Home>Finance>What Does Cycle Code Mean On An IRS Transcript?

Finance

What Does Cycle Code Mean On An IRS Transcript?

Published: November 1, 2023

Discover the meaning of cycle code on an IRS transcript and how it relates to your finances. Gain insights on navigating IRS processes and requirements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the intricacies of the Internal Revenue Service (IRS) can be a daunting task. From complex tax codes to confusing paperwork, navigating through the world of taxes can feel overwhelming. To make matters more challenging, the IRS uses various codes and jargon that can leave taxpayers scratching their heads.

One such code that often appears on IRS transcripts is the cycle code. If you’ve ever obtained an IRS transcript, you may have noticed a string of numbers and letters labeled as the cycle code. While it may seem cryptic at first glance, understanding the meaning and significance of cycle codes can provide valuable insights into your tax status.

In this article, we will dive into the world of cycle codes on IRS transcripts. We’ll explore what cycle codes are, why they are important, and how to interpret them. Additionally, we’ll discuss common cycle codes and their meanings, as well as why these codes may change over time. Finally, we’ll provide essential information on how to request an IRS transcript for your records.

By the end of this article, you’ll have a clear understanding of what cycle codes mean on an IRS transcript and how they can impact your tax situation. So, let’s get started and unravel the mysteries of cycle codes.

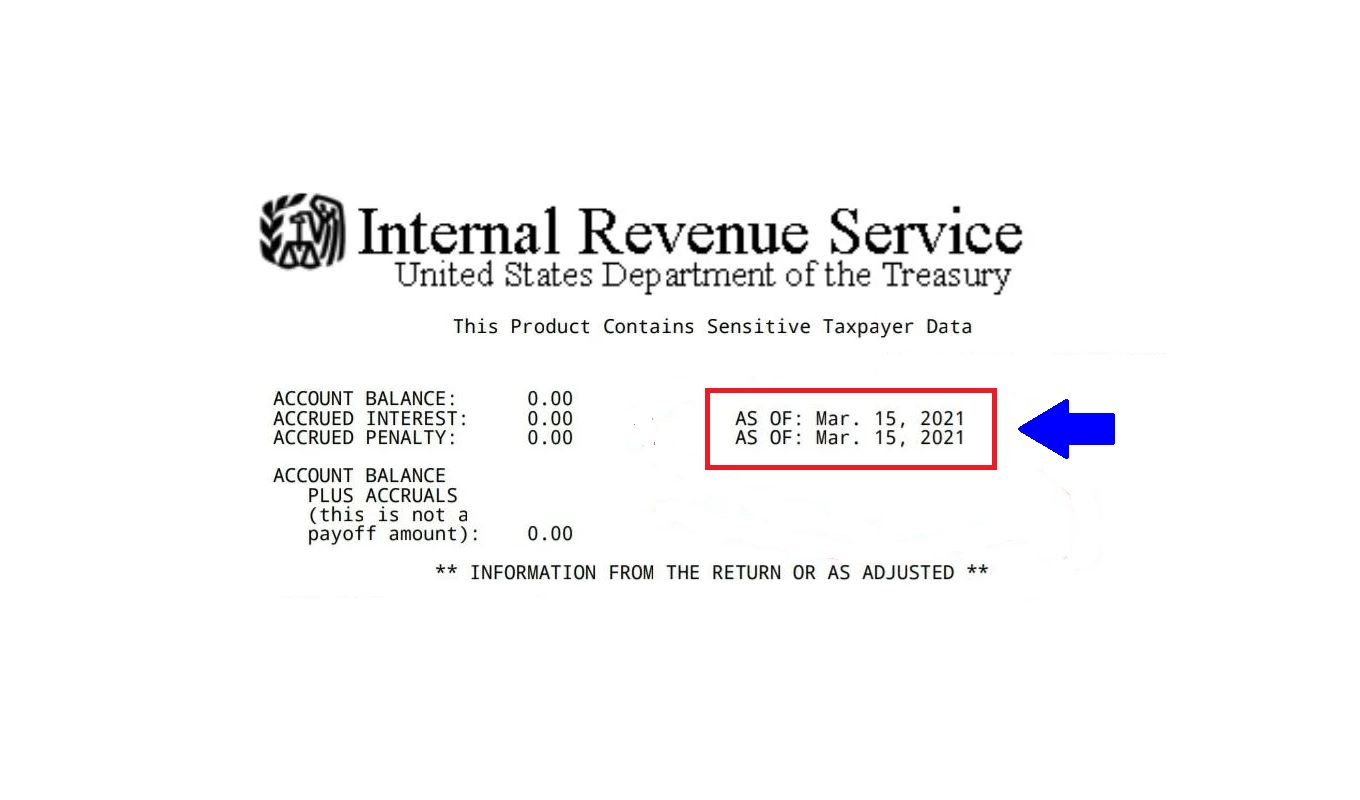

Understanding IRS Transcripts

Before we delve into the world of cycle codes, it is vital to have a basic understanding of IRS transcripts. An IRS transcript is a document that summarizes your tax return information. It contains a record of your financial transactions and interactions with the IRS, such as filing tax returns, making payments, and requesting refunds.

IRS transcripts are commonly used by taxpayers to verify income when applying for loans, mortgages, or financial aid. They can also be helpful in resolving tax disputes, identifying errors on past tax returns, or detecting potential cases of identity theft.

There are several types of IRS transcripts available, including:

- Account Transcript: Provides a comprehensive overview of your tax account, including payments made, refunds issued, and any amounts owed.

- Return Transcript: Summarizes key information from your most recently filed tax return, such as filing status, income reported, and deductions claimed.

- Record of Account Transcript: Combines the information from both the account transcript and return transcript into a single document.

- Wage and Income Transcript: Lists income reported to the IRS by employers, financial institutions, and other entities.

Regardless of the specific type, IRS transcripts contain valuable information that can provide insights into your tax history and current standing with the IRS.

Now that we have a basic understanding of IRS transcripts, let’s explore the concept of cycle codes and their significance on these documents.

What is a Cycle Code?

A cycle code is a unique identifier assigned by the IRS to each tax return and associated tax year. It consists of a string of numbers and letters and serves as a way for the IRS to track and organize tax returns for processing.

Each tax return is assigned a specific cycle code based on the date it was received and the processing period it falls under. The cycle code provides valuable information about when your tax return will be processed and when you can expect to receive any refunds or correspondence from the IRS.

The cycle code is typically found on the top right-hand corner of an IRS transcript, along with the transaction code and the amount of any refund or balance due. It is important to note that the cycle code does not indicate the status or outcome of your tax return. Instead, it serves as a reference point for IRS operations.

Understanding the significance of cycle codes can help taxpayers gauge the progress of their tax return and gain insight into the timing of refund disbursements or IRS communications.

Now that we have a basic understanding of what cycle codes are, let’s explore why they are important and how you can interpret them on an IRS transcript.

Importance of Cycle Codes on IRS Transcripts

The cycle codes displayed on an IRS transcript may seem like random numbers and letters, but they hold significant importance in understanding the status of your tax return and the corresponding actions taken by the IRS. Here’s why cycle codes are important:

1. Tracking Tax Return Progress: Cycle codes provide a way for taxpayers to track the progress of their tax return through the IRS system. By referencing the cycle code, you can determine the stage of processing your return is currently in and estimate when you might receive your refund or any notices from the IRS.

2. Timing of Refunds and Correspondence: The cycle code can help you estimate when to expect your refund or any correspondence from the IRS. Different cycle codes correspond to different processing cycles within the IRS, giving you an idea of when your refund is likely to be issued or when you might receive an update regarding your tax return.

3. Identifying Issues or Errors: Cycle codes can also indicate if there are any issues or errors with your tax return. For example, if you receive a cycle code indicating a delay in processing or further review, it may suggest that the IRS has identified discrepancies or needs additional information before finalizing your return.

4. Monitoring Tax Account Activity: By analyzing the cycle codes on your IRS transcript, you can monitor the activity on your tax account. This includes tracking any adjustments made, payments applied, or penalties assessed. Cycle codes can give you insights into the status of these updates and allow you to stay informed about any changes to your tax account.

Understanding the importance of cycle codes on IRS transcripts can help you navigate the tax process more effectively. By interpreting these codes, you can gain valuable insights into the progress of your tax return, anticipate the timing of refunds or notices, and address any issues or errors promptly.

Now that we recognize the importance of cycle codes, let’s dive into how to decode and interpret them on an IRS transcript.

How to Interpret Cycle Codes

Interpreting cycle codes on an IRS transcript may seem complex, but with a little guidance, you can decode their meaning. Here are some steps to help you interpret cycle codes:

1. Understanding the Format: Cycle codes typically follow a specific format. They are comprised of four digits, followed by a letter or combination of letters. The first two digits represent the calendar year, while the next two digits represent the week of the year in which the return was processed. The letter(s) indicate the type of processing cycle the return falls under.

2. Deciphering the Year and Week: Look at the first four digits of the cycle code to determine the year and week of processing. For example, a cycle code of 202012 refers to the twelfth week of processing in the year 2020.

3. Identifying the Type of Processing Cycle: The letter(s) in the cycle code represent the type of processing cycle. Different letters correspond to different IRS functions. For example:

- A: Automatic Return Released

- B: Nonelectronic preprocessing (manually processed returns)

- C: Cycle control (reconciliation and posting functions)

- D: Office examination or audit

- E: Examination return transcript

- F: General inventory (manually processed return)

These are just a few examples, and the letter codes can vary depending on the specific function being performed by the IRS.

4. Determining the Status: Based on the year, week, and type of processing cycle, you can determine the status of your tax return. For example, if the cycle code indicates a processing cycle that is several weeks behind the current date, it suggests a delay in processing. If the cycle code indicates an examination or audit, it may indicate further review of your return by the IRS.

Interpreting cycle codes on an IRS transcript can provide valuable insights into the progress and status of your tax return. By understanding the year, week, and type of processing cycle, you can estimate the timing of refunds or notices, identify potential issues, and stay informed about the activity on your tax account.

Now that we know how to interpret cycle codes, let’s explore some common cycle codes and their meanings.

Decoding Cycle Codes

Decoding cycle codes on an IRS transcript involves understanding the specific combinations of numbers and letters and their corresponding meanings. While cycle codes can vary, there are some common patterns to look out for:

1. Weekly and Daily Cycles: The first two digits of the cycle code represent the calendar year, and the next two digits represent the week of processing. For example, a cycle code of 202012 refers to the twelfth week of processing in the year 2020. Some cycle codes may even include a two-digit day indicator for more precise tracking.

2. Processing Type: The letter(s) in the cycle code indicate the type of processing cycle. Different letters correspond to different functions within the IRS. For instance:

- A: Automatic Return Released

- B: Nonelectronic preprocessing (manually processed returns)

- C: Cycle control (reconciliation and posting functions)

- D: Office examination or audit

- E: Examination return transcript

- F: General inventory (manually processed return)

These are just a few examples, and the letters can vary based on the specific IRS function being performed.

3. Status and Actions: By deciphering the year, week, and processing type, you can determine the status and actions associated with your tax return. For example, if the cycle code indicates a processing cycle that is behind the current date, it may suggest a delay in processing. If it indicates an examination or audit, it signifies further review of your return by the IRS.

It is important to note that cycle codes can change over time as the IRS processes returns and updates its systems. Therefore, it’s essential to regularly check the latest cycle code on your IRS transcript for the most up-to-date information.

Decoding cycle codes allows you to gain valuable insights into the progress, timing, and status of your tax return. By understanding the weekly and daily cycles, processing types, and associated actions, you can track your refund, identify any delays or issues, and navigate the IRS system more efficiently.

Now, let’s explore some common cycle codes and their meanings to further enhance our understanding.

Common Cycle Codes and their Meanings

Cycle codes on IRS transcripts can vary, but there are some commonly encountered codes and their corresponding meanings that taxpayers should be aware of:

1. Cycle Code 202X01: This code indicates that your tax return was received and processed early in the tax season. It is often associated with taxpayers who file their returns electronically and are among the first to receive refunds.

2. Cycle Code 202X05: If you see this cycle code, it means your tax return is still being processed, and a refund date will be provided once available. This code typically signifies that the IRS has reviewed your return and is in the process of finalizing the necessary calculations.

3. Cycle Code 202X08: This code suggests that your refund has been approved and is scheduled to be issued on a specific date. It indicates that the IRS has completed processing your return and is preparing to send the refund to you.

4. Cycle Code 202X10: If you come across this code, it means that your refund has been offset or reduced to satisfy certain outstanding debts, such as unpaid taxes, child support, or student loans. The IRS will provide details on the amount of the offset and the agencies or entities to which it was applied.

5. Cycle Code 202X37: This cycle code is often associated with returns that have been selected for examination or audit by the IRS. If you receive this code, it indicates that your return requires further review, and you may be contacted by the IRS for additional documentation or clarification.

Remember, cycle codes can change over time, and the specific codes and their meanings may vary. It’s always a good idea to consult the most up-to-date information from the IRS or speak with a tax professional for accurate and personalized guidance regarding your specific situation.

Understanding common cycle codes and their meanings can provide valuable insights into the processing status of your tax return, the timing of your refund, and any potential issues or outstanding debts that may affect the final amount. By having this knowledge, you can stay informed and take appropriate action if necessary.

Now that we’ve explored common cycle codes, let’s examine why cycle codes can change over time.

Why Cycle Codes Change

Cycle codes on IRS transcripts can change over time due to various factors and updates within the IRS system. Here are some common reasons why cycle codes may change:

1. Processing Updates: The IRS constantly updates its processing systems and schedules to accommodate the large volume of tax returns it receives. As a result, cycle codes may change to reflect these updates and ensure efficient processing and tracking of tax returns.

2. Processing Delays: If there are delays in processing tax returns, such as during peak tax season or when the IRS faces resource constraints, cycle codes may be adjusted to account for the backlog. This allows the IRS to prioritize and process returns in a more organized manner.

3. Error Corrections: If errors or discrepancies are identified during the processing of a tax return, the IRS may update the cycle code to indicate that further review or correction is necessary. This ensures that any issues are appropriately addressed before the return is finalized.

4. Audit Selection: The IRS may select certain tax returns for examination or audit. In these cases, the cycle code may change to reflect the additional review and examination process. This helps the IRS track the progress of the audit and ensures that the taxpayer is aware of the ongoing review.

5. Account Activity: If there are significant changes or updates to a taxpayer’s account, such as the application of a payment, the assessment of penalties, or the resolution of an outstanding issue, the cycle code may be adjusted to reflect these updates and keep the taxpayer informed.

It’s important to note that cycle code changes do not necessarily indicate a problem or issue with your tax return. They are primarily administrative adjustments made by the IRS to accommodate processing requirements, updates, and specific taxpayer situations.

While cycle code changes may not directly impact the outcome of your tax return, they can provide insights into the progress and status of your return within the IRS system. It’s always a good practice to regularly check for any changes in your cycle code to stay informed about the processing of your return and any updates to your tax account.

Now that we understand why cycle codes can change, let’s explore how to request an IRS transcript to obtain the necessary information.

How to Request an IRS Transcript

If you need to obtain an IRS transcript, whether for personal record keeping, loan applications, or resolving tax disputes, there are several methods you can use to request one:

1. Online Request: The easiest and fastest way to request an IRS transcript is through the IRS website. Visit the “Get Transcript” page (www.irs.gov/transcript) and follow the prompts to provide the necessary information, such as your Social Security number, date of birth, and mailing address. You can choose between various transcript types, including tax return transcripts, account transcripts, or wage and income transcripts.

2. Phone Request: Alternatively, you can request an IRS transcript by calling the IRS Transcript toll-free line at 1-800-908-9946. Follow the automated prompts to provide the required information and select the type of transcript you need. The transcript will be mailed to your address of record within five to 10 business days.

3. Mail Request: If you prefer a more traditional method, you can complete Form 4506-T, Request for Transcript of Tax Return, and mail it to the appropriate IRS address based on your location. The form is available on the IRS website and includes instructions for completion and submission. It may take several weeks to receive the transcript by mail.

4. Third-Party Request: If you need a third party, such as a lender or tax professional, to request the transcript on your behalf, you can authorize them by completing Form 4506-T and providing it to the designated representative. This allows them to request and receive the transcript on your behalf.

It’s important to note that IRS transcripts are generally available for the current and past three tax years. However, older transcripts may be requested for certain purposes, such as resolving tax matters or filing an amended return.

By following these steps, you can easily request an IRS transcript and obtain the necessary documentation for various purposes. Transcripts provide valuable insights into your tax history, income verification, and IRS account activity, helping you make informed financial decisions and address any tax-related issues.

Now that we’ve covered how to request an IRS transcript, let’s wrap up our discussion.

Conclusion

Understanding cycle codes on IRS transcripts is essential for navigating the intricacies of the tax system. These unique identifiers can provide valuable insights into the processing status, timing of refunds, and potential issues with your tax return. By deciphering cycle codes, you can stay informed, anticipate refund disbursements or IRS communications, and address any discrepancies or delays promptly.

In this article, we explored the significance of cycle codes on IRS transcripts and how to interpret them. We discussed the format of cycle codes, the importance of understanding the year, week, and processing type, and how these codes can change over time. We also delved into common cycle codes and their meanings, giving you a glimpse into the possible outcomes associated with specific codes.

Furthermore, we provided information on how to request an IRS transcript through various methods, including online requests, phone calls, and mail submissions. Accessing IRS transcripts is crucial for verifying income, resolving tax disputes, and maintaining accurate financial records.

Remember, while cycle codes provide valuable insights, they do not determine the outcome of your tax return. If you have questions or concerns about your tax situation, it’s always a good idea to consult a tax professional or reach out to the IRS for personalized assistance.

By understanding and utilizing cycle codes, you can navigate the tax system with confidence and ensure a smooth and transparent experience. Stay informed, stay proactive, and stay on top of your tax obligations to achieve financial peace of mind.