Finance

What Does LTM Stand For In Banking

Published: October 11, 2023

Discover the meaning of LTM in banking and its relevance to finance. Explore how LTM impacts financial institutions and the broader financial industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The world of finance is filled with various acronyms and terms that may seem confusing to those who are not well-versed in the industry. One such acronym that often pops up in the banking sector is LTM. If you have ever come across this term and wondered what it stands for and its relevance in banking, you’ve come to the right place.

LTM stands for “Last Twelve Months” and is a commonly used term in financial analysis, specifically in the banking industry. It refers to a period of time that spans the most recent twelve months from a given point in time. LTM is often used as a benchmark or reference point when evaluating a bank’s financial performance and earning capacity.

In this article, we will delve deeper into the meaning of LTM in banking, exploring its importance, applications, and the challenges it presents. By understanding LTM and how it is used in the banking industry, you will gain valuable insights into this key financial metric and its significance in assessing a bank’s financial health and stability.

Definition of LTM in Banking

LTM, or Last Twelve Months, is a financial metric used in the banking industry to assess a bank’s performance over a specific period of time. It represents the aggregate data from the past twelve months leading up to the current date. LTM is calculated by adding up the relevant financial data on a quarterly or annual basis for the most recent four quarters.

LTM is an essential tool in financial analysis as it provides a more comprehensive and up-to-date view of a bank’s financial performance compared to traditional annual or quarterly reporting. By looking at a bank’s performance over the last twelve months, analysts and investors can gain insights into its growth trajectory, revenue generation, profitability, and stability.

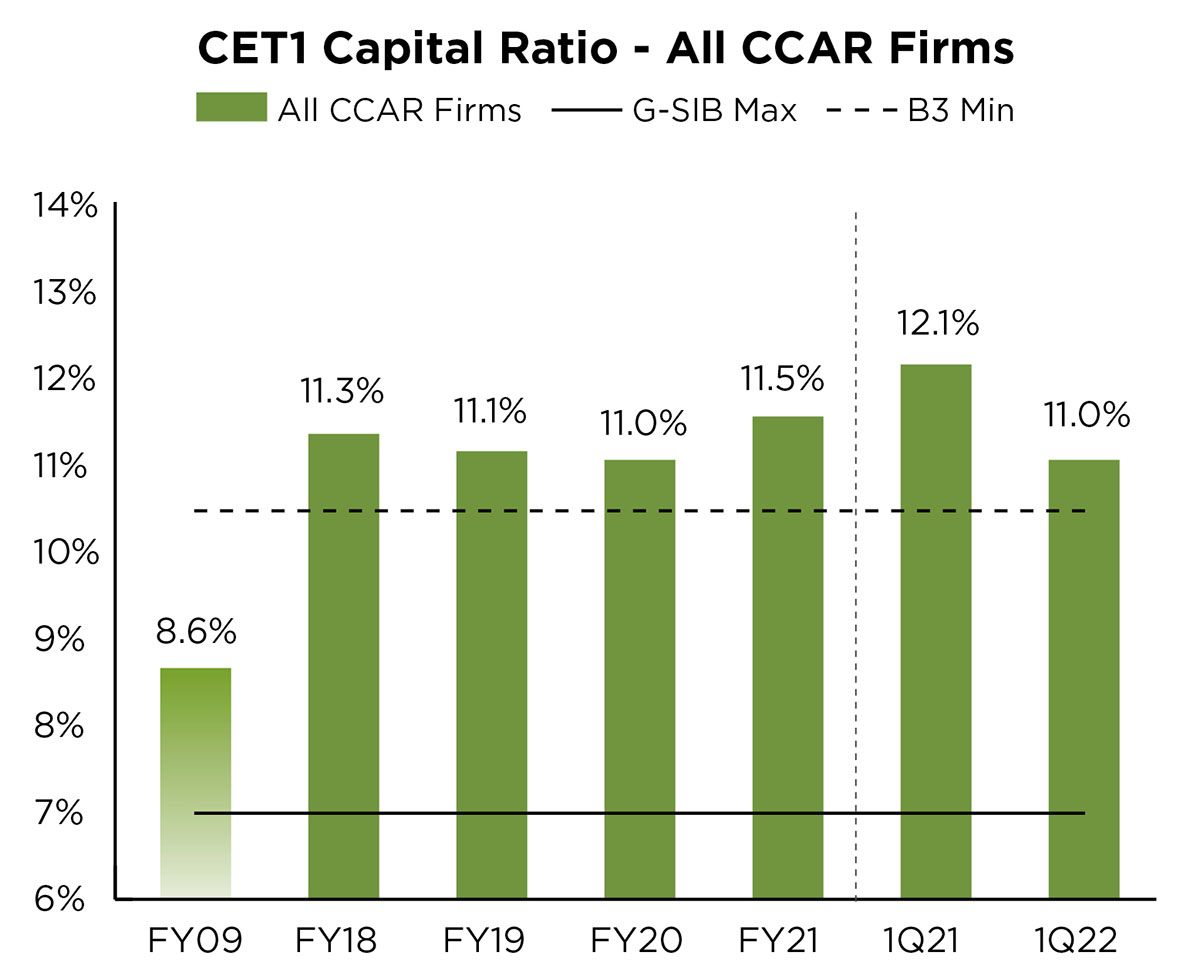

Key financial metrics that are often analyzed using LTM include revenue, net income, operating profit, earnings per share, return on equity, and various ratios such as the efficiency ratio and capital adequacy ratio. These metrics help evaluate a bank’s ability to generate profits, manage expenses, and measure its financial strength and risk profile.

LTM is particularly useful in banking as the industry experiences fluctuations and economic cycles that can impact a bank’s financial performance. By analyzing LTM data, stakeholders can get a more accurate understanding of a bank’s recent performance, identify trends, and make informed decisions regarding investments, lending, or mergers and acquisitions.

It is worth noting that LTM is often compared to the same period in the previous year, known as LTM YoY (Year-over-Year). This comparison helps assess the bank’s growth rate and the impact of external factors such as changes in market conditions or regulatory environment.

Overall, LTM provides a snapshot of a bank’s financial performance over the most recent twelve months, allowing stakeholders to gauge its health and profitability. It serves as a crucial tool for analysts, investors, regulators, and other industry players to make informed decisions and evaluate a bank’s long-term sustainability.

Importance of LTM in Banking

The Last Twelve Months (LTM) metric holds great importance in the banking industry as it provides valuable insights into a bank’s financial performance and stability. Here are some key reasons why LTM is significant in banking:

- Accurate and up-to-date assessment: LTM allows analysts and stakeholders to have a more accurate understanding of a bank’s recent performance compared to traditional annual or quarterly reports. By considering the most recent twelve-month period, LTM provides a more current and comprehensive assessment of a bank’s financial health and trajectory.

- Identification of trends and patterns: Analyzing LTM data helps identify trends, patterns, and fluctuations in a bank’s financial performance. This information is useful in assessing a bank’s ability to generate consistent profits, manage risks, and adapt to changing market conditions.

- Evaluation of growth trajectory: LTM enables stakeholders to assess a bank’s growth rate by comparing its performance over the past twelve months to the same period in the previous year (LTM YoY). This comparison helps gauge the bank’s ability to sustain growth and adapt to market dynamics.

- Measurement of profitability and efficiency: LTM allows for the evaluation of a bank’s profitability and efficiency by analyzing metrics such as revenue, net income, and various ratios like the efficiency ratio. This analysis helps identify areas of improvement, cost-cutting opportunities, and measures to enhance overall financial performance.

- Informed decision-making: LTM data serves as a basis for making informed decisions regarding investments, lending, mergers and acquisitions, and regulatory compliance. By considering a bank’s recent performance using LTM, stakeholders can better assess risks, opportunities, and potential returns on investment.

Overall, LTM plays a crucial role in the banking industry by providing an accurate assessment of a bank’s financial performance, identifying trends, evaluating growth trajectory, measuring profitability, and informing decision-making processes. By leveraging LTM data, stakeholders can make informed decisions that support long-term financial stability and success.

LTM Applications in Banking

The Last Twelve Months (LTM) metric has various applications in the banking industry. Here are some key ways in which LTM is used in banking:

- Financial statement analysis: LTM is used to analyze a bank’s financial statements, including income statements, balance sheets, and cash flow statements. By examining the financial performance over the past twelve months, analysts can gain insights into revenue generation, expense management, and overall profitability.

- Comparative analysis: LTM allows for comparative analysis within the banking industry. Analysts can compare the financial performance of different banks over the same twelve-month period, enabling them to identify top performers, industry trends, and potential areas for improvement.

- Investment evaluation: LTM is an essential tool for evaluating the investment potential of a bank. Investors can assess a bank’s financial performance, growth trajectory, and profitability using LTM data. This aids in making informed decisions regarding investments in bank stocks, bonds, or other financial products.

- Risk assessment: LTM is used to assess a bank’s risk profile. By analyzing LTM data, regulators, investors, and other stakeholders can evaluate a bank’s ability to manage risks, such as loan defaults, interest rate volatility, or regulatory compliance issues. This information is crucial for maintaining financial stability within the banking sector.

- Mergers and acquisitions: LTM is a vital metric used in merger and acquisition (M&A) evaluations in the banking industry. When considering a merger or acquisition, banks analyze each other’s LTM financial data to assess the potential synergies, growth prospects, and overall financial health of the target bank.

- Loan underwriting: LTM plays a role in loan underwriting processes. By evaluating a bank’s LTM financial performance, lenders can assess the bank’s ability to repay loans and manage potential risks. This information helps lenders determine the terms and conditions of the loan.

In summary, LTM has various applications in banking. It aids in financial statement analysis, comparative analysis, investment evaluation, risk assessment, M&A evaluations, and loan underwriting. By leveraging LTM data, stakeholders in the banking industry can make informed decisions that support financial stability, growth, and risk management.

LTM Challenges in Banking

While the Last Twelve Months (LTM) metric is a valuable tool in assessing a bank’s financial performance, it also presents certain challenges in the banking industry. Here are some of the key challenges faced when using LTM in banking:

- Data accuracy and completeness: One of the main challenges in using LTM is ensuring the accuracy and completeness of the financial data. Banks must have robust data collection and reporting systems in place to capture all relevant financial information accurately. Inaccurate or incomplete data can lead to distorted LTM calculations, leading to misleading analysis and decision-making.

- Seasonality and cycles: The banking industry is subject to seasonal fluctuations and economic cycles, which can impact a bank’s financial performance. Analyzing LTM data may not fully capture the cyclical nature of the industry, making it challenging to accurately assess a bank’s long-term trajectory.

- Changing market conditions: LTM data is based on historical financial information, which may not reflect current or future market conditions. Rapid changes in interest rates, regulatory environment, or market trends can affect a bank’s financial performance, making it difficult to solely rely on LTM data for decision-making.

- External factors: LTM metrics can be influenced by external factors beyond a bank’s control. These factors include changes in government policies, economic stability, industry regulations, or geopolitical events. It is important to consider these external factors when interpreting LTM data and making informed decisions.

- Time lag: LTM calculations rely on data from the past twelve months, which means there is a time lag between the current analysis and the actual financial performance. This lag can make it challenging to evaluate real-time trends or react to sudden changes in the market.

- Comparability: Comparing LTM data across banks can be challenging due to differences in accounting practices, size, business models, and geographical locations. These factors can make it difficult to make meaningful comparisons and benchmarks.

Despite these challenges, LTM remains a valuable metric in the banking industry. It is essential to be aware of these challenges and complement LTM analysis with other financial indicators and qualitative assessments to gain a comprehensive understanding of a bank’s performance and future prospects.

Conclusion

The Last Twelve Months (LTM) metric plays a significant role in the banking industry, providing valuable insights into a bank’s financial performance, stability, and growth trajectory. By analyzing a bank’s performance over the most recent twelve months, stakeholders can gain a more accurate and up-to-date understanding of its financial health and profitability.

The applications of LTM in banking are diverse. It is used for financial statement analysis, comparative analysis, investment evaluation, risk assessment, M&A evaluations, and loan underwriting. LTM enables stakeholders to make informed decisions, support long-term stability, and navigate the dynamic banking environment.

However, there are challenges associated with using LTM. These include issues related to data accuracy and completeness, seasonality and cycles, changing market conditions, external factors, time lag, and comparability. It is crucial to address these challenges and complement LTM analysis with other financial indicators and qualitative assessments to gain a more comprehensive understanding of a bank’s performance.

In conclusion, LTM is a valuable tool that aids in evaluating a bank’s financial performance and growth potential. By leveraging LTM data alongside other financial metrics, stakeholders in the banking industry can make informed decisions and strategies to support long-term financial stability and success.