Finance

What Does ALCO Stand For In Banking

Modified: February 21, 2024

ALCO, which stands for Asset Liability Committee, plays a crucial role in finance and banking, managing risks and ensuring regulatory compliance. Discover what ALCO means in the financial industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of banking and finance, ALCO is an acronym that holds significant importance. ALCO stands for Asset Liability Management Committee, which is a crucial entity within a bank or financial institution. The ALCO plays a vital role in managing the balance sheet and ensuring the optimal allocation of assets and liabilities.

The primary objective of the ALCO is to maintain a balance between the bank’s assets and liabilities, thereby minimizing risk and maximizing profitability. By carefully analyzing and monitoring various factors such as interest rates, liquidity, and market conditions, the ALCO makes data-driven decisions to safeguard the financial stability of the institution.

ALCO is responsible for managing the asset-liability mix, interest rate risk, liquidity risk, and funding requirements of the bank. It plays a pivotal role in formulating and implementing strategies that ensure the bank’s financial well-being and sustainable growth. The decisions made by the ALCO have a profound impact on the bank’s profitability, risk exposure, and overall performance.

In this article, we will delve deeper into the world of ALCO in banking, exploring its definition, role, composition, decision-making process, and importance. Understanding the functions and significance of ALCO will provide valuable insights into the inner workings of banking institutions and the management of their balance sheets.

Definition of ALCO

ALCO, an acronym for Asset Liability Management Committee, is a key component of any banking or financial institution. It is a strategic committee responsible for the management of the institution’s assets and liabilities to maintain financial stability and achieve desired financial objectives.

The core function of ALCO is to monitor and control the bank’s balance sheet, ensuring a well-balanced asset and liability mix. This entails assessing various risks, such as interest rate risk, liquidity risk, and funding risk, and formulating strategies to mitigate them effectively.

The ALCO is comprised of senior members of the institution, including executives from treasury, risk management, finance, and lending departments. These experts bring their knowledge and expertise to collectively drive the decision-making process regarding the bank’s financial operations.

ALCO’s primary objective is to optimize the bank’s profitability while keeping risk at an acceptable level. This includes managing interest rate spreads, liquidity positions, capital adequacy, and overall risk exposure. The committee carefully analyzes market conditions, economic trends, and regulatory requirements to make informed decisions that align with the institution’s goals.

By actively monitoring and reviewing the bank’s financial performance and risk metrics, ALCO ensures that the institution is adequately capitalized and maintains solvency. It plays a crucial role in safeguarding the bank’s financial health and ensuring its long-term viability in a challenging and dynamic market environment.

Overall, ALCO provides a systematic approach to managing the bank’s assets and liabilities, enabling effective risk management and decision-making. It serves as a key pillar of financial governance, ensuring that the institution operates in a prudent and sustainable manner.

Role of ALCO in Banking

The Asset Liability Management Committee (ALCO) plays a critical role in the banking industry by overseeing the management of assets and liabilities in financial institutions. The committee’s primary responsibility is to ensure the bank’s overall financial stability and optimize its profitability.

ALCO serves as a key strategic body that provides guidance and sets the direction for the bank’s balance sheet management. It is responsible for formulating and implementing strategies to manage interest rate risk, liquidity risk, and funding risk effectively. This involves assessing market conditions, economic trends, and regulatory requirements to make informed decisions.

One of the important roles of ALCO is to manage the asset-liability mix, which involves determining the appropriate allocation of assets and liabilities to maintain a well-balanced balance sheet. This includes managing the bank’s loan portfolio, investments, and funding sources to optimize the risk-return profile.

ALCO plays a crucial role in monitoring and managing interest rate risk. Fluctuations in interest rates can have a significant impact on a bank’s profitability and financial stability. ALCO analyzes interest rate scenarios, evaluates potential risks, and develops strategies to hedge and manage these risks effectively.

Liquidity risk management is another vital role of ALCO in banking. The committee ensures that the bank has sufficient liquidity to meet its financial obligations and funding requirements. It develops policies and procedures to assess liquidity needs, maintain appropriate liquidity buffers, and establish contingency plans to address potential liquidity disruptions.

Furthermore, ALCO assists in managing funding risk by monitoring the bank’s funding sources, evaluating the cost and maturity profiles, and maintaining diversified funding channels. The committee aims to secure stable and cost-effective funding while reducing reliance on volatile or short-term funding.

ALCO also plays a significant role in capital management and capital adequacy assessment. It assesses the bank’s capital position, evaluates regulatory requirements, and formulates strategies to optimize the capital structure to support the bank’s growth and risk management objectives.

Overall, the role of ALCO in banking is to ensure effective balance sheet management, mitigate risk, optimize profitability, and maintain financial stability. The committee’s decisions and actions directly impact the bank’s performance, risk exposure, and ability to navigate the ever-changing dynamics of the banking industry.

Functions of ALCO

The Asset Liability Management Committee (ALCO) in a banking institution performs a range of functions that are essential in managing the bank’s assets and liabilities effectively. These functions are aimed at optimizing profitability, mitigating risks, and ensuring the institution’s financial stability.

Here are the key functions of ALCO:

- Balance Sheet Management: ALCO is responsible for managing the bank’s balance sheet by maintaining a well-balanced asset-liability mix. It evaluates the composition of assets and liabilities, ensuring that they align with the institution’s financial objectives and risk appetite.

- Interest Rate Risk Management: ALCO monitors and manages the interest rate risk by analyzing the impact of interest rate fluctuations on the bank’s earnings and net interest margin. It formulates strategies to mitigate this risk through actions such as adjusting the pricing of loans and deposits, considering interest rate derivatives, and implementing hedging strategies.

- Liquidity Risk Management: ALCO ensures that the bank maintains adequate liquidity to meet its financial obligations. It develops and implements liquidity risk management policies, defines appropriate liquidity ratios and buffers, and establishes contingency plans to address potential funding shortfalls. ALCO regularly assesses the bank’s liquidity position and takes necessary actions to maintain a healthy liquidity profile.

- Funding and Capital Management: ALCO oversees the management of the bank’s funding sources and evaluates their cost, maturity, and stability. It formulates strategies to diversify funding channels, reduce reliance on volatile funding, and optimize the cost of funds. Additionally, ALCO assesses the bank’s capital position, ensures compliance with regulatory capital requirements, and develops strategies to optimize capital structure to support the institution’s objectives.

- Strategic Planning: ALCO plays a significant role in the bank’s strategic planning process. It aligns the institution’s financial goals with its strategic objectives and formulates strategies to achieve them. ALCO evaluates economic conditions, market trends, and competitive landscapes to make informed decisions regarding product development, expansion plans, and market positioning.

- Risk Analysis and Mitigation: ALCO conducts risk analysis across various areas such as interest rate risk, liquidity risk, credit risk, and operational risk. It identifies potential risks and develops risk mitigation strategies to ensure the bank operates within acceptable risk limits. ALCO also monitors compliance with regulatory requirements and oversees risk management practices across the institution.

These functions collectively contribute to effective balance sheet management, risk mitigation, and profitability optimization. ALCO’s expertise and decision-making are instrumental in maintaining the financial stability and success of the banking institution.

Objectives of ALCO

The Asset Liability Management Committee (ALCO) in a banking institution serves specific objectives that guide its decision-making process and overall functioning. These objectives are designed to ensure the financial stability, profitability, and long-term viability of the bank. Here are the key objectives of ALCO:

- Optimizing Profitability: One of the primary objectives of ALCO is to optimize the bank’s profitability. It aims to achieve this by effectively managing the bank’s asset-liability mix, ensuring efficient allocation of resources, and enhancing revenue-generation capabilities. ALCO evaluates various factors, such as interest rates, market conditions, and customer demand, to devise strategies that maximize the bank’s profitability.

- Maintaining Financial Stability: ALCO plays a vital role in maintaining the financial stability of the bank. It monitors and manages risks, such as interest rate risk, liquidity risk, and funding risk, to ensure that the institution remains resilient in the face of market fluctuations and economic challenges. ALCO sets risk tolerance levels and formulates risk management strategies to maintain the stability of the bank’s balance sheet.

- Managing Interest Rate Risk: ALCO aims to effectively manage and mitigate interest rate risk. This involves analyzing the impact of interest rate fluctuations on the bank’s earnings and net interest margin. ALCO sets policies and strategies to align interest rate risk exposure with the bank’s risk appetite and regulatory requirements. By managing interest rate risk, ALCO aims to protect the bank’s profitability and asset quality.

- Ensuring Liquidity Adequacy: Another objective of ALCO is to ensure liquidity adequacy in the bank. It assesses the bank’s liquidity needs, establishes liquidity risk management policies, and develops contingency plans to address potential funding shortfalls. ALCO monitors the bank’s liquidity position and takes necessary actions to maintain appropriate liquidity levels, ensuring the bank can meet its financial obligations in a timely manner.

- Optimizing Capital Utilization: ALCO focuses on optimizing the bank’s capital utilization. It assesses the bank’s capital position, evaluates regulatory capital requirements, and formulates strategies to optimize the capital structure. ALCO aims to ensure that the bank maintains adequate capital to support its growth objectives, absorb losses, and comply with regulatory requirements.

- Aligning with Business Objectives: ALCO aligns its objectives with the overall business objectives of the bank. It works closely with other departments and stakeholders to ensure that the balance sheet management strategies support the bank’s growth plans, product development initiatives, and market positioning strategies. ALCO’s objectives are designed to support the overarching goals of the institution.

By focusing on these objectives, ALCO aims to strike the right balance between risk and reward, and make informed decisions that contribute to the bank’s long-term success and sustainability.

ALCO Composition

The composition of the Asset Liability Management Committee (ALCO) in a banking institution typically includes key individuals who bring expertise and knowledge from various areas within the organization. The composition may vary depending on the size and complexity of the institution, but certain roles are commonly found in ALCO. Here are the typical members of ALCO:

- Chief Financial Officer (CFO): The CFO is a crucial member of ALCO as they bring financial expertise and insights into the committee. They oversee the financial operations of the bank, including financial reporting, budgeting, and capital management. The CFO provides valuable inputs on financial performance, risk management, and strategic financial planning.

- Treasurer: The Treasurer is responsible for managing the bank’s treasury operations, including liquidity management, investments, and funding. They bring expertise in managing interest rate risk, liquidity risk, and funding requirements. The Treasurer plays a vital role in ALCO by providing insights into market conditions, interest rate trends, and funding strategies.

- Chief Risk Officer (CRO): The CRO is responsible for overseeing the risk management function within the bank. They bring insights into risk assessment, risk appetite, and risk mitigation strategies. The CRO provides valuable inputs on managing various risks such as credit risk, market risk, and operational risk, ensuring that risk management practices align with the bank’s overall objectives and risk appetite.

- Head of Lending: The Head of Lending, often the head of the commercial lending department, brings expertise in assessing credit risk and evaluating loan portfolios. They provide insights into lending strategies, portfolio performance, and credit risk management. Their presence ensures that ALCO considers the impact of lending activities and credit risk exposure on the overall balance sheet.

- Head of Treasury: In larger institutions, there may be a dedicated head of treasury who provides specialized expertise in treasury operations. This individual oversees the bank’s funding, liquidity management, investment activities, and foreign exchange transactions.

- Chief Executive Officer (CEO): In some institutions, the CEO or a senior executive may be part of ALCO to provide strategic direction and alignment with the overall business goals. Their presence ensures that the decisions made by ALCO align with the institution’s long-term objectives.

It is important to note that ALCO’s composition may vary depending on the institution’s structure and specific requirements. Additional members, such as the Head of Compliance or Head of Asset Management, may also be included to provide expertise in regulatory compliance and investment management, respectively.

The composition of ALCO aims to bring together individuals with diverse skill sets and expertise to ensure comprehensive decision-making and effective management of the institution’s assets and liabilities. The collective knowledge and experience of the ALCO members enable informed and strategic decision-making to achieve the bank’s financial objectives.

Responsibilities of ALCO Members

The members of the Asset Liability Management Committee (ALCO) in a banking institution have distinct responsibilities that contribute to the overall management of the institution’s assets and liabilities. Each member brings specific expertise and knowledge to ensure comprehensive decision-making and effective risk management. Here are the typical responsibilities of ALCO members:

- Chief Financial Officer (CFO): The CFO is responsible for providing financial insights and expertise to ALCO. They oversee financial planning, capital management, and financial reporting. The CFO assesses the financial risks associated with the bank’s balance sheet and provides strategies to optimize profitability and manage risks effectively.

- Treasurer: The Treasurer is responsible for managing the bank’s liquidity, investments, and funding. As an ALCO member, they provide insights into market conditions, interest rate trends, and funding strategies. The Treasurer collaborates with other members to formulate strategies that effectively manage interest rate risk and ensure sufficient liquidity for the bank.

- Chief Risk Officer (CRO): The CRO oversees the bank’s risk management function. Their responsibilities in ALCO include identifying, measuring, and mitigating various risks, such as credit risk, market risk, and operational risk. The CRO provides inputs on risk appetite, risk limits, and risk mitigation strategies, ensuring that risk management practices align with the bank’s objectives.

- Head of Lending: The Head of Lending is responsible for managing the bank’s loan portfolio and evaluating credit risk. They provide insights into lending strategies, loan performance, and credit risk management. As an ALCO member, they assess the impact of lending activities and credit risk exposure on the overall balance sheet and contribute to the formulation of strategies to optimize loan portfolio performance.

- Head of Treasury: If present, the Head of Treasury provides specialized expertise in treasury operations, including funding, liquidity management, investments, and foreign exchange transactions. They contribute insights into market conditions, funding strategies, and liquidity management practices to support ALCO’s decision-making process.

- Chief Executive Officer (CEO): In some institutions, the CEO or a senior executive participates in ALCO to provide strategic direction and alignment with the overall business goals. The CEO ensures that the decisions made by ALCO align with the institution’s long-term objectives, growth plans, and risk appetite.

Each ALCO member actively participates in the decision-making process, shares knowledge, provides insights, and contributes to the risk management and profitability optimization efforts of the institution. Together, they evaluate market conditions, assess risks, and formulate strategies that ensure the bank’s financial stability and successful performance.

Additionally, ALCO members collaborate with other department heads, such as Compliance and Asset Management, if present, to ensure regulatory compliance, effective risk control, and efficient asset management.

By fulfilling their respective responsibilities, ALCO members contribute to the institution’s strategic decision-making, risk management initiatives, and overall financial well-being.

ALCO Decision-Making Process

The Asset Liability Management Committee (ALCO) in a banking institution follows a structured decision-making process to ensure informed and effective management of the institution’s assets and liabilities. The decision-making process of ALCO typically involves the following steps:

- Data Collection and Analysis: ALCO members gather relevant data and information related to the bank’s balance sheet, financial performance, risk metrics, market conditions, and regulatory requirements. This data includes interest rate trends, liquidity position, loan portfolio quality, and funding sources. The data is then carefully analyzed to understand the current state of the bank’s assets and liabilities.

- Risk Assessment: ALCO conducts a comprehensive risk assessment, evaluating various risks that the institution may face. This includes interest rate risk, liquidity risk, credit risk, and funding risk. It assesses the potential impact of these risks on the bank’s financial stability and profitability. The risk assessment provides a basis for formulating risk management strategies and setting risk tolerance levels.

- Scenario Analysis: ALCO performs scenario analysis to evaluate the potential impact of different scenarios on the bank’s balance sheet and financial performance. This involves assessing the bank’s resilience to changing market conditions, interest rate movements, and liquidity shocks. The scenario analysis helps in understanding the potential risks and rewards associated with different scenarios, aiding in decision-making.

- Strategy Formulation: Based on the data analysis, risk assessment, and scenario analysis, ALCO develops strategic options to optimize the bank’s balance sheet management. This includes determining the asset-liability mix, managing interest rate risk, addressing liquidity needs, and formulating funding and capital management strategies. ALCO considers factors such as expected interest rate movements, market trends, regulatory requirements, and the bank’s financial objectives while formulating strategies.

- Decision Making: ALCO members come together to discuss and debate the strategic options. Each member provides insights, expertise, and perspectives to contribute to the decision-making process. Decisions are made based on a consensus-driven approach or by considering voting mechanisms, depending on the institution’s governance structure. The decisions taken by ALCO are aimed at balancing risk and reward, aligning with the institution’s overall goals, and optimizing financial performance.

- Implementation and Monitoring: Once decisions are made, ALCO oversees the implementation of approved strategies. It monitors the execution of the strategies, evaluates their effectiveness, and assesses their impact on the bank’s balance sheet, profitability, and risk profile. ALCO ensures ongoing monitoring and reporting of key performance indicators to track the success of implemented strategies and make necessary adjustments if required.

The ALCO decision-making process is iterative and dynamic, allowing for adjustments and refinements as market conditions and internal factors evolve. It relies on data analysis, risk assessment, scenario analysis, and collaborative decision-making to ensure effective management of assets and liabilities in line with the institution’s goals and risk appetite.

By following a systematic decision-making process, ALCO can make well-informed decisions that optimize profitability, manage risks, and maintain the financial stability of the banking institution.

ALCO Meetings

ALCO meetings are a critical component of the decision-making process within the Asset Liability Management Committee (ALCO) in a banking institution. These meetings provide a platform for ALCO members to discuss, analyze, and make informed decisions related to the management of the institution’s assets and liabilities. Here are key aspects of ALCO meetings:

- Frequency: ALCO meetings are typically held at regular intervals, depending on the institution’s needs and the prevailing market conditions. They may be conducted monthly, quarterly, or as required. The frequency allows for timely decision-making and monitoring of the bank’s balance sheet.

- Agenda Setting: Before each meeting, an agenda is prepared that outlines the topics to be discussed, including risk assessments, financial performance review, interest rate strategies, liquidity position, and funding requirements. The agenda sets the focus for the meeting and ensures that all relevant topics are addressed.

- Data Presentation and Analysis: During each ALCO meeting, members receive presentations that provide comprehensive data and analysis related to the bank’s assets, liabilities, and risk metrics. These presentations include information on interest rate trends, liquidity measurements, loan portfolios, funding sources, and market conditions. This data helps in informed decision-making.

- Discussion and Decision-Making: ALCO meetings facilitate open and collaborative discussions among members. Each member contributes their expertise and insights while discussing strategic options, risk assessment outcomes, and potential scenarios. The members collectively make decisions based on the information presented, aiming for consensus or following established governance mechanisms. The decisions made during these meetings guide the institution’s overall asset and liability management strategies.

- Action Planning: Following the decision-making process, the ALCO sets out action plans and implementation timelines. These plans outline the steps necessary to execute the approved strategies. Responsibilities are assigned to relevant individuals or departments, ensuring accountability for the implementation process.

- Monitoring and Review: ALCO meetings also include a review of the progress and outcomes of previously made decisions. This allows members to assess whether the implemented strategies are achieving the desired outcomes and whether any adjustments are necessary. The monitoring and review process provides an opportunity to evaluate the success of the decision-making process and make improvements if needed.

ALCO meetings play a crucial role in ensuring effective communication, collaboration, and decision-making among the members. These meetings enable ALCO to align the institution’s overall objectives with the management of its assets and liabilities, optimizing financial performance, and managing risks.

It is important to note that ALCO meetings may involve other individuals or experts invited to provide insights on specific topics, such as regulatory compliance, economic analysis, or technological advancements, to enhance the decision-making process with external expertise.

By regularly convening and conducting ALCO meetings, banks can facilitate robust discussions, make well-informed decisions, and address the evolving challenges and opportunities in the management of their balance sheets.

Importance of ALCO in Banking

The Asset Liability Management Committee (ALCO) plays a crucial role in the banking industry by ensuring effective management of assets and liabilities. ALCO’s importance stems from its ability to optimize profitability, mitigate risks, and maintain financial stability in a dynamic and competitive market. Here are the key reasons why ALCO is important in banking:

- Optimizing Profitability: ALCO focuses on enhancing the bank’s profitability by strategically managing the asset-liability mix and interest rate risk. By analyzing market conditions, ALCO formulates strategies to optimize interest rate spreads, improve net interest income, and maximize revenue generation. This helps the bank achieve sustainable profitability while positioning it for future growth.

- Risk Management: ALCO plays a vital role in managing risks, such as interest rate risk, liquidity risk, and funding risk. By carefully monitoring and analyzing these risks, ALCO formulates risk management strategies that align with the institution’s risk appetite and regulatory requirements. This strengthens the bank’s resilience against adverse market conditions and ensures financial stability.

- Balance Sheet Management: ALCO oversees the management of the bank’s balance sheet by evaluating and optimizing the asset-liability mix. This involves assessing the composition of assets and liabilities to achieve an optimal balance that supports the bank’s financial goals. ALCO ensures that the bank’s assets and liabilities are aligned with its risk tolerance and funding requirements.

- Liquidity Management: ALCO is responsible for maintaining an adequate level of liquidity within the bank. By assessing liquidity needs and developing appropriate strategies, ALCO ensures that the bank can meet its financial obligations and withstand unforeseen liquidity disruptions. Effective liquidity management enhances the bank’s ability to support customer demands and navigate market challenges.

- Strategic Decision-Making: ALCO plays a pivotal role in strategic decision-making within the bank. By evaluating economic trends, market conditions, and regulatory changes, ALCO helps shape the institution’s long-term objectives and strategies. ALCO’s insights contribute to product development, market expansion, and capital allocation decisions, ensuring the bank’s competitive positioning in the industry.

- Regulatory Compliance: ALCO ensures that the bank complies with relevant regulatory guidelines and requirements. By monitoring regulatory changes and assessing their impact, ALCO formulates strategies to adapt to new regulations. This helps the bank maintain a good standing with regulatory authorities and reduces the risk of non-compliance penalties.

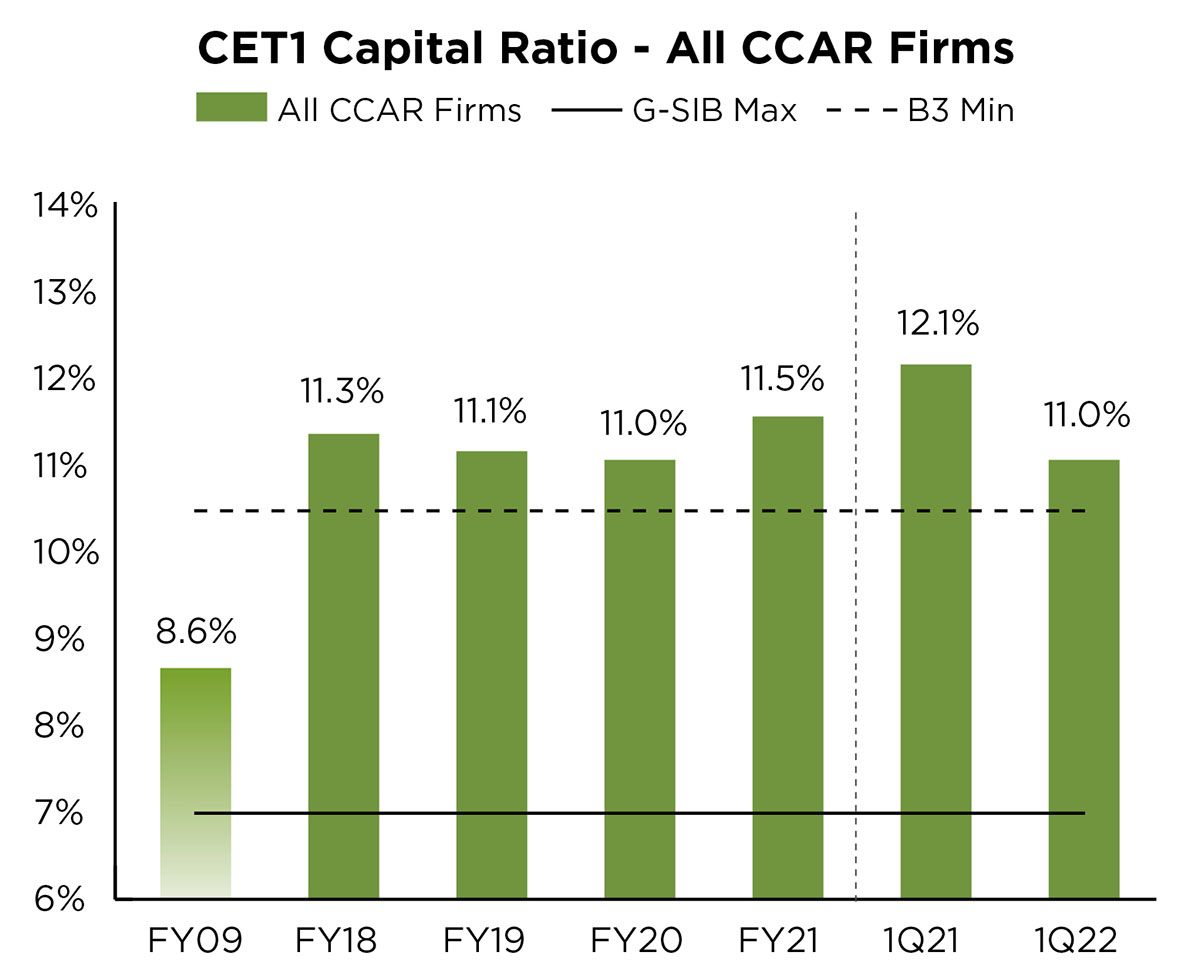

- Capital Adequacy: ALCO assesses the bank’s capital requirements and ensures compliance with regulatory capital adequacy ratios. By optimizing the bank’s capital structure, ALCO supports the institution’s growth objectives and ability to absorb potential losses. This enhances investors’ confidence and supports the bank’s overall financial health.

ALCO’s importance lies in its ability to provide a holistic approach to managing assets and liabilities, balancing risk and reward, and making informed decisions in the best interest of the banking institution. By optimizing profitability, managing risks, and maintaining financial stability, ALCO contributes to the long-term success and sustainability of the bank.

Conclusion

The Asset Liability Management Committee (ALCO) plays a vital role in the banking industry by overseeing the management of assets and liabilities in financial institutions. ALCO’s responsibilities include optimizing profitability, managing risks, and maintaining financial stability. Through a structured decision-making process, ALCO evaluates market conditions, assesses risks, and formulates strategies to achieve the institution’s financial objectives.

The functions of ALCO encompass balance sheet management, interest rate risk management, liquidity risk management, and funding and capital management. ALCO’s composition includes key individuals such as the CFO, Treasurer, CRO, Head of Lending, and the CEO. These members collaborate, share insights, and contribute to the decision-making process.

The importance of ALCO in banking is evident in its ability to optimize profitability, mitigate risks, and maintain financial stability. ALCO’s strategies are designed to ensure a well-balanced asset-liability mix, effective risk management, and efficient utilization of capital resources. Additionally, ALCO’s role in strategic decision-making and regulatory compliance further enhances the bank’s competitiveness and regulatory standing.

ALCO meetings provide a platform for ALCO members to discuss, analyze, and make informed decisions. These meetings facilitate open discussions, data analysis, and collaborative decision-making, allowing for timely and effective management of assets and liabilities.

In conclusion, ALCO serves as a valuable entity within a banking institution, contributing to the optimization of profitability, mitigation of risks, and maintenance of financial stability. By employing data-driven strategies, ALCO ensures the institution’s long-term success, resilience, and ability to adapt to evolving market conditions. The critical functions and responsibilities of ALCO make it an integral component of successful banking operations.