Finance

What Does Unapplied Credit Mean On Rent

Modified: February 21, 2024

Learn what unapplied credit means on rent and how it affects your finances. Gain insights into the implications of unapplied credit in the rental industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on understanding unapplied credit on rent. If you have ever rented a property or managed rental properties, you may have come across the term “unapplied credit”. This concept refers to a situation where a payment made by a tenant is received but not applied or allocated to a specific invoice or rent period.

Unapplied credit can occur for various reasons and can have implications for both tenants and landlords. It is crucial to have a clear understanding of this concept to effectively manage rental finances and maintain accurate records.

In this article, we will delve into the causes of unapplied credit, discuss its implications, and provide tips on how to manage it effectively. Whether you are a tenant who wants to ensure your payments are properly accounted for or a landlord seeking insights into handling unapplied credit, we have you covered.

So, let’s dive in and explore the world of unapplied credit on rent!

Understanding Unapplied Credit on Rent

Unapplied credit on rent refers to a situation where a payment made by a tenant is not immediately applied or allocated to a specific invoice or rent period. Instead, it remains as a credit balance within the tenant’s account until it is applied to future rent or expenses.

When a tenant makes a payment, it is typically expected that the payment will be applied towards their outstanding rent for the specified period. However, there are instances when the payment may not be immediately allocated due to a variety of reasons. These reasons can include administrative errors, software glitches, delays in processing, or discrepancies in the payment amount.

In some cases, unapplied credit can also occur when a tenant makes an overpayment, either intentionally or accidentally. This may happen when the tenant pays more than the required amount for a particular rent period, resulting in a surplus credit balance.

It’s important to note that unapplied credit is different from prepayment. Prepayment occurs when a tenant pays rent in advance for a future period, whereas unapplied credit relates to payments that have been made but not yet applied to any specific invoice or rent period.

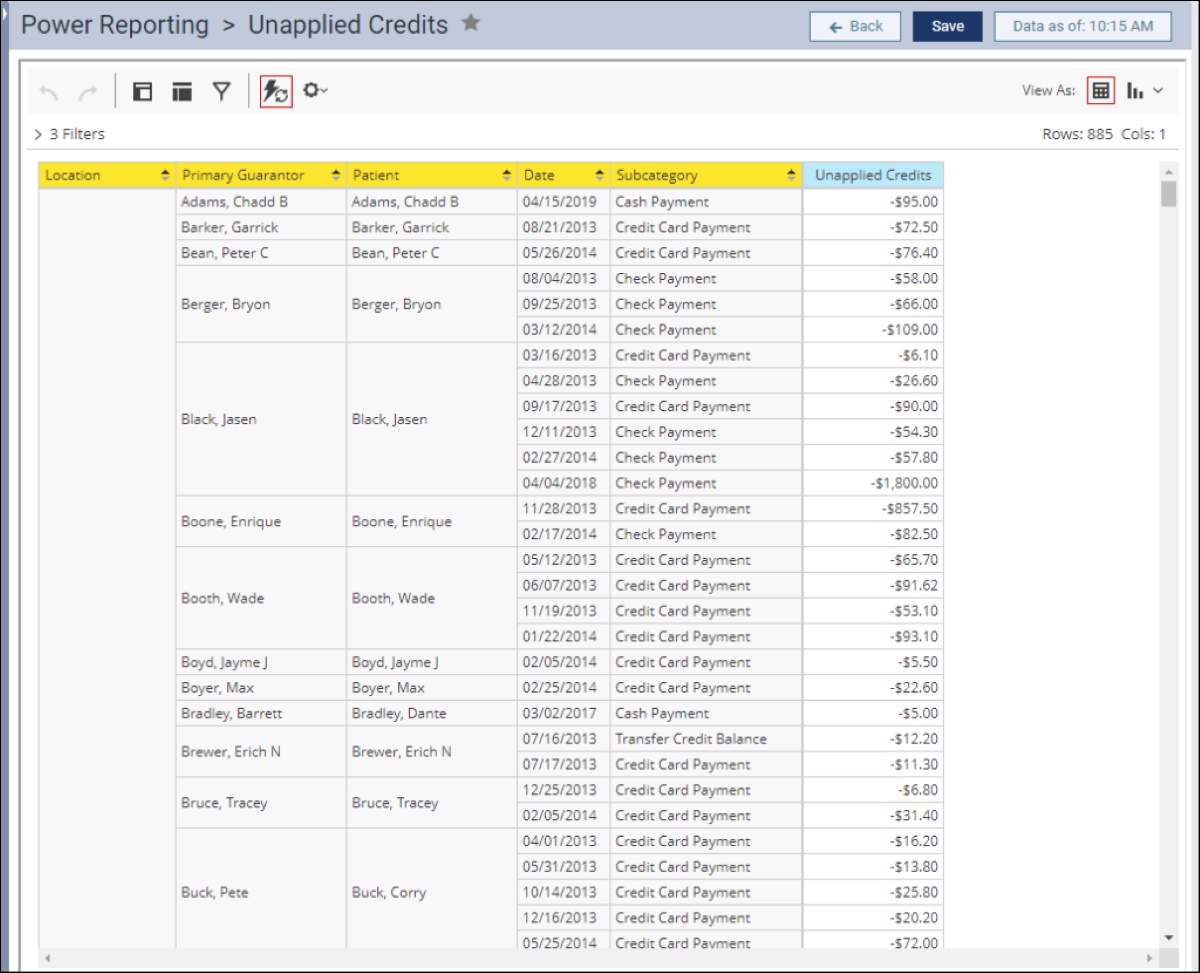

Landlords or property management companies often have accounting systems in place to track and manage unapplied credit. These systems help ensure that all payments are correctly allocated, reducing the likelihood of unapplied credit and minimizing discrepancies in rent accounting.

Now that we have a clear understanding of what unapplied credit on rent means, let’s explore some of the common causes behind it.

Causes of Unapplied Credit

Unapplied credit on rent can occur due to several reasons. Let’s discuss some of the common causes:

- Administrative Errors: Mistakes made in the accounting or payment processing department can lead to unapplied credit. This can include data entry errors, miscommunication, or oversight while recording or applying payments to specific invoices.

- Software Glitches: In some cases, unapplied credit can be attributed to software or system errors. Issues with the property management software or accounting systems can result in payments not being properly allocated to rent periods or invoices, leading to unapplied credit.

- Delayed Processing: Sometimes, payments may experience delays in processing, especially if there is a high volume of transactions or if there are issues with the payment gateway or banking systems. These delays can result in payment receipts not being applied in a timely manner.

- Discrepancies in Payment Amount: If there is a discrepancy between the amount paid by the tenant and the amount due for a specific rent period, the excess amount may remain unapplied until it can be correctly allocated. This can happen due to misunderstandings, rounding errors, or miscommunication regarding the correct payment amount.

- Overpayment: Tenants may sometimes intentionally or accidentally make an overpayment. This can occur if the tenant miscalculates the amount due or makes a payment for future rent periods. The excess amount then remains as unapplied credit until it can be allocated to future rent or expenses.

These are just a few of the common causes of unapplied credit on rent. Understanding these factors can help both landlords and tenants identify and address any issues that may arise and ensure proper allocation of payments.

Next, let’s explore the implications of unapplied credit and how it can affect both tenants and landlords.

Implications of Unapplied Credit

Unapplied credit on rent can have several implications for both tenants and landlords. Let’s explore some of the key implications:

- Confusion and Miscommunication: When payments are not properly applied to specific rent periods or invoices, it can lead to confusion and miscommunication between tenants and landlords. Tenants may be unsure of the amount owed or the status of their payments, while landlords may face difficulties in accurately tracking rent payments.

- Inaccurate Rent Accounting: Unapplied credit can result in inaccurate rent accounting on the landlord’s side. If payments are not properly allocated, it can lead to discrepancies in financial records and make it challenging to determine the true outstanding balance owed by the tenant.

- Financial Impact on Tenants: Unapplied credit can have a financial impact on tenants. If a payment is not allocated to a specific rent period, tenants may inadvertently fall behind on their rent payments or accrue late fees. This can cause unnecessary financial stress and strain the tenant-landlord relationship.

- Difficulties in Tenant Screening: For landlords or property management companies, unapplied credit can pose challenges during tenant screening processes. Inaccurate rent accounting and unresolved unapplied credit can make it difficult to assess the financial reliability and payment history of potential tenants.

- Loss of Trust and Reputation: Unresolved unapplied credit can erode trust between landlords and tenants. It may indicate a lack of professionalism in rent management and contribute to a negative reputation for the landlord or property management company.

It’s important for both tenants and landlords to address unapplied credit promptly to avoid these implications. By understanding the causes and developing effective strategies to manage unapplied credit, it is possible to maintain accurate rent accounting and foster a positive tenant-landlord relationship.

Now, let’s move on to the next section and explore ways to effectively manage unapplied credit on rent.

Managing Unapplied Credit

Managing unapplied credit on rent is crucial to maintain accurate rent accounting and ensure a smooth tenant-landlord relationship. Here are some strategies for effectively managing unapplied credit:

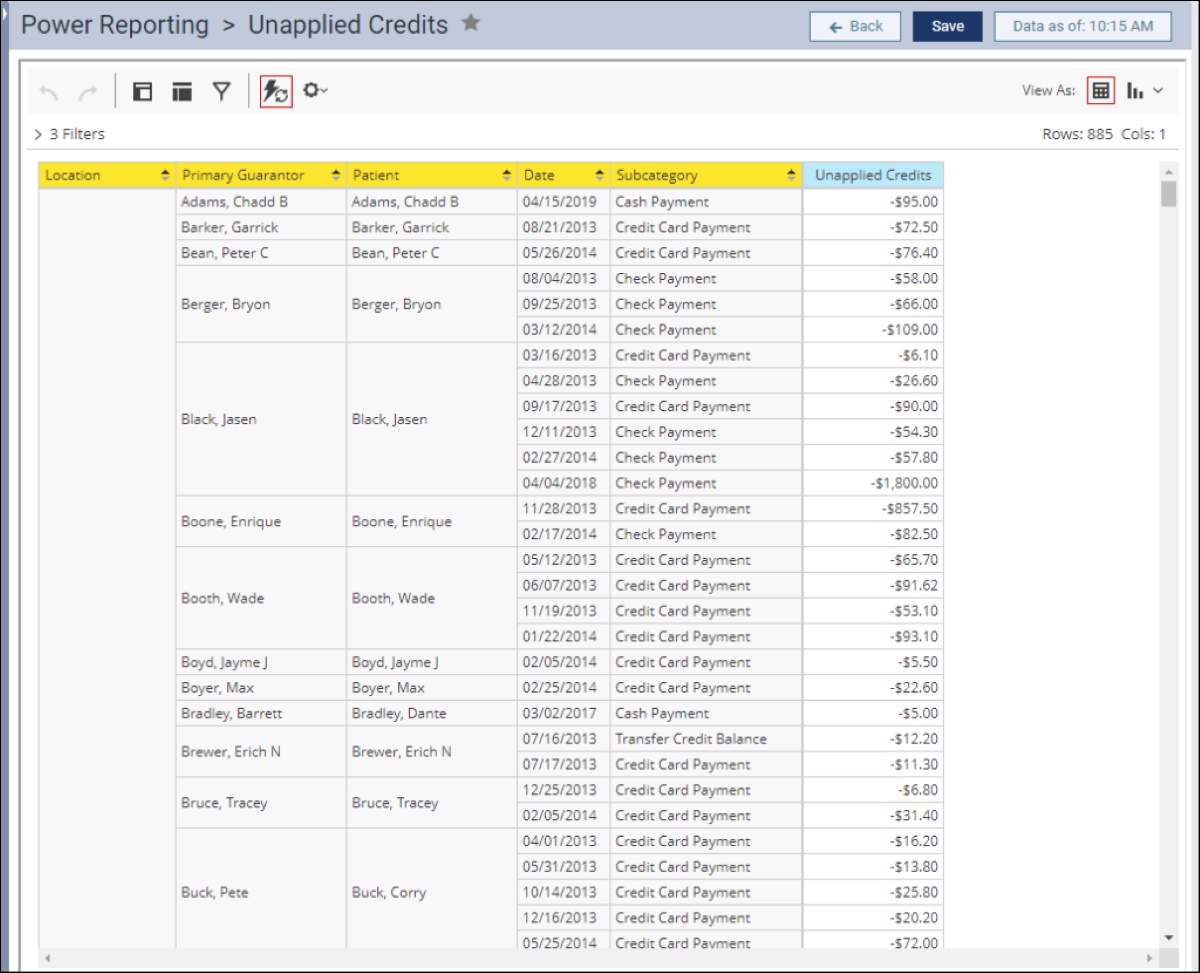

- Regular Reconciliation: Landlords or property management companies should regularly reconcile tenant accounts and payment records to identify any instances of unapplied credit. This involves comparing payment receipts with outstanding invoices and allocating payments to the correct rent periods or expenses.

- Clear Communication: Establish clear communication channels with tenants regarding payments and addressing any unapplied credit. Clearly explain the process for applying payments and encourage tenants to notify you if they notice any discrepancies or unapplied credit in their account statements.

- Prompt Application of Payments: Aim to apply payments to the appropriate rent period or invoice as soon as they are received. This helps prevent unapplied credit from accumulating and reduces the risk of confusion or miscommunication regarding rent payments.

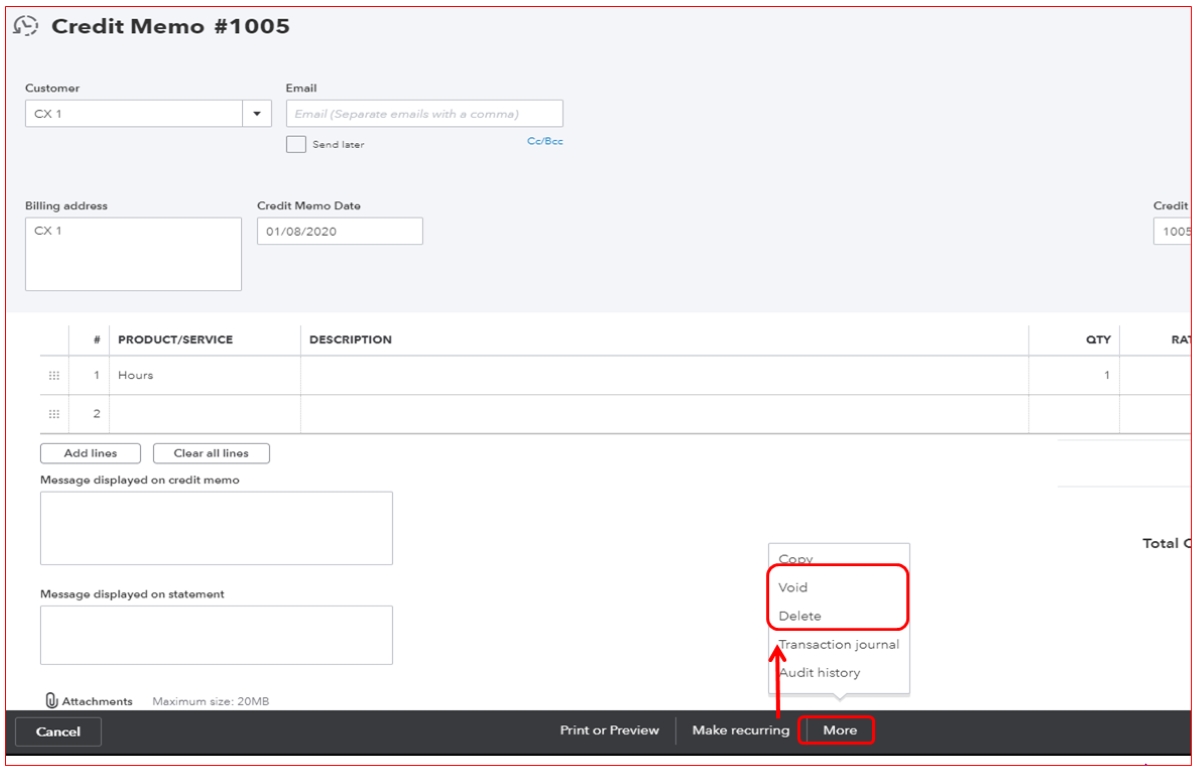

- Automated Accounting Systems: Utilize property management software or accounting systems that have robust features for tracking and allocating payments. These systems can streamline the process of applying payments, minimize errors, and provide a transparent record of rent accounting.

- Transparent Rent Statements: Provide tenants with regular and transparent rent statements that clearly outline the applied payments, outstanding balance, and any unapplied credit. This helps tenants understand their financial standing and enables them to raise any concerns or discrepancies.

- Prompt Resolution: When unapplied credit is identified, resolve it promptly by allocating the payments to the appropriate rent periods or invoices. Communicate the resolution to the tenant and provide an updated rent statement reflecting the correct allocation of payments.

- Documentation and Record-Keeping: Maintain thorough documentation and records of all rent payments, invoices, and the resolution of unapplied credit. This ensures accountability and assists in audit trails if any disputes arise regarding rent payments in the future.

By implementing these strategies, landlords and property management companies can effectively manage unapplied credit, minimize discrepancies, and maintain accurate rent accounting.

Now, let’s wrap up and summarize the key points discussed in this article.

Conclusion

Unapplied credit on rent can be a source of confusion and complications for both tenants and landlords. Understanding the causes, implications, and strategies to manage unapplied credit is essential for maintaining accurate rent accounting and fostering a positive tenant-landlord relationship.

In this comprehensive guide, we explored the concept of unapplied credit on rent and discussed its various causes. Administrative errors, software glitches, delayed processing, discrepancies in payment amounts, and overpayments were identified as common reasons for unapplied credit.

We also discussed the implications of unapplied credit, including confusion, inaccurate rent accounting, financial impact on tenants, difficulties in tenant screening, and potential damage to trust and reputation.

To effectively manage unapplied credit, we outlined several strategies. Regular reconciliation, clear communication, prompt payment application, automated accounting systems, transparent rent statements, prompt resolution, and thorough documentation were highlighted as key practices in managing unapplied credit.

By implementing these strategies, landlords and property management companies can minimize the occurrence of unapplied credit, maintain accurate rent accounting, and ensure a positive relationship with tenants.

In conclusion, understanding and effectively managing unapplied credit on rent is crucial for maintaining financial transparency, fostering trust with tenants, and ensuring a smooth rental experience for all parties involved. By staying proactive and attentive to rent accounting, landlords can create a reliable and professional rental environment.