Home>Finance>What Happens To Precious Metals When Interest Rates Rise?

Finance

What Happens To Precious Metals When Interest Rates Rise?

Published: November 1, 2023

Wondering what happens to precious metals when interest rates rise? Learn more about the impact of rising interest rates on the finance industry and the price of gold, silver, and other precious metals.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Precious Metals

- Relationship Between Interest Rates and Precious Metals

- Historical Trends

- Factors Influencing Precious Metals during Interest Rate Hikes

- Potential Impact of Rising Interest Rates on Gold

- Potential Impact of Rising Interest Rates on Silver

- Potential Impact of Rising Interest Rates on Platinum

- Potential Impact of Rising Interest Rates on Palladium

- Conclusion

Introduction

In the world of finance, interest rates play a crucial role in shaping the economy and influencing various asset classes. One area that is particularly affected by changes in interest rates is the precious metals market. Precious metals, such as gold, silver, platinum, and palladium, have long been sought after for their inherent value and as a hedge against inflation and economic uncertainties.

As interest rates rise, the relationship between interest rates and precious metals becomes an important topic of discussion. Many investors wonder what happens to these valuable commodities when interest rates start to climb. To gain a better understanding of this relationship, let’s first define what precious metals are and then explore the historical trends that can shed light on what we can expect in the future.

Definition of Precious Metals

Precious metals are rare and naturally occurring metallic elements that have high economic value. The most commonly traded precious metals include gold, silver, platinum, and palladium. These metals possess unique physical properties, such as durability, malleability, and conductivity, that make them valuable for a variety of industrial, jewelry, and investment purposes.

Relationship Between Interest Rates and Precious Metals

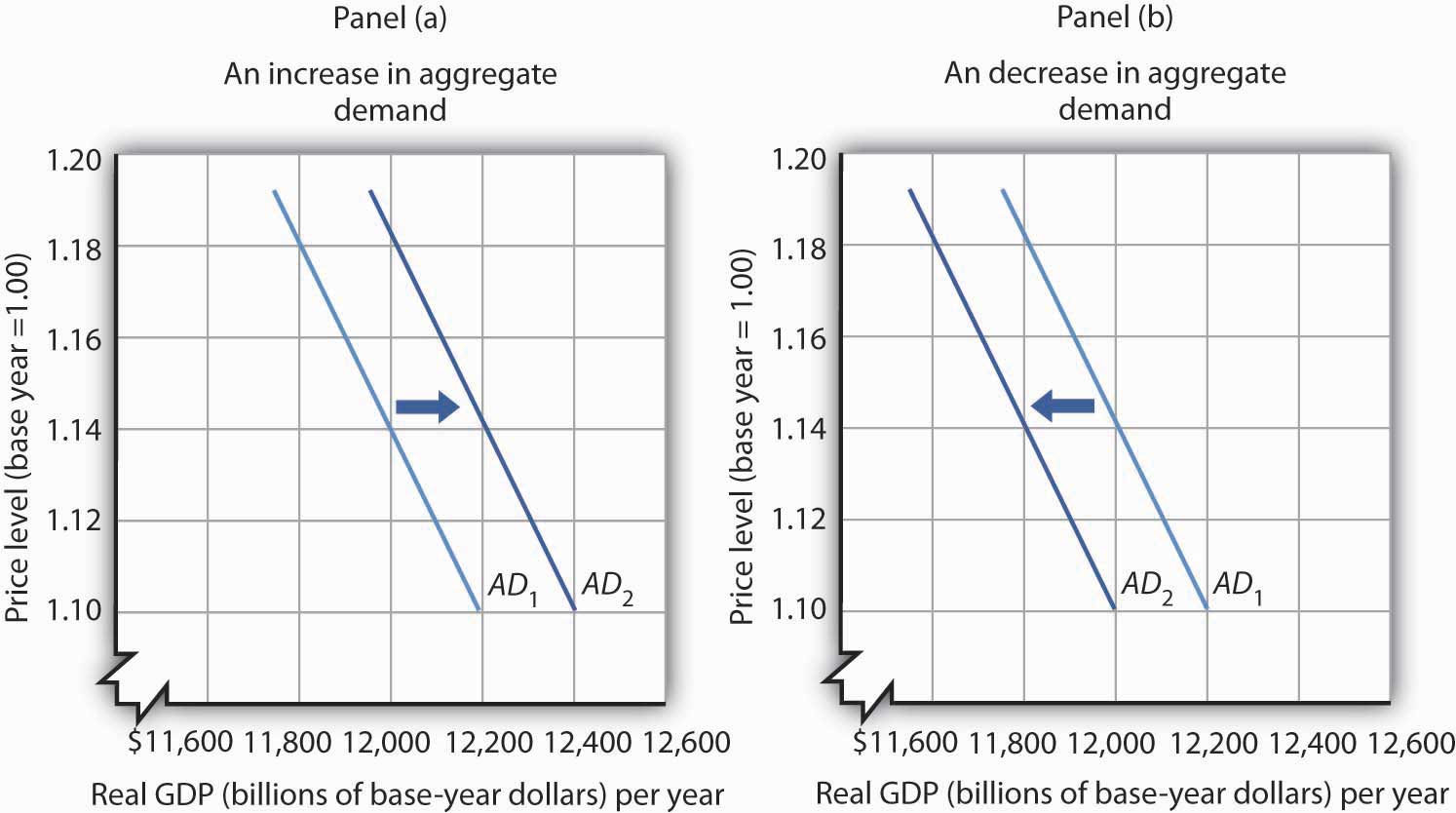

The relationship between interest rates and precious metals is complex and multifaceted. In general, interest rates have an inverse relationship with the price of precious metals. When interest rates are low, the opportunity cost of holding non-yielding assets like gold or silver is relatively low, leading to increased demand and higher prices.

Conversely, when interest rates rise, the opportunity cost of holding precious metals increases. Investors may opt to allocate their capital towards other investments that offer higher yield potential, such as bonds or equities. This shift in investment preferences can lead to a decrease in demand for precious metals and a subsequent decline in their prices.

Historical Trends

Examining the historical trends can provide insights into the relationship between interest rates and precious metals. In the past, there have been periods of rising interest rates that coincided with both positive and negative performance in the precious metals market.

For example, during the 1970s, when interest rates were high due to inflationary pressures, the price of gold experienced a significant surge. This was driven by investors seeking a safe haven and an inflation hedge amid economic uncertainties. Similarly, in the period following the 2008 financial crisis, when interest rates were low, gold prices reached record highs as investors sought refuge from market volatility.

On the other hand, there have also been periods when rising interest rates have been accompanied by a decline in precious metal prices. For instance, in 2013, when the Federal Reserve started hinting at tapering its quantitative easing program, interest rates began to increase, resulting in a decline in gold prices.

Definition of Precious Metals

Precious metals are rare and naturally occurring metallic elements that have high economic value. These metals are distinguished by their beauty, durability, and rarity, making them highly sought after for a range of purposes, including jewelry, industrial applications, and investment.

The most commonly traded precious metals include gold, silver, platinum, and palladium.

Gold: Gold is perhaps the most well-known precious metal. It has been valued for centuries for its lustrous appearance and resistance to tarnish. In addition to its aesthetic appeal, gold is highly valued for its use in jewelry making and as a store of value. Gold is often viewed as a safe haven asset, providing a hedge against inflation and economic uncertainties. It is also used in a variety of industrial applications, including electronics, dentistry, and aerospace.

Silver: Silver is another widely recognized precious metal. It has a beautiful, shiny appearance and is known for its excellent conductivity, making it valuable for use in electronics, batteries, and solar panels. Silver is also used in jewelry making and has a long history as a medium of exchange and store of value. While silver is sometimes considered a secondary precious metal to gold, it has unique industrial applications that contribute to its demand and price.

Platinum: Platinum is a dense, malleable, and corrosion-resistant metal that is highly valued for its rarity and versatility. It is primarily used in automotive catalytic converters due to its ability to reduce harmful emissions. Platinum is also used in various industrial applications, including chemical production, jewelry making, and electronics. Its scarcity and industrial demand make platinum one of the most expensive precious metals.

Palladium: Palladium is a silvery-white metal that shares many properties with platinum. It is primarily used in catalytic converters to reduce emissions from vehicles. Palladium is also used in electronics, dentistry, and jewelry. Like platinum, palladium is relatively rare, which contributes to its high price.

These precious metals, gold, silver, platinum, and palladium, have unique physical properties that make them highly valued. Their scarcity, durability, conductivity, and aesthetic appeal have led to their widespread use in various industries and as investments.

In addition to their intrinsic value, precious metals also play a symbolic and cultural role. They are often associated with wealth, luxury, and power, and have been used as symbols of status and adornment throughout history.

Understanding the definition and characteristics of precious metals provides a foundation for exploring their relationship with interest rates and their behavior in the financial markets.

Relationship Between Interest Rates and Precious Metals

The relationship between interest rates and precious metals is complex and influenced by various factors. Generally, precious metals, particularly gold and silver, have an inverse relationship with interest rates.

When interest rates are low, holding non-yielding assets like gold or silver becomes more appealing to investors. The opportunity cost of holding these precious metals is relatively low compared to investing in other assets, such as bonds or equities, which generate income through interest or dividends. As a result, the demand for precious metals increases, driving up their prices.

Conversely, when interest rates rise, the opportunity cost of holding non-yielding assets becomes higher. Investors may choose to allocate their capital towards other investments that offer higher yield potential. These alternative investments may include bonds or fixed-income securities that provide a steady income stream. Consequently, the demand for precious metals diminishes, leading to a decline in their prices.

It is important to note that the relationship between interest rates and precious metals is not always linear or immediate. Other factors such as market sentiment, inflation expectations, and geopolitical uncertainties can also influence the demand and price of precious metals.

Additionally, different precious metals may respond differently to changes in interest rates. Historically, gold has been more sensitive to interest rate movements compared to other precious metals. This is because gold is often seen as a safe-haven asset that investors turn to during times of economic uncertainty or inflationary pressures. As such, when interest rates rise, there may be a temporary sell-off in gold as investors seek higher-yielding assets. However, if economic uncertainties persist or inflation concerns arise, the demand for gold may rebound, driving its price higher.

Silver, on the other hand, has a dual role as both a precious metal and an industrial commodity. Its price dynamics are influenced by factors beyond interest rates, including industrial demand, supply constraints, and market sentiment. As a result, the relationship between silver and interest rates may not always be as pronounced as that of gold.

It is worth noting that the relationship between interest rates and precious metals can vary during different economic cycles and market conditions. Therefore, it is essential for investors to analyze a range of factors and consider their individual investment objectives before making decisions related to precious metal investments.

Historical Trends

Examining historical trends can provide valuable insights into the relationship between interest rates and precious metals. Over the years, there have been periods when rising interest rates have coincided with both positive and negative performance in the precious metals market.

One notable example is the period of the 1970s, marked by high inflation and rising interest rates. During this time, gold experienced a significant surge in price. Investors sought refuge in gold as a hedge against inflation and economic uncertainties. The demand for gold as a store of value increased, driving its price to new highs. This historical trend suggests that during periods of economic instability or inflation, the value of gold tends to rise as investors seek safe haven assets.

Similarly, in the aftermath of the 2008 financial crisis, central banks around the world employed expansionary monetary policies to stimulate economic growth. As interest rates were lowered, the price of gold soared. Investors viewed gold as a safe haven during times of market volatility and sought refuge in the precious metal. The rise in gold prices during this period demonstrates the inverse relationship between interest rates and the demand for gold.

However, there have also been instances when rising interest rates have put downward pressure on precious metal prices. For example, in 2013, when the Federal Reserve started to signal a potential tapering of its quantitative easing program, speculation of a reduction in monetary stimulus led to an increase in interest rates. Consequently, the price of gold experienced a significant decline. The anticipation of a higher cost of borrowing and potentially lower inflation expectations dampened the demand for gold as a safe haven asset.

It is important to note that historical trends can provide useful insights but are not definitive indicators of future performance. The relationship between interest rates and precious metals can be influenced by various factors, including economic conditions, monetary policy decisions, geopolitical events, and market sentiment.

Therefore, it is crucial for investors to conduct thorough analysis and consider multiple factors before making investment decisions related to precious metals. These may include examining current economic indicators, assessing global macroeconomic trends, and staying informed about central bank policies and geopolitical developments.

By understanding historical trends and continuously monitoring market conditions, investors can better navigate the dynamic relationship between interest rates and precious metals.

Factors Influencing Precious Metals during Interest Rate Hikes

During periods of interest rate hikes, several factors come into play that can influence the behavior of precious metals. While the relationship between interest rates and precious metals is generally inverse, the overall impact can be influenced by various market dynamics. Here are some key factors to consider:

Economic Outlook: The economic outlook is a significant factor that affects the performance of precious metals during interest rate hikes. If interest rate hikes are seen as a positive signal for economic growth and stability, investors may shift their focus to other assets, such as equities, which offer greater potential returns. This could lead to a decrease in demand for precious metals and a subsequent decline in their prices.

Inflation Expectations: Inflation is a crucial consideration during interest rate hikes. If higher interest rates are implemented to curb inflationary pressures, the value of precious metals such as gold may increase. This is because precious metals are often viewed as a hedge against inflation. Investors may turn to gold as a store of value to protect their wealth from eroding purchasing power.

Market Sentiment: Market sentiment plays a significant role in determining the performance of precious metals during interest rate hikes. Investor perception and sentiment towards the overall economy, financial markets, and geopolitical events can impact the demand for precious metals. If uncertain or turbulent market conditions prevail, investors may seek the stability and perceived safety of precious metals, thereby driving up their prices.

Dollar Strength: The strength of the U.S. dollar can exert influence on precious metals during interest rate hikes. As interest rates rise, the attractiveness of holding the U.S. dollar increases due to higher yields. A stronger dollar can negatively impact the prices of precious metals, as they are often denominated in dollars. When the dollar strengthens, it takes fewer dollars to purchase the same amount of precious metals, leading to reduced demand and potentially lower prices.

Supply and Demand Dynamics: Supply and demand dynamics of precious metals also play a role in their performance during interest rate hikes. Mining production, recycling rates, and global demand for industrial purposes, jewelry, and investment all contribute to the overall supply and demand balance. Changes in interest rates can impact the cost of mining and production, potentially affecting the supply side. Additionally, fluctuations in industrial demand and investor sentiment can influence the overall demand for precious metals.

Geopolitical Factors: Geopolitical events and uncertainties can impact the demand for precious metals during interest rate hikes. Precious metals are often seen as a safe haven during times of geopolitical tensions or conflicts. If geopolitical risks increase, investors may flock to precious metals as a means to safeguard their wealth, driving up prices.

It is important to note that the interplay of these factors is complex, and the impact on precious metals during interest rate hikes can vary. Therefore, investors should take a comprehensive approach, considering multiple factors and staying informed about macroeconomic trends, market conditions, and geopolitical developments when analyzing the potential impact on precious metals.

Potential Impact of Rising Interest Rates on Gold

Rising interest rates can have both direct and indirect impacts on the price of gold. While the relationship between interest rates and gold is often inverse, there are several factors to consider when assessing the potential impact:

Opportunity Cost: As interest rates rise, the opportunity cost of holding non-yielding assets like gold increases. Investors may look to allocate their capital towards other investments that offer higher yields, such as bonds or fixed-income securities. This shift in investment preferences could lead to a decrease in demand for gold and consequently lower its price.

Market Sentiment: Rising interest rates can signal a stronger economy and potential inflationary pressures. In times of economic stability and optimism, investors may demonstrate less interest in holding safe haven assets like gold. Positive market sentiment may lead investors to seek higher-risk, higher-yielding assets, dampening the demand for gold and potentially causing its price to decrease.

Inflation Hedge: While rising interest rates can indicate attempts to control inflation, they can also be a response to rising inflationary pressures. In such instances, gold tends to perform well as an inflation hedge. Investors may turn to gold to preserve their purchasing power as the value of fiat currencies erodes. The potential for increased inflation during periods of rising interest rates can drive demand for gold and potentially push its price higher.

Dollar Strength: The strength of the U.S. dollar can impact the price of gold during interest rate hikes. Gold is often priced in dollars, so a stronger dollar can make gold relatively more expensive for investors using other currencies. As interest rates rise, the attractiveness of holding the U.S. dollar increases due to higher yields, potentially leading to a stronger dollar. A stronger dollar may weigh on the demand for gold and put downward pressure on its price.

Geopolitical Uncertainties: Geopolitical events and uncertainties can also influence the price of gold during interest rate hikes. Gold is historically considered a safe haven asset, and during times of geopolitical tensions or conflicts, investors seek its perceived stability and store of value. Heightened geopolitical risks can increase the demand for gold, potentially pushing its price higher despite rising interest rates.

It is important to remember that the impact of rising interest rates on gold is not a linear or immediate relationship. Other factors, such as global economic conditions, market sentiment, and investor behavior, also play a role in determining the price of gold. Therefore, investors should conduct thorough analysis and consider multiple factors before making any investment decisions related to gold.

Potential Impact of Rising Interest Rates on Silver

Rising interest rates can have various effects on the price of silver. While the relationship between interest rates and silver is not as pronounced as that of gold, there are several factors to consider when assessing the potential impact:

Industrial Demand: Silver has a significant industrial demand due to its excellent conductivity and various industrial applications. As interest rates rise, it may indicate economic growth and increased industrial activity, which could result in higher demand for silver. Industrial sectors such as electronics, solar panels, and batteries heavily rely on silver. Therefore, rising interest rates could potentially drive up the price of silver through increased industrial demand.

Investor Sentiment: Silver is not only an industrial metal but also a precious metal sought after by investors. Rising interest rates can influence investor sentiment in different ways. Some investors may view rising interest rates as a positive sign for the economy and shift their focus to higher-yielding assets, potentially reducing demand for silver. On the other hand, others may view rising interest rates as a potential indicator of inflationary pressures and seek the perceived stability of precious metals like silver as a hedge. The net effect on silver’s price would depend on the prevailing sentiment among investors.

Correlation with Gold: Silver often follows the price movements of gold, although with higher volatility. Gold is typically more sensitive to interest rate changes, and silver tends to reflect this relationship to some extent. If rising interest rates lead to a decline in the price of gold, silver may also experience downward pressure. Conversely, if rising interest rates lead to increased demand for gold as an inflation hedge, silver may also benefit from the positive sentiment and see its price rise.

Dollar Strength: As with gold, the strength of the U.S. dollar can impact the price of silver. A stronger dollar can make silver relatively more expensive for investors using other currencies. However, the impact of the dollar’s strength on silver may not be as pronounced as that on gold since silver has a larger industrial demand component and is priced at a more accessible level for retail investors.

Geopolitical Uncertainties: Geopolitical events and uncertainties can fuel investor demand for silver as a safe haven asset. During times of geopolitical tensions, silver has historically attracted investors seeking refuge. If rising interest rates coincide with increased geopolitical risks, the demand for silver may rise, potentially pushing its price higher.

It is important to note that the relationship between interest rates and silver is influenced by a range of factors beyond just interest rates. Factors such as industrial demand, market sentiment, currency dynamics, and geopolitical uncertainties interact to shape the price of silver. Therefore, investors should consider a comprehensive analysis of these factors and the overall market conditions before making investment decisions related to silver.

Potential Impact of Rising Interest Rates on Platinum

The potential impact of rising interest rates on platinum can be influenced by several factors. While the relationship between interest rates and platinum may not be as direct or pronounced as that of gold or silver, it is important to consider the following factors when assessing the potential impact:

Industrial Demand: Platinum is primarily an industrial metal, with a significant portion of its demand coming from industrial applications. It is widely used in automotive catalytic converters, chemical production, and various other industries. As interest rates rise, an expansionary economic environment may lead to increased industrial activity and higher demand for platinum. Therefore, rising interest rates can potentially drive up the price of platinum through increased industrial demand.

Automotive Sector: The automotive industry plays a crucial role in platinum demand due to its use in catalytic converters. When interest rates rise, it can indicate a strengthening economy and potentially higher consumer spending. This may lead to increased vehicle production and consequently higher demand for platinum. However, factors such as vehicle electrification and changes in emission regulations can also impact platinum demand in the automotive sector, and these factors should be considered alongside interest rates.

Supply Dynamics: The supply dynamics of platinum can also influence its price during interest rate hikes. Factors like mining production, recycling rates, and geopolitical risks can impact the overall supply of platinum. Any disruptions to the supply chain or changes in mining activity may affect the price of platinum. Therefore, it is important to consider these supply-side factors alongside interest rates to assess the potential impact on platinum.

Market Sentiment: Investor sentiment and market perceptions can play a role in the price dynamics of platinum during interest rate hikes. Platinum is often seen as a precious metal and a store of value, much like gold and silver. Positive market sentiment towards precious metals during uncertain economic times or inflationary periods can increase investor demand for platinum, potentially driving up its price. Conversely, if rising interest rates are seen as a sign of economic stability and reduced inflationary pressures, investors may be less inclined to allocate their funds to platinum, leading to decreased demand.

Dollar Exchange Rate: The value of the U.S. dollar can impact the price of platinum, as it is often priced in dollars. When interest rates increase, it often leads to a stronger dollar. A stronger dollar can make platinum relatively more expensive for investors using other currencies, potentially dampening demand and putting downward pressure on its price.

Geopolitical Factors: Geopolitical events and uncertainties can also have an impact on the price of platinum during interest rate hikes. Geopolitical tensions or supply disruptions in platinum-producing regions can affect the supply-demand dynamics and influence the price of platinum. Increased geopolitical risks may heighten investor demand for platinum as a safe haven asset, driving up its price despite rising interest rates.

While considering interest rates, it is essential to assess these various factors that influence the price of platinum. Thorough analysis and an understanding of market conditions are crucial for investors in making informed decisions regarding platinum investments.

Potential Impact of Rising Interest Rates on Palladium

The potential impact of rising interest rates on palladium can be influenced by several factors. While the relationship between interest rates and palladium may not be as direct or pronounced as some other precious metals, it is important to consider the following factors when assessing the potential impact:

Industrial Demand: Palladium has a strong industrial demand, primarily due to its use in automotive catalytic converters. As interest rates rise, a strengthening economy and increased industrial activity may drive higher demand for vehicles, thus increasing the demand for palladium. This can potentially lead to a price increase for palladium as a result of heightened industrial demand.

Auto Industry Dynamics: The automotive industry plays a critical role in palladium demand, particularly for catalytic converters. While rising interest rates may indicate a strengthening economy, other factors such as changing emission regulations, advancements in vehicle technology, and shifts towards electric vehicles can also impact the demand for palladium. These factors should be considered alongside interest rates when assessing the potential impact on palladium price.

Supply Dynamics: The supply dynamics of palladium can influence its price during interest rate hikes. Palladium is primarily sourced from mines concentrated in a few regions, and disruptions to the supply chain or changes in mining activity can impact the overall supply of palladium. Any disruptions to supply can potentially lead to increased prices for palladium, particularly if demand remains strong.

Investor Sentiment: Investor sentiment and market perceptions can also influence the price dynamics of palladium during interest rate hikes. Palladium is considered both a precious metal and an industrial metal. Positive market sentiment towards precious metals, along with increased industrial demand, can contribute to the price appreciation of palladium. However, if rising interest rates are seen as an indication of economic stability and reduced inflationary pressures, investor demand for palladium may be dampened.

Dollar Exchange Rate: Since palladium is often priced in dollars, the value of the U.S. dollar can impact its price during interest rate hikes. When interest rates increase, it often leads to a stronger U.S. dollar. A stronger dollar can make palladium relatively more expensive for investors using other currencies, potentially impacting the demand for palladium and its price.

Geopolitical Factors: Geopolitical events and uncertainties can also have an impact on the price of palladium during interest rate hikes. Geopolitical tensions or supply disruptions in the regions where palladium is produced can affect the supply-demand dynamics and influence the price of palladium. Increased geopolitical risks may also lead to heightened investor demand for palladium as a safe haven asset, potentially contributing to price appreciation.

When considering the potential impact of rising interest rates on palladium, it is crucial to analyze these various factors that shape its market dynamics. A comprehensive assessment of market conditions, industrial demand, investor sentiment, supply dynamics, and geopolitical factors can assist investors in making well-informed decisions related to palladium investments.

Conclusion

The relationship between interest rates and precious metals is complex and influenced by various factors. While there is generally an inverse relationship between interest rates and precious metals, other market dynamics, such as economic outlook, inflation expectations, market sentiment, and geopolitical uncertainties, can also play a significant role in shaping the behavior of precious metals.

Gold, often viewed as a safe haven asset and inflation hedge, can experience both positive and negative impacts from rising interest rates. The overall direction of gold prices during interest rate hikes can depend on factors such as the opportunity cost of holding gold, market sentiment, inflation expectations, and the strength of the U.S. dollar.

Silver, with a significant industrial demand, may exhibit a more nuanced response to interest rate hikes. Its price dynamics can be influenced by industrial demand, market sentiment, correlation with gold, and the strength of the U.S. dollar.

Platinum, primarily an industrial metal, may see its price influenced by factors such as industrial demand, automotive sector dynamics, supply dynamics, investor sentiment, and geopolitical uncertainties. Analyzing these factors alongside interest rates can provide insights into the potential impact on platinum.

Palladium, which also has strong industrial demand, particularly in the automotive sector, can be influenced by industrial demand, auto industry dynamics, supply dynamics, investor sentiment, the strength of the U.S. dollar, and geopolitical factors. Understanding these factors is crucial when assessing the potential impact of rising interest rates on palladium.

In conclusion, when examining the potential impact of rising interest rates on precious metals, it is crucial to consider a wide range of factors and their interplay. The relationship between interest rates and precious metals is dynamic, and while an inverse relationship is often observed, it is essential to account for other factors such as market sentiment, inflation expectations, industrial demand, supply dynamics, and geopolitical uncertainties.

As an investor, thorough analysis, staying informed about market conditions, and closely monitoring the developments in the global economy and geopolitical landscape are essential for making well-informed decisions related to precious metal investments in the face of rising interest rates.