Finance

What Does Purchase APR On A Credit Card Mean

Modified: March 3, 2024

Understand the meaning of Purchase APR on a credit card and its impact on your finances, ensuring you make informed decisions when managing your credit.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to credit cards, there are a plethora of terms and concepts to understand in order to make informed financial decisions. One such term is “Purchase APR.” In this article, we will explore the meaning of Purchase APR and its significance in the world of credit cards.

Before we delve into the details, let’s first define what Purchase APR stands for. APR stands for Annual Percentage Rate, which represents the annual interest rate charged on credit card purchases. Essentially, it is the cost you pay to borrow money when using your credit card for purchases.

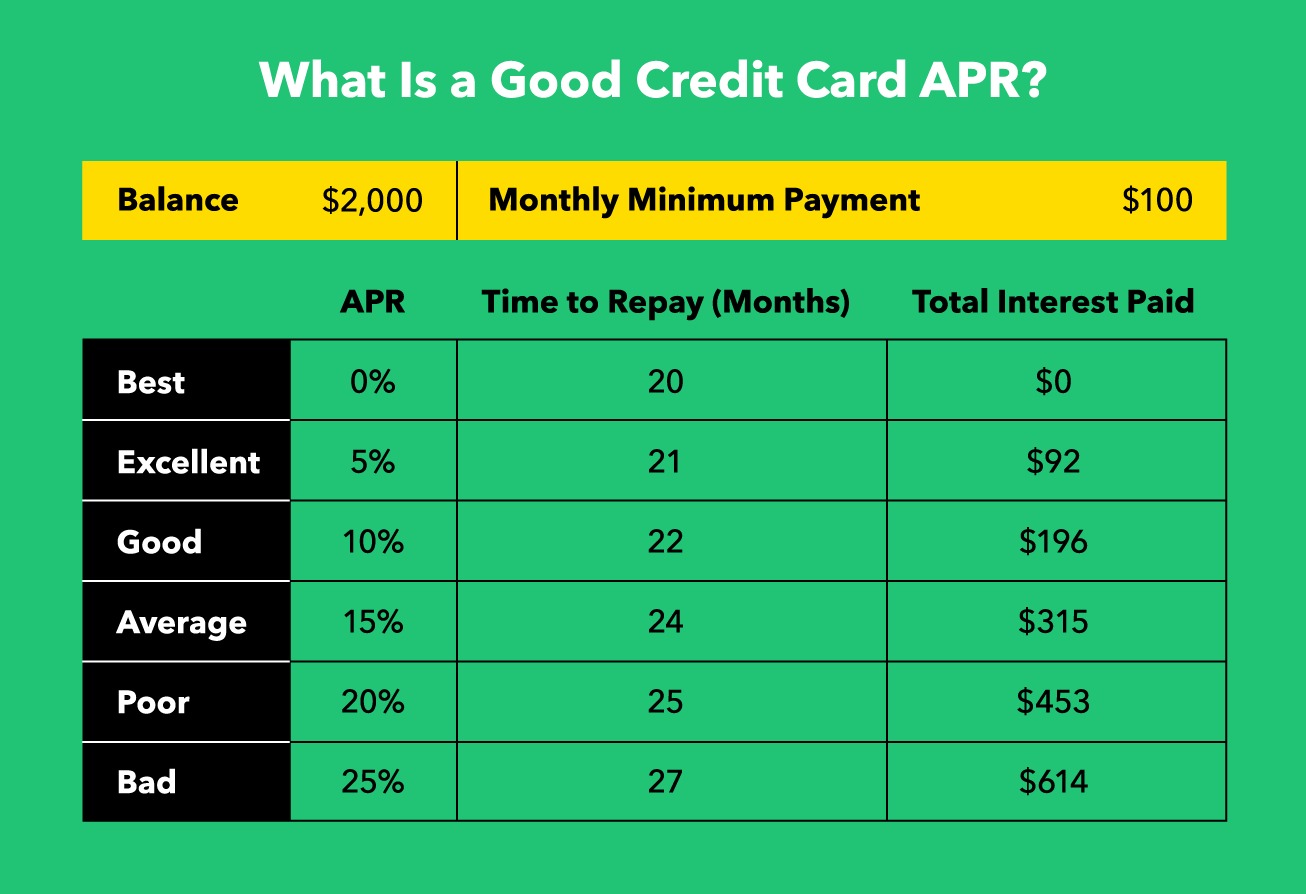

Understanding your credit card’s Purchase APR is crucial because it has a direct impact on your overall credit card costs. This rate can vary from one credit card to another, and it is influenced by various factors, including your creditworthiness and the current market conditions.

Now that you have a general idea of what Purchase APR entails, let’s take a closer look at how it is calculated. Different credit card companies may use slightly different methods, but in general, Purchase APR is determined by adding a margin or spread to a base rate, such as the prime rate or the U.S. Treasury bill rate. The resulting rate is then applied to the outstanding statement balance to calculate the interest charges.

Understanding the Purchase APR on your credit card is crucial for several reasons. Firstly, it allows you to estimate the total cost of carrying a balance on your card over time. This knowledge is essential for making informed decisions about when and how to make payments to minimize interest charges.

Additionally, knowing your Purchase APR is crucial when comparing credit card offers to ensure you choose a card with the most favorable terms. A lower Purchase APR can save you money in interest payments, especially if you tend to carry a balance on your card.

In the next sections, we will explore the factors that determine your Purchase APR, the benefits of having a low APR, the drawbacks of a high APR, and strategies you can employ to lower your Purchase APR. By the end of this article, you will have a comprehensive understanding of Purchase APR and be equipped to make smarter credit card decisions.

Definition of Purchase APR

Before we delve deeper into the concept of Purchase APR, let’s break down its meaning. Purchase APR, also known as the Annual Percentage Rate for purchases, refers to the interest rate that applies to the amount you borrow when making purchases using your credit card. It represents the cost of borrowing money and is expressed as a yearly percentage.

Simply put, when you use your credit card to make a purchase and carry a balance, the Purchase APR determines the amount of interest you will be charged on that balance. For example, if your credit card has a Purchase APR of 18%, and you carry a balance of $1,000, you would be charged interest of $180 over the course of a year.

It is important to note that Purchase APR only applies to the unpaid balance on your credit card, not to the full amount of your credit limit. If you pay your credit card bill in full each month, you can avoid paying any interest on your purchases.

It is also worth mentioning that Purchase APR is different from other types of APR, such as Balance Transfer APR or Cash Advance APR. Each of these APRs has its own rates and terms, so it’s crucial to understand which APR applies to different types of transactions on your credit card.

Furthermore, it is essential to differentiate between the introductory APR and the regular Purchase APR. Many credit cards offer a promotional or introductory APR, which is usually lower than the regular Purchase APR. This promotional rate is often applied to new cardholders or for a limited period of time. After the introductory period, the regular Purchase APR will come into effect.

Finally, it’s important to note that some credit cards have a variable APR, meaning that the interest rate can fluctuate based on changes in the market index or the issuer’s discretion. On the other hand, some credit cards have a fixed APR, which means the interest rate remains the same throughout the term.

Understanding the definition of Purchase APR is the first step towards making informed financial decisions regarding your credit card usage. In the next sections, we will explore how Purchase APR is calculated, the factors that influence it, and its significance in managing your credit card debt.

How Purchase APR is Calculated

Calculating Purchase APR involves a combination of factors, including the base rate, margin, and any additional fees or charges imposed by the credit card issuer. While the exact calculation may vary slightly between credit card companies, the general formula for determining Purchase APR is as follows:

- Base Rate: The credit card issuer starts with a base rate, such as the prime rate or the U.S. Treasury bill rate. This is often a benchmark interest rate established by financial institutions and serves as a starting point for calculating the APR.

- Margin: The credit card issuer adds a margin or spread to the base rate. This margin is determined by various factors, including the applicant’s creditworthiness, the issuer’s risk assessment, and market conditions. The margin reflects the additional interest the credit card issuer charges to compensate for the risk associated with lending money.

- Additional fees or charges: In some cases, credit card issuers may impose additional fees, such as an annual fee or transaction fees. These fees can also impact the overall APR calculation, although they are not included in the core interest rate.

Once these factors are determined, the credit card issuer combines them to calculate the Purchase APR. The resulting rate is then applied to the outstanding balance on your credit card to calculate the interest charges for a specific period, typically on a yearly basis.

It’s important to note that credit card companies may have different methods of calculating Purchase APR. Some may use a simple interest calculation, while others may employ a compound interest calculation, which takes into account the accrued interest on previous months’ balances as well.

Additionally, it’s worth mentioning that credit card companies are required by law to disclose the annual percentage rate and the method used to calculate it in the credit card agreement and monthly statements. This provides cardholders with transparency and allows them to understand how their APR is calculated.

Understanding how Purchase APR is calculated is vital for managing your credit card usage effectively. By having a clear grasp of this calculation, you can make informed decisions about paying off your balance, avoiding unnecessary interest charges, and comparing credit card offers to choose the most favorable terms.

Importance of Understanding Purchase APR

Understanding Purchase APR is essential for several reasons, as it directly impacts your credit card usage and overall financial well-being. Here are some key reasons why it is crucial to have a clear understanding of Purchase APR:

- Evaluating Total Cost: By understanding the Purchase APR on your credit card, you can estimate the total cost of carrying a balance on your card over time. This knowledge allows you to make informed decisions about when and how to make payments in order to minimize interest charges. It helps you avoid unnecessary expenses and manage your credit card debt more effectively.

- Comparing Credit Card Offers: Knowing the Purchase APR is vital when comparing different credit card offers. It enables you to choose a card with the most favorable terms, including a lower Purchase APR, which can save you money in interest payments, especially if you regularly carry a balance. By carefully examining the APR on different credit cards, you can select the one that aligns with your financial goals and spending habits.

- Financial Planning: Understanding your credit card’s Purchase APR allows you to incorporate it into your overall financial planning. It helps you anticipate and budget for interest charges when using your credit card for purchases. By having a clear idea of how your Purchase APR affects your finances, you can make strategic decisions about when to use your credit card and when to explore alternative payment methods.

- Credit Card Debt Management: Purchase APR plays a crucial role in managing credit card debt. A lower APR means less interest accrual, allowing you to pay down your balances more efficiently. By understanding your Purchase APR, you can strategize your payments to prioritize high-interest balances and minimize the overall interest expenses associated with your credit card debt.

It’s important to note that other factors, such as minimum payments, repayment terms, and penalty fees, also contribute to the overall cost of credit card debt. However, understanding your Purchase APR is fundamental to making informed decisions about managing your credit card usage and minimizing the financial burden associated with borrowing money.

By taking the time to educate yourself about Purchase APR, you empower yourself to make smarter financial choices and improve your overall financial well-being. Whether you’re paying off your credit card balance, comparing credit card offers, or planning your financial future, understanding Purchase APR is a crucial step towards achieving financial success.

Factors That Determine Purchase APR

Several factors influence the determination of Purchase APR on your credit card. Understanding these factors can help you assess and manage your credit card usage effectively. Here are the key elements that credit card companies consider when setting your Purchase APR:

- Creditworthiness: Your creditworthiness, as reflected in your credit history and credit score, plays a significant role in determining your Purchase APR. Credit card companies use this information to assess your risk as a borrower. Individuals with higher credit scores and a strong credit history are generally considered lower-risk borrowers and may be offered lower Purchase APRs. On the other hand, those with lower credit scores or a history of late payments and defaults may be subject to higher APRs.

- Market Conditions: The prevailing interest rates in the market also influence the Purchase APR. Credit card companies take into account economic factors, such as the prime rate or the U.S. Treasury bill rate, which serve as benchmarks for setting interest rates. If these rates increase, it is likely that the Purchase APR on your credit card may also rise.

- Issuer’s Policies: Each credit card issuer has its own policies and guidelines for determining Purchase APR. These policies may vary based on the company’s risk appetite, business strategy, and competitive positioning. Some issuers may offer lower APRs to attract and retain customers, while others may have higher APRs to offset potential default risks.

- Cardholder Behavior: Your behavior as a credit card user can also influence your Purchase APR. For example, consistently making on-time payments and keeping your credit card utilization low may demonstrate responsible financial behavior, leading to potential APR reductions or promotional offers. Conversely, late payments, maxed-out credit limits, or other indications of financial instability may result in higher APRs.

- Introductory Offers: Credit card companies commonly offer promotional or introductory APRs for new cardholders. These rates are usually lower than the regular Purchase APR and may apply for a limited period, such as six months or a year. After the promotional period ends, the regular Purchase APR comes into effect.

It’s essential to recognize that the Purchase APR set by credit card companies can vary widely. Therefore, it’s crucial to read the terms and conditions of a credit card offer carefully and compare different cards to find the one with the most favorable terms.

By understanding the factors that determine Purchase APR, you can gain insights into why your APR may vary from card to card and take steps to improve your creditworthiness, such as making timely payments and maintaining a good credit utilization ratio. Additionally, staying informed about market conditions and examining promotional offers can help you make informed decisions when selecting a credit card that aligns with your financial goals and preferences.

Benefits of Low Purchase APR

Having a low Purchase APR on your credit card can bring a range of benefits. Here are some of the advantages of having a low Purchase APR:

- Reduced Interest Payments: One of the most significant benefits of a low Purchase APR is the ability to save money on interest payments. With a lower APR, a smaller portion of your monthly payment goes towards interest charges, allowing you to pay off your balance more quickly.

- Cost Savings on Long-Term Debt: If you tend to carry a balance on your credit card, a low Purchase APR can lead to substantial cost savings over time. By paying less in interest, you can save money and potentially pay off your debt more efficiently.

- Flexibility in Repayment: A lower APR gives you more flexibility in managing your credit card debt. With reduced interest charges, you have the option to make smaller monthly payments while still making progress towards paying off your balance.

- Less Financial Stress: High APRs can lead to financial stress, as more of your monthly payment goes towards interest rather than reducing the principal balance. By having a low Purchase APR, you can experience less financial strain, leading to improved peace of mind and better overall financial well-being.

- Easier Debt Consolidation: If you have multiple credit cards or outstanding balances on different accounts, having a credit card with a low Purchase APR can make debt consolidation easier and more cost-effective. By transferring your balances to a card with a lower APR, you can save on interest charges and simplify your debt repayment strategy.

- Opportunity for Interest-Free Periods: Some credit cards offer an interest-free grace period on purchases if your balance is paid in full each month. With a low Purchase APR, you have a better chance of being able to pay off your balance in full and take advantage of this interest-free period, saving you money on interest charges.

Overall, a low Purchase APR can provide you with financial advantages and greater control over your credit card debt. It allows you to save money, reduce interest costs, and potentially pay off your balance more quickly. It’s important to consider the benefits of a low APR when comparing credit card offers, as it can significantly impact your overall financial well-being.

Drawbacks of High Purchase APR

High Purchase APRs on credit cards can come with several drawbacks that can impact your financial situation. It’s important to be aware of these potential disadvantages before using a credit card with a high APR. Here are some of the drawbacks of having a high Purchase APR:

- Increased Interest Charges: The most obvious drawback of a high Purchase APR is the increased amount of interest you will be charged on your outstanding balance. This can result in significantly higher interest payments, especially if you carry a balance on your card from month to month.

- Longer Debt Repayment: Higher APRs can prolong the time it takes to pay off your credit card debt. More of your monthly payment goes towards interest charges, making it challenging to make significant progress in reducing the principal balance. This can lead to a longer repayment timeline and potentially more interest paid over time.

- Financial Strain: High APRs can cause financial strain, especially if you are unable to make larger monthly payments. More of your budget is allocated towards interest charges, leaving less room for other expenses or savings. This can result in a cycle of debt and financial stress.

- Limited Credit Card Usage: A high Purchase APR may discourage you from using your credit card for purchases. This can limit the benefits and convenience of using a credit card for everyday transactions, as you may opt for alternative payment methods to avoid accumulating high-interest charges.

- Difficulty in Paying Down Balances: Higher APRs make it more challenging to pay down your credit card balances, particularly if you have multiple cards with high interest rates. Accumulating interest charges can make it difficult to make significant progress in reducing your overall debt and can make it easier to fall into a cycle of revolving credit card balances.

- Impact on Credit Score: A high Purchase APR can have an adverse effect on your credit utilization ratio, which is an important factor in determining your credit score. High credit utilization, caused by high balances and high APRs, can lower your credit score and make it harder to obtain future credit.

Understanding the drawbacks of high Purchase APRs can help you make informed decisions when selecting and using credit cards. While high APRs may be unavoidable for some individuals with limited credit options, it is essential to consider the potential long-term financial implications and explore strategies to minimize interest charges.

It’s important to note that even if you have a credit card with a high APR, there are steps you can take to mitigate the impact. Strategies such as making larger monthly payments, reducing credit card balances, and exploring balance transfer options with lower APRs can help you manage and ultimately reduce the financial drawbacks associated with high Purchase APRs.

How to Find and Compare Purchase APRs

When it comes to finding and comparing Purchase APRs on credit cards, it’s important to consider several key factors. Here are some steps you can take to find and compare the Purchase APRs offered by different credit cards:

- Research Online: Start by conducting online research. Visit credit card comparison websites or individual credit card issuer websites to gather information on different credit cards and their associated Purchase APRs. These websites often provide detailed information about the APRs, fees, and rewards offered by each card.

- Read Terms and Conditions: Once you narrow down your options, carefully read the terms and conditions of each credit card. Look for the specific details outlined in the agreement, including the regular Purchase APR and any introductory APRs. Pay attention to any potential limitations or restrictions that may apply.

- Consider Your Personal Circumstances: Take into account your own financial situation and creditworthiness. Credit card companies may offer different APRs based on your credit score and credit history. If you have a good credit score, you may have access to credit cards with lower APRs, while those with lower credit scores may be offered higher APRs.

- Compare Introductory and Regular APRs: Pay attention to whether the credit card offers an introductory APR. This introductory rate may be lower than the regular Purchase APR and may apply for a specific period, such as six months or a year. Be sure to consider what the APR will be after the introductory period ends.

- Consider Other Fees and Features: While the Purchase APR is an important factor to consider, don’t forget to evaluate other fees and features of the credit card. Look at annual fees, balance transfer fees, foreign transaction fees, and any rewards or benefits offered. These additional factors can impact the overall value and affordability of the credit card.

- Seek Personalized Advice: If you’re unsure about comparing Purchase APRs or understanding the implications, consider seeking personalized financial advice. Consult with a financial advisor or visit a local bank branch to discuss your options and receive guidance based on your specific financial goals and circumstances.

By following these steps, you can gather the necessary information to compare Purchase APRs and choose a credit card that suits your needs. Remember to take into account your own financial situation and objectives, as well as any additional fees or rewards that may affect the overall value of the credit card.

Comparing Purchase APRs is an important aspect of selecting a credit card that aligns with your financial goals and preferences. It helps you make an informed decision and choose a card that offers the most favorable terms for your specific circumstances.

Strategies to Lower Purchase APR

Lowering your Purchase APR can help you save money on interest and manage your credit card debt more effectively. While you may not have direct control over the APR offered by credit card companies, there are several strategies you can employ to potentially lower your Purchase APR:

- Improve Your Credit Score: Your credit score is a key factor in determining the APR offered by credit card companies. By consistently making on-time payments, reducing your credit utilization ratio, and maintaining a good credit history, you can improve your credit score over time and potentially qualify for credit cards with lower APRs.

- Negotiate with Your Credit Card Issuer: Contacting your credit card issuer and negotiating for a lower APR is worth a try. If you have a good payment history and a strong relationship with the issuer, they may be willing to lower your APR to retain your business. Be prepared to provide reasons for the rate reduction request and explain why a lower APR would benefit both parties.

- Consider Balance Transfers: If you have a credit card with a high APR, consider transferring your balance to a card with a lower APR through a balance transfer offer. This can help you consolidate your debt and take advantage of a lower interest rate for a specified period. Be aware of any balance transfer fees and the regular APR that will apply after the promotional period ends.

- Prompt Payment: Making prompt and timely payments is crucial for maintaining a good credit history and potentially improving your chances of accessing lower APRs in the future. Pay your credit card bill in full and on time each month to avoid accumulating interest charges and to demonstrate responsible credit usage.

- Shop around for Lower APRs: If you’re in the market for a new credit card, thoroughly research and compare different credit card offers. Look for cards that specifically advertise lower APRs or introductory APR offers. Compare the rates, fees, and features of each card to find the one that best suits your financial goals and offers the most favorable terms.

- Consider Credit Union or Community Bank Options: Credit unions and community banks often offer credit cards with lower APRs compared to large financial institutions. Consider exploring these options as they may provide more favorable terms and potentially lower rates.

Remember that not all strategies may be applicable to your situation, and the impact of these strategies may vary depending on your creditworthiness and the specific credit card issuer. It’s crucial to thoroughly evaluate your options and consider the potential benefits and drawbacks of each strategy before making any decisions.

Lowering your Purchase APR can make a significant difference in reducing your interest payments and managing your credit card debt. By being proactive and employing these strategies, you can maximize your chances of accessing lower APRs and improve your overall financial well-being.

Conclusion

Understanding Purchase APR is crucial for anyone using credit cards or considering applying for one. It plays a significant role in the cost of borrowing money and managing credit card debt. By having a clear understanding of Purchase APR, you can make informed financial decisions and take control of your credit card usage.

In this article, we have defined Purchase APR as the Annual Percentage Rate for purchases – the interest rate charged on credit card purchases. We have explored how Purchase APR is calculated, taking into consideration factors such as the base rate, margin, and additional fees. We have also emphasized the importance of understanding Purchase APR and its impact on evaluating the total cost, comparing credit card offers, financial planning, and debt management.

Furthermore, we have highlighted the factors that determine Purchase APR, such as creditworthiness, market conditions, issuer policies, and cardholder behavior. We have discussed the benefits of having a low Purchase APR, including reduced interest payments, cost savings on long-term debt, flexibility in repayment, and less financial stress.

On the other hand, we have explored the drawbacks of high Purchase APR, such as increased interest charges, longer debt repayment, financial strain, limited credit card usage, and potential impact on credit scores.

Additionally, we have provided strategies on how to find and compare Purchase APRs, including researching online, reading terms and conditions, considering personal circumstances, and seeking personalized advice. We have also discussed strategies to potentially lower Purchase APR, such as improving your credit score, negotiating with your credit card issuer, considering balance transfers, making prompt payments, and shopping around for lower APRs.

In conclusion, understanding Purchase APR is essential for managing your credit card usage and overall financial well-being. By being informed, proactive, and strategic, you can make smarter credit card decisions, save on interest charges, and work towards achieving your financial goals.