Finance

What Does IVR Mean In Banking

Modified: February 21, 2024

Discover the meaning of IVR in banking and its significance in the finance industry. Learn how this technology improves customer experience and streamlines financial services.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of IVR

- IVR in Banking

- Benefits of IVR in Banking

- Enhanced Customer Experience

- Improved Efficiency and Cost Savings

- Increased Accessibility and Convenience

- Challenges and Limitations of IVR in Banking

- Security Concerns

- Lack of Personalized Interaction

- Best Practices for Implementing IVR in Banking

- Conclusion

Introduction

In today’s fast-paced digital world, customers expect quick and efficient service when it comes to their banking needs. One technology that has revolutionized the way banks interact with their customers is Interactive Voice Response (IVR). IVR systems have become an integral part of the banking industry, offering a convenient and efficient way for customers to access a wide range of services.

IVR, short for Interactive Voice Response, is a technology that allows customers to interact with a computerized system through voice or touch-tone input. It uses pre-recorded voice prompts and menus to guide customers through various options and services. IVR systems are commonly used in banking for tasks such as checking account balances, transferring funds, paying bills, and much more.

In the past, customers had to visit a bank branch or call a customer service representative to perform these tasks. However, IVR has transformed the banking experience by providing self-service options that are available 24/7, allowing customers to access their accounts and complete transactions from the comfort of their homes or on the go.

IVR technology has evolved significantly over the years, incorporating natural language processing and speech recognition capabilities to make interactions more seamless and intuitive. Today, IVR systems can understand and respond to customers’ requests in a more human-like manner, further enhancing the customer experience.

In this article, we will explore the role of IVR in the banking industry and delve into the benefits it offers both customers and banks. We will also discuss the challenges and limitations associated with IVR and provide best practices for implementing IVR in banking to ensure a successful and satisfying customer journey.

Definition of IVR

Interactive Voice Response (IVR) is a technology that enables customers to interact with a computerized system through voice or touch-tone input. It is a self-service technology that uses pre-recorded voice prompts and menus to guide customers through various options and services. IVR systems are commonly used in industries such as banking, telecommunications, healthcare, and customer support.

IVR systems are designed to handle a wide range of customer inquiries and transactions. Customers can access information, perform transactions, and even resolve issues without the need for human intervention. IVR systems typically offer a series of menus and options that customers can navigate through using their voice or touch-tone keypad.

IVR can be categorized into two types: inbound IVR and outbound IVR. Inbound IVR is used when customers initiate contact with the system, such as calling a support hotline or accessing account information. Outbound IVR, on the other hand, is used when the system initiates contact with customers, such as sending automated reminders or notifications.

With advancements in natural language processing and speech recognition technologies, IVR systems have become more sophisticated and capable of understanding and responding to customer requests in a more human-like manner. This enhances the overall customer experience and reduces the need for customers to interact with live agents, saving time and resources for both customers and businesses.

IVR systems can be integrated with other technologies such as customer relationship management systems and databases to provide personalized and accurate information to customers. They also often incorporate features like call routing, call queuing, and call transfer to ensure customers are connected to the right department or agent.

Overall, IVR technology has transformed the way businesses interact with their customers, offering convenience, efficiency, and cost savings. In the banking industry, IVR plays a crucial role in providing self-service options and streamlining customer transactions.

IVR in Banking

IVR technology has become an essential component of modern banking systems, revolutionizing the way customers access and manage their accounts. In the banking industry, IVR provides a convenient and efficient self-service option for customers to perform a wide range of transactions and inquiries.

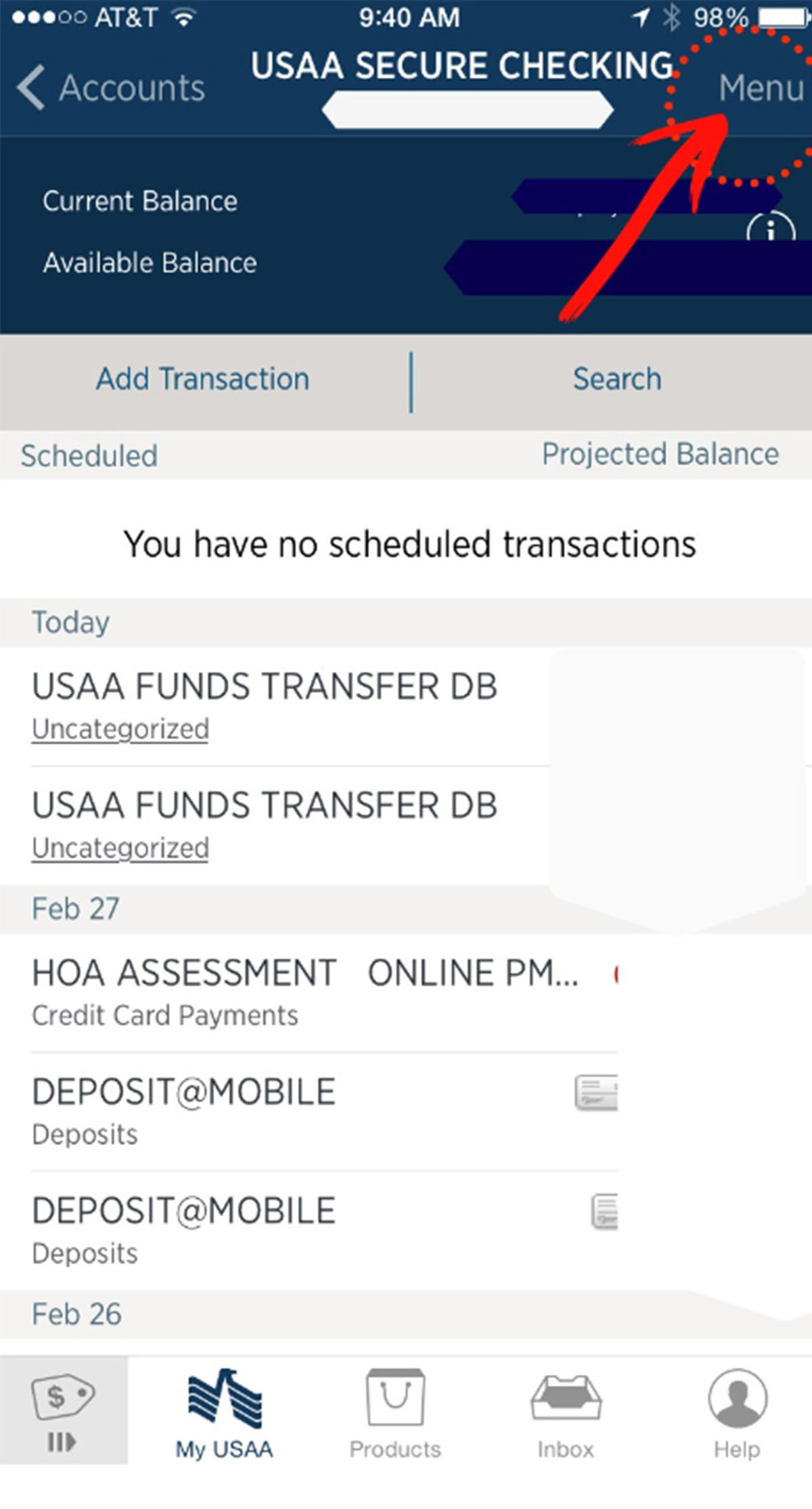

Banking IVR systems offer a variety of services, including checking account balances, transferring funds, making bill payments, requesting statements, ordering checkbooks, updating personal information, and more. By using IVR, customers can access these services at any time, without the need to visit a branch or speak to a customer service representative.

One of the primary advantages of IVR in banking is its ability to handle a large volume of customer interactions simultaneously. IVR systems can handle multiple calls and provide prompt and accurate responses to customer queries. This not only reduces wait times and eliminates the need for customers to be put on hold but also improves overall customer satisfaction.

Moreover, IVR in banking provides a consistent and standardized experience for customers. The pre-recorded voice prompts and menus guide customers through the available options, ensuring that each interaction follows a standardized process. This consistency helps eliminate human errors and ensures that customers receive accurate information and complete their transactions seamlessly.

IVR technology also allows banks to automate routine and repetitive tasks, freeing up customer service representatives to focus on more complex inquiries and providing personalized assistance to customers who need it. This improves efficiency and reduces operating costs for banks.

Furthermore, IVR systems in banking can often be accessed from multiple channels, including phone calls, mobile apps, and web portals. This multi-channel accessibility gives customers the flexibility to choose the most convenient method of interacting with the bank. For example, they can use their smartphones to check account balances or make payments, or they can call the IVR system from a landline if they prefer.

In summary, IVR technology has transformed the way banking services are delivered to customers. It offers a self-service option that is available 24/7, improves efficiency, provides consistent and accurate information, and enhances the overall customer experience. With the increasing adoption of digital banking, IVR will continue to play a vital role in providing convenient and accessible banking services to customers around the world.

Benefits of IVR in Banking

Interactive Voice Response (IVR) technology has brought numerous benefits to the banking industry, transforming the way customers interact with their financial institutions. Here are some key benefits of IVR in banking:

- Enhanced Customer Experience: IVR systems offer a self-service option that improves overall customer experience. Customers can access their accounts and perform various transactions at any time, without the need to visit a branch or speak to a customer service representative. This convenience and accessibility lead to increased customer satisfaction and loyalty.

- Improved Efficiency and Cost Savings: IVR automates routine and repetitive tasks, reducing the workload of customer service representatives. This allows banks to reallocate resources to more complex inquiries and provide personalized assistance where needed. By streamlining processes and reducing the need for human intervention, IVR systems improve efficiency and reduce operating costs for banks.

- Increased Accessibility and Convenience: With IVR, customers can access banking services from anywhere, at any time. They can check account balances, transfer funds, and make payments using their smartphones or traditional landlines. IVR systems also provide multilingual options, making banking services accessible to a diverse customer base.

- Quicker Service and Reduced Wait Times: IVR systems can handle multiple customer interactions simultaneously, eliminating the need for customers to wait in queues or be put on hold. By providing prompt and accurate responses, IVR reduces wait times and improves the overall speed of service.

- 24/7 Availability: IVR systems are available round the clock, allowing customers to access their accounts and perform transactions at their convenience. This eliminates the time constraints associated with traditional banking hours and provides customers with the flexibility to manage their finances whenever they need to.

Overall, IVR in banking offers a range of benefits that enhance the customer experience, improve efficiency, and provide greater accessibility to banking services. By leveraging IVR technology, banks can meet the evolving needs of their customers in an increasingly digital world, while also saving time and resources.

Enhanced Customer Experience

One of the key benefits of Interactive Voice Response (IVR) in banking is the enhanced customer experience it provides. IVR systems offer a self-service option that allows customers to access and manage their accounts conveniently and efficiently. Here are some ways IVR enhances the customer experience in banking:

- 24/7 Availability: IVR systems are available round the clock, giving customers the freedom to access banking services at any time. They can check account balances, transfer funds, and perform various transactions whenever it is convenient for them, without being limited by traditional banking hours.

- Convenience and Accessibility: IVR allows customers to interact with their bank through voice or touch-tone input, offering a user-friendly and familiar interface. Whether they are using their smartphones, landlines, or even public phone booths, customers can easily navigate through the IVR menus and access a wide range of banking services.

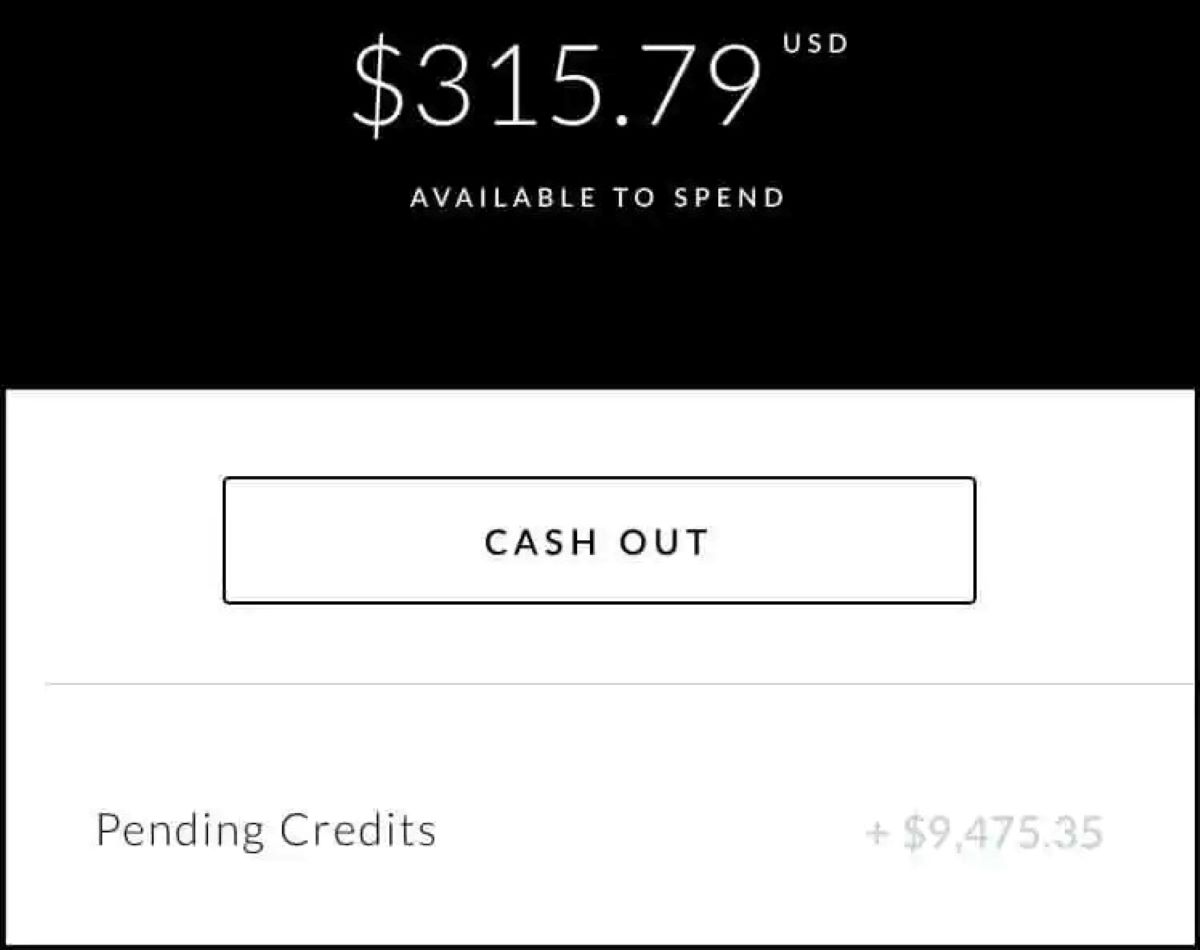

- Efficient Transaction Processing: By leveraging IVR technology, customers can quickly and securely complete routine transactions without the need for human intervention. They can check their account balances, transfer funds between accounts, pay bills, and perform other tasks efficiently, avoiding the need to visit a bank branch or speak with a customer service representative.

- Personalized Service: IVR systems can be customized to provide personalized information and recommendations based on a customer’s account history and preferences. By leveraging customer data, IVR can offer targeted offers, provide account-specific information, and deliver a tailored banking experience to each customer.

- Reduced Wait Times: IVR systems can handle multiple customer interactions simultaneously, reducing wait times for callers. Customers no longer need to wait in long queues or be put on hold to speak with a customer service representative. IVR provides quick and accurate responses, ensuring a seamless and efficient customer experience.

- Seamless Integration with Other Channels: IVR systems can be integrated with other customer touchpoints, such as mobile apps and online banking portals. This integration ensures a seamless experience for customers as they transition between different channels. For example, a customer who initiates a transaction through IVR can easily continue and complete it on the bank’s mobile app without any interruption.

By offering convenience, accessibility, personalized service, reduced wait times, and seamless integration with other channels, IVR enhances the overall customer experience in banking. It empowers customers to have greater control over their finances and provides them with a convenient and efficient way to manage their accounts at their own pace and preference.

Improved Efficiency and Cost Savings

Interactive Voice Response (IVR) technology offers significant benefits to banks by improving efficiency and generating cost savings. Here are some ways in which IVR enhances operational efficiency and reduces costs in the banking industry:

- Automation of Routine Tasks: IVR systems automate routine transactions and inquiries, such as balance inquiries, funds transfers, and bill payments. By providing self-service options, customers can complete these tasks without the need for human intervention, freeing up bank staff to focus on more complex customer inquiries and assistance.

- 24/7 Availability: IVR systems are accessible round the clock, enabling customers to access their accounts and perform transactions at any time. This reduces the pressure on bank branches and call centers during peak hours and allows customers to complete their banking activities at their convenience. As a result, banks can optimize their resources and reduce the need for extended customer service hours.

- Reduced Call Volumes: IVR systems handle a large volume of customer interactions simultaneously. By providing prompt and accurate responses to common inquiries, customers can get the information they need without the need to speak with a customer service representative. This reduces call volumes and wait times, allowing bank staff to focus on more complex and specialized tasks.

- Cost-effective Customer Service: IVR systems provide cost-effective customer service by reducing the need for additional staff. Instead of hiring more customer service representatives to handle increased call volumes, banks can leverage IVR technology to handle routine inquiries and transactions. This allows banks to optimize their workforce and allocate employees to higher-value tasks.

- Streamlined Process Flows: IVR systems offer standardized menus and prompts to guide customers through their transactions. This ensures that each interaction follows a standardized process, reducing the likelihood of errors or misunderstandings. By streamlining process flows, banks can improve operational efficiency, minimize the risk of human errors, and enhance the overall customer experience.

- Data Collection and Analysis: IVR systems are capable of collecting valuable customer data, such as transaction history, preferences, and trends. Banks can leverage this data to analyze customer behavior, anticipate needs, and offer personalized services. These insights enable banks to refine their marketing strategies, tailor offerings to specific customer segments, and improve overall operational efficiency.

By automating routine tasks, optimizing call volumes, streamlining processes, and leveraging customer data, IVR technology significantly improves efficiency and generates cost savings for banks. It allows banks to provide efficient customer service while optimizing their resources, ultimately resulting in improved profitability and customer satisfaction.

Increased Accessibility and Convenience

Interactive Voice Response (IVR) technology has greatly increased accessibility and convenience in the banking industry. By offering a self-service option, IVR systems provide customers with greater flexibility in accessing and managing their accounts. Here are some ways in which IVR enhances accessibility and convenience for banking customers:

- 24/7 Availability: IVR systems are available round the clock, allowing customers to access banking services at any time, including evenings, weekends, and even holidays. This eliminates the time restrictions associated with traditional banking hours and provides customers with the flexibility to manage their finances whenever it suits them.

- Multi-channel Access: IVR systems can be accessed through multiple channels, including phone calls, mobile apps, or web portals. This multi-channel accessibility gives customers the freedom to choose the most convenient method of interacting with their bank. For instance, they can use their smartphones to check account balances or make payments, or they can call the IVR system from a landline if they prefer.

- Convenient Transaction Processing: IVR allows customers to perform various banking transactions at their convenience. With a simple phone call or a few taps on their mobile device, customers can check account balances, transfer funds between accounts, and pay bills. This eliminates the need to visit a physical bank branch or spend time waiting in queues.

- Easy Navigation and User-friendly Interface: IVR systems provide customers with easy-to-follow voice prompts or touch-tone menus to navigate through different banking services and options. The menus are designed to be intuitive and user-friendly, ensuring a seamless and hassle-free banking experience for customers of all technical abilities.

- Accessible to Diverse Customer Base: IVR systems can accommodate a wide range of languages and can be tailored to cater to customers with different language preferences. This ensures that customers with diverse backgrounds and language requirements can access banking services easily and comfortably in their preferred language.

- Improved Customer Service: IVR technology allows customers to quickly access account information and perform routine transactions without the need to wait in long queues or speak to a customer service representative. This improves customer service by providing instant access to vital information and reducing waiting times, leading to greater customer satisfaction.

The increased accessibility and convenience provided by IVR systems have transformed the way customers interact with their banks. Whether it’s accessing account information, performing transactions, or seeking assistance, IVR technology offers a convenient and efficient self-service option that empowers customers to take control of their banking needs at their own pace and convenience.

Challenges and Limitations of IVR in Banking

While Interactive Voice Response (IVR) technology offers numerous benefits to the banking industry, it also brings certain challenges and limitations that need to be considered. Here are some of the key challenges and limitations of IVR in banking:

- Security Concerns: IVR systems may face security challenges, especially when it comes to identity verification and sensitive transactional information. Banks need to implement robust security measures to protect customer data and prevent unauthorized access to accounts.

- Lack of Personalized Interaction: IVR systems may offer limited scope for personalized interaction compared to speaking with a live bank representative. While they can provide basic account information and perform routine transactions, customers with complex inquiries or specific needs may find it challenging to get the personalized assistance they require via IVR.

- Complex Menu Structures: IVR menus can sometimes become overly complex and difficult to navigate. Customers may find it frustrating to listen to a long list of options or struggle to find the right menu selection. Clear and concise menu prompts, along with well-designed menu structures, are crucial to ensure a smooth user experience.

- Language and Accent Barriers: IVR systems need to accommodate customers with diverse language preferences and accents. Automated voice recognition systems may struggle to understand different accents, leading to inaccuracies in understanding customer requests. This can result in a frustrating experience for customers and may require additional support channels to address language-related challenges.

- Dependency on Reliable Network Connectivity: IVR systems require a stable and reliable network connection for seamless operation. Technical issues or network outages can lead to disruptions in service, which can negatively impact the customer experience. Banks must ensure robust network infrastructure and backup plans to minimize downtime and maintain uninterrupted service.

- Resistance to Change: Some customers may resist using IVR systems due to a preference for human interaction or a lack of familiarity with the technology. Banks need to provide appropriate education and support to help customers understand the benefits and functionality of IVR systems, ultimately encouraging adoption.

By addressing these challenges and limitations, banks can optimize the use of IVR technology and provide a seamless and satisfactory customer experience. Clear communication, efficient menu structures, robust security measures, and personalized support channels can help overcome these limitations and maximize the benefits of IVR in the banking industry.

Security Concerns

While Interactive Voice Response (IVR) technology offers convenience and efficiency in the banking industry, it also raises security concerns that need to be addressed to safeguard customer information and mitigate risks. Here are some of the key security concerns associated with IVR in banking:

- Identity Verification: One of the primary security concerns with IVR systems is ensuring the accurate verification of customer identities. Banks need to implement robust authentication methods to authenticate customers and prevent unauthorized access to sensitive information and accounts. Multi-factor authentication, such as voice biometrics, PIN codes, or security questions, can enhance identity verification and strengthen security.

- Confidentiality of Customer Information: IVR systems handle and process sensitive customer information, such as account numbers, social security numbers, and transaction details. Banks must implement encryption techniques to ensure the confidentiality of this data, both during transmission and storage. Compliance with industry standards, such as the Payment Card Industry Data Security Standard (PCI DSS), is crucial to protect customer data and maintain data security standards.

- Protection against Fraudulent Activities: IVR systems can be vulnerable to various fraudulent activities, including phishing attacks, spoofing, and social engineering. Banks must educate customers about potential threats and implement mechanisms to detect and prevent fraudulent activities. This may involve monitoring call patterns, implementing fraud detection algorithms, and employing voice recognition technologies to verify customer identities.

- Secure Transmission and Storage: Banks need to ensure that customer data transmitted through IVR systems is encrypted and securely stored. The use of secure protocols, such as Transport Layer Security (TLS), for communication with the IVR system is crucial. Additionally, the customer data stored within the IVR system should be protected through strong access controls and encryption to prevent unauthorized access.

- Regular Security Assessments and Updates: It is important for banks to conduct regular security assessments and audits of their IVR systems to identify and address vulnerabilities. This includes patching any software vulnerabilities, monitoring system logs for unusual activities, and regularly updating security protocols to stay ahead of emerging threats.

Banks must prioritize customer data security and maintain a proactive approach to address security concerns associated with IVR systems. By implementing robust authentication measures, ensuring data confidentiality, protecting against fraudulent activities, securing data transmission and storage, and conducting regular security assessments, banks can instill confidence in customers and protect their sensitive information.

Lack of Personalized Interaction

While Interactive Voice Response (IVR) technology offers convenience and efficiency in banking, one limitation is the lack of personalized interaction compared to speaking with a live bank representative. IVR systems are designed to provide self-service options and automate routine tasks, which may limit the level of personalized assistance for customers. Here are some considerations regarding the lack of personalized interaction with IVR in banking:

- Complex or Unique Inquiries: IVR systems may struggle to handle complex or unique customer inquiries that require more in-depth or personalized assistance. Customers with specific or uncommon banking situations may find it challenging to navigate the menu options and obtain the information or support they need. In such cases, a live bank representative may be better equipped to address their individual needs.

- Limited Contextual Understanding: IVR systems rely on predetermined prompts and menu options, which may limit their ability to understand and respond to complex customer requests accurately. They may not have the same level of contextual understanding as a human representative who can interpret nuances and clarify specific queries. This can result in potential misunderstandings or inaccurate responses, leading to a less satisfactory customer experience.

- Emotional Support and Empathy: IVR systems may lack the ability to provide emotional support and empathy, which customers may seek during certain banking interactions. Some situations, such as financial hardships or fraud concerns, may require a compassionate and understanding approach that IVR systems may not be able to provide. Human representatives can offer empathy and personalized guidance, making customers feel heard and supported.

- Adaptability to Individual Preferences: IVR systems typically offer a standardized set of options and procedures, making it challenging to adapt to individual banking preferences or specific customer requirements. Customers with unique banking preferences or those who prefer a customized approach to their interactions may find the lack of adaptability with IVR systems limiting.

- Complex Issue Resolution: While IVR systems can handle many routine transactions and inquiries, there are occasions when more complex issues arise, requiring personalized assistance. Customers may face difficulties resolving complex problems solely through the IVR system and may need to escalate their inquiries to a live representative for a more tailored resolution.

To address the lack of personalized interaction with IVR systems, banks can implement strategies that strike a balance between self-service automation and human support. This may involve offering options to transfer to a live representative when customers encounter complex issues, providing clear instructions on how to reach a human agent, or integrating chatbots alongside IVR systems to enhance the level of personalized assistance available.

It is crucial for banks to assess customer needs and expectations, continuously seek customer feedback, and adapt their IVR systems accordingly. By finding the right balance between automation and personalized interaction, banks can optimize the IVR experience and provide a more satisfactory customer journey.

Best Practices for Implementing IVR in Banking

Implementing Interactive Voice Response (IVR) technology in banking requires careful planning and execution to ensure a seamless and successful customer experience. Here are some best practices to consider when implementing IVR in the banking industry:

- Clear and Concise Prompts: Design IVR prompts and menus to be clear, concise, and easy to understand. Use plain language and avoid technical jargon or complex terminology. This will help customers navigate through the options smoothly and minimize confusion.

- Well-Structured Menu Trees: Develop well-structured menu trees with logical menu options, making it easy for customers to find the information or complete the transaction they need. Consider conducting user testing to ensure the menu flow is user-friendly and intuitive.

- Voice Recognition and Natural Language Processing: Leverage voice recognition and natural language processing technologies to enhance IVR interactions with customers. This allows for a more human-like and conversational experience, enabling customers to speak naturally and have their requests understood accurately.

- Personalization and Customization: Implement personalization features in the IVR system to offer tailored experiences for customers. Utilize customer data to provide personalized greetings, account-specific information, and relevant offers. Customers appreciate a more customized experience that meets their individual needs and preferences.

- Multi-Channel Integration: Integrate IVR with other customer service channels such as mobile apps, websites, and chatbots. This enables seamless transitions for customers who may start a transaction with IVR but prefer to continue or seek additional support through another channel, ensuring a consistent and uninterrupted customer journey.

- Proactive Communication: Use IVR for proactive communication with customers, providing them with relevant updates, account notifications, and reminders. This can include payment due dates, fraud alerts, or personalized offers. Proactive communication enhances the customer experience and helps build trust in the banking relationship.

- Security Measures: Implement robust security measures to protect customer data and prevent fraudulent activities. Use encryption for secure data transmission, employ multi-factor authentication for identity verification, and regularly monitor and update security protocols to stay ahead of emerging threats.

- Customer Feedback and Continuous Improvement: Encourage customers to provide feedback on their IVR experiences and use that feedback to continuously improve and enhance the system. Monitor call analytics, review customer surveys, and identify areas for improvement. Regularly update and optimize the IVR system based on customer feedback and emerging customer needs.

By following these best practices, banks can deploy an IVR system that delivers a seamless, personalized, and secure customer experience. IVR technology, when implemented effectively, streamlines banking operations, enhances customer satisfaction, and improves overall efficiency in the delivery of banking services.

Conclusion

Interactive Voice Response (IVR) technology has revolutionized the banking industry by providing a convenient and efficient self-service option for customers. IVR offers benefits such as enhanced customer experience, improved efficiency, increased accessibility, and cost savings. Customers can access their accounts, perform transactions, and obtain information at any time, without the need for human intervention.

However, IVR technology also presents challenges and limitations that should be addressed. Security concerns, the lack of personalized interaction, and the need for clear and concise menu prompts are among the challenges that banks must navigate when implementing IVR systems.

To ensure a successful implementation, banks should follow best practices such as utilizing clear prompts, designing intuitive menu structures, incorporating voice recognition and natural language processing, implementing personalized experiences, integrating IVR with other channels, prioritizing security measures, and actively seeking customer feedback for continuous improvement.

By balancing automation and human interaction, banks can optimize the IVR experience, provide efficient and personalized customer service, and maintain a high level of data security. IVR technology represents a powerful tool in streamlining banking operations, improving customer satisfaction, and meeting the evolving needs of customers in the digital age.

As technology continues to evolve, so will IVR systems, offering even more advanced functionalities and seamless integrations. With banks embracing digital transformation, IVR will continue to play a vital role in providing accessible, convenient, and customer-centric banking services.