Finance

What Is Quickbooks Checking Account

Modified: March 3, 2024

Discover the benefits of Quickbooks Checking Account and how it can simplify your financial management. Streamline your finance tasks with Quickbooks today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Overview of QuickBooks

- What is a Checking Account?

- Features of QuickBooks Checking Account

- Setting Up a Checking Account in QuickBooks

- Managing Transactions in QuickBooks Checking Account

- Reconciling the Checking Account in QuickBooks

- Reporting and Analysis with QuickBooks Checking Account

- Benefits of QuickBooks Checking Account

- Conclusion

Introduction

Managing your finances effectively is crucial for businesses of all sizes. One essential aspect is keeping track of your expenses, income, and cash flow. QuickBooks, a versatile and widely used accounting software, offers a range of features to help businesses streamline their financial management processes. One key feature is the ability to set up and manage checking accounts within the QuickBooks platform.

In this article, we will explore the concept of a QuickBooks checking account and how it can benefit your business. We will delve into the features of QuickBooks checking accounts, including how to set them up, manage transactions, reconcile accounts, and generate reports. By the end, you will have a comprehensive understanding of how QuickBooks checking accounts can help you stay on top of your financials.

QuickBooks by Intuit has become an industry leader in accounting and bookkeeping software due to its user-friendly interface and powerful functionality. It caters to the needs of businesses of all sizes, from small startups to large enterprises. With its intuitive features and tools, QuickBooks simplifies the accounting process and allows business owners and accountants to efficiently track, record, and analyze financial transactions.

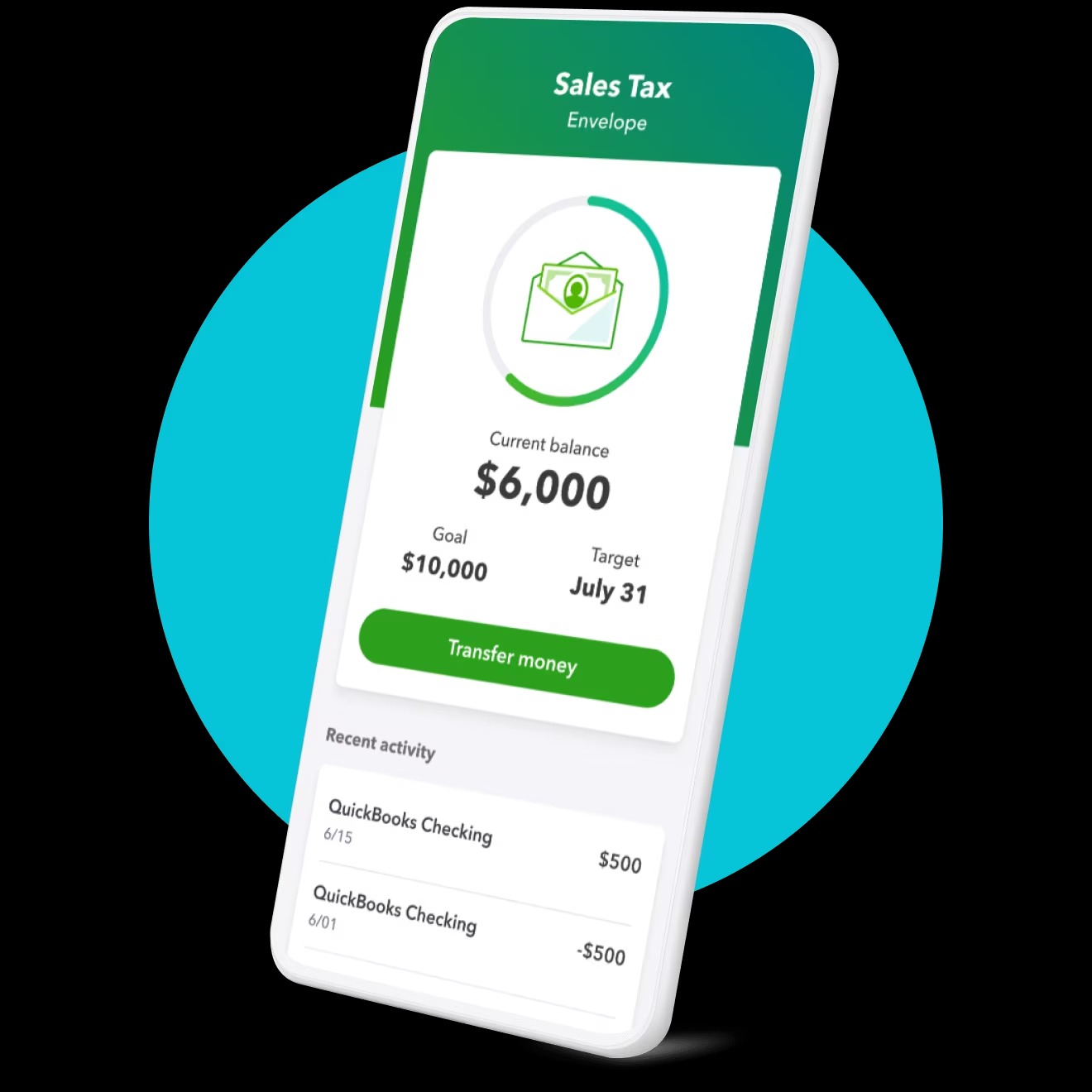

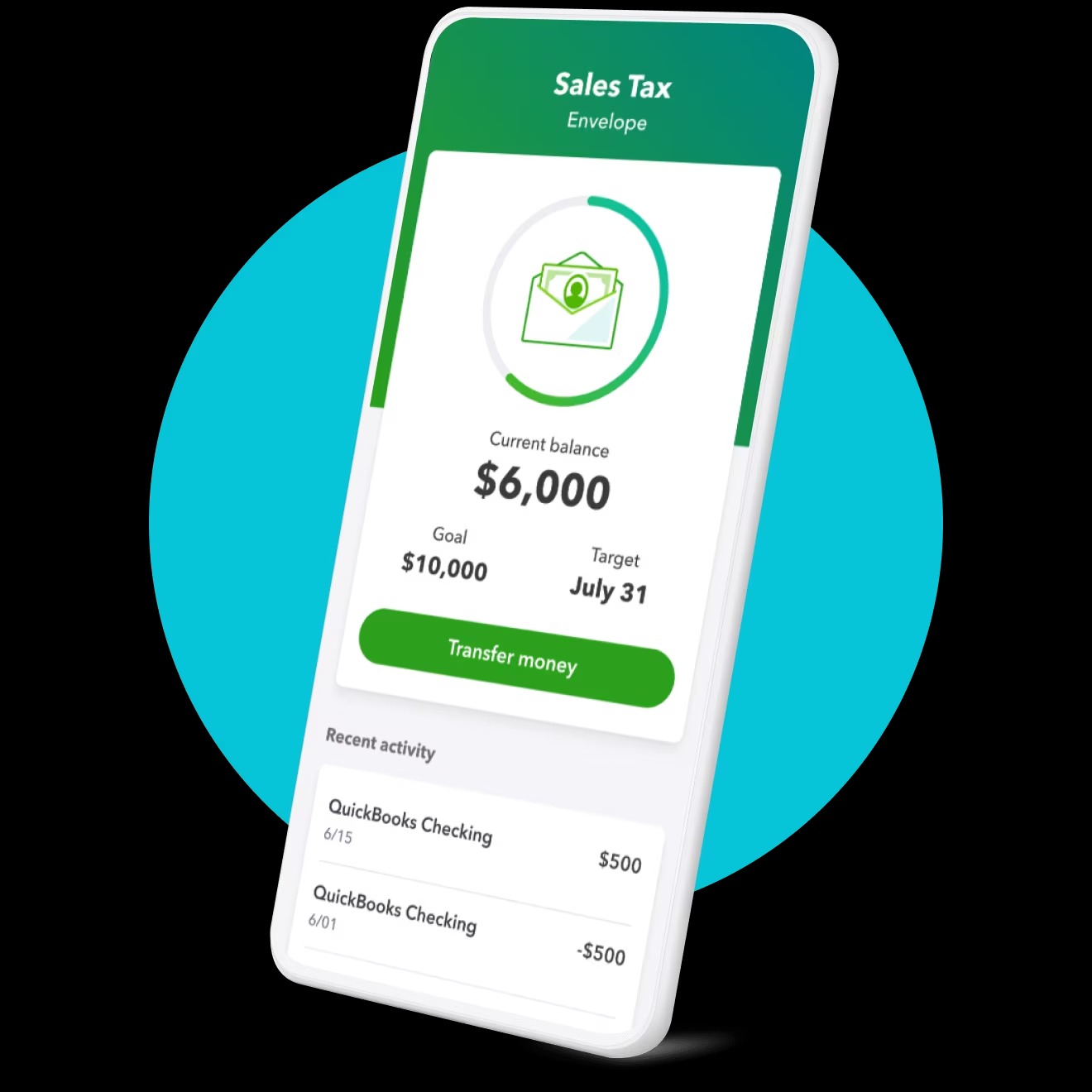

A checking account is a type of bank account that allows you to deposit and withdraw funds conveniently. It acts as a primary account for managing day-to-day business expenses, paying bills, and receiving payments. With QuickBooks’ checking account feature, you can integrate your bank accounts directly into the software, enabling seamless synchronization of transactions and simplifying the financial management process.

Setting up a checking account in QuickBooks is straightforward. You need to provide the necessary details, such as the account name, account number, bank details, and opening balance. Once set up, QuickBooks allows you to manage your transactions efficiently, categorizing income and expenses, and providing a real-time view of your cash flow.

Reconciling your checking account in QuickBooks is an essential step to ensure that your recorded transactions match the bank statement. By comparing the transactions in QuickBooks with the ones in your bank statement, you can identify any discrepancies and accurately track your funds. QuickBooks provides a user-friendly reconciliation process, helping you spot errors or missing transactions easily.

With QuickBooks’ reporting and analysis tools, you can generate various financial reports related to your checking account. These reports offer insights into your business’s financial health, including income and expense summaries, profit and loss statements, and cash flow projections. By analyzing these reports, you can make informed decisions about budgeting, forecasting, and overall financial planning.

Overall, QuickBooks’ checking account feature offers numerous benefits for business owners and accountants. It simplifies financial management, provides real-time visibility into cash flow, automates transaction categorization, streamlines bank reconciliation, and offers robust reporting and analysis capabilities. By leveraging QuickBooks’ checking account feature, you can stay organized and make informed financial decisions to drive your business’s success.

Overview of QuickBooks

QuickBooks is a comprehensive accounting software developed by Intuit that is designed to streamline financial management for businesses. With its user-friendly interface and powerful features, QuickBooks has become the go-to choice for small businesses, freelancers, and accounting professionals.

The software offers a wide range of functionalities, including but not limited to, invoicing, expense tracking, payroll management, inventory management, and financial reporting. QuickBooks is available in various versions, including QuickBooks Online (cloud-based), QuickBooks Desktop (installed on a computer), and QuickBooks Self-Employed (for freelancers and independent contractors).

One of the key advantages of QuickBooks is its accessibility and ease of use. You don’t need to be an accounting expert to navigate through its features. QuickBooks provides a user-friendly interface with step-by-step guidance, making it accessible even for those with limited accounting knowledge.

QuickBooks allows you to automate many aspects of your financial management, saving you time and reducing the risk of errors. You can connect your bank accounts, credit cards, and other financial institutions directly to QuickBooks, enabling seamless synchronization of your transactions. This eliminates the need for manual data entry and ensures accuracy in your financial records.

Another advantage of QuickBooks is its scalability. Whether you are a sole proprietor, a small business with a handful of employees, or a larger organization with complex financial needs, QuickBooks has the flexibility to accommodate your requirements.

With QuickBooks, you can create and send professional-looking invoices, track income and expenses, manage bills and payments, and even generate financial reports. These features help you stay organized, monitor your cash flow, and make informed financial decisions.

In addition to its core features, QuickBooks offers a vast marketplace of applications and integrations. These integrations allow you to further extend the functionality of QuickBooks, such as integrating with e-commerce platforms, time-tracking tools, point-of-sale systems, and more.

QuickBooks also provides robust security measures to protect your financial data. They use advanced encryption technology to safeguard your sensitive information and provide regular updates and backups to ensure data integrity.

Overall, QuickBooks is a versatile and powerful accounting software that simplifies financial management for businesses of all sizes. With its intuitive interface, automation capabilities, scalability, and extensive features, QuickBooks empowers businesses to efficiently handle their accounting tasks and make informed financial decisions.

What is a Checking Account?

A checking account is a type of bank account that allows individuals and businesses to deposit and withdraw funds easily. It serves as a primary account for managing everyday financial transactions, such as paying bills, writing checks, and receiving payments. Checking accounts offer a convenient and secure way to access and track your money.

As the name suggests, a checking account gives you the flexibility to “check” your balance and make transactions whenever needed. Unlike savings accounts, which typically have limitations on the number of withdrawals per month, checking accounts have no restrictions on the number of transactions you can make.

When you open a checking account, the bank provides you with a unique account number and issues a checkbook or a debit card linked to the account. These instruments allow you to withdraw funds or make payments directly from the account.

In addition to checks and debit cards, checking accounts often come with other features, such as online banking, mobile banking, and electronic fund transfers. These digital banking tools enable convenient access to your funds, allowing you to manage your account, make payments, and track your transactions from anywhere, at any time.

One key benefit of using a checking account is the ability to keep your money safe. Banks provide various security measures, such as encryption and fraud monitoring, to protect your funds against unauthorized access and fraudulent activity.

A checking account also offers a record-keeping system. Every transaction made through the account is recorded, either in the form of a physical check or an electronic transaction. This record allows you to track your expenses, monitor your cash flow, and provide documentation for tax purposes.

Checking accounts usually incur fees for certain activities, such as overdrafts, out-of-network ATM withdrawals, and monthly maintenance. These fees vary depending on the bank and the type of account you have. However, many banks offer fee waivers or reduced fees if you maintain a minimum balance or meet certain criteria.

It’s important to note that a checking account is different from a savings account or a money market account. While checking accounts focus on day-to-day transactions and easy access to funds, savings accounts are designed for storing money and earning interest over time. Money market accounts are a hybrid between checking and savings accounts, offering higher interest rates while still providing some check-writing capabilities.

In summary, a checking account is a versatile financial tool that offers convenient access to your funds and facilitates everyday transactions. It provides security, record-keeping, and digital banking features that make managing your money easier. Whether you are an individual or a business, a checking account is essential for effectively and efficiently managing your financial affairs.

Features of QuickBooks Checking Account

QuickBooks offers a range of powerful features that make managing your checking account seamless and efficient. These features are designed to simplify your financial management tasks and provide you with real-time visibility into your cash flow. Let’s explore some of the key features of QuickBooks checking account:

- Easy account setup: QuickBooks allows you to set up your checking account in just a few simple steps. You can provide the necessary details, such as the account name, account number, bank details, and opening balance. Once set up, QuickBooks will import your bank transactions automatically, ensuring that your records are always up to date.

- Transaction management: QuickBooks enables you to efficiently manage transactions in your checking account. You can record and categorize income and expenses, including checks, electronic payments, and credit card transactions. This categorization helps you track where your money is coming from and where it’s going, providing insights into your spending patterns.

- Bank reconciliation: Reconciling your checking account is a vital process to ensure that your recorded transactions match the ones in your bank statement. QuickBooks makes bank reconciliation simple by allowing you to compare your transactions with the ones provided by your bank. This helps you identify any discrepancies or errors and ensures the accuracy of your financial records.

- Budgeting and forecasting: QuickBooks checking account feature includes budgeting and forecasting capabilities that help you plan and analyze your finances. You can create budgets for specific categories or time periods, track your expenses against the budget, and generate reports to assess your financial performance. This feature assists in making informed decisions about spending and forecasting future cash flow.

- Financial reporting: With QuickBooks, you can generate a wide range of financial reports related to your checking account. These reports offer valuable insights into your business’s financial health, including income and expense summaries, profit and loss statements, and cash flow projections. The customizable reporting feature allows you to view the information that is most relevant to you and your business.

- Integration with bank accounts: QuickBooks seamlessly integrates with your bank accounts, allowing for automatic synchronization of transactions. This feature eliminates the need for manual data entry and significantly reduces the chance of errors. With real-time updates, you can stay on top of your cash flow and ensure that your financial records are accurate and up to date.

- Multiple users and access controls: QuickBooks offers multi-user functionality, allowing multiple team members or accountants to access the checking account simultaneously. You can set different user roles and permissions to control who can view, edit, or perform specific actions within the software. This feature enhances collaboration and ensures data security and privacy.

- Mobile access: QuickBooks provides a mobile app that enables you to access your checking account on the go. Whether you need to review transactions, send invoices, or check your account balance, the mobile app allows you to manage your finances conveniently from your smartphone or tablet.

- Add-ons and integrations: QuickBooks has a wide range of add-ons and integrations that extend the functionality of the software. You can integrate QuickBooks with other business applications, such as payment gateways, e-commerce platforms, time-tracking tools, and more. These integrations allow for a seamless workflow and enhance efficiency in managing your checking account.

These are just a few of the many features that QuickBooks offers for managing your checking account. With its robust functionality and user-friendly interface, QuickBooks enables you to handle your financial tasks effectively, stay organized, and make informed decisions for the financial health of your business.

Setting Up a Checking Account in QuickBooks

Setting up a checking account in QuickBooks is a straightforward process that allows you to seamlessly manage your financial transactions within the software. Follow these simple steps to get started:

- Open QuickBooks and navigate to the Chart of Accounts: The Chart of Accounts is where you can view and manage all your accounts in QuickBooks. To access it, open QuickBooks and click on the “Lists” menu, then select “Chart of Accounts.”

- Add a new account: In the Chart of Accounts, click on the “Account” button and select “New.” You will be prompted to choose the account type. Select “Bank” as the account type and click “Continue.”

- Enter the account details: Fill in the required information for your checking account, including the account name, account number, and bank details. You can also provide an opening balance if applicable. Make sure to double-check the accuracy of the information before proceeding.

- Connect your bank account: QuickBooks allows you to connect your checking account directly to the software, enabling automatic synchronization of transactions. To connect your bank account, select the option to “Connect bank account for automatic downloads” and follow the prompts to provide your bank’s login credentials. QuickBooks will securely connect to your bank and import your transactions.

- Categorize your transactions: Once your checking account is set up and connected, you can start categorizing your transactions. QuickBooks provides categories such as income, expenses, and transfers. Assign the appropriate category to each transaction to organize your financial records and track your cash flow accurately.

- Set up online banking: If you haven’t already done so, you can set up online banking within QuickBooks. This allows you to download bank feeds and match them to the transactions in your checking account. It streamlines the bank reconciliation process and ensures that your records are up to date.

- Customize your checking account preferences: QuickBooks offers various customization options to tailor the checking account to your needs. You can set defaults for payment terms, invoice templates, and other preferences. Take the time to explore the different settings and personalize them based on your business requirements.

- Test the account: Before fully utilizing your checking account in QuickBooks, it’s a good practice to test it by entering a few sample transactions or importing past bank statements. This allows you to check if the transactions are properly categorized and reconcile them without affecting your actual financial records.

- Set user access and permissions: If you have multiple team members or accountants who will be working with the checking account in QuickBooks, you can set up user access and permissions. This ensures that only authorized individuals can view, edit, or perform specific actions within the software.

By following these steps, you can quickly and effectively set up your checking account in QuickBooks. Once set up, you will have the ability to manage your transactions, reconcile your accounts, generate reports, and gain real-time insights into your business’s financial health—all within the powerful and user-friendly QuickBooks software.

Managing Transactions in QuickBooks Checking Account

Once you have set up your checking account in QuickBooks, you can efficiently manage your transactions within the software. QuickBooks provides a user-friendly and intuitive interface that allows you to record, categorize, and track your financial transactions accurately. Here are some key steps for managing transactions in your QuickBooks checking account:

- Recording transactions: When a financial transaction occurs, such as a payment received or an expense incurred, you can easily record it in QuickBooks. Navigate to your checking account, either through the Chart of Accounts or the Banking menu, and click on the “Record a Deposit” or “Write Checks” option, depending on the type of transaction. Enter the necessary details, including the date, payee, amount, and category, and save the transaction.

- Categorizing transactions: Categorizing transactions is an essential step to track your income and expenses accurately. QuickBooks provides a list of predefined categories, but you can also create custom categories that align with your specific business needs. Assign the appropriate category to each transaction to ensure proper tracking and reporting.

- Matching bank feeds: If you have set up online banking in QuickBooks for your checking account, you can download bank feeds directly into the software. When bank feeds are available, QuickBooks will match the downloaded transactions with the ones you have recorded. Verify the matches and make any necessary adjustments to keep your records in sync with your bank statement.

- Splitting transactions: In some cases, a single transaction may involve multiple expense categories or income sources. QuickBooks allows you to split a transaction into different categories, allocating the amounts accordingly. This feature is particularly useful when dealing with complex transactions or when you need to allocate expenses to different cost centers or departments.

- Recurring transactions: For transactions that occur regularly, QuickBooks offers a recurring transactions feature. This feature automates the entry of repetitive transactions, such as monthly rent or utility payments. Set up the transaction details, including the frequency and start date, and QuickBooks will automatically create and record the transaction at the designated intervals.

- Batch transactions: QuickBooks allows you to perform batch actions on multiple transactions simultaneously. This feature is particularly useful when you need to edit or delete multiple transactions at once. Select the transactions you want to modify, choose the appropriate batch action, and QuickBooks will apply the changes to all selected transactions simultaneously.

- Attachments: QuickBooks allows you to attach supporting documents, such as receipts or invoices, to your transactions. This feature helps you maintain a digital record of your financial documents and makes it easy to retrieve them when needed.

- Transaction search: QuickBooks provides a robust search functionality that allows you to find specific transactions quickly. You can search by various criteria, such as transaction type, date range, payee, or amount. This feature enables you to locate specific transactions easily and review or modify them as necessary.

- Reconciling your account: Regularly reconciling your QuickBooks checking account with your bank statement is an essential step to ensure the accuracy of your financial records. QuickBooks provides a streamlined reconciliation process that allows you to match the transactions in QuickBooks with the ones in your bank statement. Resolve any discrepancies and ensure the balances match to maintain the integrity of your financial data.

By effectively managing your transactions in QuickBooks, you can maintain accurate and up-to-date financial records, track your income and expenses, and have a clear understanding of your cash flow. QuickBooks’ user-friendly interface and powerful features make it easy to record, categorize, and reconcile your transactions, ultimately saving you time and improving your financial management processes.

Reconciling the Checking Account in QuickBooks

Reconciling your checking account is an important process to ensure the accuracy of your financial records and bank balances. QuickBooks provides a user-friendly and efficient reconciliation feature that helps you compare the transactions recorded in QuickBooks with the ones provided by your bank. Here’s how you can reconcile your checking account in QuickBooks:

- Access the Reconciliation page: To start the reconciliation process, go to the Banking menu in QuickBooks and select “Reconcile.” Choose the checking account you want to reconcile from the list of accounts.

- Enter the statement information: Enter the statement date and ending balance from your bank statement into QuickBooks. QuickBooks will display the beginning balance based on the previous reconciliation, but you can manually adjust it if needed.

- Match transactions: QuickBooks will display a list of transactions in your checking account that have not yet been reconciled. Compare these transactions with the ones on your bank statement. Mark each transaction as “Cleared” if it matches the ones on your statement.

- Handle discrepancies: If you identify any discrepancies between QuickBooks and your bank statement, investigate and resolve them. Common discrepancies may include missing transactions, duplicate transactions, or errors in amounts or dates. Follow the appropriate steps to reconcile the discrepancies and ensure your balances match.

- Reconciliation reports: After reconciling your checking account, QuickBooks provides reconciliation reports for your reference. These reports include details about the transactions, adjustments made, and any discrepancies found during the reconciliation process. You can save these reports or print them for your records.

- Reconciliation adjustments: In some cases, you may need to make adjustments during the reconciliation process. This could include recording bank fees, interest income, or any other transactions that were not included in your regular banking transactions. QuickBooks allows you to add these adjustment transactions directly within the reconciliation window.

- Reconcile future transactions: If you have transactions that occur after the statement end date but are included on your bank statement, you can reconcile them as future transactions. QuickBooks will prompt you to enter the statement end date for which the transaction is included and will include them in the reconciliation process.

- Complete the reconciliation: Once you have reviewed and matched all the transactions, and resolved any discrepancies, you can complete the reconciliation process. QuickBooks will provide a summary screen showing the ending balance, cleared balance, and any adjustment transactions made. If everything matches, you can click “Reconcile Now” to finalize the reconciliation.

- Review and save the reconciliation report: After completing the reconciliation, QuickBooks will generate a reconciliation report summarizing the process and the results. Review the report to ensure everything looks accurate and save it for your records. The reconciliation report serves as proof of the reconciliation process and can be useful for auditing purposes.

Reconciling your checking account in QuickBooks is a critical step to maintain accurate financial records and ensure the integrity of your bank balances. By regularly reconciling, you can identify and resolve discrepancies, avoid errors, and have confidence in the accuracy of your financial data. QuickBooks’ reconciliation feature simplifies the process, allowing you to efficiently compare and match transactions, make adjustments, and generate reports for future reference.

Reporting and Analysis with QuickBooks Checking Account

QuickBooks provides a robust reporting and analysis functionality that allows you to gain valuable insights into your financials through your checking account. With a wide variety of customizable reports, you can assess your business’s financial health, track income and expenses, identify trends, and make informed decisions. Here’s how you can utilize reporting and analysis with QuickBooks checking account:

- Financial reports: QuickBooks offers a suite of financial reports that provide an overview of your checking account activity. These reports include income statements, balance sheets, and cash flow statements. You can generate these reports for specific time periods, allowing you to assess your business’s profitability, liquidity, and overall financial performance.

- Income and expense summaries: QuickBooks allows you to generate reports summarizing your income and expenses. These reports provide insights into your revenue sources, cost of goods sold, operating expenses, and more. By analyzing these summaries, you can identify areas of growth, manage expenses, and make strategic decisions to improve your profitability.

- Profit and loss statements: QuickBooks’ profit and loss statements, also known as income statements, give you a comprehensive view of your revenues, expenses, and net income or loss over a particular period. By analyzing these statements, you can evaluate the profitability of your business and identify areas where costs can be reduced or revenue can be increased.

- Cash flow projections: Understanding your cash flow is crucial for managing your business’s financial health. QuickBooks allows you to generate cash flow projections based on your checking account’s transactions. These projections provide insights into your expected cash inflows and outflows, helping you plan for any upcoming financial obligations or investment opportunities.

- Transaction detail reports: QuickBooks offers transaction detail reports that provide a comprehensive breakdown of all the transactions in your checking account. These reports can be customized to show specific time ranges, transaction types, or classes. By analyzing these reports, you can gain detailed insights into your spending patterns, track specific transactions, and identify any discrepancies or errors.

- Custom reporting: QuickBooks allows you to create custom reports based on your specific reporting needs. You can choose the data and columns you want to include, apply filters and sorting options, and save the reports for future use. Custom reports enable you to analyze your checking account data in a way that is most relevant to your business’s unique requirements.

- Budget vs. actuals: QuickBooks enables you to compare your budgeted amounts with the actual income and expenses in your checking account. By generating budget vs. actual reports, you can assess your financial performance against the targets you have set. This analysis helps you identify areas where you may be overspending or underspending, allowing you to make adjustments to stay on track.

- Graphical representations: In addition to numerical reports, QuickBooks provides graphical representations of your checking account data. These visualizations, such as bar charts and pie charts, offer a clear and concise overview of your income, expenses, and other financial metrics. Graphical representations make it easier to spot trends, highlight key areas, and present your financial information in a visually appealing manner.

- Exporting and sharing: QuickBooks allows you to export your reports to various formats, such as Excel or PDF. This feature enables you to share the reports with other stakeholders, such as investors, lenders, or your accountant. Exporting reports also allows you to further analyze the data or include it in presentations or financial forecasts.

With QuickBooks’ reporting and analysis capabilities, you can gain actionable insights into your business’s financial performance and make informed decisions based on reliable data. By regularly reviewing and analyzing the reports generated from your checking account transactions, you can track your progress, identify areas for improvement, and drive the financial success of your business.

Benefits of QuickBooks Checking Account

Using a QuickBooks checking account offers numerous benefits for businesses of all sizes. Whether you’re a small startup or a larger organization, QuickBooks’ powerful features and user-friendly interface can streamline your financial management processes and provide valuable insights into your business’s financial health. Here are some key benefits of using a QuickBooks checking account:

- Efficient financial management: QuickBooks simplifies the management of your checking account by providing a centralized platform to record, categorize, and track your financial transactions. With automated synchronization of bank feeds, you can easily stay up to date with your checking account activity, reducing the need for manual data entry.

- Real-time visibility of cash flow: By integrating your checking account with QuickBooks, you gain real-time visibility into your cash flow. You can monitor income and expenses, track account balances, and make informed decisions based on accurate and up-to-date financial information.

- Seamless synchronization of transactions: QuickBooks allows for seamless synchronization of your checking account transactions. This eliminates the need for manual reconciliation, reduces the risk of errors, and ensures that your financial records are accurate and in sync with your bank statement.

- Powerful reporting and analysis: QuickBooks provides a robust reporting and analysis functionality that enables you to generate a wide range of financial reports related to your checking account. These reports offer valuable insights into your business’s financial performance, allowing you to evaluate profitability, track expenses, and make data-driven decisions.

- Streamlined bank reconciliations: The reconciliation feature in QuickBooks simplifies the process of matching your recorded transactions with your bank statement. It helps identify any discrepancies or errors, ensuring that your financial records accurately reflect your actual bank balances.

- Integration with other financial tools: QuickBooks seamlessly integrates with a wide range of financial tools, such as payment gateways, e-commerce platforms, and time-tracking software. This integration streamlines your financial workflows, automates data transfer, and reduces manual effort in managing your checking account.

- Customization and scalability: QuickBooks offers customization options to tailor your checking account to your business’s unique needs. You can create custom categories, set up unique account preferences, and generate custom reports. Additionally, QuickBooks is scalable, accommodating businesses of all sizes and complexities.

- Enhanced collaboration and access controls: If you have multiple team members or accountants, QuickBooks allows you to set user roles and permissions, controlling who can view, edit, or perform specific actions within the software. This enhances collaboration while ensuring data security and privacy.

- Automation and time savings: QuickBooks’ automation features, such as transaction categorization and recurring transactions, save you time and reduce the likelihood of errors. By automating routine tasks, you can focus on more strategic aspects of your business.

- Improved financial decision-making: With accurate and up-to-date financial data at your fingertips, you can make informed and timely financial decisions. QuickBooks provides the tools and insights to evaluate your business’s financial health, identify areas for improvement, and set goals for growth.

Overall, using a QuickBooks checking account brings numerous benefits to your business’s financial management. From streamlined processes to real-time visibility and powerful reporting capabilities, QuickBooks empowers you to effectively manage your checking account and make informed decisions to drive financial success.

Conclusion

Managing your finances efficiently is crucial for the success of any business, and QuickBooks provides a powerful solution to streamline your financial management processes. With its checking account feature, QuickBooks offers a range of benefits that simplify the management of your financial transactions and provide valuable insights into your business’s financial health.

From setting up your checking account to managing transactions, reconciling with your bank statement, and generating comprehensive reports, QuickBooks ensures that your financial records are accurate and up to date. With its user-friendly interface and automation capabilities, QuickBooks saves you time and reduces the risk of errors, allowing you to focus on growing your business.

The powerful reporting and analysis tools in QuickBooks provide real-time visibility into your cash flow, enabling you to make data-driven decisions to drive your business’s success. The ability to customize reports, integrate with other financial tools, and scale with your business’s needs makes QuickBooks a flexible and adaptable solution.

By leveraging the benefits of a QuickBooks checking account, you can efficiently manage your finances, track income and expenses, forecast cash flows, and make informed financial decisions. The streamlined processes, enhanced collaboration, and automation features of QuickBooks contribute to improved efficiency and productivity in your financial management tasks.

In conclusion, QuickBooks’ checking account feature offers a comprehensive solution for businesses of all sizes to effectively manage their finances. Whether you’re a small startup or a larger organization, QuickBooks provides the tools and insights you need to stay on top of your cash flow, ensure accurate financial records, and make informed decisions for the success of your business.