Home>Finance>What Is The Minimum Payment On Sears 0% Interest

Finance

What Is The Minimum Payment On Sears 0% Interest

Modified: March 1, 2024

Learn about the minimum payment for Sears 0% interest financing. Get insights on managing your finances effectively. Discover more.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When you make a purchase using a credit card that offers a 0% interest rate for a certain period, it can be an enticing opportunity to buy what you need while avoiding the burden of interest charges. However, it's essential to understand the terms and conditions associated with such offers, including the minimum payment requirement.

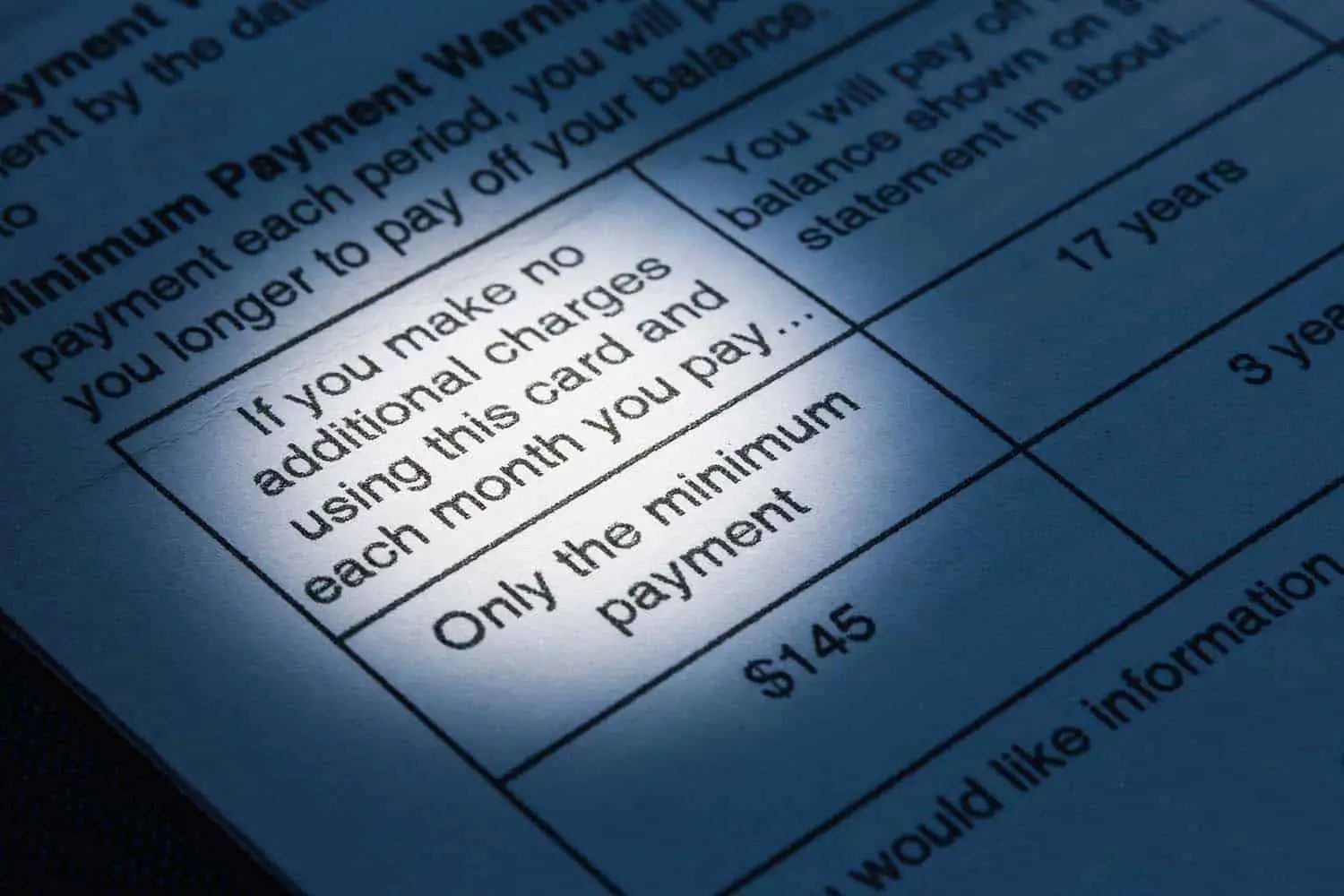

The minimum payment on a Sears 0% interest credit card refers to the lowest amount you must pay each month to keep your account in good standing. While it may seem convenient to pay only the minimum, it's important to grasp the implications of doing so. This article will delve into the concept of the minimum payment, the factors influencing it, and why it's crucial to consider paying more than the minimum to manage your finances effectively.

Understanding the minimum payment on a 0% interest credit card is vital for responsible financial management. By exploring the intricacies of this concept, you can make informed decisions about your credit card usage and ensure that you are leveraging such offers to your advantage. Let's explore the minimum payment on a Sears 0% interest credit card in detail.

Understanding the Minimum Payment

The minimum payment on a Sears 0% interest credit card represents the smallest amount you are required to pay each month to avoid penalties and maintain your account in good standing. It typically comprises a percentage of your outstanding balance, along with any fees and accrued interest. While the exact calculation method may vary among credit card issuers, the minimum payment is designed to ensure that cardholders fulfill their financial obligations on time.

It’s important to recognize that making only the minimum payment can lead to long-term financial challenges. This approach may result in a prolonged repayment period and substantial interest charges once the 0% interest promotional period ends. By understanding the minimum payment, cardholders can grasp the significance of managing their credit card balances responsibly and strive to pay more than the minimum to avoid accruing excessive interest.

Moreover, comprehending the minimum payment empowers individuals to make informed decisions about their spending and repayment strategies. It provides insight into the relationship between the amount paid each month and its impact on overall debt reduction. By gaining a clear understanding of the minimum payment, cardholders can navigate their financial responsibilities more effectively and work towards achieving greater financial stability.

Factors Affecting the Minimum Payment

Several factors influence the calculation of the minimum payment on a Sears 0% interest credit card. Understanding these factors is crucial for cardholders seeking to manage their finances prudently and make informed decisions about their repayment strategy. The primary elements that affect the minimum payment include:

- Outstanding Balance: The amount owed on the credit card significantly impacts the minimum payment. Typically, the minimum payment is calculated as a percentage of the outstanding balance, often ranging from 1% to 3% of the total amount due. As the outstanding balance fluctuates, so does the minimum payment requirement.

- Accrued Interest and Fees: If any interest charges or fees have been applied to the account, these will factor into the minimum payment calculation. Cardholders should be mindful of additional charges, as they can elevate the minimum payment and contribute to a higher overall debt burden.

- Terms and Conditions: The specific terms and conditions outlined by the credit card issuer play a pivotal role in determining the minimum payment. Cardholders should review the terms of their 0% interest offer to understand how the minimum payment is calculated and any additional requirements that may apply.

- Payment History: A cardholder’s payment history, including any missed or late payments, can impact the minimum payment. In some cases, a history of delinquency may lead to an increase in the minimum payment amount as a risk mitigation measure for the issuer.

By considering these factors, cardholders can gain insight into the dynamics of minimum payment calculations and proactively manage their credit card obligations. Awareness of these influences enables individuals to make informed financial decisions and take proactive steps to minimize their debt burden while leveraging the benefits of a 0% interest offer.

Calculating the Minimum Payment

The minimum payment on a Sears 0% interest credit card is typically calculated using a predetermined formula that considers various factors, including the outstanding balance, accrued interest, and any applicable fees. While the specific calculation method may vary by credit card issuer, the following provides a general overview of how the minimum payment is determined:

- Percentage of Outstanding Balance: One of the primary components in calculating the minimum payment is a percentage of the outstanding balance. This percentage, often ranging from 1% to 3% of the total amount due, serves as the foundation for the minimum payment requirement. As the outstanding balance fluctuates, the minimum payment adjusts accordingly.

- Accrued Interest and Fees: If any interest charges or fees have been applied to the account, these amounts are typically added to the minimum payment. This ensures that cardholders address not only the principal balance but also any additional costs incurred, thereby contributing to the overall payment obligation.

- Minimum Fixed Amount: Some credit card issuers set a minimum fixed payment that cardholders must meet, regardless of the outstanding balance and accrued charges. This serves as a baseline requirement to ensure a minimum level of repayment consistency.

- Terms and Conditions: The specific terms and conditions outlined by the credit card issuer play a crucial role in the minimum payment calculation. Cardholders should review the terms of their 0% interest offer to understand the precise methodology used to calculate the minimum payment and any additional stipulations that may apply.

By understanding the components involved in calculating the minimum payment, cardholders can gain insight into the factors driving their monthly payment obligations. This knowledge empowers individuals to make informed decisions about their financial management and develop strategies to address their credit card balances effectively.

Importance of Paying More Than the Minimum

While meeting the minimum payment requirement on a Sears 0% interest credit card is essential for maintaining account stability, it’s equally crucial for cardholders to recognize the significance of paying more than the minimum. By exceeding the minimum payment, individuals can unlock several benefits and safeguard themselves against potential financial pitfalls. The importance of paying more than the minimum encompasses the following key aspects:

- Accelerated Debt Repayment: Paying more than the minimum amount enables cardholders to expedite the reduction of their outstanding balance. By allocating additional funds towards their credit card payments, individuals can make substantial progress in diminishing their debt, ultimately working towards financial freedom.

- Interest Savings: By paying more than the minimum, cardholders can minimize the accumulation of interest charges. This proactive approach reduces the overall cost of borrowing and can result in significant long-term savings, especially when leveraging a 0% interest promotional period.

- Improved Credit Score: Consistently paying more than the minimum reflects positively on a cardholder’s credit utilization ratio and payment history, both of which are influential factors in determining credit scores. This proactive approach can contribute to an enhanced credit profile and greater financial opportunities in the future.

- Financial Discipline: Making payments above the minimum requirement cultivates financial discipline and responsible money management. It instills a proactive mindset towards debt repayment and encourages individuals to prioritize long-term financial well-being over short-term convenience.

By embracing the importance of paying more than the minimum, cardholders can position themselves for greater financial stability and long-term prosperity. This proactive approach empowers individuals to take control of their financial future, reduce debt burdens, and maximize the benefits of their 0% interest credit card while fostering a positive relationship with credit and money management.

Conclusion

Understanding the minimum payment on a Sears 0% interest credit card is integral to responsible financial management. By grasping the significance of the minimum payment, cardholders can navigate their credit card obligations with clarity and make informed decisions to optimize their financial well-being. The minimum payment represents the baseline requirement for maintaining account stability, yet paying more than the minimum is paramount for achieving long-term financial success.

Factors such as the outstanding balance, accrued interest, and specific terms and conditions influence the calculation of the minimum payment. By considering these elements, individuals can gain insight into the dynamics of minimum payment calculations and proactively manage their credit card obligations. Moreover, paying more than the minimum offers a multitude of benefits, including accelerated debt repayment, interest savings, improved credit scores, and the cultivation of financial discipline.

As cardholders navigate the realm of 0% interest credit cards, they should prioritize a holistic approach to managing their balances, leveraging the promotional benefits, and fostering responsible financial habits. By understanding the nuances of the minimum payment and embracing the importance of paying more than the minimum, individuals can set themselves on a path towards financial empowerment and long-term prosperity.

In conclusion, the minimum payment on a 0% interest credit card serves as a foundational aspect of responsible credit card usage. However, by recognizing the significance of paying more than the minimum and embracing proactive financial management, cardholders can maximize the benefits of their 0% interest offer and pave the way for a financially secure future.