Finance

What Does ALM Stand For In Banking

Published: October 13, 2023

ALM, or Asset Liability Management, is a crucial concept in the world of finance. Discover the meaning of ALM and its significance in banking.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The world of banking is dynamic and ever-evolving, influenced by numerous internal and external factors. In order to navigate the complexities of the financial landscape, banks employ various strategies and tools to manage risk, optimize profitability, and ensure overall stability. One such important tool is Asset and Liability Management (ALM).

ALM is a comprehensive approach that allows banks to align their assets and liabilities in a way that minimizes risk and maximizes returns. It involves a systematic analysis of a bank’s financial position, taking into account its assets (loans, investments, etc.) and liabilities (deposits, borrowings, etc.) along with their respective maturity profiles.

The primary objective of ALM in banking is to identify, measure, monitor, and manage risks arising from imbalance or mismatch between assets and liabilities. By effectively managing these risks, banks can safeguard against potential losses, maintain liquidity, and support sustainable growth.

ALM is not just a tool, but a strategic approach that encompasses a range of activities and practices. It involves understanding the bank’s risk appetite, setting risk limits, and implementing effective risk management frameworks. ALM is crucial for banks of all sizes, from small community banks to large multinational institutions.

In the following sections, we will delve deeper into the definition, components, strategies, benefits, and challenges of ALM in banking. We will also explore its role in risk management, the regulatory framework surrounding it, and best practices for its implementation. By the end, you will have a comprehensive understanding of ALM and its significance in the banking sector.

Definition of ALM

Asset and Liability Management (ALM) is a strategic management process used by banks to manage and optimize the risks associated with their assets and liabilities. It involves the analysis and monitoring of a bank’s balance sheet, with a focus on minimizing the potential for losses due to mismatches in maturity, interest rate, liquidity, and credit risk.

ALM aims to ensure that banks have adequate liquidity to meet their obligations, maintain a healthy capital position, and optimize profitability. It involves a comprehensive assessment of a bank’s assets, including loans, investments, and other earning assets, as well as its liabilities, which comprise deposits, borrowings, and other sources of funding.

The key objective of ALM is to achieve an optimal balance between risk and return by aligning the maturity and interest rate characteristics of assets and liabilities. This helps banks to effectively manage interest rate risk, liquidity risk, credit risk, and market risk.

ALM involves forecasting and modeling various scenarios to assess potential risks and their impact on the bank’s financial position. It requires a deep understanding of the bank’s risk appetite and the prevailing market conditions. Through effective ALM practices, banks can identify and mitigate risks, enhance profitability, and maintain a strong financial position.

ALM is not just limited to managing risks; it also plays a significant role in strategic decision-making. It helps banks in determining the optimal allocation of resources and capital, evaluating the viability of new products or business lines, and identifying opportunities for growth and expansion.

In summary, ALM is a dynamic process that involves the integration of risk management, financial planning, and business strategy. It provides banks with a framework to assess, monitor, and manage risks associated with their assets and liabilities, ensuring stability, profitability, and long-term sustainability.

Importance of ALM in Banking

Asset and Liability Management (ALM) plays a crucial role in the banking industry, serving as a fundamental tool for financial stability, risk management, and profitability. Here are the key reasons why ALM is of utmost importance in banking:

- Risk Management: ALM helps banks in identifying, assessing, and managing various risks associated with their assets and liabilities. By aligning maturity, interest rate, and liquidity profiles, ALM minimizes the risk of potential losses due to interest rate fluctuations, credit defaults, or liquidity shortfalls.

- Liquidity Management: Maintaining adequate liquidity is vital for banks to meet depositor demands, withdraw funds, and fund new loans. ALM enables banks to monitor and manage their liquidity positions, ensuring they have sufficient cash reserves and access to funding sources during both normal and stressed market conditions.

- Capital Management: ALM assists banks in maintaining a healthy capital position by optimizing the balance between risk and return. By aligning their assets and liabilities, banks can ensure they have adequate capital to absorb unexpected losses and regulatory requirements, enhancing their overall financial stability.

- Profitability Optimization: ALM allows banks to optimize their profitability by managing the spread between the interest earned on assets and the interest paid on liabilities. By effectively managing their interest rate risk and deploying capital efficiently, banks can maximize their margins and returns on equity.

- Strategic Decision-Making: ALM provides valuable insights to banks, enabling them to make informed strategic decisions. By analyzing the potential impact of different scenarios on their financial position, banks can evaluate the viability of new products, expansion plans, and other strategic initiatives, enhancing their long-term competitiveness.

- Compliance and Regulatory Requirements: ALM helps banks in meeting regulatory expectations and compliance requirements. Regulators expect banks to have robust risk management frameworks and maintain sufficient capital and liquidity buffers. Implementing effective ALM practices ensures that banks comply with regulatory guidelines and safeguards against regulatory penalties.

In summary, ALM is vital for banks as it ensures financial stability, effective risk management, optimal capital and liquidity management, profitability optimization, informed decision-making, and regulatory compliance. By implementing sound ALM practices, banks gain a competitive edge, protect their stakeholders’ interests, and sustain long-term success in a dynamic and challenging banking landscape.

Components of ALM in Banking

Asset and Liability Management (ALM) in banking involves several key components that work together to effectively manage risks, optimize profitability, and ensure overall financial stability. These components include:

- ALM Policy and Governance: ALM starts with the development of a robust ALM policy and governance framework. This involves defining the bank’s risk appetite, setting limits for various risk factors, establishing reporting mechanisms, and assigning responsibilities for ALM-related activities.

- ALM Information Systems: Banks rely on advanced information systems to effectively manage ALM. These systems gather, store, and analyze data related to a bank’s assets and liabilities, providing real-time insights into risk positions, liquidity profiles, and profitability metrics.

- Asset Management: The asset management component of ALM focuses on managing the bank’s assets, such as loans, investments, and other earning assets. This includes evaluating the credit quality of loans, diversifying investments, and aligning asset maturity profiles with funding sources.

- Liability Management: Liability management involves the management of a bank’s liabilities, including deposits, borrowings, and other sources of funding. This component ensures that the bank has a well-balanced and diversified funding base with appropriate maturity and interest rate characteristics.

- Interest Rate Risk Management: Interest rate risk is a significant concern for banks, and ALM encompasses strategies for managing this risk. It involves monitoring and mitigating the potential impact of interest rate changes on the bank’s net interest income and economic value of equity, utilizing tools such as interest rate hedging and repricing models.

- Liquidity Risk Management: Liquidity risk management is a critical component of ALM, ensuring that banks have sufficient liquidity to meet their obligations. This involves maintaining an appropriate balance between short-term and long-term funding sources, establishing contingency funding plans, and conducting stress testing to assess liquidity needs in adverse scenarios.

- Stress Testing and Scenario Analysis: ALM incorporates stress testing and scenario analysis to evaluate the impact of adverse market conditions on a bank’s financial position. This involves simulating various economic scenarios, assessing the bank’s ability to withstand shocks, and making informed decisions to strengthen its resilience and risk management capabilities.

- Reporting and Risk Monitoring: Effective reporting and risk monitoring are essential components of ALM. Banks leverage regular reporting mechanisms to assess and monitor key risk indicators, measure performance against established limits, and identify emerging risks or issues that require attention or corrective actions.

These components work together to form a comprehensive ALM framework that enables banks to align their assets and liabilities, manage risk exposures, optimize profitability, and enhance overall financial performance and stability. By effectively implementing the components of ALM, banks can navigate the complexities of the banking industry and adapt to changing market dynamics.

ALM Strategies and Techniques

Asset and Liability Management (ALM) in banking involves the formulation and implementation of various strategies and techniques to effectively manage risks and optimize financial performance. Here are some key ALM strategies and techniques utilized by banks:

- Asset-Liability Matching: This strategy involves aligning the maturity and cash flow profiles of a bank’s assets and liabilities. By matching the repayment obligations of loans and investments with the sources of funding, banks can minimize the risk of cash flow imbalances and reduce their exposure to interest rate and liquidity risk.

- Duration Gap Analysis: Duration gap analysis is a technique that helps banks manage interest rate risk. It involves calculating the difference between the weighted average duration of a bank’s assets and liabilities. Banks can then adjust the duration gap to maintain a desired risk position based on their risk tolerance and market expectations.

- Yield Curve Analysis and Spread Management: Banks use yield curve analysis to assess the term structure of interest rates and identify opportunities for spread management. By analyzing the yield curve, banks can determine the optimal mix of short-term and long-term assets and liabilities to maximize net interest income and optimize profitability.

- Stress Testing and Scenario Analysis: Stress testing and scenario analysis are techniques used to assess the impact of adverse market conditions on a bank’s financial position. By simulating various scenarios, banks can measure the resilience of their balance sheet, evaluate the effectiveness of mitigating actions, and make informed decisions to enhance risk management strategies.

- Liquidity Contingency Planning: Banks develop liquidity contingency plans to ensure they have sufficient liquidity to meet their obligations during stressed market conditions. These plans outline strategies for accessing additional funding sources, establishing lines of credit, and managing contingent liquidity events, thereby mitigating liquidity risk.

- Interest Rate Hedging: Interest rate hedging is a technique used to manage interest rate risk by entering into derivative contracts, such as interest rate swaps or options. Banks can use these instruments to limit exposure to interest rate movements, protect the net interest margin, and enhance profitability.

- Optimal Capital Allocation: ALM strategies also involve determining the optimal allocation of capital across various asset classes and business lines. Banks analyze risk-return profiles, regulatory capital requirements, and market opportunities to allocate capital efficiently, maximize risk-adjusted returns, and ensure compliance with regulatory guidelines.

These strategies and techniques are not exhaustive, and banks may employ a combination of approaches based on their specific risk appetite, market conditions, business objectives, and regulatory environment. It is crucial for banks to continually monitor and adjust their ALM strategies to adapt to changing economic conditions, market dynamics, and regulatory changes.

Benefits and Challenges of ALM in Banking

Asset and Liability Management (ALM) in banking offers several benefits, but it also comes with its share of challenges. Understanding these advantages and challenges is essential for banks to effectively implement ALM and maximize its benefits while addressing potential risks. Let’s explore the benefits and challenges of ALM:

Benefits of ALM

- Risk Mitigation: ALM helps banks minimize potential losses arising from interest rate fluctuations, credit defaults, liquidity shortages, and other risk factors. By aligning assets and liabilities, banks can effectively manage risk exposures, enhance stability, and safeguard against unexpected events.

- Profitability Optimization: Through strategic asset and liability management, banks can optimize their net interest income, enhance margins, and improve overall profitability. By matching assets and liabilities with appropriate maturity and interest rate characteristics, banks can maximize their returns on equity.

- Enhanced Liquidity Management: Effective ALM enables banks to maintain adequate liquidity buffers and manage liquidity risks. By closely monitoring cash flows, diversifying funding sources, and implementing contingency plans, banks can ensure they have sufficient liquidity to meet obligations, thereby reducing the risk of funding shortages.

- Regulatory Compliance: ALM helps banks meet regulatory requirements and guidelines related to capital adequacy, liquidity management, and risk management. By implementing robust ALM practices, banks demonstrate their commitment to sound governance, ensuring compliance with regulatory expectations and avoiding penalties.

- Data-driven Decision Making: ALM relies on data analysis and modeling techniques to assess risk exposures, evaluate scenarios, and make informed decisions. By leveraging accurate and timely information, banks can gain insights into their financial position, enabling more effective planning, risk management, and strategic decision-making.

Challenges of ALM

- Data Quality and Availability: ALM requires reliable and comprehensive data on assets, liabilities, and market variables. Banks may face challenges in sourcing, aggregating, and validating data, as well as ensuring data accuracy and consistency across different systems and platforms.

- Complexity and Market Volatility: The banking industry is constantly evolving, influenced by market dynamics, regulatory changes, and economic factors. ALM requires banks to adapt to evolving conditions, analyze complex scenarios, and make timely adjustments to their strategies to effectively manage risks and optimize performance.

- Risk Measurement and Modeling: ALM relies on risk measurement and modeling techniques to assess potential risks and their impact on a bank’s financial position. The accuracy and reliability of risk models play a crucial role in managing risk effectively. Banks need to ensure their risk models are robust and capable of capturing relevant risk factors and scenarios.

- Interest Rate Risk Management: Managing interest rate risk is a significant challenge for banks, particularly in a changing interest rate environment. Banks need to carefully monitor and manage the impact of interest rate movements on their net interest income, economic value of equity, and overall profitability.

- Optimal Balance between Risk and Return: Achieving the optimal balance between risk and return is a constant challenge in ALM. Banks must carefully evaluate risk appetite, regulatory requirements, market opportunities, and business objectives to strike a balance that maximizes profitability while ensuring prudency and long-term sustainability.

While ALM provides numerous benefits, banks need to navigate these challenges to effectively implement ALM practices. By building robust systems, investing in advanced analytics, and maintaining a strong risk management culture, banks can overcome these challenges and leverage the benefits of ALM to enhance stability, profitability, and resilience in an ever-changing banking landscape.

Role of ALM in Risk Management

Asset and Liability Management (ALM) plays a crucial role in the overall risk management framework of banks. It helps banks identify, measure, monitor, and manage various risks arising from their assets and liabilities. Let’s explore the key role of ALM in risk management:

- Identifying Risks: ALM enables banks to identify and assess risks associated with their assets and liabilities. By conducting comprehensive analysis and stress testing, ALM helps banks identify potential risks such as interest rate risk, liquidity risk, credit risk, and market risk.

- Measuring and Quantifying Risks: ALM provides a framework for measuring and quantifying risks. Banks employ risk measurement techniques such as Value at Risk (VaR), duration analysis, and sensitivity analysis to quantify the potential impact of risks on their financial position.

- Monitoring and Reporting: ALM involves monitoring risks on an ongoing basis. Banks establish risk monitoring systems and reporting mechanisms to track key risk indicators, assess risk exposure, and report risk positions to management and regulators in a timely manner.

- Hedging and Risk Mitigation: ALM helps banks develop strategies to mitigate risks. Banks may employ hedging techniques, such as derivatives and interest rate swaps, to manage interest rate and market risks effectively. By implementing risk mitigation strategies, banks can protect their financial position and minimize potential losses.

- Liquidity Risk Management: Liquidity risk is a critical aspect of risk management, and ALM plays a vital role in managing this risk. By monitoring and managing cash flow mismatches, maintaining sufficient liquidity buffers, and establishing contingency funding plans, banks can mitigate liquidity risks effectively.

- Capital Adequacy: ALM is also instrumental in managing capital adequacy. By optimizing the balance between risk and return, ALM helps banks ensure they have adequate capital to absorb unexpected losses and meet regulatory capital requirements. This enhances the bank’s ability to withstand adverse market conditions and contributes to overall financial stability.

- Regulatory Compliance: ALM helps banks comply with regulatory guidelines and requirements. Regulators expect banks to have a robust risk management framework that encompasses ALM practices. By implementing effective ALM techniques, banks can demonstrate compliance with regulatory expectations and mitigate the risk of regulatory penalties.

In summary, ALM plays a critical role in risk management for banks. It helps banks identify, measure, and monitor various risks associated with their assets and liabilities. By implementing risk mitigation strategies, optimizing capital allocation, and ensuring regulatory compliance, ALM contributes to overall financial stability and enhances the ability of banks to navigate the complexities of the banking industry.

Regulations and Guidelines for ALM in Banking

The field of Asset and Liability Management (ALM) in banking is subject to a range of regulations and guidelines put forth by regulatory bodies. These regulations aim to ensure that banks have robust risk management practices in place and maintain financial stability. Let’s explore some key regulations and guidelines for ALM in banking:

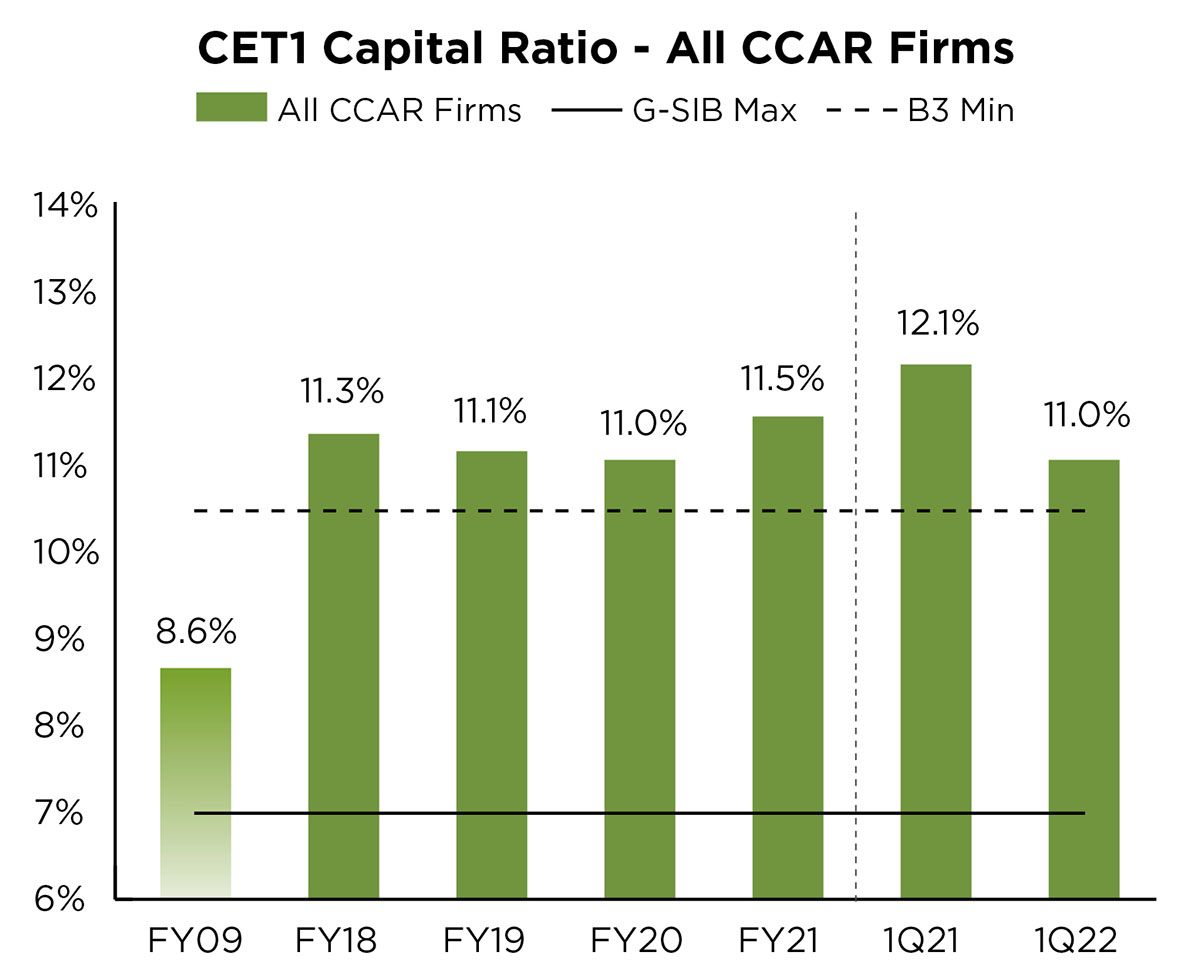

- Basel III: The Basel III framework, developed by the Basel Committee on Banking Supervision (BCBS), sets out global standards for bank capital adequacy, liquidity risk management, and stress testing. Basel III requires banks to enhance their ALM capabilities by implementing measures such as the Liquidity Coverage Ratio (LCR), Net Stable Funding Ratio (NSFR), and enhanced risk management practices.

- International Financial Reporting Standards (IFRS 9): IFRS 9 introduced principles for accounting and reporting of financial instruments, including impairment of loans and credit losses. It requires banks to incorporate expected credit loss calculations into their ALM frameworks, resulting in more accurate assessment and provision for credit risks.

- Local Regulatory Standards: Various countries have specific regulations and guidelines for ALM in banking. For example, in the United States, the Office of the Comptroller of the Currency (OCC) issues guidelines on interest rate risk management, liquidity risk management, and stress testing. Similarly, other regulatory bodies worldwide provide regulatory standards tailored to the specific needs of their banking systems.

- Banking Laws and Capital Requirements: Banking laws and capital requirements set by regulatory authorities impose standards for capital adequacy and risk management. These laws establish minimum capital ratios, such as the Common Equity Tier 1 (CET1) ratio, and require banks to maintain sufficient capital levels to absorb losses and mitigate risks effectively.

- Internal Risk Management Guidelines: In addition to external regulations, banks often establish their own internal risk management guidelines. These guidelines outline internal policies, risk appetite, limits, and monitoring procedures for ALM activities. Banks develop sophisticated risk measurement models, stress testing frameworks, and risk reporting mechanisms to ensure compliance with internal risk management guidelines.

Banks must adhere to these regulations and guidelines to meet regulatory requirements, safeguard against financial instability, and protect stakeholders’ interests. Failure to comply with these standards can result in penalties, reputational damage, and increased risk exposure.

It is important for banks to stay up-to-date with evolving regulations and guidelines, as regulatory frameworks can change over time to address emerging risks and challenges in the banking industry. Banks must implement robust ALM practices and maintain effective risk management systems to ensure compliance and mitigate risks effectively.

Best Practices for Implementing ALM in Banking

Implementing Asset and Liability Management (ALM) practices effectively is essential for banks to optimize risk management, enhance profitability, and maintain financial stability. Here are some best practices for implementing ALM in banking:

- Establish a Robust ALM Policy: Develop a comprehensive ALM policy that outlines the bank’s risk appetite, objectives, and limits. The policy should be aligned with regulatory requirements and provide clear guidance for decision-making and risk management activities.

- Utilize Advanced ALM Systems: Invest in sophisticated ALM information systems that can handle large volumes of data, perform accurate risk measurements, and provide real-time monitoring and reporting capabilities. These systems should integrate data from various sources and enable scenario analysis and stress testing.

- Implement a Sound Governance Structure: Establish a strong governance structure with clearly defined roles, responsibilities, and reporting lines for ALM activities. Promote a risk-aware culture throughout the organization and ensure that risk management processes are integrated into day-to-day operations.

- Adopt Integrated Risk Management Approaches: Implement integrated risk management approaches that consider the interdependencies between different risk types, such as interest rate risk, liquidity risk, credit risk, and market risk. This allows for a holistic view of risks and facilitates effective risk mitigation strategies.

- Regularly Monitor and Analyze Key Risk Indicators: Continuously monitor and analyze key risk indicators related to ALM, such as net interest income, interest rate sensitivity, liquidity ratios, and capital adequacy. Set up a robust risk reporting framework to ensure timely and accurate reporting to management and regulatory authorities.

- Conduct Regular Stress Testing and Scenario Analysis: Perform regular stress testing and scenario analysis to assess the bank’s resilience under adverse market conditions. Evaluate the impact of various risk factors on the bank’s financial position and use the results to enhance risk management strategies and contingency plans.

- Optimize Asset and Liability Allocation: Optimize the allocation of assets and liabilities to achieve a balanced funding structure, manage interest rate risk, and maximize profitability. Consider the maturity, yield, and liquidity profiles of assets and liabilities to align them effectively and reduce potential mismatches.

- Ensure Regulatory Compliance: Stay updated with regulatory requirements and comply with relevant regulations and guidelines related to ALM. This includes adherence to capital adequacy standards, liquidity management guidelines, interest rate risk management rules, and reporting requirements.

- Promote Continuous Learning and Development: Foster a culture of continuous learning and development within the ALM team. Regularly train staff on ALM practices, market trends, and regulatory changes to ensure they have the knowledge and skills to effectively perform their roles.

By implementing these best practices, banks can enhance their ALM capabilities, mitigate risks, optimize profitability, and maintain financial stability. However, it is important to note that best practices may vary depending on the size, complexity, and risk profile of the bank. Banks should tailor these practices to their specific needs and regularly review and update their ALM strategies to adapt to changing market conditions and regulatory requirements.

Conclusion

Asset and Liability Management (ALM) is a critical tool used by banks to manage risks, optimize profitability, and maintain financial stability. By aligning assets and liabilities, banks can effectively mitigate risks such as interest rate fluctuations, liquidity shortages, credit defaults, and market volatility. ALM provides banks with a framework to identify, measure, monitor, and manage these risks, enhancing their overall risk management capabilities.

ALM offers several benefits to banks, including risk mitigation, profitability optimization, enhanced liquidity management, regulatory compliance, and data-driven decision making. It allows banks to make informed strategic decisions, adapt to changing market conditions, and allocate capital efficiently. Additionally, ALM helps banks comply with regulatory requirements and bolster their financial resilience.

However, implementing ALM practices also comes with challenges. Banks must navigate complexities related to data quality, market volatility, risk measurement modeling, interest rate risk management, and striking the balance between risk and return. It requires strong governance, advanced information systems, and continuous monitoring and analysis of key risk indicators.

To successfully implement ALM, banks should establish robust ALM policies, utilize sophisticated ALM systems, adopt integrated risk management approaches, and regularly monitor and analyze key risk indicators. They should also conduct stress testing, optimize asset and liability allocation, ensure regulatory compliance, and promote continuous learning and development within their ALM teams.

In conclusion, ALM plays a pivotal role in the banking industry. It enables banks to effectively manage risks, optimize profitability, and maintain financial stability. By implementing sound ALM practices, banks can navigate the challenges of the ever-evolving financial landscape, ensure regulatory compliance, and foster long-term success in the highly competitive banking sector.