Home>Finance>How Do Credit Card Companies Make Money If You Pay In Full

Finance

How Do Credit Card Companies Make Money If You Pay In Full

Modified: March 1, 2024

Discover how credit card companies profit from customers who pay their balance in full, explore the intricacies of finance behind this industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Credit card companies play a significant role in the financial ecosystem, providing consumers with convenient access to credit and enabling them to make purchases without carrying cash. While it may seem counterintuitive, credit card companies can still make money even if customers pay their balances in full each month. How exactly do they do it? In this article, we will delve into the various ways credit card companies generate revenue.

Understanding how credit card companies make money is essential for consumers to make informed decisions when managing their finances. By understanding the different revenue streams utilized by credit card companies, individuals can select the right credit card for their needs and use it responsibly.

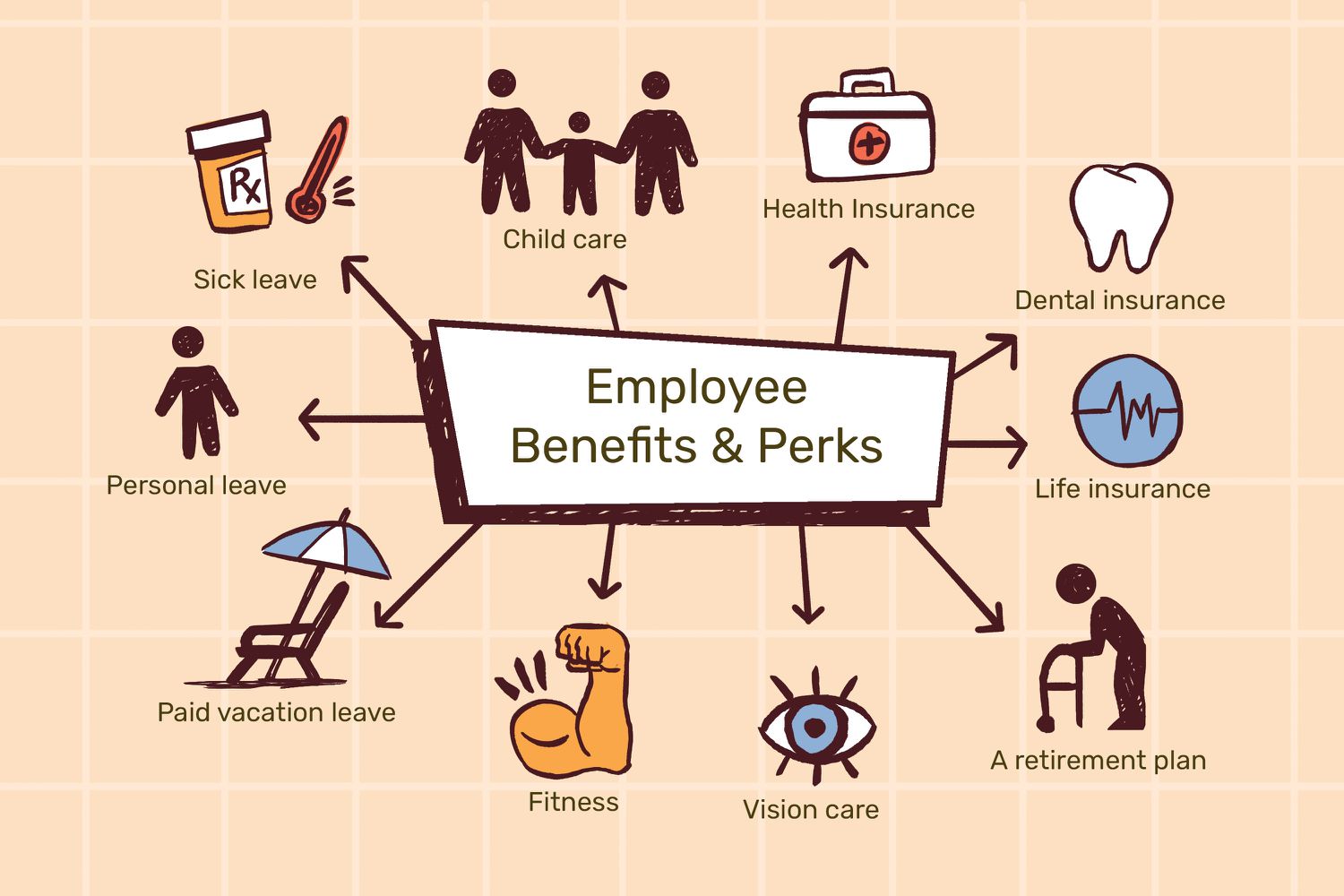

From interest rates to annual fees, merchant fees, and cashback programs, credit card companies employ several strategies to generate revenue. By examining these avenues, we can gain a better understanding of the underlying mechanisms that contribute to the profitability of credit card companies.

So, how exactly do credit card companies manage to make money even when customers pay off their balances each month? Let’s delve into the various revenue streams that allow credit card companies to stay profitable in the highly competitive financial industry.

Understanding Credit Card Companies

Credit card companies are financial institutions that issue credit cards to consumers and facilitate electronic transactions. They act as intermediaries between consumers, merchants, and banks, providing a convenient method of payment for everyday purchases. These companies make money by charging fees and interest on balances carried by cardholders.

One of the primary ways credit card companies generate revenue is through the interest rates they charge on outstanding balances. When cardholders carry a balance from one billing cycle to the next, they are charged interest on the amount owed. The interest rates can vary based on factors such as the cardholder’s creditworthiness and the type of card. This interest income is a significant revenue source for credit card companies.

In addition to interest income, credit card companies also earn revenue through annual fees and other charges. Some credit cards have an annual fee that cardholders must pay for the privilege of using the card. This fee contributes to the company’s profitability, especially for cards that offer premium benefits or rewards programs. Credit card companies may also charge fees for certain transactions, such as cash advances or balance transfers, adding to their overall revenue stream.

Another source of income for credit card companies is merchant fees. Merchants, or businesses that accept credit card payments, pay a percentage of each transaction to the credit card company as a fee. This fee, known as an interchange fee or merchant discount fee, helps cover the costs associated with processing payments and maintaining the infrastructure required for electronic transactions. The merchant fee can vary depending on factors such as the type of card, the transaction amount, and the merchant’s industry.

Credit card companies also generate revenue through rewards and cashback programs. To encourage card usage and customer loyalty, many credit cards offer various rewards, such as cashback, points, or airline miles. These rewards are funded by the interchange fees paid by merchants. While the rewards may entice cardholders to spend more, credit card companies benefit from increased transaction volume and the possibility of cardholders carrying a balance and incurring interest charges.

It is important for consumers to understand that credit card companies derive a significant portion of their revenue from customers who carry a balance and pay interest. While paying off the balance in full each month can be financially advantageous for the cardholder, it reduces the interest income for the credit card company. However, it is worth noting that responsible credit card usage can still provide benefits to the cardholder, such as rewards and improved credit scores.

Overall, credit card companies employ various revenue streams to make money, including interest rates, annual fees, merchant fees, and rewards programs. By understanding these sources of income, consumers can make informed decisions when selecting and using credit cards, ensuring that they align with their financial goals and needs while minimizing any unnecessary fees or charges.

The Role of Interest Rates

Interest rates play a crucial role in the revenue generation of credit card companies. When cardholders carry a balance from one billing cycle to the next, they are charged interest on the outstanding amount. These interest charges can significantly contribute to credit card companies’ profitability.

Interest rates on credit cards can vary based on factors such as the cardholder’s creditworthiness, the type of card, and prevailing market conditions. Credit card companies typically offer different interest rate tiers, with lower rates for individuals with excellent credit scores and higher rates for those with lower credit scores.

For cardholders who carry a balance, credit card companies apply interest charges to any unpaid amount after the due date. These charges are typically expressed as an annual percentage rate (APR) but are applied monthly to the outstanding balance. The higher the APR, the more interest cardholders will pay if they carry a balance over time.

It’s important for cardholders to understand the impact of interest rates on their credit card balances. The longer a balance is carried, the more interest accrues, potentially leading to a significant increase in the total amount owed. This is why financial advisors often advise paying off credit card balances in full each month to avoid interest charges and minimize debt accumulation.

From the perspective of credit card companies, interest rates are a key revenue source. The interest charges levied on balances help offset the risk of extending credit to cardholders and cover the operational costs associated with maintaining credit card programs. By collecting interest, credit card companies can generate substantial income, especially if a significant portion of their customers carry a balance.

It’s worth noting that credit card companies typically offer an interest-free grace period for cardholders who pay their balances in full by the due date. This grace period usually lasts between 21 and 25 days, depending on the card issuer. During this period, cardholders are not charged any interest on new purchases. However, if the balance is not paid in full by the due date, interest charges will be applied retroactively to the date of purchase.

Understanding the role of interest rates is crucial for cardholders. It allows for better financial planning and helps individuals make informed decisions. By keeping balances low and paying them off in a timely manner, cardholders can minimize interest charges and reduce their overall debt burden. On the other hand, credit card companies rely on interest income to sustain their operations and profitability.

Annual Fees and Other Charges

In addition to interest rates, credit card companies generate revenue through annual fees and other charges imposed on cardholders. While not all credit cards have annual fees, those that do contribute to the profitability of credit card companies.

An annual fee is a predetermined amount that cardholders must pay each year for the privilege of using a particular credit card. The fee can vary widely depending on the type of card and the benefits it offers. Premium or elite credit cards often come with higher annual fees due to their enhanced rewards programs, exclusive perks, and personalized customer service.

Annual fees serve as a way for credit card companies to offset the costs associated with maintaining and administering credit card programs. These costs include customer support services, card production, marketing, and technology infrastructure. The more premium the card and the more benefits it provides, the higher the annual fee typically charged.

While annual fees may seem like an added expense for cardholders, they can often be justified by the benefits and rewards that accompany the card. For example, a premium travel credit card may offer access to airport lounges, travel insurance, and generous rewards for airfare and hotel stays. In such cases, the value of the perks and rewards can outweigh the annual fee, making it worthwhile for frequent travelers.

Aside from annual fees, credit card companies can also generate revenue through other charges and fees. These charges may include balance transfer fees, cash advance fees, foreign transaction fees, and late payment fees. Each of these fees is designed to recover costs or discourage certain behaviors.

Balance transfer fees are typically charged when cardholders transfer balances from one credit card to another. This fee is usually a percentage of the transferred amount and helps cover the administrative costs associated with processing the transfer.

Cash advance fees are charged when cardholders use their credit cards to withdraw cash from an ATM or obtain cash-like transactions. These fees can be a flat fee or a percentage of the cash advance amount and are meant to offset the higher risk and processing costs associated with cash transactions.

Foreign transaction fees are charged when cardholders use their credit cards for purchases made outside their home country. These fees help cover the additional costs of currency conversion and payment processing in different jurisdictions.

Late payment fees are applied when cardholders fail to make the minimum payment by the due date. These fees not only serve as a deterrent for late payments but also generate revenue for credit card companies.

While the assortment of fees and charges may seem overwhelming, it is important for cardholders to understand them to make informed financial decisions. By being aware of the potential fees associated with their credit cards and practicing responsible financial management, cardholders can avoid unnecessary charges and keep their credit card usage cost-effective.

Merchant Fees and Transaction Fees

Merchant fees and transaction fees are another significant source of revenue for credit card companies. When consumers use their credit cards to make purchases, the merchant accepting the payment is required to pay a fee to the credit card company for processing the transaction.

Merchant fees, also known as interchange fees or merchant discount fees, are a percentage of each transaction that the merchant pays to the credit card company as a processing fee. This fee covers the cost of processing the payment, including the infrastructure required for electronic transactions, payment network fees, and fraud protection measures. The exact fee percentage varies depending on factors such as the type of card, the transaction amount, and the merchant’s industry.

Credit card companies negotiate interchange fees with various merchants based on factors such as transaction volume, industry type, and typical purchase amounts. These fees are an important revenue stream for credit card companies, especially given the prevalence of electronic payments across various industries.

Transaction fees are additional charges that credit card companies may impose on specific types of transactions. For example, some credit card companies charge a fee for cash advances, which occur when a cardholder withdraws cash from an ATM using their credit card. This fee is separate from the interest charged on the cash advance amount and is typically a flat fee or a percentage of the cash advance amount.

Similarly, credit card companies may charge fees for balance transfers, which involve moving outstanding balances from one credit card to another. These fees help cover the administrative costs associated with processing the transfer and are typically a percentage of the transferred amount.

It’s important to note that merchant fees and transaction fees are not directly charged to the cardholders themselves. Instead, they are borne by the merchants who accept credit card payments. However, it’s worth noting that some merchants may pass on these costs to consumers indirectly by adjusting their prices or implementing surcharges for credit card payments.

The revenue generated from merchant fees and transaction fees helps credit card companies cover the costs associated with operating their payment networks, including technology infrastructure, fraud prevention measures, and customer support services. As electronic payments continue to dominate the consumer landscape, credit card companies benefit from the increased transaction volume and the resulting merchant fees.

Ultimately, merchant fees and transaction fees contribute significantly to the profitability of credit card companies. While consumers may not directly bear these costs, it’s essential to recognize their presence and understand the role they play in sustaining the credit card industry.

Rewards and Cashback Programs

Rewards and cashback programs are a popular feature offered by many credit card companies as a way to incentivize card usage and build customer loyalty. These programs allow cardholders to earn rewards, such as points, miles, or cashback, based on their spending patterns.

Through rewards programs, credit card companies encourage cardholders to make purchases using their credit cards, thereby increasing transaction volume. This increased usage benefits credit card companies by generating more merchant fees and potential interest charges if cardholders carry a balance.

Rewards programs vary widely depending on the credit card and its issuer. Some credit cards offer points-based rewards, where cardholders accumulate points based on their spending and can redeem them for various items, such as merchandise, travel bookings, or gift cards. Other cards may focus on airline miles or hotel points, allowing cardholders to earn rewards towards discounted or free travel.

Cashback programs, on the other hand, provide cardholders with a percentage of their purchases back as a statement credit or direct cashback. For example, a credit card may offer 1% cashback on all purchases and higher percentages for specific categories like groceries or gas. Cashback programs appeal to consumers who prefer the simplicity of receiving tangible monetary benefits for their spending.

Credit card companies fund rewards and cashback programs through various means. One significant revenue stream is the interchange fees paid by merchants on each transaction. Part of these fees is used to cover the costs of the rewards program and provide the incentives for cardholders. Additionally, some credit cards with annual fees often allocate a portion of those fees towards funding rewards and enhancing the overall benefits of the card.

While rewards and cashback programs can be enticing, it’s essential for cardholders to carefully consider their financial habits and spending patterns. It’s crucial to choose rewards programs that align with their lifestyle and provide meaningful benefits. For example, frequent travelers may find more value in credit cards that offer airline miles or hotel points, while individuals who prioritize cash savings may prefer cashback programs.

It is worth noting that rewards and cashback programs work best when cardholders use credit cards responsibly and pay their balances in full each month. Carrying a balance and incurring interest charges can negate the value of the rewards earned. Moreover, cardholders need to be cautious of any restrictions or limitations on redeeming rewards, such as expiration dates or minimum redemption thresholds.

Overall, rewards and cashback programs are a key marketing tool for credit card companies. They help drive card usage, increase transaction volume, and promote customer loyalty. By understanding the terms and conditions of these programs, cardholders can maximize their benefits and make the most of their credit card usage.

Late Payment Fees and Penalties

Late payment fees and penalties are charges imposed by credit card companies when cardholders fail to make the minimum payment by the due date specified on their credit card statement. These fees serve as both a deterrent for late payments and a source of revenue for credit card companies.

Late payment fees can vary depending on the credit card issuer, but they typically range from $25 to $40 for the first offense. If cardholders continue to make late payments, the fees may increase with subsequent occurrences. These fees are intended to cover the costs associated with tracking late payments, managing delinquent accounts, and mitigating the risk of default.

Aside from late payment fees, credit card companies can also impose penalties that impact cardholders’ credit scores and overall financial well-being. Late payments can result in higher interest rates, as credit card companies may consider cardholders who consistently make late payments as higher-risk customers. This means that cardholders may end up paying more in interest charges if they carry a balance from month to month.

Moreover, late payments can have a negative impact on cardholders’ credit scores. Payment history is a crucial factor in determining creditworthiness, and late payments can result in a significant drop in credit scores. This can make it harder for cardholders to access favorable loan terms, such as mortgages or auto loans, in the future.

To avoid late payment fees and penalties, it is important for cardholders to make timely payments and stay organized. Setting up automatic payments or reminders can help ensure that payments are made on time. Cardholders should also carefully review their credit card statements to verify payment due dates and ensure accurate information.

If cardholders are experiencing financial difficulties and are unable to make the minimum payment on time, it’s crucial to communicate with the credit card company. Many issuers may be willing to work out a payment plan or provide assistance for customers facing hardship. It is essential to contact the credit card company as early as possible to explore available options and avoid additional fees and penalties.

Overall, late payment fees and penalties serve as a mechanism to encourage timely payments and offset the costs associated with managing delinquent accounts. By staying vigilant and making consistent, on-time payments, cardholders can avoid these charges, maintain a positive credit history, and preserve their financial well-being.

Other Sources of Revenue

Aside from interest rates, annual fees, merchant fees, rewards programs, and late payment fees, credit card companies have additional sources of revenue that contribute to their profitability. These sources of revenue help cover operational costs, generate income, and sustain the functionality of credit card programs.

One significant revenue stream for credit card companies is foreign exchange fees. When cardholders make purchases in a foreign currency, credit card companies often charge a fee for converting the transaction amount into the cardholder’s local currency. This fee, usually a percentage of the transaction amount, helps offset the costs and risks associated with currency conversion.

Over-limit fees are another source of revenue for credit card companies. These fees are charged when cardholders exceed their credit limit, either by making purchases or by carrying a balance that pushes the outstanding amount over the limit. Over-limit fees can range from $25 to $35 and are intended to discourage cardholders from exceeding their available credit. To avoid these fees, cardholders should monitor their credit limits and strive to keep their balances well below the assigned limit.

Credit card companies also earn revenue through balance protection programs. These programs offer cardholders insurance coverage to help protect against unexpected events, such as job loss or disability, that may impact their ability to make payments. Cardholders who enroll in such programs are typically charged a monthly fee based on a percentage of their outstanding balance. However, it’s important for cardholders to carefully consider the terms and coverage of these programs, as they may not always provide comprehensive protection or represent the best value for every individual.

Additional revenue sources for credit card companies include fees for expedited payments or card replacements, fees for requesting paper statements, and fees for using credit card services like cash checks or wire transfers. Each of these fees, while relatively small compared to other revenue sources, contributes to the overall profitability of credit card companies.

Credit card companies may also engage in partnerships and co-branding initiatives with other businesses. These partnerships may involve offering co-branded credit cards with specific merchants or providing exclusive benefits and rewards to cardholders. In such collaborations, credit card companies receive revenue through various arrangements, such as revenue-sharing agreements, interchange fees, or marketing fees paid by the partnering company.

While some of these fees and revenue sources may seem burdensome to cardholders, it’s essential to view them in the context of the overall services provided by credit card companies. These revenue streams help sustain credit card programs, support customer service, and fund innovations that enhance the customer experience.

As a responsible credit card user, it’s important to be aware of these potential fees and make informed decisions about credit card usage. By understanding the various revenue sources for credit card companies, individuals can select cards that align with their financial goals and preferences while minimizing unnecessary fees and charges.

Conclusion

Credit card companies employ various strategies to generate revenue and remain profitable in the financial industry. Understanding how they make money is essential for consumers to make informed decisions when choosing and using credit cards.

Interest rates play a significant role in credit card companies’ revenue generation. When cardholders carry a balance, they are charged interest on the outstanding amount, contributing to the profitability of credit card companies. Annual fees and other charges, such as merchant fees and transaction fees, also contribute to their revenue streams.

Rewards and cashback programs incentivize card usage and generate income for credit card companies. These programs are funded by interchange fees paid by merchants, allowing cardholders to earn points or cashback based on their spending.

Late payment fees and penalties serve as deterrents for late payments and generate additional revenue for credit card companies. It’s important for cardholders to make timely payments to avoid these charges and protect their credit scores.

Other sources of revenue for credit card companies include foreign exchange fees, over-limit fees, balance protection program fees, and various transactional fees. These additional revenue streams contribute to their overall profitability while covering operational costs and supporting credit card programs.

In conclusion, credit card companies have multiple avenues for generating revenue beyond interest charges. By understanding these sources of income, consumers can make informed decisions about credit card usage, select cards that align with their needs, and minimize unnecessary fees and charges.

As responsible credit card users, individuals should strive to manage their credit cards wisely by paying bills on time, avoiding carrying large balances, and maximizing the benefits of rewards programs. By doing so, cardholders can enjoy the convenience of credit cards while minimizing costs and maximizing financial well-being.