Home>Finance>What Happens To My Stocks If Robinhood Goes Bankrupt

Finance

What Happens To My Stocks If Robinhood Goes Bankrupt

Modified: February 21, 2024

Find out what would happen to your stocks if Robinhood were to go bankrupt. Understand the potential financial implications and how to protect your investments in this scenario.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of online stock trading, where platforms like Robinhood have revolutionized the way people invest. With its user-friendly interface and commission-free trades, Robinhood has become a popular choice for both first-time investors and experienced traders alike. However, like any financial institution, there is always a risk involved. What happens to your stocks if Robinhood goes bankrupt?

This question may seem alarming, but it’s important to understand the potential risks and protections in place when investing with an online brokerage like Robinhood. In this article, we will delve into the intricacies of what happens to your stocks if Robinhood were to face financial difficulties.

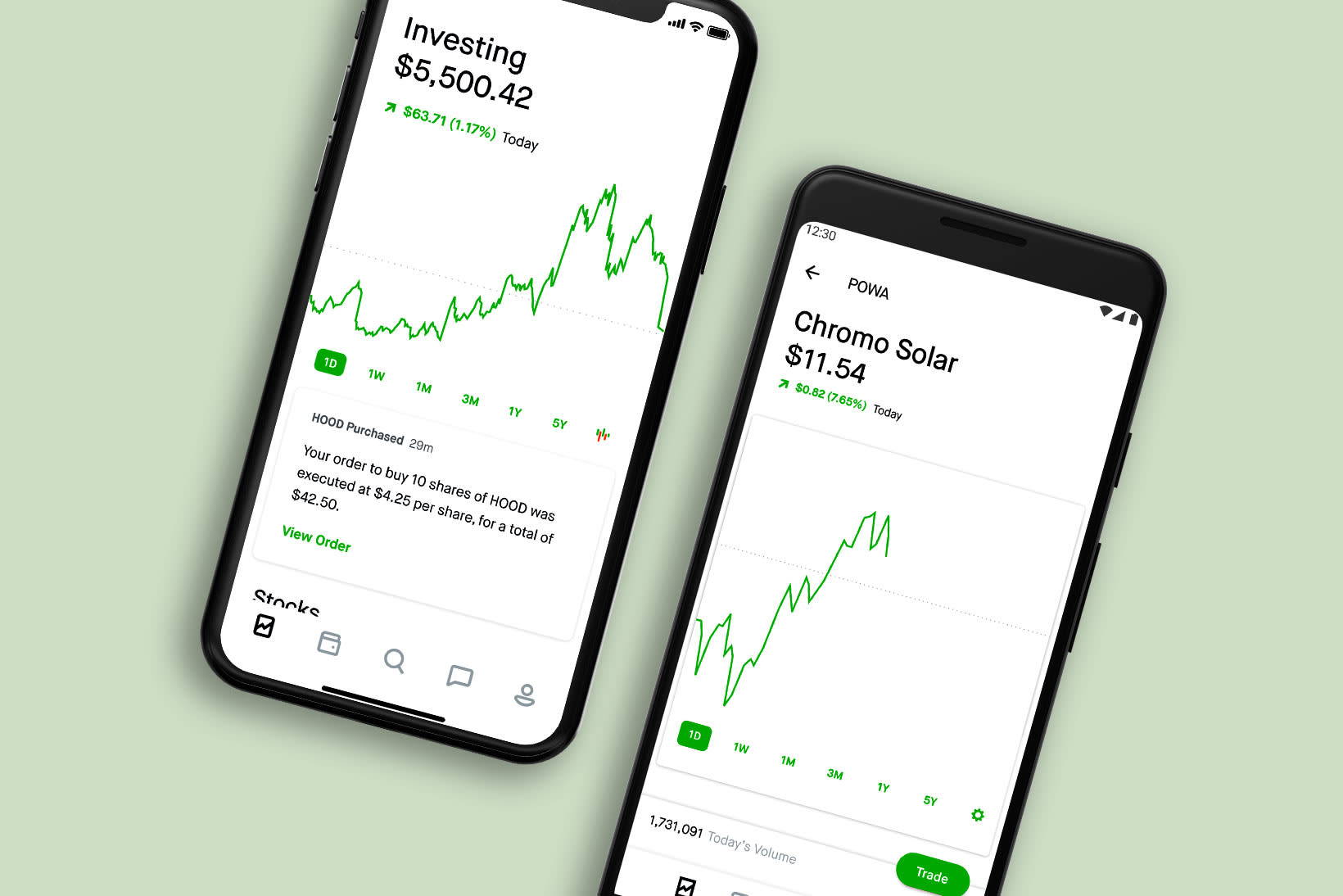

Before we dive into the details, let’s first gain a better understanding of what Robinhood is. Founded in 2013, Robinhood offers a mobile-based trading platform that allows users to buy and sell stocks, options, and cryptocurrencies. It quickly gained popularity due to its intuitive interface, commission-free trades, and accessibility to even the smallest investors.

As with any investment platform, there is always some level of risk involved. While Robinhood takes measures to ensure the safety and security of your investments, it is important to recognize the potential risks associated with any financial institution.

So, let’s explore the scenario of Robinhood going bankrupt and what it means for you as an investor. Understanding the possible outcomes will help you make informed decisions about your investments and take necessary precautions to protect your assets.

Understanding Robinhood

Before we delve into the potential risks and outcomes of Robinhood going bankrupt, let’s first gain a deeper understanding of how Robinhood operates as an online brokerage platform.

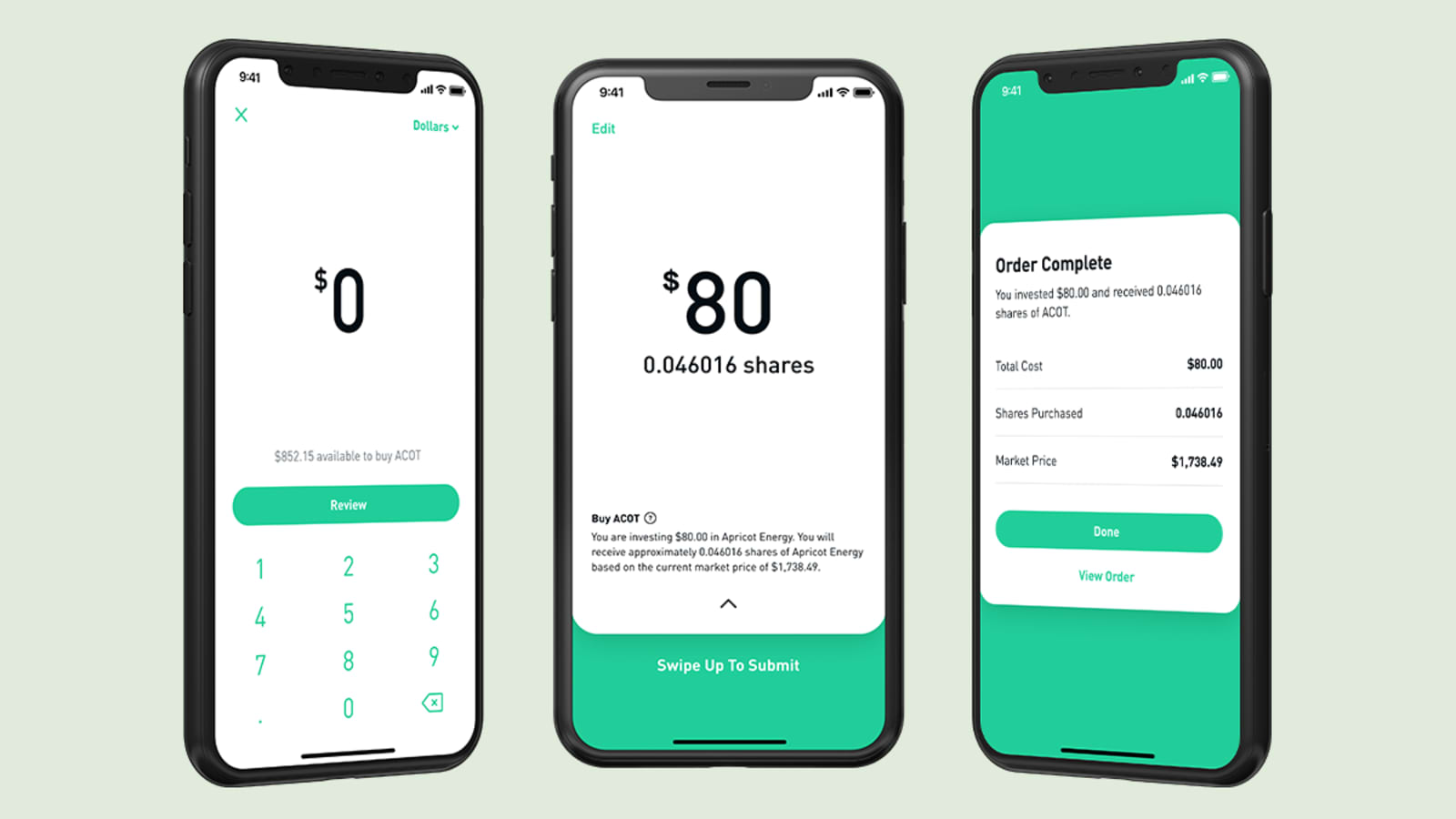

Robinhood is designed to make investing accessible and affordable for everyone. It offers commission-free trades, which means you can buy and sell stocks, options, and cryptocurrencies without incurring any transaction fees. This fee structure has made it a popular choice for both new and experienced investors.

One of the key features of Robinhood is its user-friendly mobile app. The app provides a simple and intuitive platform for users to manage their investments on the go. It offers real-time market data, customizable watchlists, and even allows for fractional share trading, which means you can own a portion of a share instead of purchasing it in whole.

Robinhood also offers a wide range of investment options, including stocks, exchange-traded funds (ETFs), options, and cryptocurrencies. This gives users the flexibility to diversify their portfolios and explore different investment strategies.

However, it’s important to note that Robinhood operates as a brokerage platform and not a full-service financial institution. This means that while they facilitate trades and provide investment services, they do not offer services like financial planning, retirement accounts, or investment advice.

As with any investment platform, it’s crucial to understand the risks involved when investing with Robinhood. While they prioritize the security of your investments, it’s essential to be aware of the potential outcomes in the event of financial difficulties or bankruptcy.

Now that we have a better understanding of Robinhood’s operations as an online brokerage platform, let’s explore the risks and potential consequences in the unfortunate event that Robinhood goes bankrupt.

The Risk of Robinhood Going Bankrupt

Like any financial institution, Robinhood is not immune to the risk of bankruptcy. While the likelihood of this happening may be low, it’s important for investors to understand the potential risks involved.

One potential risk is the financial mismanagement or poor business decisions that could lead to insolvency. While Robinhood has grown rapidly and attracted a large user base, there is always a possibility that the company may face financial difficulties due to unforeseen circumstances or economic downturns.

Another risk is the potential impact of regulatory changes or legal issues that could arise. As an online brokerage, Robinhood is subject to various regulations and compliance requirements. Any legal disputes or regulatory actions against the company can have a significant impact on its financial stability and operations.

Furthermore, the competitive landscape of the financial industry is constantly evolving. New entrants or established players offering similar services could pose a threat to Robinhood’s business model. Disruption in the industry or loss of market share could potentially affect the financial health of the company.

It’s important to note that the risk of Robinhood going bankrupt does not automatically mean the loss of your investments. There are regulatory safeguards in place to protect investors in the event of a brokerage firm’s insolvency.

Now that we understand the potential risks of Robinhood going bankrupt, let’s explore what would happen to your stocks if such an unfortunate situation were to occur.

What Happens to My Stocks If Robinhood Goes Bankrupt

If Robinhood were to go bankrupt, you may be concerned about the fate of your stocks and investments. While the situation can be unsettling, there are safeguards in place to protect investors in the event of a brokerage firm’s insolvency.

When a brokerage firm like Robinhood becomes insolvent, it undergoes a liquidation process. During this process, your stocks and other assets held with the firm are not forfeited or lost. Instead, they are transferred to a new brokerage firm or custodian.

The regulatory body that oversees the protection of customers’ assets in the United States is the Securities Investor Protection Corporation (SIPC). The SIPC provides limited protection to investors if a brokerage firm fails. It works to return customers’ securities and funds held with the firm, up to certain limits.

Under the SIPC rules, if Robinhood were to go bankrupt, the assets registered in your name, such as stocks, would be transferred to a new brokerage firm or custodian. You would maintain ownership of your stocks, and they would not be lost or forfeited.

The specific process and timeline for the transfer of your assets may vary depending on the circumstances and the involvement of court-appointed trustees. However, the overall goal is to safeguard your investments and ensure their transfer to a new custodian in a timely manner.

It’s important to note that while the SIPC provides protection for the assets held by a brokerage firm, it does not cover all types of investments. For example, certain types of investments, such as commodities, futures contracts, and investment contracts, are not eligible for protection under the SIPC rules.

Additionally, the SIPC provides limited protection for cash and cash equivalents held in your brokerage account. The coverage is up to a maximum of $250,000 per customer, including a $250,000 limit for cash claims.

It’s always a good practice to regularly review your investment holdings and ensure they align with your risk tolerance and investment goals. Diversifying your portfolio and considering investments across different brokerage firms can also provide an added layer of protection in case of any unforeseen events.

While the notion of Robinhood going bankrupt may be concerning, it’s important to remember that the likelihood of this happening is relatively low. The SIPC protection and the regulatory measures in place are designed to safeguard investors’ assets and provide a safety net in case of such unfortunate circumstances.

Now that we understand the fate of your stocks if Robinhood were to go bankrupt, let’s explore the role of the Securities Investor Protection Corporation (SIPC) in more detail.

The Role of the Securities Investor Protection Corporation (SIPC)

The Securities Investor Protection Corporation (SIPC) plays a crucial role in protecting investors in the United States in the event of a brokerage firm’s insolvency. Established by Congress in 1970, the SIPC is a nonprofit membership corporation that provides limited protection to investors if a brokerage firm fails.

The primary purpose of the SIPC is to restore customers’ investments held with failed brokerage firms. It works to return customers’ securities and funds as quickly and efficiently as possible, up to certain limits.

If Robinhood were to go bankrupt, the SIPC would step in to oversee the distribution and transfer of customers’ assets. The SIPC does not operate like a typical insurance company, but rather as a backstop to help protect investors’ assets if a brokerage firm fails.

Under the SIPC rules, the coverage limits are as follows:

- The SIPC provides coverage for up to $500,000 per customer, including a $250,000 limit for cash claims.

- For individual accounts, the SIPC protection covers up to $500,000 worth of securities, including a $250,000 limit for cash claims.

- In cases of joint accounts, each account holder is considered a separate customer and is eligible for coverage up to $500,000 worth of securities, with a maximum of $250,000 of that limit for cash claims.

It’s important to note that the SIPC protection is not the same as having insurance on your investments. The SIPC does not protect against declines in the value of your investments or guarantee their future performance. Its primary role is to facilitate the return of securities that you own.

It’s worth mentioning that the SIPC coverage only applies to brokerage failures caused by financial insolvency. It does not cover losses due to investment fraud, unauthorized trading, or account disputes. For these types of losses, you may need to seek additional remedies through other legal avenues.

While the SIPC provides important protection for investors, it’s also essential to understand its limitations. Certain types of investments, such as commodities, futures contracts, and investment contracts, are not eligible for protection under the SIPC rules.

Additionally, it’s important to note that the SIPC protection is specific to the U.S. market. If you hold investments in foreign markets or with foreign brokers, different rules and protections may apply.

Now that we understand the role of the SIPC in protecting investors’ assets, let’s explore the liquidation process in more detail and how you can recover your stocks and funds if Robinhood were to go bankrupt.

The Liquidation Process

In the unfortunate event that Robinhood goes bankrupt, a liquidation process would take place to facilitate the transfer of customer assets to a new brokerage firm or custodian. This process aims to protect the investments of customers and ensure their orderly transition to a new custodian.

During the liquidation process, a court-appointed trustee or an appropriate authority would be responsible for overseeing the distribution of customer assets. The trustee’s role is to collect and marshal the assets of the bankrupt brokerage firm, determine their value, and facilitate their transfer to a new custodian.

The exact timeline and details of the liquidation process would depend on the specific circumstances and the involvement of court-appointed trustees. However, the goal is to complete the process efficiently and prioritize the protection of customer assets.

Under the supervision of the trustee, the customer assets, including stocks, would be transferred to a new brokerage firm or custodian. It’s important to note that you would maintain ownership of your stocks throughout this process. Your investments are not lost or forfeited in the event of Robinhood’s bankruptcy.

It’s worth mentioning that the liquidation process can take time, depending on the complexity of the situation and the number of customer accounts involved. During this period, you may experience a temporary suspension of trading and access to your account. However, once the transfer is complete, you would regain access to your investments through the new custodian.

Throughout the liquidation process, the Securities Investor Protection Corporation (SIPC) plays a crucial role in protecting customer assets. The SIPC ensures that customer assets are safeguarded and transferred to the new custodian in accordance with the SIPC rules and regulations.

While the liquidation process aims to protect customer assets, it’s important to understand that it may not result in a seamless transition. Delays and disruptions can occur during the process, and there may be additional administrative steps required to resume normal trading activities.

Now that we understand the liquidation process, let’s explore how you can recover your stocks and funds in the event of Robinhood going bankrupt.

Recovering Your Stocks and Funds

In the event of Robinhood going bankrupt, you may be concerned about how to recover your stocks and funds. Rest assured that there are processes in place to ensure the protection and recovery of customer assets.

As mentioned earlier, the Securities Investor Protection Corporation (SIPC) plays a vital role in safeguarding customer assets. The SIPC works to return customers their securities and funds held with a failed brokerage firm, up to certain limits.

Through the liquidation process overseen by a court-appointed trustee, your stocks and funds would be transferred to a new brokerage firm or custodian. This transfer aims to ensure the continuity of your investments and minimize any disruptions caused by the bankruptcy of Robinhood.

Once the transfer is complete, you would regain access to your investments through the new custodian. This means you would still retain ownership of your stocks and funds, and they would be held in your name at the new brokerage firm.

During the liquidation process, it’s important to stay informed and follow the instructions provided by the trustee and the new custodian. They would communicate relevant updates and instructions to ensure a smooth transition of your investments.

In the event that the value of your investments exceeds the coverage limits provided by the SIPC, there may be additional steps you can take to recover your assets. Consulting with an attorney or seeking legal advice can provide you with guidance on any potential options available to you.

It’s worth noting that while the goal is to recover your stocks and funds, the process may take some time to complete. Delays and administrative complexities can occur during the liquidation process, so it’s important to remain patient and stay informed throughout the transition.

Being proactive about protecting your investments is also prudent. This can include regularly reviewing your investment accounts, diversifying your portfolio across multiple brokerage firms, and staying up to date with industry news and developments.

In summary, in the unfortunate event of Robinhood going bankrupt, you can recover your stocks and funds through the liquidation process overseen by a court-appointed trustee. The SIPC provides crucial protection for customer assets, ensuring their transfer to a new custodian. By staying informed and following the instructions provided, you can navigate the process and regain access to your investments.

Now, let’s explore the options for seeking legal recourse if necessary.

Seeking Legal Recourse

In the unfortunate event that Robinhood goes bankrupt, you may find yourself in a situation where you need to seek legal recourse. While the Securities Investor Protection Corporation (SIPC) provides limited protection for your investments, there may be circumstances where additional legal action is necessary.

If you believe that your losses are not adequately addressed through the SIPC protection or if you have experienced any misconduct or fraudulent activities related to Robinhood’s bankruptcy, you may need to consult with an attorney specializing in securities law. They can assess your situation, guide you through the legal process, and help you explore available options.

When seeking legal recourse, it’s important to keep the following considerations in mind:

- Document your losses: Keep a record of all relevant information, including account statements, transaction records, and any communication with Robinhood or the trustee overseeing the liquidation process. This documentation will be crucial in supporting your case and seeking compensation.

- Find an experienced attorney: Look for an attorney with expertise in securities law and experience in handling cases related to brokerage firm insolvencies. They can provide guidance specific to your situation and advise you on the available legal avenues.

- Understand your rights: Familiarize yourself with your rights as an investor. This includes understanding the terms and conditions of your agreement with Robinhood and any applicable laws and regulations.

- Consider class-action lawsuits: In some cases, investors may come together to file a class-action lawsuit against a brokerage firm. This form of legal action allows individuals with similar claims to collectively seek compensation.

- Be aware of time limitations: Legal actions may have specific time limitations, known as statutes of limitations. It’s important to consult with an attorney promptly to ensure that you meet any deadlines for filing claims or initiating legal proceedings.

It’s important to note that engaging in legal proceedings can be time-consuming, complex, and costly. It’s advisable to carefully consider the potential costs and benefits before pursuing legal action, especially if the losses are within the coverage limits provided by the SIPC or if other forms of resolution are available.

While the hope is that the regulatory protections and the liquidation process will be sufficient to safeguard your investments, seeking legal recourse can be an option in some cases where additional remedies are necessary.

Now, let’s conclude our discussion on what happens to your stocks if Robinhood goes bankrupt.

Conclusion

Investing with online brokerage platforms like Robinhood offers convenience, accessibility, and the potential for financial growth. However, it’s crucial to understand the potential risks involved, including the possibility of bankruptcy. While the likelihood of Robinhood going bankrupt is relatively low, it’s important to be aware of the potential consequences and the safeguards in place to protect investors.

In the unfortunate event that Robinhood faces financial difficulties and goes bankrupt, your stocks and investments are not lost. The Securities Investor Protection Corporation (SIPC) plays a vital role in overseeing the liquidation process and ensuring the transfer of customer assets to a new custodian.

The SIPC provides limited protection for your investments, up to certain limits, and works to return your securities and funds. Your ownership of stocks and other assets is maintained, and they are transferred to a new brokerage firm or custodian.

It’s important to stay informed throughout the liquidation process, follow instructions from the court-appointed trustee, and cooperate with any communication from the new custodian. While the process may involve delays, the goal is to safeguard your investments and facilitate a smooth transition.

In the event that you feel your losses are not adequately addressed through the SIPC protection, seeking legal recourse may be an option. Consulting with an attorney specializing in securities law can help assess your situation and explore available legal avenues.

As an investor, it’s prudent to regularly review your portfolio, diversify your investments across multiple brokerage firms, and stay informed about the financial health of your chosen platforms.

While the prospect of Robinhood going bankrupt may raise concerns, it’s essential to remember that the protections and regulations in place are designed to safeguard your investments to the best of their ability.

Investing in the stock market carries inherent risks, and being aware of these risks empowers you to make informed decisions and take necessary precautions to protect your assets.

In conclusion, while the risk of Robinhood going bankrupt exists, there are protective measures in place to ensure the safety and transfer of your stocks and funds. By staying informed, diversifying your investments, and seeking legal recourse when necessary, you can navigate potential challenges and continue on your investment journey with confidence.