Finance

What Does RCV Mean In Insurance?

Published: November 6, 2023

Understanding the meaning of RCV in insurance and its implications for your finances. Find out how this term affects your coverage and claims.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to insurance, understanding the various terms and acronyms can be overwhelming. One such term, RCV, is commonly used in the insurance industry. RCV stands for Replacement Cost Value, and it plays a crucial role in insurance policies.

So, what does RCV mean exactly? RCV refers to the amount it would cost to replace or repair damaged property or belongings with a comparable item at current market prices. This value takes into account the cost of labor, materials, and other factors required to restore the property to its pre-loss condition.

Insurers use RCV to determine the amount they will pay to policyholders in the event of a covered loss. It is important to understand RCV and its significance in insurance to ensure you have the appropriate coverage and protection for your assets.

In this article, we will delve deeper into the concept of RCV, its importance, the factors that can influence it, and how it affects insurance claims. We will also discuss RCV coverage limits and additional endorsements you can consider to enhance your coverage.

Understanding RCV

When determining the Replacement Cost Value (RCV) of a property, several factors are taken into consideration. These factors include the cost to repair or rebuild the property, the current market value of materials and labor, and any additional expenses involved in the restoration process.

RCV takes into account the full cost of replacing or repairing damaged property without considering depreciation. This means that RCV represents the cost of restoring the property to its original condition, regardless of its age or condition prior to the loss. It is important to note that RCV does not include the value of land, as land does not depreciate and does not need to be replaced.

For example, let’s say a homeowner experiences a fire that damages their kitchen. The RCV of the damaged kitchen would factor in the cost of replacing the cabinets, appliances, countertops, flooring, and any other items affected by the fire. The insurer would then pay the homeowner the RCV amount to cover the costs of restoring the kitchen.

In the case of personal belongings, RCV refers to the cost of replacing or repairing items with similar ones at current market prices. This can include furniture, electronics, clothing, and other possessions. Insurers often use industry-specific databases and pricing guides to determine the RCV of personal belongings.

It is important to understand RCV because it directly impacts the amount of money you will receive from your insurance company in the event of a covered loss. By having a clear understanding of RCV, you can ensure that you have adequate coverage to rebuild or replace your property without incurring significant out-of-pocket expenses.

The Importance of RCV in Insurance

RCV plays a vital role in insurance policies as it helps determine the amount of coverage needed to adequately protect your assets. Understanding the importance of RCV is essential to ensure you have the appropriate insurance coverage.

One of the key advantages of RCV is that it provides a higher level of protection for policyholders. By considering the cost to replace or repair damaged property at current market prices, RCV ensures that you will be able to fully restore your property without incurring significant out-of-pocket expenses. This is particularly important for high-value items or properties with unique features that may be more expensive to replace.

Furthermore, RCV takes into account inflation and the rising costs of construction materials and labor. Over time, these costs can increase significantly, and having RCV coverage helps safeguard against the potential financial burden of having to pay the difference between the actual cost of restoration and the coverage provided by the insurance company.

Another benefit of RCV is that it encourages policyholders to maintain their properties and keep them in good condition. Since RCV aims to restore the property to its pre-loss condition, insurers often require policyholders to meet certain maintenance standards to ensure coverage. This incentivizes homeowners and property owners to regularly inspect and maintain their assets, reducing the risk of preventable damages and losses.

Additionally, RCV is particularly important in instances where the property is underinsured. If the insured amount is not sufficient to cover the full replacement or repair cost, the policyholder may be responsible for covering the remaining expenses. With RCV coverage, the likelihood of being underinsured is significantly reduced, providing peace of mind knowing that you will be adequately compensated in the event of a covered loss.

Overall, the importance of RCV in insurance cannot be overstated. It ensures that you have the necessary financial protection to rebuild or replace your property, taking into account the current cost of materials and labor. By having RCV coverage, you can have confidence in your insurance policy’s ability to fully restore your assets in the event of unexpected damages or losses.

Factors Affecting RCV

Several factors can influence the Replacement Cost Value (RCV) of a property or belongings. It is important to understand these factors as they can impact the amount of coverage needed in your insurance policy. Here are the key factors that can affect RCV:

- Materials and Labor Costs: The cost of materials and labor plays a significant role in determining RCV. The prices of construction materials and skilled labor can vary based on factors such as location, market conditions, and supply and demand. Changes in these costs can directly impact the overall RCV of a property.

- Property Age and Condition: The age and condition of a property can affect its RCV. Older properties may require additional repairs or updates to bring them up to current building codes, which can increase the overall cost of restoration. Similarly, properties in poor condition may require extensive repairs or replacements, contributing to a higher RCV.

- Special Features and Upgrades: Properties with special features, unique architectural elements, or high-end finishes may have a higher RCV. These features often require specialized materials and skilled labor, which can increase the cost of replacement. Upgrades or renovations made to a property can also impact its RCV, as the insurance policy needs to reflect the enhanced value.

- Location and Accessibility: The location of a property can also affect its RCV. Properties located in areas with high construction costs or limited availability of contractors may have higher RCVs. Additionally, if a property is difficult to access due to its location (such as being in a remote area or on a steep slope), the cost of repairs or replacements may increase, affecting the RCV.

- Economic Factors: Economic factors, such as inflation and changes in the economy, can influence RCV. Inflation can lead to increased costs for materials and labor, driving up the RCV over time. Similarly, changes in the economy, such as a recession or fluctuations in the housing market, can impact construction costs and, consequently, the RCV of a property.

It is important to regularly review and update the RCV of your insurance policy to reflect these factors accurately. Failure to do so may result in being underinsured and facing potential out-of-pocket expenses in the event of a loss.

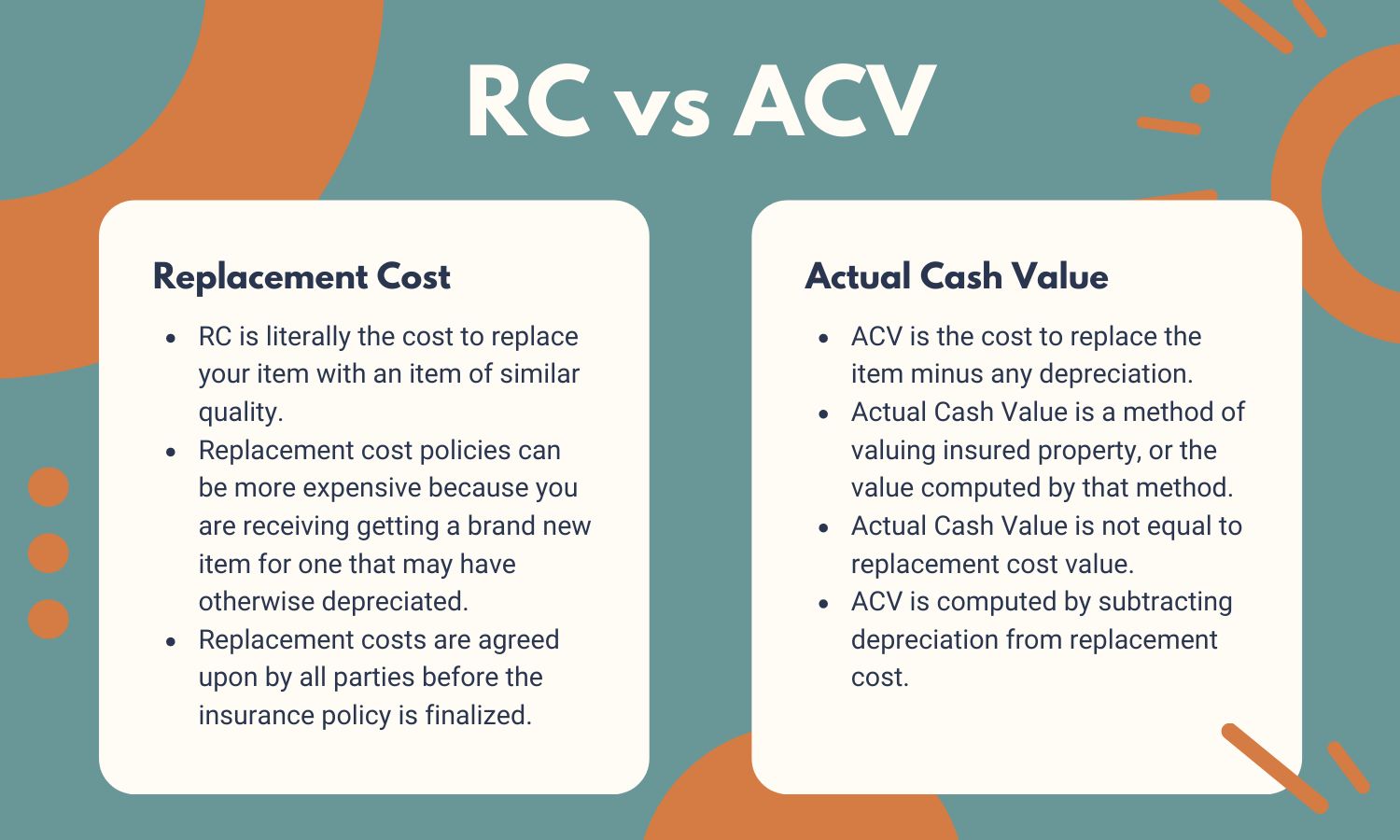

RCV versus Actual Cash Value (ACV)

When discussing insurance coverage, it is important to understand the difference between Replacement Cost Value (RCV) and Actual Cash Value (ACV). While both terms relate to the value of property or belongings, they represent different approaches to calculating reimbursement in the event of a covered loss.

RCV, as mentioned earlier, refers to the cost of replacing or repairing damaged property with a comparable item at current market prices. It takes into account factors such as labor, materials, and other expenses required to restore the property to its pre-loss condition, without considering depreciation.

On the other hand, ACV represents the value of damaged property or belongings after depreciation has been subtracted. Depreciation is the decrease in value that occurs over time due to wear-and-tear, age, and other factors. ACV takes into account the original cost of the property or belongings and then reduces that value to reflect their current condition.

For example, if a ten-year-old television is damaged in a covered loss, the RCV would be the cost of replacing it with a new television of a similar model and quality. In contrast, the ACV would consider the original cost of the television when it was purchased and then subtract the depreciation based on its age and condition.

It is important to note that ACV typically results in a lower payout compared to RCV due to the depreciation factor. This means that if you have ACV coverage, you may receive less money from your insurance company to replace or repair your damaged property compared to having RCV coverage. As a result, policyholders with ACV coverage may have to contribute more out-of-pocket expenses to cover the difference between the ACV reimbursement and the actual cost of replacement or repair.

It is recommended to carefully consider whether RCV or ACV coverage is more appropriate for your insurance needs. While ACV coverage may result in lower premiums, it may not provide sufficient reimbursement to fully restore your assets in the event of a loss. RCV coverage, although typically more expensive, offers a higher level of protection by considering the full cost of replacement or repair without factoring in depreciation.

Ultimately, the decision between RCV and ACV coverage depends on your specific circumstances, the value of your assets, and your budget. Consulting with an insurance professional can help you determine which option is best suited for your needs and provide the appropriate level of protection.

How RCV Impacts Insurance Claims

Replacement Cost Value (RCV) has a significant impact on insurance claims, as it determines the amount of reimbursement that policyholders receive for covered losses. Understanding how RCV affects insurance claims is crucial in ensuring that you are adequately compensated in the event of property damage or loss.

When filing a claim, RCV coverage ensures that you are reimbursed for the full cost of replacing or repairing damaged property without factoring in depreciation. This means that your insurance company will pay the actual cost of restoring your property to its pre-loss condition, considering current market prices for materials, labor, and other necessary expenses.

For example, let’s say your home experiences a severe hailstorm that damages your roof. If you have RCV coverage, your insurance company will assess the damage, determine the cost of replacing the damaged roof with a similar one, and provide you with the necessary funds to cover the full cost of the restoration.

On the other hand, if you have Actual Cash Value (ACV) coverage instead of RCV coverage, the insurance company will consider depreciation when calculating your reimbursement. This means that you may only receive a portion of the total cost of restoration, with the amount adjusted based on the age and condition of the damaged property.

It is important to note that RCV coverage typically results in higher claim payouts compared to ACV coverage. This is because RCV considers the current cost of replacement, whereas ACV adjusts for depreciation, often resulting in a lower reimbursement amount.

RCV coverage eliminates the need for policyholders to cover the difference between the depreciated value of the damaged property and the actual cost of replacement out of their own pockets. This can provide significant financial relief and peace of mind during a stressful time when your property has suffered damage or loss.

It is crucial to review and understand the terms and conditions of your insurance policy to ensure that you have RCV coverage for the assets you want to protect. This way, you can receive appropriate compensation in the event of a covered loss, allowing you to restore your property without facing significant financial burdens.

Remember to document and provide evidence of the damage when filing a claim, as the insurance company will need to assess the extent of the loss and determine the appropriate reimbursement amount based on the RCV of the damaged property.

In summary, RCV coverage significantly impacts insurance claims by ensuring that policyholders are reimbursed for the full cost of replacing or repairing damaged property without considering depreciation. This coverage provides financial protection and helps restore your property to its pre-loss condition, allowing you to recover with minimal financial strain.

RCV Coverage Limits

When it comes to Replacement Cost Value (RCV) coverage, it is important to understand that there may be limits on the amount of reimbursement you can receive in the event of a covered loss. These limits are known as RCV coverage limits, and they can impact the overall protection of your insurance policy.

Insurance policies typically include a maximum limit on the amount that the insurer will pay for RCV in the event of a loss. This limit is set to ensure that the insurance company is not responsible for paying an excessive amount that goes beyond the reasonable cost of replacing or repairing the damaged property.

The RCV coverage limit can vary depending on the type of property or belongings covered under the policy. For example, homeowner’s insurance may have separate limits for the dwelling, personal belongings, and additional structures on the property. Similarly, commercial property insurance may have different limits based on the value and type of assets being covered.

It is important to review and understand the RCV coverage limits in your insurance policy to ensure that you have adequate coverage for your property. In some cases, you may need to supplement your policy with additional endorsements or higher coverage limits to fully protect your assets.

If an insurance claim exceeds the RCV coverage limit, you may be responsible for covering the difference out of pocket. This is why it is essential to evaluate your insurance needs carefully and consider the potential cost of replacing or repairing your property in the event of a loss.

Insurance companies typically provide options to increase the RCV coverage limits by purchasing additional endorsements or increasing the overall coverage amount on your policy. These endorsements or increased limits may come at an additional cost, but they can provide you with greater peace of mind knowing that you have adequate coverage in case of a significant loss.

When evaluating your coverage limits, consider factors such as the size, value, and location of your property, as well as the cost of construction materials and labor in your area. It is also a good idea to periodically reassess your coverage limits and make necessary adjustments as the value of your property changes over time.

By understanding RCV coverage limits and assessing your insurance needs, you can ensure that you have appropriate coverage to fully protect your property and belongings in the event of a covered loss.

Additional RCV Endorsements

When it comes to Replacement Cost Value (RCV) coverage, there are additional endorsements that you can consider adding to your insurance policy to enhance your level of protection. These endorsements provide additional coverage options and safeguards to ensure you are adequately compensated in the event of a covered loss.

One common RCV endorsement is the Extended Replacement Cost endorsement. This endorsement increases the coverage limit beyond the stated RCV coverage limit in your policy. It provides an extra cushion by allowing the insurer to pay up to a specified percentage (usually 125% or 150%) of the RCV coverage limit to account for unexpected increases in labor and material costs.

Another valuable endorsement is Inflation Guard coverage. With this endorsement, the RCV coverage limit is automatically adjusted over time to keep up with inflation. It ensures that your coverage remains sufficient even as the cost of materials and labor gradually increases due to market conditions and economic factors.

Some policies also offer Guaranteed Replacement Cost coverage. This endorsement provides the highest level of protection by guaranteeing that the insurer will pay the full cost of replacing or repairing your property, regardless of the coverage limit stated in the policy. This is especially beneficial in situations where the cost of restoration exceeds the coverage limit due to unforeseen circumstances or market fluctuations.

Additionally, there may be specific endorsements available for certain types of property or unique circumstances. For example, if you own valuable artwork, jewelry, or collectibles, you may want to consider scheduled personal property endorsements. These endorsements provide additional coverage for specific high-value items, ensuring that you are adequately compensated for their full value in the event of loss or damage.

It is important to carefully review and evaluate the available endorsements and discuss them with your insurance agent or broker. They can provide guidance on which endorsements are most suitable for your specific needs and circumstances.

Keep in mind that adding endorsements to your policy may increase your premium. However, the added protection and peace of mind they provide can far outweigh the minimal increase in cost. It is essential to strike a balance between adequate coverage and affordability when selecting endorsements for your insurance policy.

By considering additional RCV endorsements, you can customize your insurance policy to best meet your needs, providing enhanced protection for your valuable assets and ensuring that you can fully restore your property in the event of a covered loss.

Conclusion

Replacement Cost Value (RCV) is a critical concept in insurance that determines the amount of reimbursement policyholders receive for covered losses. Understanding RCV and its importance can greatly impact your insurance coverage and provide you with the necessary financial protection in times of unexpected property damage or loss.

RCV ensures that you are reimbursed for the full cost of replacing or repairing damaged property or belongings without considering depreciation. It takes into account factors such as labor, materials, and other expenses required to restore the property to its pre-loss condition at current market prices.

Having RCV coverage offers several advantages. It provides a higher level of protection, encourages property maintenance, and safeguards against the rising costs of labor and materials over time. RCV coverage ensures that you can rebuild or replace your property without shouldering significant out-of-pocket expenses.

On the other hand, Actual Cash Value (ACV) coverage factors in depreciation, resulting in lower reimbursement amounts. While ACV coverage may be more affordable, it may not fully restore your assets to their pre-loss condition.

Several factors can influence RCV, including materials and labor costs, property age and condition, special features, location, and economic factors. Being aware of these factors can help you determine the appropriate coverage and ensure that you are adequately protected.

RCV coverage limits are also important to consider. These limits cap the amount of reimbursement you can receive in the event of a covered loss. It is crucial to review these limits and potentially add additional endorsements to your policy to enhance your coverage.

Additional RCV endorsements, such as Extended Replacement Cost, Inflation Guard, and Guaranteed Replacement Cost coverage, can provide added protection and adjust for unforeseen circumstances and inflation over time. Considering these endorsements can help tailor your coverage to meet your specific needs.

In conclusion, understanding RCV and its impact on insurance claims is essential for ensuring that you have the appropriate coverage to fully restore your property or belongings in the event of a covered loss. By reviewing your policy, considering coverage limits and endorsements, and regularly reassessing your coverage needs, you can have peace of mind knowing that you are adequately protected and prepared for any unexpected events.