Finance

What Does Minimum Payment Due At 0 Mean?

Published: February 27, 2024

Learn what "minimum payment due at 0" means in finance and how it impacts your financial obligations. Explore the implications and considerations for managing your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Minimum Payment Due at 0

When it comes to managing credit card payments, the term “minimum payment due at 0” may seem perplexing at first glance. However, this concept holds significant weight in the realm of personal finance. Understanding the implications of this minimum payment requirement is crucial for responsible financial management. In this article, we will delve into the intricacies of the minimum payment due at 0, its impact on credit card balances, and the importance of paying more than the minimum amount to effectively manage debt and improve financial well-being.

It’s not uncommon for individuals to encounter confusion or misconceptions surrounding the minimum payment due at 0. This article aims to demystify this aspect of credit card management, empowering readers with the knowledge needed to make informed decisions about their financial obligations. By shedding light on the significance of the minimum payment due at 0, we can equip individuals with the tools to navigate credit card payments effectively, ultimately contributing to their overall financial stability.

Understanding the Minimum Payment Due

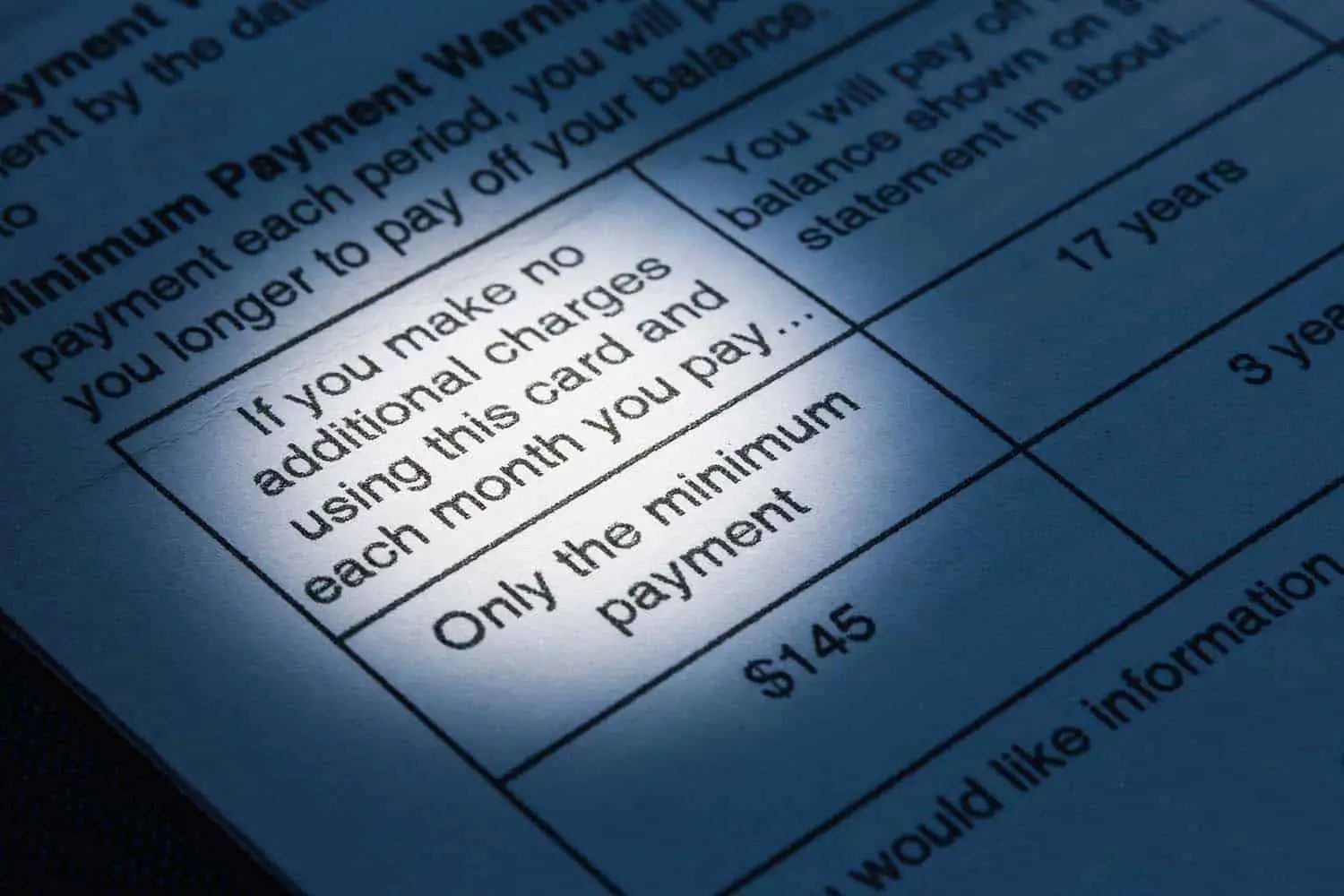

When you receive your credit card statement, you may notice a section specifying the “minimum payment due.” This represents the smallest amount you are required to pay by the due date to keep your account in good standing. The minimum payment due is typically calculated as a percentage of your total outstanding balance, often around 1-3% of the balance, in addition to any interest and fees incurred during the billing cycle.

It’s important to recognize that while paying the minimum amount may fulfill the immediate obligation, it can lead to long-term financial repercussions. By only submitting the minimum payment, you are essentially carrying over the remaining balance to the next billing cycle, incurring additional interest charges. This cycle of accumulating interest on the outstanding balance can result in a significant increase in the total amount owed over time.

Furthermore, credit card issuers are mandated to disclose the potential long-term consequences of making minimum payments. This information is typically presented in the statement, emphasizing the extended time and increased interest required to pay off the balance if only minimum payments are made. Understanding these implications is crucial for individuals to grasp the true cost of carrying a balance and the impact it can have on their financial well-being.

Impact of Paying Minimum Payment Due

Opting to pay only the minimum amount due on your credit card may seem like a convenient short-term solution, but it can have a substantial impact on your overall financial health. By adhering to the minimum payment requirement, you may find yourself trapped in a cycle of debt accumulation and prolonged repayment periods.

One of the immediate consequences of making minimum payments is the accrual of interest on the remaining balance. This interest compounds over time, leading to a significant increase in the total amount owed. As a result, a substantial portion of subsequent payments goes towards servicing the interest rather than reducing the principal balance. This perpetuates the cycle of debt and can impede your ability to make meaningful progress in paying off the outstanding balance.

Additionally, consistently making minimum payments can impact your credit score. Credit utilization, which is the ratio of your credit card balances to your credit limits, is a key factor in determining your credit score. By carrying over balances and only paying the minimum amount, you may elevate your credit utilization ratio, potentially leading to a negative impact on your credit score.

Furthermore, the prolonged repayment period associated with making minimum payments can result in a diminished financial outlook. As interest continues to accrue, the total cost of the debt escalates, making it increasingly challenging to achieve financial milestones and build a secure financial future.

Understanding the repercussions of paying only the minimum amount due is essential for individuals to make informed decisions about managing their credit card debt. By recognizing the long-term implications of this approach, individuals can take proactive steps to mitigate the adverse effects and work towards achieving greater financial stability.

Importance of Paying More Than the Minimum Payment Due

While meeting the minimum payment requirement on your credit card is essential to avoid late fees and maintain a positive payment history, it is equally crucial to understand the benefits of paying more than the minimum amount due. By allocating additional funds towards reducing your credit card balance, you can mitigate the adverse effects of carrying over debt and expedite your journey towards financial freedom.

One of the primary advantages of paying more than the minimum amount due is the reduction of interest costs. By chipping away at the principal balance, you decrease the amount on which interest is calculated, ultimately lowering the total interest accrued over time. This can lead to substantial savings and expedite the process of becoming debt-free.

Moreover, making larger payments allows you to progress towards eliminating your credit card debt more rapidly. By accelerating the reduction of the outstanding balance, you can shorten the repayment period and alleviate the burden of carrying long-term debt. This not only provides financial relief but also empowers you to reallocate funds towards achieving other financial goals.

Additionally, consistently paying more than the minimum amount due demonstrates responsible financial behavior and discipline to creditors and credit bureaus. This can positively impact your credit score and enhance your overall creditworthiness, potentially opening doors to better financial opportunities in the future.

Furthermore, by embracing a proactive approach to debt repayment and prioritizing larger payments, you cultivate a mindset of financial empowerment. Taking control of your credit card balances and actively working towards reducing debt instills a sense of confidence and progress, fostering a positive relationship with your financial well-being.

Ultimately, understanding the importance of paying more than the minimum amount due empowers individuals to take charge of their financial journey. By leveraging the benefits of larger payments, individuals can expedite debt repayment, reduce interest costs, and pave the way towards a brighter financial future.

Conclusion

Managing credit card payments and understanding the implications of the minimum payment due at 0 is a pivotal aspect of responsible financial stewardship. By comprehending the significance of the minimum payment requirement and its impact on credit card balances, individuals can make informed decisions to safeguard their financial well-being.

It is imperative to recognize that while meeting the minimum payment due is essential to avoid penalties, it often falls short of effectively addressing the underlying debt. By solely adhering to the minimum payment, individuals risk perpetuating a cycle of accumulating interest and prolonged repayment periods, hindering their path to financial freedom.

Embracing a proactive approach to credit card payments and prioritizing larger payments can yield substantial benefits, including reduced interest costs, accelerated debt repayment, and enhanced creditworthiness. By leveraging these advantages, individuals can take significant strides towards alleviating the burden of debt and cultivating a more secure financial future.

In essence, the minimum payment due at 0 serves as a starting point in managing credit card obligations, but it should not be viewed as the endpoint. By understanding the long-term implications of making minimum payments and embracing the importance of paying more than the minimum amount due, individuals can chart a course towards financial empowerment and liberation from the constraints of debt.

Empowered with this knowledge, individuals can navigate credit card payments with confidence, proactively working towards reducing their balances and achieving greater financial stability. By fostering a mindset of financial responsibility and actively managing credit card debt, individuals can pave the way towards a brighter and more prosperous financial future.