Finance

How To Sell My Stocks On Robinhood

Published: January 17, 2024

Learn how to sell your stocks on Robinhood and manage your finances effectively with this comprehensive guide. Take control of your investments and maximize your returns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of stock trading! If you are new to investing and exploring ways to sell your stocks, then you’ve come to the right place. In this article, we will guide you through the process of selling stocks on Robinhood – a popular and user-friendly investment platform.

Robinhood has revolutionized the way individuals can participate in the stock market. With its commission-free trades and intuitive interface, Robinhood has made investing accessible to a wider audience. Whether you are a seasoned investor or just starting, Robinhood provides a platform for buying and selling stocks with ease.

Selling stocks can be an essential part of your investment strategy. It allows you to profit from your investments, make adjustments to your portfolio, or simply take advantage of a favorable market condition. Understanding how to sell stocks on Robinhood is crucial for maximizing your returns and managing your investments effectively.

Before we dive into the details of selling stocks on Robinhood, let’s cover the basics. First, you need to have a Robinhood account set up. If you haven’t done so, head to the Robinhood website or download the Robinhood mobile app and follow the sign-up instructions.

Once you have your Robinhood account ready, you can start exploring the different types of stocks available for trading on the platform. Robinhood offers a wide range of stocks from various industries, allowing you to diversify your portfolio and invest in companies that align with your investment goals and interests.

Now that you have a brief introduction to Robinhood, selling stocks, and the importance of understanding the process, let’s explore in detail how to sell your stocks on Robinhood. We’ll cover topics such as researching stock performance, making the decision to sell, executing the sale, and monitoring the process along the way.

Continue reading to gain valuable insights and tips on how to sell your stocks on Robinhood and make informed decisions about your investments.

Understanding Robinhood

Before you start selling stocks on Robinhood, it’s important to have a good understanding of how the platform works. Robinhood is a commission-free brokerage that offers a user-friendly interface for trading stocks, options, ETFs, and cryptocurrencies.

One of the main advantages of using Robinhood is that it allows you to buy and sell stocks without incurring any commission fees. This is especially beneficial for investors who are starting out or those who make frequent trades, as it helps to minimize their trading costs.

On Robinhood, you can access a wide range of stocks from well-known companies in various industries. These stocks are listed on major exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ, allowing you to easily invest in companies that you’re familiar with or have identified as potential investment opportunities.

In addition to stocks, Robinhood also allows you to trade options and ETFs. Options give you the right, but not the obligation, to buy or sell a specific stock at a predetermined price within a specific time frame. ETFs, or Exchange-Traded Funds, allow you to invest in a collection of stocks or assets, providing diversification to your portfolio.

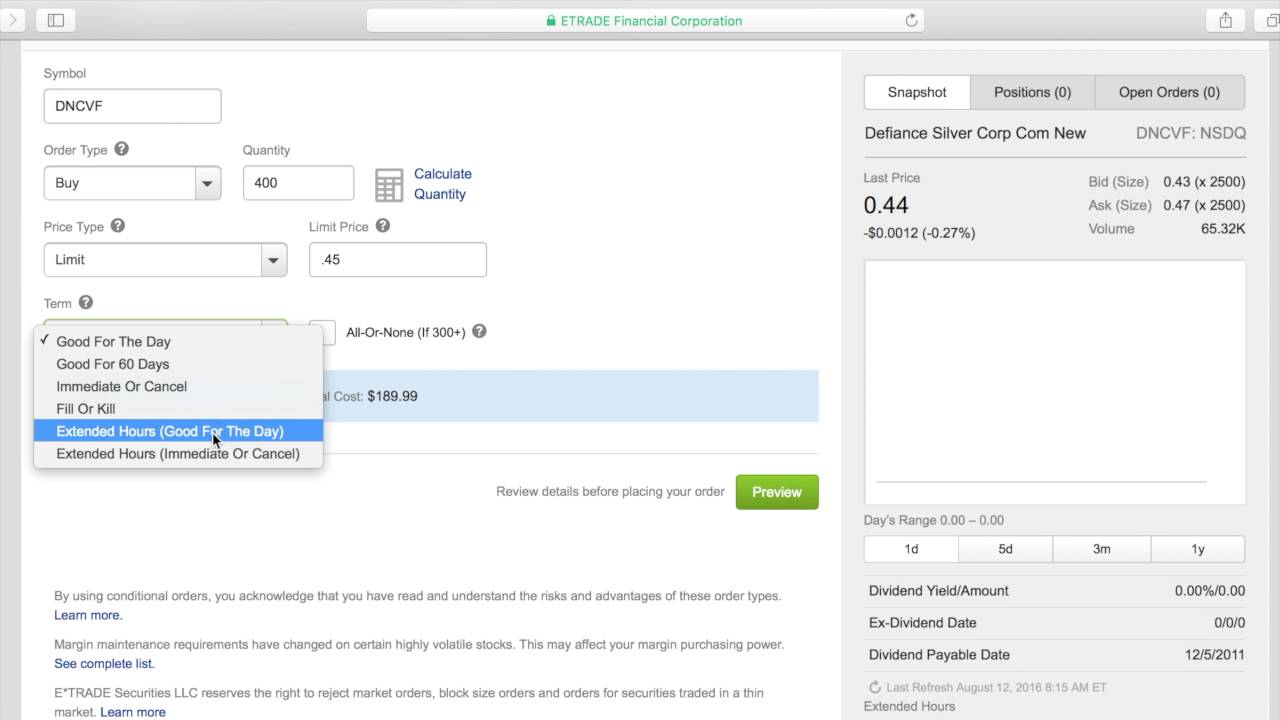

When it comes to executing trades on Robinhood, there are two types of orders you can place: market orders and limit orders. A market order is an instruction to buy or sell a stock at the current market price. This type of order ensures immediate execution but may come with a higher level of price volatility.

On the other hand, a limit order allows you to specify the maximum price you are willing to pay when buying or the minimum price you are willing to accept when selling. This type of order gives you more control over the price at which your trade is executed, but it may not be immediately filled if the market price does not meet your specified limit.

It’s essential to understand these order types and their implications when selling stocks on Robinhood. Depending on your investment strategy and market conditions, you can choose the most appropriate order type to execute your trades.

Now that you have a better understanding of how Robinhood works, let’s move on to exploring the different types of stocks available on the platform and how to research their performance.

Types of Stocks on Robinhood

When it comes to trading stocks on Robinhood, you have access to a wide range of companies from various industries. This allows you to build a diversified portfolio and invest in companies that align with your investment goals and interests.

Robinhood offers stocks listed on major exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. This means you can invest in well-known companies like Apple, Amazon, Microsoft, and many more.

There are several types of stocks you can find on Robinhood:

- Large-Cap Stocks: These are stocks of companies with a market capitalization of several billions of dollars. Large-cap stocks are known for their stability and tend to attract investors looking for long-term growth and dividend income.

- Mid-Cap Stocks: These are stocks of companies with a medium market capitalization, generally between $2 billion and $10 billion. Mid-cap stocks have the potential for higher growth compared to large-cap stocks but may also carry more volatility.

- Small-Cap Stocks: These are stocks of companies with a relatively small market capitalization, typically under $2 billion. Small-cap stocks have the potential for significant growth, but they are also associated with higher risks and volatility.

- Growth Stocks: Growth stocks are shares of companies that are expected to grow at an above-average rate compared to other companies in the market. These stocks often reinvest their profits into the business rather than distributing dividends.

- Value Stocks: Value stocks are shares of companies that are considered undervalued by the market. These stocks may have lower price-to-earnings ratios (P/E ratios) compared to their industry peers, and investors believe they have the potential for future price appreciation.

- Dividend Stocks: Dividend stocks are shares of companies that distribute a portion of their earnings to shareholders in the form of dividends. These stocks are popular among income-focused investors who seek regular cash flow.

It’s important to note that investing in stocks carries risks, and past performance is not indicative of future results. It’s essential to conduct thorough research and analysis before making investment decisions.

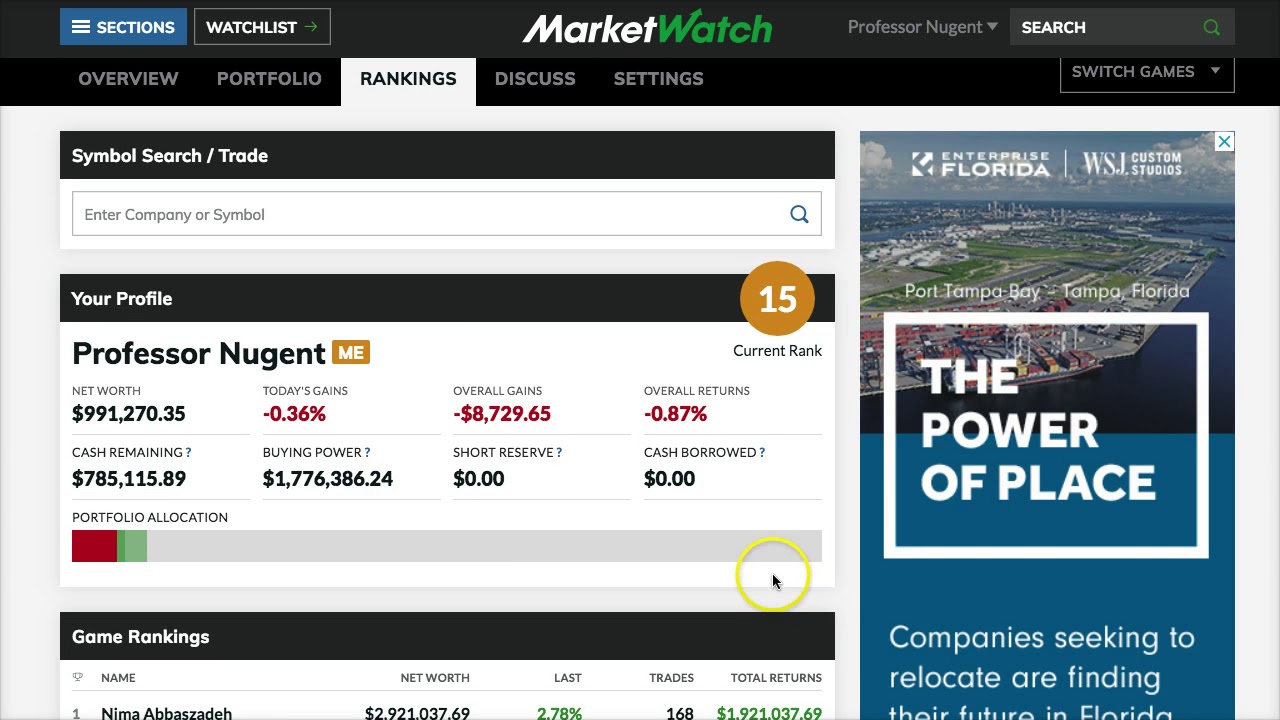

On Robinhood, you can access key information about each stock, including its current price, market performance, company profile, financial statements, and analyst ratings. This information can help you make more informed decisions when selecting stocks to sell.

In the next section, we will delve into the process of researching stock performance and understanding the factors that can influence your decision to sell your stocks on Robinhood.

Researching Stock Performance

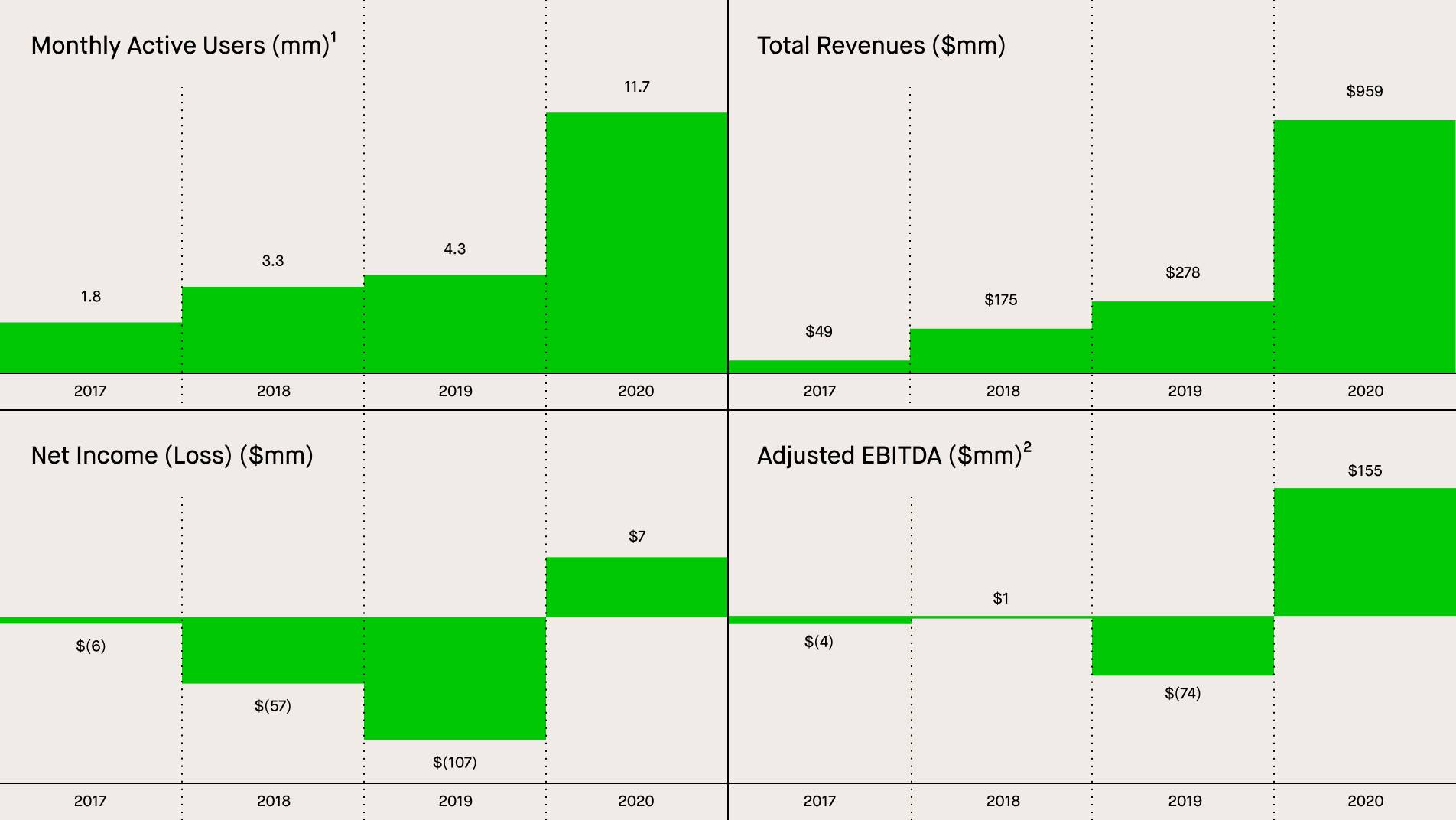

Researching stock performance is a crucial step when it comes to deciding whether to sell your stocks on Robinhood. It involves analyzing various factors that can impact a stock’s value, such as financial performance, industry trends, and market conditions.

Start by examining the financial statements of the company whose stock you are considering selling. Look at their revenue growth, profitability, and any recent news or events that may have affected the company’s financial health. This information can provide valuable insights into the company’s overall performance and prospects.

In addition to financial performance, consider the broader industry trends. Assess the competitive landscape and determine whether the company is positioned to thrive in its sector. Look for any upcoming industry disruptions or innovations that could impact the company’s future growth potential.

Market conditions also play a significant role in stock performance. Keep an eye on economic indicators, interest rates, and geopolitical events that could influence the market as a whole. Understanding the broader market sentiment can help you make more informed decisions about selling your stocks.

Analyst ratings can also provide valuable information when researching stock performance. Robinhood provides access to analyst ratings from various research firms, which can give you a sense of market sentiment and expert opinions on a particular stock.

Furthermore, it’s essential to stay updated on any news or events related to the company. News articles, press releases, and regulatory filings can provide insights into company developments, partnerships, new product launches, or potential legal issues. By staying informed, you can make informed decisions about whether or when to sell your stocks.

Consider using Robinhood’s research tools, such as the news feed and earnings calendar, to get real-time updates and stay informed about the stocks in your portfolio. Take advantage of the available information to enhance your understanding of the stocks you own and their potential for future growth or decline.

Remember that investing involves risks, and no amount of research can guarantee a favorable outcome. However, conducting thorough research and staying informed about your stocks can help you make more calculated decisions about selling them on Robinhood.

In the next section, we will discuss the factors to consider when making the decision to sell your stocks on Robinhood.

Making the Decision to Sell

Deciding when to sell your stocks on Robinhood can be a challenging task. It requires careful analysis of various factors and consideration of your investment goals. Here are some key factors to consider when determining whether it’s time to sell your stocks.

First, evaluate the company’s financial health and performance. Has the company’s profitability declined? Are there any significant changes in its revenue growth? If the company’s fundamentals have deteriorated, it may be a warning sign to consider selling your stocks.

Next, assess the industry and market conditions. Is the industry experiencing significant changes or disruptions? Are there new competitors entering the market? If the industry outlook is bleak or if there is a shift in consumer preferences, it may be prudent to sell your stocks in companies that may struggle to adapt.

Take into account the reason why you invested in the stock in the first place. Have your investment goals changed? If the reasons that initially prompted you to invest in the company are no longer valid or if they are not aligned with your current objectives, it may be time to sell and reallocate your investments accordingly.

Consider the potential for future growth. Has the company lost its competitive advantage? Are there other companies with better growth prospects that you may want to invest in? If you believe that the stock has limited upside potential or if you identify more promising investment opportunities, it may be worth selling your stocks.

Additionally, personal circumstances and financial goals should be taken into account. If you need immediate liquidity for a specific purpose, such as funding a big purchase or covering an unexpected expense, selling your stocks might be necessary. It’s crucial to balance your short-term financial needs with your long-term investment objectives.

Emotion can also play a role in the decision-making process. Do not let fear or greed drive your decisions. Set realistic expectations and avoid making impulsive decisions based on short-term market fluctuations. Remember that markets can be volatile, and it’s important to have a disciplined approach to investing.

Ultimately, the decision to sell your stocks on Robinhood should be based on a comprehensive assessment of the company’s financial performance, industry trends, market conditions, your investment goals, and personal circumstances. Regularly review and reassess your holdings to ensure they align with your investment strategy.

In the next section, we will explore the process of selling stocks on Robinhood, including setting limit orders and market orders.

Selling Stocks on Robinhood

Once you have made the decision to sell your stocks on Robinhood, the next step is to execute the sale. Robinhood provides a user-friendly platform that makes selling stocks a straightforward process. Here’s how you can sell your stocks on Robinhood:

1. Log into your Robinhood account: Visit the Robinhood website or open the mobile app and sign in to your account using your credentials.

2. Navigate to the stock you want to sell: Locate the stock you want to sell in your portfolio. You can do this by searching for the stock symbol or scrolling through your list of holdings.

3. Choose the “Sell” option: Once you have found the stock, select the “Sell” button to initiate the selling process.

4. Select the order type: Choose whether you want to place a limit order or a market order. A limit order allows you to set a specific price at which you want to sell your stock, while a market order sells the stock at the current market price.

5. Enter the quantity: Specify the number of shares you wish to sell. Ensure that the quantity matches the number of shares you want to sell, as mistyped quantities can lead to unintended transactions.

6. Review the details: Double-check the details of your order, including the stock symbol, order type, quantity, and any applicable fees or restrictions.

7. Confirm and submit the order: Once you are satisfied with the details, review your order one last time and click the “Submit” button to place the order for selling your stocks.

8. Monitor the sale: After placing the sell order, keep an eye on the market and monitor the progress of your sale. You can track the execution of your order in the “Order History” section of your Robinhood account.

9. Finalize the sale: Once your sell order is executed, the funds from the sale will be credited to your Robinhood account. You can choose to leave the funds in your account or withdraw them to your linked bank account.

It’s important to note that the market is dynamic, and the price at which your sell order is executed may fluctuate. In some cases, there may be a delay between placing the order and its execution, particularly during periods of high trading volume or market volatility.

Additionally, it’s worth considering any tax implications of selling your stocks. Consult with a tax advisor to ensure you understand the potential tax consequences of your transactions.

Now that you understand the process of selling stocks on Robinhood, you can confidently navigate the platform and execute your sell orders when the time is right.

In the next section, we will dive deeper into the two types of orders you can place on Robinhood: limit orders and market orders.

Setting a Limit Order

When selling stocks on Robinhood, one of the options you have is to set a limit order. A limit order allows you to specify the minimum price at which you are willing to sell your stock. This gives you more control over the selling price and can help you achieve a desired profit or avoid selling at a lower price.

Here’s how you can set a limit order on Robinhood:

- Log into your Robinhood account: Access your Robinhood account through the website or mobile app using your login credentials.

- Find the stock you want to sell: Locate the stock you want to sell in your portfolio. You can search for the stock symbol or browse your holdings.

- Select the “Sell” option: Once you have chosen the stock, tap on the “Sell” button to initiate the selling process.

- Choose “Limit Order” as the order type: When prompted to select the order type, opt for a “Limit Order” instead of a market order.

- Specify the price: Enter the minimum price at which you are willing to sell your stock. This should be the lowest price you would accept for selling your shares.

- Enter the quantity: Indicate the number of shares you want to sell. Ensure that the quantity you input matches the desired amount.

- Review the order: Carefully review the details of your order, including the stock symbol, order type (limit order), price, and quantity.

- Confirm and submit the order: If you are satisfied with the order details, click the “Submit” button to place the limit order.

Once your limit order is placed, it will remain active until it is executed, canceled, or expires. If the stock price reaches or exceeds your specified limit price, the order will be executed, and your shares will be sold at the set price or better. Keep in mind that there is no guarantee that your limit order will be filled, as it depends on market conditions and the demand for the stock at your specified price.

Setting a limit order can be a useful strategy when you have a specific target price in mind or when you want to manage the selling process more actively. It allows you to remain in control of the selling price and potentially avoid selling at a lower price due to short-term market fluctuations.

Remember to regularly monitor your limit orders and make adjustments if necessary. Market conditions can change rapidly, and it’s important to stay informed to ensure your sell orders align with your investment goals and market conditions.

In the next section, we will discuss the other option for selling stocks on Robinhood – setting a market order.

Setting a Market Order

When it comes to selling stocks on Robinhood, another option you have is to set a market order. A market order is an instruction to sell your stock at the current market price. This type of order ensures immediate execution, but it may result in the selling price being slightly different from the current displayed price due to market fluctuations.

Setting a market order to sell stocks on Robinhood is a straightforward process:

- Log into your Robinhood account: Access your Robinhood account on the website or mobile app using your login credentials.

- Locate the stock you want to sell: Find the stock you want to sell from your portfolio. You can search for the stock symbol or browse your holdings.

- Choose the “Sell” option: Once you have selected the stock, click on the “Sell” button to initiate the selling process.

- Select “Market Order” as the order type: When prompted to choose the order type, select “Market Order” instead of a limit order.

- Enter the quantity: Specify the number of shares you want to sell. Ensure that the quantity you input matches the amount you wish to sell.

- Review the order: Take a moment to review the order details, including the stock symbol, order type (market order), and quantity.

- Confirm and submit the order: If you are satisfied with the order details, click the “Submit” button to place the market order.

Once your market order is placed, it is immediately executed at the prevailing market price. This means that the selling price may differ slightly from the current displayed price due to fluctuations in the market. While a market order provides quick execution, it may result in a slightly different selling price compared to the moment you placed the order.

Using a market order is suitable when you prioritize speed of execution over specific price control. It is particularly useful during periods of high market volatility or when you want to sell your shares quickly without waiting for a specific price target.

Keep in mind that market conditions can change rapidly, and the selling price can fluctuate between the time you place the order and its execution. Therefore, it’s important to stay updated and monitor the progress of your market order to ensure it aligns with your desired outcome.

Whether you choose a market order or limit order to sell your stocks on Robinhood depends on your individual investment strategy, risk tolerance, and market conditions. Understanding these order types empowers you to make informed decisions based on your specific goals.

In the next section, we will explore the importance of monitoring the sale process and provide tips for finalizing the sale on Robinhood.

Monitoring the Sale

Once you have placed a sell order on Robinhood, it is crucial to monitor the sale process to ensure everything progresses smoothly. By staying engaged and aware of the status, you can make informed decisions and address any issues that may arise. Here are some tips for monitoring your sale on Robinhood:

1. Keep an eye on the market: Stay informed about market conditions and fluctuations in the stock’s price. The market can be volatile, and the selling price may change between the time of order placement and execution.

2. Monitor order status: Check the status of your sell order in the “Order History” section of your Robinhood account. It will show whether the order is pending, partially filled, or fully executed. This allows you to be aware of the progress of your sale and any potential delays.

3. Stay updated with notifications: Enable notifications on your Robinhood app to receive real-time updates on order status, trade executions, and any important market news that may affect your sale.

4. Consider setting price alerts: Use Robinhood’s price alert feature to receive notifications when the stock reaches a certain price level. This can help you stay informed and make timely decisions during the sale process.

5. Evaluate changing market conditions: Continuously assess the market conditions and news related to the stock you are selling. Significant developments or news events may impact the sale process and market sentiment. Stay informed and adjust your strategy if needed.

6. Be patient: Remember that the sale process may take some time, especially during high trading volumes or market volatility. Keep a long-term perspective and avoid making impulsive decisions based on short-term price fluctuations.

7. Seek support if needed: If you encounter any issues or have questions about your sale, reach out to Robinhood’s customer support for assistance. They can provide guidance and address any concerns you may have.

Monitoring the sale process on Robinhood is important to ensure that your sell order is executed as intended. It allows you to stay informed, make adjustments if necessary, and respond to any unexpected events that may impact the sale of your stocks.

Once the sale is executed, you can proceed to finalize the process and review your overall investment strategy. In the next section, we will discuss the steps for finalizing the sale on Robinhood.

Finalizing the Sale

After your sell order has been executed on Robinhood, it’s time to finalize the sale and review the outcome. The finalization process involves reviewing the transaction details, assessing the financial impact, and considering any next steps you may want to take. Here are the steps to follow when finalizing the sale on Robinhood:

1. Review the trade confirmation: Once your sell order is executed, you will receive a trade confirmation. Take the time to carefully review the details, including the stock symbol, selling price, quantity, transaction fees, and any applicable taxes.

2. Assess the financial impact: Calculate the proceeds from the sale – the amount you received after deducting any transaction fees. Consider the impact on your overall portfolio and investment strategy. Evaluate whether the sale aligns with your investment goals and risk tolerance.

3. Reflect on your investment thesis: Take the opportunity to reflect on the reasons you initially invested in the stock and whether those factors have changed. Review your investment thesis and assess if selling was the right decision based on the information available at the time.

4. Consider tax implications: Selling stocks may have tax implications, especially if you have realized a capital gain. Consult with a tax advisor to understand the potential tax consequences of the sale and any strategies you can employ to manage your tax liability effectively.

5. Evaluate your overall portfolio: With the sale complete, reassess your portfolio’s composition and alignment with your investment goals. Consider whether you need to rebalance your holdings to maintain diversification and manage risk.

6. Plan for reinvestment: If you have generated proceeds from the sale, decide what you will do with the funds. Determine if you want to reinvest in other stocks, explore different asset classes, or use the proceeds for other financial goals.

7. Learn from the experience: Take the opportunity to learn from your selling experience. Analyze the performance of the stock, the factors that influenced your decision, and the outcome of the sale. Use this knowledge to refine your investment strategy and make more informed decisions in the future.

8. Stay informed for future opportunities: Continue to stay informed about market trends, industry developments, and potential investment opportunities. Regularly monitor your portfolio and reassess your investment holdings to ensure they align with your evolving financial goals.

Finalizing the sale on Robinhood involves careful consideration of the transaction, reflection on investment decisions, and evaluation of your overall investment strategy. By following these steps, you can make well-informed decisions and manage your investments effectively.

Remember, investing involves risks, and past performance is not indicative of future results. Always conduct thorough research and consider seeking advice from financial professionals before making any investment decisions.

With the sale finalized, you are now ready to move forward with your investment journey. Continue learning and exploring new opportunities as you navigate the world of investing.

Conclusion

Congratulations! You have now learned how to sell your stocks on Robinhood. Understanding the process of selling stocks is crucial for managing your investments effectively and maximizing your returns. We have covered the key steps involved, from understanding Robinhood as a commission-free brokerage to researching stock performance, making the decision to sell, executing the sale, and finalizing the process.

With Robinhood, you have access to a wide range of stocks from various industries, allowing you to build a diversified portfolio that aligns with your investment goals. Whether you choose to sell using a limit order or a market order, it’s important to consider factors such as financial performance, industry trends, and market conditions when making your decision.

Throughout the selling process, monitoring the sale and staying informed about market fluctuations are essential. By being proactive and attentive, you can make timely decisions and adjust your strategy if necessary. Remember to review the trade confirmation, assess the financial impact, and consider any tax implications that may arise from the sale.

As you finalize the sale on Robinhood, take the opportunity to reflect on your investment journey. Evaluate your portfolio, consider reinvestment options, and continuously learn from your experiences. Investing is an ongoing process, and staying informed and adaptable will help you navigate the ever-changing markets.

Always remember that investing comes with risks, and no investment strategy can guarantee success. Conduct thorough research, seek advice from financial professionals if needed, and align your investment decisions with your financial goals and risk tolerance.

Now that you have a solid understanding of how to sell your stocks on Robinhood, you are equipped to make informed decisions and manage your investments confidently. Embrace the opportunities that the stock market offers, continue to expand your knowledge, and enjoy your journey as an investor!