Finance

What Does Representative APR Mean?

Published: March 3, 2024

Representative APR is a key term in finance, indicating the average interest rate customers will receive. Understanding its significance is crucial for informed financial decisions. Discover more about representative APR and its impact.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the Importance of Representative APR in Financial Decision-Making

- Unraveling the Significance of Annual Percentage Rate (APR)

- Deciphering the Meaning and Relevance of Representative APR

- Empowering Informed Decision-Making Through Understanding Representative APR

- Leveraging Representative APR for Informed Borrowing Decisions

- Empowering Financial Literacy Through Representative APR

Introduction

Understanding the Importance of Representative APR in Financial Decision-Making

When it comes to managing personal finances, understanding key concepts and terminologies is crucial. One such term that significantly impacts borrowing and lending decisions is APR, or Annual Percentage Rate. Whether you're applying for a credit card, loan, or mortgage, the APR plays a pivotal role in determining the overall cost and terms of the financial product. However, the term "Representative APR" often raises questions for many individuals seeking financial products. In this comprehensive guide, we will delve into the essence of APR and demystify the significance of Representative APR, shedding light on its implications for consumers.

Understanding APR is paramount for making informed financial decisions. It goes beyond the nominal interest rate and encompasses additional costs and fees associated with borrowing. Representative APR, in particular, serves as a benchmark for comparing and evaluating various financial products offered by lenders. By grasping the nuances of Representative APR, consumers can navigate the financial landscape more effectively, ensuring that they select products aligned with their financial goals and capabilities.

In the subsequent sections, we will explore the intricacies of APR, dissect the concept of Representative APR, highlight its importance, and provide practical insights on leveraging this information to make sound financial choices. Whether you're a seasoned investor or a novice in the realm of personal finance, this guide aims to equip you with the knowledge and confidence to harness the power of Representative APR in your financial endeavors.

Understanding APR

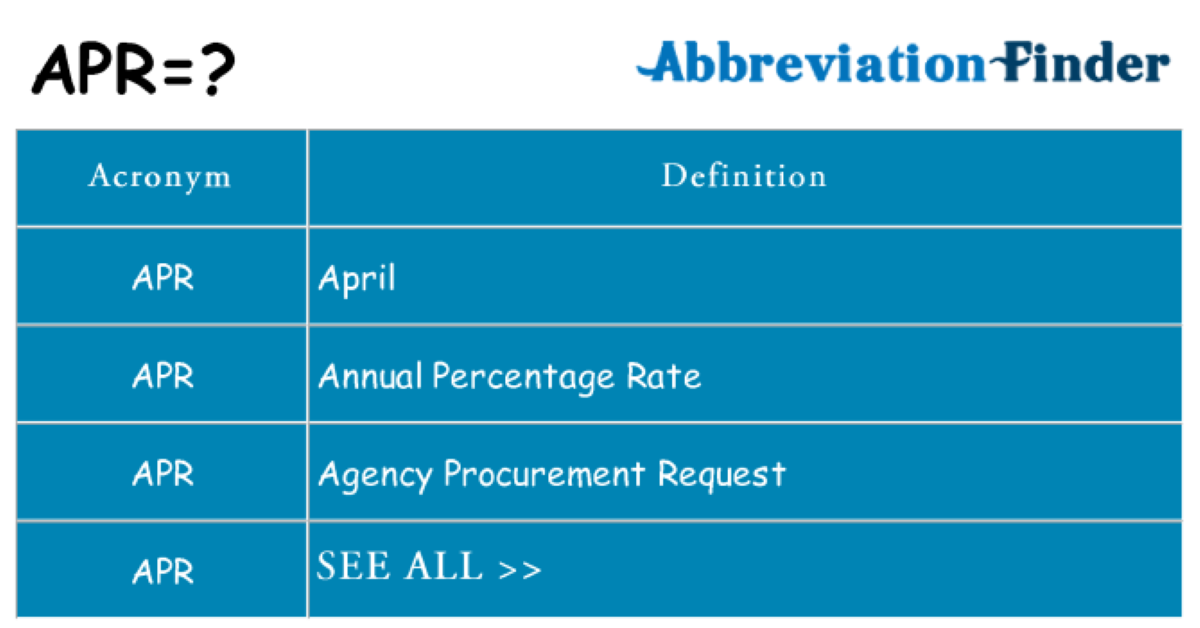

Unraveling the Significance of Annual Percentage Rate (APR)

APR, or Annual Percentage Rate, serves as a pivotal metric in the realm of borrowing and lending. It represents the total cost of borrowing over a year, encapsulating not only the nominal interest rate but also any additional fees and charges imposed by the lender. This comprehensive figure provides consumers with a holistic view of the financial product’s true cost, enabling them to compare different offerings on a like-for-like basis.

Unlike the nominal interest rate, which solely reflects the interest charged on the principal amount, APR offers a more comprehensive insight into the financial commitment associated with a loan, credit card, or mortgage. It considers various elements such as arrangement fees, annual fees, and any other upfront or ongoing charges, painting a more accurate picture of the overall expense incurred by the borrower.

By incorporating all relevant costs, APR empowers consumers to make informed decisions, steering clear of potentially deceptive offers that may appear enticing solely based on the nominal interest rate. This holistic approach to cost disclosure aligns with regulatory requirements, fostering transparency and fair practices within the financial industry.

Furthermore, APR facilitates comparability, allowing individuals to assess the cost-effectiveness of different borrowing options. Whether evaluating credit cards with varying APRs or comparing mortgage offers from different lenders, understanding the APR enables consumers to discern the most favorable and cost-efficient solution tailored to their financial circumstances.

It is important to note that while APR provides a standardized benchmark for comparing financial products, individual circumstances and creditworthiness can influence the actual APR offered by lenders. Moreover, certain products, such as introductory 0% APR credit card offers, may entail nuances that necessitate a deeper understanding of the terms and conditions to make informed decisions.

As we navigate the intricacies of financial products, the significance of APR becomes increasingly evident, underscoring its role as a comprehensive yardstick for assessing borrowing costs. In the subsequent sections, we will delve into the concept of Representative APR, shedding light on its relevance and implications for consumers seeking financial products.

Representative APR Explained

Deciphering the Meaning and Relevance of Representative APR

Representative APR, often featured prominently in financial product advertisements, serves as a standardized representation of the APR offered to the majority of successful applicants. It is a pivotal tool designed to provide consumers with a clear and comparable indication of the borrowing costs associated with a particular financial product, such as a credit card or loan.

When a lender advertises a Representative APR, it signifies the APR that at least 51% of successful applicants are expected to receive. This figure acts as a guide for potential borrowers, offering insight into the typical cost of the financial product and enabling them to gauge its affordability and competitiveness in the market.

It is important to recognize that the Representative APR is not a guarantee of the APR an individual will receive. Factors such as credit history, income, and the specific terms of the product can influence the actual APR offered to an applicant. However, the Representative APR serves as a standardized benchmark for initial assessment and comparison, empowering consumers to make informed decisions when exploring financial options.

Moreover, the inclusion of Representative APR in financial advertisements aligns with regulatory requirements aimed at enhancing transparency and consumer protection. By presenting a representative APR, lenders provide a clear indication of the typical costs associated with the product, enabling consumers to evaluate its suitability and affordability.

Consumers are encouraged to view the Representative APR as a starting point for assessing the cost of borrowing, recognizing that individual circumstances may lead to variations in the actual APR offered. Additionally, understanding the distinction between Representative APR and personalized APR offers insights into the dynamics of borrowing costs and aids in navigating the financial landscape more effectively.

As we unravel the intricacies of Representative APR, it becomes evident that this standardized representation plays a pivotal role in empowering consumers to make informed financial decisions. In the subsequent sections, we will delve deeper into the significance of Representative APR and its implications for individuals seeking financial products.

Importance of Representative APR

Empowering Informed Decision-Making Through Understanding Representative APR

The significance of Representative APR transcends mere numerical representation, as it serves as a cornerstone for consumers navigating the complex landscape of financial products. By encapsulating the typical borrowing costs associated with a specific product, the Representative APR empowers individuals to make informed and comparative assessments, fostering transparency and aiding in the selection of financial products aligned with their needs and financial capabilities.

One of the primary advantages of the Representative APR lies in its role as a standardized benchmark for evaluating the affordability and competitiveness of financial offerings. By presenting the APR that the majority of successful applicants are expected to receive, it provides potential borrowers with a clear indication of the typical cost associated with the product, enabling them to gauge its suitability within the broader market context.

Moreover, the inclusion of Representative APR in financial advertisements aligns with regulatory requirements aimed at enhancing transparency and consumer protection. By presenting a representative APR, lenders provide a clear indication of the typical costs associated with the product, enabling consumers to evaluate its suitability and affordability.

Furthermore, the Representative APR fosters an environment of fair and transparent lending practices, ensuring that consumers are equipped with essential information to make sound financial decisions. It mitigates the risk of individuals being misled by seemingly attractive offers based solely on the nominal interest rate, as the Representative APR offers a comprehensive view of the overall borrowing costs, including any associated fees and charges.

By understanding the importance of Representative APR, consumers can navigate the financial landscape with confidence, armed with the knowledge to discern competitive and suitable financial products. This informed approach not only facilitates prudent borrowing decisions but also contributes to fostering a consumer-friendly financial market characterized by transparency and fair practices.

As we delve deeper into the realm of financial literacy, the significance of Representative APR becomes increasingly apparent, underscoring its pivotal role in empowering consumers to make sound financial choices. In the subsequent section, we will explore practical insights on leveraging Representative APR to make informed borrowing decisions and navigate the financial terrain effectively.

How to Use Representative APR

Leveraging Representative APR for Informed Borrowing Decisions

Effectively utilizing the concept of Representative APR entails a strategic approach to evaluating and comparing financial products, ultimately empowering individuals to make informed borrowing decisions aligned with their financial goals and circumstances. By following a structured methodology, consumers can harness the power of Representative APR to navigate the financial landscape and select the most suitable and cost-effective offerings.

Evaluating Comparative Costs: When exploring financial products, it is essential to utilize the Representative APR as a benchmark for comparing the typical borrowing costs associated with different offerings. By juxtaposing the Representative APR of various products, individuals can gain insights into the comparative affordability and select the most cost-effective solution tailored to their needs.

Considering Personalized Factors: While the Representative APR provides a standardized representation of typical borrowing costs, it is crucial to recognize that individual circumstances and creditworthiness can influence the actual APR offered by lenders. Therefore, consumers should consider their specific financial situation and credit profile when assessing the applicability of the Representative APR to their borrowing decisions.

Seeking Clarity on Terms and Conditions: To make well-informed borrowing decisions, individuals should delve into the terms and conditions associated with the financial products of interest. Understanding the nuances of the offering, including any introductory rates, promotional periods, and potential variations in the APR, enables consumers to make comprehensive assessments beyond the Representative APR.

Consulting Financial Advisors: For complex financial decisions, seeking guidance from qualified financial advisors can provide valuable insights into leveraging the Representative APR effectively. Advisors can offer personalized recommendations based on individual financial circumstances, aiding in the selection of products aligned with long-term financial objectives.

Utilizing Online Comparison Tools: Leveraging online resources and comparison platforms can facilitate a streamlined assessment of financial products based on their Representative APR. These tools empower consumers to efficiently compare offerings from various lenders, enabling them to make informed decisions in a dynamic and competitive financial market.

By incorporating these strategies, individuals can harness the power of Representative APR to make well-informed borrowing decisions, ensuring that they select financial products aligned with their financial objectives and capable of meeting their borrowing needs effectively.

Understanding how to effectively use Representative APR empowers consumers to navigate the financial landscape with confidence, fostering transparency and informed decision-making. In the subsequent section, we will consolidate the insights gained and conclude our exploration of Representative APR’s significance in the realm of personal finance.

Conclusion

Empowering Financial Literacy Through Representative APR

As we conclude our exploration of Representative APR and its implications for consumers, it becomes evident that this standardized representation of borrowing costs plays a pivotal role in fostering financial literacy and informed decision-making. By unraveling the intricacies of Representative APR, individuals gain the knowledge and tools necessary to navigate the complex landscape of financial products with confidence and clarity.

Representative APR serves as a beacon of transparency, offering consumers a standardized benchmark for evaluating the typical borrowing costs associated with various financial products. It empowers individuals to make comparative assessments, enabling them to discern the most suitable and cost-effective solutions aligned with their financial goals and circumstances.

Moreover, the inclusion of Representative APR in financial advertisements aligns with regulatory requirements aimed at enhancing transparency and consumer protection. By presenting a representative APR, lenders provide a clear indication of the typical costs associated with the product, fostering an environment of fair and transparent lending practices.

By leveraging the concept of Representative APR, consumers can make well-informed borrowing decisions, considering their personalized financial circumstances and seeking products that align with their long-term objectives. The strategic utilization of Representative APR enables individuals to navigate the financial terrain effectively, ensuring that they select products capable of meeting their borrowing needs while maintaining cost-efficiency.

Ultimately, the journey through the realm of Representative APR underscores its pivotal role in empowering individuals to make sound financial choices, fostering transparency and informed decision-making within the consumer lending landscape. By embracing the knowledge gained from this exploration, consumers can approach financial decisions with confidence and clarity, contributing to a consumer-friendly financial market characterized by fairness and transparency.

As we continue to enhance our financial literacy and understanding of key concepts, the significance of Representative APR remains ingrained in our approach to borrowing and lending, ensuring that we navigate the financial landscape equipped with the knowledge and insights necessary to make prudent and informed decisions.