Finance

What Happened To Worthy Bonds

Published: October 12, 2023

Discover what happened to Worthy Bonds, the innovative finance platform. Stay informed about the latest updates and developments in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where the landscape is constantly evolving, and investors must adapt to the ever-changing market conditions. One such investment platform that has caught the attention of many is Worthy Bonds. However, recent developments in its operations have left investors wondering what has happened to Worthy Bonds.

Worthy Bonds is a unique investment platform that offers individuals the opportunity to invest as little as $10 in bonds that support small businesses. In return, investors earn a fixed interest rate on their investment, making it an attractive option for those looking for stable returns in a low-risk investment. Originally launched in 2016, Worthy Bonds gained popularity for its innovative approach to connecting investors with small businesses.

However, in recent months, there have been significant changes in Worthy Bonds’ operations that have raised concerns among investors. These changes have led to uncertainty and confusion about the future of the platform and the investments made by its users.

It’s important to understand the context of these changes and their potential impact on investors. In this article, we will delve into the recent developments surrounding Worthy Bonds, analyze the implications for investors, and explore potential solutions for the platform’s future.

So, let’s dive deeper into what has happened to Worthy Bonds and what it means for investors.

Background on Worthy Bonds

Before we explore the recent changes in Worthy Bonds’ operations, let’s take a moment to understand the background of this investment platform.

Worthy Bonds was founded in 2016 with a mission to connect investors with small businesses needing capital. The platform offered a unique opportunity for individuals to invest in small business bonds, starting with a minimum investment of $10. The funds raised from these investments were then used to provide working capital to small businesses, enabling them to grow and thrive.

One of the key aspects that set Worthy Bonds apart from traditional investment options was its focus on impact investing. The platform aimed to empower small business owners, supporting local communities and driving economic growth in the process. This approach resonated with investors who were seeking both financial returns and the satisfaction of supporting small businesses.

Additionally, Worthy Bonds positioned itself as an accessible investment platform, catering to both seasoned investors and those new to the world of finance. With its low minimum investment requirement and user-friendly interface, Worthy Bonds made it easy for anyone to participate in the platform and potentially earn a return on their investment.

Furthermore, Worthy Bonds promised a fixed interest rate of 5% on the investments made by users. This steady return, coupled with the socially conscious aspect of supporting small businesses, made Worthy Bonds an appealing choice for many investors.

Over the years, Worthy Bonds gained traction and built a loyal customer base. Thousands of individuals invested their hard-earned money in Worthy Bonds, attracted by the platform’s promise of stable returns and positive impact on the community.

However, as we will explore in the next section, recent changes in Worthy Bonds’ operations have raised concerns and left investors questioning the future of their investments.

Changes in Worthy Bonds’ Operations

In recent months, Worthy Bonds has undergone significant changes in its operations, leading to uncertainty and concern among investors. These changes have impacted various aspects of the platform, including investment terms and the availability of investment opportunities.

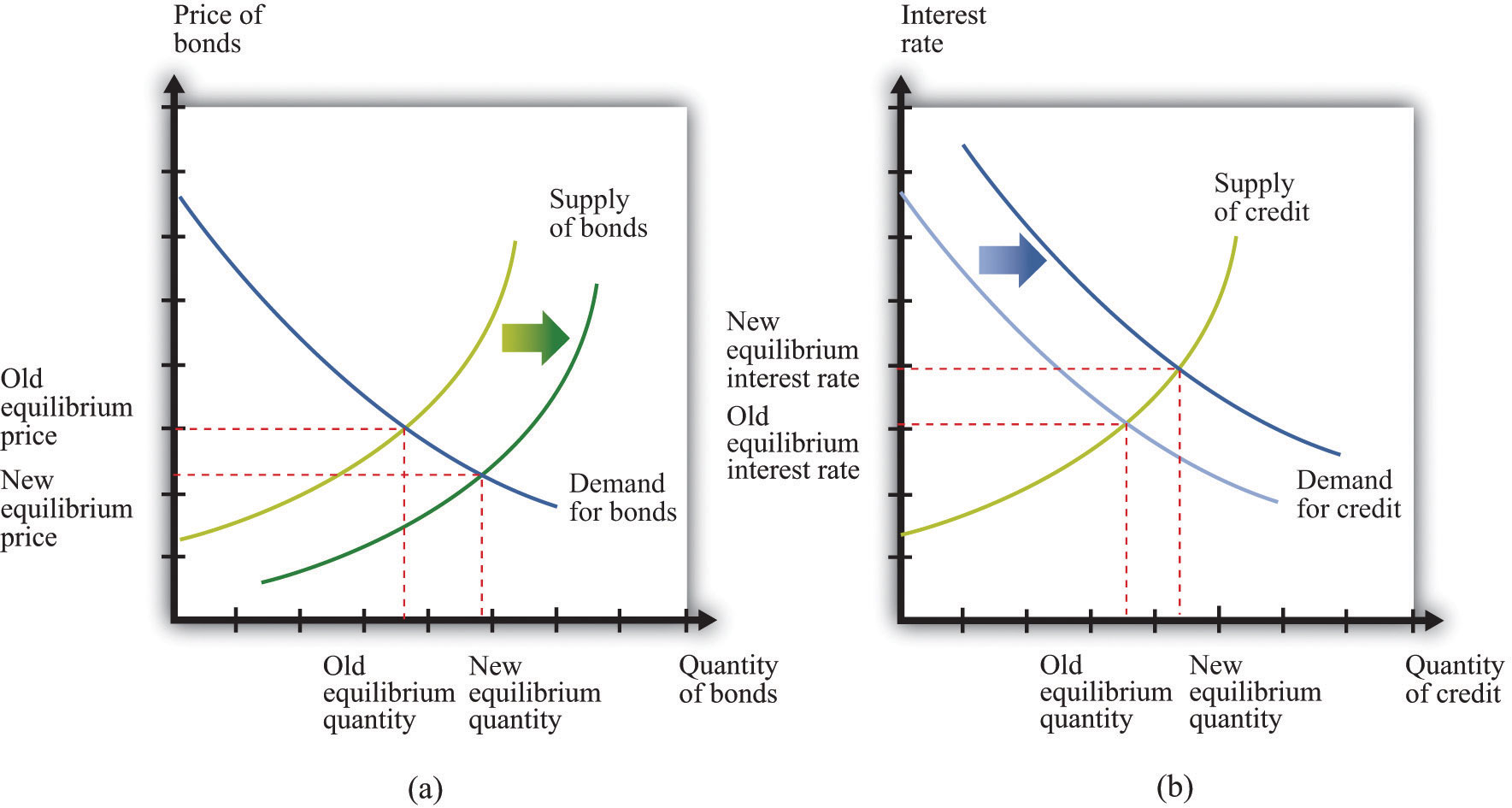

One of the notable changes is the decision by Worthy Bonds to reduce the fixed interest rate offered to investors. Previously, investors could expect a 5% annual return on their investments. However, in an attempt to adjust to changing market conditions, Worthy Bonds lowered the interest rate to 4.5%. While a 0.5% reduction may seem minor, it has raised questions among investors about the stability and profitability of their investments.

Furthermore, Worthy Bonds has also adjusted the frequency at which interest is paid out to investors. Previously, investors received interest payments on a quarterly basis. However, the platform has now transitioned to monthly interest payments. While this may be seen as a positive change by some investors, others are concerned about the potential impact on the overall returns they receive.

Another significant change in Worthy Bonds’ operations is the limited availability of investment opportunities. Previously, investors could continuously invest in Worthy Bonds, with new bonds being issued regularly. However, the platform has recently restricted the issuance of new bonds, making it more challenging for investors to allocate additional funds or diversify their portfolios.

These changes in Worthy Bonds’ operations have left investors questioning the reliability and consistency of their investments. The reduced interest rate, altered payment frequency, and limited investment opportunities have prompted concerns about the future viability and profitability of Worthy Bonds as an investment platform.

It’s important for investors to assess and understand these changes in order to make informed decisions about their investments and consider potential alternatives.

Impact on Worthy Bonds Investors

The changes in Worthy Bonds’ operations have had varying impacts on its investors, affecting their expectations, returns, and overall investment experience.

Firstly, the reduction in the fixed interest rate from 5% to 4.5% has understandably disappointed some investors. This adjustment means that the returns they were initially anticipating have been slightly diminished. While a 0.5% reduction may not seem significant, it can impact the overall financial goals and plans of investors, especially those who relied on the stability of the previously offered rate.

Furthermore, the transition from quarterly to monthly interest payments has both advantages and disadvantages. On the positive side, investors may appreciate the more frequent access to their returns, allowing for increased liquidity and potential reinvestment opportunities. However, the transition may also result in smaller individual interest payments, which can be a disadvantage for investors who rely on larger periodic disbursements.

The limited availability of investment opportunities has also affected investors. With fewer bonds being issued, investors face challenges in allocating additional funds or diversifying their portfolios. This restriction has the potential to hinder the growth potential of their investments and limit the ability to manage risk effectively.

Moreover, these changes in Worthy Bonds’ operations have shaken investor confidence. The platform’s previous allure was its promise of stable returns and positive impact through investing in small businesses. With the adjustments in interest rates, payment frequency, and investment availability, some investors may question whether Worthy Bonds can still deliver on its initial value proposition.

As a result of these changes, some investors may start exploring alternative investment opportunities that can better align with their financial goals and risk tolerance. It is crucial for investors to evaluate the impact of these changes on their individual circumstances and determine if Worthy Bonds remains a suitable investment option for them.

Overall, the impact on Worthy Bonds investors is a mix of disappointment, reevaluation of their investment strategies, and a sense of uncertainty about the future performance and direction of the platform.

Analysis of Worthy Bonds’ Current Situation

Given the recent changes in Worthy Bonds’ operations and the impact on its investors, it is essential to analyze the platform’s current situation to gain a better understanding of its prospects and challenges.

One key factor to consider is the reasoning behind the changes made by Worthy Bonds. The decision to lower the fixed interest rate and adjust the payment frequency can be attributed to the evolving market conditions and economic landscape. Interest rates across financial markets have been relatively low in recent times, making it challenging for Worthy Bonds to sustain the previous 5% rate. By implementing these adjustments, the platform aims to strike a balance between investor expectations and the economic reality.

Additionally, the restricted availability of investment opportunities may be a result of Worthy Bonds’ desire to maintain a responsible lending approach. Limiting the issuance of new bonds allows the platform to carefully assess the borrowing needs of small businesses and ensure that capital is allocated wisely. However, this may pose challenges for investors seeking to expand their portfolios or diversify their investments.

While some investors may be disappointed by these changes, it is crucial to recognize that they may contribute to the long-term sustainability and viability of Worthy Bonds. By adapting to the current economic climate, Worthy Bonds can better navigate potential market fluctuations and ensure the continuity of its operations.

Another aspect to consider is the impact of these changes on the platform’s reputation and investor trust. When a financial institution undergoes significant shifts in operations, it can affect the confidence investors have in the platform. Worthy Bonds will need to communicate transparently and effectively with its investors to address any concerns and maintain trust in its ability to deliver on its promises.

Furthermore, it is important to recognize that the changes in Worthy Bonds’ operations may not be indicative of permanent setbacks, but rather adjustments to optimize the platform’s performance. The financial landscape is dynamic, and investment platforms must be agile in their response to market conditions. As Worthy Bonds continues to refine its operations and adapt to the changing environment, it may discover new opportunities or strategies to enhance the investor experience and deliver meaningful investment returns.

Overall, the analysis of Worthy Bonds’ current situation reveals a combination of challenges and potential opportunities. By assessing the motives behind the changes, understanding the impact on investor trust, and recognizing the need to adapt in a volatile marketplace, Worthy Bonds can shape its future path and regain investor confidence.

Potential Solutions and Future Outlook for Worthy Bonds

In light of the recent changes in Worthy Bonds’ operations and the impact on its investors, there are potential solutions that the platform can explore to address concerns and enhance its future outlook.

Firstly, Worthy Bonds could consider diversifying its investment offerings. While the platform initially focused on small business bonds, expanding its investment options to include other asset classes or financial products could provide investors with increased opportunities for diversification and potentially higher returns. By incorporating different investment instruments, Worthy Bonds can cater to a broader range of investor preferences and risk profiles.

Secondly, enhancing communication with investors is crucial. Worthy Bonds should proactively communicate the reasoning behind the changes in its operations and provide updates on the platform’s performance. Transparent and timely communication can help rebuild trust and ensure that investors are well-informed about the current situation and the steps being taken to overcome challenges. Implementing a robust customer support system can also address any queries or concerns that investors may have.

Another potential solution for Worthy Bonds is to explore partnerships or collaborations with other financial institutions. By leveraging the expertise and resources of established players in the industry, Worthy Bonds can enhance its capabilities, access a wider investor base, and potentially secure more favorable investment terms. Collaborations can also provide opportunities to tap into new markets or innovative technologies that can further strengthen the platform’s position.

Moreover, Worthy Bonds could consider conducting regular reviews and assessments of its operations to ensure ongoing alignment with investor expectations and market conditions. This includes regularly evaluating the interest rates offered, payment frequencies, and availability of investment opportunities. By routinely revisiting and adjusting these factors, Worthy Bonds can demonstrate its commitment to providing a fair and competitive investment platform.

Looking ahead, the future outlook for Worthy Bonds depends on its ability to adapt and innovate within the changing financial landscape. The platform should continue to monitor market trends, anticipate customer needs, and iterate its business model accordingly. By staying agile and proactive, Worthy Bonds can secure its position as a reliable and attractive investment platform.

Ultimately, the success of Worthy Bonds will hinge on its ability to deliver consistent returns, maintain transparent communication, and offer a compelling investment proposition to its investors. By implementing potential solutions and continuously evolving to meet market demands, Worthy Bonds can navigate the challenges it faces and position itself for long-term growth and success.

Conclusion

The recent changes in Worthy Bonds’ operations have undoubtedly stirred concern among investors and raised questions about the future of the platform. However, it is essential to approach these changes with a balanced perspective and consider potential solutions and the overall outlook for Worthy Bonds.

While investors may be disappointed by the reduction in the fixed interest rate, the adjustment can be seen as a necessary response to the prevailing market conditions. Similarly, the transition to monthly interest payments may have its benefits for certain investors, despite potential drawbacks for others.

The limited availability of investment opportunities is another aspect that investors should consider. While it may pose challenges for diversification, it demonstrates Worthy Bonds’ commitment to responsible lending practices and careful allocation of capital.

To address concerns and enhance the future outlook of Worthy Bonds, potential solutions include diversifying investment offerings, strengthening communication with investors, exploring partnerships, and conducting regular reviews of operations.

While the current situation may test investor confidence, Worthy Bonds has the opportunity to rebuild trust by transparently addressing concerns and demonstrating their commitment to delivering a reliable and attractive investment platform.

Looking ahead, the future of Worthy Bonds rests on its ability to adapt to changing market dynamics, innovate within the financial landscape, and provide consistent returns to its investors. With careful strategic planning and a customer-centric approach, Worthy Bonds can navigate the challenges it currently faces and position itself for long-term success.

As investors evaluate their options, it is essential to consider their individual financial goals, risk tolerance, and long-term investment strategies. Worthy Bonds may still hold potential as a viable investment platform, provided investors assess the changes in its operations and make informed decisions.

Investing in the active pursuit of financial goals involves both opportunities and risks. As the financial landscape continues to evolve, it is crucial for investors to stay informed, diversify their portfolios, and adapt their strategies accordingly.

In conclusion, the changes in Worthy Bonds’ operations have elicited mixed reactions from investors. By analyzing the situation, exploring potential solutions, and considering the platform’s future outlook, investors can determine the best course of action for their investment portfolios.