Finance

How Much Per Tick In Futures Contracts

Published: December 23, 2023

Get a clear understanding of how much per tick in futures contracts in the finance industry. Discover the financial implications and opportunities that arise from this crucial aspect of trading.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of futures contracts, where financial markets come alive with anticipation and excitement. If you’re new to the world of investing or are looking to expand your portfolio, understanding the dynamics of futures contracts is crucial.

A futures contract is a standardized agreement to buy or sell a specific asset, such as commodities, currencies, or indices, at a predetermined price on a future date. These contracts are traded on regulated exchanges and are popular among investors and traders due to their potential for profit and risk management.

One important aspect of futures contracts that affects traders’ strategies and profitability is the tick size. The tick size refers to the minimum price increment at which the contract’s price can fluctuate. Understanding tick size is vital as it impacts trading decisions, risk assessment, and profit potential.

In this article, we will delve into the intricacies of tick size in futures contracts, its implications, and how it varies across different markets. By the end, you will have a solid grasp of tick size and how it can impact your trading ventures.

Understanding Futures Contracts

Before diving into tick size, it’s essential to have a clear understanding of what futures contracts are and how they work.

A futures contract is a legal agreement between two parties to buy or sell an underlying asset at a specific price on a future date. The underlying asset can range from commodities like crude oil and gold to financial instruments like stock indices and currencies.

One key characteristic of futures contracts is that they are standardized. This means that the terms of the contract, including the size of the contract, the expiry date, and the tick size, are predetermined and consistent across all market participants. This standardization allows for ease of trading and ensures liquidity in the market.

When you trade a futures contract, you are not buying or selling the physical asset itself. Instead, you are entering into an agreement to buy or sell the asset at a specified price in the future. This allows traders to speculate on the price movement of the asset without actually owning it.

Futures contracts have a defined lifespan, known as the contract’s expiration date. After the expiration date, the contract becomes invalid, and traders either settle the contract by physically delivering or accepting the underlying asset or by offsetting their positions through an opposite transaction.

Now that we have a foundation in understanding futures contracts, let’s explore the concept of tick size and its significance in trading.

Tick Size in Futures Contracts

The tick size in futures contracts refers to the minimum price increment by which the contract’s price can move. It represents the smallest unit of price movement and allows for precise tracking of price changes in the market.

For example, let’s say you are trading a futures contract with a tick size of $0.01. This means that the price of the contract can change in increments of $0.01. So, if the current price is $100.00, the next possible prices would be $100.01, $100.02, $100.03, and so on.

The tick size is an essential factor in determining a contract’s liquidity and trading dynamics. A smaller tick size allows for more precise pricing, while a larger tick size can lead to wider bid-ask spreads and less granular price movements.

The tick size is determined by the exchange on which the futures contract is traded and is based on various factors, including the nature of the underlying asset and market conditions. Different futures contracts can have different tick sizes, depending on the asset and its volatility.

It’s important to note that tick size can vary across different exchanges and even within different contracts on the same exchange. Therefore, it is crucial to familiarize yourself with the specific tick size of the contracts you are trading.

The tick size is typically expressed in terms of monetary value rather than percentage points. However, it’s important to understand that the tick size itself does not represent the value of the contract or the potential profit or loss. It only represents the smallest increment at which the price can move.

Now that we have a clear understanding of tick size let’s explore how it can impact trading strategies and decision-making.

How Tick Size Affects Trading

The tick size in futures contracts plays a significant role in shaping trading strategies and influencing trading decisions. Here are a few key ways in which tick size affects trading:

1. Price Precision: The tick size determines the level of price precision in the market. A smaller tick size allows for more granular price movements, providing traders with the ability to execute trades at more precise levels. This can be advantageous for traders employing scalping or short-term trading strategies, where even small price differentials can lead to profitable trades.

2. Bid-Ask Spread: The tick size impacts the bid-ask spread, which is the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). A smaller tick size generally results in narrower spreads, making it more cost-effective for traders to enter and exit positions. Conversely, larger tick sizes may lead to wider bid-ask spreads, increasing transaction costs.

3. Volatility and Risk: Tick size can also influence the perceived volatility and risk associated with a futures contract. A smaller tick size allows for finer price movements, potentially leading to more frequent and rapid price fluctuations. This increased volatility may appeal to traders seeking higher profit potential but can also increase the risk of larger losses.

4. Order Types and Execution: Tick size impacts the types of orders that can be placed and the execution of trades. Some exchanges allow for different order types, such as market orders, limit orders, and stop orders, which can be affected by the tick size. Additionally, tick sizes may influence the order book depth, determining how quickly orders can be filled.

5. Position Sizing and Risk Management: For traders, tick size plays a crucial role in position sizing and risk management. A smaller tick size allows for more precise determination of profit targets and stop-loss levels. Traders can design their risk management strategies more effectively by aligning their position sizes with the tick size and the desired risk-reward ratio.

Understanding how tick size influences trading strategies and decision-making is essential for traders to effectively navigate the futures market and optimize their trading outcomes.

Factors Determining Tick Value

The tick value in futures contracts refers to the monetary value of each tick movement. It represents the amount of profit or loss that occurs with each tick change in price. Several factors influence the tick value of a futures contract:

1. Contract Size: The contract size, also known as the lot size, is the quantity of the underlying asset that the futures contract represents. The tick value is typically calculated by multiplying the tick size by the contract size. For example, if the tick size is $0.01 and the contract size is 100 barrels of crude oil, then the tick value would be $1 ($0.01 x 100).

2. Tick Size: The tick size itself is a factor in determining the tick value. As mentioned earlier, tick size represents the minimum price increment by which the contract’s price can move. A smaller tick size generally results in a smaller tick value, while a larger tick size leads to a larger tick value.

3. Currency Exchange Rate: For currency futures contracts, the tick value depends on the exchange rate between the two currencies involved in the contract. Fluctuations in the exchange rate can directly affect the tick value and the potential profit or loss for traders.

4. Percentage Movement: In some cases, the tick value may be based on a percentage movement of the contract’s price rather than a fixed monetary amount. For example, a futures contract on a stock index may have a tick value based on 0.01% movement of the index value. This allows for consistent tick value across different price levels of the index.

5. Contract Specifications: The exchange on which the futures contract is traded determines the contract specifications, including the tick value. Each exchange has its own set of rules and regulations regarding tick size and tick value for different contracts. It is crucial for traders to familiarize themselves with the specific contract specifications of the exchanges they trade on.

It is important to note that tick value may change over time due to adjustments in contract specifications or market conditions. Traders should regularly check for any updates or changes in tick value to ensure accurate risk management and profit calculations.

Examples of Tick Sizes in Different Futures Contracts

The tick size in futures contracts can vary significantly depending on the nature of the underlying asset and the exchange where the contract is traded. Here are a few examples of tick sizes in different futures contracts:

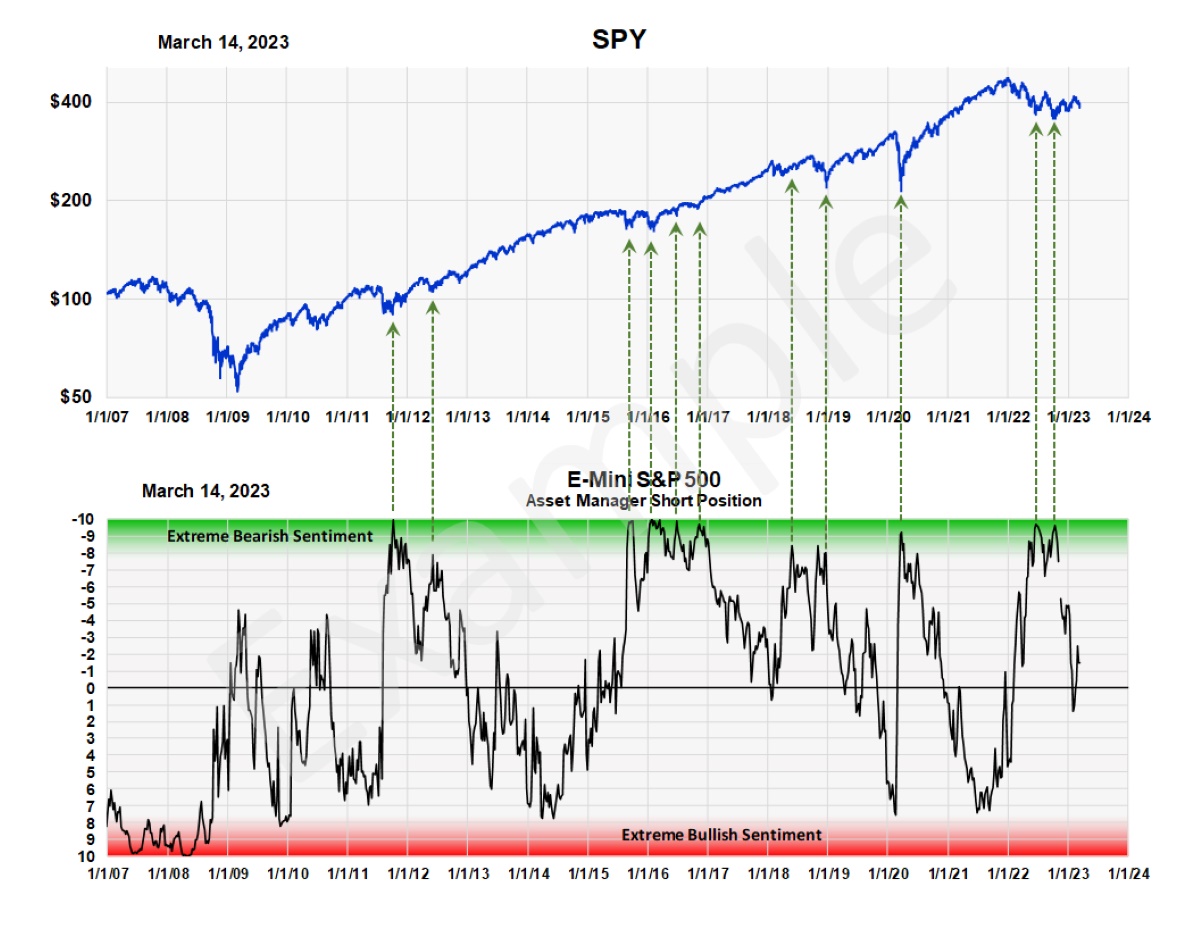

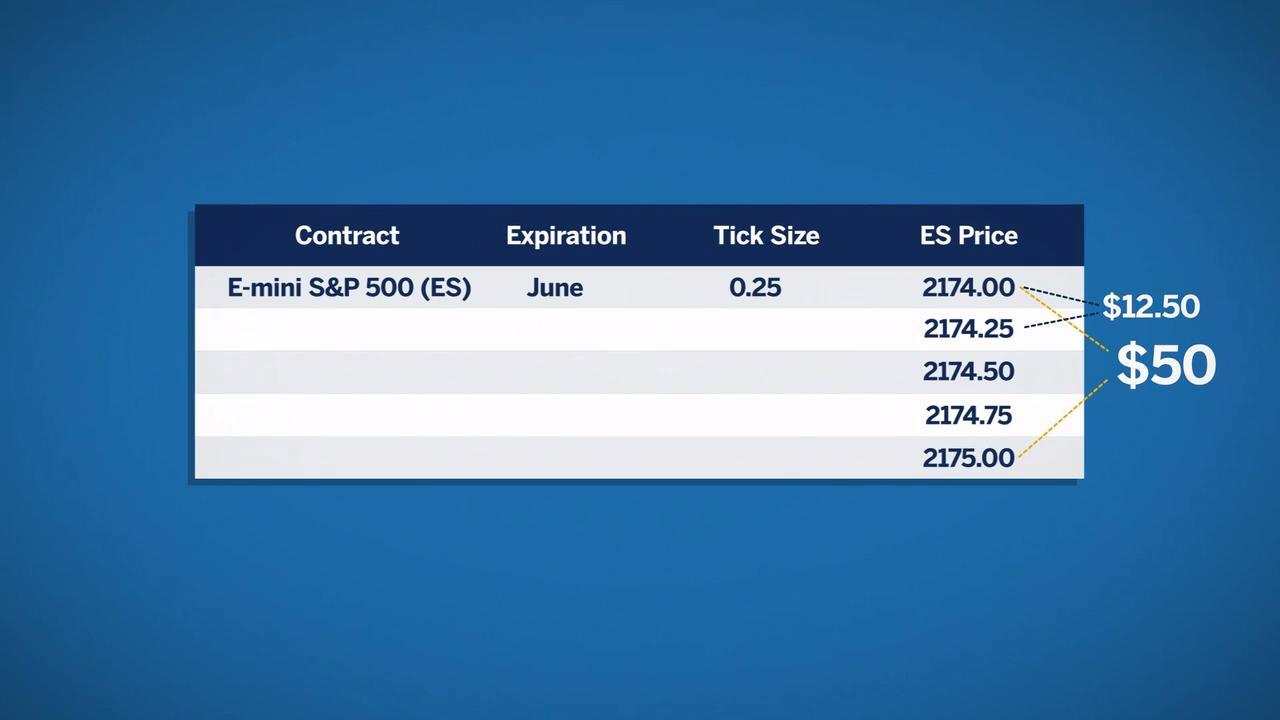

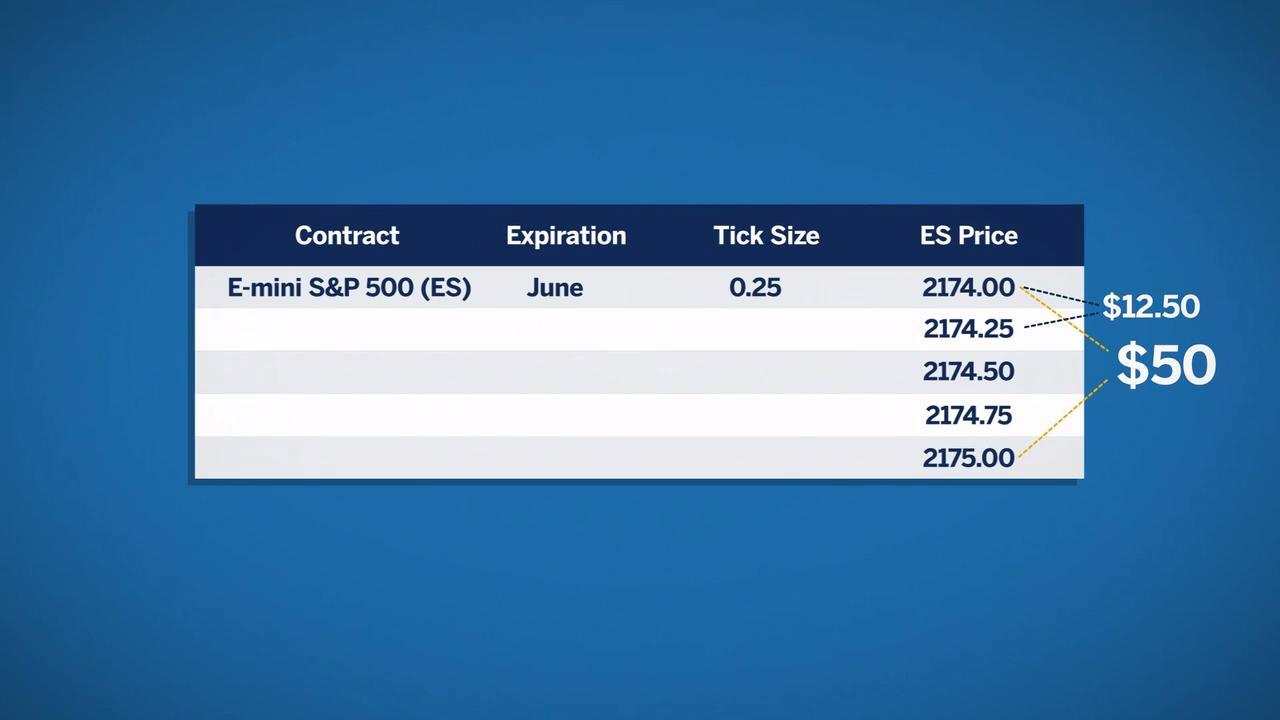

1. E-mini S&P 500 Futures: This popular equity futures contract, traded on the Chicago Mercantile Exchange (CME), has a tick size of 0.25 index points. Each tick movement represents a $12.50 change in value. Therefore, if the price of the contract moves from 4000.00 to 4000.25, that represents a tick movement of 0.25 index points.

2. Crude Oil Futures: Crude oil futures contracts, traded on the New York Mercantile Exchange (NYMEX), typically have a tick size of $0.01 per barrel. This means that each tick movement represents a $10 change in value for a contract size of 1,000 barrels. For example, if the price of crude oil increases from $70.00 to $70.01, that represents a tick movement of $0.01.

3. Gold Futures: Gold futures contracts, traded on the COMEX division of the CME, have a tick size of $0.10 per ounce. This tick size applies to the most actively traded contract, which has a contract size of 100 troy ounces. Therefore, each tick movement represents a $10 change in value. If the price of gold moves from $1,800.00 to $1,800.10, that represents a tick movement of $0.10.

4. Eurodollar Futures: Eurodollar futures contracts, traded on the CME, have a tick size of 0.0050 percentage points. This tick size applies to the most actively traded contract, which represents a notational value of $1,000,000. Each tick movement represents a $12.50 change in value. For instance, if the contract price moves from 98.5000 to 98.5050, that represents a tick movement of 0.0050 percentage points.

5. Wheat Futures: Wheat futures contracts, traded on the Chicago Board of Trade (CBOT), typically have a tick size of $0.0025 per bushel. Each tick movement represents a $12.50 change in value for a contract size of 5,000 bushels. For example, if the price of wheat increases from $7.50 to $7.5025, that represents a tick movement of $0.0025.

These examples demonstrate the variability in tick sizes across different futures contracts. Traders should always consult the specific contract specifications and exchange rules to determine the tick size and tick value of the contracts they intend to trade.

Conclusion

Understanding the concept of tick size in futures contracts is essential for any trader or investor looking to venture into the exciting world of financial markets. The tick size represents the minimum price increment by which the contract’s price can move and plays a significant role in trading strategies, risk management, and overall profitability.

By grasping the concept of tick size and its implications, traders gain the ability to make more informed decisions in their trading activities. The tick size determines price precision, bid-ask spreads, volatility considerations, and the types of orders that can be placed. It also influences position sizing and risk management strategies, allowing traders to align their trades with their desired risk-reward ratios.

Moreover, tick size values are not standardized across all futures contracts. They vary depending on the nature of the underlying asset and the exchange on which the contract is traded. Traders must familiarize themselves with the specific tick size and tick value of the contracts they wish to trade to ensure accurate calculations and risk assessments.

In conclusion, understanding tick size in futures contracts is crucial for successful trading and investing in the financial markets. It provides traders with the necessary knowledge to navigate price movements, execute trades effectively, and manage risk. By incorporating an understanding of tick size into their trading strategies, traders can improve their chances of achieving their financial goals.