- Cost of Capital: The goal of an optimal capital structure is to minimize the WACC. Companies need to evaluate the cost of debt and equity and determine the appropriate mix that achieves the lowest overall cost of capital. This may involve considering the tax advantages of debt financing, the cost of issuing equity, and the risk and return expectations of investors.

- Flexibility and Growth: A flexible capital structure allows a company to adapt to changing market conditions and seize growth opportunities. An optimal capital structure provides access to different financing options, enabling the company to raise funds when needed and support its expansion plans.

- Industry Considerations: Different industries have varying capital structure norms and requirements. Companies should consider industry benchmarks and practices when determining their optimal capital structure, as industry dynamics and risk profiles can significantly influence financing decisions.

- Investor Perception: The capital structure can impact how investors perceive the company’s risk and value. A well-balanced mix of debt and equity financing can instill investor confidence and enhance the company’s access to capital markets.

- Competitive Advantage: The optimal capital structure should align with the company’s competitive advantage and business model. For example, a technology startup with high growth potential may opt for equity financing to maintain flexibility and attract investors, while a stable utility company may employ a higher proportion of debt financing due to stable cash flows and low business risks.

Finding the optimal capital structure requires a careful evaluation of these factors and a deep understanding of the company’s financial position, future growth plans, risk appetite, and market conditions. It is an iterative process that may require adjustments over time as the company evolves.

However, it is important to note that even with an optimal capital structure, external factors such as changes in interest rates, economic conditions, or industry disruptions can impact the cost of capital and the overall financial health of a company.

By striving to establish the optimal capital structure, companies can achieve a competitive advantage, enhance their financial stability, and maximize value for their shareholders.

In the next section, we will discuss the impact of capital structure on WACC and its implications for a company’s financial performance.

Impact of Capital Structure on WACC

The capital structure of a company has a significant impact on its weighted average cost of capital (WACC), which is a key financial metric used to assess the profitability and investment potential of a company. Understanding the relationship between capital structure and WACC is essential for effective financial management and decision-making.

Here are the key impacts of capital structure on WACC:

- Cost of Debt: The use of debt financing in the capital structure directly affects the cost of debt component of WACC. Debt typically comes with lower costs compared to equity financing, as interest payments are tax-deductible. By increasing the proportion of debt in the capital structure, companies can potentially reduce their overall cost of capital.

- Cost of Equity: The cost of equity is influenced by the risks associated with the company’s operations and the returns expected by equity investors. The use of equity financing, such as issuing shares or equity instruments, increases the cost of equity component in WACC. This is because equity investors expect higher returns to compensate for the higher risk and the absence of tax advantages associated with equity financing.

- Optimal Balance: Finding the optimal balance between debt and equity is critical to achieving the lowest possible WACC. Companies aim to minimize the overall cost of capital by considering the tax advantages of debt, the cost of equity, and the specific risk profile and financial stability of the company. The right mix of debt and equity can allow the company to leverage low-cost debt while maintaining a healthy level of equity to instill investor confidence and minimize risk.

- Financial Risk: The capital structure impacts a company’s financial risk. Higher levels of debt increase the financial risk, as companies have fixed debt obligations that need to be met. Excessive debt and a high debt-to-equity ratio can raise concerns for lenders, investors, and credit rating agencies, leading to increased borrowing costs and limiting the company’s access to funding. This can result in a higher cost of capital and negatively impact WACC.

- Market Perception: The capital structure can influence how investors perceive the company’s risk and value. Companies with a conservative capital structure, characterized by lower leverage and higher equity proportions, may be regarded as less risky, potentially leading to a lower cost of capital. Conversely, a capital structure heavily reliant on debt may be seen as riskier, resulting in higher borrowing costs and a higher cost of capital.

It is important for companies to regularly assess and optimize their capital structure to achieve an efficient WACC. This involves considering factors such as industry practices, financial stability, risk appetite, and investor perception. Striking the right balance between debt and equity financing is essential for minimizing the overall cost of capital and maximizing value for shareholders.

In the next section, we will explore real-life case studies to illustrate the impact of capital structure on WACC and financial performance.

Case Studies on Capital Structure and WACC

Examining real-life case studies can provide valuable insights into the impact of capital structure on the weighted average cost of capital (WACC) and its implications for a company’s financial performance. Let’s explore a couple of examples:

- Case Study 1: Technology Start-up

- Case Study 2: Utility Company

In this case study, let’s consider a technology start-up that operates in a highly competitive and rapidly evolving industry. Due to the nature of the business, the company has high growth prospects but limited cash flow in the initial stages.

In the early stages, the start-up decides to focus on equity financing to attract potential investors who are willing to take on high-risk investments in return for significant returns. This equity financing helps the company maintain financial flexibility and pursue its aggressive growth strategies without the burden of excessive debt obligations.

As the company establishes itself and achieves initial success, it seeks to expand its operations and invest in new research and development projects. At this stage, the start-up might consider incorporating debt financing into its capital structure. With a proven track record and growing cash flows, the start-up can access debt markets at lower interest rates, reducing its overall cost of capital.

This case study demonstrates how a technology start-up can strategically use equity financing initially for rapid growth and transition to a balanced capital structure with a mix of debt and equity as it matures and improves its financial position.

Let’s consider a utility company that operates in a stable and regulated industry with predictable cash flows. The company has a strong market position and a history of steady income generation.

Due to the stable cash flows and low business risk associated with the industry, the utility company can comfortably rely on debt financing for its capital structure. With a high debt-to-equity ratio, the company benefits from the tax advantages of interest payments and can achieve a lower cost of capital.

This case study highlights how companies in stable industries with consistent cash flows often maintain high debt levels to take advantage of the tax shield benefits associated with debt financing. By optimizing their capital structure, they can achieve a lower WACC and enhance their financial performance.

These case studies demonstrate the importance of considering industry dynamics, growth prospects, cash flow positions, and risk profiles when determining the optimal capital structure. Successful companies strategically assess and adjust their capital structure over time to align with their specific circumstances, ensuring competitiveness, financial stability, and value creation.

In the final section, we will conclude our discussion on the significance of capital structure in WACC optimization.

Conclusion

The capital structure of a company plays a crucial role in determining its weighted average cost of capital (WACC) and overall financial health. By finding the optimal mix of debt and equity financing, companies can minimize their cost of capital, maximize shareholder value, and ensure long-term sustainability.

Understanding the importance of capital structure and its impact on WACC is key to effective financial management. Companies must consider several factors when evaluating their capital structure, including industry norms, company size, growth prospects, risk tolerance, and market conditions.

Evaluating the debt-to-equity ratio is a critical step in determining the appropriate capital structure. This ratio helps assess the level of leverage and financial stability of a company, considering factors such as industry standards, financial position, tax advantages, risk appetite, and investor perception.

By optimizing their capital structure, companies can achieve a lower WACC and reduce their overall cost of capital. This involves striking the right balance between debt and equity financing, ensuring access to funding, maintaining financial stability, and aligning with industry benchmarks and investor expectations.

Real-life case studies demonstrate how different companies strategically approach their capital structure decisions based on their specific circumstances, industry dynamics, and growth plans. Whether it’s a technology start-up focusing on equity financing for rapid growth, or a utility company leveraging debt financing for stable cash flows, companies can tailor their capital structure to support their unique needs.

In conclusion, the capital structure significantly impacts a company’s financial performance and value creation. By carefully considering the factors influencing capital structure choices and optimizing the debt-to-equity ratio, businesses can effectively manage their cost of capital and position themselves for long-term success.

Ultimately, the goal is to establish an optimal capital structure that maximizes the company’s financial flexibility, minimizes risk, and enhances the potential for growth and profitability, all while maintaining the confidence and trust of investors.